USANA (USNA)

USANA doesn’t excite us. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think USANA Will Underperform

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

- Sales tumbled by 4.2% annually over the last three years, showing consumer trends are working against its favor

- Sales were less profitable over the last three years as its earnings per share fell by 20.9% annually, worse than its revenue declines

- On the plus side, its products command premium prices and lead to a best-in-class gross margin of 80%

USANA is skating on thin ice. Better stocks can be found in the market.

Why There Are Better Opportunities Than USANA

High Quality

Investable

Underperform

Why There Are Better Opportunities Than USANA

At $20.90 per share, USANA trades at 12x forward P/E. USANA’s valuation may seem like a bargain, especially when stacked up against other consumer staples companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. USANA (USNA) Research Report: Q4 CY2025 Update

Health and wellness products company USANA Health Sciences (NYSE:USNA) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.9% year on year to $226.2 million. The company’s full-year revenue guidance of $962.5 million at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP profit of $0.60 per share was 46.3% above analysts’ consensus estimates.

USANA (USNA) Q4 CY2025 Highlights:

- Revenue: $226.2 million vs analyst estimates of $226 million (5.9% year-on-year growth, in line)

- Adjusted EPS: $0.60 vs analyst estimates of $0.41 (46.3% beat)

- Adjusted EBITDA: $28.47 million vs analyst estimates of $25.31 million (12.6% margin, 12.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.12 at the midpoint, beating analyst estimates by 15.2%

- EBITDA guidance for the upcoming financial year 2026 is $105.3 million at the midpoint, in line with analyst expectations

- Operating Margin: 1.7%, down from 3.8% in the same quarter last year

- Market Capitalization: $382.1 million

Company Overview

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE:USNA) manufactures and sells nutritional, personal care, and skincare products.

Specifically, the company relies on the multi-level marketing approach to selling. This means that USANA customers act as its salespeople and these salespeople earn money through the recruitment of new salespeople, getting a percentage of sales made by their recruits.

With regard to its product portfolio, USANA offers vitamin and mineral supplements designed to meet cardiovascular, skeletal/structural, and digestive health needs. The company also sells meal replacement shakes, snack bars, and other related products. Lastly, it is also known for Celavive, a skin care regimen.

The USANA core customer is someone who cares about health and nutrition. These individuals are willing to spend a little extra to achieve their wellness goals, whether that is weight loss or improved overall health. Given its multi-level marketing approach, USANA customers are typically connected to someone who has had a good experience with the products.

However, many are skeptical about multi-level marketing approaches. Some say these companies are nothing more than pyramid schemes, which are illegal businesses where returns for older customers or investors are paid using the capital of newer customers and investors, rather than from profit earned. The structure relies on recruitment to sustain itself rather than actual demand for products.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors offering health and wellness supplements and products include Herbalife (NYSE:HLF), Bellring Brands (NYSE:BRBR), and The Simply Good Foods Company (NASDAQ:SMPL).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $925.3 million in revenue over the past 12 months, USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

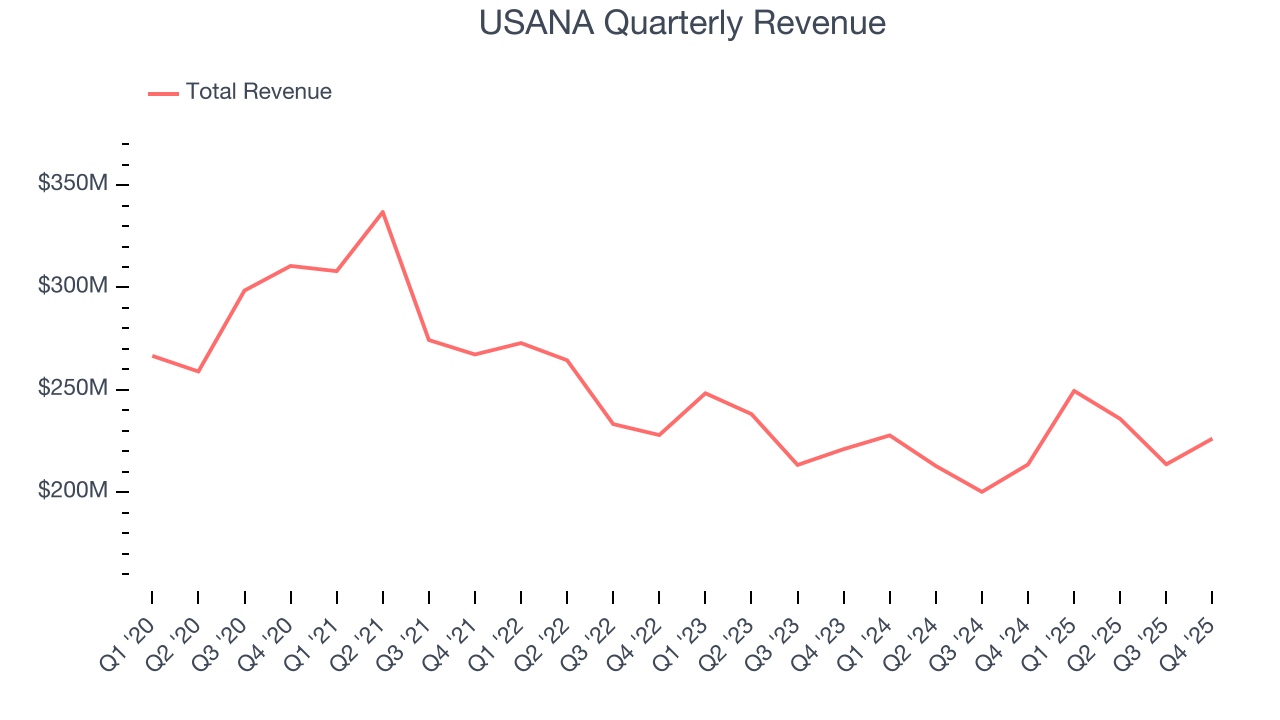

As you can see below, USANA struggled to generate demand over the last three years. Its sales dropped by 2.5% annually, a rough starting point for our analysis.

This quarter, USANA grew its revenue by 5.9% year on year, and its $226.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. Although this projection suggests its newer products will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

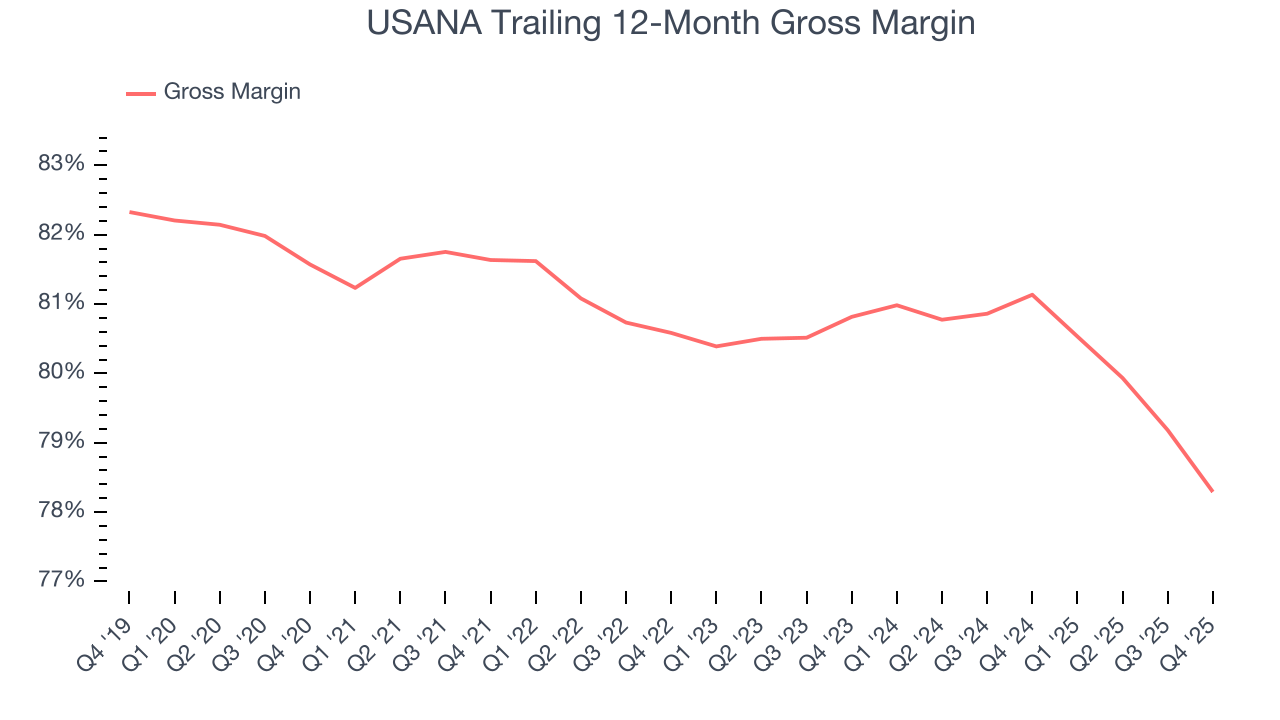

USANA has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 79.7% gross margin over the last two years. That means USANA only paid its suppliers $20.34 for every $100 in revenue.

USANA produced a 78.2% gross profit margin in Q4, down 3.8 percentage points year on year. USANA’s full-year margin has also been trending down over the past 12 months, decreasing by 2.8 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

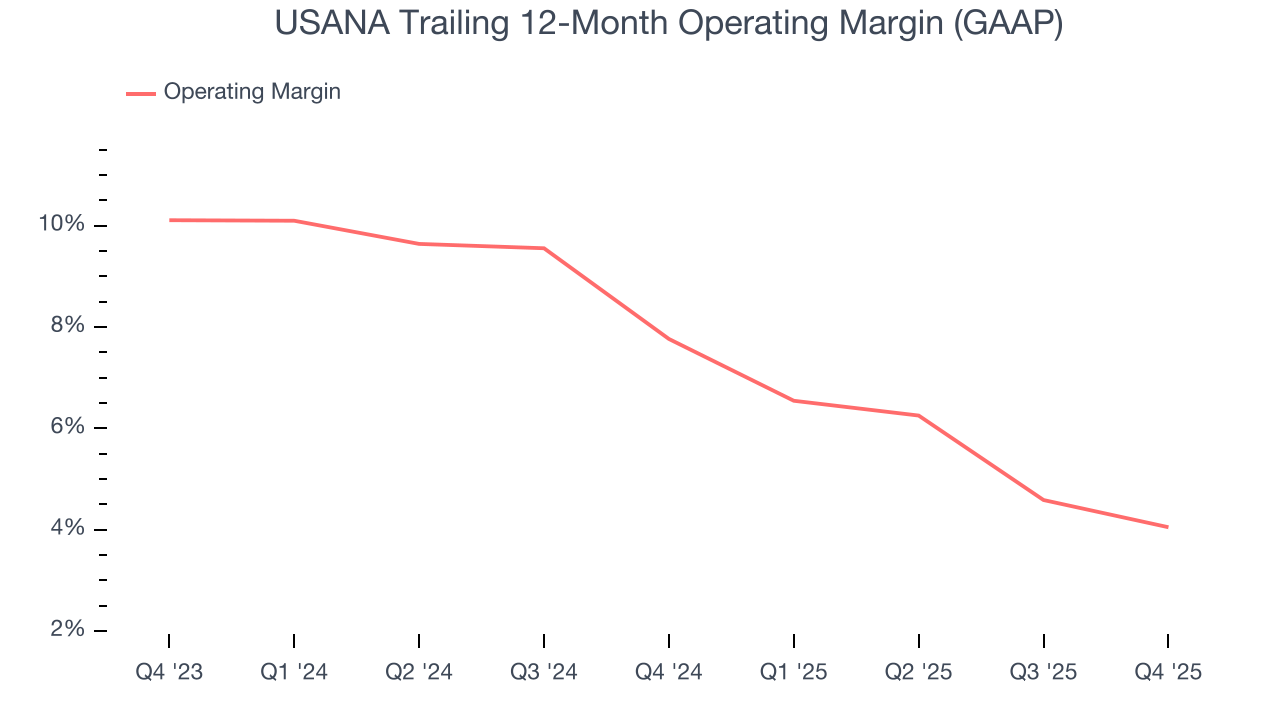

USANA was profitable over the last two years but held back by its large cost base. Its average operating margin of 5.8% was weak for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Looking at the trend in its profitability, USANA’s operating margin decreased by 3.7 percentage points over the last year. USANA’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, USANA generated an operating margin profit margin of 1.7%, down 2.2 percentage points year on year. Since USANA’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, and administrative overhead expenses.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

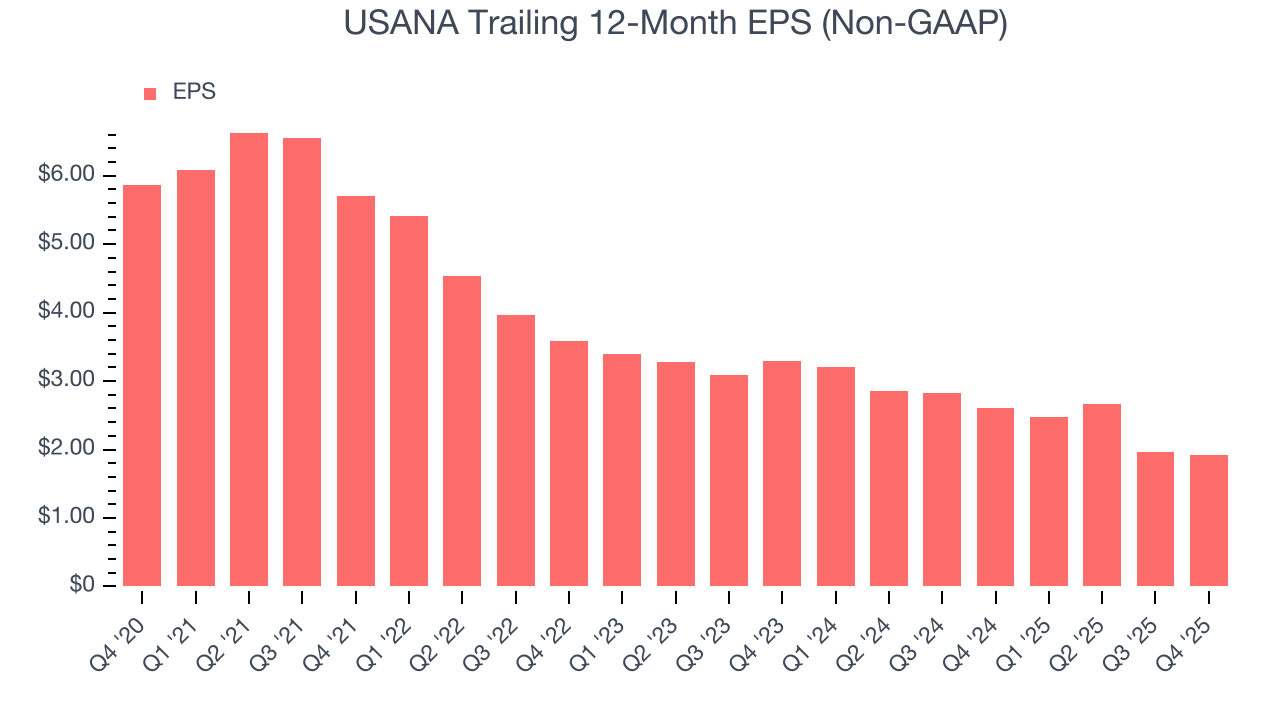

Sadly for USANA, its EPS declined by 18.8% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, USANA reported adjusted EPS of $0.60, down from $0.64 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects USANA’s full-year EPS of $1.92 to shrink by 3.6%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

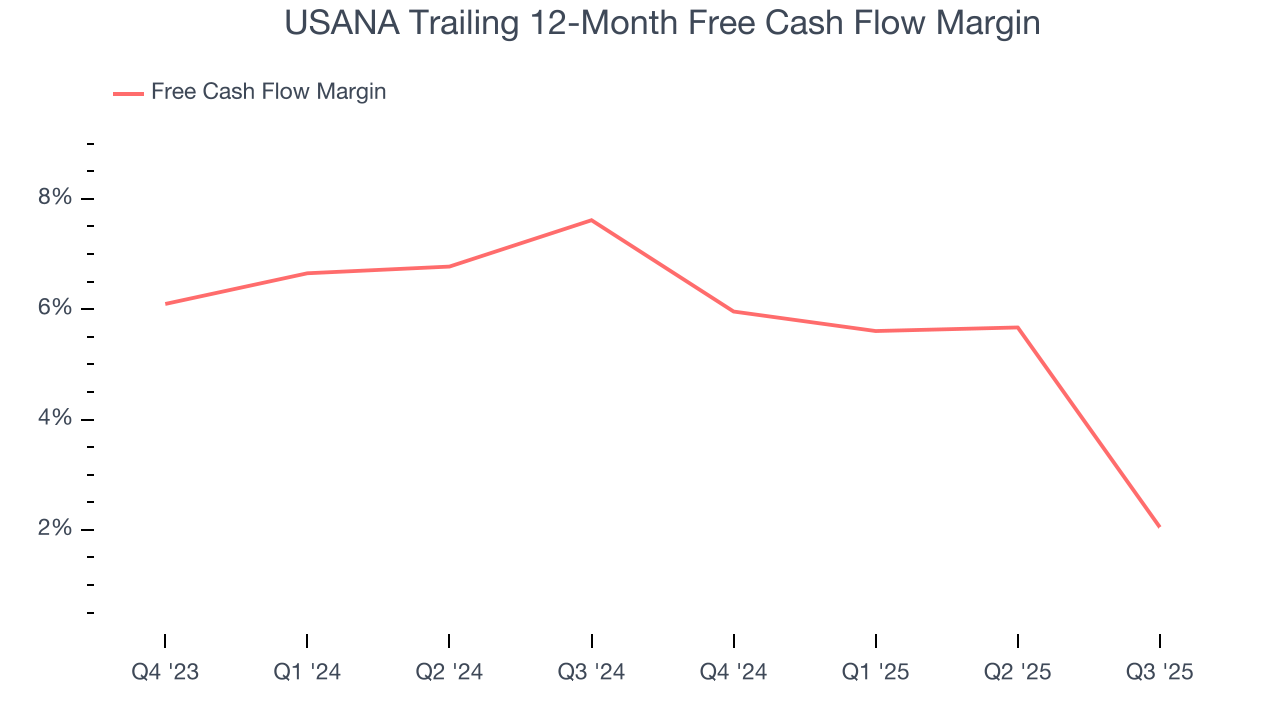

USANA has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.2%, subpar for a consumer staples business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

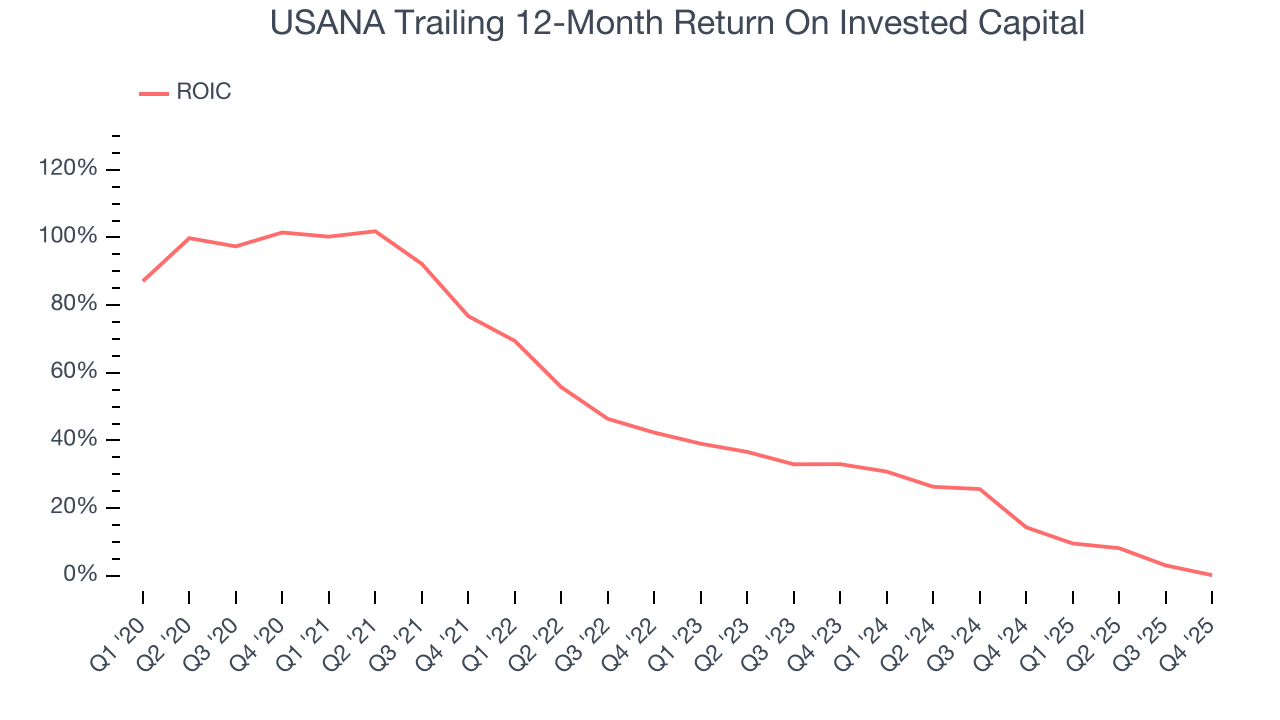

Although USANA hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 33.3%, splendid for a consumer staples business.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

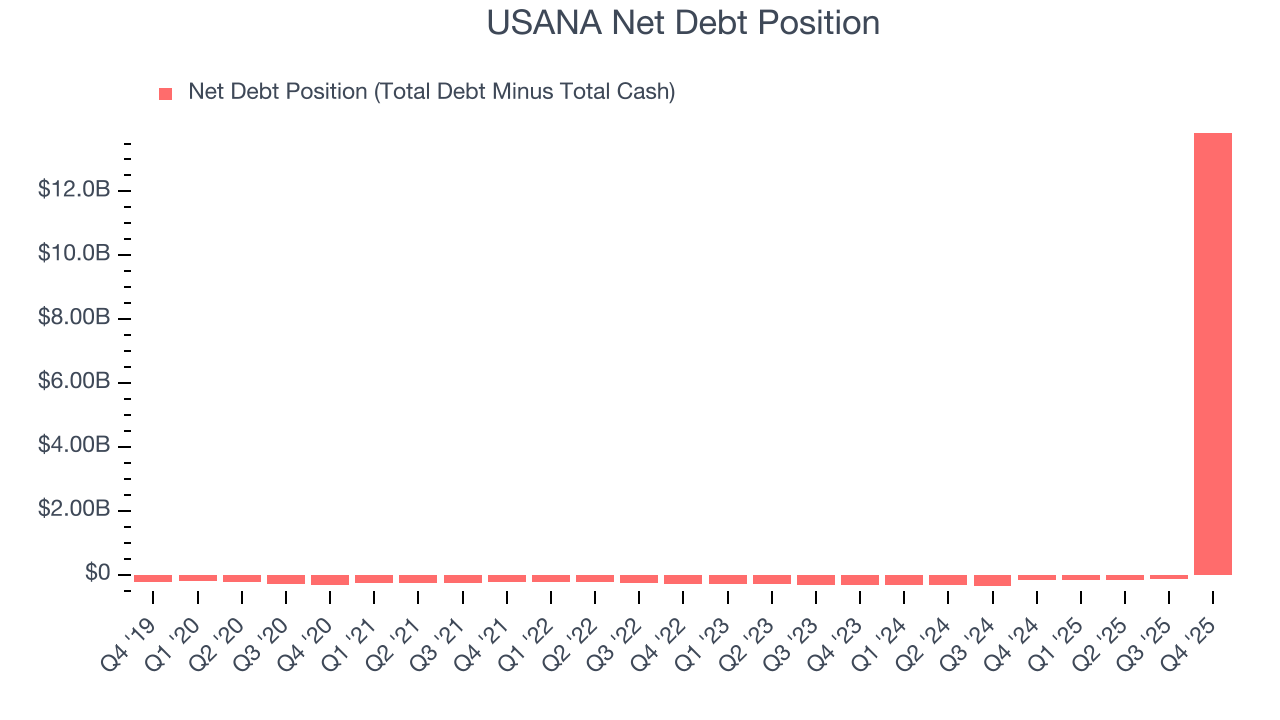

USANA’s $14 billion of debt exceeds the $158.4 million of cash on its balance sheet. Furthermore, its 134× net-debt-to-EBITDA ratio (based on its EBITDA of $103.1 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. USANA could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope USANA can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from USANA’s Q4 Results

It was good to see USANA beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Overall, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $20.65 immediately after reporting.

13. Is Now The Time To Buy USANA?

Updated: February 17, 2026 at 4:35 PM EST

Before investing in or passing on USANA, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

USANA isn’t a terrible business, but it isn’t one of our picks. To begin with, its revenue has declined over the last three years. While its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its brand caters to a niche market.

USANA’s P/E ratio based on the next 12 months is 11.2x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $39 on the company (compared to the current share price of $20.65).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.