Toast (TOST)

We see potential in Toast. Its ARR growth highlights the stickiness of its business model and suggests it’s winning market share.― StockStory Analyst Team

1. News

2. Summary

Why Toast Is Interesting

Born from the frustrations of three friends waiting too long for their restaurant bill, Toast (NYSE:TOST) provides a cloud-based digital technology platform with software, payment processing, and hardware solutions built specifically for restaurants.

- Annual revenue growth of 49.5% over the past five years was outstanding, reflecting market share gains

- Customers view its software as mission-critical to their operations as its ARR has averaged 29.4% growth over the last year

- One risk is its sky-high servicing costs result in an inferior gross margin of 26% that must be offset through increased usage

Toast is solid, but not perfect. If you like the story, the price looks reasonable.

Why Is Now The Time To Buy Toast?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Toast?

Toast is trading at $30.15 per share, or 2.5x forward price-to-sales. Toast’s current price appears to be a good deal for the revenue growth you get.

It could be a good time to invest if you see something the market doesn’t.

3. Toast (TOST) Research Report: Q4 CY2025 Update

Restaurant technology platform Toast (NYSE:TOST) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 22% year on year to $1.63 billion. Its GAAP profit of $0.16 per share was 33.1% above analysts’ consensus estimates.

Toast (TOST) Q4 CY2025 Highlights:

- Revenue: $1.63 billion vs analyst estimates of $1.62 billion (22% year-on-year growth, 0.5% beat)

- EPS (GAAP): $0.16 vs analyst estimates of $0.12 (33.1% beat)

- Adjusted EBITDA: $298 million vs analyst estimates of $150.2 million (18.2% margin, 98.3% beat)

- EBITDA guidance for the upcoming financial year 2026 is $785 million at the midpoint, below analyst estimates of $790.6 million

- Operating Margin: 5.2%, up from 2.4% in the same quarter last year

- Free Cash Flow Margin: 10.9%, up from 9.4% in the previous quarter

- Annual Recurring Revenue: $2.05 billion vs analyst estimates of $2.06 billion (25.9% year-on-year growth, in line)

- Market Capitalization: $16.48 billion

Company Overview

Born from the frustrations of three friends waiting too long for their restaurant bill, Toast (NYSE:TOST) provides a cloud-based digital technology platform with software, payment processing, and hardware solutions built specifically for restaurants.

Toast's platform serves as a comprehensive restaurant operating system that connects front-of-house and back-of-house operations across various service models including dine-in, takeout, delivery, catering, and retail. The company's offerings span several categories: point-of-sale software, integrated payment processing, restaurant-grade hardware, digital ordering and delivery solutions, marketing and loyalty programs, team management tools, supply chain and accounting features, and financial technology solutions.

The hardware lineup includes custom-built, restaurant-grade devices like Toast Flex terminals, Toast Go handheld POS devices, and Toast Tap card readers—all designed to withstand the demanding restaurant environment. On the software side, Toast's Android-based system enables tableside ordering, kitchen display systems, online ordering, QR code ordering and payment, reservation management, and detailed analytics.

Toast monetizes through multiple revenue streams. Restaurants pay subscription fees for software access, hardware purchases or financing, and payment processing fees when guests pay by card. The company also offers financial services, including Toast Capital, which provides eligible restaurants with access to loans based on their payment processing history.

For a neighborhood pizzeria, Toast might provide the ordering system for both in-store and online orders, process customer payments, help manage staff scheduling, track inventory, and even offer a loyalty program that rewards repeat customers—all while collecting valuable data that helps the restaurant optimize its operations.

4. Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Toast competes with traditional restaurant POS providers like NCR Aloha and Oracle MICROS, as well as newer technology platforms including Square (NYSE:SQ), Lightspeed (NYSE:LSPD), Clover (owned by Fiserv, NASDAQ:FISV), and privately-held companies like SpotOn and Revel Systems.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Toast grew its sales at an incredible 49.5% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Toast’s annualized revenue growth of 26.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Toast reported robust year-on-year revenue growth of 22%, and its $1.63 billion of revenue topped Wall Street estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 20.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and indicates the market is baking in success for its products and services.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Toast’s ARR punched in at $2.05 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 29.4% year-on-year increases. This alternate topline metric grew faster than total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Toast’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

8. Gross Margin & Pricing Power

For software companies like Toast, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Toast’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 25.9% gross margin over the last year. Said differently, Toast had to pay a chunky $74.06 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Toast has seen gross margins improve by 4.3 percentage points over the last 2 year, which is very good in the software space.

In Q4, Toast produced a 25.9% gross profit margin, in line with the same quarter last year. On a wider time horizon, Toast’s full-year margin has been trending up over the past 12 months, increasing by 1.9 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

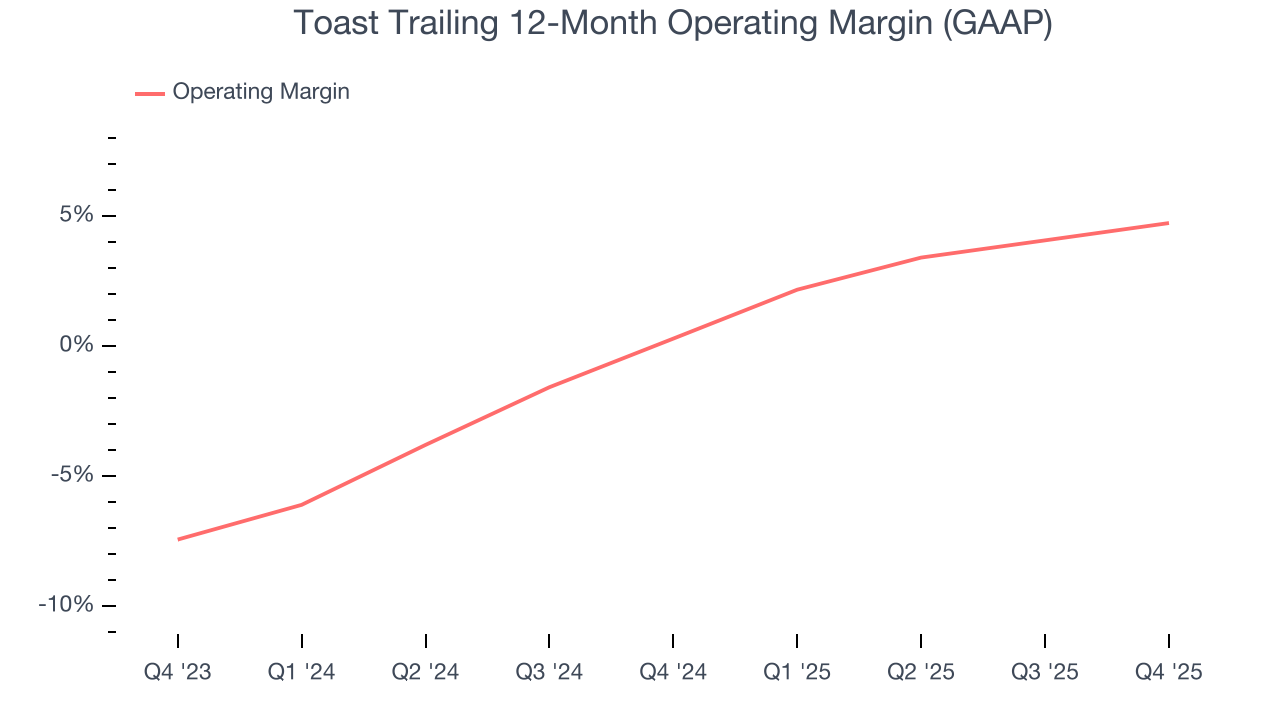

Toast has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 4.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Toast’s operating margin rose by 4.4 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Toast generated an operating margin profit margin of 5.2%, up 2.8 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Toast has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.9%, subpar for a software business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Toast to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Toast’s free cash flow clocked in at $178 million in Q4, equivalent to a 10.9% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts’ consensus estimates show they’re expecting Toast’s free cash flow margin of 9.9% for the last 12 months to remain the same.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Toast is a profitable, well-capitalized company with $2.06 billion of cash and $20 million of debt on its balance sheet. This $2.04 billion net cash position is 12.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Toast’s Q4 Results

We were impressed by how significantly Toast blew past analysts’ EBITDA expectations this quarter. We were also glad its EBITDA guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed, and this is weighing on shares. Investors were likely hoping for more, and shares traded down 8% to $24.53 immediately after reporting.

13. Is Now The Time To Buy Toast?

Updated: March 6, 2026 at 9:27 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Toast.

In our opinion, Toast is a good company. First off, its revenue growth was exceptional over the last five years. And while its customer acquisition is less efficient than many comparable companies, its surging ARR shows its fundamentals and revenue predictability are improving. On top of that, its operating margins are in line with the overall software sector.

Toast’s price-to-sales ratio based on the next 12 months is 2.5x. When scanning the software space, Toast trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $37.22 on the company (compared to the current share price of $30.15), implying they see 23.5% upside in buying Toast in the short term.