Victoria's Secret (VSCO)

Victoria's Secret is up against the odds. Its flat sales show demand is soft and its weak profitability limits how much it can reinvest to ignite growth.― StockStory Analyst Team

1. News

2. Summary

Why We Think Victoria's Secret Will Underperform

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

- Poor expense management has led to an operating margin that is below the industry average

- Poor same-store sales performance over the past two years indicates it’s having trouble bringing new shoppers into its brick-and-mortar locations

- Gross margin of 36.9% is below its competitors, leaving less money for marketing and promotions

Victoria's Secret’s quality is insufficient. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Victoria's Secret

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Victoria's Secret

Victoria's Secret’s stock price of $59.76 implies a valuation ratio of 22.3x forward P/E. This multiple rich for the business quality. Not a great combination.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Victoria's Secret (VSCO) Research Report: Q3 CY2025 Update

Intimatewear and beauty retailer Victoria’s Secret (NYSE:VSCO) announced better-than-expected revenue in Q3 CY2025, with sales up 9.2% year on year to $1.47 billion. Guidance for next quarter’s revenue was better than expected at $2.19 billion at the midpoint, 0.9% above analysts’ estimates. Its non-GAAP loss of $0.27 per share was 54.2% above analysts’ consensus estimates.

Victoria's Secret (VSCO) Q3 CY2025 Highlights:

- Revenue: $1.47 billion vs analyst estimates of $1.41 billion (9.2% year-on-year growth, 4.7% beat)

- Adjusted EPS: -$0.27 vs analyst estimates of -$0.59 (54.2% beat)

- Adjusted Operating Income: -$18,000 vs analyst estimates of -$41.28 million (0% margin, 100% beat)

- Revenue Guidance for Q4 CY2025 is $2.19 billion at the midpoint, above analyst estimates of $2.17 billion

- Adjusted EPS guidance for the full year is $2.53 at the midpoint, beating analyst estimates by 19%

- Operating Margin: -1.3%, up from -3.5% in the same quarter last year

- Locations: 1,404 at quarter end, up from 1,380 in the same quarter last year

- Same-Store Sales rose 8% year on year (3% in the same quarter last year)

- Market Capitalization: $3.33 billion

Company Overview

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Earlier in its history, the company targeted males who wanted to buy lingerie for their partners without feeling uncomfortable in traditional department stores. Victoria's Secret has pivoted to targeting the wearers of these garments themselves, which tends to be a woman between 18 and 45 who feels empowered by sexy and fashion forward intimate apparel, sleepwear, and personal care products.

The company built its brand by hosting the extravagant Victoria's Secret Fashion Show featuring top supermodels. This show aired annually from 1995 to 2018 and was a much-talked-about event attracting millions of television viewers. In the subsequent years, though, the company faced criticism for its lack of inclusivity (race, body types, etc.), which led to more diversity in the company’s image and go-to-market approach.

The average size of a Victoria's Secret store is around 10,000 square feet and typically located in high-traffic shopping malls and strip centers alongside other retailers. In the Fashion Show days, stores were dark and adorned with lace and chandeliers to resemble a boudoir. After the revamping of brand image, stores became brighter and more inviting, with organized sections for undergarments, sleepwear, swimwear, and personal care.

4. Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Retailers offering intimates, undergarments, and sleepwear for women include American Eagle’s (NYSE:AEO) Aerie brand and LVMH’s (ENXTPA:MC) La Perla brand as well as private companies ThirdLove and Adore Me.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.39 billion in revenue over the past 12 months, Victoria's Secret is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Victoria's Secret struggled to increase demand as its $6.39 billion of sales for the trailing 12 months was close to its revenue three years ago (we compare to 2019 to normalize for COVID-19 impacts). This was surprising given it opened new stores to expand its reach.

This quarter, Victoria's Secret reported year-on-year revenue growth of 9.2%, and its $1.47 billion of revenue exceeded Wall Street’s estimates by 4.7%. Company management is currently guiding for a 3.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2% over the next 12 months. Although this projection suggests its newer products will spur better top-line performance, it is still below average for the sector.

6. Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Victoria's Secret operated 1,404 locations in the latest quarter. It has generally opened new stores over the last two years and averaged 1.2% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Victoria's Secret’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Victoria's Secret should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Victoria's Secret’s same-store sales rose 8% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Victoria's Secret has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 36.9% gross margin over the last two years. Said differently, Victoria's Secret had to pay a chunky $63.14 to its suppliers for every $100 in revenue.

Victoria's Secret’s gross profit margin came in at 36.4% this quarter, up 1.7 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

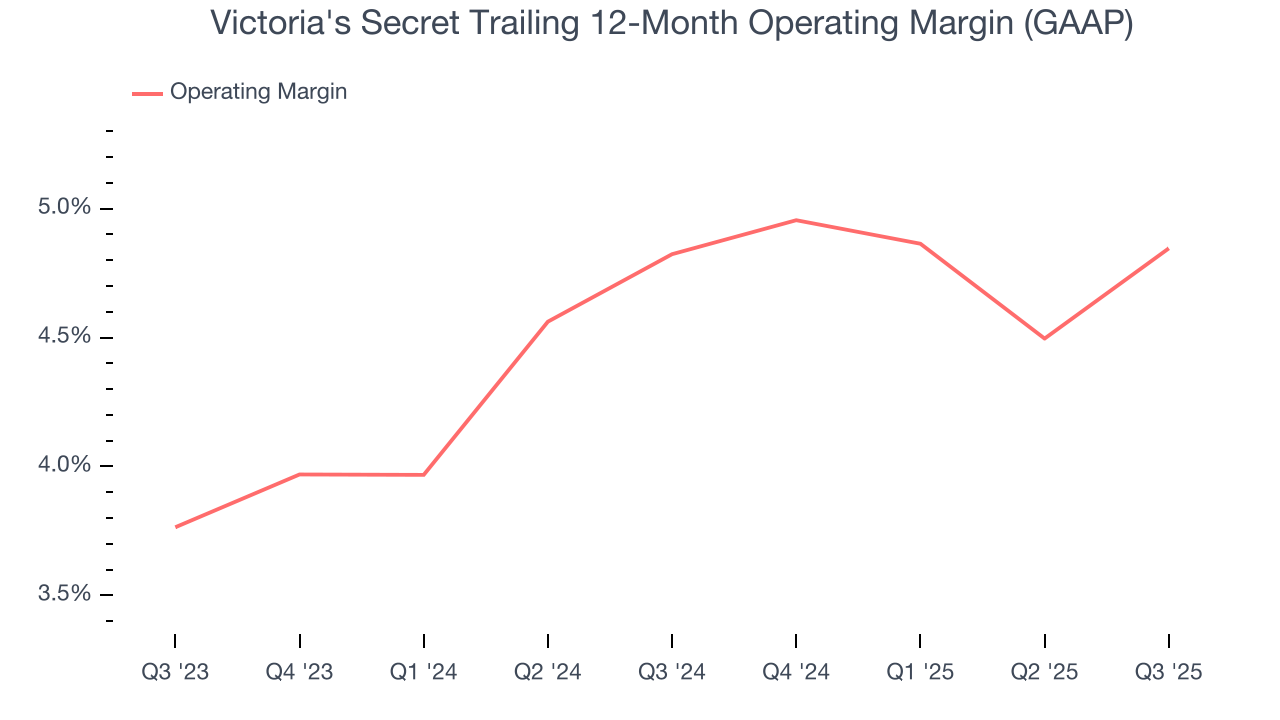

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Victoria's Secret’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.8% over the last two years. This profitability was paltry for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Victoria's Secret’s operating margin might fluctuated slightly but has generally stayed the same over the last year, meaning it will take a fundamental shift in the business model to change.

This quarter, Victoria's Secret generated an operating margin profit margin of negative 1.3%, up 2.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

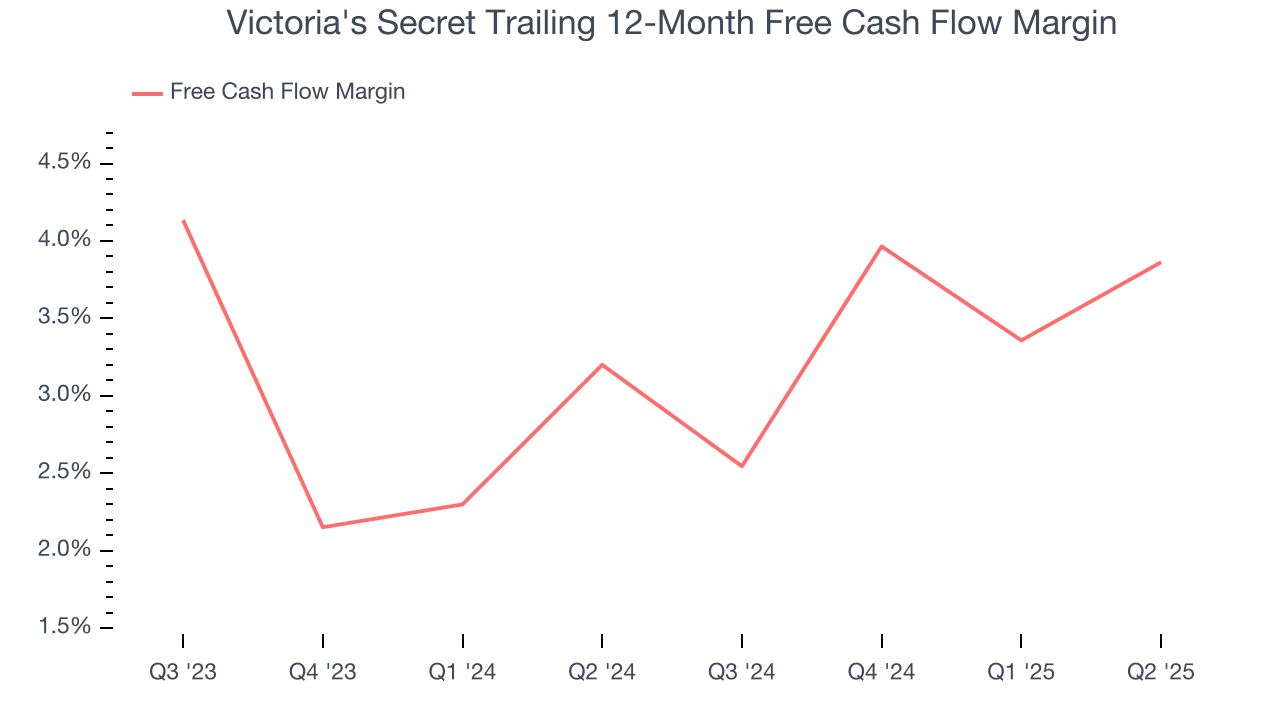

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Victoria's Secret has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.3% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

10. Balance Sheet Assessment

Victoria's Secret reported $249 million of cash and $3.19 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $637.4 million of EBITDA over the last 12 months, we view Victoria's Secret’s 4.6× net-debt-to-EBITDA ratio as safe. We also see its $73.38 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Victoria's Secret’s Q3 Results

It was good to see Victoria's Secret beat analysts’ EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 13.1% to $47.03 immediately after reporting.

12. Is Now The Time To Buy Victoria's Secret?

Updated: January 21, 2026 at 9:39 PM EST

When considering an investment in Victoria's Secret, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Victoria's Secret falls short of our quality standards. To begin with, its revenue has declined over the last three years. And while its solid free cash flow generation gives it reinvestment options, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its operating margins are low compared to other retailers.

Victoria's Secret’s P/E ratio based on the next 12 months is 22.3x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $61.44 on the company (compared to the current share price of $64.97), implying they don’t see much short-term potential in Victoria's Secret.