United Natural Foods (UNFI)

United Natural Foods keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think United Natural Foods Will Underperform

With a vast network of 55 distribution centers spanning approximately 30 million square feet of warehouse space, United Natural Foods (NYSE:UNFI) is North America's premier grocery wholesaler distributing natural, organic, and conventional products to over 30,000 retail locations across the US and Canada.

- Easily substituted products (and therefore stiff competition) result in an inferior gross margin of 13.4% that must be offset through higher volumes

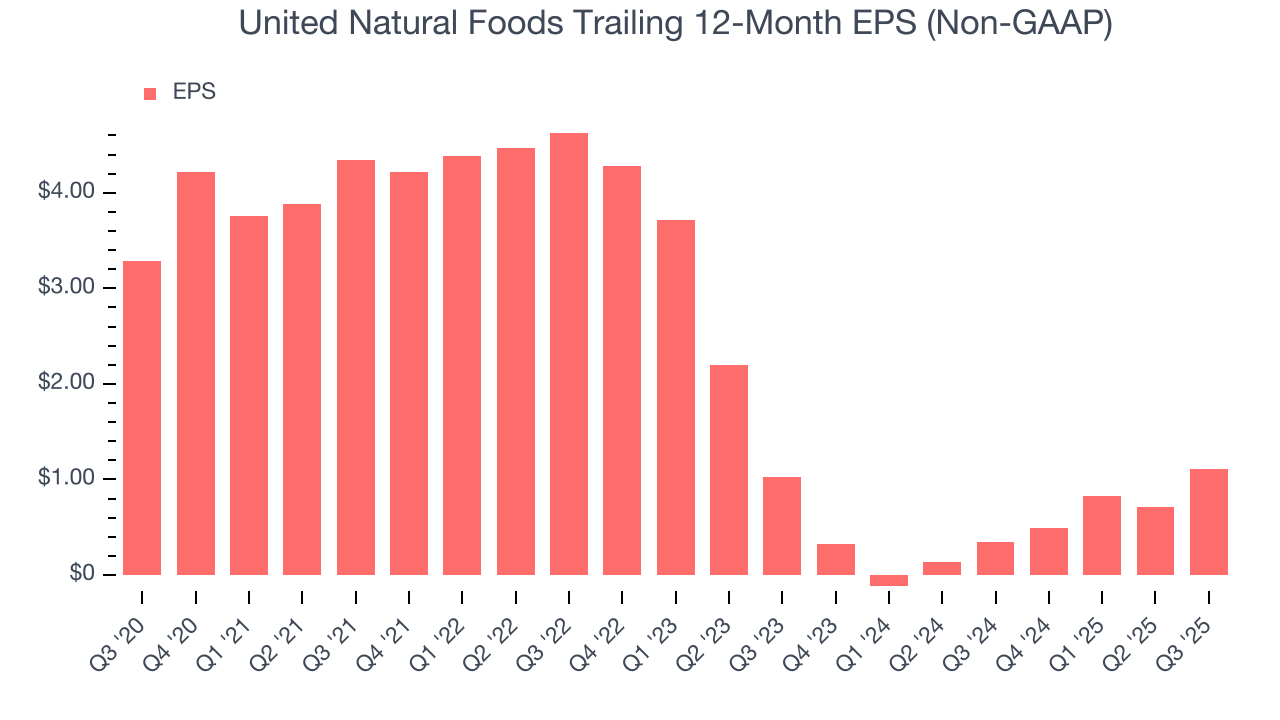

- Earnings per share fell by 37.9% annually over the last three years while its revenue grew, showing its incremental sales were much less profitable

- 6× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

United Natural Foods falls short of our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than United Natural Foods

High Quality

Investable

Underperform

Why There Are Better Opportunities Than United Natural Foods

United Natural Foods’s stock price of $40.30 implies a valuation ratio of 18x forward P/E. This multiple is quite expensive for the quality you get.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. United Natural Foods (UNFI) Research Report: Q3 CY2025 Update

Food distribution company United Natural Foods (NYSE:UNFI) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $7.84 billion. The company’s full-year revenue guidance of $31.8 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $0.56 per share was 40.3% above analysts’ consensus estimates.

United Natural Foods (UNFI) Q3 CY2025 Highlights:

- Revenue: $7.84 billion vs analyst estimates of $7.91 billion (flat year on year, 0.9% miss)

- Adjusted EPS: $0.56 vs analyst estimates of $0.40 (40.3% beat)

- Adjusted EBITDA: $167 million vs analyst estimates of $156.2 million (2.1% margin, 6.9% beat)

- EBITDA guidance for the full year is $665 million at the midpoint, in line with analyst expectations

- Operating Margin: 0.2%, in line with the same quarter last year

- Free Cash Flow was -$54 million compared to -$159 million in the same quarter last year

- Market Capitalization: $2.04 billion

Company Overview

With a vast network of 55 distribution centers spanning approximately 30 million square feet of warehouse space, United Natural Foods (NYSE:UNFI) is North America's premier grocery wholesaler distributing natural, organic, and conventional products to over 30,000 retail locations across the US and Canada.

UNFI serves as a critical link in the food supply chain, offering approximately 230,000 products across diverse categories including grocery items, perishables, frozen foods, wellness products, and bulk goods. The company operates through three segments: Natural (distributing organic and specialty items), Conventional (handling mainstream grocery products), and Retail (operating 75 Cub Foods and Shoppers grocery stores).

Beyond distribution, UNFI provides retailers with an array of services to enhance their competitiveness, including shelf management, store design, electronic payment processing, marketing programs, and data analytics. The company also maintains a portfolio of private label brands such as ESSENTIAL EVERYDAY, WILD HARVEST, and WOODSTOCK, offering customers national brand equivalent products at competitive prices.

UNFI's sophisticated logistics network employs advanced technology including radio-frequency devices, automated order selection, and transportation management systems that optimize delivery routes. The company also operates Marketplace by UNFI, a business-to-business digital platform connecting emerging brands with retailers. Through its Woodstock Farms Manufacturing subsidiary, UNFI produces nuts, dried fruits, seeds, and other natural snacks in its organic-certified facility in New Jersey.

4. Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

UNFI competes with other major food distributors including Sysco Corporation (NYSE:SYY), Performance Food Group (NYSE:PFGC), C&S Wholesale Grocers (privately held), and KeHE Distributors (privately held), which also serve various segments of the grocery retail industry.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $31.75 billion in revenue over the past 12 months, United Natural Foods is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, United Natural Foods likely needs to optimize its pricing or lean into new products and international expansion.

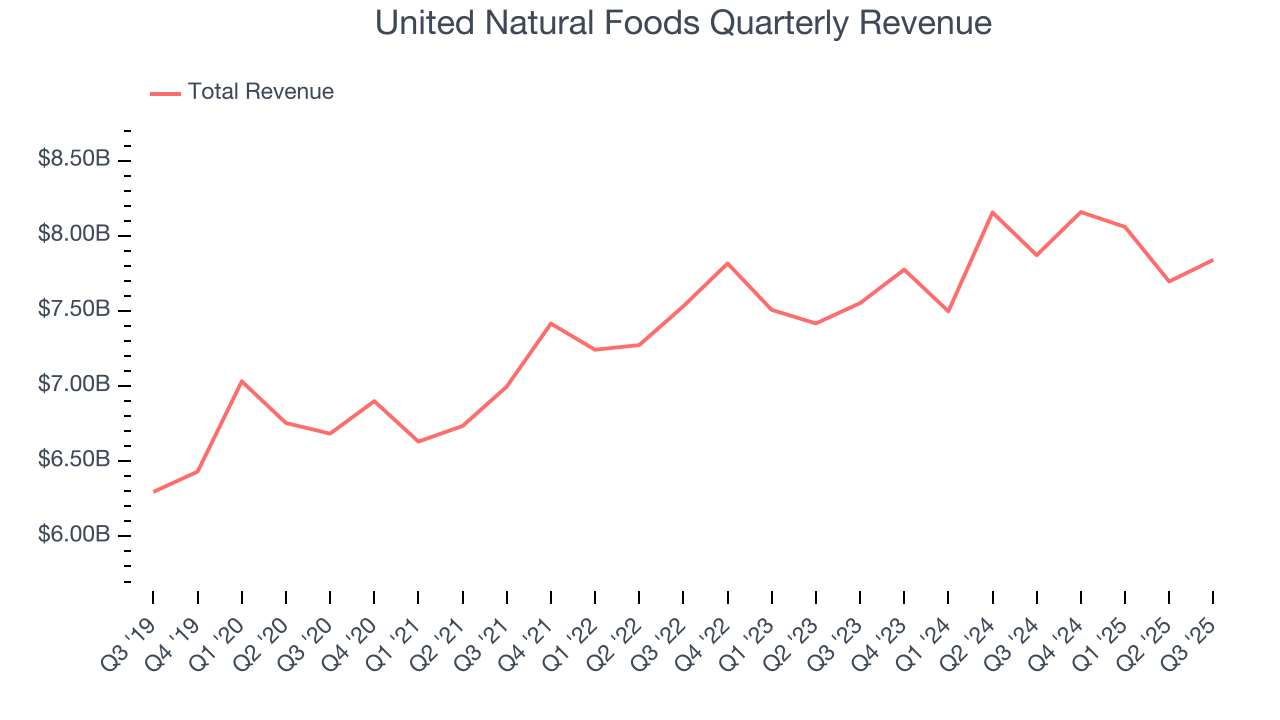

As you can see below, United Natural Foods’s 2.5% annualized revenue growth over the last three years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, United Natural Foods missed Wall Street’s estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $7.84 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products will see some demand headwinds.

6. Gross Margin & Pricing Power

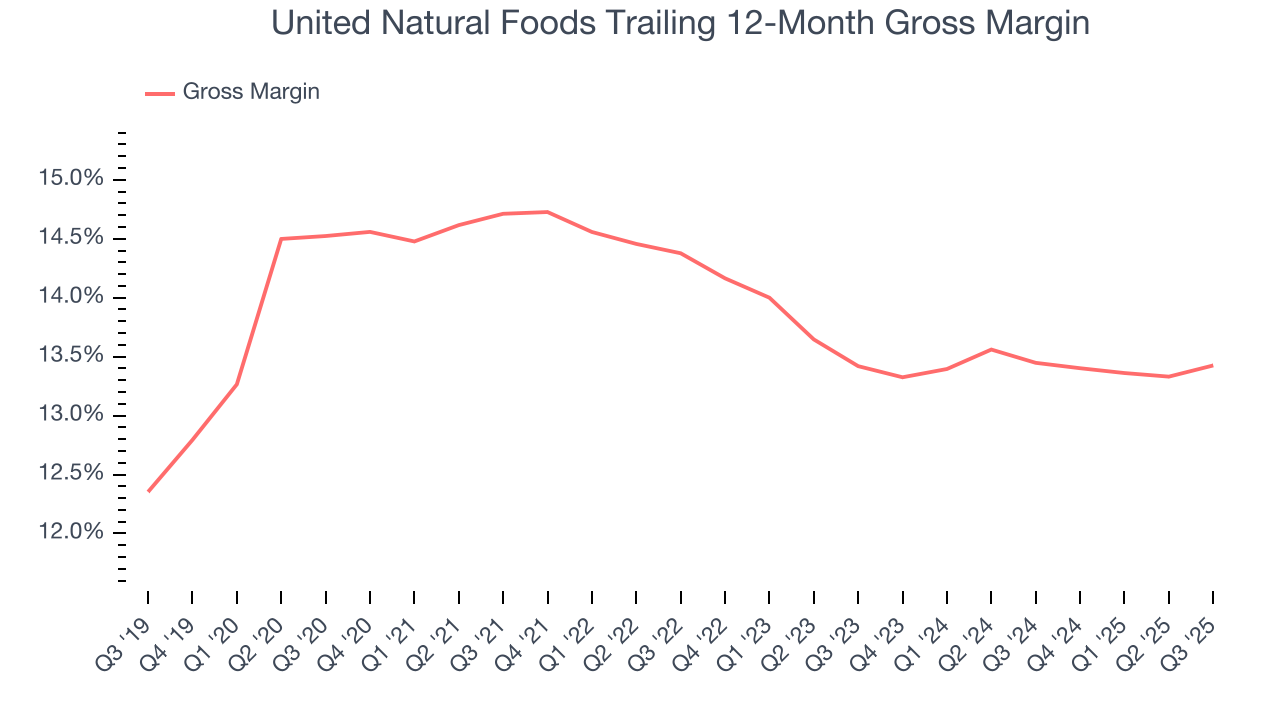

United Natural Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 13.4% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $86.56 went towards paying for raw materials, production of goods, transportation, and distribution.

United Natural Foods produced a 13.6% gross profit margin in Q3, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

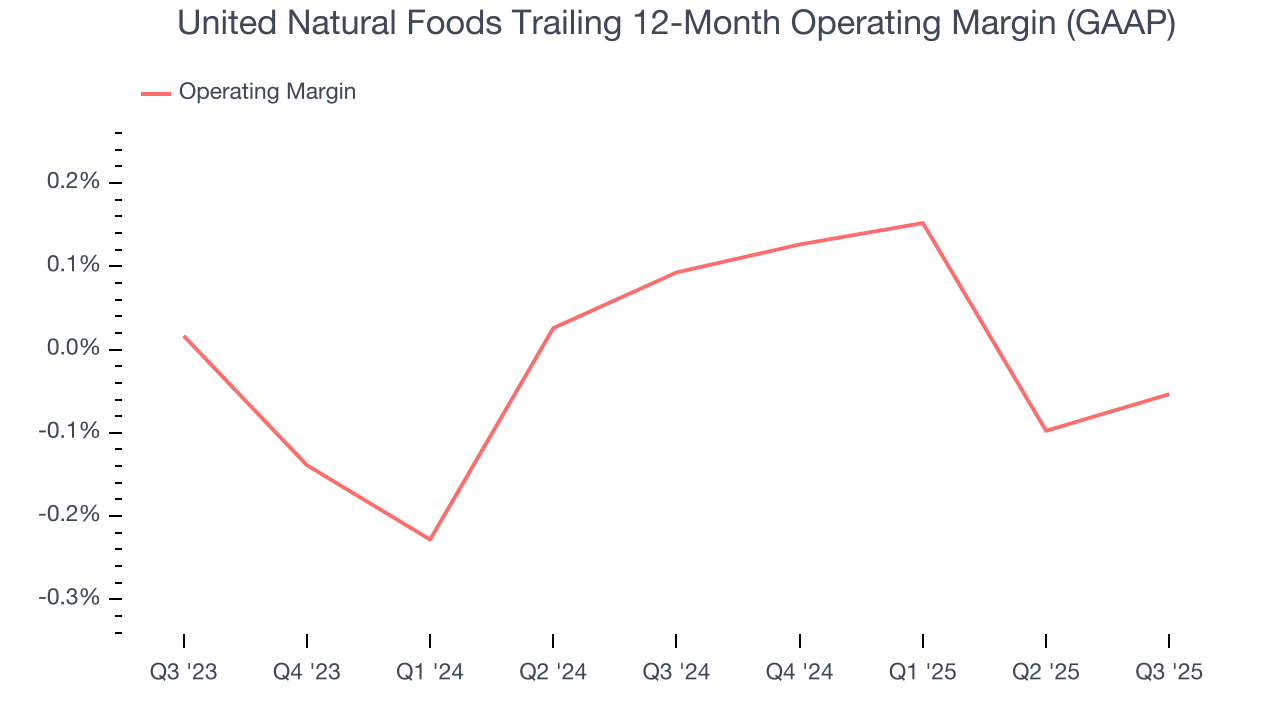

United Natural Foods’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last two years, lousy for a consumer staples business. Its large expense base , inefficient cost structure, and low gross margin were the main culprits behind this performance.

Analyzing the trend in its profitability, United Natural Foods’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, United Natural Foods’s breakeven margin was in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, United Natural Foods reported adjusted EPS of $0.56, up from $0.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects United Natural Foods’s full-year EPS of $1.11 to grow 101%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

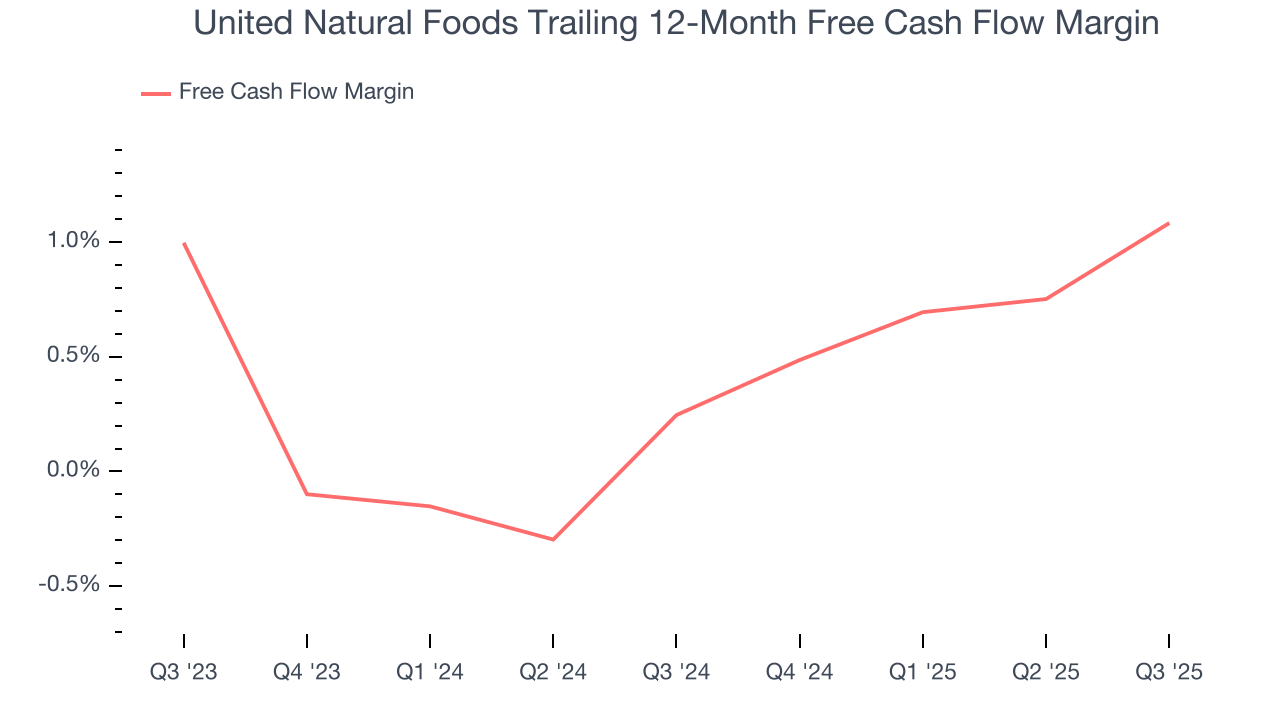

United Natural Foods broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

United Natural Foods broke even from a free cash flow perspective in Q3. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

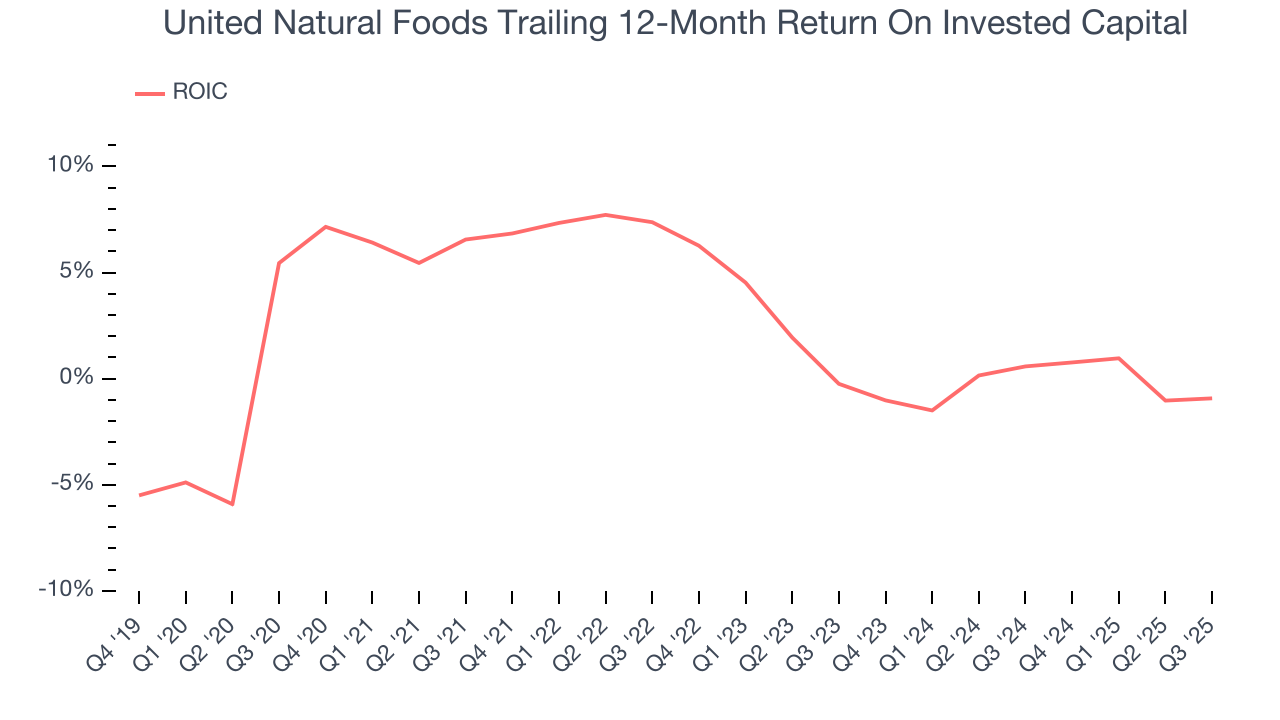

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

United Natural Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.7%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

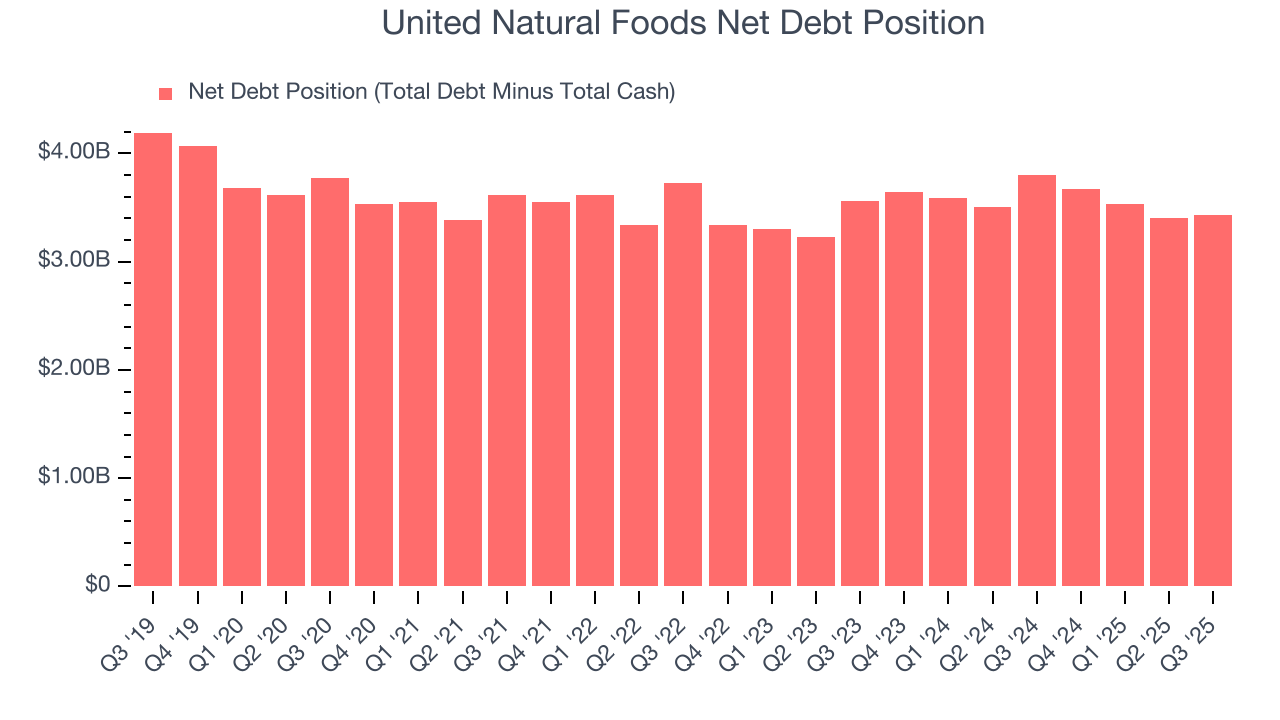

United Natural Foods’s $3.47 billion of debt exceeds the $38 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $585 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. United Natural Foods could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope United Natural Foods can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from United Natural Foods’s Q3 Results

It was good to see United Natural Foods beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed and its revenue fell slightly short of Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $33.42 immediately following the results.

13. Is Now The Time To Buy United Natural Foods?

Updated: February 17, 2026 at 12:06 AM EST

Before making an investment decision, investors should account for United Natural Foods’s business fundamentals and valuation in addition to what happened in the latest quarter.

United Natural Foods doesn’t pass our quality test. For starters, its revenue growth was uninspiring over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses.

United Natural Foods’s P/E ratio based on the next 12 months is 18x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $41.13 on the company (compared to the current share price of $40.30).