Skillz (SKLZ)

Skillz is up against the odds. Its plummeting sales and historical cash burn make us question the business’s long-term viability.― StockStory Analyst Team

1. News

2. Summary

Why We Think Skillz Will Underperform

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

- Sales tumbled by 33.5% annually over the last three years, showing consumer trends are working against its favor

- Historical EBITDA margin losses point to an inefficient cost structure

- Negative free cash flow raises questions about the return timeline for its investments

Skillz’s quality isn’t up to par. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Skillz

Why There Are Better Opportunities Than Skillz

At $4.35 per share, Skillz trades at 0.7x forward price-to-gross profit. This multiple rich for the business quality. Not a great combination.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. Skillz (SKLZ) Research Report: Q3 CY2025 Update

Mobile game developer Skillz (NYSE:SKLZ) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 11.4% year on year to $27.37 million. Its GAAP loss of $1.14 per share was 3.6% below analysts’ consensus estimates.

Skillz (SKLZ) Q3 CY2025 Highlights:

- Revenue: $27.37 million vs analyst estimates of $29.07 million (11.4% year-on-year growth, 5.8% miss)

- EPS (GAAP): -$1.14 vs analyst expectations of -$1.10 (3.6% miss)

- Adjusted EBITDA: -$11.76 million vs analyst estimates of -$7.54 million (-43% margin, 56% miss)

- Operating Margin: -59.4%, up from -85.5% in the same quarter last year

- Free Cash Flow was -$25.8 million compared to -$22.5 million in the previous quarter

- Paying Monthly Active Users: 155,000, up 34,000 year on year

- Market Capitalization: $97.19 million

Company Overview

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Having gone public via SPAC in December 2020, Skillz provides a mobile gaming platform for developers to create and distribute games where users can pay fees to compete for real cash prizes. The company maintains that because winning is based on skill and not on chance, its games are not traditional casino gambling. However, some argue there is potential legal risk as the lines can sometimes be blurred.

Developers can use Skillz's software development kit (SDK) to add competitive multiplayer functionality and cash prize tournaments to their games, while players can compete against each other for real money. Skillz generates revenue by taking a percentage of the entry fees and cash prizes of each tournament. Game developers themselves can monetize their games through advertisements and in-app purchases. As a result of this dynamic, Skillz and game developers are incentivized to make games addictive to keep player engagement–which drives revenue–high.

Solitaire Cube is an example of a popular game on the Skillz platform. This game resembles the classic solitaire card game, but players can compete head-to-head or in tournaments against others for real money.

4. Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Competitors offering casual digital games that may feature casino-like activities include PLAYSTUDIOS (NASDAQ:MYPS) and Huuuge (WSE:HUG).

5. Revenue Growth

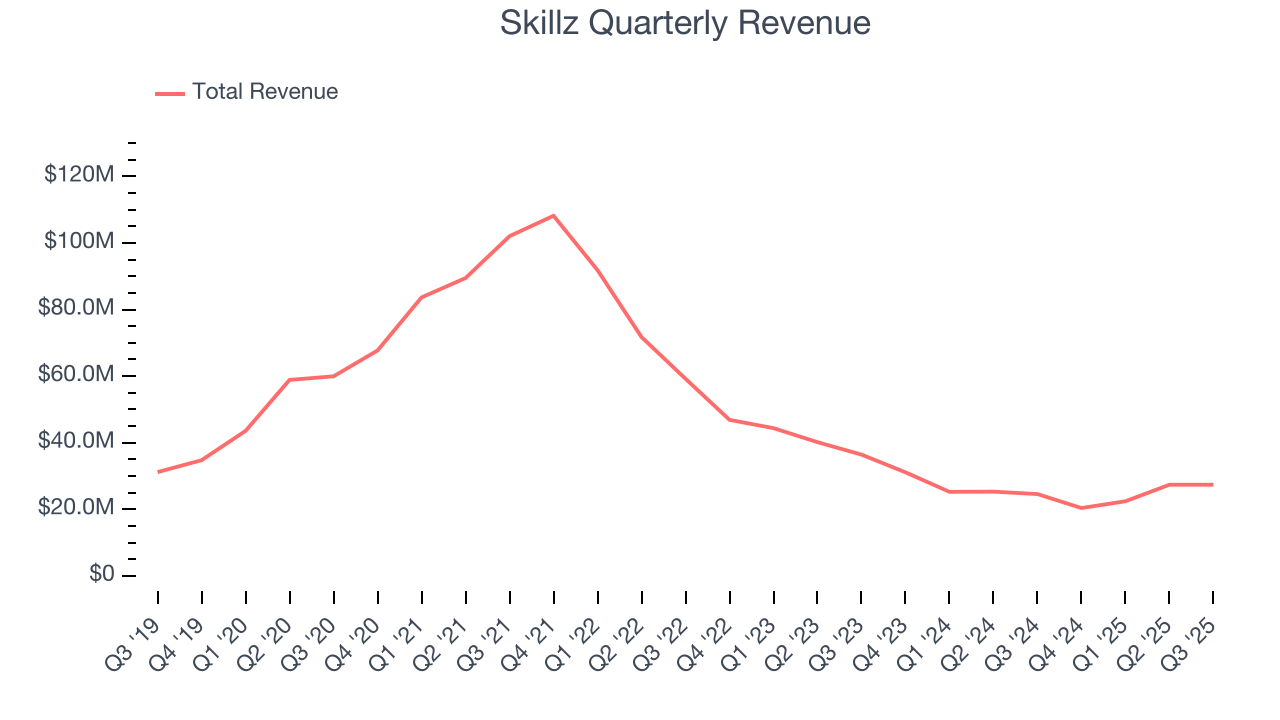

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Skillz’s demand was weak over the last three years as its sales fell at a 33.5% annual rate. This was below our standards and is a sign of poor business quality.

This quarter, Skillz’s revenue grew by 11.4% year on year to $27.37 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 21.1% over the next 12 months, an acceleration versus the last three years. This projection is noteworthy and suggests its newer products and services will catalyze better top-line performance.

6. Paying Monthly Active Users

User Growth

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

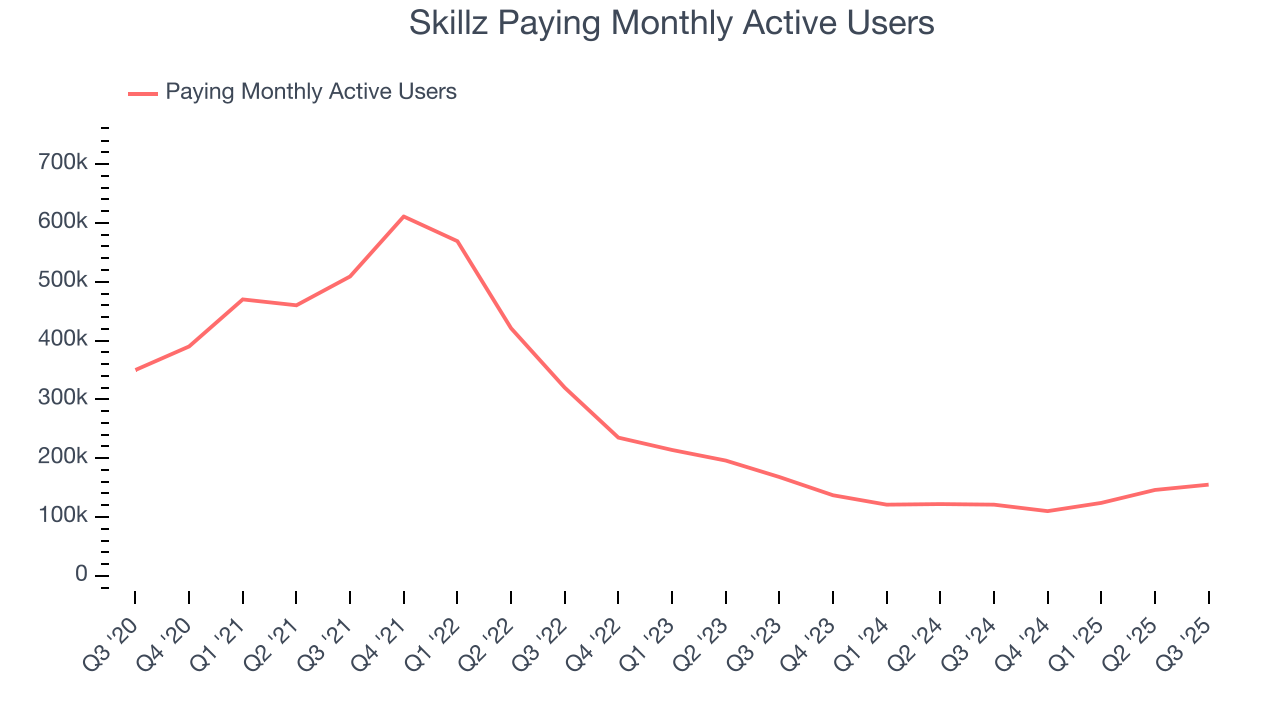

Skillz struggled with new customer acquisition over the last two years as its paying monthly active users have declined by 15% annually to 155,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Skillz wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Luckily, Skillz added 34,000 paying monthly active users in Q3, leading to 28.1% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

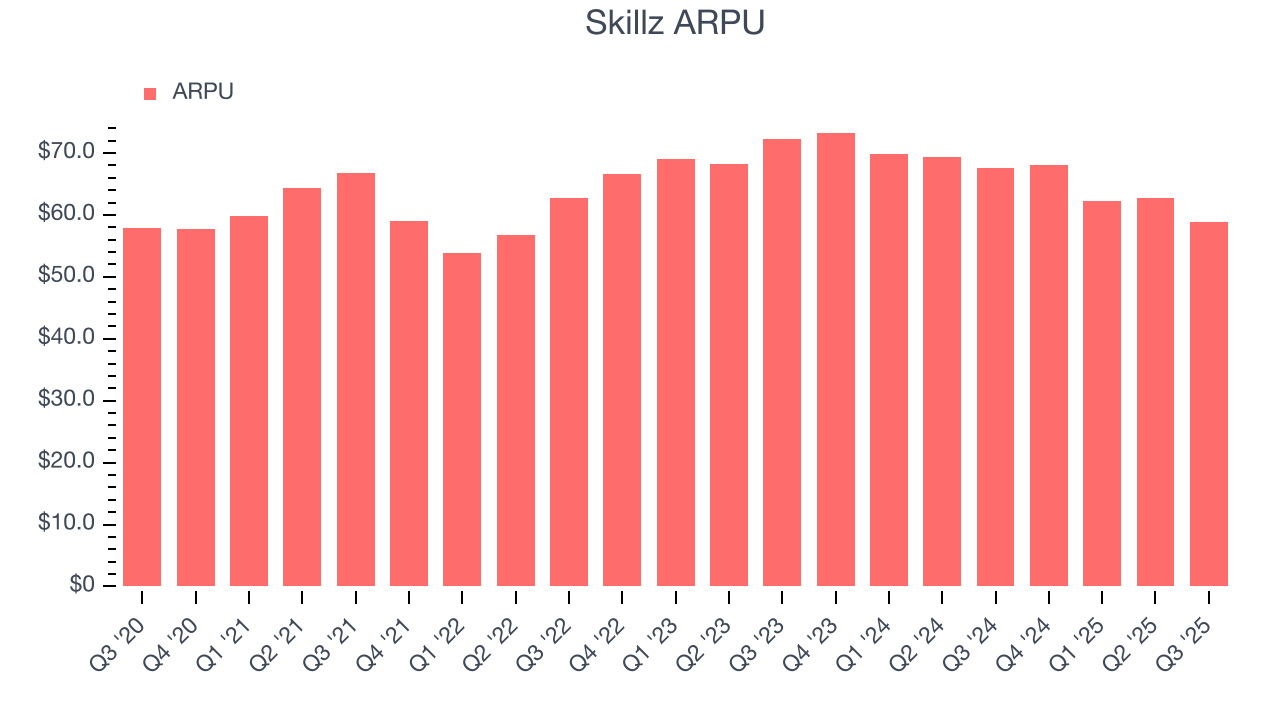

Average revenue per user (ARPU) is a critical metric to track because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Skillz’s ARPU fell over the last two years, averaging 4.3% annual declines. This signals its platform’s value is eroding when paired with its declining paying monthly active users. If Skillz wants to increase its users, it must either develop new features or provide some existing ones for free.

This quarter, Skillz’s ARPU clocked in at $58.90. It declined 12.9% year on year, worse than the change in its paying monthly active users.

7. Gross Margin & Pricing Power

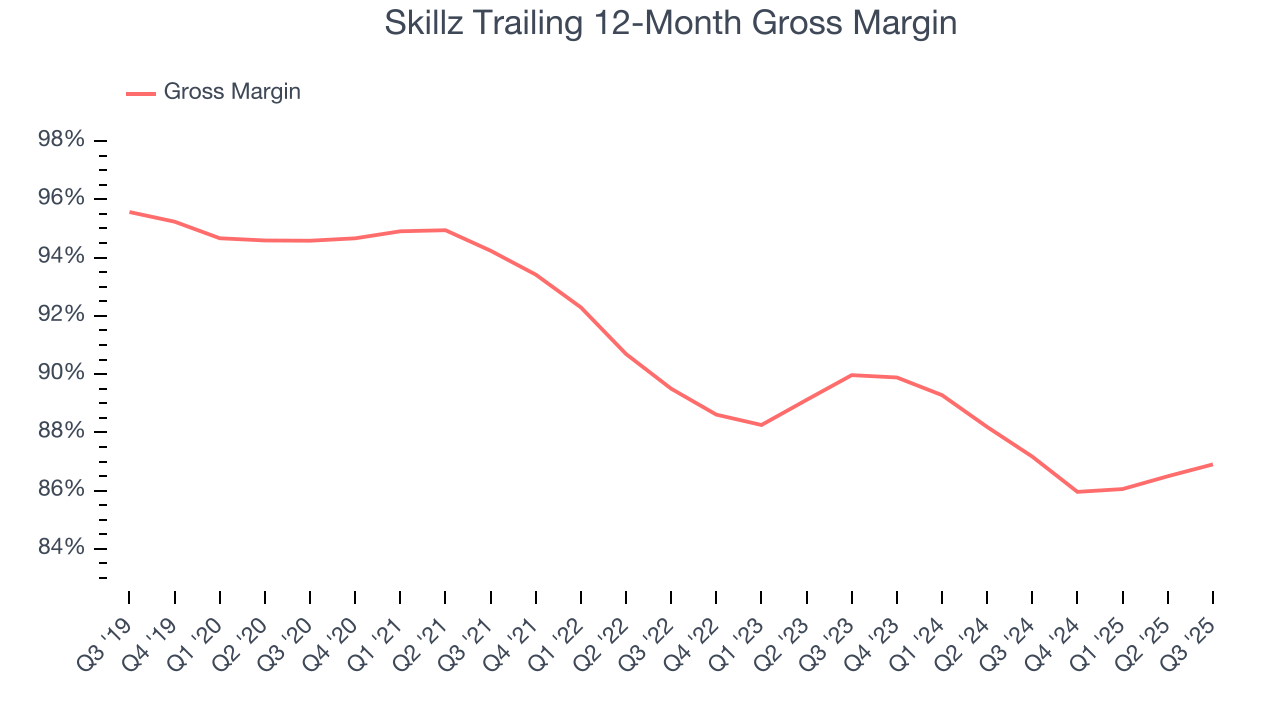

For gaming businesses like Skillz, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include royalties to sports leagues or celebrities featured in games, fees paid to Alphabet or Apple for games downloaded in their digital app stores, and data center hosting expenses associated with delivering games over the internet.

Skillz’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 87% gross margin over the last two years. That means Skillz only paid its providers $12.96 for every $100 in revenue.

In Q3, Skillz produced a 87.7% gross profit margin, marking a 1.5 percentage point increase from 86.3% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

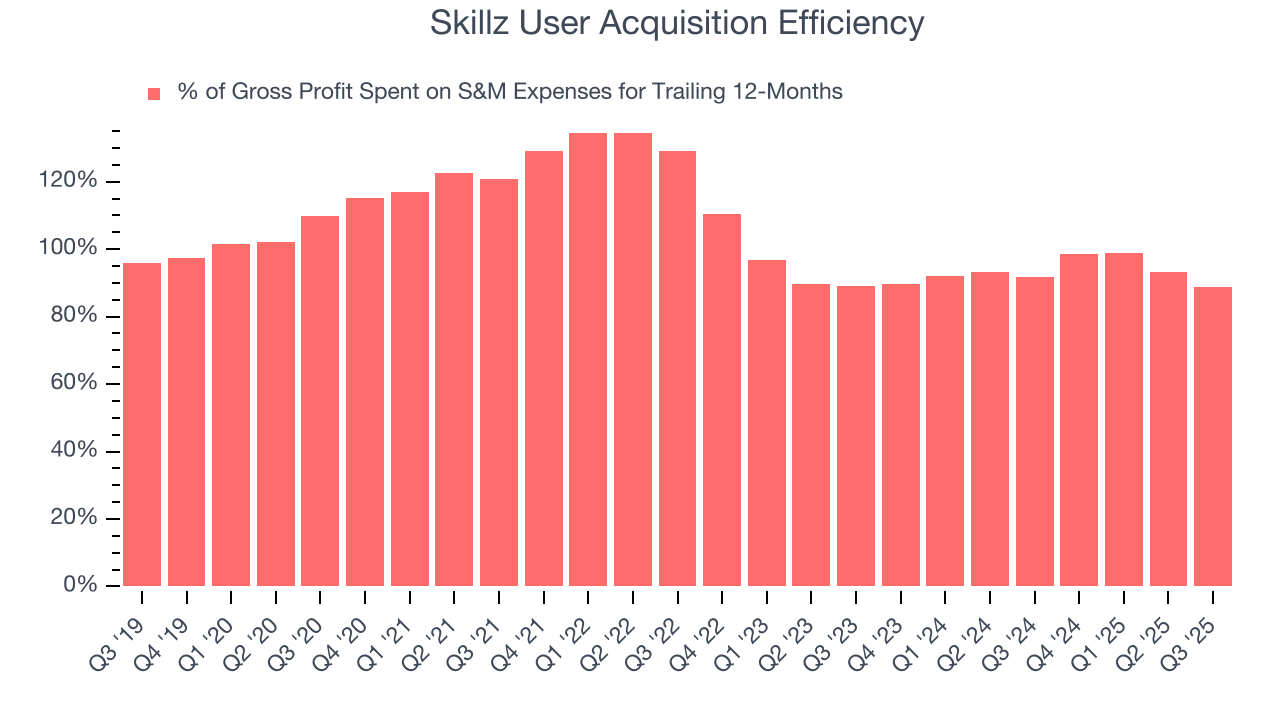

8. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Skillz grow from a combination of product virality, paid advertisement, and incentives.

It’s very expensive for Skillz to acquire new users as the company has spent 88.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Skillz and its peers.

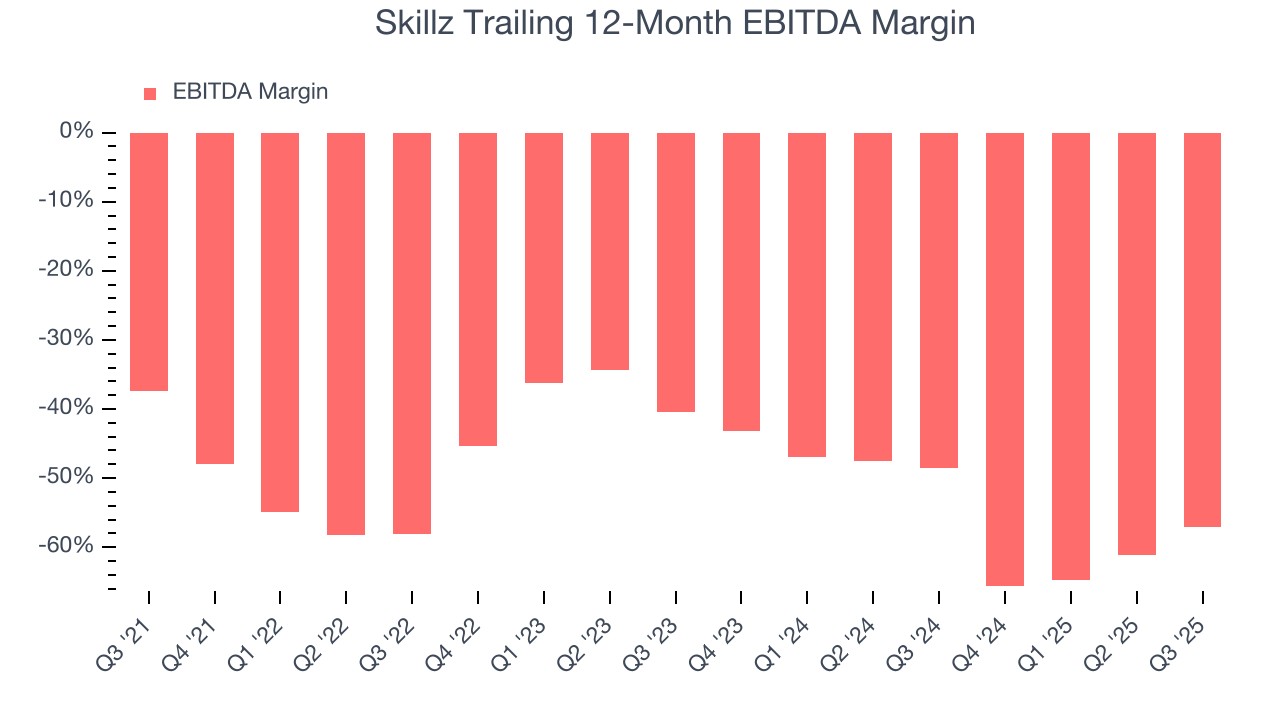

9. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Skillz’s EBITDA margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging negative 52.6% over the last two years. Unprofitable consumer internet companies that fail to improve their losses or grow sales rapidly deserve extra scrutiny. For the time being, it’s unclear if Skillz’s business model is sustainable.

Looking at the trend in its profitability, Skillz’s EBITDA margin might fluctuated slightly but has generally stayed the same over the last few years, meaning it will take a fundamental shift in the business model to change.

Skillz’s EBITDA margin was negative 43% this quarter. The company's consistent lack of profits raise a flag.

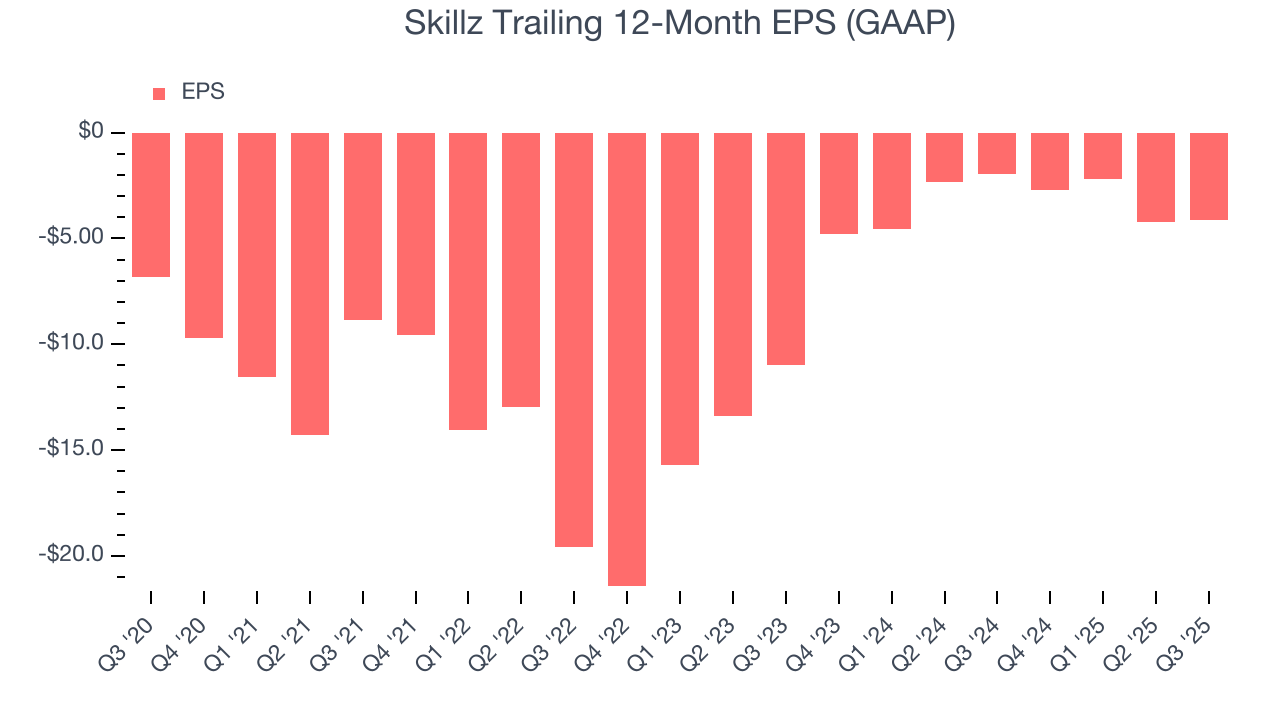

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, Skillz reported EPS of negative $1.14, up from negative $1.20 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Skillz to perform poorly. Analysts forecast its full-year EPS of negative $4.14 will tumble to negative $4.20.

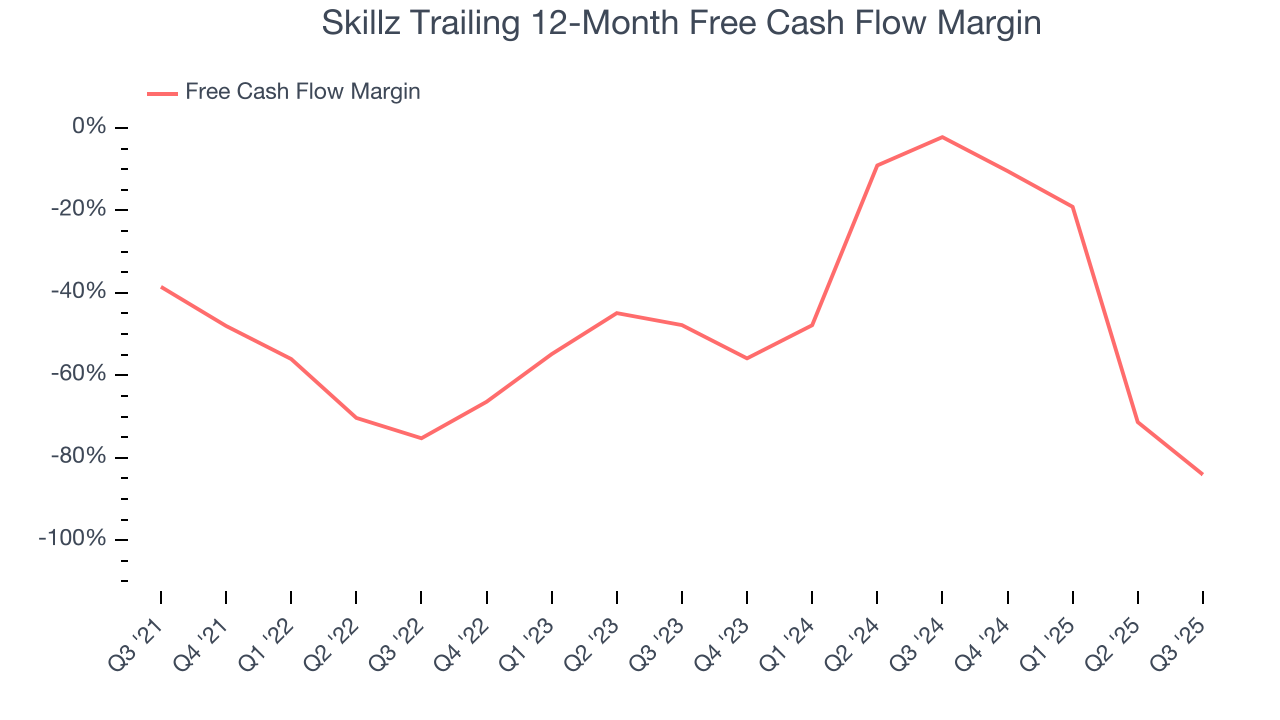

11. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Skillz’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 41.4%, meaning it lit $41.39 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Skillz’s margin dropped by 8.8 percentage points over the last few years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Skillz burned through $25.8 million of cash in Q3, equivalent to a negative 94.3% margin. The company’s cash burn was similar to its $11.38 million of lost cash in the same quarter last year.

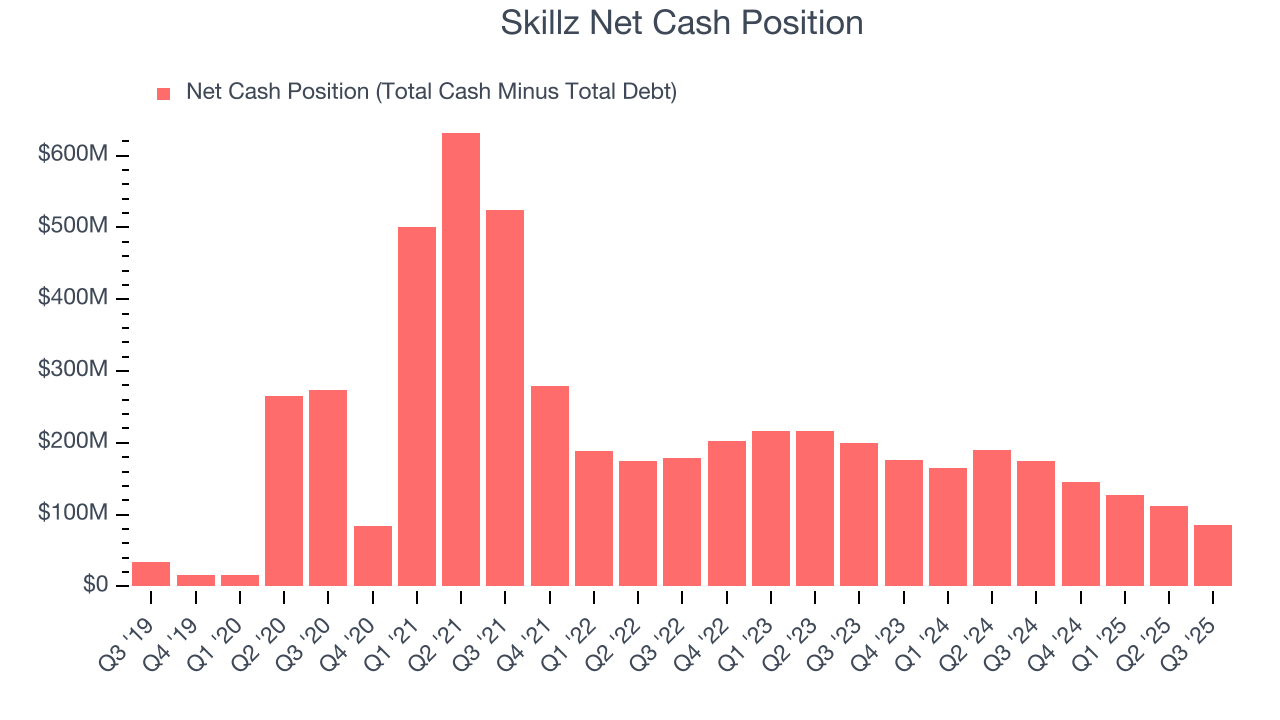

12. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Skillz is a well-capitalized company with $212.8 million of cash and $127.3 million of debt on its balance sheet. This $85.54 million net cash position is 88% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Skillz’s Q3 Results

We enjoyed seeing Skillz increase its number of users this quarter. We were also glad its number of paying monthly active users outperformed Wall Street’s estimates. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.7% to $6 immediately following the results.

14. Is Now The Time To Buy Skillz?

Updated: January 12, 2026 at 9:32 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies serving everyday consumers, but in the case of Skillz, we’ll be cheering from the sidelines. For starters, its revenue has declined over the last three years. And while its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its sales and marketing spend is very high compared to other consumer internet businesses. On top of that, its monthly active users have declined.

Skillz’s price-to-gross profit ratio based on the next 12 months is 0.7x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $6 on the company (compared to the current share price of $4.35).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.