USANA (USNA)

USANA doesn’t excite us. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think USANA Will Underperform

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

- Annual sales declines of 4.2% for the past three years show its products struggled to connect with the market

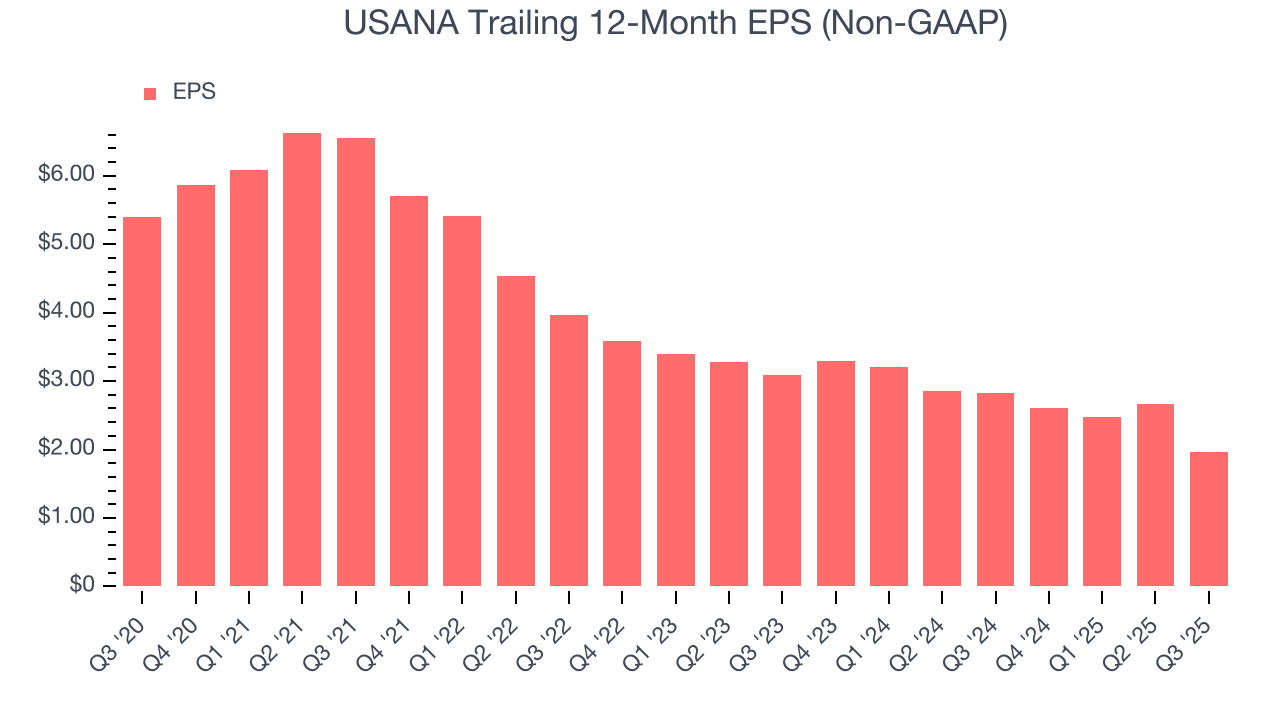

- Performance over the past three years shows each sale was less profitable as its earnings per share dropped by 20.9% annually, worse than its revenue

- One positive is that its unique products and pricing power lead to a best-in-class gross margin of 80%

USANA doesn’t meet our quality criteria. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than USANA

High Quality

Investable

Underperform

Why There Are Better Opportunities Than USANA

At $22.52 per share, USANA trades at 12.6x forward P/E. USANA’s multiple may seem like a great deal among consumer staples peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. USANA (USNA) Research Report: Q3 CY2025 Update

Health and wellness products company USANA Health Sciences (NYSE:USNA) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.7% year on year to $213.7 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $920 million at the midpoint. Its non-GAAP loss of $0.15 per share was in line with analysts’ consensus estimates.

USANA (USNA) Q3 CY2025 Highlights:

- Revenue: $213.7 million vs analyst estimates of $213.9 million (6.7% year-on-year growth, in line)

- Adjusted EPS: -$0.15 vs analyst estimates of -$0.15 (in line)

- Adjusted EBITDA: $14.59 million vs analyst estimates of $13.78 million (6.8% margin, 5.8% beat)

- The company dropped its revenue guidance for the full year to $920 million at the midpoint from $960 million, a 4.2% decrease

- Management lowered its full-year Adjusted EPS guidance to $1.73 at the midpoint, a 35.3% decrease

- EBITDA guidance for the full year is $98 million at the midpoint, above analyst estimates of $96.74 million

- Operating Margin: 0.6%, down from 7.8% in the same quarter last year

- Market Capitalization: $384.3 million

Company Overview

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

Specifically, the company relies on the multi-level marketing approach to selling. This means that USANA customers act as its salespeople and these salespeople earn money through the recruitment of new salespeople, getting a percentage of sales made by their recruits.

With regard to its product portfolio, USANA offers vitamin and mineral supplements designed to meet cardiovascular, skeletal/structural, and digestive health needs. The company also sells meal replacement shakes, snack bars, and other related products. Lastly, it is also known for Celavive, a skin care regimen.

The USANA core customer is someone who cares about health and nutrition. These individuals are willing to spend a little extra to achieve their wellness goals, whether that is weight loss or improved overall health. Given its multi-level marketing approach, USANA customers are typically connected to someone who has had a good experience with the products.

However, many are skeptical about multi-level marketing approaches. Some say these companies are nothing more than pyramid schemes, which are illegal businesses where returns for older customers or investors are paid using the capital of newer customers and investors, rather than from profit earned. The structure relies on recruitment to sustain itself rather than actual demand for products.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors offering health and wellness supplements and products include Herbalife (NYSE:HLF), Bellring Brands (NYSE:BRBR), and The Simply Good Foods Company (NASDAQ:SMPL).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $912.7 million in revenue over the past 12 months, USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

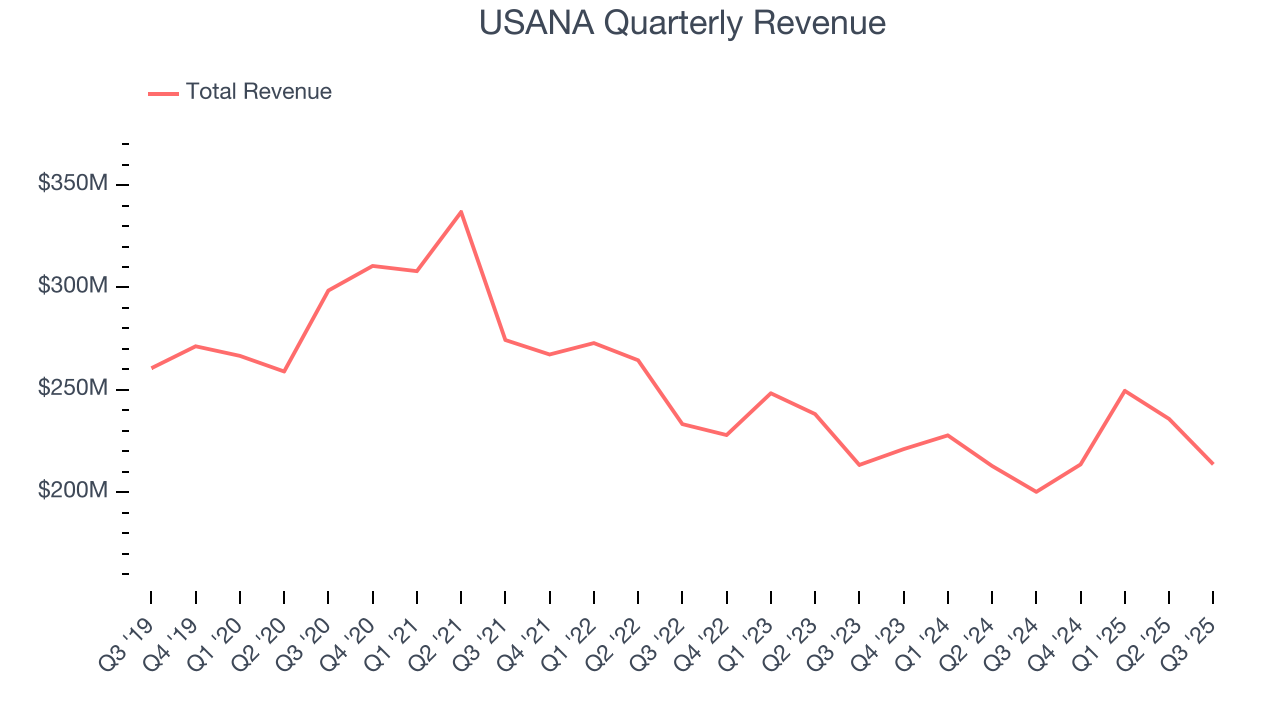

As you can see below, USANA struggled to generate demand over the last three years. Its sales dropped by 4.2% annually, a tough starting point for our analysis.

This quarter, USANA grew its revenue by 6.7% year on year, and its $213.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months. Although this projection implies its newer products will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

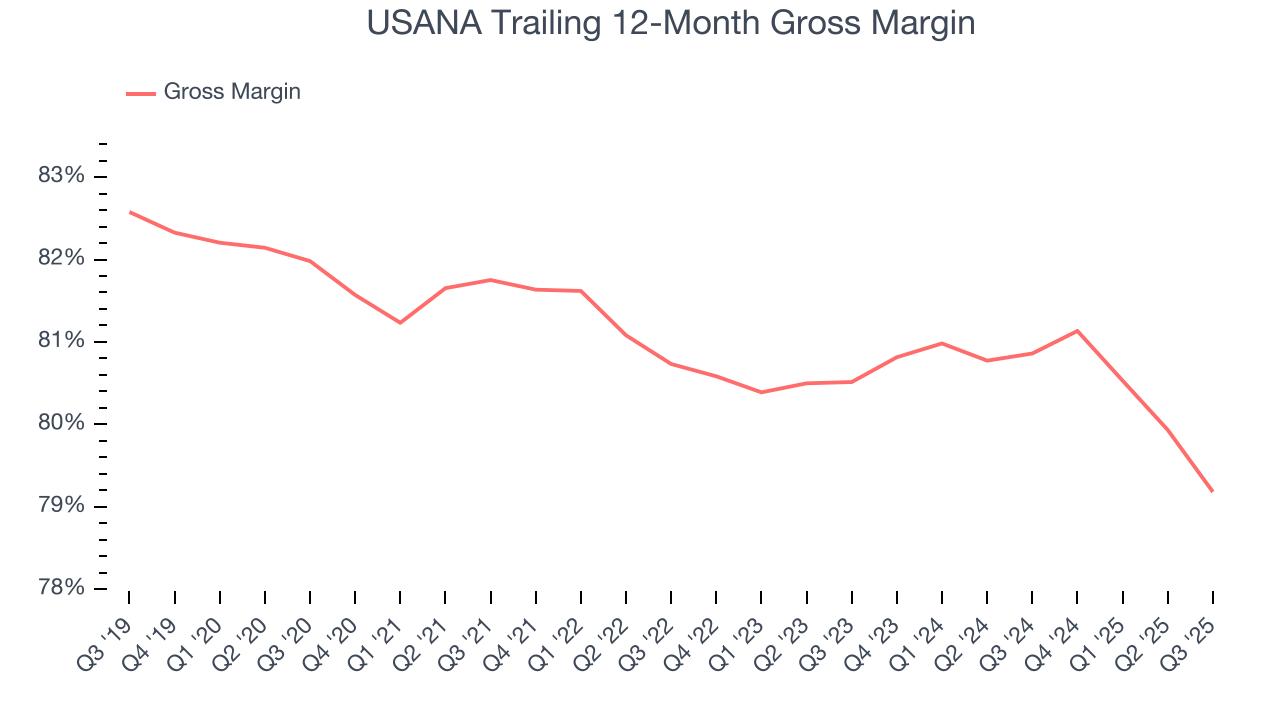

USANA has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 80% gross margin over the last two years. That means for every $100 in revenue, only $20.00 went towards paying for raw materials, production of goods, transportation, and distribution.

USANA’s gross profit margin came in at 77.2% this quarter, marking a 3.2 percentage point decrease from 80.4% in the same quarter last year. USANA’s full-year margin has also been trending down over the past 12 months, decreasing by 1.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

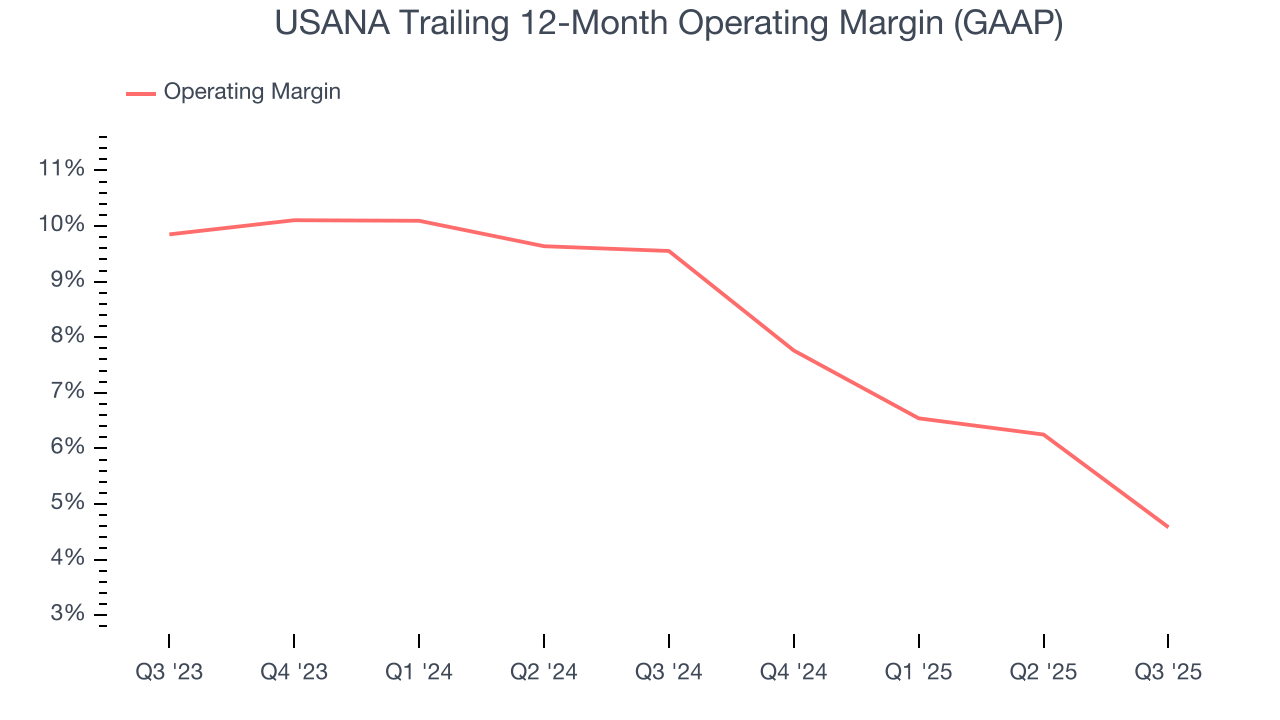

USANA was profitable over the last two years but held back by its large cost base. Its average operating margin of 7% was weak for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, USANA’s operating margin decreased by 5 percentage points over the last year. USANA’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, USANA’s breakeven margin was down 7.2 percentage points year on year. Since USANA’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, USANA reported adjusted EPS of negative $0.15, down from $0.56 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects USANA’s full-year EPS of $1.96 to grow 14.8%.

9. Cash Is King

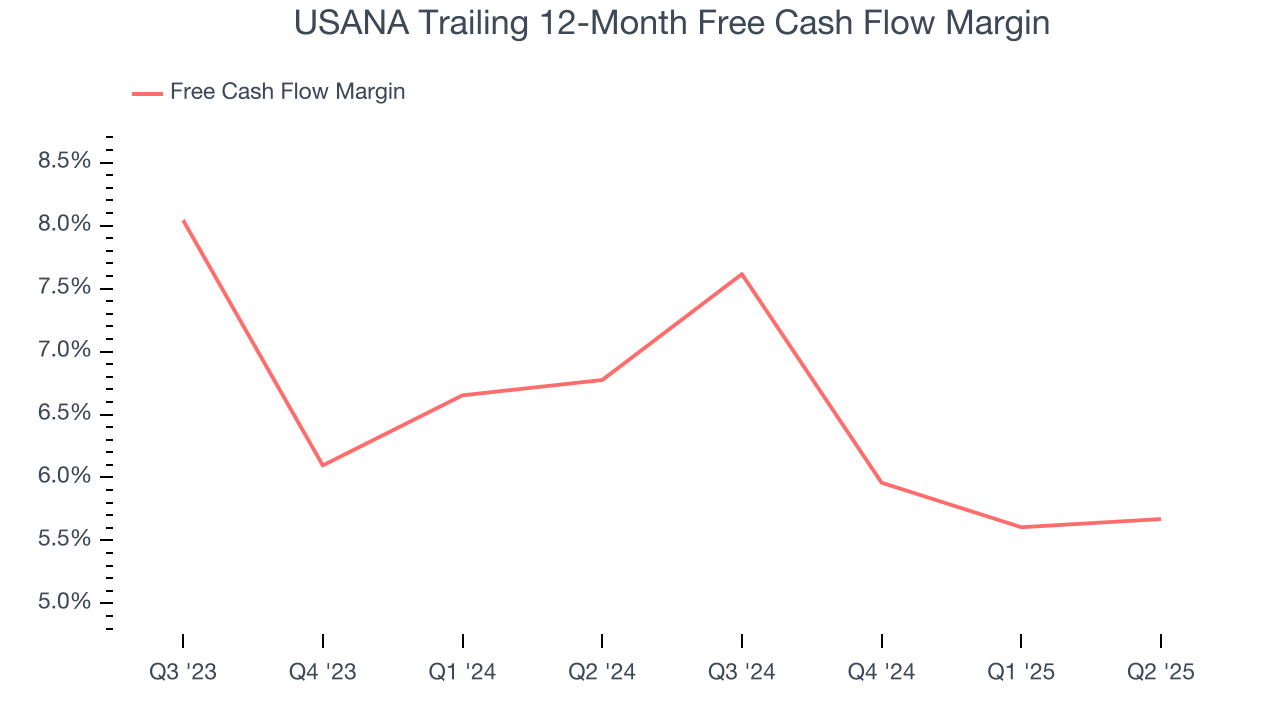

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

USANA has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.7% over the last two years, slightly better than the broader consumer staples sector.

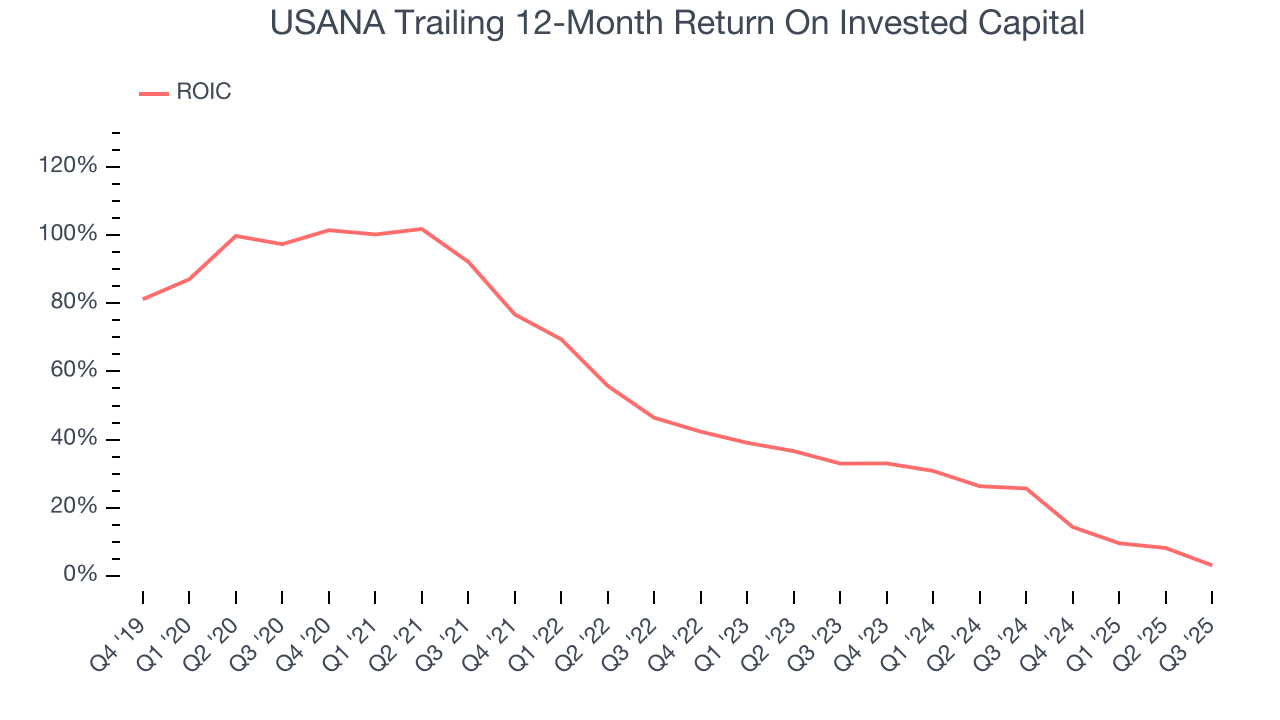

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although USANA hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 40.1%, splendid for a consumer staples business.

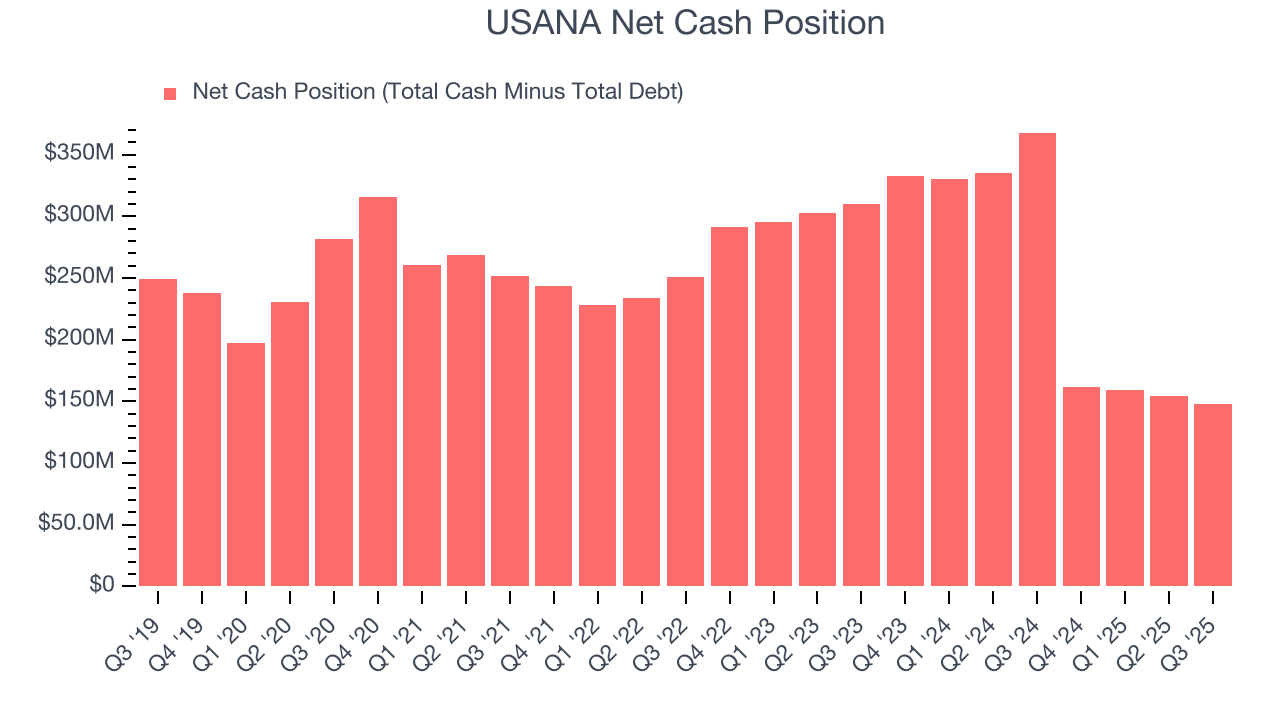

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

USANA is a profitable, well-capitalized company with $148.2 million of cash and no debt. This position is 41.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from USANA’s Q3 Results

Revenue and EPS met Wall Street's expectations. However, the company lowered full-year revenue and EPS guidance, which is usually a big negative. The stock traded down 10.2% to $18.80 immediately after reporting.

13. Is Now The Time To Buy USANA?

Updated: January 23, 2026 at 9:54 PM EST

Before making an investment decision, investors should account for USANA’s business fundamentals and valuation in addition to what happened in the latest quarter.

USANA isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue has declined over the last three years. And while its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its projected EPS for the next year is lacking.

USANA’s P/E ratio based on the next 12 months is 12.6x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $39 on the company (compared to the current share price of $22.52).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.