Revolve (RVLV)

We wouldn’t buy Revolve. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Revolve Will Underperform

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ:RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

- Falling earnings per share over the last three years has some investors worried as stock prices ultimately follow EPS over the long term

- Sales trends were unexciting over the last three years as its 3.4% annual growth was below the typical consumer internet company

- Monetization and engagement metrics haven’t budged over the last two years, suggesting it may need to increase the efficacy of its platform

Revolve doesn’t satisfy our quality benchmarks. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Revolve

Why There Are Better Opportunities Than Revolve

At $29.09 per share, Revolve trades at 20.8x forward EV/EBITDA. This multiple is high given its weaker fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Revolve (RVLV) Research Report: Q3 CY2025 Update

Online fashion retailer Revolve (NASDAQ:RVLV) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 4.4% year on year to $295.6 million. Its GAAP profit of $0.29 per share was significantly above analysts’ consensus estimates.

Revolve (RVLV) Q3 CY2025 Highlights:

- Revenue: $295.6 million vs analyst estimates of $298.1 million (4.4% year-on-year growth, 0.8% miss)

- EPS (GAAP): $0.29 vs analyst estimates of $0.12 (significant beat)

- Adjusted EBITDA: $25.35 million vs analyst estimates of $14.28 million (8.6% margin, 77.5% beat)

- Operating Margin: 7.1%, up from 5% in the same quarter last year

- Free Cash Flow Margin: 2.2%, down from 3.4% in the previous quarter

- Active Customers : 2.75 million, up 119,000 year on year

- Market Capitalization: $1.52 billion

Company Overview

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ:RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

Revolve is focused on Millennials and Generation Z customers, who spend significant amounts of time on social media and often look for digital content from influencers as their inspiration for purchasing decisions. It leverages a data-driven buying and merchandising model, which spends and monitors its marketing dollars across a network of over 3,500 social media influencers’ fashion choices on TikTok, Instagram, and YouTube.

Specifically, the company’s "read and react" merchandising approach identifies and invests behind new trends in small initial order quantities. It also employs a “test and reorder” model, which minimizes fashion risk like its fast-fashion peers by quickly pivoting from one style to another.

Revolve operates through two main brands: Revolve and Forward. Revolve focuses on a broad yet curated assortment of premium apparel, footwear, accessories, and beauty products while Forward is an aspiring luxury brand.

4. Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Revolve (NYSE:RVLV) competes with Stitchfix (NASDAQ: SFIX), The RealReal (NASDAQ:REAL), Poshmark (NASDAQ: POSH), Asos (AIM:ASC), and boohoo group (AIM:BOO).

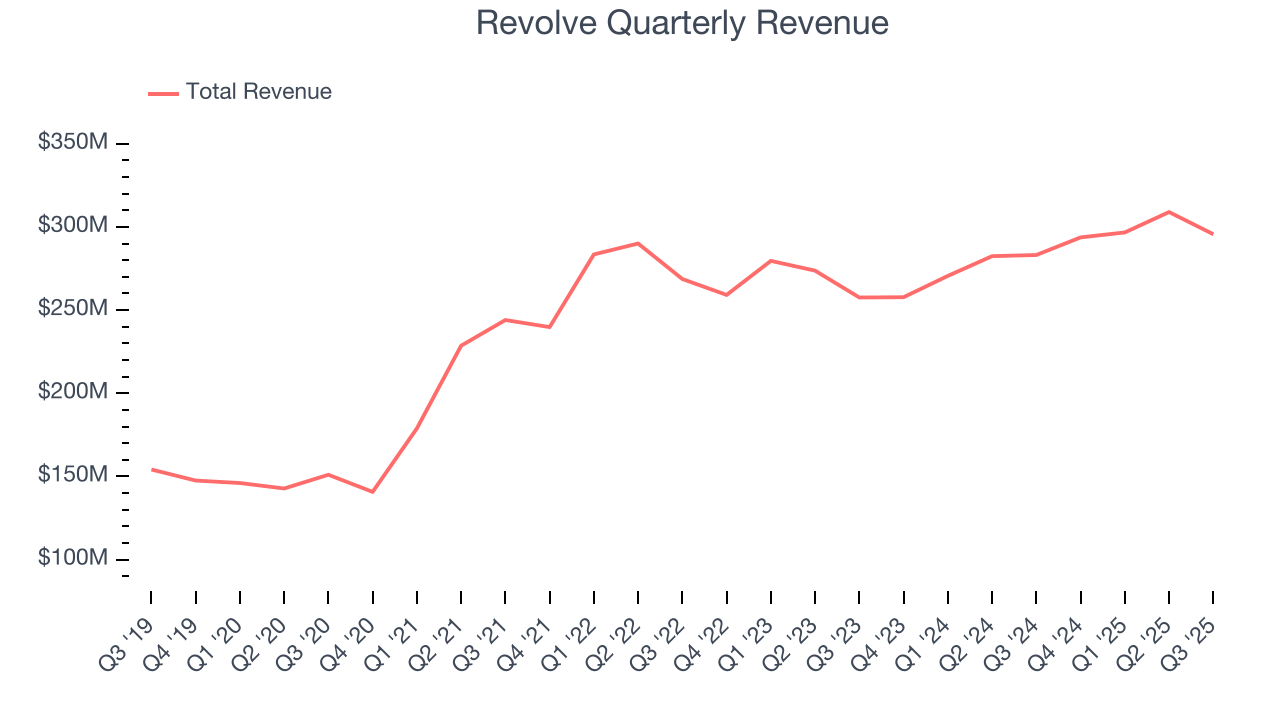

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Revolve’s sales grew at a sluggish 3.4% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Revolve’s revenue grew by 4.4% year on year to $295.6 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Active Customers

Buyer Growth

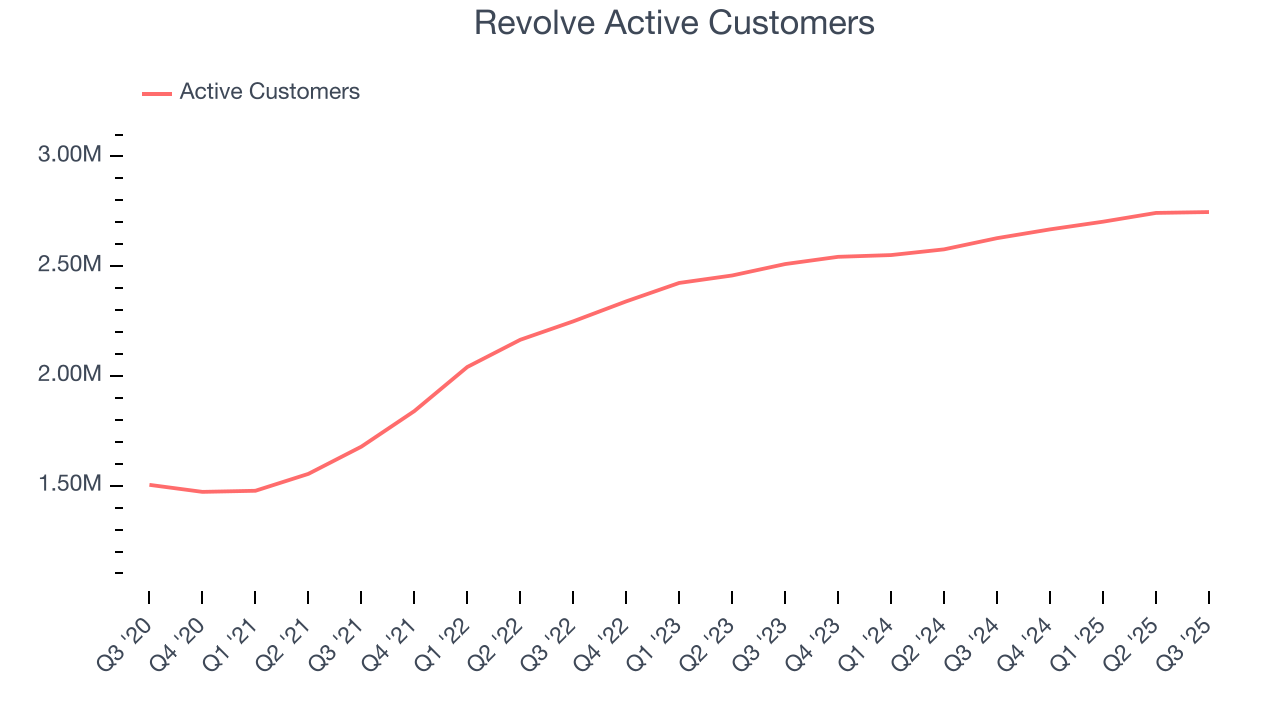

As an online retailer, Revolve generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Revolve’s active customers , a key performance metric for the company, increased by 5.7% annually to 2.75 million in the latest quarter. This growth rate lags behind the hottest consumer internet applications. If Revolve wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

In Q3, Revolve added 119,000 active customers , leading to 4.5% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating buyer growth just yet.

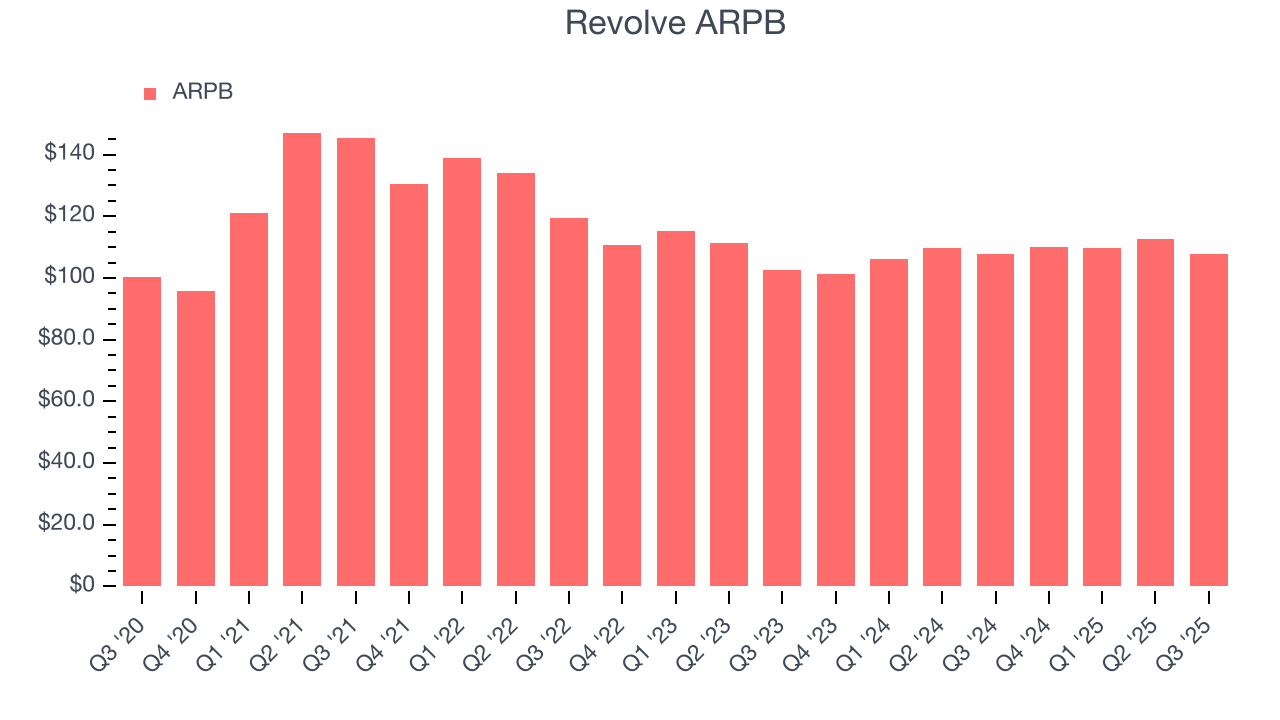

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Revolve’s ARPB has been roughly flat over the last two years. This isn’t great when combined with its weaker active customers performance. If Revolve tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyer growth would be sustainable.

This quarter, Revolve’s ARPB clocked in at $107.62. It was flat year on year, worse than the change in its active customers .

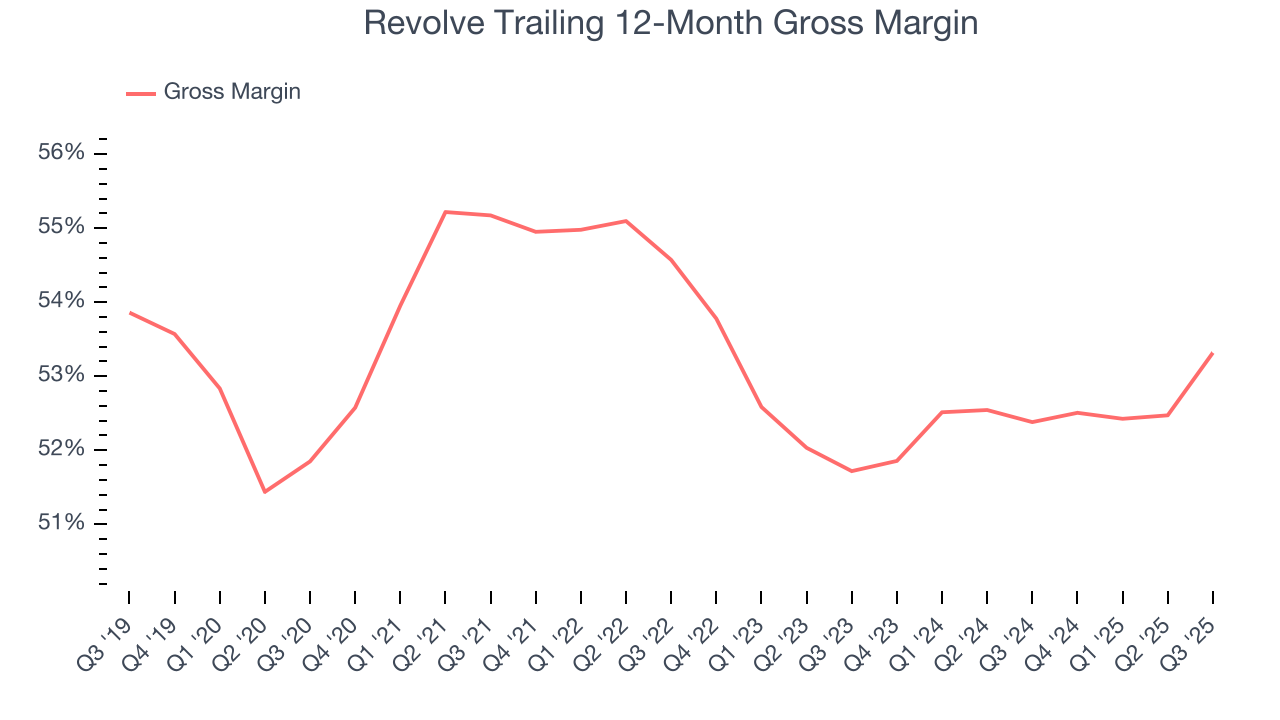

7. Gross Margin & Pricing Power

For online retail (separate from online marketplaces) businesses like Revolve, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

Revolve’s gross margin is slightly below the average consumer internet company, giving it less room to invest in areas such as product and marketing to grow its presence. As you can see below, it averaged a 52.9% gross margin over the last two years. That means Revolve paid its providers a lot of money ($47.13 for every $100 in revenue) to run its business.

Revolve produced a 54.6% gross profit margin in Q3, up 3.5 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

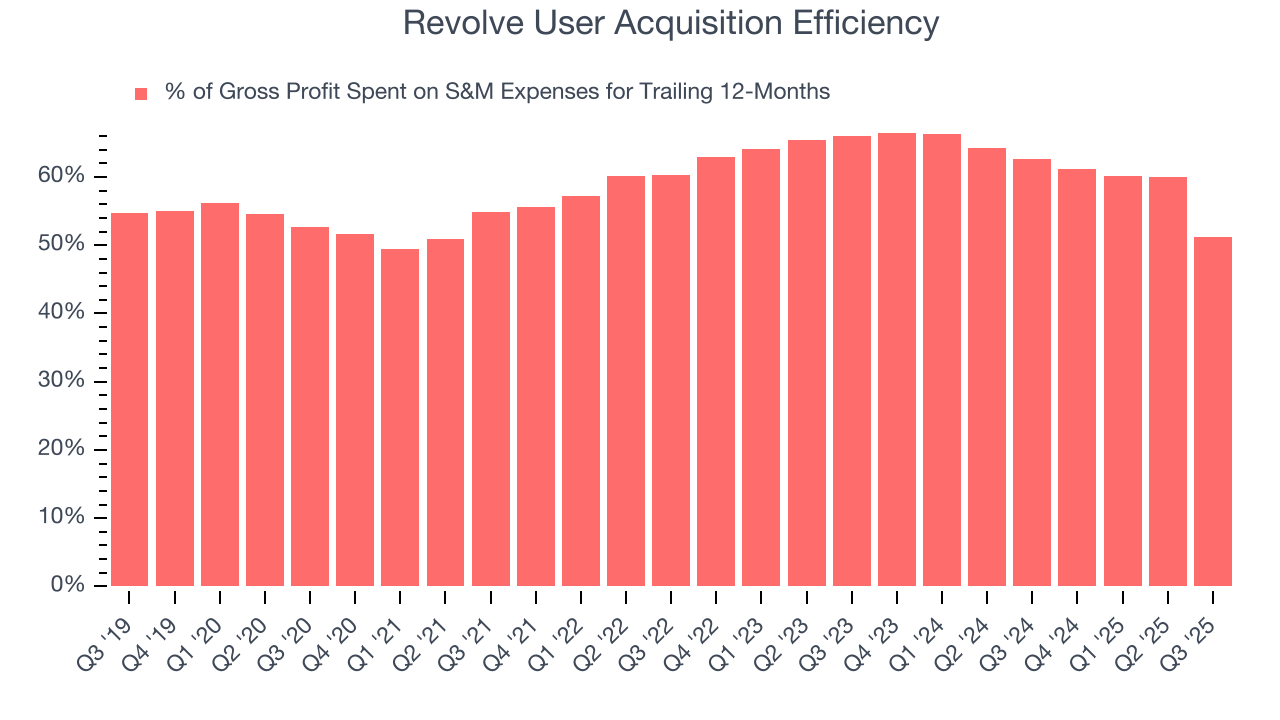

8. User Acquisition Efficiency

Consumer internet businesses like Revolve grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s expensive for Revolve to acquire new users as the company has spent 51.2% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Revolve’s product offering can be easily replicated and that it must continue investing to maintain an acceptable growth trajectory.

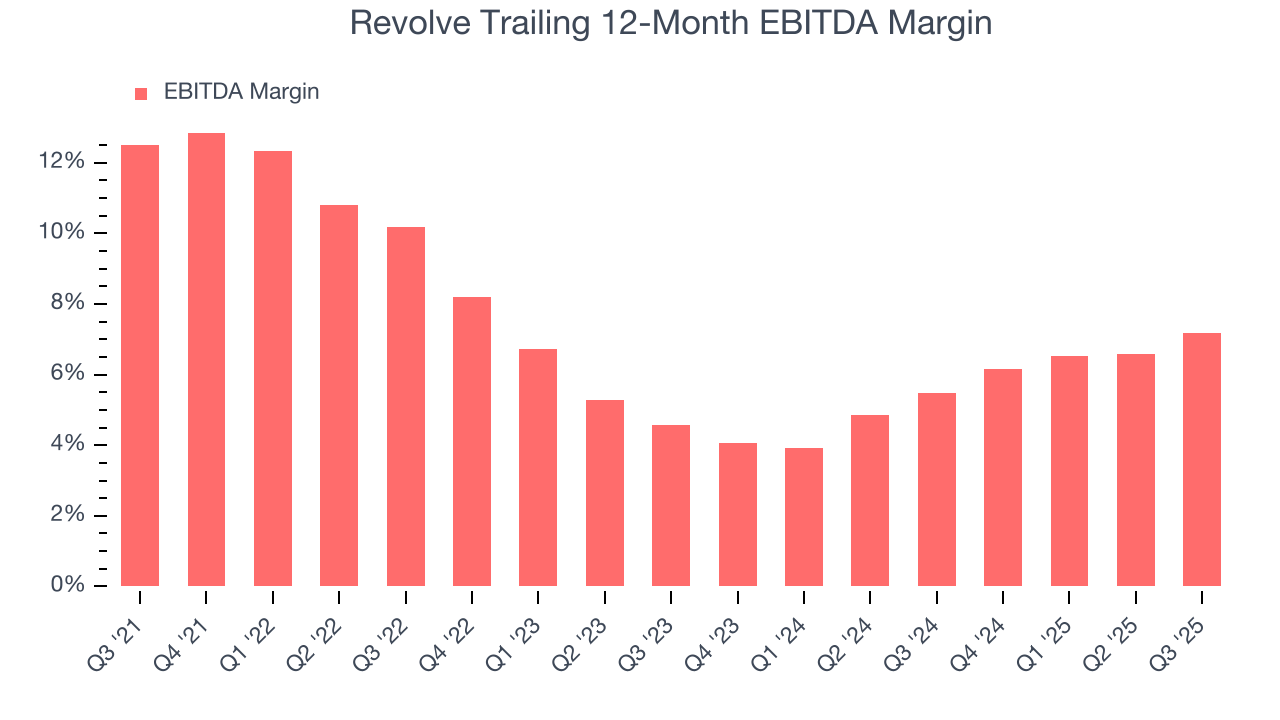

9. EBITDA

Revolve has managed its cost base well over the last two years. It demonstrated solid profitability for a consumer internet business, producing an average EBITDA margin of 6.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Revolve’s EBITDA margin decreased by 3 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Revolve generated an EBITDA margin profit margin of 8.6%, up 2.4 percentage points year on year. Since its gross margin expanded more than its EBITDA margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

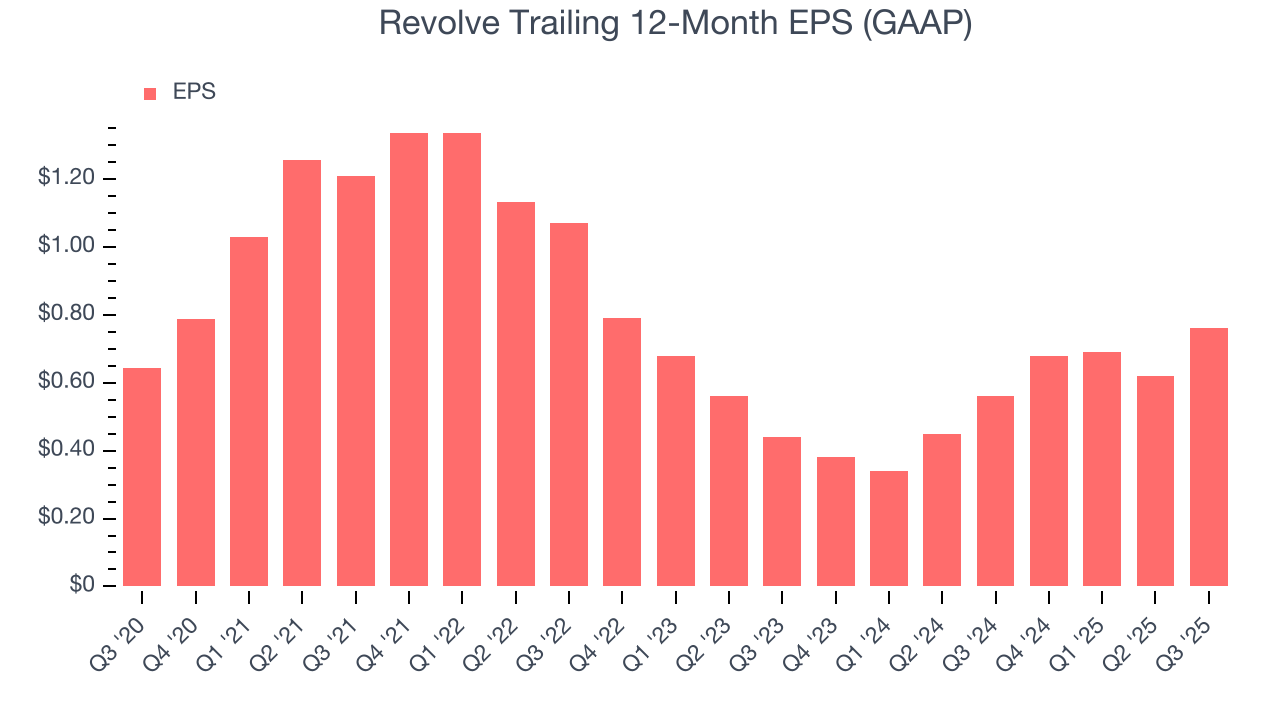

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

We can take a deeper look into Revolve’s earnings to better understand the drivers of its performance. As we mentioned earlier, Revolve’s EBITDA margin expanded this quarter but declined by 3 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Revolve reported EPS of $0.29, up from $0.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Revolve’s full-year EPS of $0.76 to shrink by 15.5%.

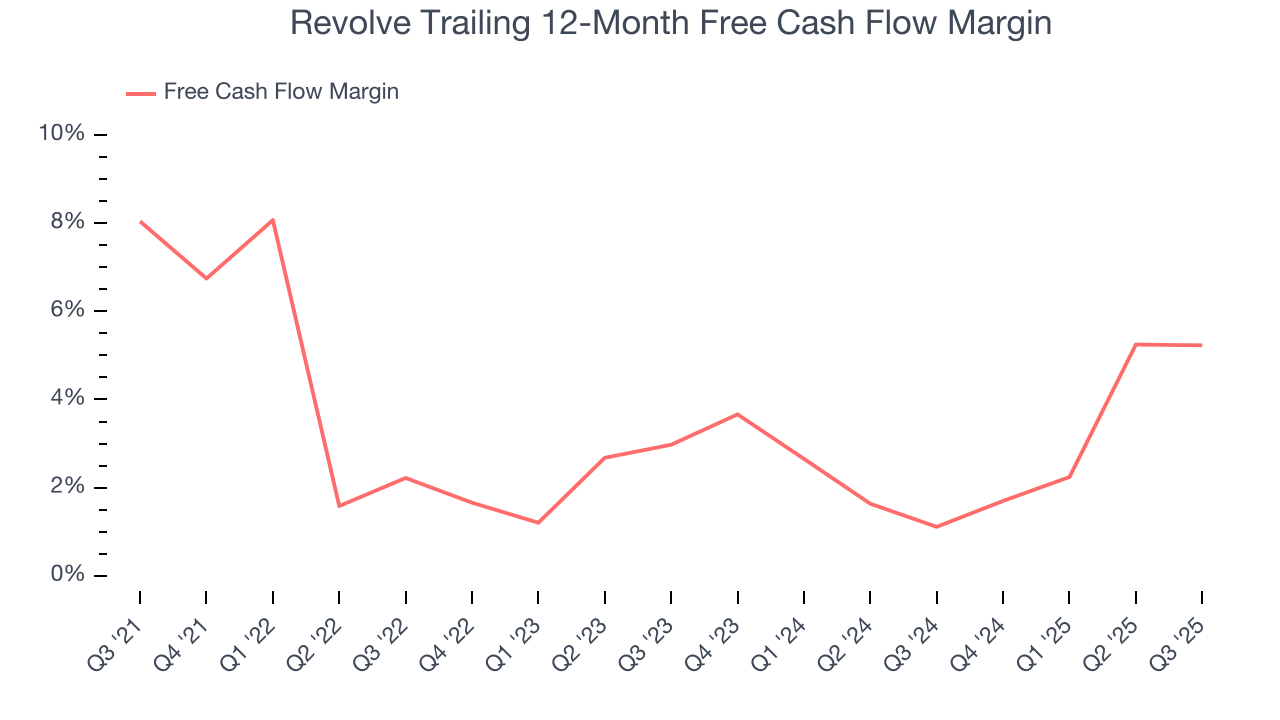

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Revolve has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.3%, subpar for a consumer internet business.

Taking a step back, an encouraging sign is that Revolve’s margin expanded by 3 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Revolve’s free cash flow clocked in at $6.63 million in Q3, equivalent to a 2.2% margin. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

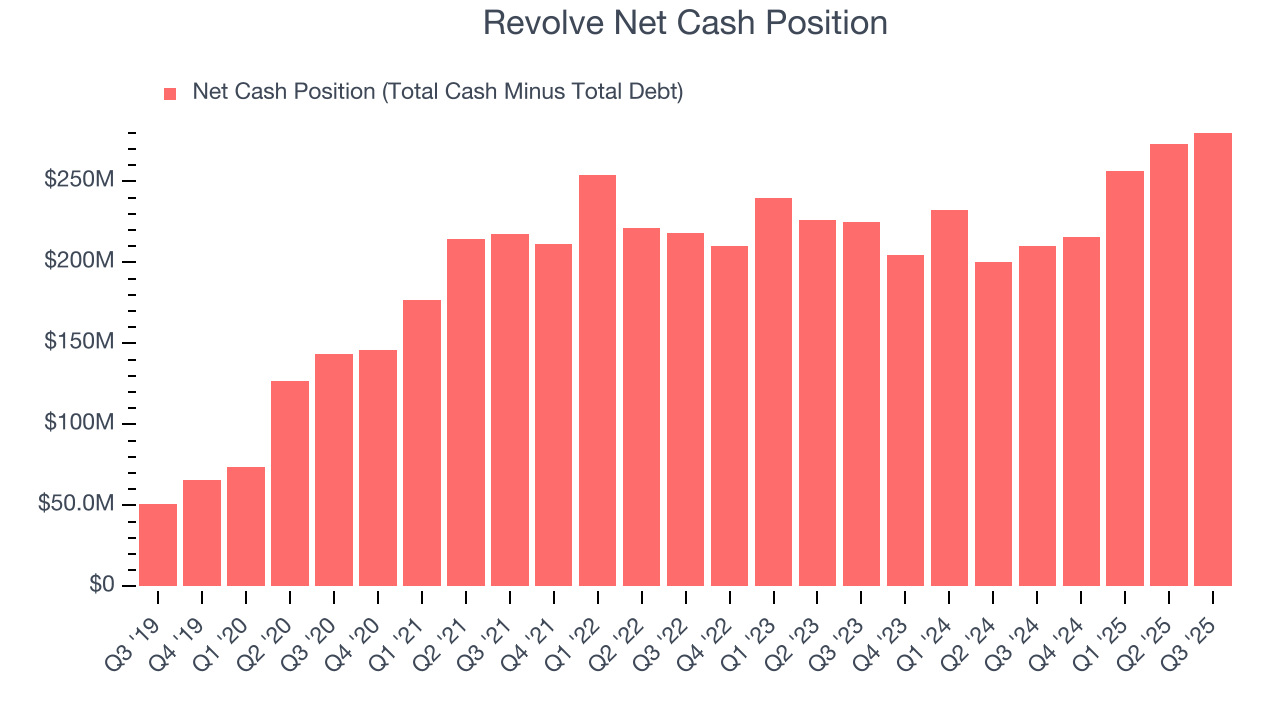

Revolve is a profitable, well-capitalized company with $315.4 million of cash and $35.29 million of debt on its balance sheet. This $280.1 million net cash position is 18.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Revolve’s Q3 Results

We were impressed by how significantly Revolve blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue slightly missed and its number of active customers fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 5.4% to $21.05 immediately after reporting due to its bottom-line outperformance.

14. Is Now The Time To Buy Revolve?

Updated: January 24, 2026 at 9:35 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Revolve.

Revolve falls short of our quality standards. To begin with, its revenue growth was weak over the last three years. And while its sturdy EBITDA margins show it has disciplined cost controls, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its ARPU was flat over the last two years.

Revolve’s EV/EBITDA ratio based on the next 12 months is 20.8x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $29.07 on the company (compared to the current share price of $29.09).