State Street (STT)

We aren’t fans of State Street. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why State Street Is Not Exciting

Dating back to 1792 when Boston's Long Wharf was the center of global shipping and trade, State Street (NYSE:STT) provides custody, investment management, and other financial services to institutional investors like pension funds, asset managers, and central banks worldwide.

- Annual sales growth of 3.6% over the last five years lagged behind its financials peers as its large revenue base made it difficult to generate incremental demand

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 9.1% annually

- On the bright side, its adequate return on equity shows management makes decent investment decisions

State Street fails to meet our quality criteria. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than State Street

High Quality

Investable

Underperform

Why There Are Better Opportunities Than State Street

State Street is trading at $120.60 per share, or 10.7x forward P/E. State Street’s valuation may seem like a bargain, especially when stacked up against other financials companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. State Street (STT) Research Report: Q4 CY2025 Update

Financial services giant State Street (NYSE:STT) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.5% year on year to $3.67 billion. Its non-GAAP profit of $2.97 per share was 4.7% above analysts’ consensus estimates.

State Street (STT) Q4 CY2025 Highlights:

- Assets Under Management: $5.67 trillion vs analyst estimates of $5.57 trillion (20.1% year-on-year growth, 1.7% beat)

- Revenue: $3.67 billion vs analyst estimates of $3.61 billion (7.5% year-on-year growth, 1.5% beat)

- Pre-tax Profit: $918 million (25% margin)

- Adjusted EPS: $2.97 vs analyst estimates of $2.84 (4.7% beat)

- Market Capitalization: $38.07 billion

Company Overview

Dating back to 1792 when Boston's Long Wharf was the center of global shipping and trade, State Street (NYSE:STT) provides custody, investment management, and other financial services to institutional investors like pension funds, asset managers, and central banks worldwide.

State Street operates through two main business segments: Investment Servicing and Investment Management. The Investment Servicing division forms the backbone of the company's operations, offering custody, accounting, fund administration, and back-office solutions that keep the financial world's machinery running smoothly. When a pension fund needs to track its investments across multiple countries or a mutual fund requires daily valuation of its holdings, State Street's systems handle these complex tasks.

For example, when a large university endowment invests in international markets, State Street provides the infrastructure to settle trades, convert currencies, and ensure regulatory compliance across different jurisdictions. The company's State Street Alpha platform combines portfolio management, trading, analytics, and compliance tools that institutional investors use to manage their investment operations.

In its Investment Management segment, operating as State Street Global Advisors (SSGA), the company creates and manages investment products, most notably its SPDR exchange-traded funds (ETFs). SSGA is particularly known for pioneering index investing strategies and managing the first U.S.-listed ETF.

State Street generates revenue primarily through fees based on assets under custody, administration, or management. The company operates globally with a presence in more than 100 markets across North America, Europe, the Middle East, and Asia. As a systemically important financial institution, State Street is subject to enhanced regulatory oversight, including stricter capital and liquidity requirements.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

State Street competes primarily with other global custody banks like Bank of New York Mellon (NYSE:BK) and Northern Trust (NASDAQ:NTRS), while its investment management division faces competition from asset management giants such as BlackRock (NYSE:BLK), Vanguard, and Fidelity.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, State Street’s revenue grew at a sluggish 3.6% compounded annual growth rate over the last five years. This fell short of our benchmark for the financials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. State Street’s annualized revenue growth of 6.8% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, State Street reported year-on-year revenue growth of 7.5%, and its $3.67 billion of revenue exceeded Wall Street’s estimates by 1.5%.

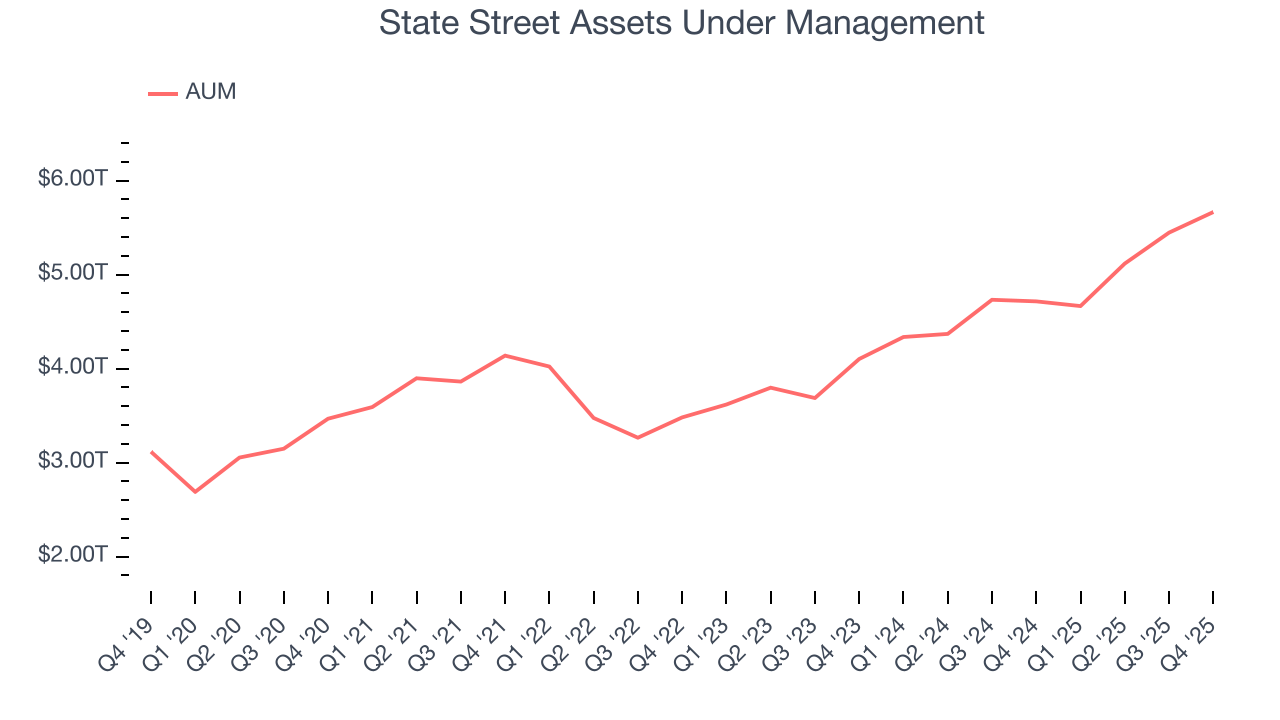

6. Assets Under Management (AUM)

Assets Under Management (AUM) is the cornerstone of a financial firm's investment division, representing all client capital under its stewardship. Management fees on this AUM create reliable, recurring revenue that maintains stability even when investment performance struggles, though prolonged poor returns can eventually affect asset retention and growth.

State Street’s AUM has grown at an annual rate of 11.1% over the last five years, a step above the broader financials industry and faster than its total revenue. When analyzing State Street’s AUM over the last two years, we can see that growth accelerated to 17.2% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. But again, we put less weight on asset growth given how lumpy and cyclical it can be.

State Street’s AUM punched in at $5.67 trillion this quarter, beating analysts’ expectations by 1.7%. This print was 20.1% higher than the same quarter last year.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last five years, State Street’s pre-tax profit margin has fallen by 1.9 percentage points, going from 26.6% to 26.7%. It has also expanded by 7.8 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

State Street’s pre-tax profit margin came in at 25% this quarter. This result was 3.1 percentage points worse than the same quarter last year.

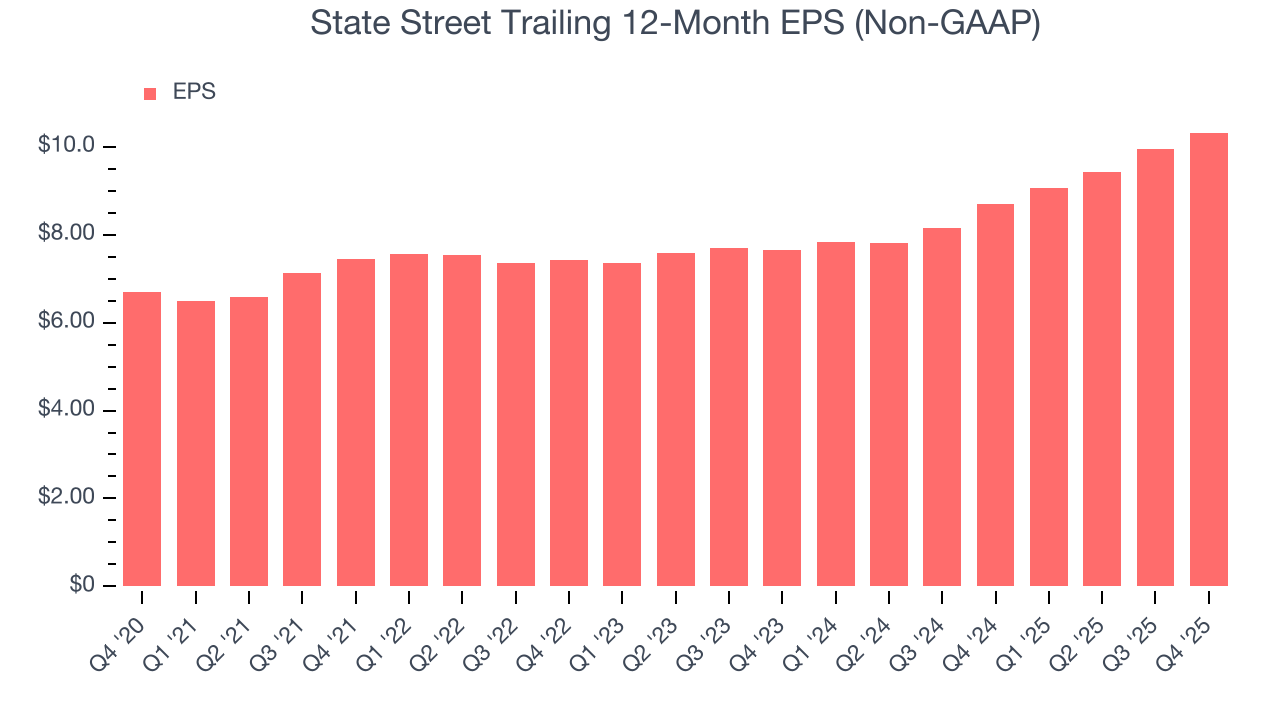

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

State Street’s EPS grew at an unimpressive 9.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For State Street, its two-year annual EPS growth of 16.1% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, State Street reported adjusted EPS of $2.97, up from $2.60 in the same quarter last year. This print beat analysts’ estimates by 4.7%. Over the next 12 months, Wall Street expects State Street’s full-year EPS of $10.32 to grow 12.9%.

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, State Street has averaged an ROE of 10.2%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired.

10. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, State Street has averaged a Tier 1 capital ratio of 12.3%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

11. Key Takeaways from State Street’s Q4 Results

It was encouraging to see State Street beat analysts’ AUM expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 2% to $133.53 immediately following the results.

12. Is Now The Time To Buy State Street?

Updated: March 7, 2026 at 12:16 AM EST

Are you wondering whether to buy State Street or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

State Street isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was weak over the last five years.

State Street’s P/E ratio based on the next 12 months is 10.7x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $144.30 on the company (compared to the current share price of $120.60).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.