Travel + Leisure (TNL)

Travel + Leisure is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Travel + Leisure Will Underperform

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE:TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

- Annual revenue growth of 9.7% over the last five years was below our standards for the consumer discretionary sector

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

- 8× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Travel + Leisure lacks the business quality we seek. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Travel + Leisure

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Travel + Leisure

At $69.23 per share, Travel + Leisure trades at 10.1x forward P/E. Travel + Leisure’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Travel + Leisure (TNL) Research Report: Q3 CY2025 Update

Hospitality company Travel + Leisure (NYSE:TNL) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5.1% year on year to $1.04 billion. Its non-GAAP profit of $1.80 per share was 5.2% above analysts’ consensus estimates.

Travel + Leisure (TNL) Q3 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.03 billion (5.1% year-on-year growth, 1% beat)

- Adjusted EPS: $1.80 vs analyst estimates of $1.71 (5.2% beat)

- Adjusted EBITDA: $266 million vs analyst estimates of $254.8 million (25.5% margin, 4.4% beat)

- EBITDA guidance for the full year is $975 million at the midpoint, in line with analyst expectations

- Operating Margin: 20.5%, up from 19% in the same quarter last year

- Free Cash Flow Margin: 19.3%, up from 12.6% in the same quarter last year

- Tours Conducted: 200,000, up 5,000 year on year

- Market Capitalization: $3.94 billion

Company Overview

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE:TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

The company's expansive portfolio includes its flagship vacation ownership business, operating under brands such as Club Wyndham, WorldMark by Wyndham, and Margaritaville Vacation Club. These brands offer a network of resort properties in desirable destinations across the United States, the Caribbean, and the Pacific.

Travel + Leisure's timeshare vacation ownership model allows customers to own or have rights to use a property for a specified period each year. In addition, the company’s vacation exchange network, RCI, allows timeshare owners to swap their owned weeks or points for stays at other properties within its global network, offering flexibility and variety in vacation planning.

Travel + Leisure has also expanded into travel services and membership programs through its acquisition of Travel + Leisure Group in 2021 (the company also inherited the acquiree's name). This division focuses on delivering travel services and products beyond the timeshare market by providing subscription travel clubs, online travel booking platforms, and branded consumer products, enhancing the company’s reach in the broader leisure travel market.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Travel + Leisure's competitors include Hilton Grand Vacations (NYSE:HGV), Marriot Vacations (NYSE:VAC), Bluegreen Vacations (NYSE:BXG), Interval Leisure Group (NASDAQ:IILG), and private companies Diamond Resorts and Anantara Vacation Club.

5. Revenue Growth

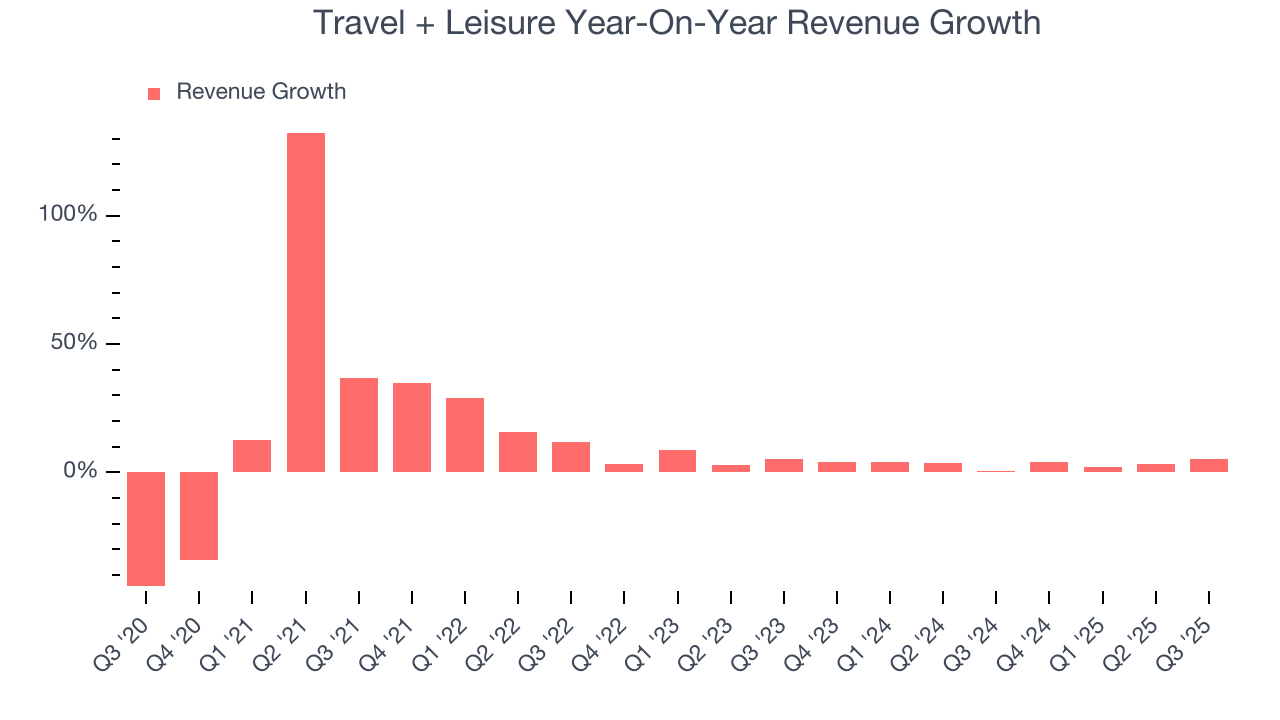

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Travel + Leisure’s sales grew at a tepid 9.7% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Travel + Leisure’s recent performance shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its number of tours conducted, which reached 200,000 in the latest quarter. Over the last two years, Travel + Leisure’s tours conducted averaged 6.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Travel + Leisure reported year-on-year revenue growth of 5.1%, and its $1.04 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Travel + Leisure’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 19.3% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q3, Travel + Leisure generated an operating margin profit margin of 20.5%, up 1.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

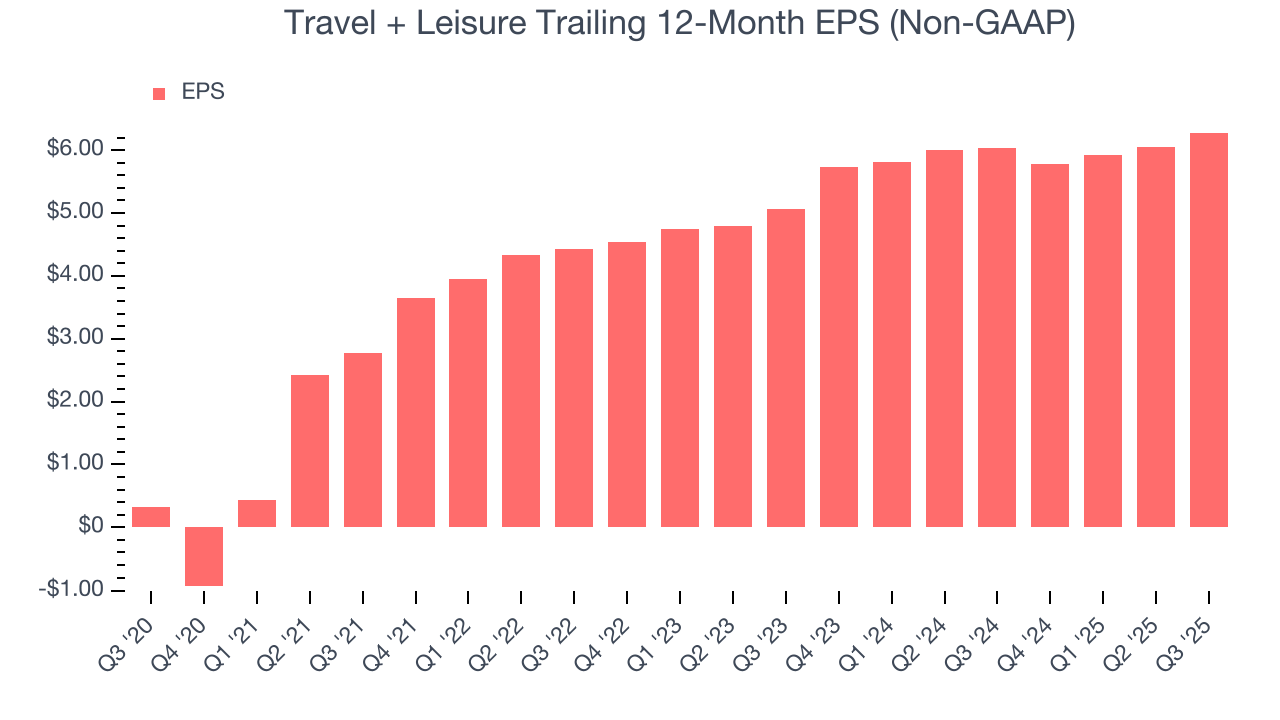

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Travel + Leisure’s EPS grew at an astounding 81.4% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Travel + Leisure reported adjusted EPS of $1.80, up from $1.57 in the same quarter last year. This print beat analysts’ estimates by 5.2%. Over the next 12 months, Wall Street expects Travel + Leisure’s full-year EPS of $6.28 to grow 13.9%.

8. Cash Is King

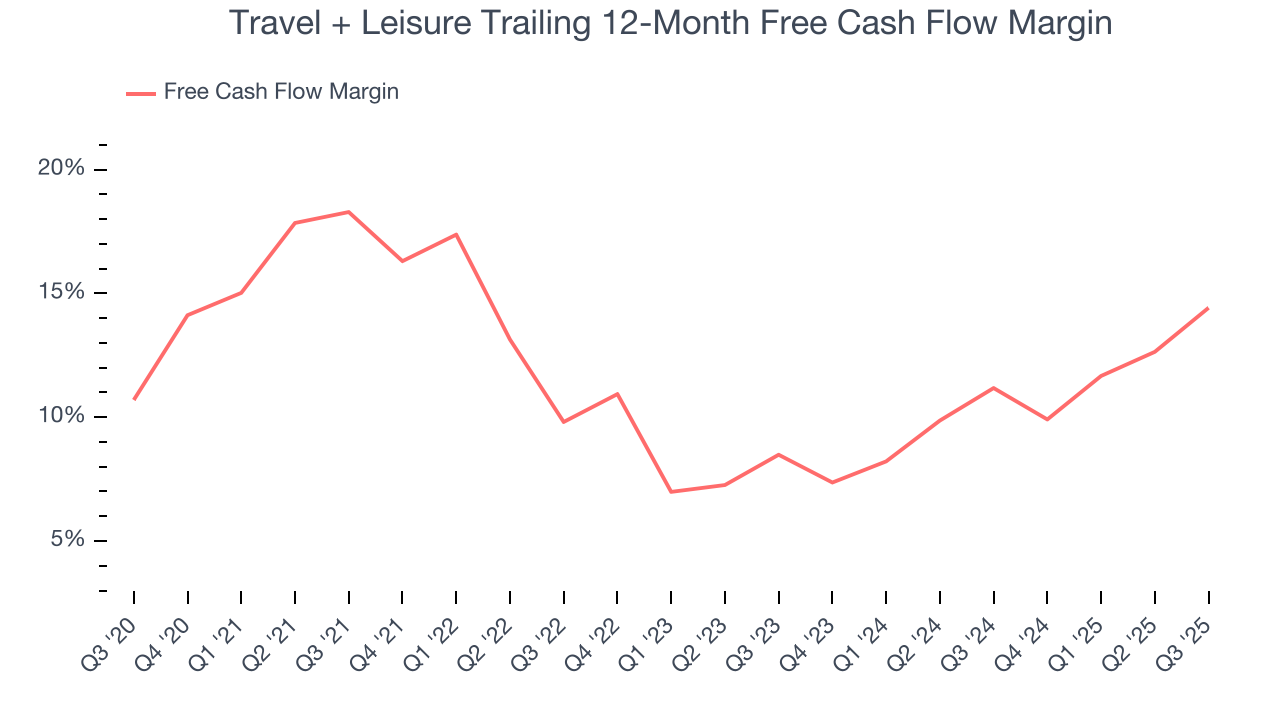

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Travel + Leisure has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.8% over the last two years, slightly better than the broader consumer discretionary sector.

Travel + Leisure’s free cash flow clocked in at $202 million in Q3, equivalent to a 19.3% margin. This result was good as its margin was 6.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Travel + Leisure’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.4% for the last 12 months will decrease to 13.3%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Travel + Leisure historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Travel + Leisure’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Travel + Leisure’s $5.58 billion of debt exceeds the $240 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $970 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Travel + Leisure could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Travel + Leisure can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Travel + Leisure’s Q3 Results

It was encouraging to see Travel + Leisure beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its . Overall, this print had some key positives. The stock traded up 3.8% to $63 immediately after reporting.

12. Is Now The Time To Buy Travel + Leisure?

Updated: January 20, 2026 at 9:56 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Travel + Leisure.

Travel + Leisure falls short of our quality standards. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its number of tours conducted has disappointed. On top of that, its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion.

Travel + Leisure’s P/E ratio based on the next 12 months is 10.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $78.33 on the company (compared to the current share price of $69.23).