Travel + Leisure (TNL)

Travel + Leisure keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Travel + Leisure Will Underperform

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE:TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

- Annual revenue growth of 9.7% over the last five years was below our standards for the consumer discretionary sector

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 12% for the last two years

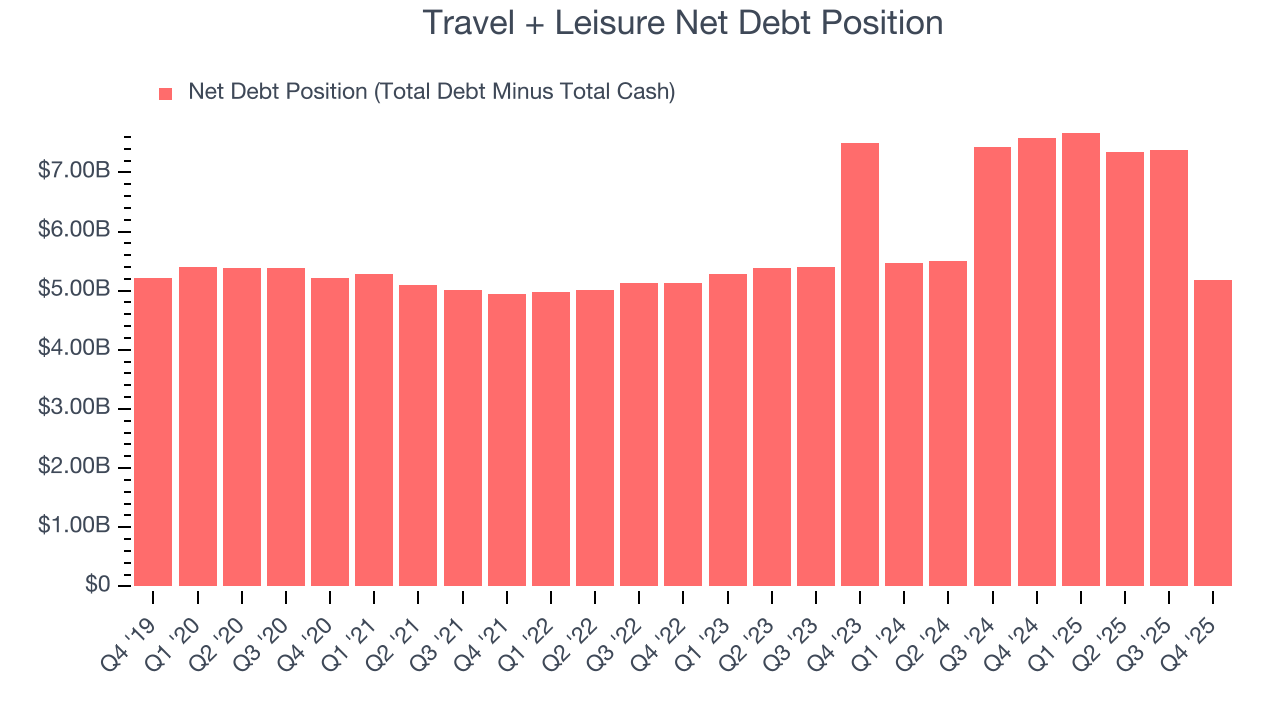

- High net-debt-to-EBITDA ratio of 8× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Travel + Leisure’s quality isn’t great. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Travel + Leisure

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Travel + Leisure

Travel + Leisure is trading at $73.17 per share, or 9.9x forward P/E. Travel + Leisure’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Travel + Leisure (TNL) Research Report: Q4 CY2025 Update

Hospitality company Travel + Leisure (NYSE:TNL) announced better-than-expected revenue in Q4 CY2025, with sales up 5.7% year on year to $1.03 billion. Its non-GAAP profit of $1.83 per share was 0.6% above analysts’ consensus estimates.

Travel + Leisure (TNL) Q4 CY2025 Highlights:

- Revenue: $1.03 billion vs analyst estimates of $996.2 million (5.7% year-on-year growth, 3% beat)

- Adjusted EPS: $1.83 vs analyst estimates of $1.82 (0.6% beat)

- Adjusted EBITDA: $272 million vs analyst estimates of $258.3 million (26.5% margin, 5.3% beat)

- EBITDA guidance for the upcoming financial year 2026 is $1.04 billion at the midpoint, above analyst estimates of $1.03 billion

- Operating Margin: -2.1%, down from 21.2% in the same quarter last year

- Free Cash Flow Margin: 18.5%, up from 7.7% in the same quarter last year

- Tours Conducted: 184,000, up 9,000 year on year

- Market Capitalization: $4.69 billion

Company Overview

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE:TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

The company's expansive portfolio includes its flagship vacation ownership business, operating under brands such as Club Wyndham, WorldMark by Wyndham, and Margaritaville Vacation Club. These brands offer a network of resort properties in desirable destinations across the United States, the Caribbean, and the Pacific.

Travel + Leisure's timeshare vacation ownership model allows customers to own or have rights to use a property for a specified period each year. In addition, the company’s vacation exchange network, RCI, allows timeshare owners to swap their owned weeks or points for stays at other properties within its global network, offering flexibility and variety in vacation planning.

Travel + Leisure has also expanded into travel services and membership programs through its acquisition of Travel + Leisure Group in 2021 (the company also inherited the acquiree's name). This division focuses on delivering travel services and products beyond the timeshare market by providing subscription travel clubs, online travel booking platforms, and branded consumer products, enhancing the company’s reach in the broader leisure travel market.

4. Consumer Discretionary - Travel and Vacation Providers

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Travel and vacation providers operate tour packages, cruise lines, online travel agencies, and vacation rental platforms, connecting consumers with leisure and business travel experiences. Tailwinds include robust post-pandemic travel demand, a consumer preference shift toward experiences over goods, and technology-enabled personalization improving conversion and loyalty. However, headwinds are significant: the industry is acutely sensitive to macroeconomic cycles, geopolitical instability, and fuel price volatility. Low switching costs mean fierce price competition, while capacity additions in segments like cruises can lead to oversupply. Regulatory burdens, weather disruptions, and public health risks further create episodic but potentially severe demand shocks.

Travel + Leisure's competitors include Hilton Grand Vacations (NYSE:HGV), Marriot Vacations (NYSE:VAC), Bluegreen Vacations (NYSE:BXG), Interval Leisure Group (NASDAQ:IILG), and private companies Diamond Resorts and Anantara Vacation Club.

5. Revenue Growth

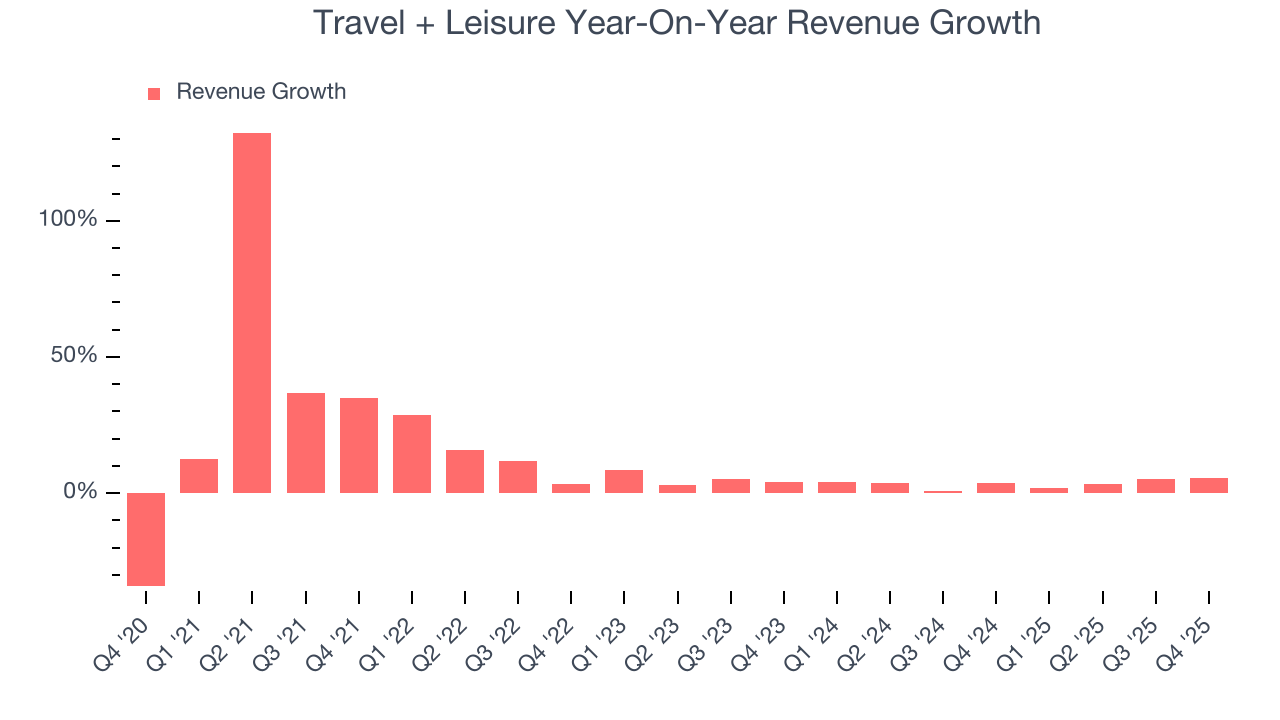

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Travel + Leisure grew its sales at a 13.2% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Travel + Leisure’s recent performance shows its demand has slowed as its annualized revenue growth of 3.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s revenue dynamics by analyzing its number of tours conducted, which reached 184,000 in the latest quarter. Over the last two years, Travel + Leisure’s tours conducted averaged 2.2% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Travel + Leisure reported year-on-year revenue growth of 5.7%, and its $1.03 billion of revenue exceeded Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

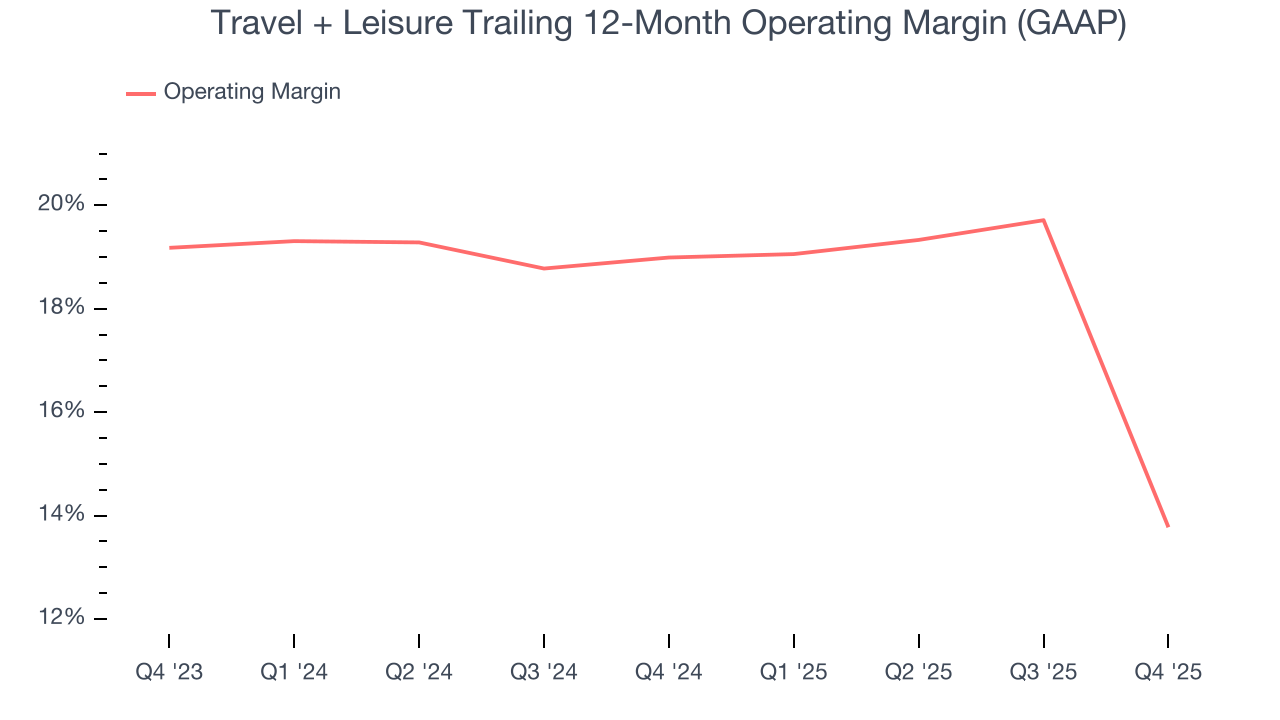

Travel + Leisure’s operating margin has been trending down over the last 12 months and averaged 16.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Travel + Leisure generated an operating margin profit margin of negative 2.1%, down 23.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

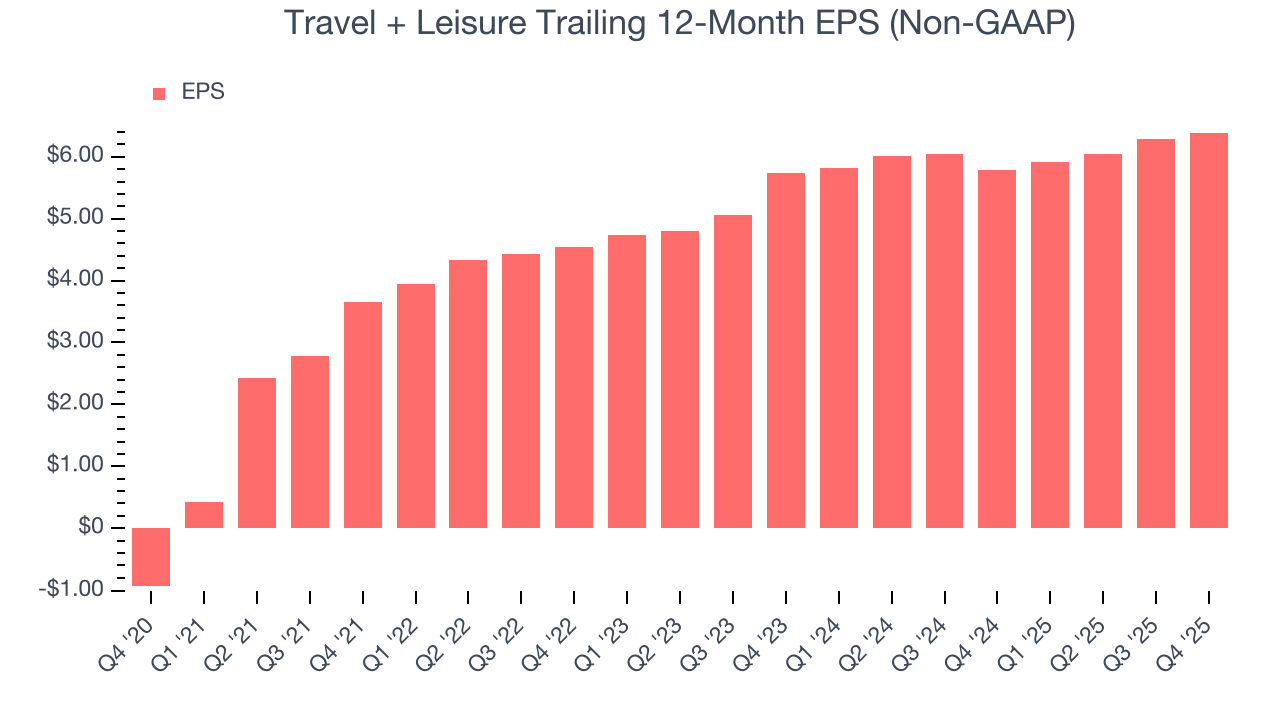

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Travel + Leisure’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Travel + Leisure reported adjusted EPS of $1.83, up from $1.72 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Travel + Leisure’s full-year EPS of $6.39 to grow 14.9%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

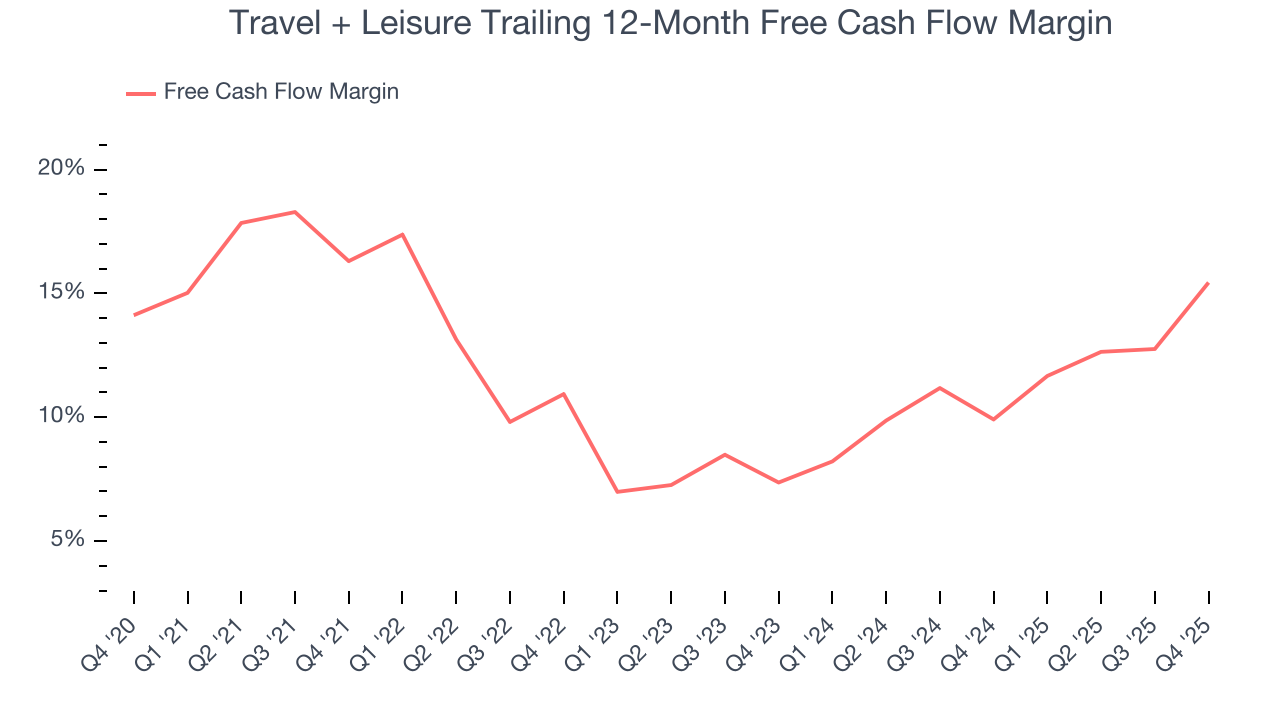

Travel + Leisure has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 12.7%, lousy for a consumer discretionary business.

Travel + Leisure’s free cash flow clocked in at $190 million in Q4, equivalent to a 18.5% margin. This result was good as its margin was 10.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Travel + Leisure’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 15.4% for the last 12 months will decrease to 12.8%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Travel + Leisure historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 12.4%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Travel + Leisure’s ROIC averaged 4.6 percentage point decreases each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Travel + Leisure’s $5.60 billion of debt exceeds the $426 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $990 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Travel + Leisure could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Travel + Leisure can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Travel + Leisure’s Q4 Results

It was great to see Travel + Leisure’s EBITDA guidance for next quarter top analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $72.57 immediately after reporting.

12. Is Now The Time To Buy Travel + Leisure?

Updated: February 18, 2026 at 6:38 AM EST

Are you wondering whether to buy Travel + Leisure or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Travel + Leisure falls short of our quality standards. While its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its number of tours conducted has disappointed. On top of that, its Forecasted free cash flow margin suggests the company will ramp up its investments next year.

Travel + Leisure’s P/E ratio based on the next 12 months is 9.9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $78.33 on the company (compared to the current share price of $72.57).