US Foods (USFD)

We wouldn’t buy US Foods. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think US Foods Will Underperform

With a fleet of over 6,500 trucks delivering everything from fresh produce to frozen entrées, US Foods (NYSE:USFD) is a major foodservice distributor that supplies food products and services to approximately 250,000 restaurants, healthcare facilities, hotels, and educational institutions across the United States.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 11.5% for the last five years

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

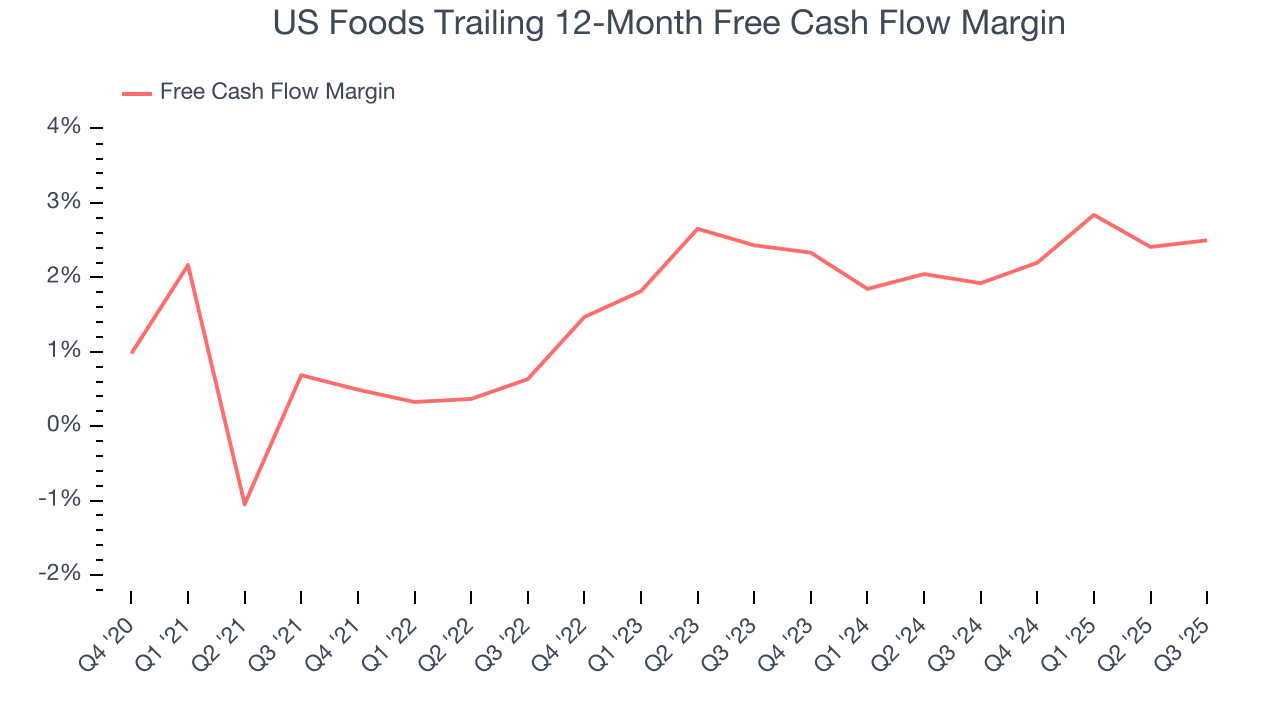

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 2.3% for the last two years

US Foods fails to meet our quality criteria. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than US Foods

Why There Are Better Opportunities Than US Foods

US Foods is trading at $101.95 per share, or 18.9x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. US Foods (USFD) Research Report: Q4 CY2025 Update

Food distribution giant US Foods (NYSE:USFD) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.3% year on year to $9.8 billion. Its non-GAAP profit of $1.04 per share was 3.4% above analysts’ consensus estimates.

US Foods (USFD) Q4 CY2025 Highlights:

- Revenue: $9.8 billion vs analyst estimates of $9.90 billion (3.3% year-on-year growth, 1% miss)

- Adjusted EPS: $1.04 vs analyst estimates of $1.01 (3.4% beat)

- Operating Margin: 3.3%, in line with the same quarter last year

- Sales Volumes were flat year on year (3.5% in the same quarter last year)

- Market Capitalization: $20.05 billion

Company Overview

With a fleet of over 6,500 trucks delivering everything from fresh produce to frozen entrées, US Foods (NYSE:USFD) is a major foodservice distributor that supplies food products and services to approximately 250,000 restaurants, healthcare facilities, hotels, and educational institutions across the United States.

The company operates as a crucial link in the food supply chain, connecting thousands of suppliers with a diverse range of customers. Its product assortment spans fresh, frozen, and dry food categories along with non-food items essential to foodservice operations. Beyond simply delivering products, US Foods differentiates itself through value-added services including digital ordering platforms, menu design, and business analytics tools.

US Foods employs approximately 4,000 sales associates supported by chefs and restaurant consultants who provide culinary expertise to customers. This team-based selling approach helps restaurants optimize their operations, reduce costs, and keep their menus on-trend. A restaurant chain might work with US Foods to develop seasonal menu items, source specialty ingredients, and manage inventory through the company's MOXe digital platform.

The company generates revenue through product markups and distribution fees. It also develops private label products under its Exclusive Brands portfolio, which offers customers alternatives to national brands at various price points. US Foods reaches customers through multiple channels including regular delivery routes, over 90 cash-and-carry CHEF'STORE locations for immediate needs, and specialty direct shipping for unique items.

4. Distributors

Distributors serve as intermediaries connecting manufacturers with retailers or end customers, managing logistics, inventory, and fulfillment across various product categories. Tailwinds include supply chain complexity driving demand for specialized distribution expertise, e-commerce growth requiring robust fulfillment networks, and businesses outsourcing logistics to focus on core operations. Consolidation opportunities may benefit scale players. Headwinds include margin pressure from powerful suppliers and customers, competition from manufacturers selling direct, and rising transportation and labor costs. Additionally, economic downturns reduce demand volumes, while inventory management challenges and potential supply chain disruptions introduce operational risks requiring sophisticated systems.

US Foods competes primarily with Sysco Corporation (NYSE: SYY), Performance Food Group (NYSE: PFGC), and Gordon Food Service (private), along with numerous regional distributors in the fragmented foodservice supply market.

5. Revenue Growth

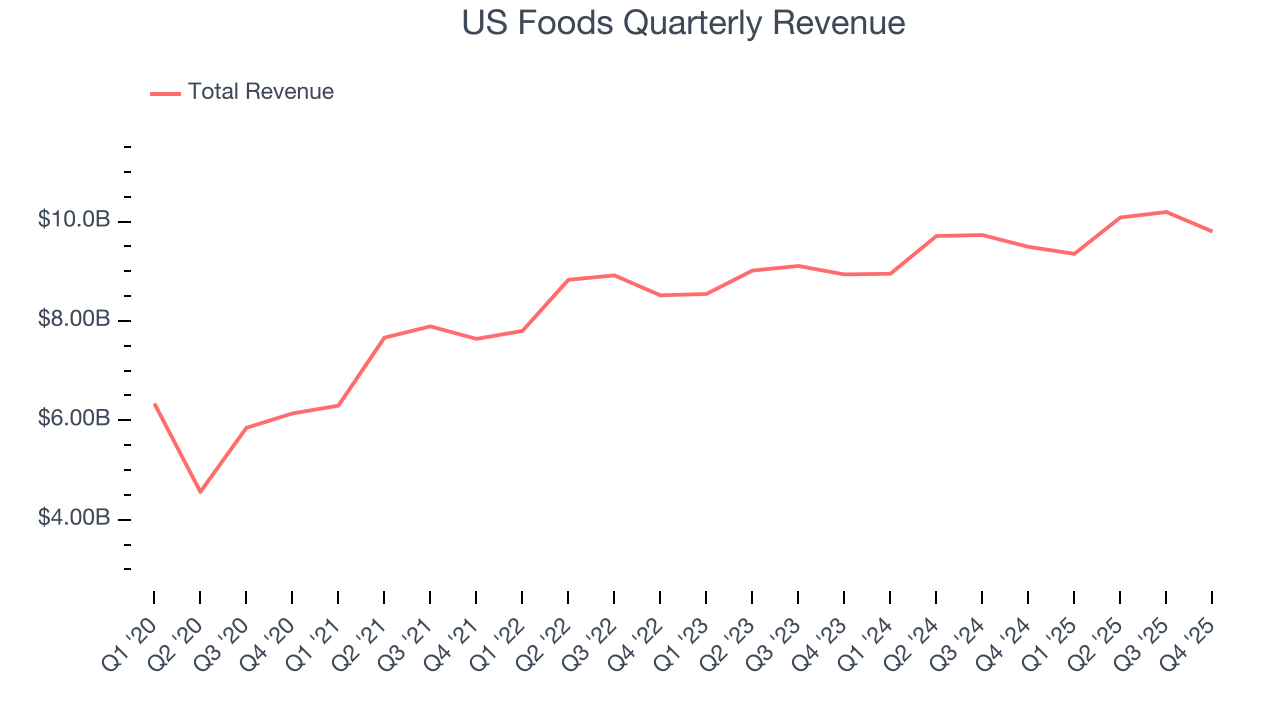

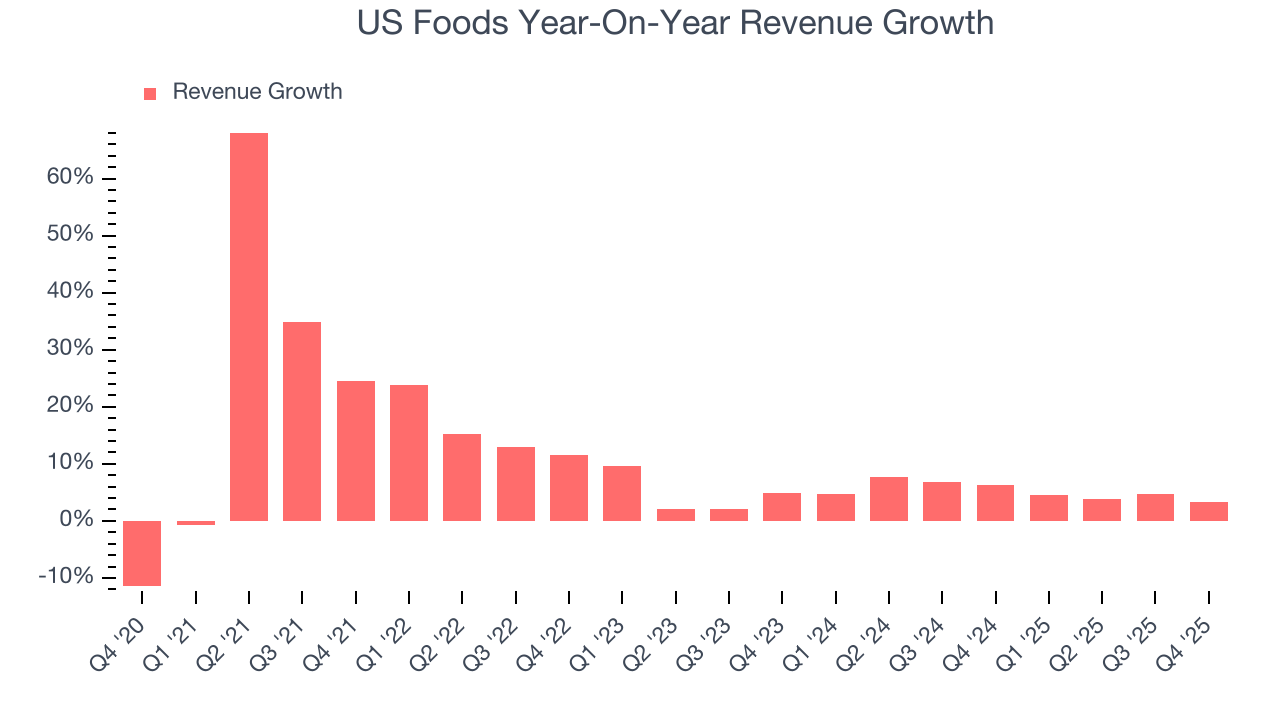

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, US Foods grew its sales at a 11.5% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. US Foods’s recent performance shows its demand has slowed as its annualized revenue growth of 5.2% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can better understand the company’s revenue dynamics by analyzing its number of units sold. Over the last two years, US Foods’s units sold averaged 2.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, US Foods’s revenue grew by 3.3% year on year to $9.8 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, similar to its two-year rate. Although this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

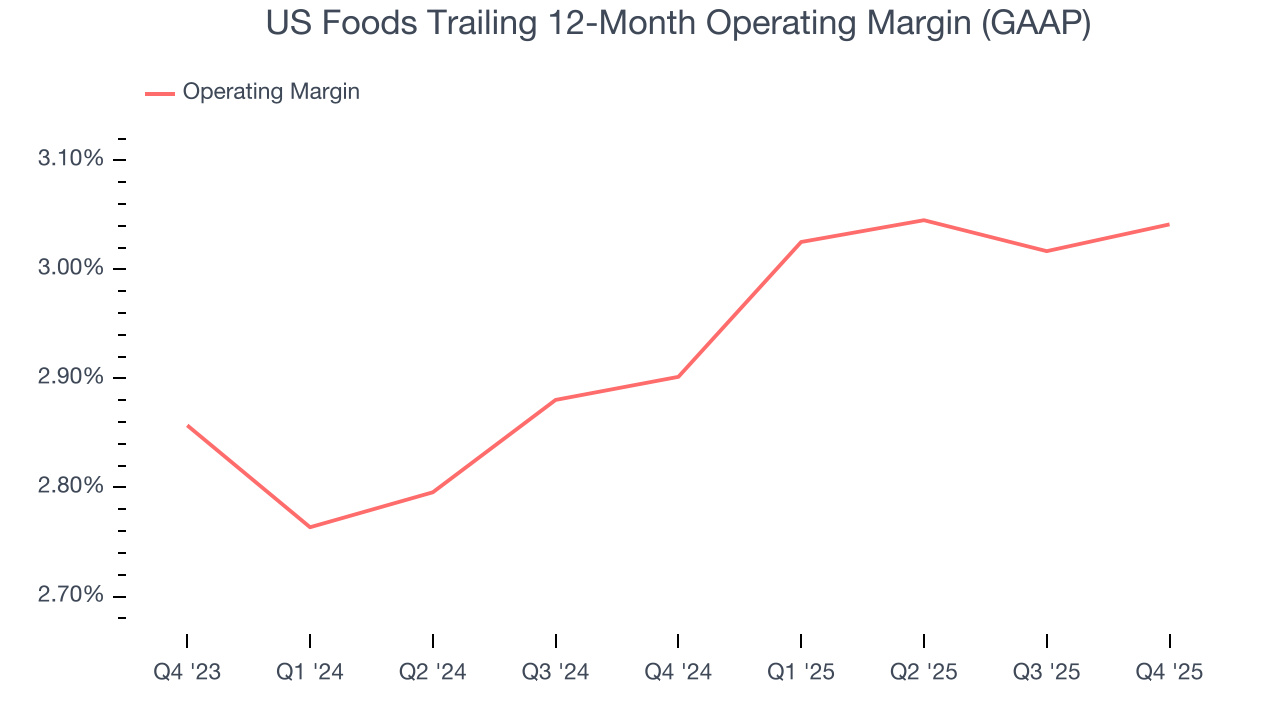

US Foods’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 3% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, US Foods generated an operating margin profit margin of 3.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

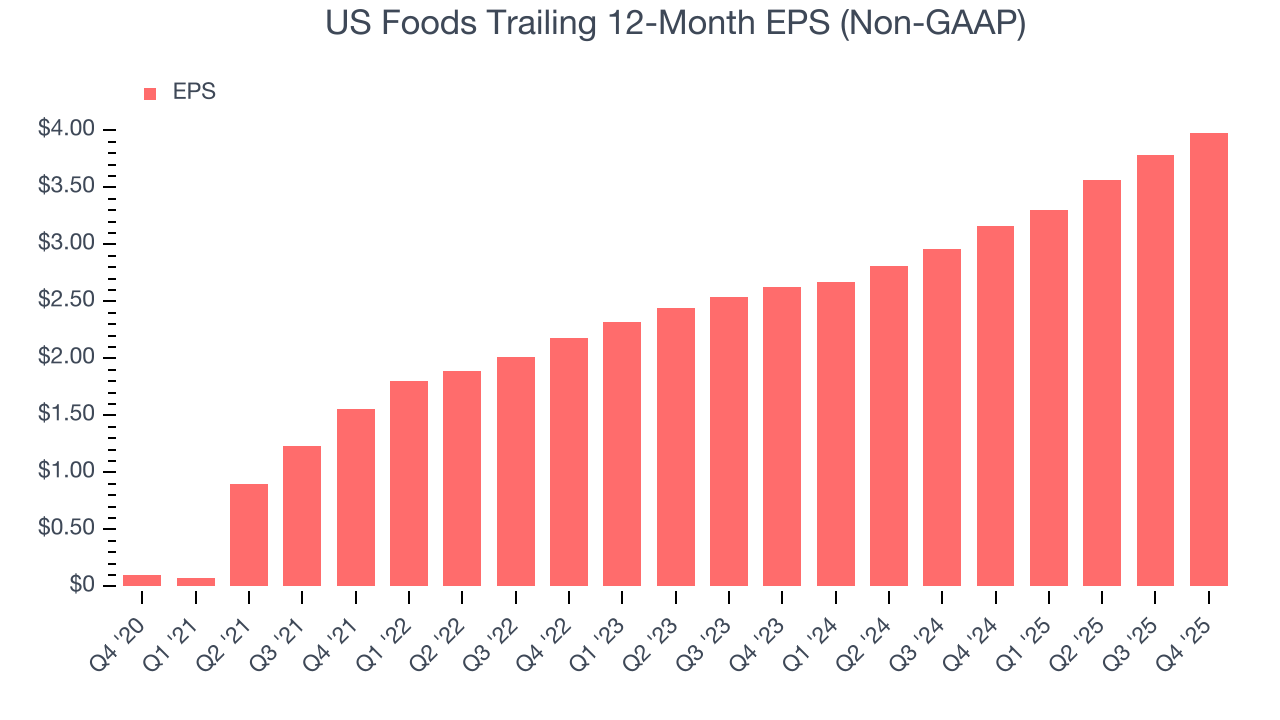

US Foods’s EPS grew at an astounding 109% compounded annual growth rate over the last five years, higher than its 11.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, US Foods reported adjusted EPS of $1.04, up from $0.84 in the same quarter last year. This print beat analysts’ estimates by 3.4%. Over the next 12 months, Wall Street expects US Foods’s full-year EPS of $3.98 to grow 18.6%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

US Foods has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.4%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

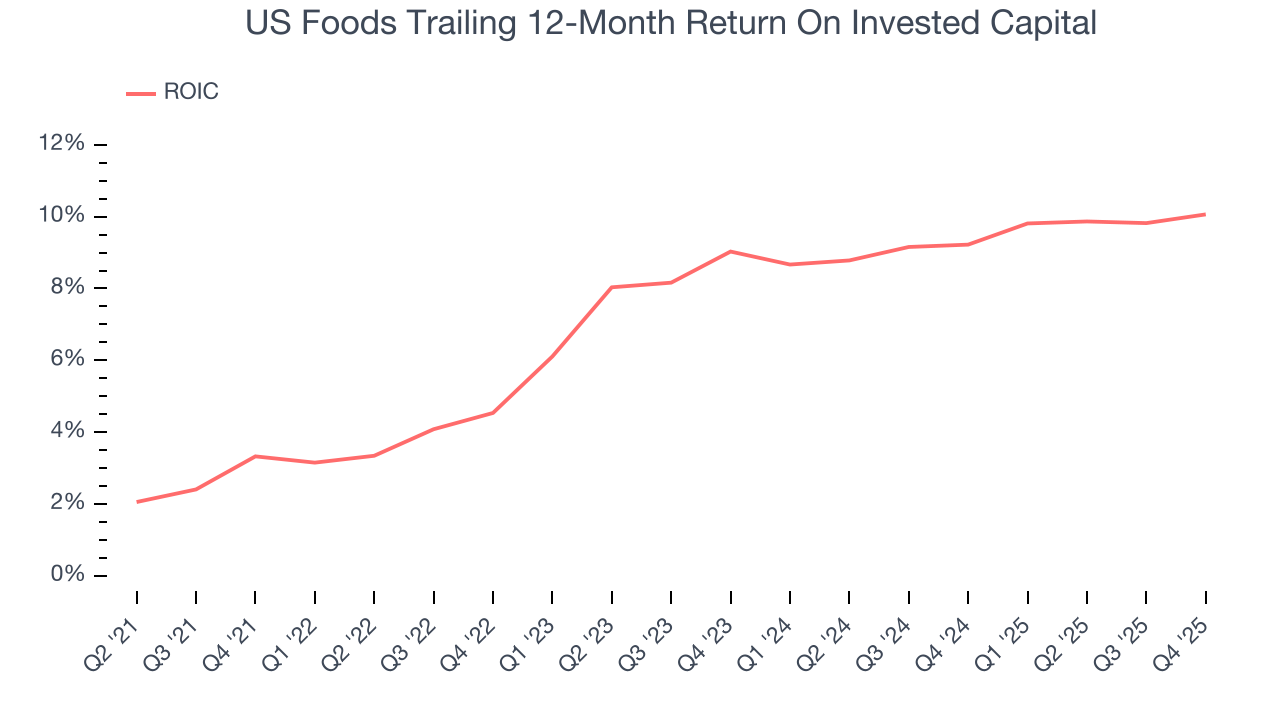

US Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.2%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. US Foods’s ROIC has increased over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

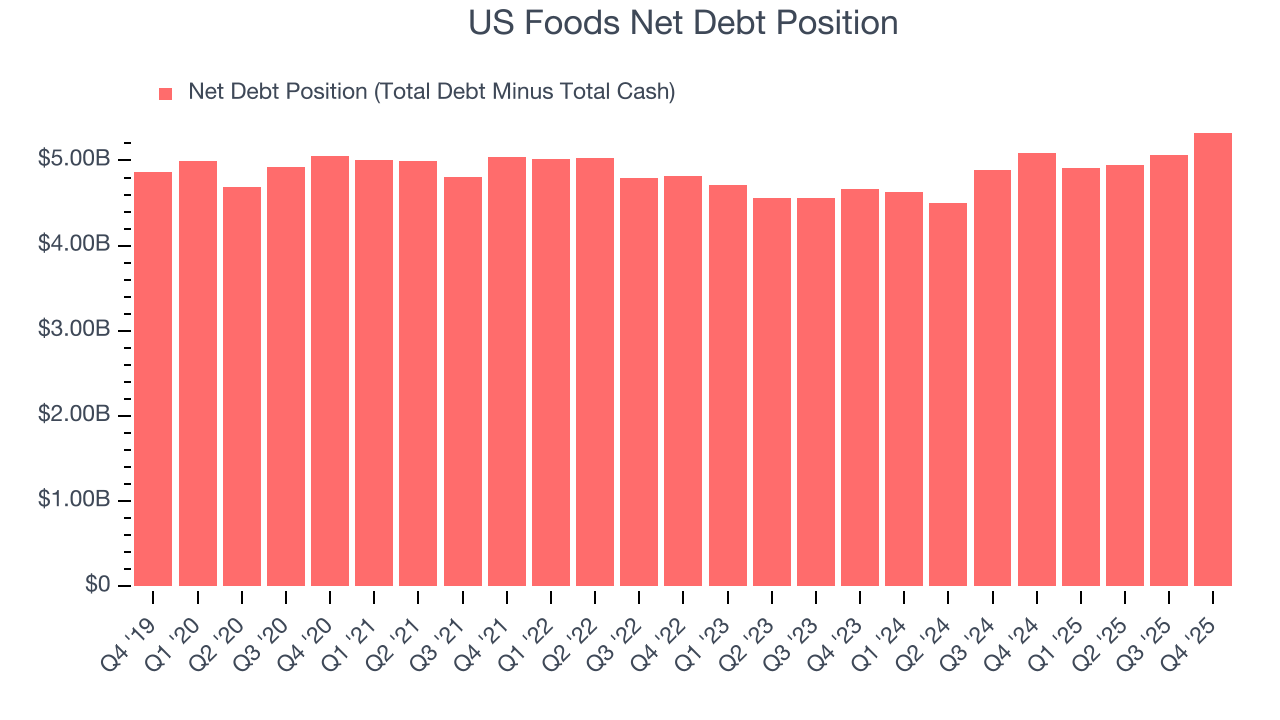

US Foods reported $41 million of cash and $5.37 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.93 billion of EBITDA over the last 12 months, we view US Foods’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $305 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from US Foods’s Q4 Results

It was good to see US Foods beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, this quarter could have been better. The stock remained flat at $90.22 immediately after reporting.

12. Is Now The Time To Buy US Foods?

Updated: February 12, 2026 at 11:58 PM EST

Before investing in or passing on US Foods, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We cheer for all companies serving everyday consumers, but in the case of US Foods, we’ll be cheering from the sidelines. While its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its . On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

US Foods’s P/E ratio based on the next 12 months is 18.9x. This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $95.19 on the company (compared to the current share price of $101.95).