Champion Homes (SKY)

Champion Homes doesn’t impress us. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Champion Homes Is Not Exciting

Founded in 1951, Champion Homes (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

- Estimated sales growth of 3.3% for the next 12 months implies demand will slow from its two-year trend

- Annual earnings per share growth of 3.9% underperformed its revenue over the last two years, showing its incremental sales were less profitable

- On the bright side, its annual revenue growth of 15.6% over the last five years was superb and indicates its market share increased during this cycle

Champion Homes falls short of our expectations. There are more promising alternatives.

Why There Are Better Opportunities Than Champion Homes

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Champion Homes

At $77.69 per share, Champion Homes trades at 20.6x forward P/E. This multiple is lower than most industrials companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Champion Homes (SKY) Research Report: Q4 CY2025 Update

Modular home and building manufacturer Champion Homes (NYSE:SKY) met Wall Streets revenue expectations in Q4 CY2025, with sales up 1.8% year on year to $656.6 million. Its non-GAAP profit of $0.96 per share was 14.1% above analysts’ consensus estimates.

Champion Homes (SKY) Q4 CY2025 Highlights:

- Revenue: $656.6 million vs analyst estimates of $655.9 million (1.8% year-on-year growth, in line)

- Adjusted EPS: $0.96 vs analyst estimates of $0.84 (14.1% beat)

- Adjusted EBITDA: $74.78 million vs analyst estimates of $68.97 million (11.4% margin, 8.4% beat)

- Operating Margin: 9.5%, down from 11.3% in the same quarter last year

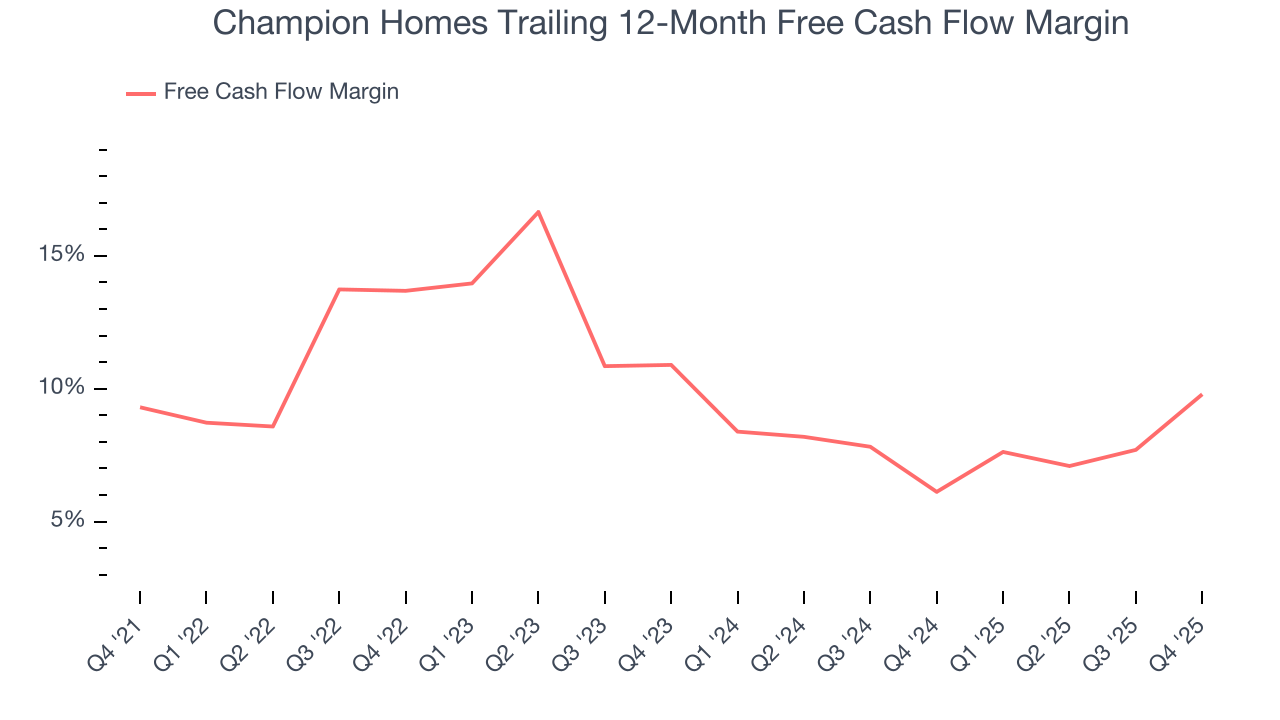

- Free Cash Flow Margin: 14.1%, up from 5.7% in the same quarter last year

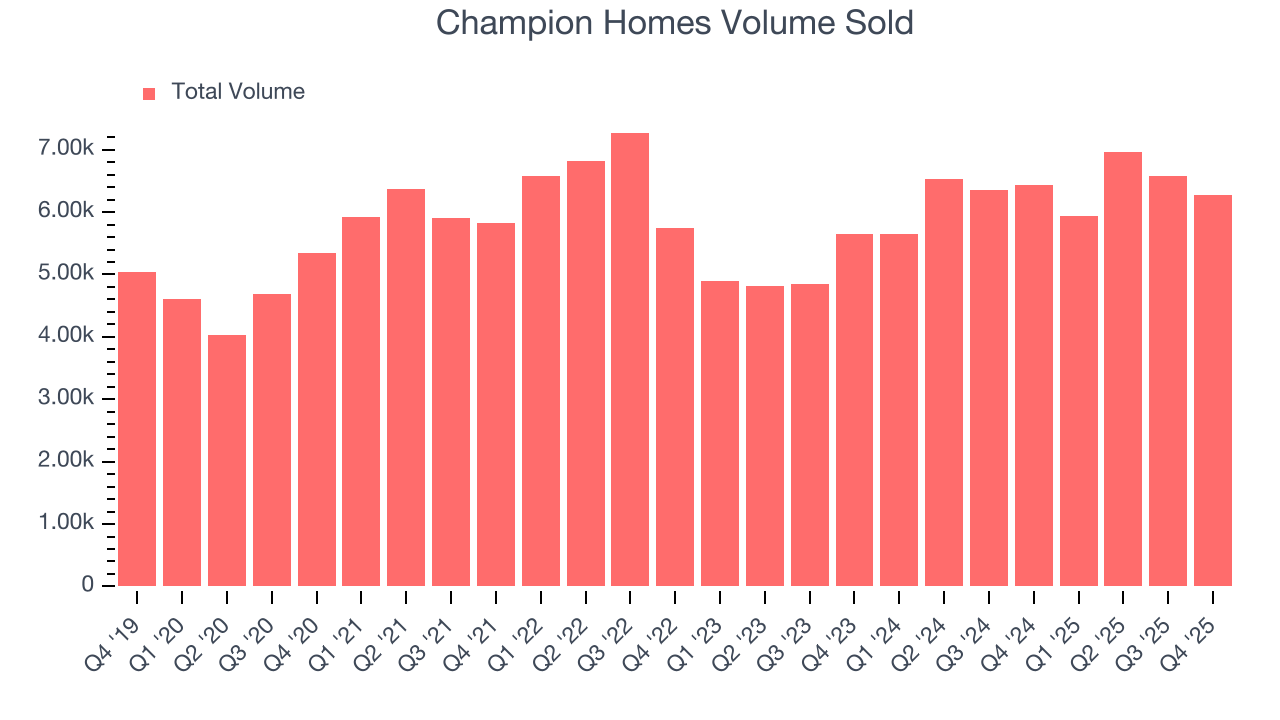

- Sales Volumes fell 2.6% year on year (14.1% in the same quarter last year)

- Market Capitalization: $4.24 billion

Company Overview

Founded in 1951, Champion Homes (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Champion Corporation is a leading producer of factory-built housing in North America, offering a comprehensive portfolio of manufactured and modular homes, park model RVs, accessory dwelling units, and modular buildings for the multi-family and hospitality sectors. The company operates 41 manufacturing facilities across the United States and western Canada, strategically located to serve strong markets and capitalize on the growing demand for affordable housing.

Champion Homes's success is driven by its extensive product offerings, strong brand reputation, broad manufacturing footprint, and complementary retail and logistics businesses. The company's commitment to innovation and sustainability is evident in its continuous improvement initiatives, standardized manufacturing processes, and investments in production automation and digital technology.

In addition to its core homebuilding business, Skyline Champion operates a factory-direct retail business, Titan Factory Direct, and a logistics business, Star Fleet Trucking, which provides transportation services to the manufactured housing and recreational vehicle industries. The company's balanced approach to organic growth and strategic acquisitions has allowed it to expand its presence and market share in key regions across North America.

4. Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Competitors in the modular building sector include Cavco Industries (NASDAQ:CVCO), Legacy Housing (NASDAQ:LEGH), and Meritage Homes (NYSE:MTH).

5. Revenue Growth

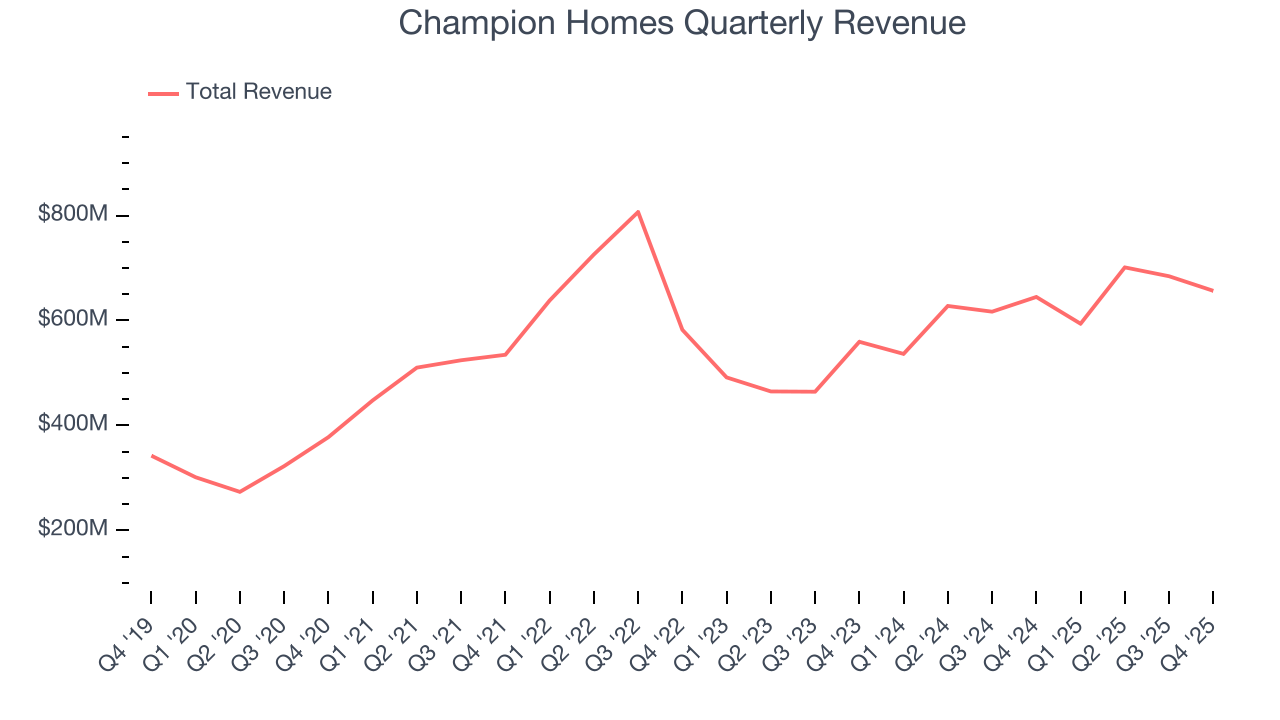

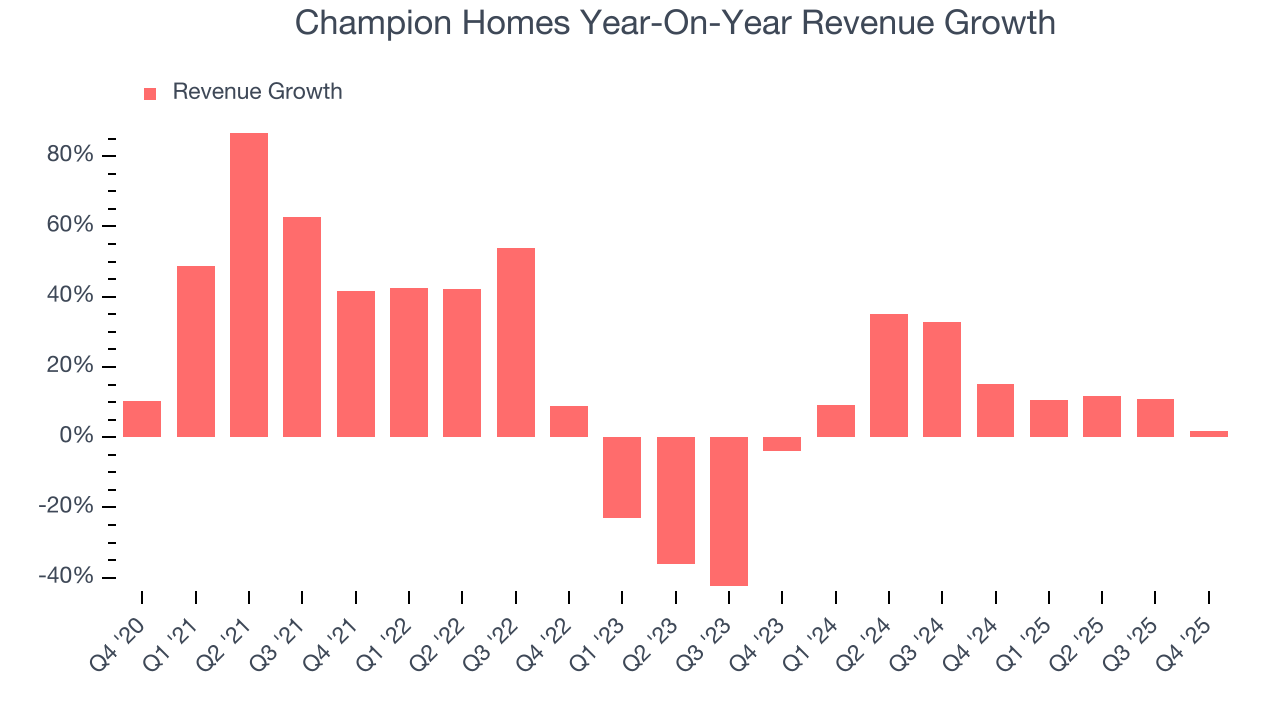

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Champion Homes grew its sales at an incredible 15.6% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Champion Homes’s annualized revenue growth of 15.4% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 6,270 in the latest quarter. Over the last two years, Champion Homes’s units sold averaged 13.6% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Champion Homes grew its revenue by 1.8% year on year, and its $656.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

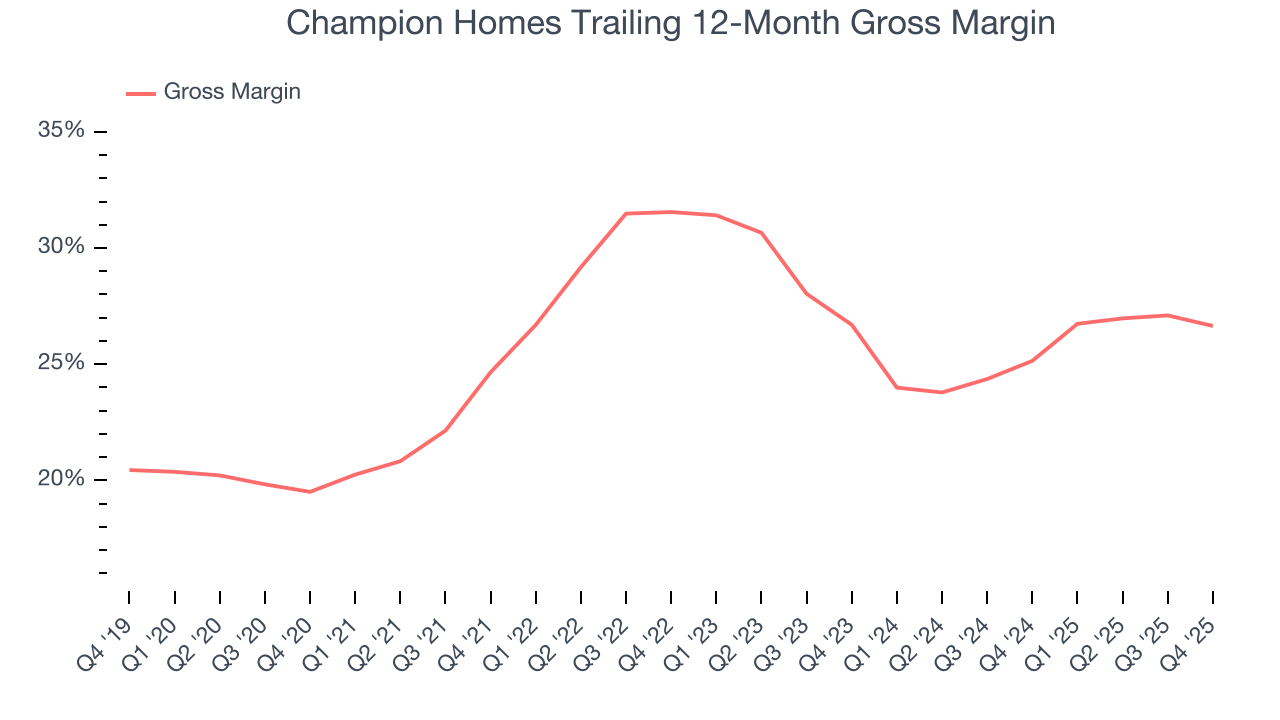

Champion Homes’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 27.1% gross margin over the last five years. That means Champion Homes paid its suppliers a lot of money ($72.85 for every $100 in revenue) to run its business.

Champion Homes produced a 26.2% gross profit margin in Q4, down 1.8 percentage points year on year. On a wider time horizon, however, Champion Homes’s full-year margin has been trending up over the past 12 months, increasing by 1.5 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

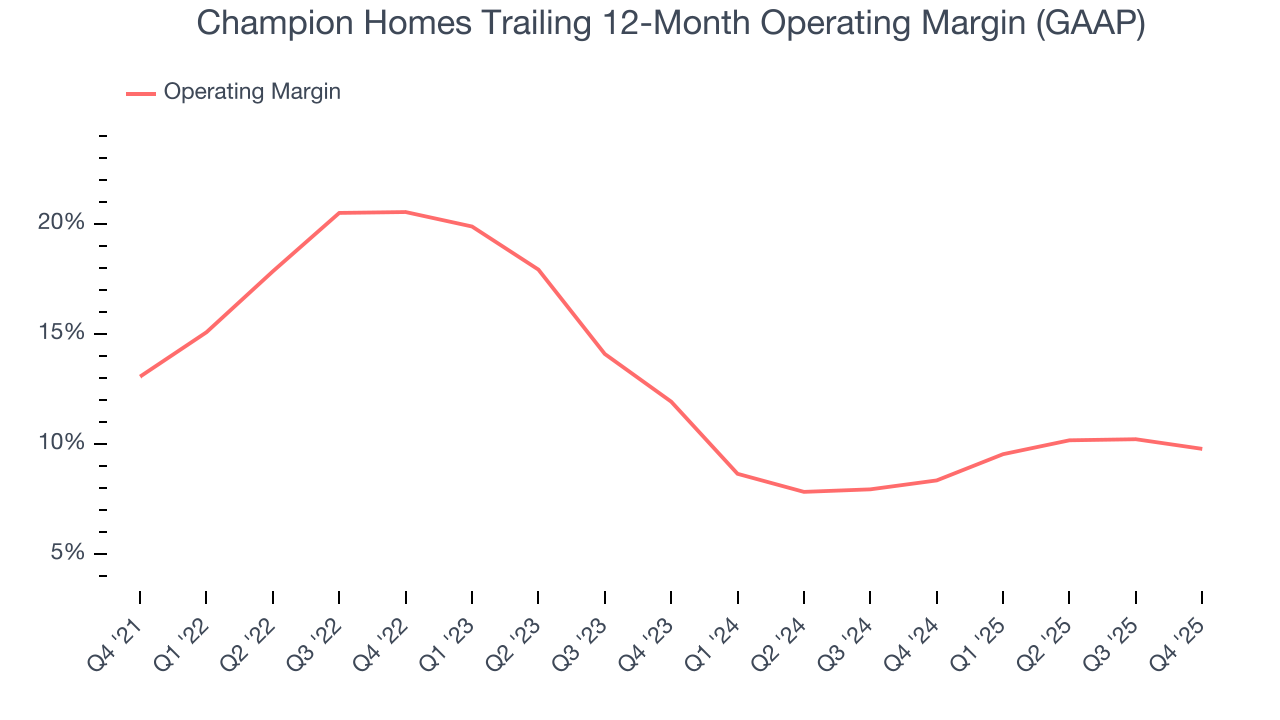

Champion Homes has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Champion Homes’s operating margin decreased by 3.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Champion Homes generated an operating margin profit margin of 9.5%, down 1.8 percentage points year on year. Since Champion Homes’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

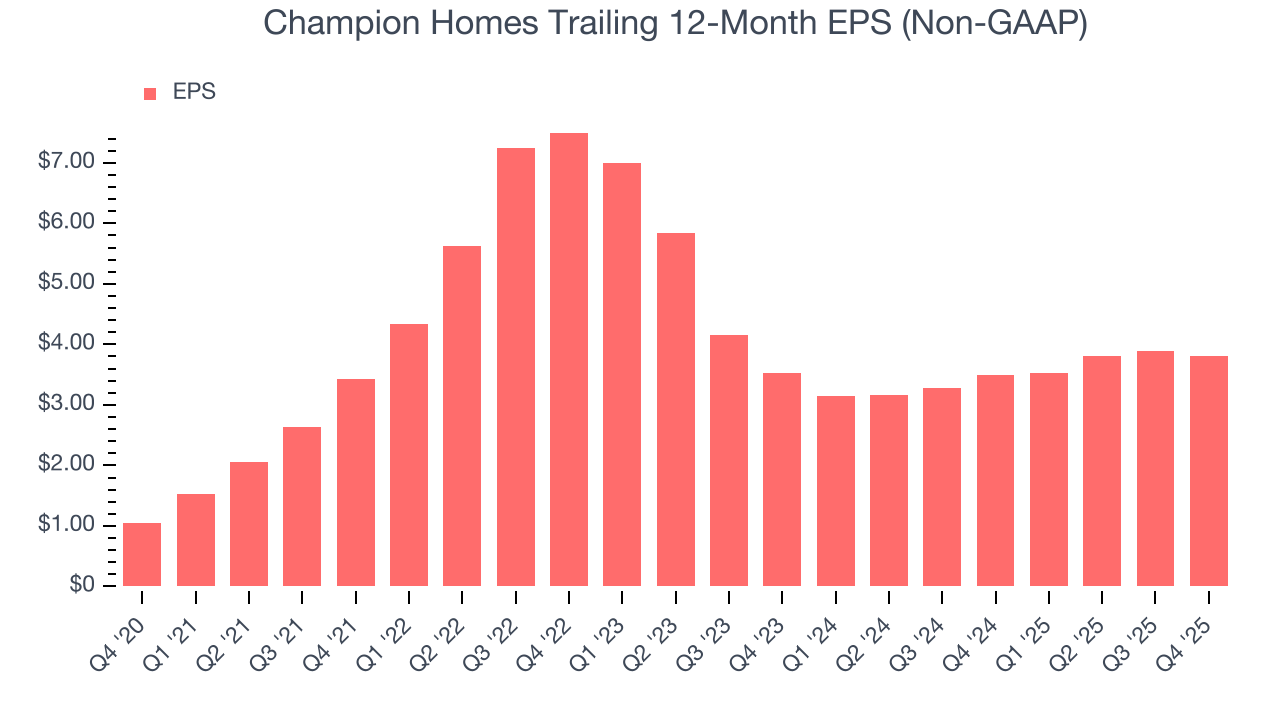

Champion Homes’s EPS grew at an astounding 29.4% compounded annual growth rate over the last five years, higher than its 15.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

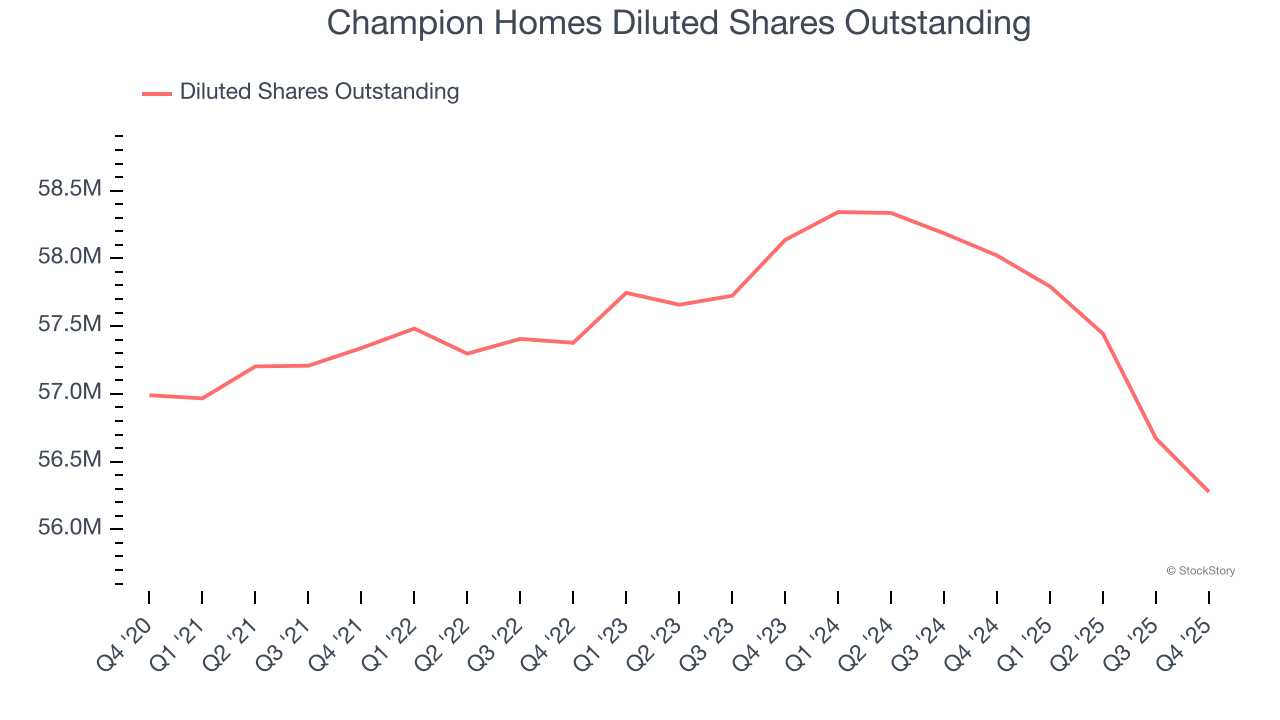

Diving into Champion Homes’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Champion Homes has repurchased its stock, shrinking its share count by 1.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Champion Homes, its two-year annual EPS growth of 3.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Champion Homes reported adjusted EPS of $0.96, down from $1.04 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Champion Homes’s full-year EPS of $3.81 to shrink by 3.4%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Champion Homes has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 10% over the last five years, quite impressive for an industrials business.

Champion Homes’s free cash flow clocked in at $92.89 million in Q4, equivalent to a 14.1% margin. This result was good as its margin was 8.4 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

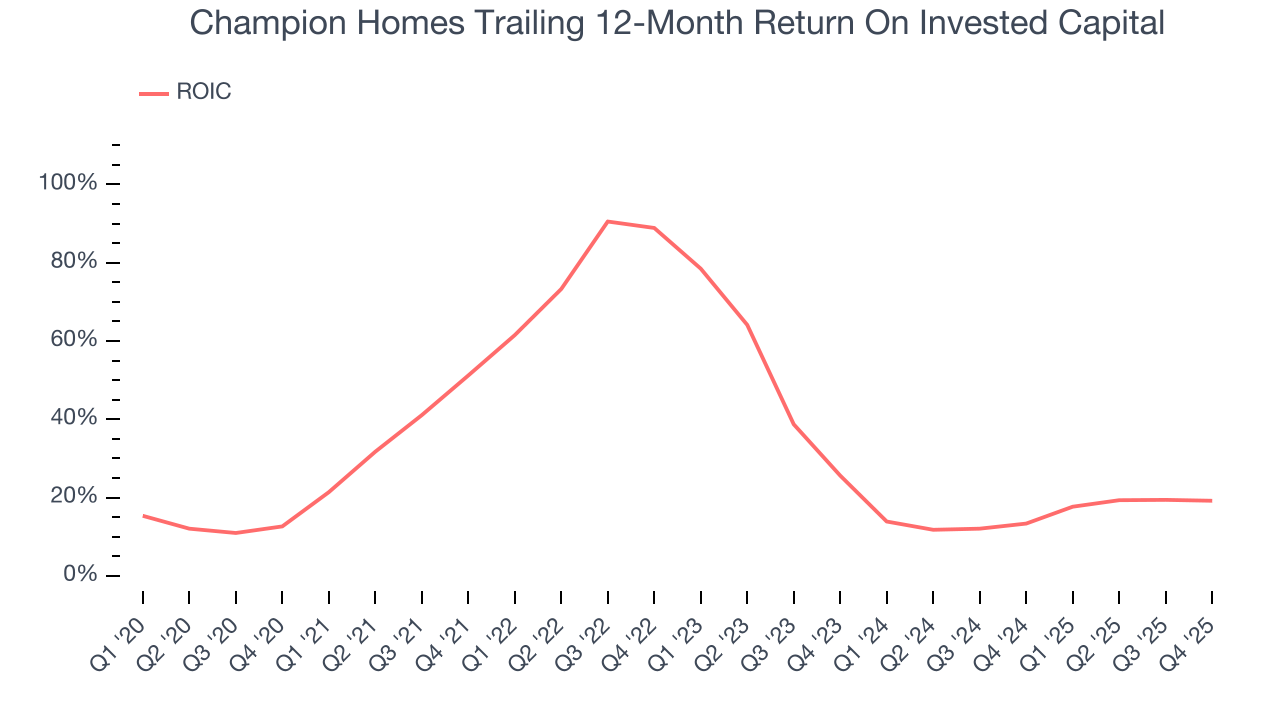

Although Champion Homes hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 39.6%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Champion Homes’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

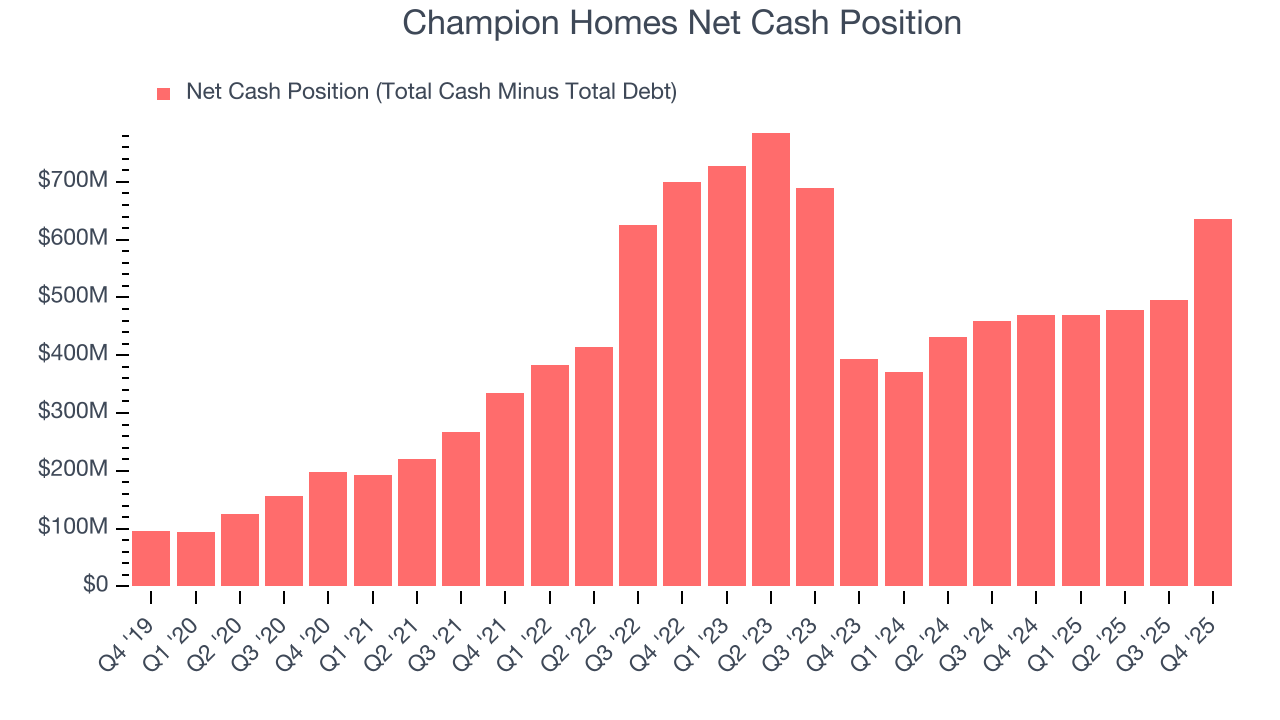

Companies with more cash than debt have lower bankruptcy risk.

Champion Homes is a profitable, well-capitalized company with $659.8 million of cash and $23.82 million of debt on its balance sheet. This $635.9 million net cash position is 15% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Champion Homes’s Q4 Results

We were impressed by how significantly Champion Homes blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $77.69 immediately after reporting.

13. Is Now The Time To Buy Champion Homes?

Updated: February 3, 2026 at 11:02 PM EST

Before deciding whether to buy Champion Homes or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Champion Homes isn’t a bad business, but we’re not clamoring to buy it here and now. First off, its revenue growth was exceptional over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Champion Homes’s P/E ratio based on the next 12 months is 20.6x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $95.80 on the company (compared to the current share price of $77.69).