Vishay Precision (VPG)

Vishay Precision is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Vishay Precision Will Underperform

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE:VPG) operates as a global provider of precision measurement and sensing technologies.

- Sales tumbled by 9% annually over the last two years, showing market trends are working against its favor during this cycle

- Earnings per share fell by 15.3% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Anticipated sales growth of 5.6% for the next year implies demand will be shaky

Vishay Precision’s quality doesn’t meet our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Vishay Precision

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Vishay Precision

Vishay Precision is trading at $53.61 per share, or 58.2x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Vishay Precision (VPG) Research Report: Q4 CY2025 Update

Precision measurement and sensing technologies provider Vishay Precision (NYSE:VPG) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.9% year on year to $80.57 million. On the other hand, next quarter’s revenue guidance of $77 million was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.07 per share was 66.1% below analysts’ consensus estimates.

Vishay Precision (VPG) Q4 CY2025 Highlights:

- Revenue: $80.57 million vs analyst estimates of $78.07 million (10.9% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.07 vs analyst expectations of $0.21 (66.1% miss)

- Adjusted EBITDA: $6.00 million vs analyst estimates of $7.85 million (7.5% margin, 23.6% miss)

- Revenue Guidance for Q1 CY2026 is $77 million at the midpoint, below analyst estimates of $77.83 million

- Operating Margin: 1.3%, in line with the same quarter last year

- Free Cash Flow Margin: 1.7%, down from 6.3% in the same quarter last year

- Market Capitalization: $711.6 million

Company Overview

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE:VPG) operates as a global provider of precision measurement and sensing technologies.

The company's history traces back to 1962 when it was part of Vishay Intertechnology. VPG was spun off as an independent public company in 2010, and since then, has made several strategic acquisitions to expand its product portfolio and global reach. These acquisitions include KELK (2013), Stress-Tek (2015), Pacific Instruments (2016), DSI (2019), and DTS (2021).

The company's portfolio includes sensors, weighing solutions, and measurement systems that interface between physical and digital realms. Vishay Precision's products serve various industries, including test and measurement, industrial, transportation, steel, avionics, military and space, as well as agriculture, consumer, and medical sectors.

The company operates through three reportable segments: Sensors, Weighing Solutions, and Measurement Systems. The Sensors segment comprises precision resistor and strain gauge businesses, offering products for applications requiring high precision and reliability. The Weighing Solutions segment includes VPG Transducers, VPG Onboard Weighing, BLH Nobel, Stress-Tek, and Vulcan businesses, providing load cells and force measurement solutions. The Measurement Systems segment offers specialized systems for steel production, materials development, and safety testing, including products from KELK, Dynamic Systems Inc. (DSI), Pacific Instruments, and Diversified Technical Systems (DTS).

4. Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Competitors of Vishay Precision include Measurement Specialties (NASDAQ:MEAS), Mettler-Toledo International (NYSE:MTD), and Ametek (NYSE:AME).

5. Revenue Growth

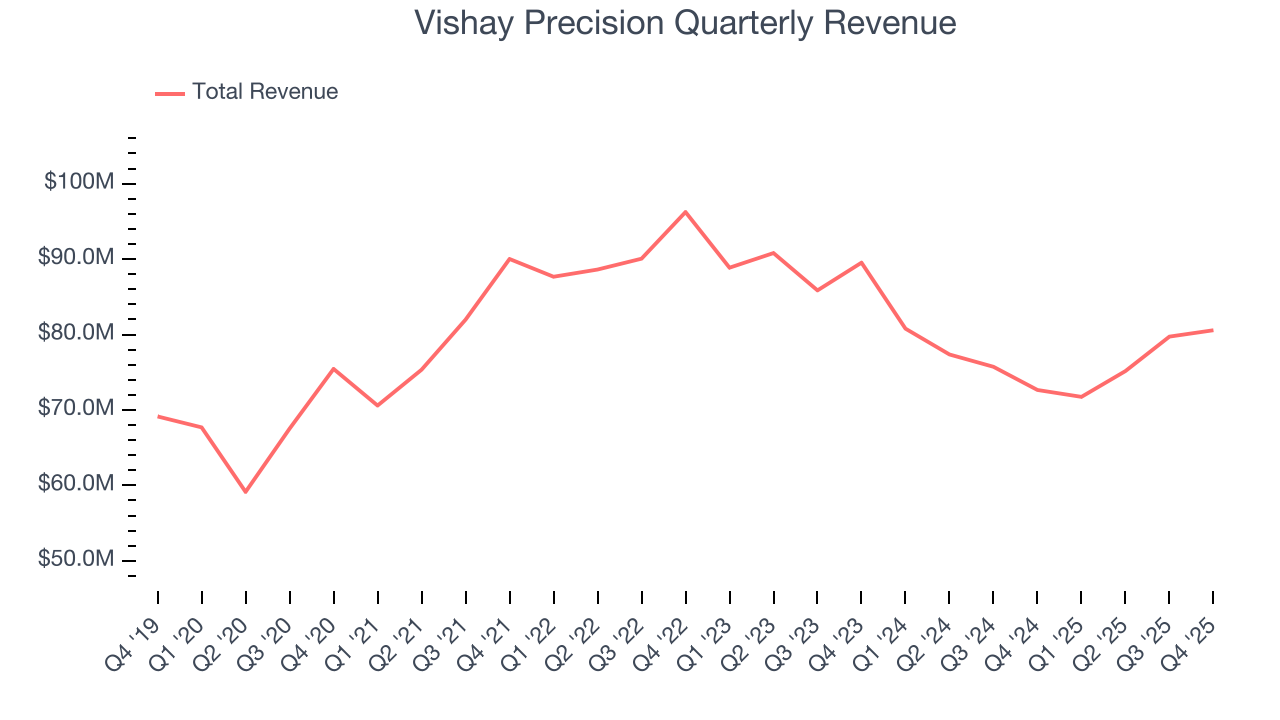

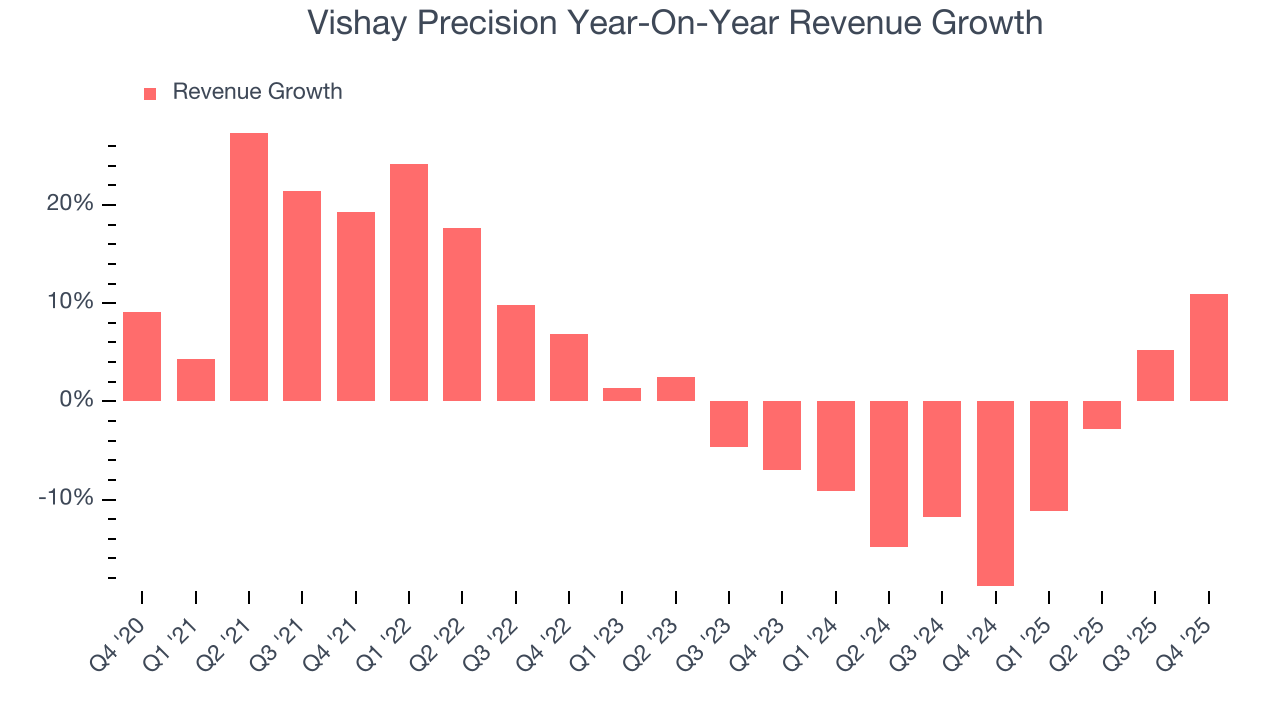

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Vishay Precision’s sales grew at a sluggish 2.6% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Vishay Precision’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7% annually.

This quarter, Vishay Precision reported year-on-year revenue growth of 10.9%, and its $80.57 million of revenue exceeded Wall Street’s estimates by 3.2%. Company management is currently guiding for a 7.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

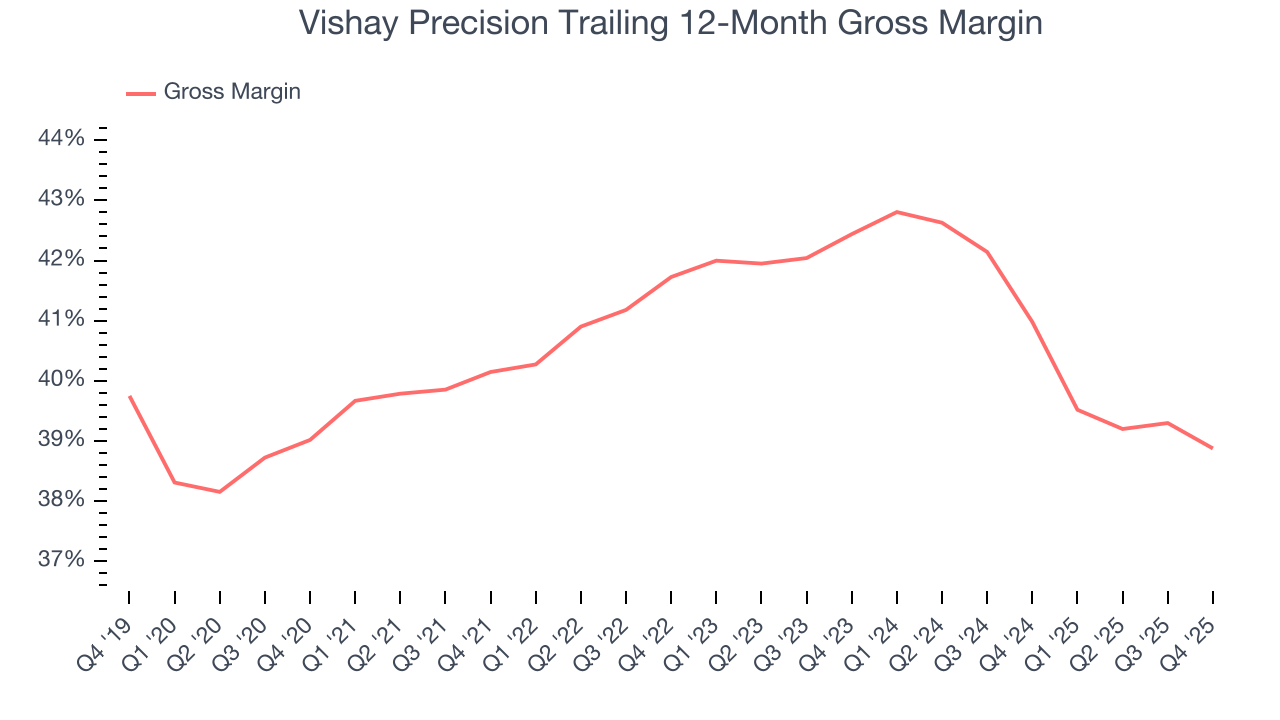

Vishay Precision’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 40.9% gross margin over the last five years. That means Vishay Precision only paid its suppliers $59.09 for every $100 in revenue.

In Q4, Vishay Precision produced a 36.8% gross profit margin, marking a 1.5 percentage point decrease from 38.3% in the same quarter last year. Vishay Precision’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

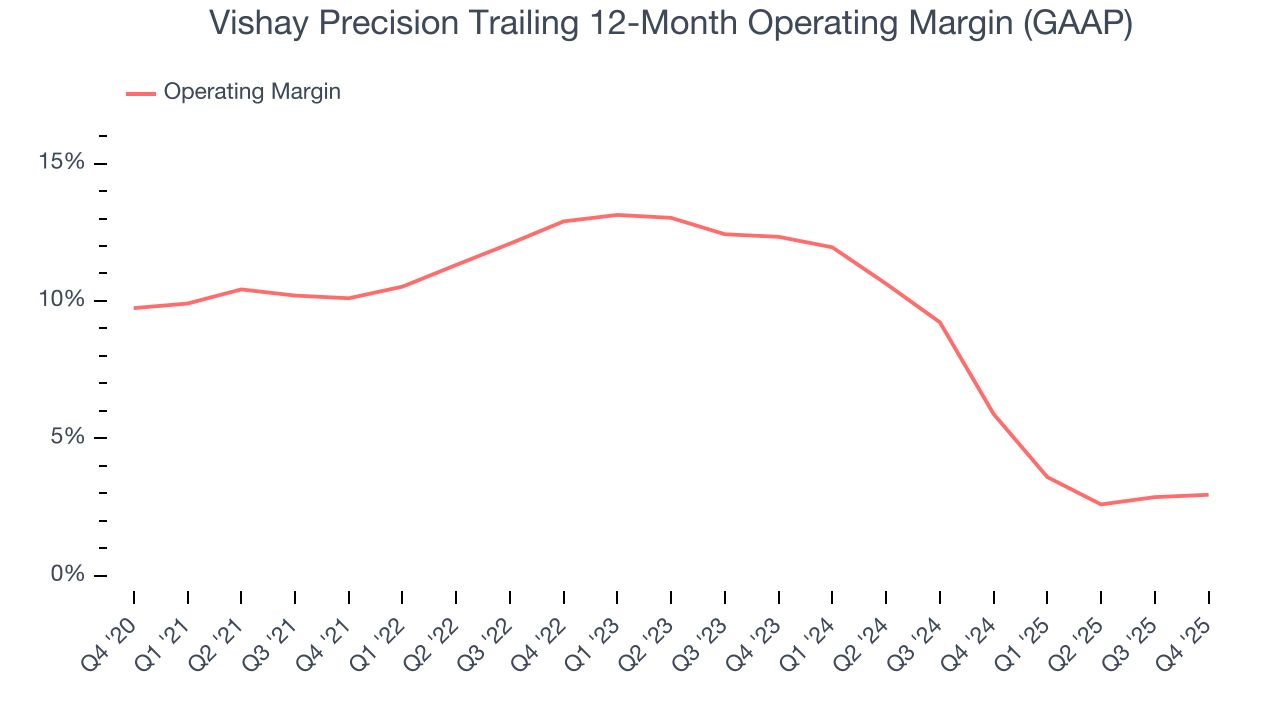

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Vishay Precision has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.1%, higher than the broader industrials sector.

Looking at the trend in its profitability, Vishay Precision’s operating margin decreased by 7.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Vishay Precision generated an operating margin profit margin of 1.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

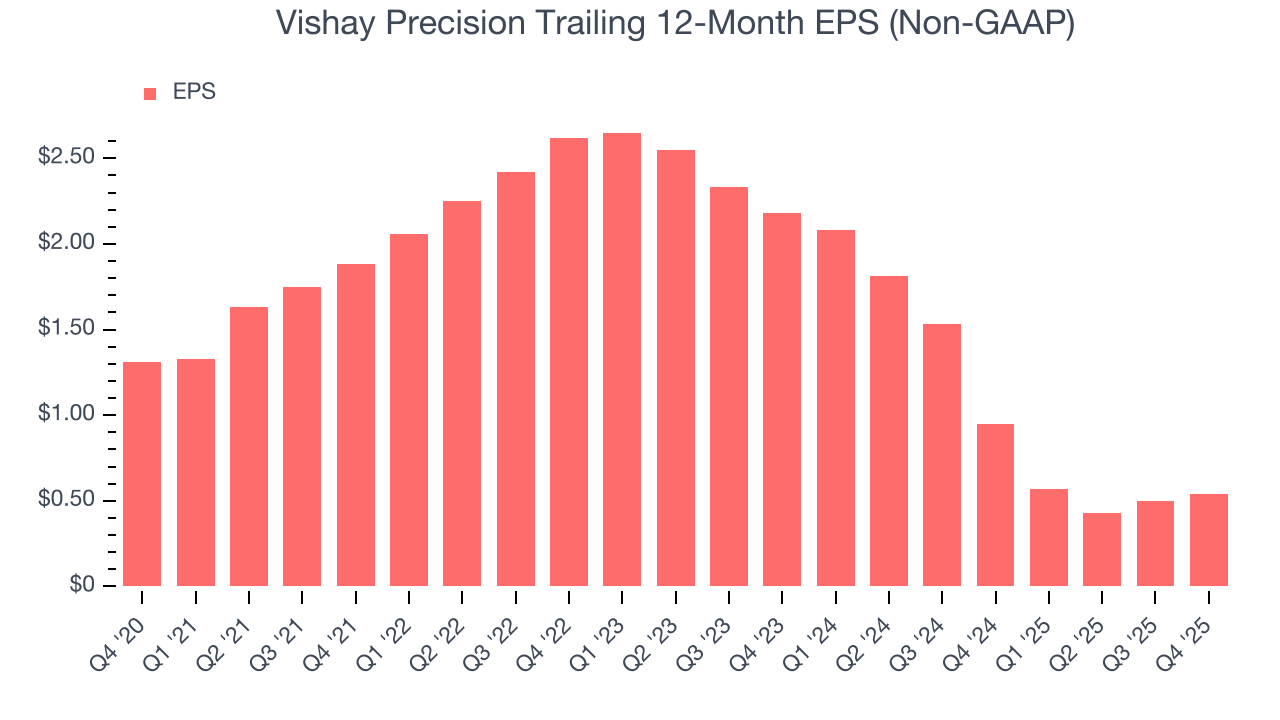

Sadly for Vishay Precision, its EPS declined by 16.2% annually over the last five years while its revenue grew by 2.6%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Vishay Precision’s earnings to better understand the drivers of its performance. As we mentioned earlier, Vishay Precision’s operating margin was flat this quarter but declined by 7.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Vishay Precision, its two-year annual EPS declines of 50.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Vishay Precision reported adjusted EPS of $0.07, up from $0.03 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Vishay Precision’s full-year EPS of $0.54 to grow 96.3%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

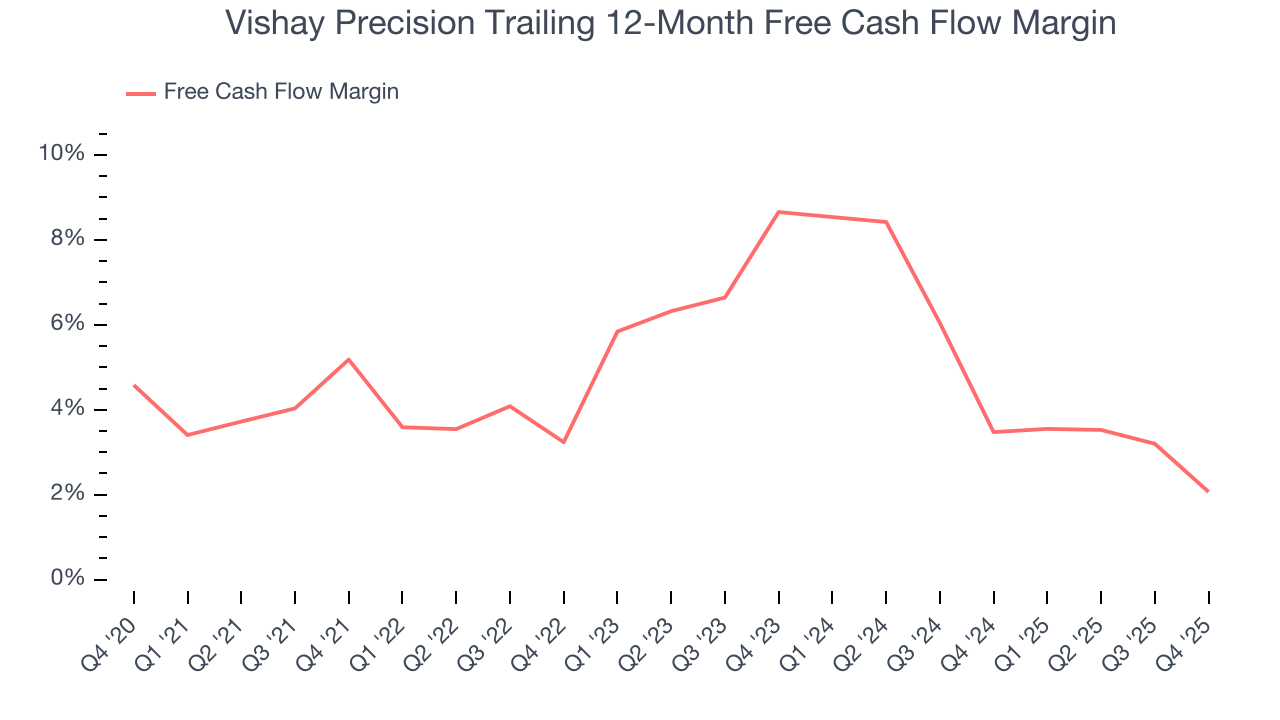

Vishay Precision has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.6%, subpar for an industrials business.

Taking a step back, we can see that Vishay Precision’s margin dropped by 3.1 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of an investment cycle.

Vishay Precision’s free cash flow clocked in at $1.35 million in Q4, equivalent to a 1.7% margin. The company’s cash profitability regressed as it was 4.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

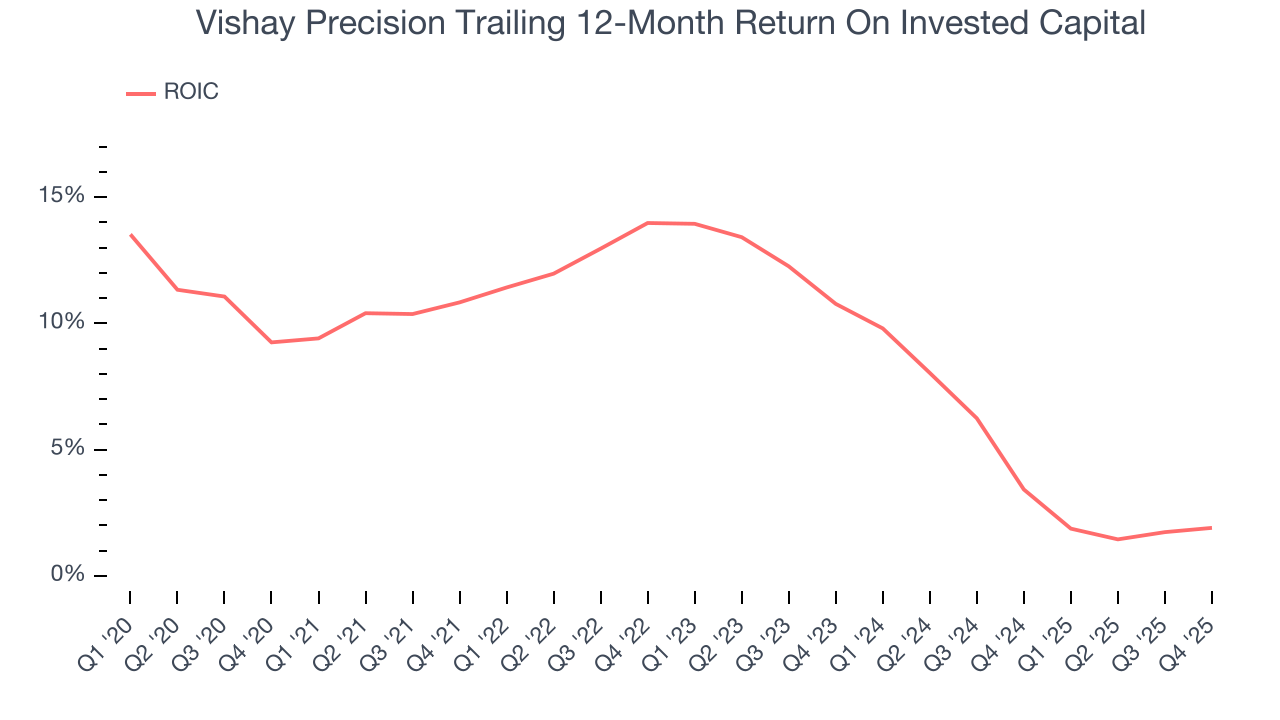

Vishay Precision historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Vishay Precision’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

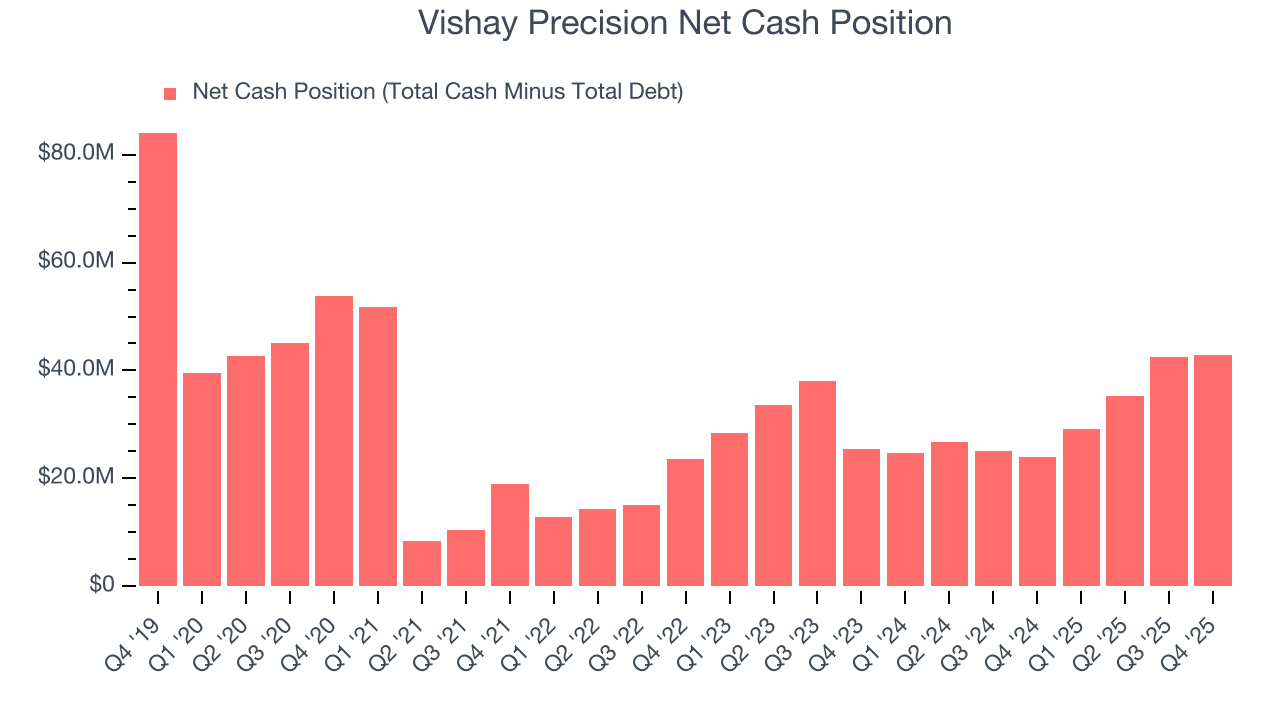

Vishay Precision is a profitable, well-capitalized company with $87.37 million of cash and $44.48 million of debt on its balance sheet. This $42.89 million net cash position is 6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Vishay Precision’s Q4 Results

We enjoyed seeing Vishay Precision beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.2% to $50.84 immediately after reporting.

13. Is Now The Time To Buy Vishay Precision?

Updated: February 11, 2026 at 6:30 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Vishay Precision falls short of our quality standards. To begin with, its revenue growth was weak over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Vishay Precision’s P/E ratio based on the next 12 months is 50.6x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $48 on the company (compared to the current share price of $50.84), implying they don’t see much short-term potential in Vishay Precision.