The Toro Company (TTC)

The Toro Company is in for a bumpy ride. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think The Toro Company Will Underperform

Ceasing all production to support the war effort during World War II, Toro (NYSE:TTC) offers outdoor equipment for residential, commercial, and agricultural use.

- Sales were flat over the last two years, indicating it’s failed to expand this cycle

- Flat earnings per share over the last two years lagged its peers

- Anticipated sales growth of 3.1% for the next year implies demand will be shaky

The Toro Company is in the doghouse. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than The Toro Company

High Quality

Investable

Underperform

Why There Are Better Opportunities Than The Toro Company

The Toro Company’s stock price of $91.47 implies a valuation ratio of 20.8x forward P/E. This multiple is lower than most industrials companies, but for good reason.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. The Toro Company (TTC) Research Report: Q3 CY2025 Update

Outdoor equipment company Toro (NYSE:TTC) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.07 billion. Its non-GAAP profit of $0.91 per share was 4.2% above analysts’ consensus estimates.

The Toro Company (TTC) Q3 CY2025 Highlights:

- Revenue: $1.07 billion vs analyst estimates of $1.05 billion (flat year on year, 2% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.87 (4.2% beat)

- Adjusted EBITDA: $135.8 million vs analyst estimates of $148.6 million (12.7% margin, 8.6% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.43 at the midpoint, missing analyst estimates by 4.5%

- Operating Margin: 8.7%, down from 10.1% in the same quarter last year

- Free Cash Flow Margin: 26.9%, up from 18.6% in the same quarter last year

- Market Capitalization: $7.11 billion

Company Overview

Ceasing all production to support the war effort during World War II, Toro (NYSE:TTC) offers outdoor equipment for residential, commercial, and agricultural use.

Toro has a rich history dating back to its founding in 1914. The company initially gained traction in the agricultural sector by manufacturing engines for the Bull Tractor Company before pivoting to produce motorized golf course mowers years later. This set the stage for its expansion into a wide array of outdoor products.

Toro has acquired various companies throughout the years which fueled its growth, primarily focusing on supplementing its core competencies in outdoor equipment. Specifically, its 2014 acquisition of snow removal equipment company Boss Products and 2019 acquisition of underground construction machinery company, The Charles Machine Works, added new products to its portfolio.

Today, Toro's product portfolio includes lawn mowers, irrigation systems, snow blowers, landscaping equipment, and other outdoor equipment. Its equipment is designed for residential and commercial use intended to maintain outdoor spaces. Within the commercial space, it primarily sells to companies in golf course management, landscaping, and agriculture.

Toro engages in both direct sales to end-users and through contract sales, particularly with municipalities, golf courses, and commercial landscapers who require ongoing equipment maintenance and support. These contracts typically span three to five years and often include provisions for regular servicing, parts replacement, and equipment upgrades.

Going forward, the company has a vision to grow the number of robotics equipment that it offers by investing in research and development or making acquisitions. For example, it launched its robotic lawn mower in 2023 and acquired Left Hand Robotics in 2021.

4. Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

Competitors offering similar products include Deere (NYSE:DE), Alamo (NYSE:ALG), and Lindsay (NYS:LNN).

5. Revenue Growth

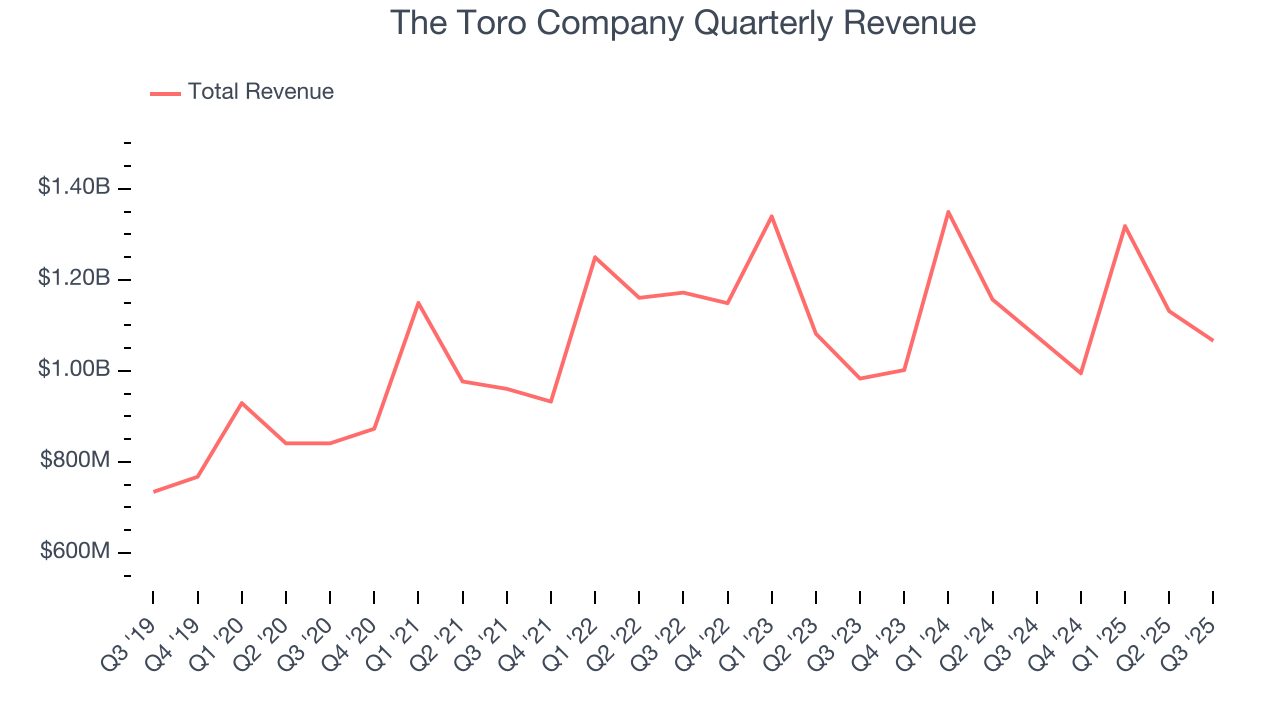

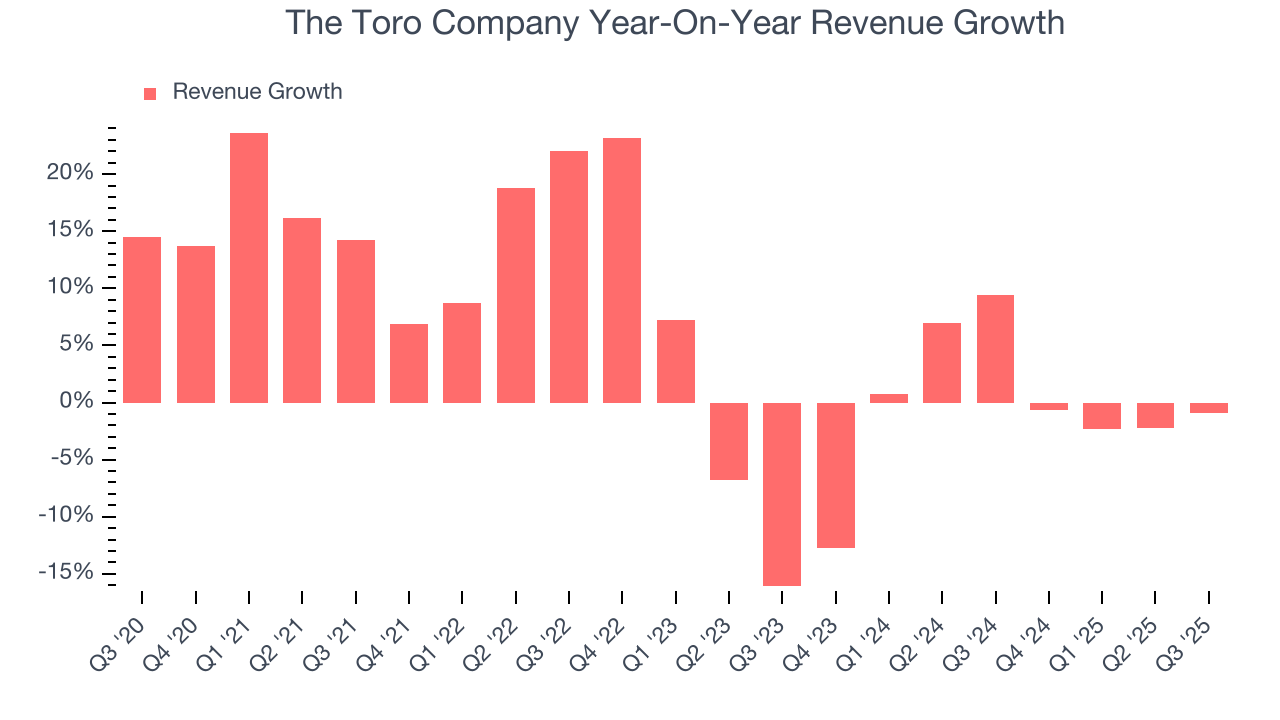

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, The Toro Company’s 5.9% annualized revenue growth over the last five years was tepid. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. The Toro Company’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Agricultural Machinery businesses have faced declining sales because of cyclical headwinds. While The Toro Company’s growth wasn’t the best, it did do better than its peers.

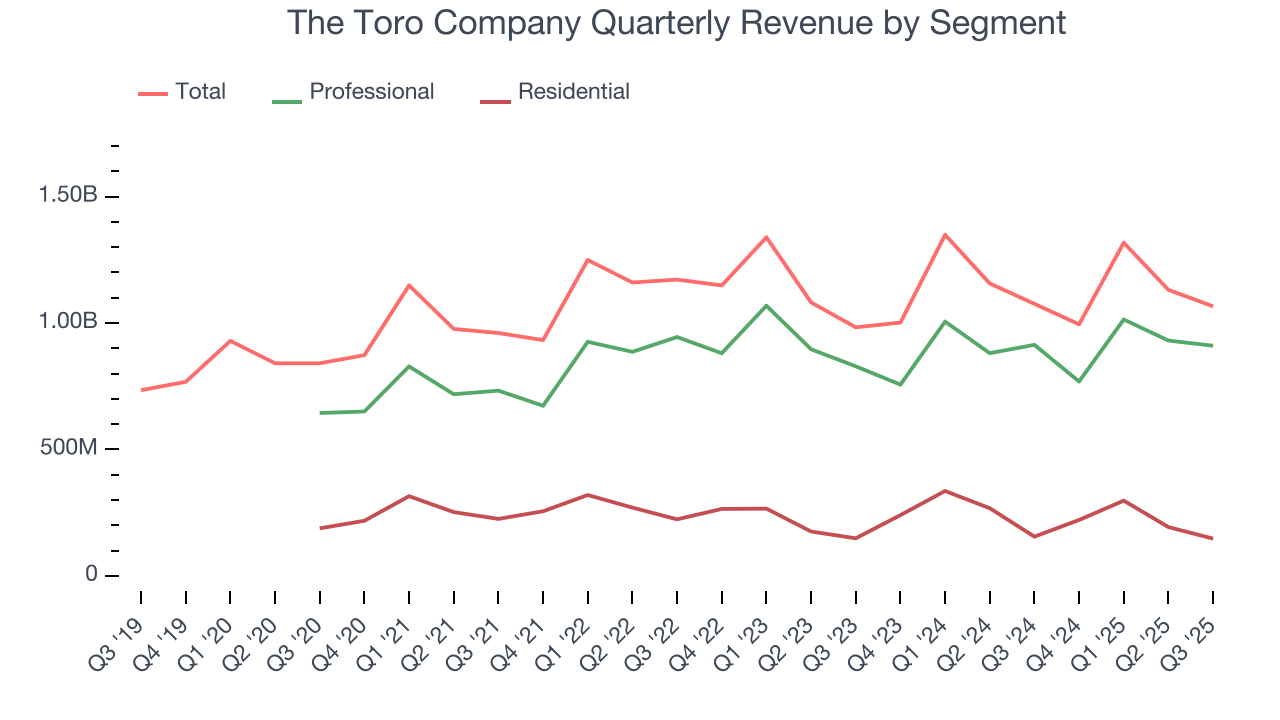

The Toro Company also breaks out the revenue for its most important segments, Professional and Residential , which are 85.4% and 13.8% of revenue. Over the last two years, The Toro Company’s Professional revenue (sales to contractors) was flat while its Residential revenue (sales to homeowners) averaged 2.7% year-on-year growth.

This quarter, The Toro Company’s $1.07 billion of revenue was flat year on year but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

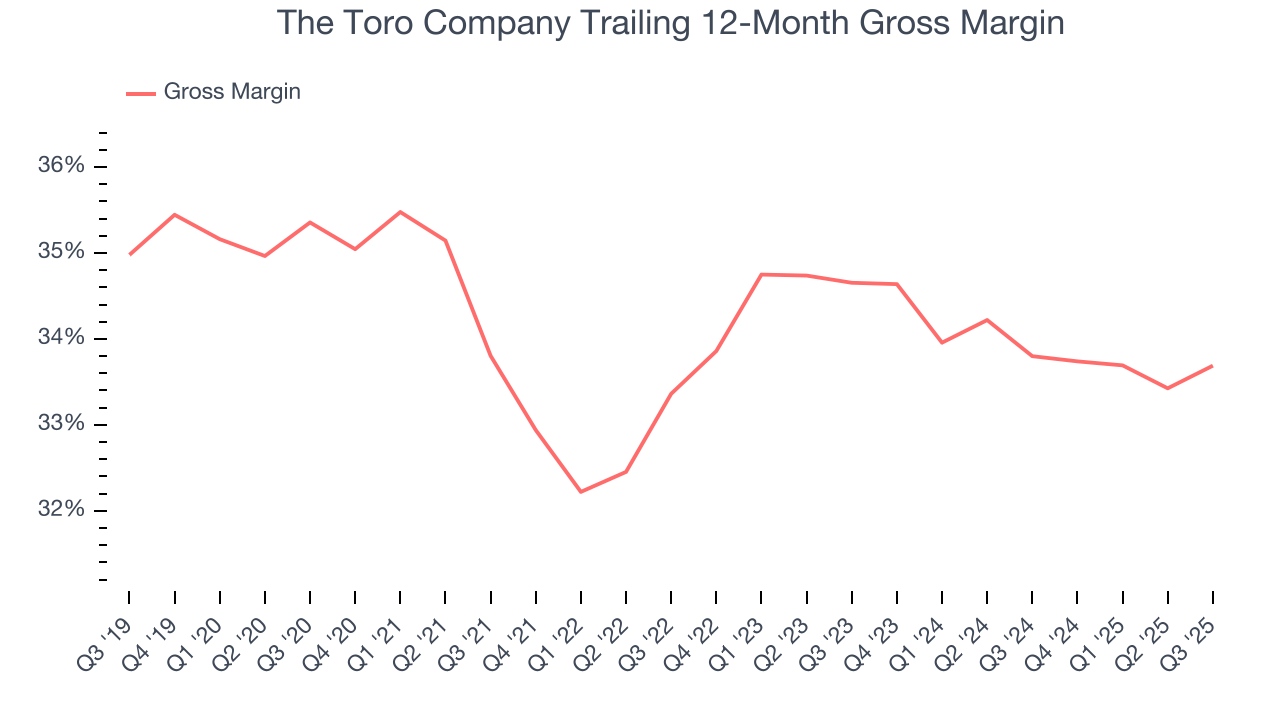

The Toro Company’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.9% gross margin over the last five years. That means for every $100 in revenue, roughly $33.86 was left to spend on selling, marketing, R&D, and general administrative overhead.

The Toro Company produced a 32.9% gross profit margin in Q3, up 1.1 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

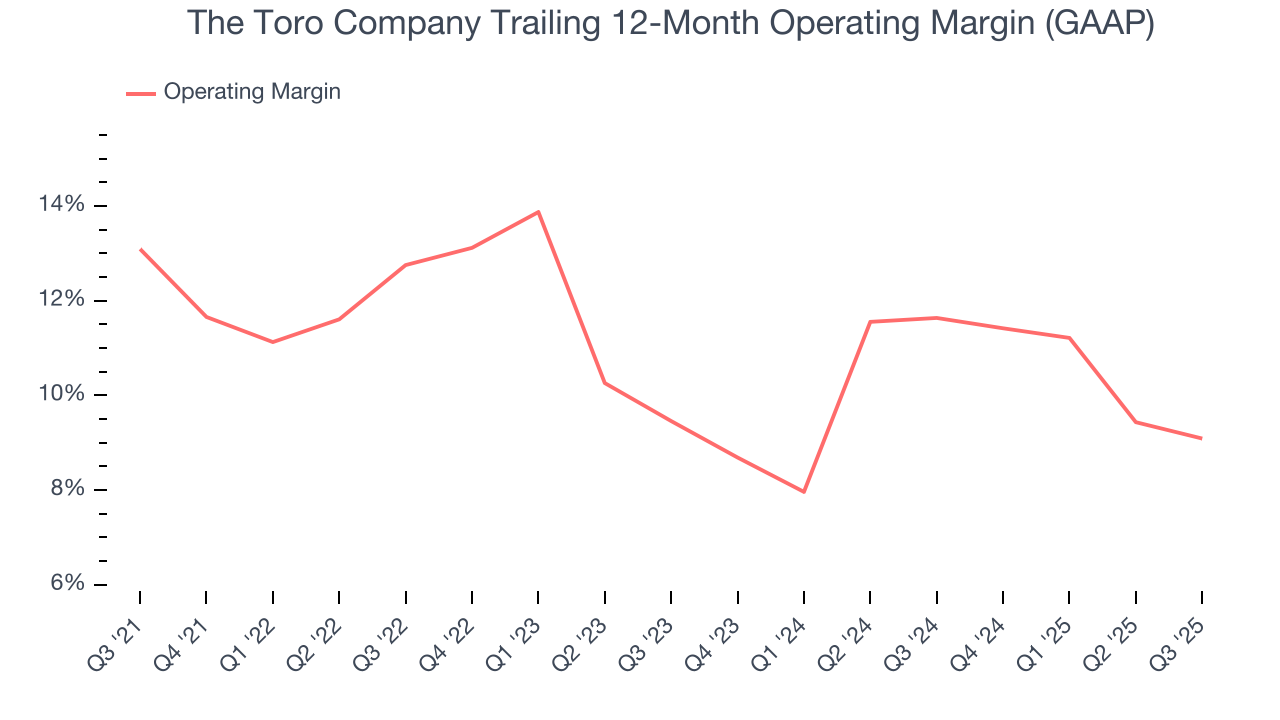

The Toro Company has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.2%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, The Toro Company’s operating margin decreased by 4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, The Toro Company generated an operating margin profit margin of 8.7%, down 1.5 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, R&D, and administrative overhead.

8. Earnings Per Share

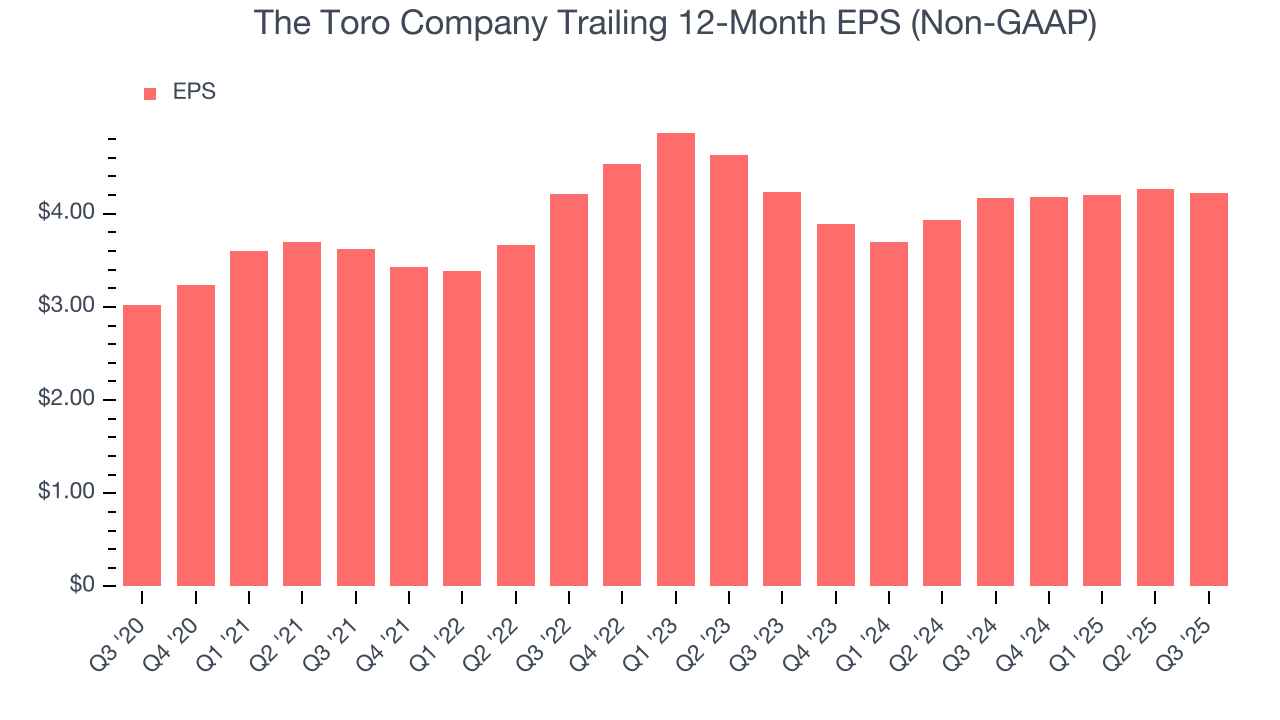

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

The Toro Company’s unimpressive 6.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For The Toro Company, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q3, The Toro Company reported adjusted EPS of $0.91, down from $0.95 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.2%. Over the next 12 months, Wall Street expects The Toro Company’s full-year EPS of $4.22 to grow 10.7%.

9. Cash Is King

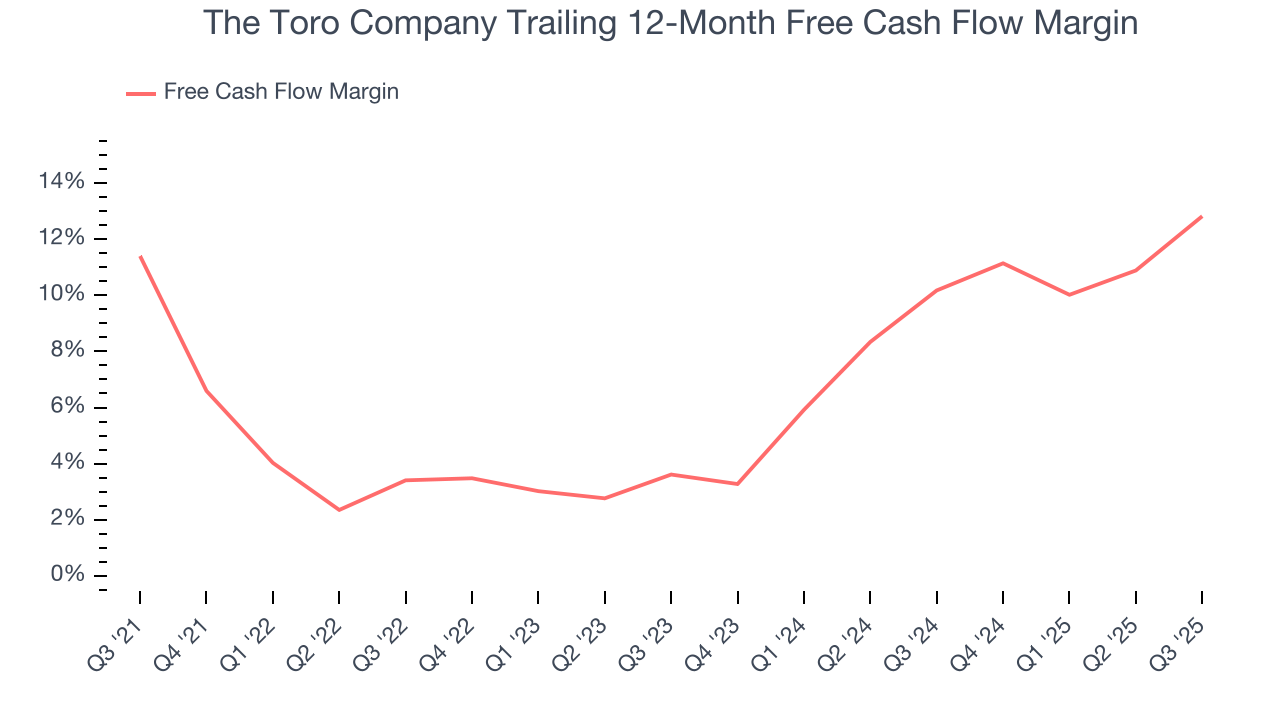

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

The Toro Company has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.2% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that The Toro Company’s margin expanded by 1.4 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

The Toro Company’s free cash flow clocked in at $286.4 million in Q3, equivalent to a 26.9% margin. This result was good as its margin was 8.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

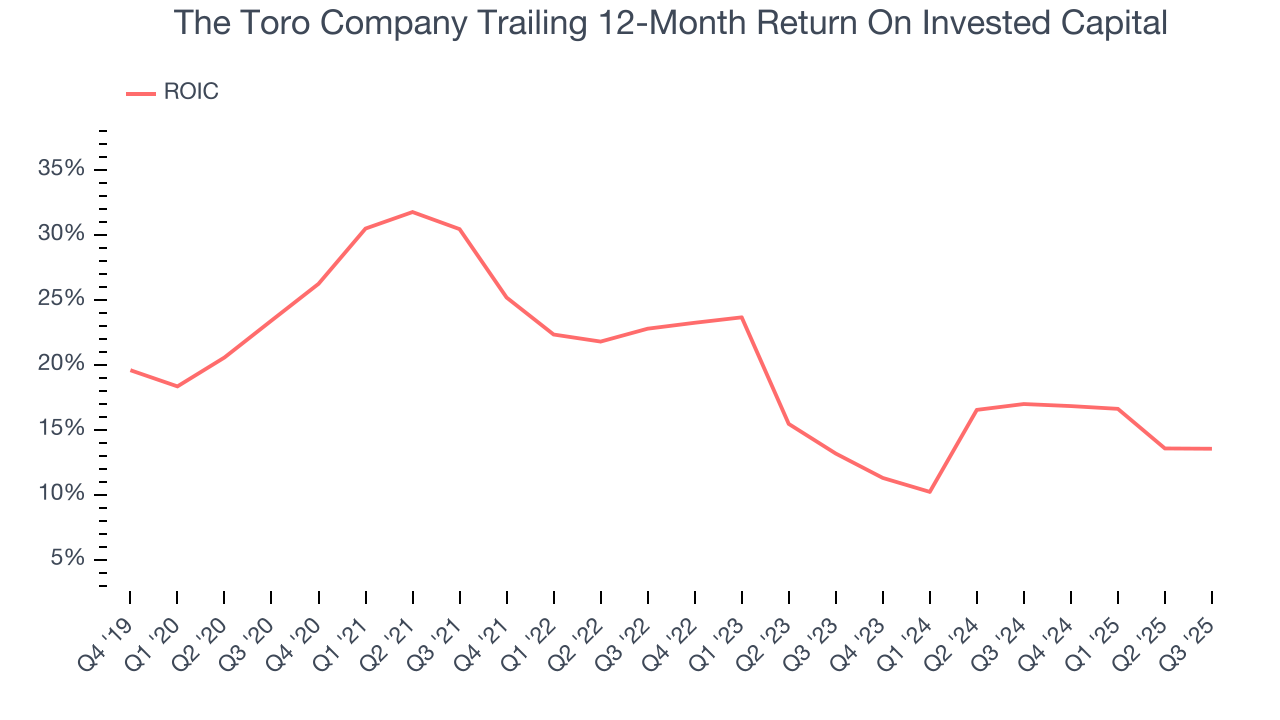

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although The Toro Company hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 19.4%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, The Toro Company’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

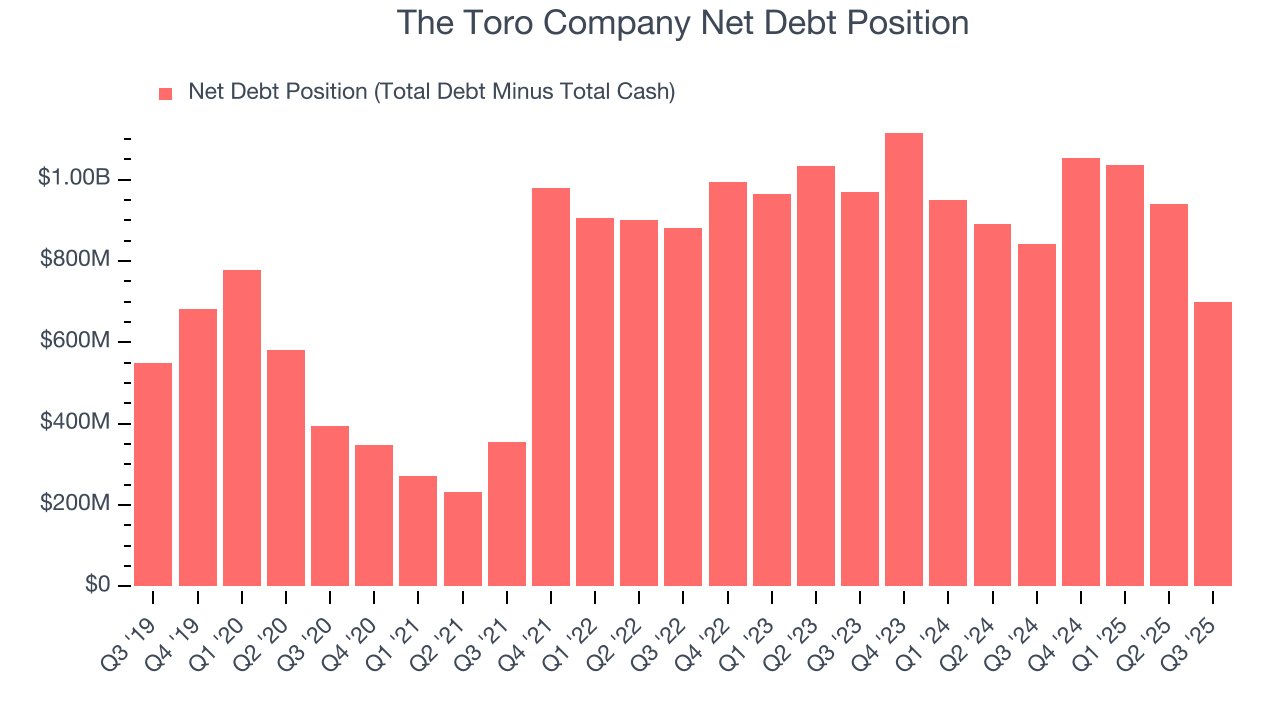

The Toro Company reported $341 million of cash and $1.04 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $660 million of EBITDA over the last 12 months, we view The Toro Company’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $32.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from The Toro Company’s Q3 Results

We were impressed by how significantly The Toro Company blew past analysts’ Residential revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 1% to $73.39 immediately following the results.

13. Is Now The Time To Buy The Toro Company?

Updated: January 30, 2026 at 10:15 PM EST

Are you wondering whether to buy The Toro Company or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We see the value of companies helping their customers, but in the case of The Toro Company, we’re out. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining operating margin shows the business has become less efficient.

The Toro Company’s P/E ratio based on the next 12 months is 20.8x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $92.60 on the company (compared to the current share price of $91.47).