Scorpio Tankers (STNG)

We aren’t fans of Scorpio Tankers. Its declining sales show demand has evaporated, a red flag for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Scorpio Tankers Will Underperform

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 2.9% annually over the last five years

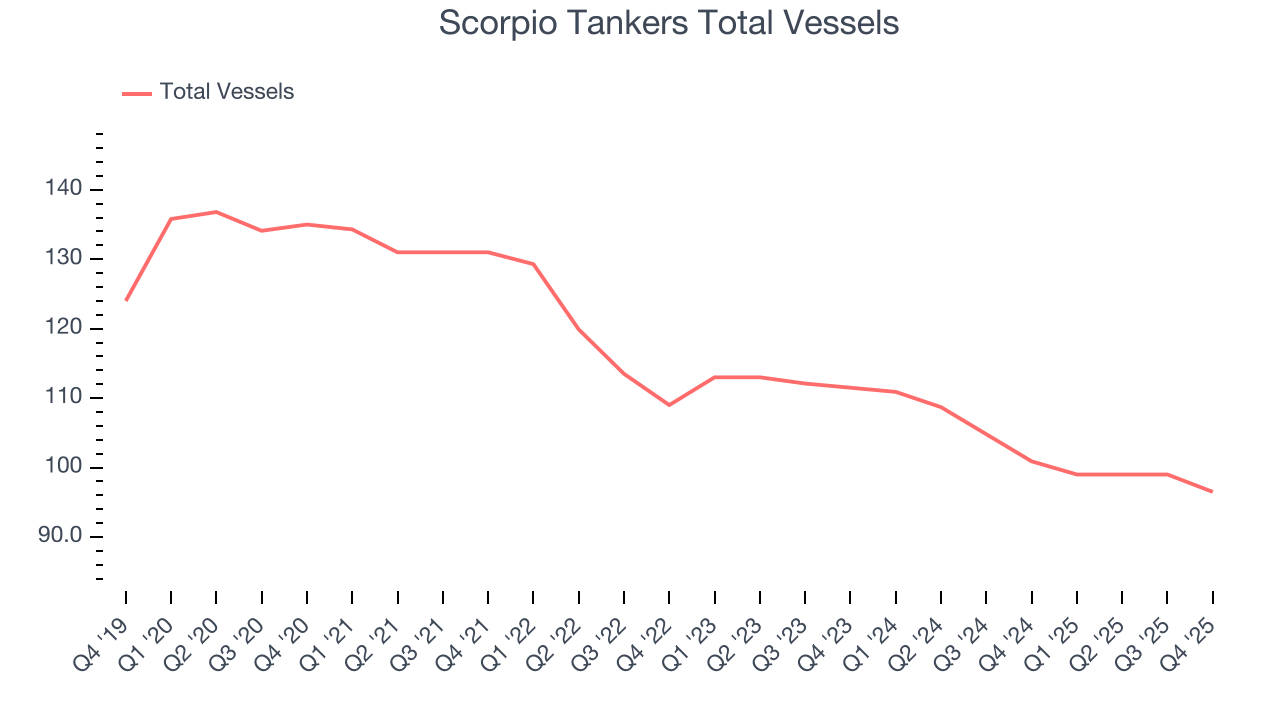

- Sluggish trends in its total vessels suggest customers aren’t adopting its solutions as quickly as the company hoped

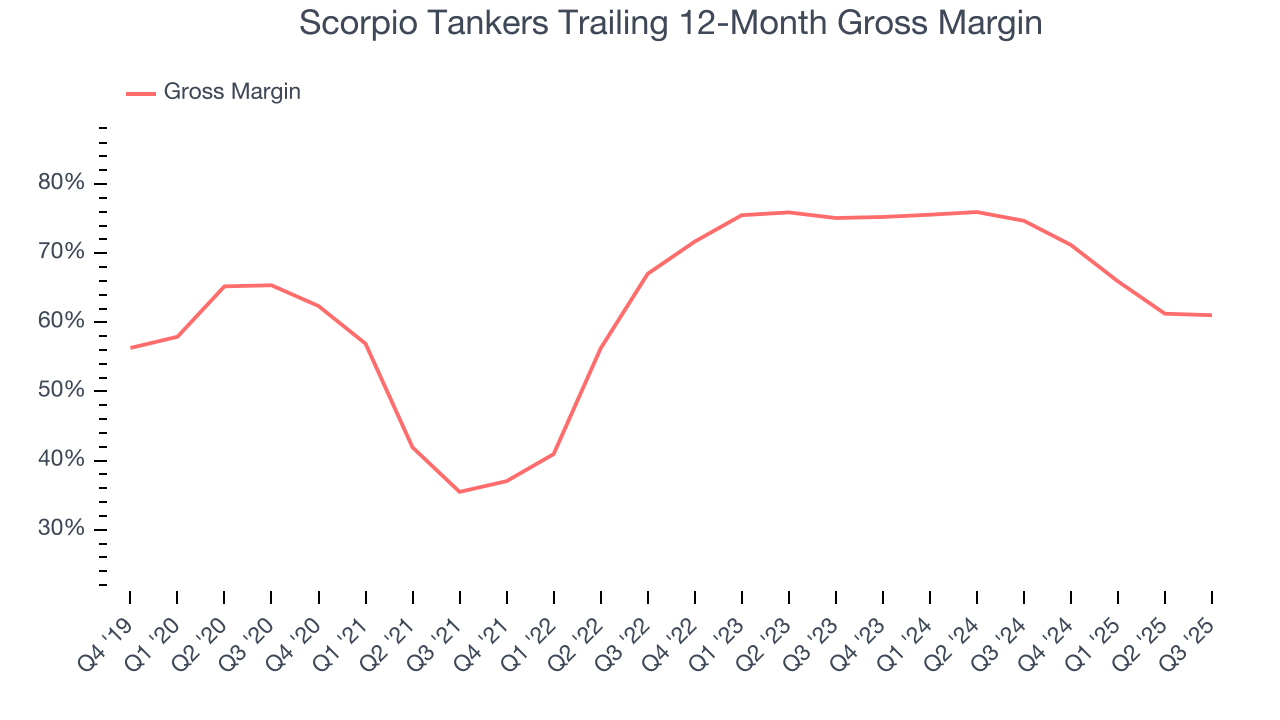

- A silver lining is that its offerings are difficult to replicate at scale and lead to a best-in-class gross margin of 67.1%

Scorpio Tankers’s quality is not up to our standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Scorpio Tankers

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Scorpio Tankers

Scorpio Tankers is trading at $68.68 per share, or 11.5x forward P/E. Scorpio Tankers’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Scorpio Tankers (STNG) Research Report: Q4 CY2025 Update

Tanking company Scorpio Tankers (NYSE:STNG) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 31.5% year on year to $252.7 million. Its GAAP profit of $2.59 per share was 55.8% above analysts’ consensus estimates.

Scorpio Tankers (STNG) Q4 CY2025 Highlights:

- Revenue: $252.7 million vs analyst estimates of $228 million (31.5% year-on-year growth, 10.8% beat)

- EPS (GAAP): $2.59 vs analyst estimates of $1.66 (55.8% beat)

- Adjusted EBITDA: $151.6 million vs analyst estimates of $134.1 million (60% margin, 13% beat)

- Operating Margin: 52.7%, up from 49.4% in the same quarter last year

- Free Cash Flow Margin: 61.6%, up from 38.6% in the same quarter last year

- total vessels: 96.5, down 4.4 year on year

- Market Capitalization: $3.29 billion

Company Overview

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Headquartered in Monaco, Scorpio Tankers operates a modern fleet of tankers, including LR2, LR1, MR, and Handymax vessels, designed to transport various petroleum products such as gasoline, diesel, jet fuel, and naphtha.

The company focuses on offering safe, reliable, and efficient transportation solutions to major oil companies, trading firms, and end-users worldwide. Scorpio Tankers is trusted by these organizations for its compliance with stringent environmental and safety regulations.

Revenue is primarily generated through the time charter and spot market employment of its tankers. While time charters (an agreement to hire a vessel and its crew for a specified period, usually a set number of months or years) can provide more predictable, recurring revenue streams, the spot market is more volatile and subject to fluctuations in demand and rates, making it less consistent. A significant portion of the company’s revenue currently comes from the spot market.

4. Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

Competitors of Scorpio Tankers include Teekay Tankers (NYSE:TNK), Frontline (NYSE:FRO), and Euronav NV (NYSE:EURN).

5. Revenue Growth

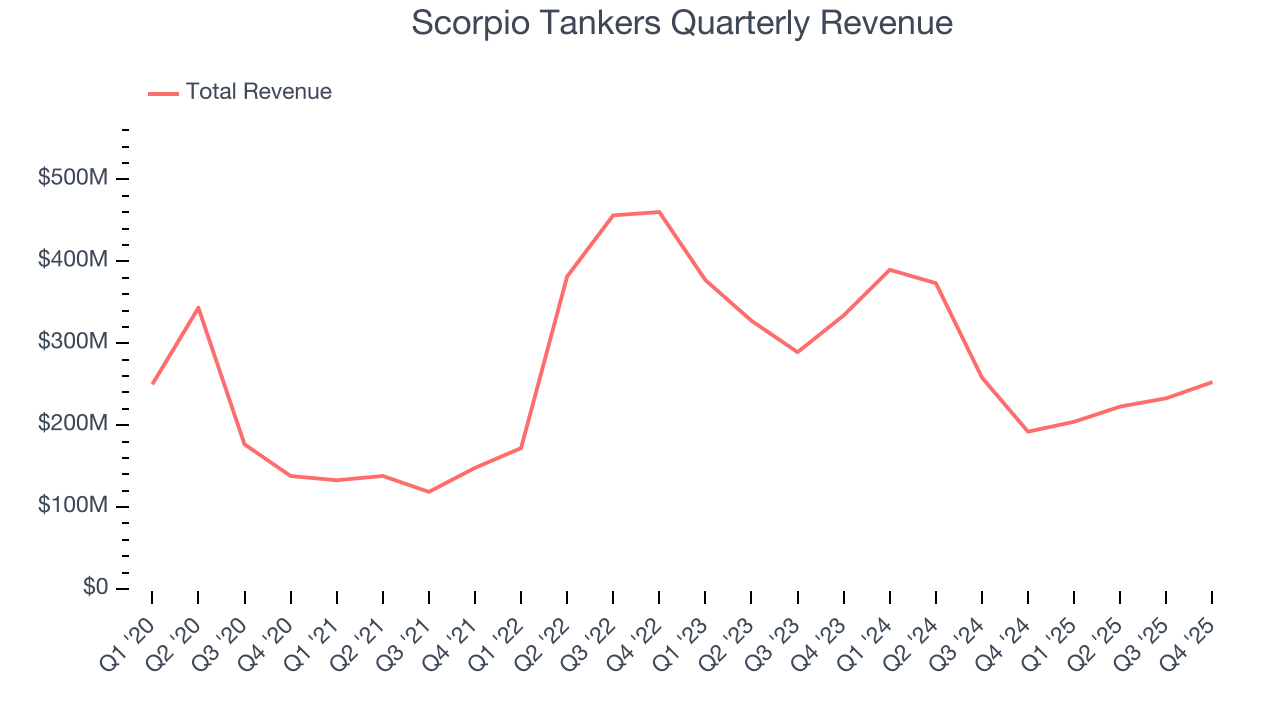

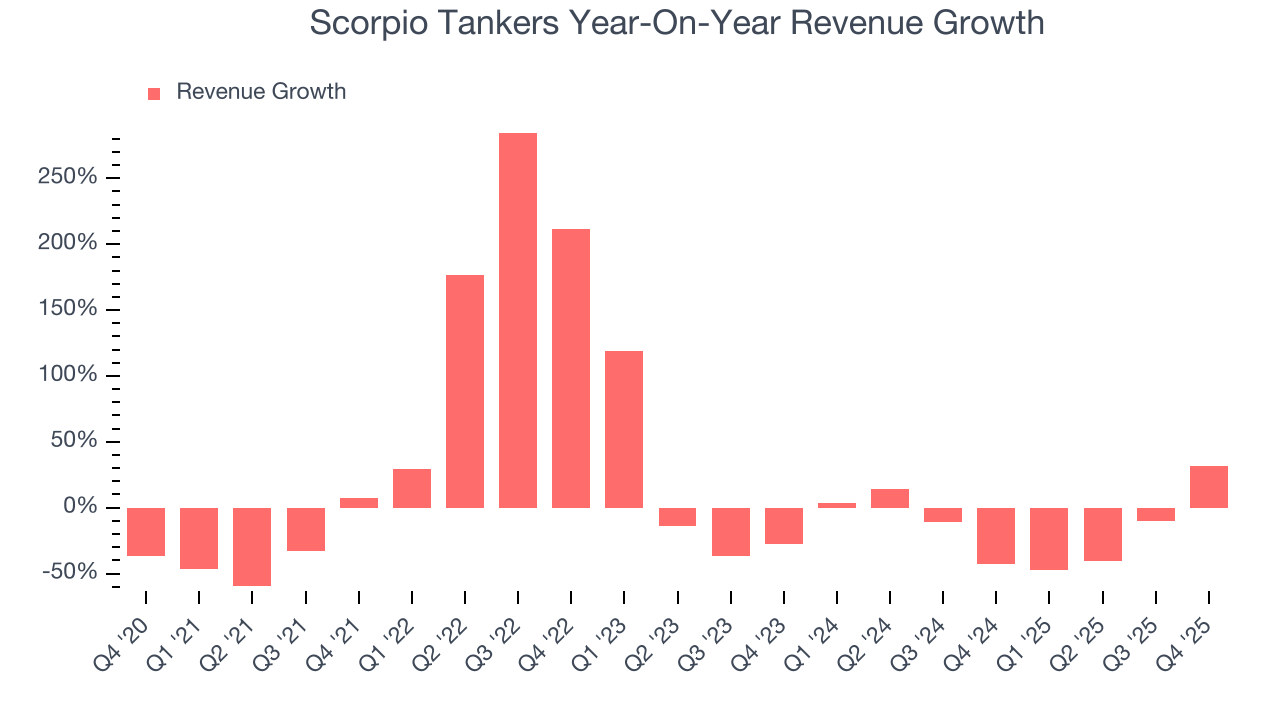

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Scorpio Tankers struggled to consistently increase demand as its $912.5 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Scorpio Tankers’s recent performance shows its demand remained suppressed as its revenue has declined by 17.1% annually over the last two years.

We can better understand the company’s revenue dynamics by analyzing its number of total vessels, which reached 96.5 in the latest quarter. Over the last two years, Scorpio Tankers’s total vessels averaged 6.4% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Scorpio Tankers reported wonderful year-on-year revenue growth of 31.5%, and its $252.7 million of revenue exceeded Wall Street’s estimates by 10.8%.

Looking ahead, sell-side analysts expect revenue to decline by 4.3% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Gross Margin & Pricing Power

Scorpio Tankers has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 67.9% gross margin over the last five years. Said differently, roughly $67.89 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

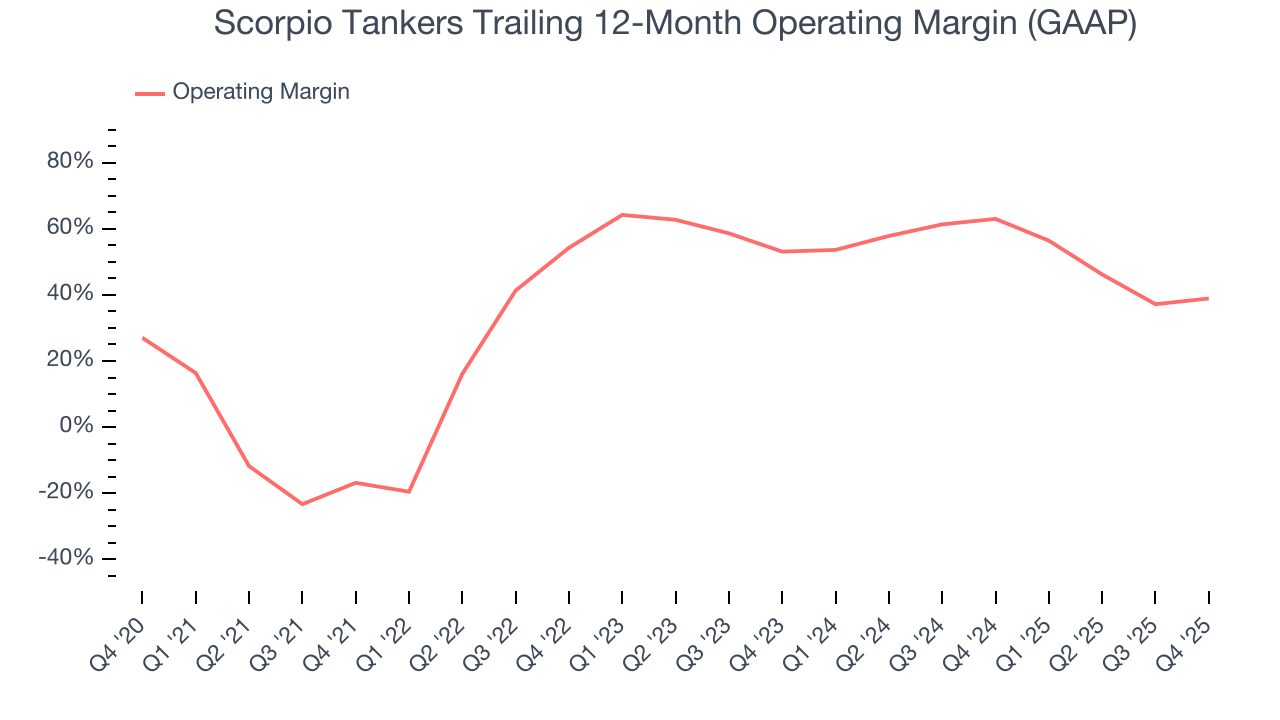

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Scorpio Tankers has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 46.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Scorpio Tankers’s operating margin rose by 55.8 percentage points over the last five years. Its expansion was impressive, especially when considering most Marine Transportation peers saw their margins plummet.

This quarter, Scorpio Tankers generated an operating margin profit margin of 52.7%, up 3.3 percentage points year on year. The increase was a welcome development and shows its expenses recently grew slower than its revenue, leading to higher efficiency.

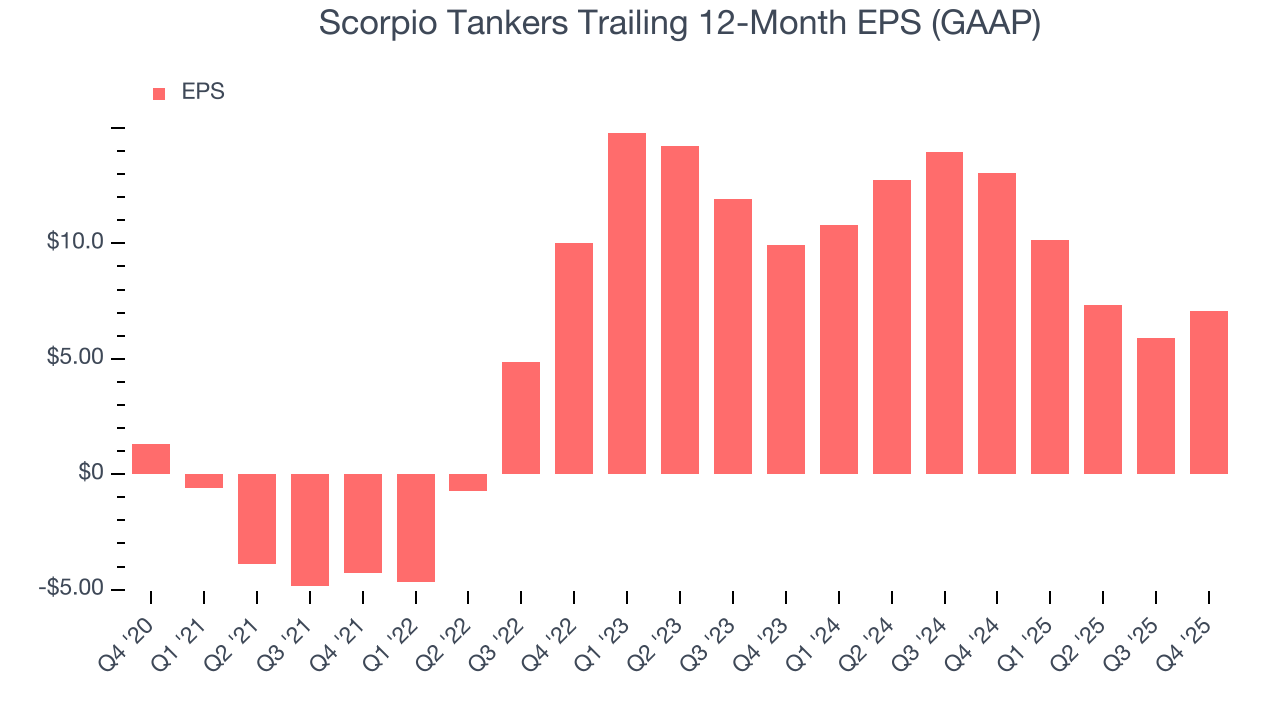

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

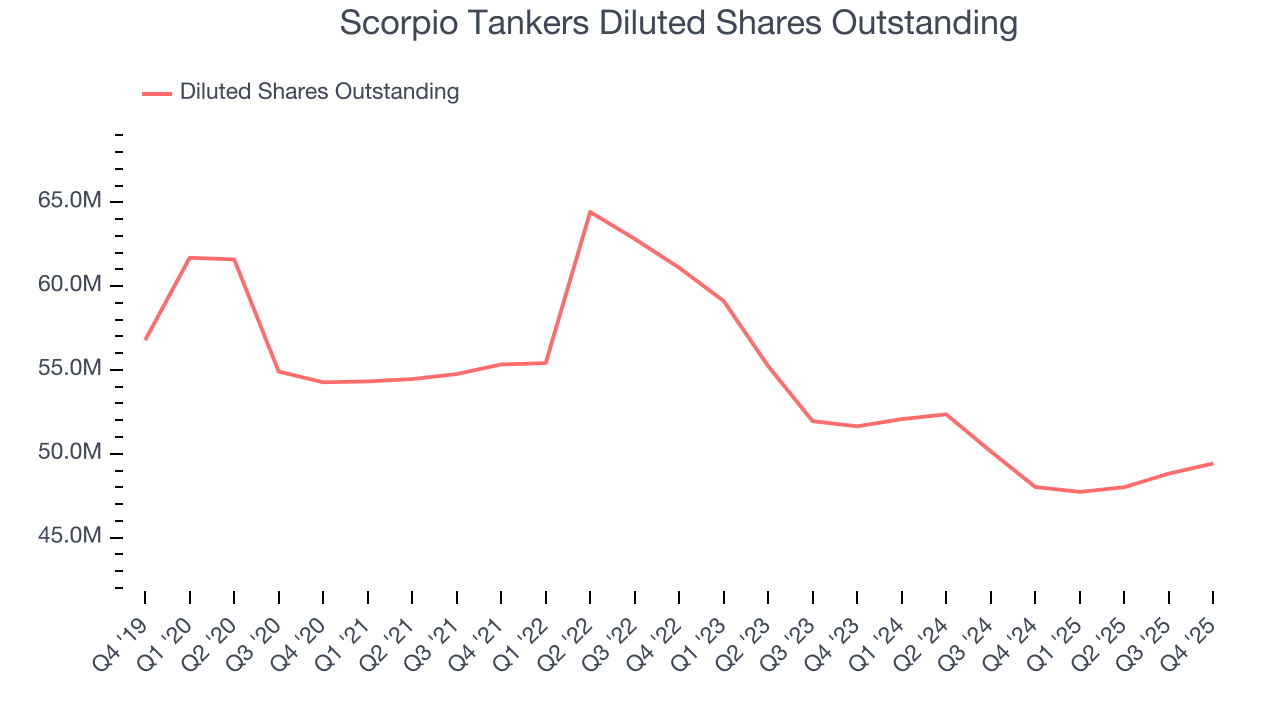

Scorpio Tankers’s EPS grew at an astounding 39.9% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

Diving into Scorpio Tankers’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Scorpio Tankers’s operating margin expanded by 55.8 percentage points over the last five years. On top of that, its share count shrank by 8.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Scorpio Tankers, its two-year annual EPS declines of 15.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Scorpio Tankers can return to earnings growth in the future.

In Q4, Scorpio Tankers reported EPS of $2.59, up from $1.43 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Scorpio Tankers’s full-year EPS of $7.07 to shrink by 17.6%.

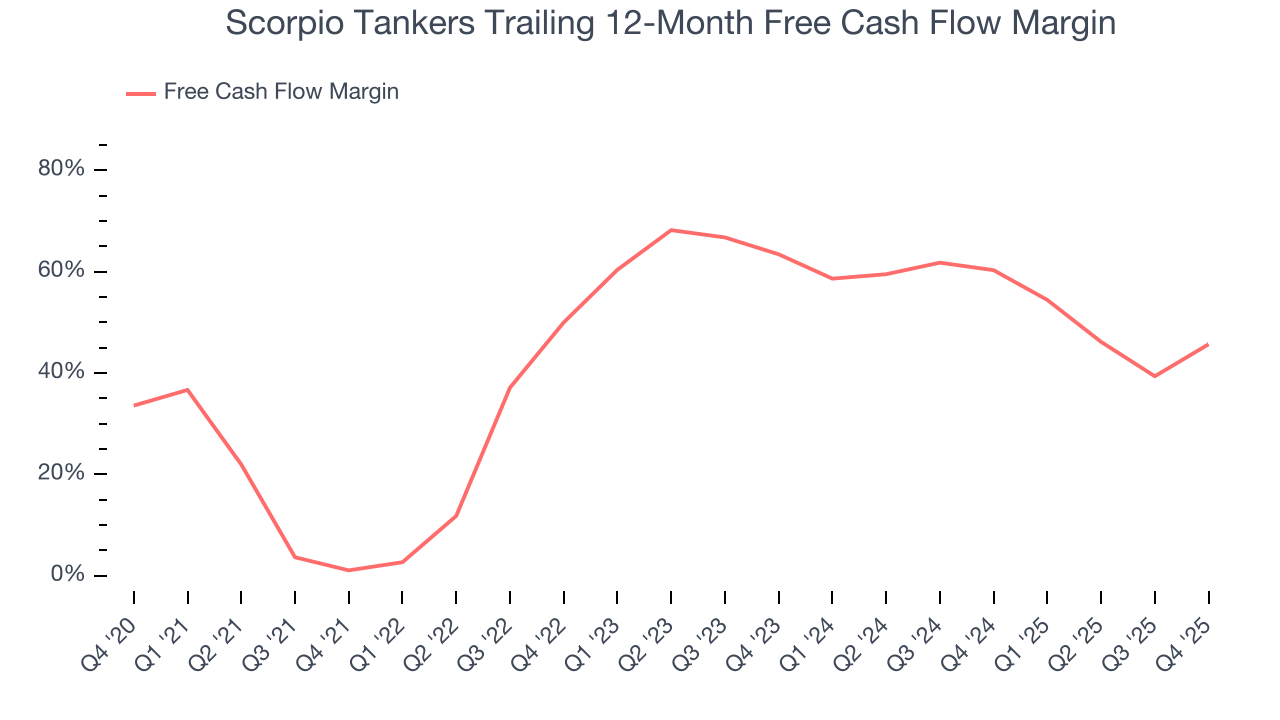

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Scorpio Tankers has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging an eye-popping 50% over the last five years.

Taking a step back, we can see that Scorpio Tankers’s margin expanded by 44.6 percentage points during that time. This is encouraging because it gives the company more optionality.

Scorpio Tankers’s free cash flow clocked in at $155.6 million in Q4, equivalent to a 61.6% margin. This result was good as its margin was 23 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

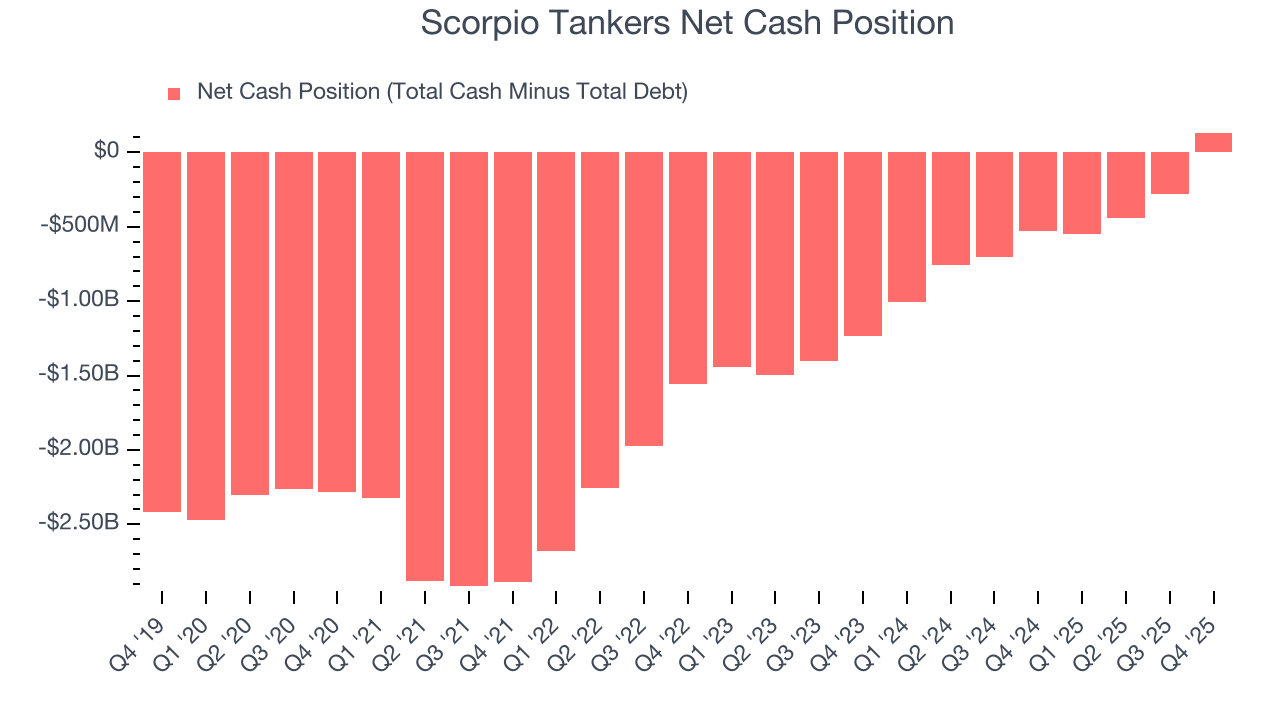

Scorpio Tankers is a profitable, well-capitalized company with $752 million of cash and $619.2 million of debt on its balance sheet. This $132.8 million net cash position is 4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Scorpio Tankers’s Q4 Results

It was good to see Scorpio Tankers beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The market seemed to be hoping for more, and the stock traded down 1.7% to $68.68 immediately after reporting.

12. Is Now The Time To Buy Scorpio Tankers?

Updated: February 12, 2026 at 7:01 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Scorpio Tankers.

Scorpio Tankers isn’t a terrible business, but it doesn’t pass our bar. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while Scorpio Tankers’s admirable gross margins indicate the mission-critical nature of its offerings, its projected EPS for the next year is lacking.

Scorpio Tankers’s P/E ratio based on the next 12 months is 12x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $76.13 on the company (compared to the current share price of $68.68).