Ryan Specialty (RYAN)

Ryan Specialty is one of our favorite stocks. Its combination of fast growth, robust profitability, and superb prospects makes it a coveted asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Ryan Specialty

Founded in 2010 by insurance industry veteran Patrick Ryan, Ryan Specialty (NYSE:RYAN) is a wholesale insurance broker and underwriting manager that helps retail brokers place complex or hard-to-place risks with insurance carriers.

- Impressive 26.6% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Earnings per share grew by 17.4% annually over the last four years, massively outpacing its peers

- Notable projected revenue growth of 16.4% for the next 12 months hints at market share gains

We’re optimistic about Ryan Specialty. The valuation seems fair when considering its quality, and we think now is a favorable time to buy.

Why Is Now The Time To Buy Ryan Specialty?

Why Is Now The Time To Buy Ryan Specialty?

Ryan Specialty’s stock price of $43.03 implies a valuation ratio of 19.6x forward P/E. This price is justified - even cheap depending on how much you believe in the bull case - for the business fundamentals.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. If you can get an attractive entry price, that’s icing on the cake.

3. Ryan Specialty (RYAN) Research Report: Q4 CY2025 Update

Insurance specialty broker Ryan Specialty (NYSE:RYAN) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 13.2% year on year to $751.2 million. Its non-GAAP profit of $0.45 per share was 8.3% below analysts’ consensus estimates.

Ryan Specialty (RYAN) Q4 CY2025 Highlights:

- Revenue: $751.2 million vs analyst estimates of $771 million (13.2% year-on-year growth, 2.6% miss)

- Adjusted EPS: $0.45 vs analyst expectations of $0.49 (8.3% miss)

- Adjusted EBITDA: $222.3 million vs analyst estimates of $240.4 million (29.6% margin, 7.5% miss)

- Operating Margin: 12.2%, down from 16.5% in the same quarter last year

- Market Capitalization: $5.54 billion

Company Overview

Founded in 2010 by insurance industry veteran Patrick Ryan, Ryan Specialty (NYSE:RYAN) is a wholesale insurance broker and underwriting manager that helps retail brokers place complex or hard-to-place risks with insurance carriers.

Ryan Specialty operates through three main business segments. Its Wholesale Brokerage unit (operating primarily as RT Specialty) serves as an intermediary between retail insurance brokers and carriers, specializing in finding coverage for risks that are difficult to place in standard markets. The Binding Authority segment provides quick-turnaround solutions for smaller premium policies with predefined underwriting criteria, allowing for efficient processing of high-volume insurance needs. The Underwriting Management division includes multiple Managing General Agents and Underwriters (MGAs/MGUs) that have been granted authority by carriers to design, underwrite, and administer specialized insurance policies.

The company's services are particularly valuable in the Excess and Surplus (E&S) insurance market, which handles risks too complex or unusual for standard carriers. For example, a retail broker struggling to find coverage for a coastal property in a hurricane-prone area might engage Ryan Specialty to access specialized carriers willing to insure such high-risk properties. Similarly, a technology company seeking cyber liability coverage with unique requirements might benefit from Ryan Specialty's expertise in navigating niche insurance markets.

Ryan Specialty generates revenue primarily through commissions and fees paid by insurance carriers based on the premiums placed. The company maintains relationships with over 20,000 retail brokerage firms and more than 250 insurance carriers, positioning itself as a critical intermediary in the specialty insurance ecosystem. A key strategic advantage is that unlike some competitors, Ryan Specialty does not operate retail brokerage services, avoiding potential conflicts with the retail brokers who are its clients.

4. Insurance Brokers

The insurance brokerage industry, while influenced by insurance pricing cycles, benefits from durable secular tailwinds as rising risk complexity (climate, data privacy), regulatory scrutiny, and insurance pricing inflation. These increase demand for professional risk-management advice. Brokers operate models that rely on commissions and fees tied to premium volumes and growing contributions from recurring advisory, benefits, and compliance services. Scale is a key advantage, enabling better carrier access, stronger data and benchmarking, and efficient deployment of technology and compliance investments, which in turn supports ongoing industry consolidation. The headwinds are labor intensity and wage inflation for producers, regulatory complexity (this cuts both ways, as you can see), and execution risk when integrating new digital tools into legacy workflows.

Ryan Specialty's main competitors include other wholesale insurance brokers such as Amwins Group, CRC Insurance Services (a subsidiary of Truist Financial), Brown & Brown (NYSE:BRO), and Marsh & McLennan's (NYSE:MMC) wholesale operations.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.05 billion in revenue over the past 12 months, Ryan Specialty is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

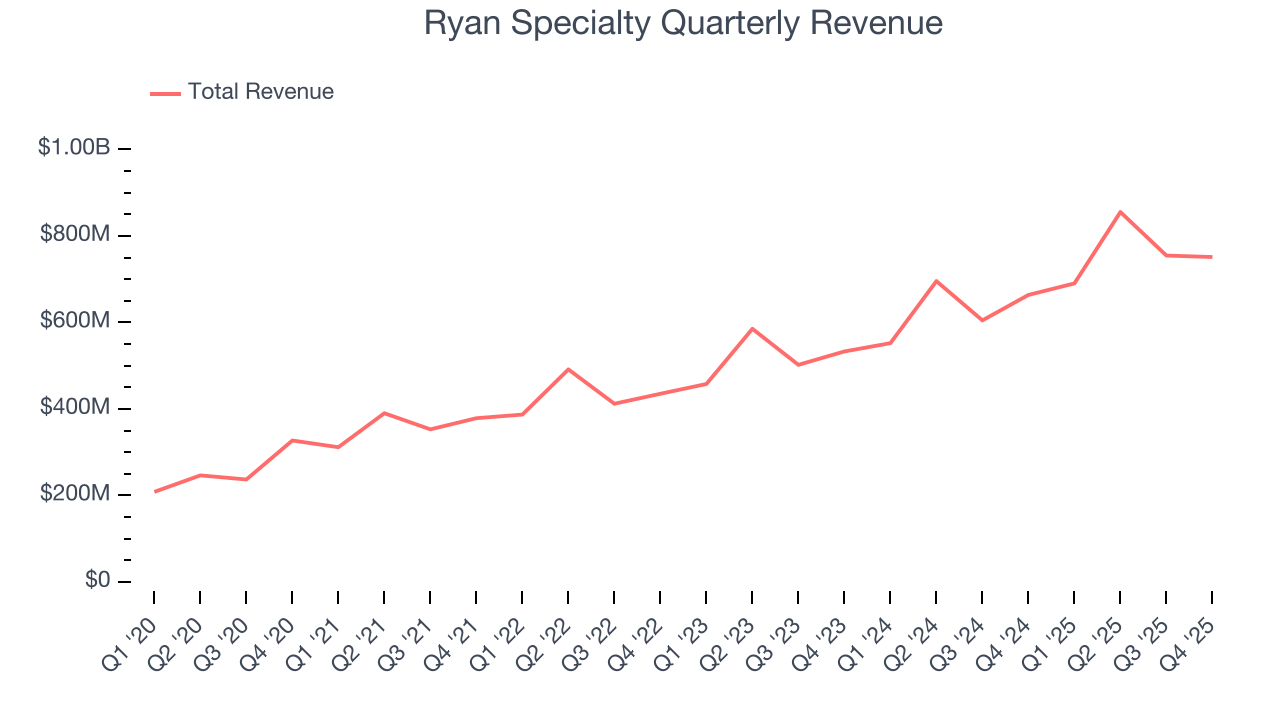

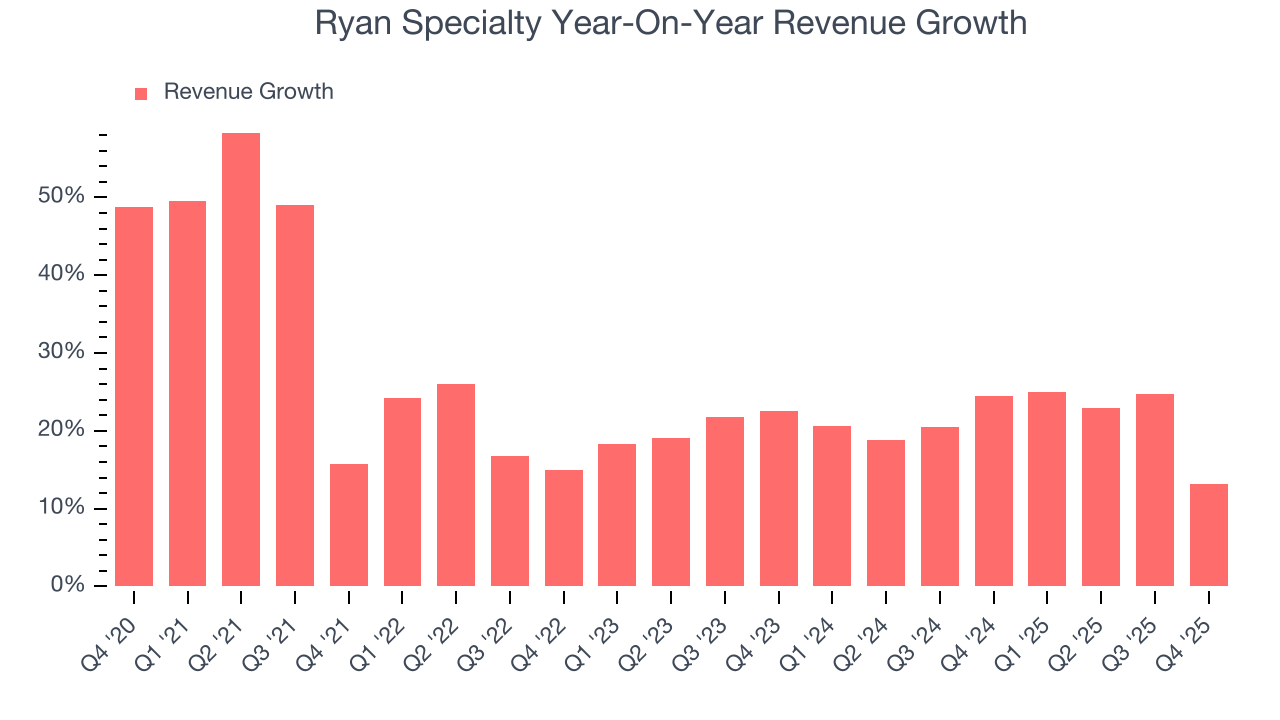

As you can see below, Ryan Specialty grew its sales at an incredible 24.5% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Ryan Specialty’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Ryan Specialty’s annualized revenue growth of 21.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Ryan Specialty’s revenue grew by 13.2% year on year to $751.2 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 17.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market is baking in success for its products and services.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

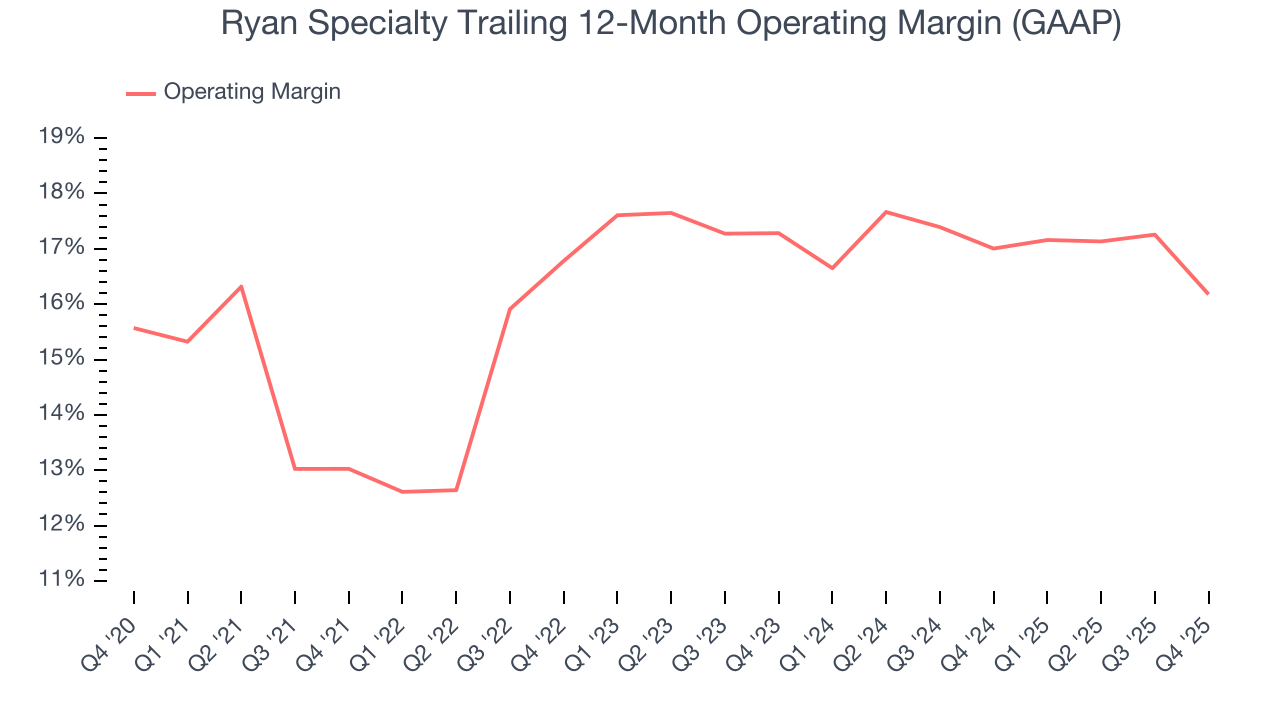

Ryan Specialty has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 16.3%.

Analyzing the trend in its profitability, Ryan Specialty’s operating margin rose by 3.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Ryan Specialty generated an operating margin profit margin of 12.2%, down 4.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

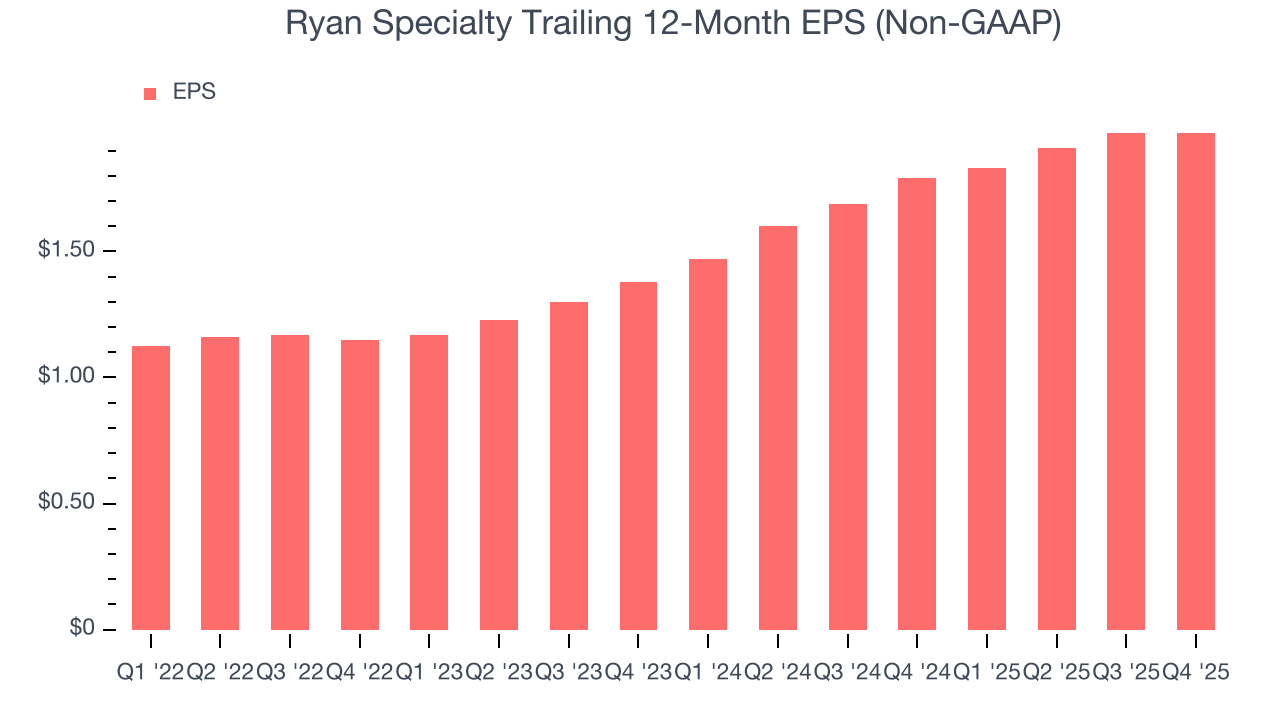

Ryan Specialty’s full-year EPS grew at an astounding 15.6% compounded annual growth rate over the last four years, better than the broader business services sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Ryan Specialty’s spectacular 19.5% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

In Q4, Ryan Specialty reported adjusted EPS of $0.45, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Ryan Specialty’s full-year EPS of $1.97 to grow 21.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

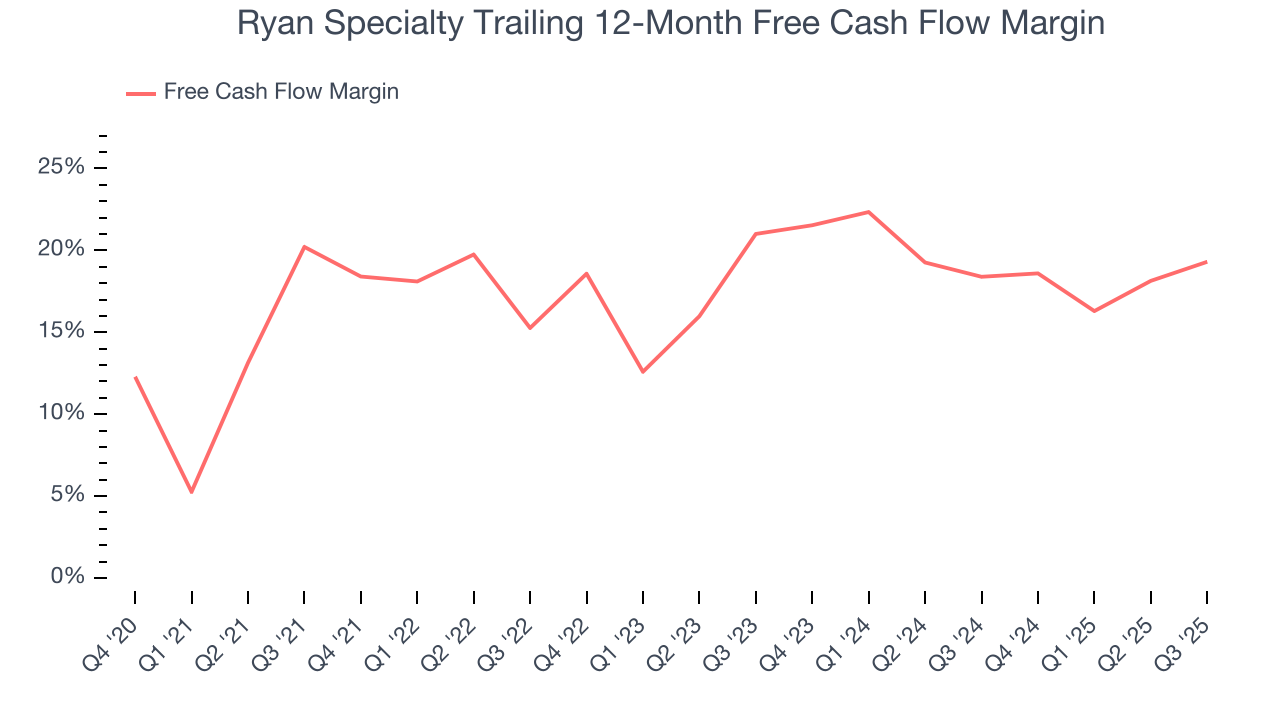

Ryan Specialty has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 18.2% over the last five years.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

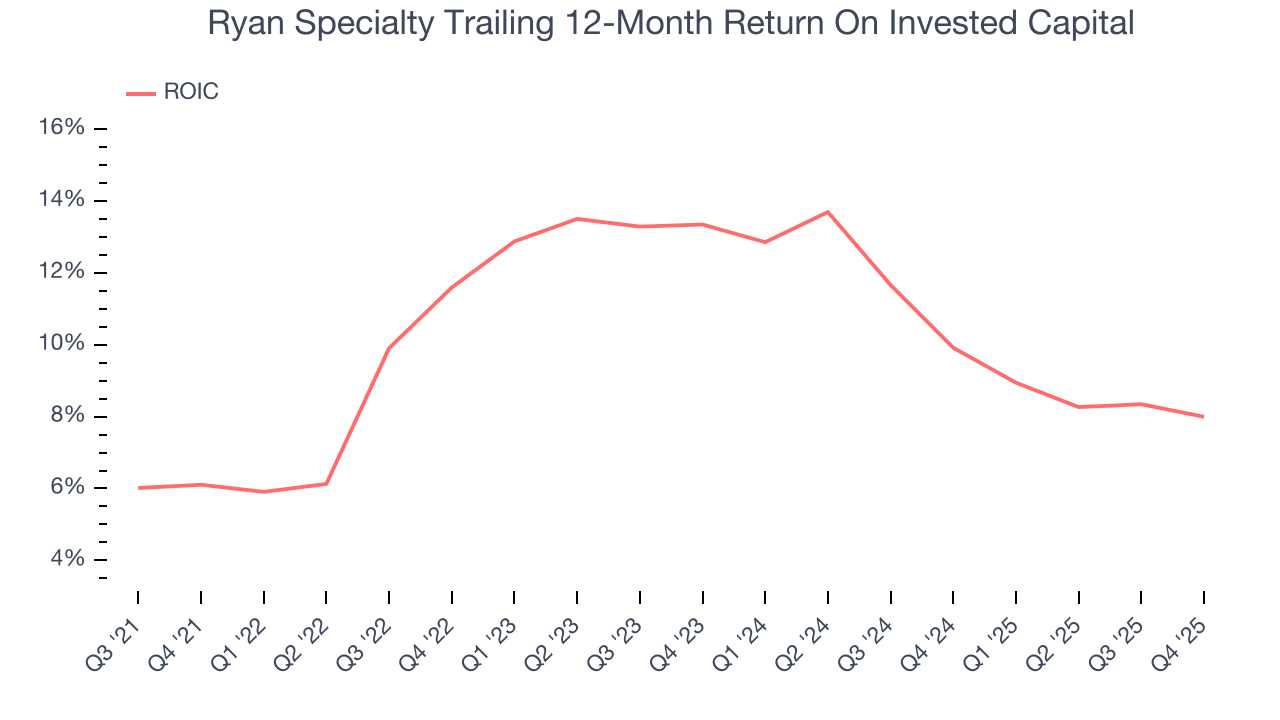

Although Ryan Specialty has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.8%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Ryan Specialty’s ROIC has stayed the same over the last few years. We still think it’s a good business, but if the company wants to reach the next level, it must improve its returns.

10. Balance Sheet Assessment

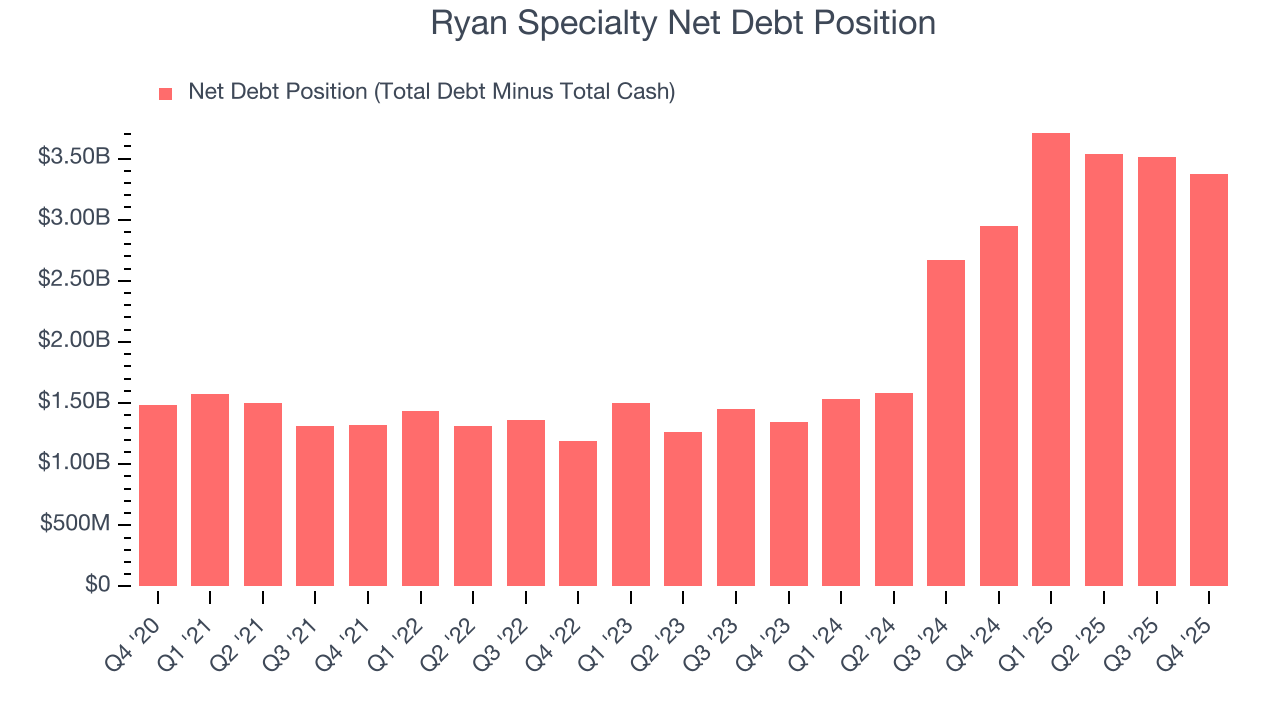

Ryan Specialty reported $158.3 million of cash and $3.53 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $966.7 million of EBITDA over the last 12 months, we view Ryan Specialty’s 3.5× net-debt-to-EBITDA ratio as safe. We also see its $72.61 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Ryan Specialty’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 11.1% to $39.47 immediately after reporting.

12. Is Now The Time To Buy Ryan Specialty?

Updated: February 12, 2026 at 11:08 PM EST

Are you wondering whether to buy Ryan Specialty or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are multiple reasons why we think Ryan Specialty is an elite business services company. For starters, its revenue growth was exceptional over the last five years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its astounding EPS growth over the last four years shows its profits are trickling down to shareholders.

Ryan Specialty’s P/E ratio based on the next 12 months is 18x. Looking across the spectrum of business services businesses, Ryan Specialty’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $64.31 on the company (compared to the current share price of $40.44), implying they see 59% upside in buying Ryan Specialty in the short term.