Charles Schwab (SCHW)

We love companies like Charles Schwab. Its .― StockStory Analyst Team

1. News

2. Summary

Why We Like Charles Schwab

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE:SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 24.9% outpaced its revenue gains

- Annual revenue growth of 15.4% over the past five years was outstanding, reflecting market share gains this cycle

- Industry-leading 14.4% return on equity demonstrates management’s skill in finding high-return investments

Charles Schwab is a top-tier company. The price looks fair when considering its quality, so this might be a favorable time to buy some shares.

Why Is Now The Time To Buy Charles Schwab?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Charles Schwab?

Charles Schwab’s stock price of $102.04 implies a valuation ratio of 17.8x forward P/E. This price is justified - even cheap depending on how much you believe in the bull case - for the business fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Entry price matters less, but if you can get a good one, all the better.

3. Charles Schwab (SCHW) Research Report: Q4 CY2025 Update

Financial services giant Charles Schwab (NYSE:SCHW) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 18.9% year on year to $6.34 billion. Its non-GAAP profit of $1.39 per share was in line with analysts’ consensus estimates.

Charles Schwab (SCHW) Q4 CY2025 Highlights:

- Revenue: $6.34 billion vs analyst estimates of $6.38 billion (18.9% year-on-year growth, 0.6% miss)

- Pre-tax Profit: $3.18 billion (50.2% margin)

- Adjusted EPS: $1.39 vs analyst estimates of $1.39 (in line)

- Market Capitalization: $179.5 billion

Company Overview

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE:SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Schwab operates through two main segments: Investor Services for individual clients and Advisor Services for independent financial advisors. The company offers a comprehensive suite of investment products including brokerage accounts, mutual funds, ETFs, and alternative investments, alongside banking services such as checking accounts, savings accounts, and various lending options.

For individual investors, Schwab provides multiple relationship models tailored to different needs and asset levels. These range from self-directed online trading platforms to personalized wealth management services with dedicated advisors for affluent clients. The company emphasizes financial education through online tools, workshops, and planning resources to help clients make informed decisions.

The Advisor Services segment has positioned Schwab as a leading custodian for Registered Investment Advisors (RIAs), providing them with trading capabilities, technology platforms, and business support services. When an independent advisor uses Schwab as custodian, their clients gain access to Schwab's investment products while the advisor maintains the primary relationship.

Schwab generates revenue primarily through net interest income (the difference between interest earned on assets like loans and securities versus what it pays on client deposits), asset management fees from its proprietary funds and advisory solutions, trading commissions, and fees from bank deposit accounts. This diversified revenue model helps the company navigate different market environments.

The company's scale is substantial, serving millions of active brokerage accounts and managing trillions in client assets. Following its acquisition of TD Ameritrade in 2020, Schwab significantly expanded its client base and technological capabilities, incorporating popular trading platforms like thinkorswim into its offerings.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Charles Schwab competes with other major financial services firms including Morgan Stanley (NYSE:MS), Bank of America's Merrill Lynch (NYSE:BAC), Fidelity Investments (privately held), and interactive Brokers (NASDAQ:IBKR). In the discount brokerage space, it also faces competition from Robinhood (NASDAQ:HOOD) and newer fintech entrants.

5. Revenue Growth

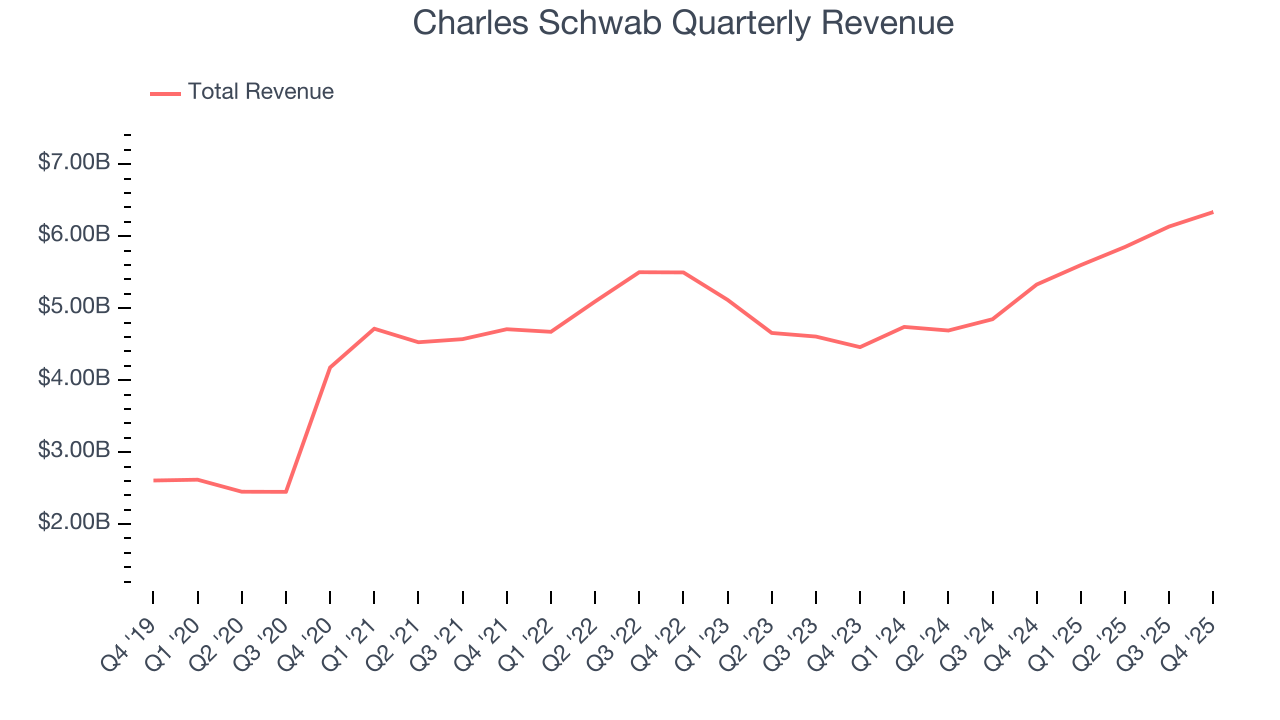

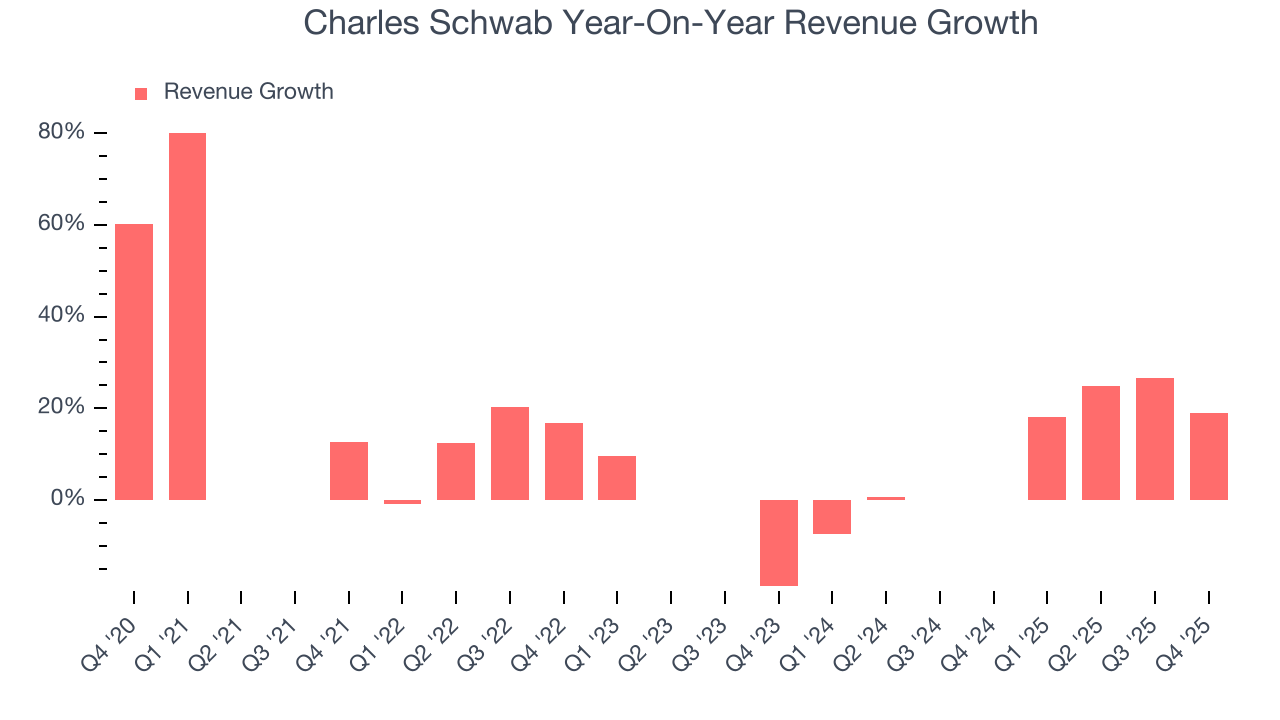

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Charles Schwab’s revenue grew at an impressive 15.4% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Charles Schwab’s annualized revenue growth of 12.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Charles Schwab’s revenue grew by 18.9% year on year to $6.34 billion but fell short of Wall Street’s estimates.

6. Pre-Tax Profit Margin

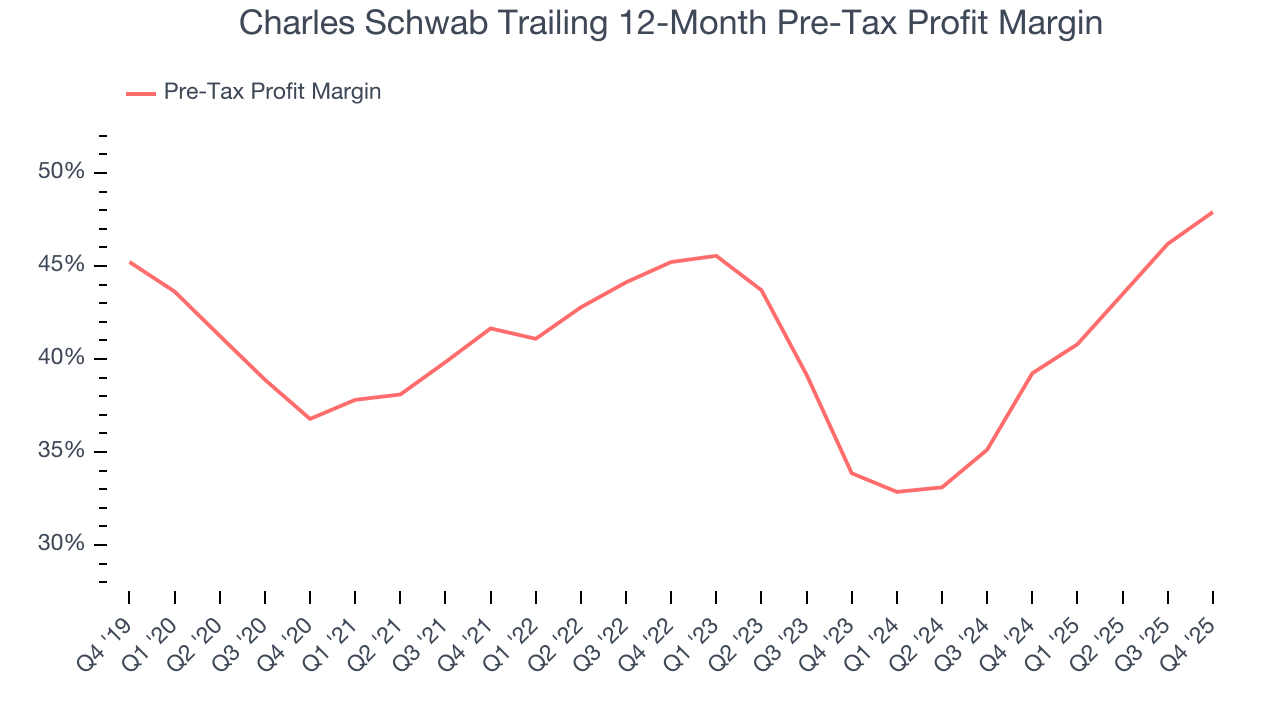

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Charles Schwab’s pre-tax profit margin has fallen by 11.1 percentage points, going from 41.6% to 47.9%. It has also expanded by 14 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Charles Schwab’s pre-tax profit margin came in at 50.2% this quarter. This result was 6.9 percentage points better than the same quarter last year.

7. Earnings Per Share

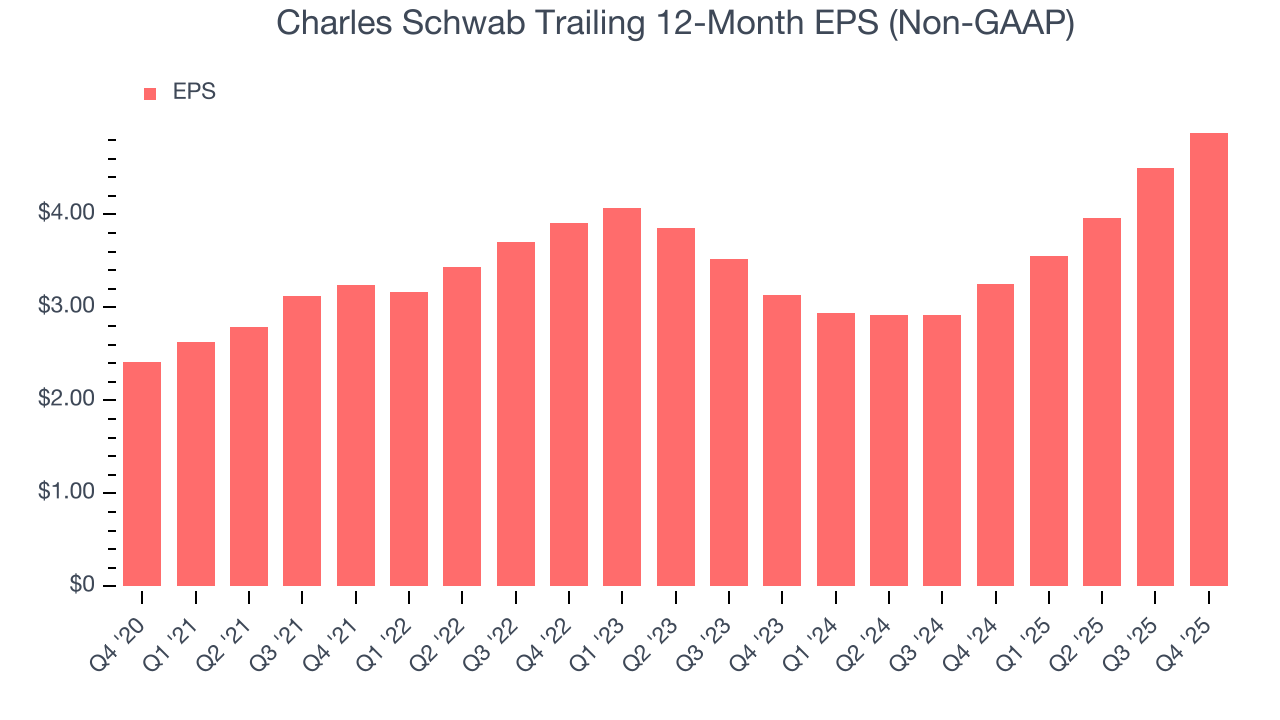

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Charles Schwab’s solid 15.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Charles Schwab’s two-year annual EPS growth of 24.9% was great and topped its 12.7% two-year revenue growth.

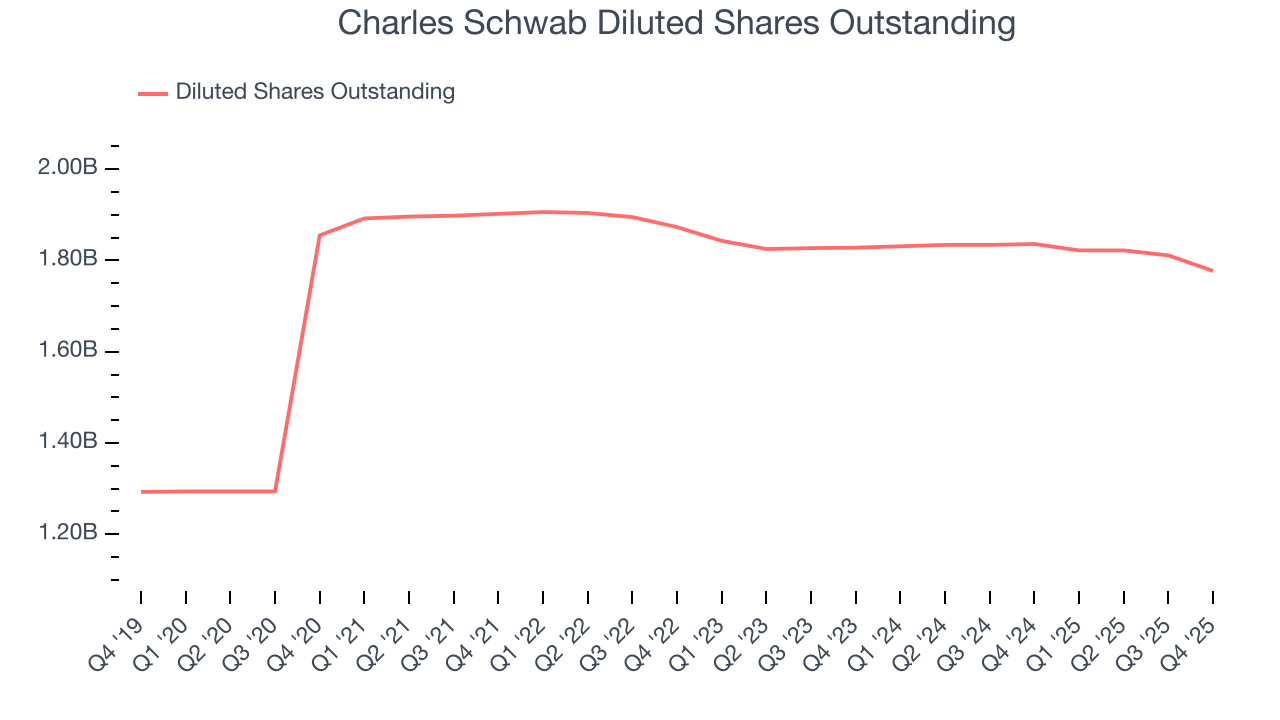

We can take a deeper look into Charles Schwab’s earnings to better understand the drivers of its performance. Charles Schwab’s pre-tax profit margin has expanded over the last two yearswhile its share count has shrunk 2.8%. Improving profitability and share buybacks are positive signs for shareholders as they juice EPS growth relative to revenue growth.

In Q4, Charles Schwab reported adjusted EPS of $1.39, up from $1.01 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Charles Schwab’s full-year EPS of $4.88 to grow 18.3%.

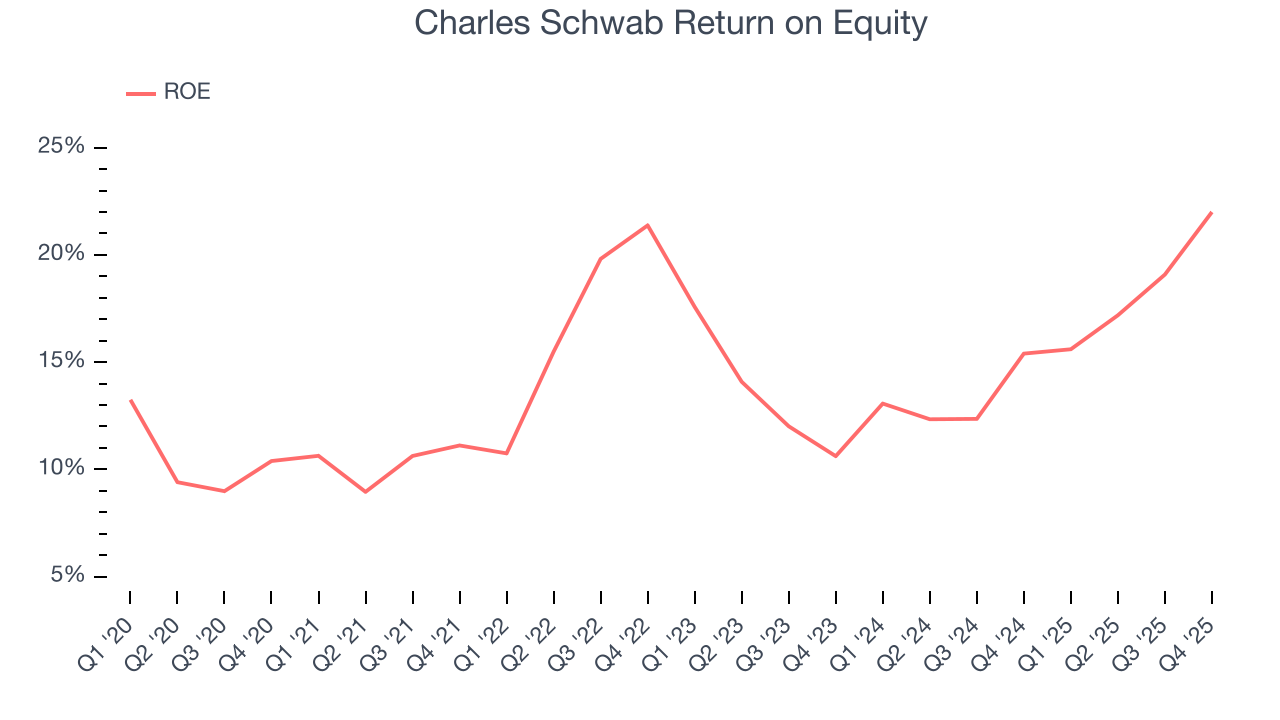

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Charles Schwab has averaged an ROE of 14.5%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Charles Schwab has a decent competitive moat.

9. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Charles Schwab has averaged a Tier 1 capital ratio of 27.9%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

10. Key Takeaways from Charles Schwab’s Q4 Results

We struggled to find many positives in these results. Revenue missed slightly, and EPS didn't make up for the topline shortfall, as it just met expectations. The stock traded down 1.2% to $98.77 immediately after reporting.

11. Is Now The Time To Buy Charles Schwab?

Updated: January 23, 2026 at 11:00 PM EST

Are you wondering whether to buy Charles Schwab or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Charles Schwab is a rock-solid business worth owning. For starters, its revenue growth was impressive over the last five years. On top of that, its expanding pre-tax profit margin shows the business has become more efficient, and its solid EPS growth over the last five years shows its profits are trickling down to shareholders.

Charles Schwab’s P/E ratio based on the next 12 months is 17.8x. Scanning the financials space today, Charles Schwab’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $120.94 on the company (compared to the current share price of $102.04), implying they see 18.5% upside in buying Charles Schwab in the short term.