Champion Homes (SKY)

We’re not sold on Champion Homes. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Champion Homes Is Not Exciting

Founded in 1951, Champion Homes (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

- Estimated sales growth of 2.6% for the next 12 months implies demand will slow from its two-year trend

- Gross margin of 26.9% is below its competitors, leaving less money to invest in areas like marketing and R&D

- A positive is that its annual revenue growth of 16.2% over the past five years was outstanding, reflecting market share gains this cycle

Champion Homes’s quality is inadequate. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Champion Homes

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Champion Homes

Champion Homes is trading at $91.64 per share, or 26.2x forward P/E. We acknowledge that the current valuation is justified, but we’re passing on this stock for the time being.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Champion Homes (SKY) Research Report: Q3 CY2025 Update

Modular home and building manufacturer Champion Homes (NYSE:SKY) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 11% year on year to $684.4 million. Its non-GAAP profit of $1.01 per share was 23.1% above analysts’ consensus estimates.

Champion Homes (SKY) Q3 CY2025 Highlights:

- Revenue: $684.4 million vs analyst estimates of $640.2 million (11% year-on-year growth, 6.9% beat)

- Adjusted EPS: $1.01 vs analyst estimates of $0.82 (23.1% beat)

- Adjusted EBITDA: $83.35 million vs analyst estimates of $66.43 million (12.2% margin, 25.5% beat)

- Operating Margin: 10.9%, in line with the same quarter last year

- Free Cash Flow Margin: 9.8%, up from 7.4% in the same quarter last year

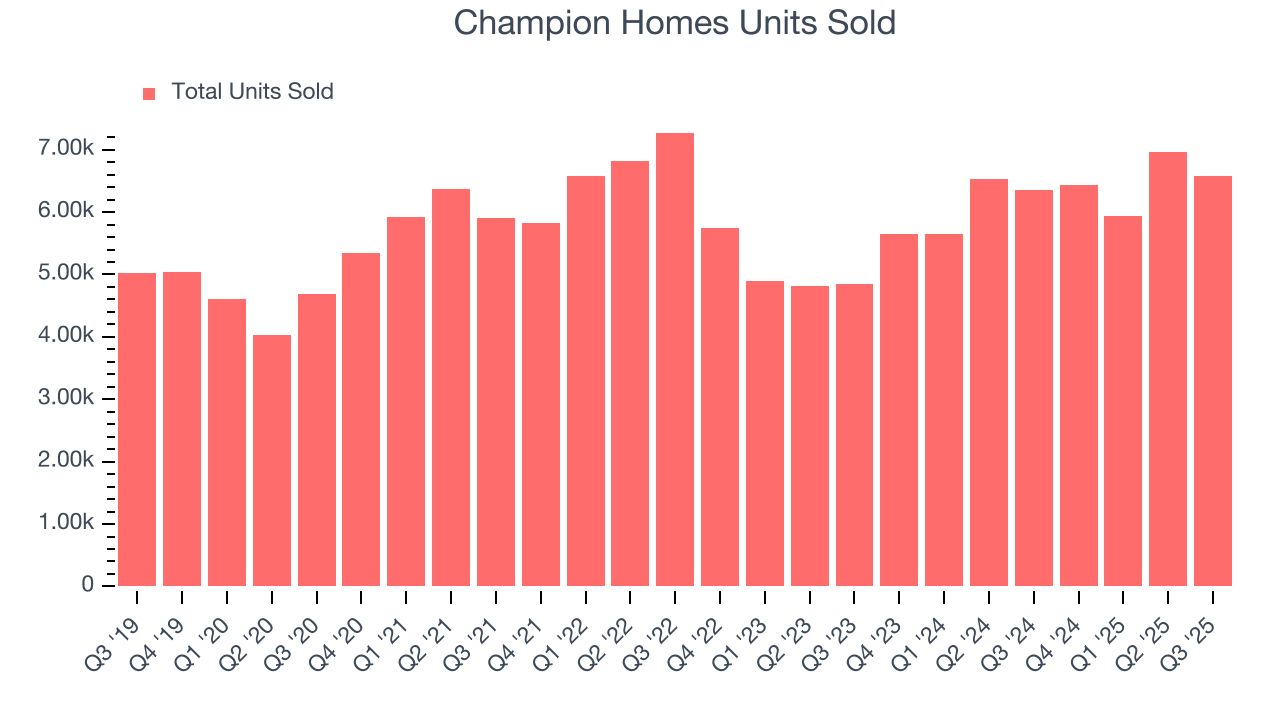

- Sales Volumes rose 3.4% year on year (31.3% in the same quarter last year)

- Market Capitalization: $3.76 billion

Company Overview

Founded in 1951, Champion Homes (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Champion Corporation is a leading producer of factory-built housing in North America, offering a comprehensive portfolio of manufactured and modular homes, park model RVs, accessory dwelling units, and modular buildings for the multi-family and hospitality sectors. The company operates 41 manufacturing facilities across the United States and western Canada, strategically located to serve strong markets and capitalize on the growing demand for affordable housing.

Champion Homes's success is driven by its extensive product offerings, strong brand reputation, broad manufacturing footprint, and complementary retail and logistics businesses. The company's commitment to innovation and sustainability is evident in its continuous improvement initiatives, standardized manufacturing processes, and investments in production automation and digital technology.

In addition to its core homebuilding business, Skyline Champion operates a factory-direct retail business, Titan Factory Direct, and a logistics business, Star Fleet Trucking, which provides transportation services to the manufactured housing and recreational vehicle industries. The company's balanced approach to organic growth and strategic acquisitions has allowed it to expand its presence and market share in key regions across North America.

4. Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Competitors in the modular building sector include Cavco Industries (NASDAQ:CVCO), Legacy Housing (NASDAQ:LEGH), and Meritage Homes (NYSE:MTH).

5. Revenue Growth

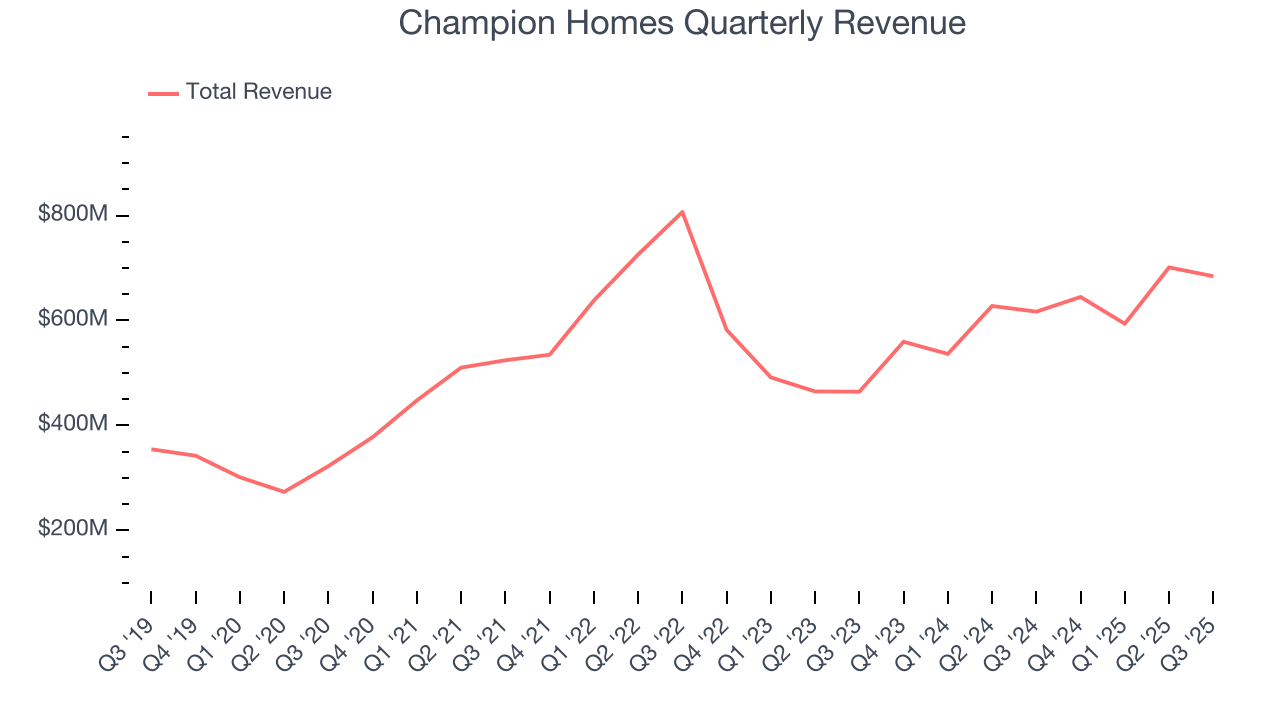

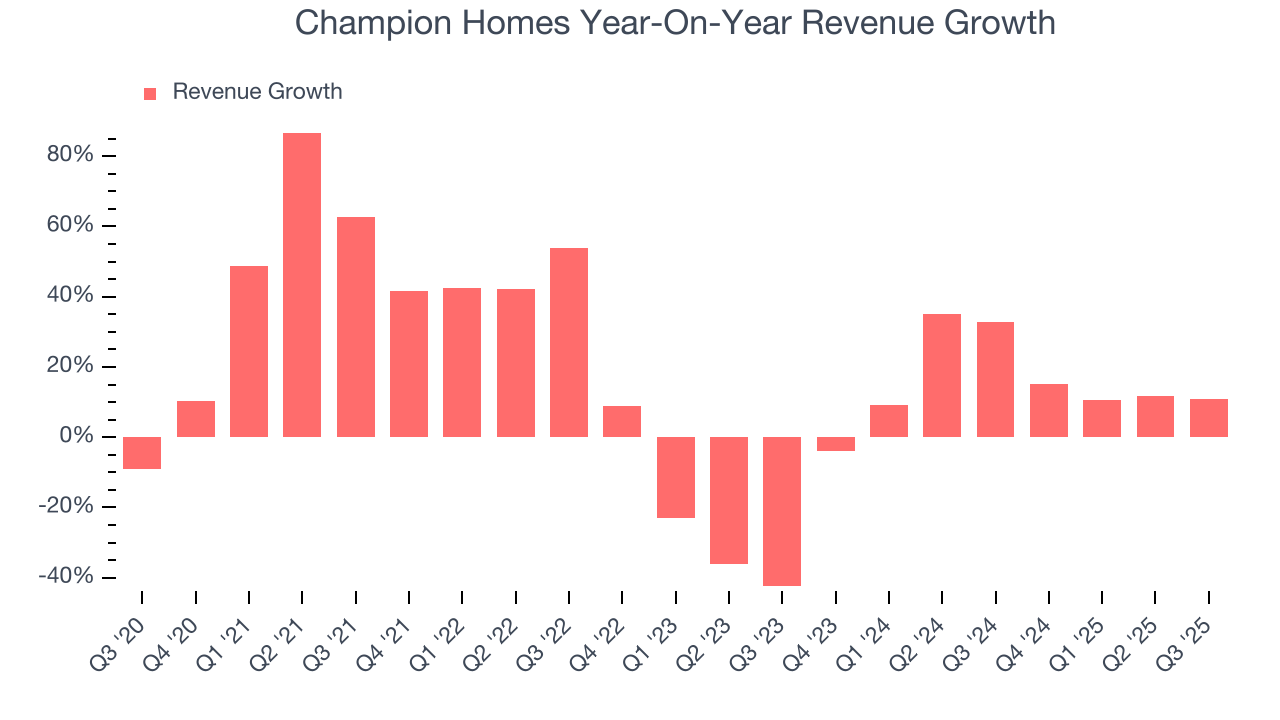

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Champion Homes grew its sales at an incredible 16.2% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Champion Homes’s annualized revenue growth of 14.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 6,575 in the latest quarter. Over the last two years, Champion Homes’s units sold averaged 13.7% year-on-year growth. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, Champion Homes reported year-on-year revenue growth of 11%, and its $684.4 million of revenue exceeded Wall Street’s estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

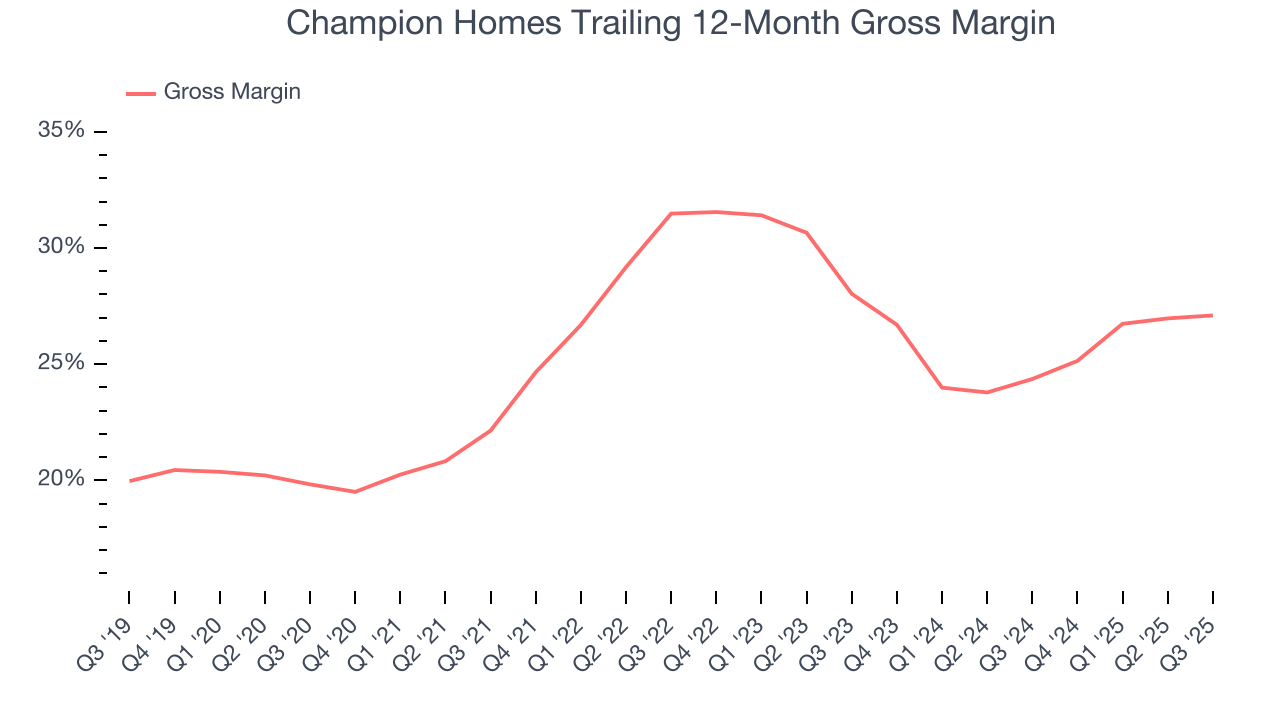

Champion Homes has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.9% gross margin over the last five years. Said differently, Champion Homes had to pay a chunky $73.07 to its suppliers for every $100 in revenue.

Champion Homes’s gross profit margin came in at 27.5% this quarter, in line with the same quarter last year. On a wider time horizon, Champion Homes’s full-year margin has been trending up over the past 12 months, increasing by 2.7 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

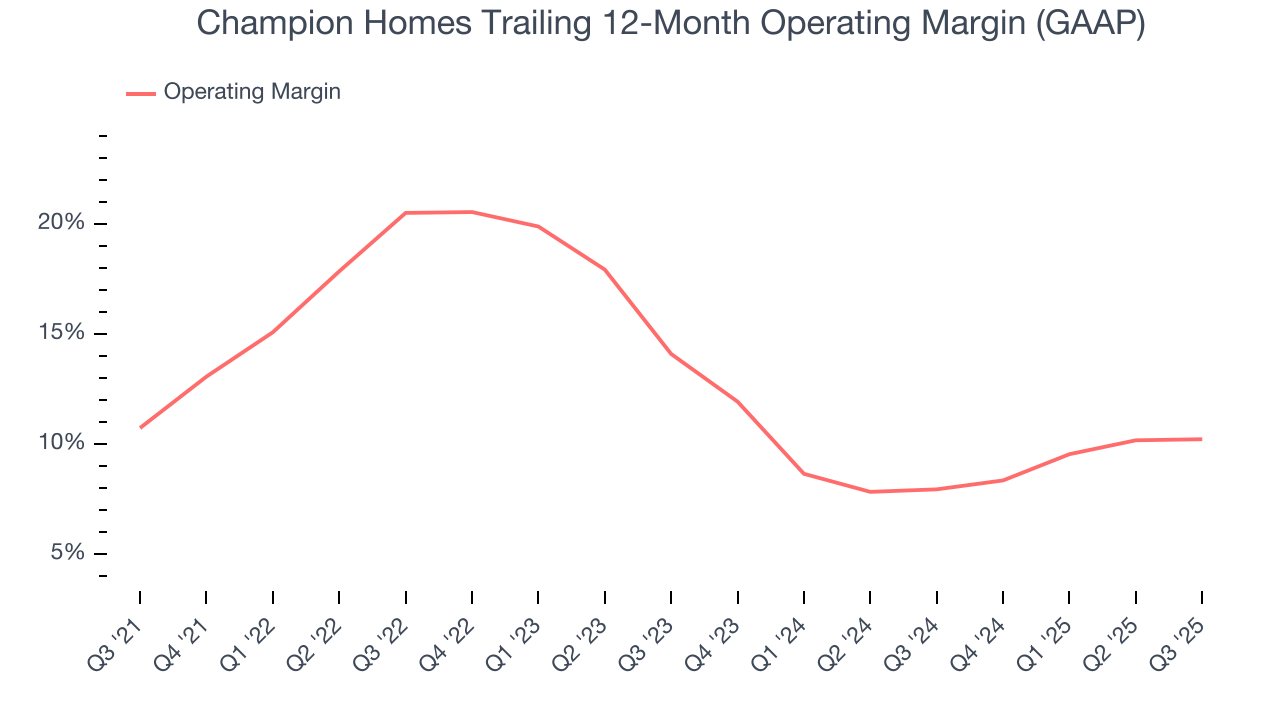

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Champion Homes’s operating margin has risen over the last 12 months and averaged 12.9% over the last five years. On top of that, its profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Champion Homes’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with Champion Homes’s performance considering most Home Builders companies saw their margins plummet.

This quarter, Champion Homes generated an operating margin profit margin of 10.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

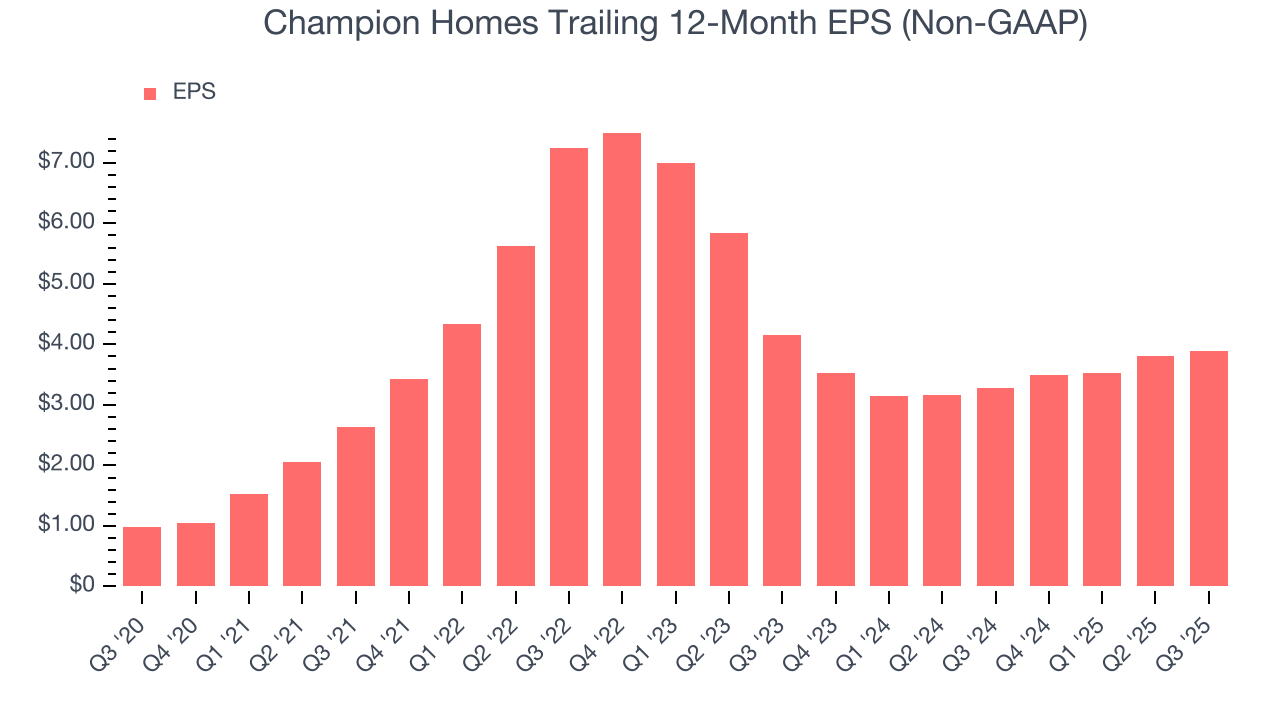

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Champion Homes’s EPS grew at an astounding 31.5% compounded annual growth rate over the last five years, higher than its 16.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Champion Homes, its two-year annual EPS declines of 3.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Champion Homes can return to earnings growth in the future.

In Q3, Champion Homes reported adjusted EPS of $1.01, up from $0.93 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Champion Homes’s full-year EPS of $3.89 to shrink by 10%.

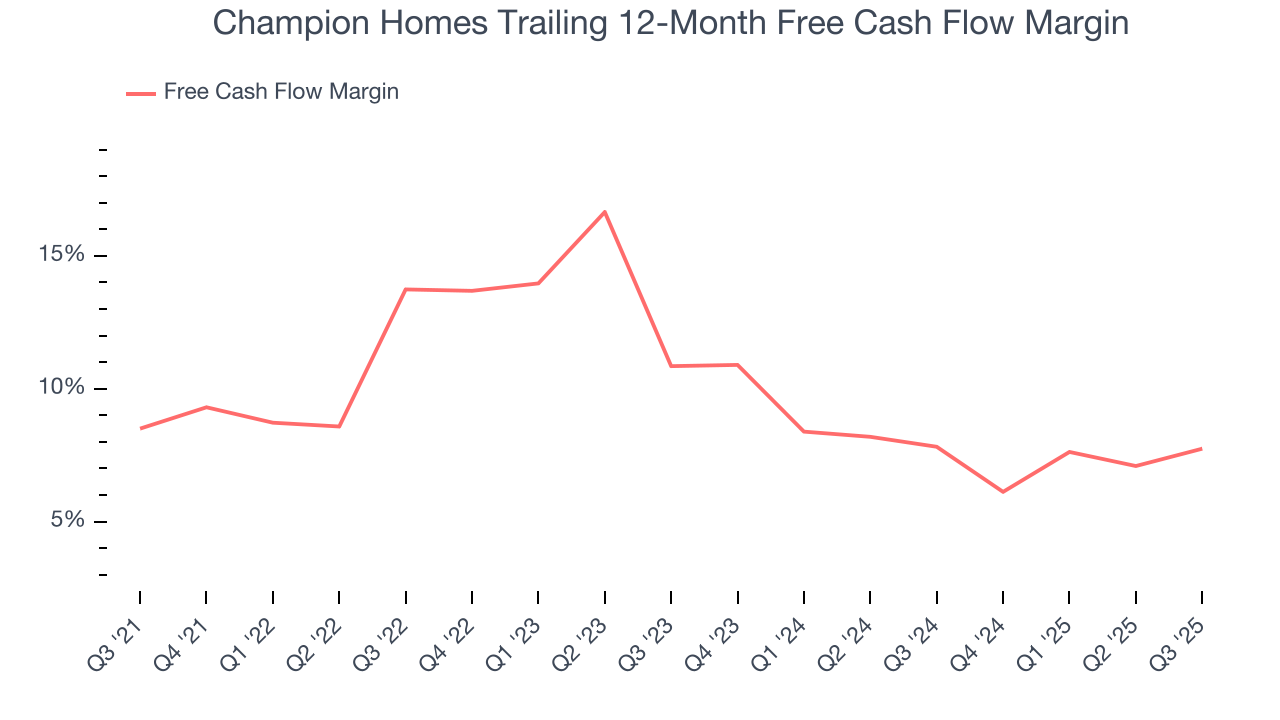

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Champion Homes has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 9.8% over the last five years, quite impressive for an industrials business.

Champion Homes’s free cash flow clocked in at $67.41 million in Q3, equivalent to a 9.8% margin. This result was good as its margin was 2.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

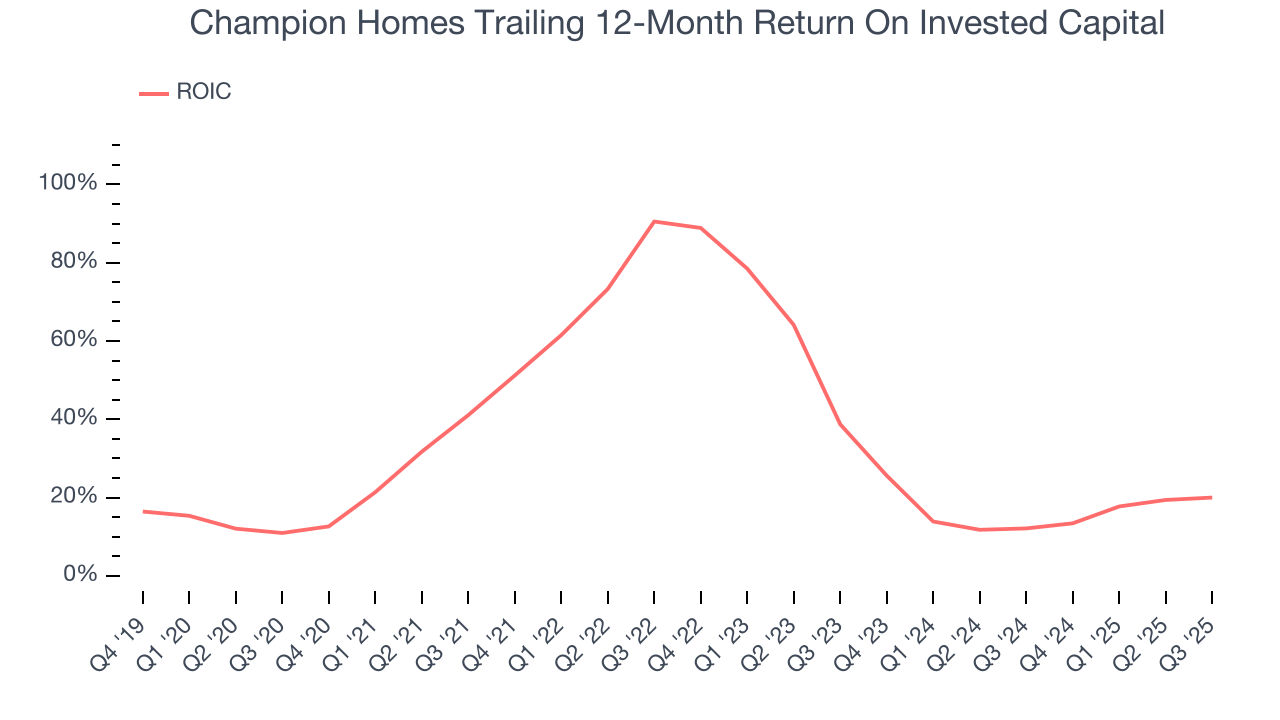

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Champion Homes hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 40.5%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Champion Homes’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

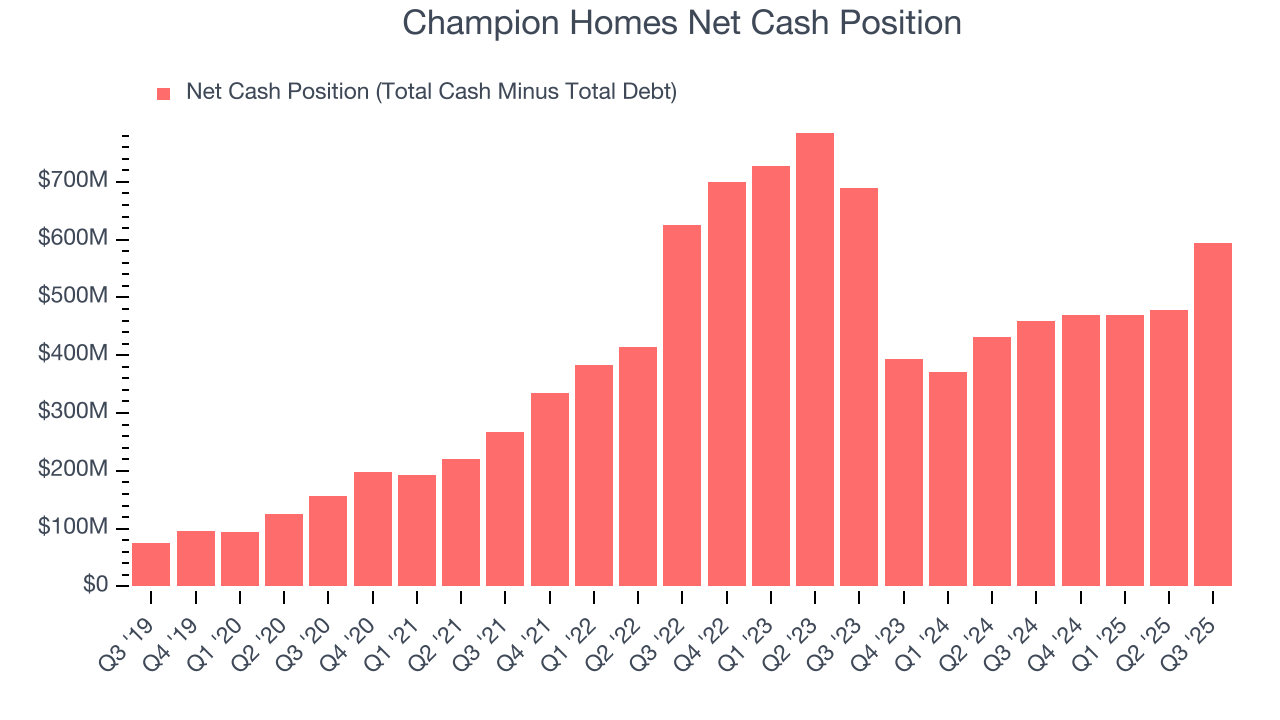

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Champion Homes is a profitable, well-capitalized company with $618.7 million of cash and $24.05 million of debt on its balance sheet. This $594.7 million net cash position is 15.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Champion Homes’s Q3 Results

We were impressed by how significantly Champion Homes blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 5.1% to $70.01 immediately following the results.

13. Is Now The Time To Buy Champion Homes?

Updated: January 23, 2026 at 10:46 PM EST

Before making an investment decision, investors should account for Champion Homes’s business fundamentals and valuation in addition to what happened in the latest quarter.

Champion Homes doesn’t top our investment wishlist, but we understand that it’s not a bad business. To kick things off, its revenue growth was exceptional over the last five years. And while Champion Homes’s diminishing returns show management's prior bets haven't worked out, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Champion Homes’s P/E ratio based on the next 12 months is 26.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $95.80 on the company (compared to the current share price of $91.64).