Stifel (SF)

Stifel is a respectable business, but it isn’t exceptional. We believe there are better places to put your money in the market.― StockStory Analyst Team

1. News

2. Summary

Why Stifel Is Not Exciting

Tracing its roots back to 1890 when the firm was established in St. Louis, Stifel Financial (NYSE:SF) is a financial services firm that provides wealth management, investment banking, and institutional brokerage services to individuals, corporations, and institutions.

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 9% annually

- A silver lining is that its industry-leading 13.2% return on equity demonstrates management’s skill in finding high-return investments

Stifel doesn’t check our boxes. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Stifel

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Stifel

Stifel’s stock price of $128.62 implies a valuation ratio of 13.9x forward P/E. This multiple is cheaper than most financials peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Stifel (SF) Research Report: Q4 CY2025 Update

Financial services firm Stifel Financial (NYSE:SF) announced better-than-expected revenue in Q4 CY2025, with sales up 14.4% year on year to $1.56 billion. Its non-GAAP profit of $2.71 per share was 8% above analysts’ consensus estimates.

Stifel (SF) Q4 CY2025 Highlights:

- Assets Under Management: $224.5 billion (17.1% year-on-year growth)

- Revenue: $1.56 billion vs analyst estimates of $1.52 billion (14.4% year-on-year growth, 2.9% beat)

- Pre-tax Profit: $307.9 million (19.7% margin)

- Adjusted EPS: $2.71 vs analyst estimates of $2.51 (8% beat)

- Market Capitalization: $12.86 billion

Company Overview

Tracing its roots back to 1890 when the firm was established in St. Louis, Stifel Financial (NYSE:SF) is a financial services firm that provides wealth management, investment banking, and institutional brokerage services to individuals, corporations, and institutions.

Stifel operates through three main business segments: Global Wealth Management, Institutional Group, and Banking. The Global Wealth Management division forms the backbone of the company, with thousands of financial advisors across dozens of states offering securities transactions, brokerage services, and financial planning to private clients. These advisors help clients navigate investment options ranging from equities and fixed income securities to insurance products and fee-based asset management programs.

The Institutional Group segment serves corporate and institutional clients through several key services. Its research department publishes analysis across multiple industries, while the sales and trading teams distribute this research and execute trades for institutional investors. The investment banking division provides merger and acquisition advisory services and handles public offerings and private placements of debt and equity securities, primarily focusing on middle-market companies. For example, Stifel might help a mid-sized healthcare company raise capital through an initial public offering or advise on its acquisition strategy.

Stifel Bancorp, which includes Stifel Bank & Trust and Stifel Bank, offers both retail and commercial banking services. Private clients can access mortgage loans, home equity lines of credit, and securities-based lending, while businesses can utilize commercial real estate loans, lines of credit, and inventory financing. This banking arm allows Stifel to provide a more comprehensive suite of financial services and efficiently utilize client cash balances that are swept into its bank subsidiaries.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Stifel Financial competes with larger financial services firms like Morgan Stanley (NYSE:MS), Raymond James Financial (NYSE:RJF), and Jefferies Financial Group (NYSE:JEF), as well as regional investment banks and wealth management firms.

5. Revenue Growth

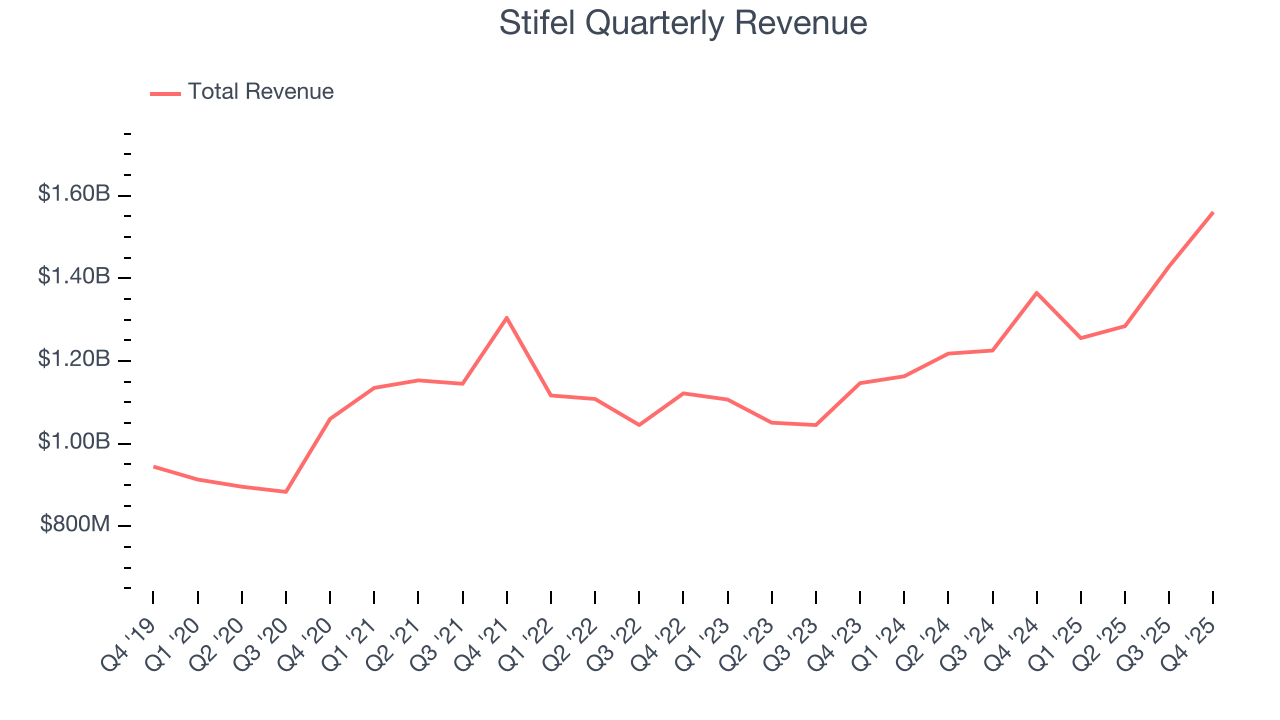

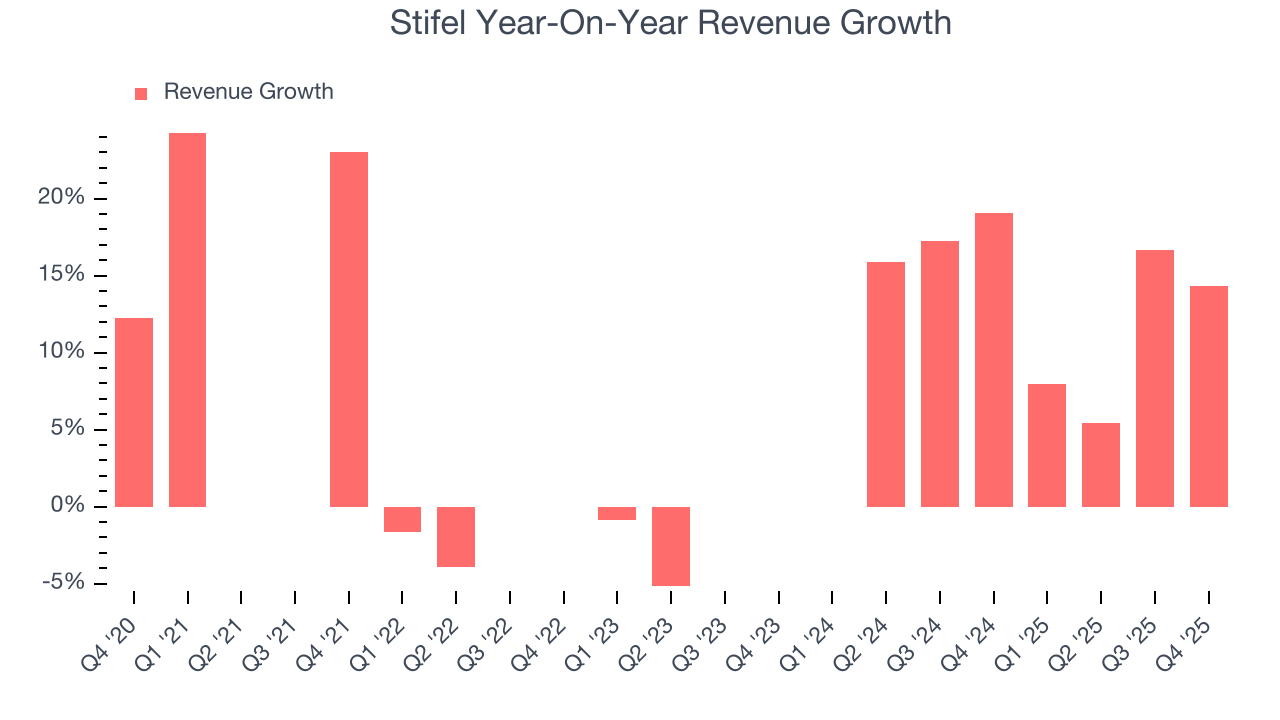

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Stifel’s revenue grew at a decent 8.1% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Stifel’s annualized revenue growth of 12.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Stifel reported year-on-year revenue growth of 14.4%, and its $1.56 billion of revenue exceeded Wall Street’s estimates by 2.9%.

6. Assets Under Management (AUM)

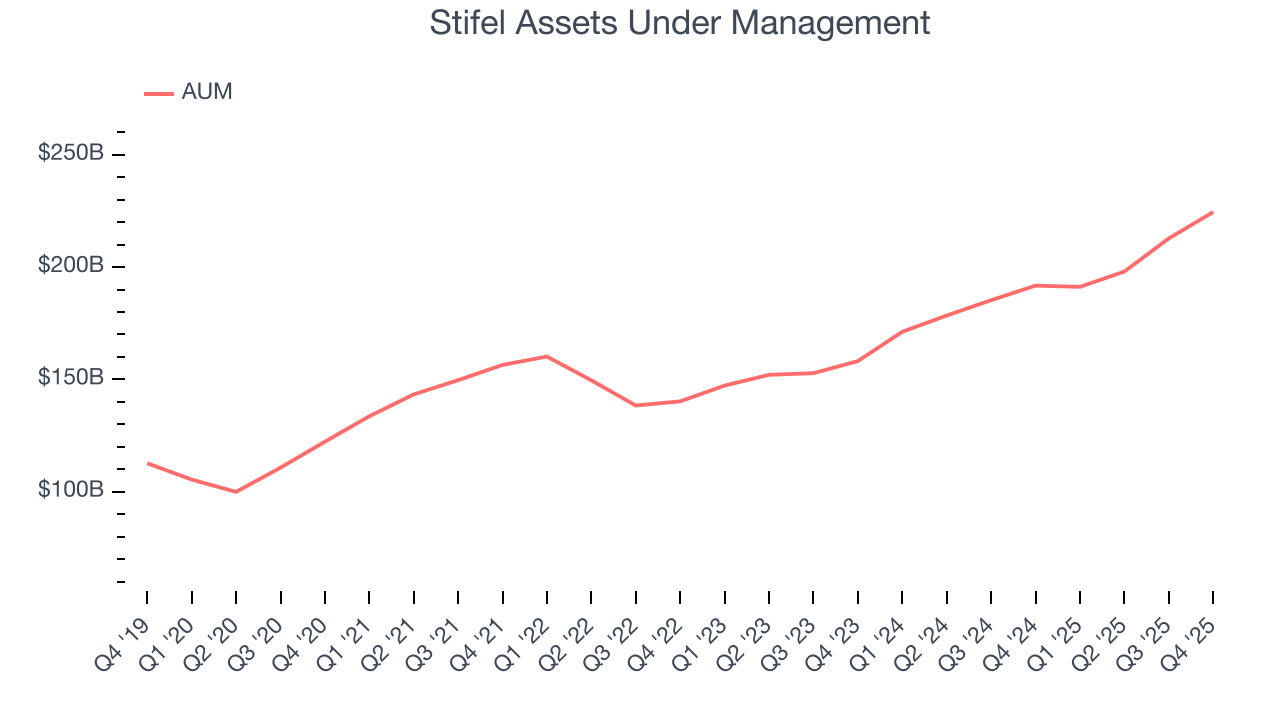

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

Stifel’s AUM has grown at an annual rate of 13.5% over the last five years, a step above the broader financials industry and faster than its total revenue. When analyzing Stifel’s AUM over the last two years, we can see that growth accelerated to 16.4% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. But again, we put less weight on asset growth given how lumpy and cyclical it can be.

Stifel’s AUM punched in at $224.5 billion this quarter. This print was 17.1% higher than the same quarter last year.

7. Pre-Tax Profit Margin

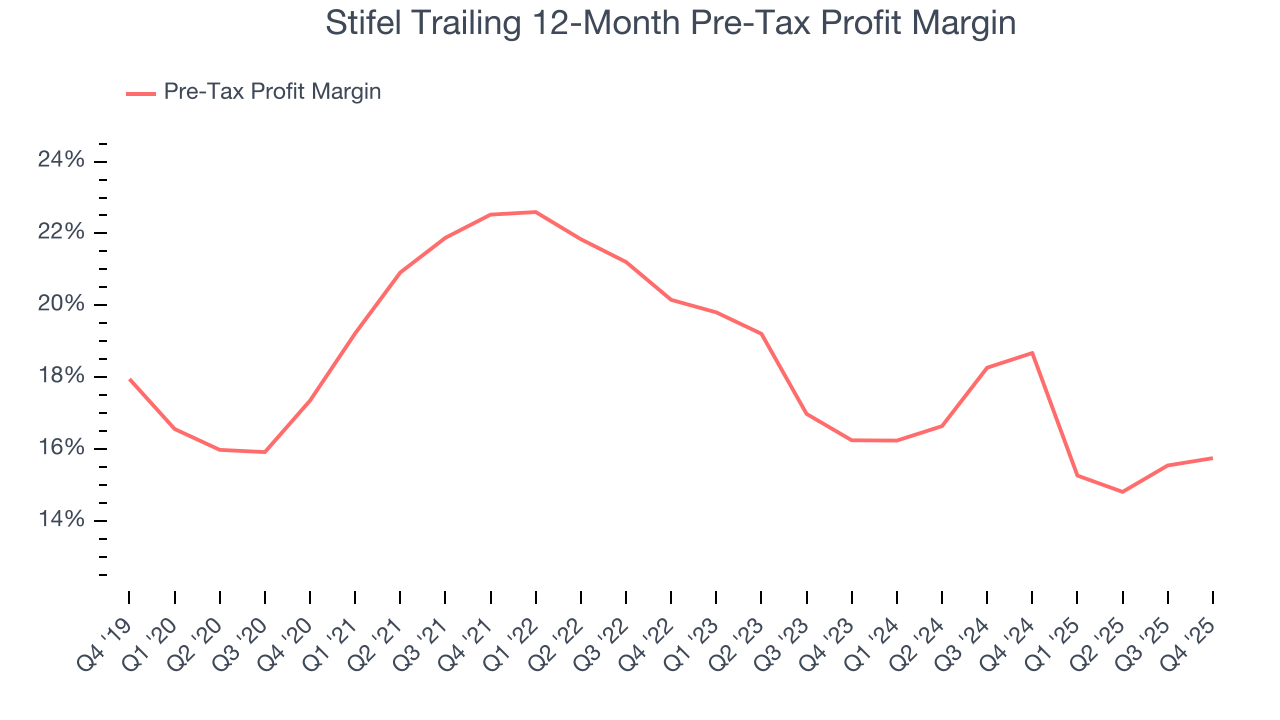

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last five years, Stifel’s pre-tax profit margin has risen by 1.6 percentage points, going from 22.5% to 15.8%. Expenses have stabilized more recently as the company’s pre-tax profit margin was flat on a two-year basis.

In Q4, Stifel’s pre-tax profit margin was 19.7%. This result was in line with the same quarter last year.

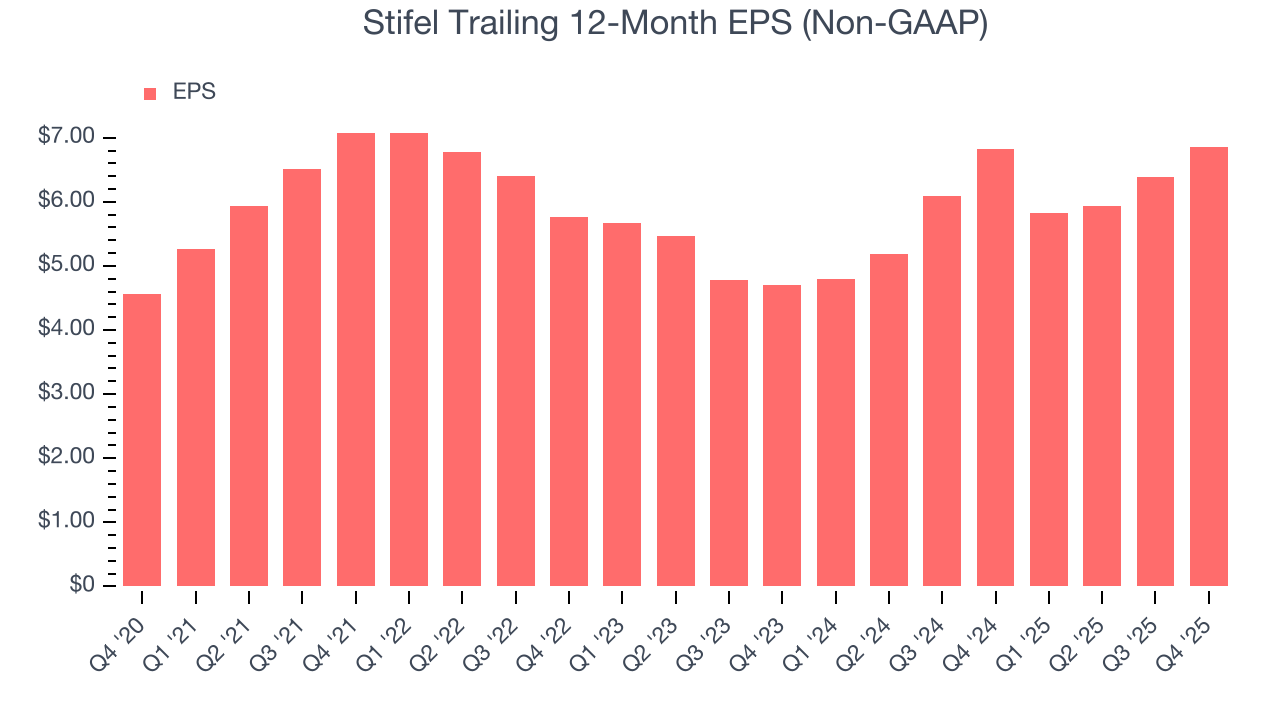

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Stifel’s unimpressive 8.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Stifel’s two-year annual EPS growth of 20.8% was great and topped its 12.8% two-year revenue growth.

In Q4, Stifel reported adjusted EPS of $2.71, up from $2.23 in the same quarter last year. This print beat analysts’ estimates by 8%. Over the next 12 months, Wall Street expects Stifel’s full-year EPS of $6.86 to grow 41.8%.

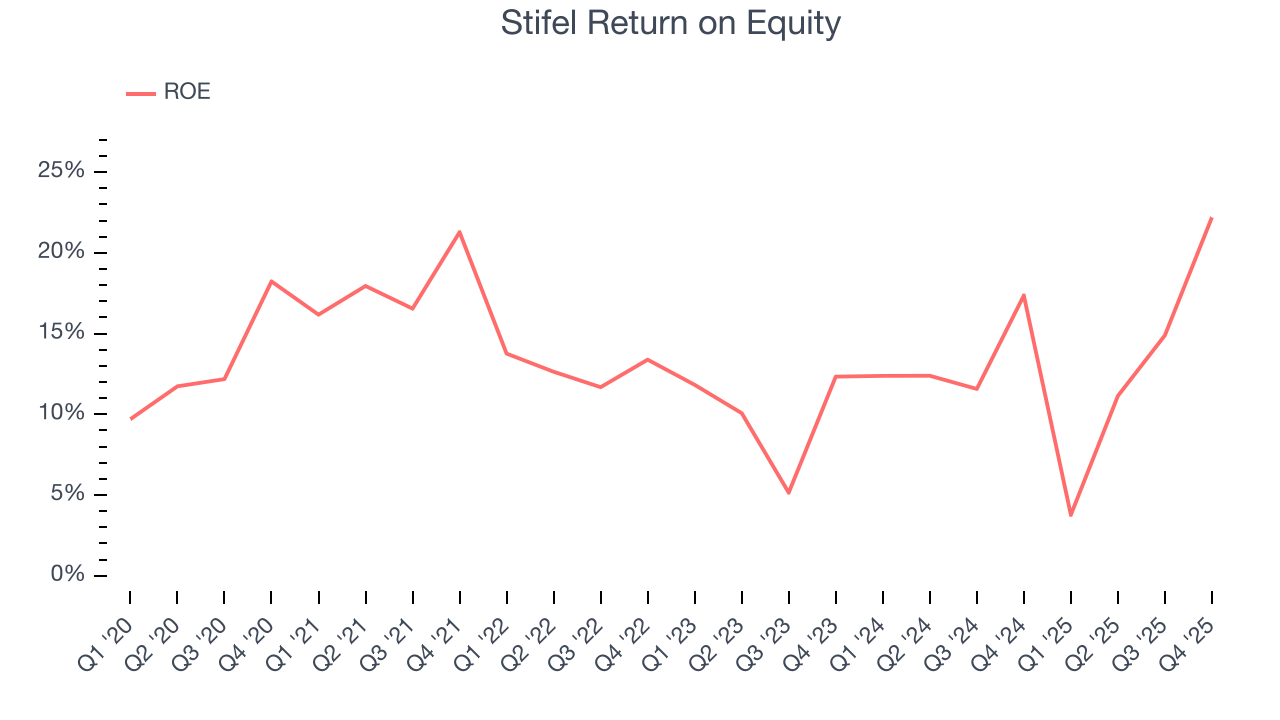

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Stifel has averaged an ROE of 13.4%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Stifel.

10. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Stifel has averaged a Tier 1 capital ratio of 14.8%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

11. Key Takeaways from Stifel’s Q4 Results

It was good to see Stifel beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2.8% to $129.88 immediately following the results.

12. Is Now The Time To Buy Stifel?

Updated: January 28, 2026 at 7:35 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Stifel has a few positive attributes, but it doesn’t top our wishlist. First off, its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months. And while its declining pre-tax profit margin shows the business has become less efficient, its AUM growth was solid over the last five years. On top of that, its above-average ROE suggests its management team has made good investment decisions.

Stifel’s P/E ratio based on the next 12 months is 13x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $139.75 on the company (compared to the current share price of $129.88).