Vishay Intertechnology (VSH)

Vishay Intertechnology keeps us up at night. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think Vishay Intertechnology Will Underperform

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

- Gross margin of 21.1% reflects its high production costs

- Cash-burning history and the downward spiral in its margin profile make us wonder if it has a viable business model

- Earnings per share fell by 15.8% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

Vishay Intertechnology’s quality is not up to our standards. You should search for better opportunities.

Why There Are Better Opportunities Than Vishay Intertechnology

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Vishay Intertechnology

Vishay Intertechnology is trading at $20.43 per share, or 39.8x forward P/E. This multiple is higher than most semiconductor companies, and we think it’s quite expensive for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Vishay Intertechnology (VSH) Research Report: Q3 CY2025 Update

Semiconductor manufacturer Vishay Intertechnology (NYSE:VSH) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.5% year on year to $790.6 million. The company expects next quarter’s revenue to be around $790 million, close to analysts’ estimates. Its non-GAAP profit of $0.04 per share was in line with analysts’ consensus estimates.

Vishay Intertechnology (VSH) Q3 CY2025 Highlights:

- Revenue: $790.6 million vs analyst estimates of $780.9 million (7.5% year-on-year growth, 1.2% beat)

- Adjusted EPS: $0.04 vs analyst estimates of $0.04 (in line)

- Adjusted EBITDA: $76 million vs analyst estimates of $69.22 million (9.6% margin, 9.8% beat)

- Revenue Guidance for Q4 CY2025 is $790 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 2.4%, up from -2.5% in the same quarter last year

- Free Cash Flow was -$24.33 million compared to -$8.83 million in the same quarter last year

- Inventory Days Outstanding: 109, down from 112 in the previous quarter

- Market Capitalization: $2.18 billion

Company Overview

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology mainly manufactures discrete semiconductors and passive electronic components that can be found in almost any electronic device. Discrete semiconductors are chips that have a small number of transistors and are used for basic functions. Discrete semiconductors essentially exist in an on or off state and function alongside more complex chips in virtually every electronic device. The company also manufactures passive electronic devices such as resistors, inductors, and capacitors. These components are essential for the operation of electronic devices and work in tandem with more complex parts from other manufacturers. Through the manufacturing of discrete semiconductors and passive electronic components, it is essentially supplying the most basic elements of any electronic device.Vishay Intertechnology’s peers and competitors include Analog Devices (NASDAQ: ADI) Texas Instruments (NASDAQ: TXN), Skyworks (NASDAQ:SWKS), Infineon (XTRA:IFX), NXP Semiconductors NV (NASDAQ:NXPI), ON Semi (NASDAQ:ON), Marvell Technology (NASDAQ:MRVL), and Microchip (NASDAQ:MCHP).

4. Revenue Growth

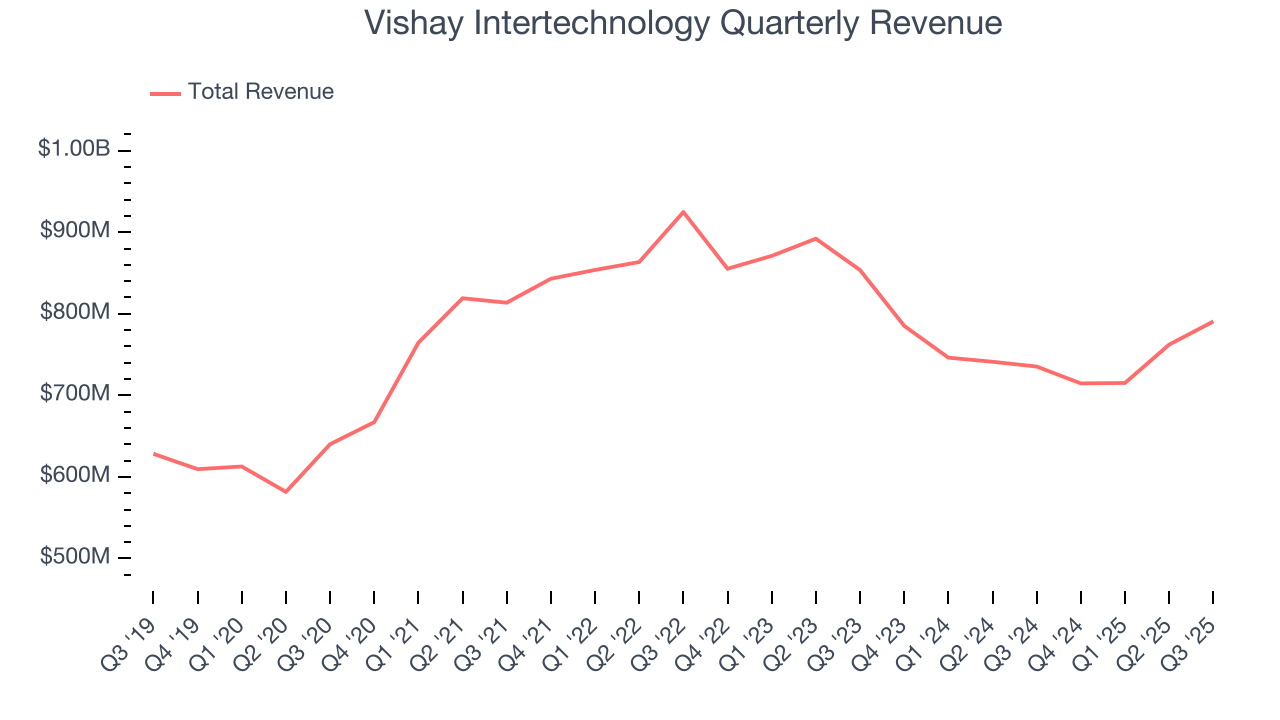

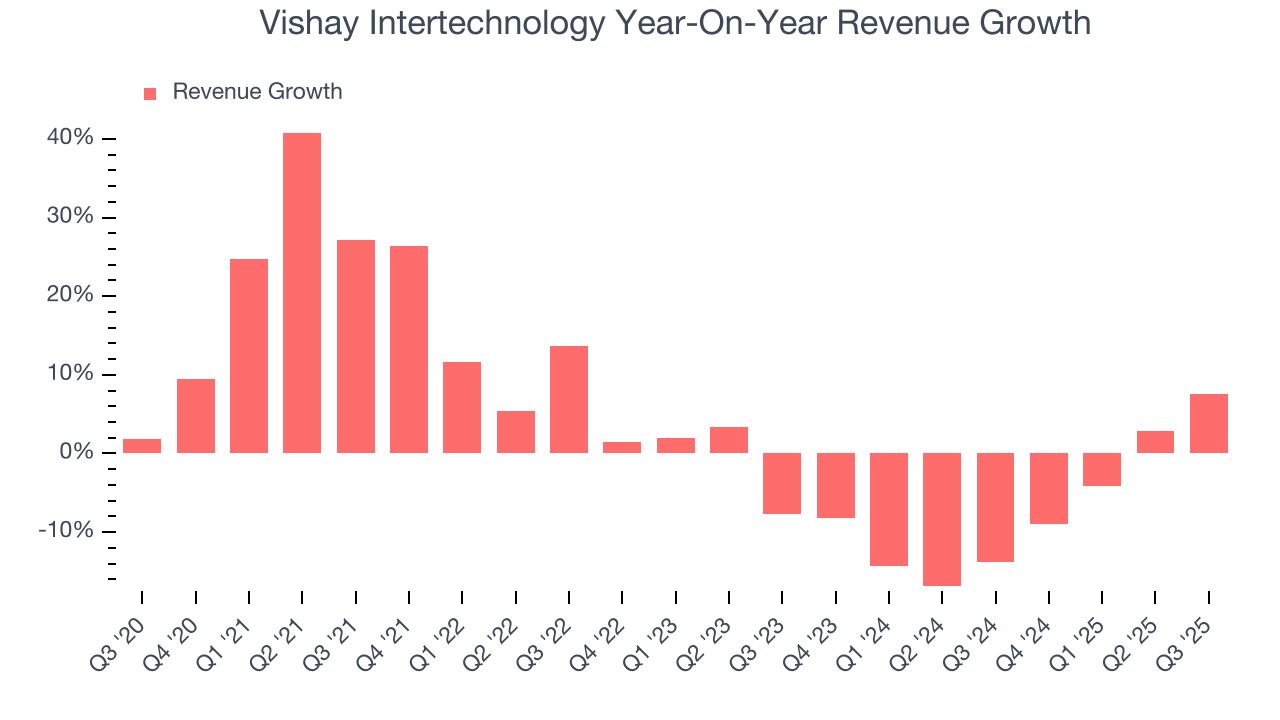

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Vishay Intertechnology’s 4.1% annualized revenue growth over the last five years was mediocre. This was below our standard for the semiconductor sector and is a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Vishay Intertechnology’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.3% annually.

This quarter, Vishay Intertechnology reported year-on-year revenue growth of 7.5%, and its $790.6 million of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 10.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

5. Product Demand & Outstanding Inventory

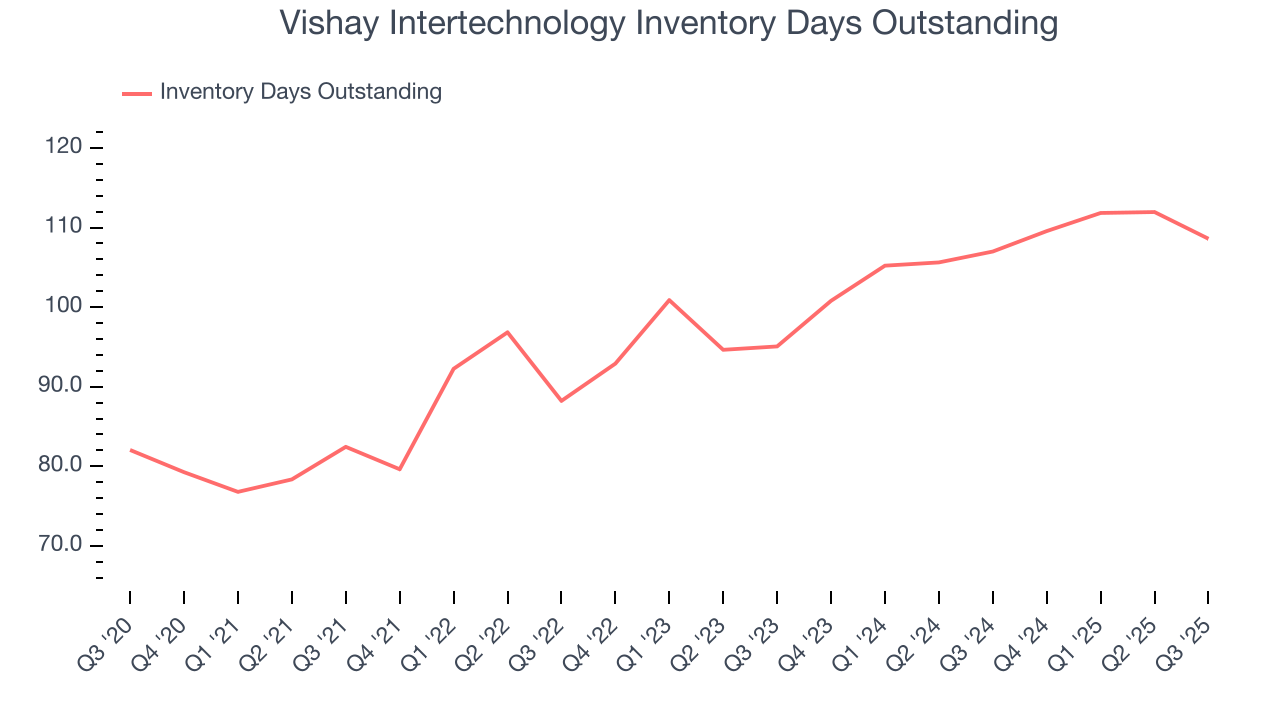

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Vishay Intertechnology’s DIO came in at 109, which is 13 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

6. Gross Margin & Pricing Power

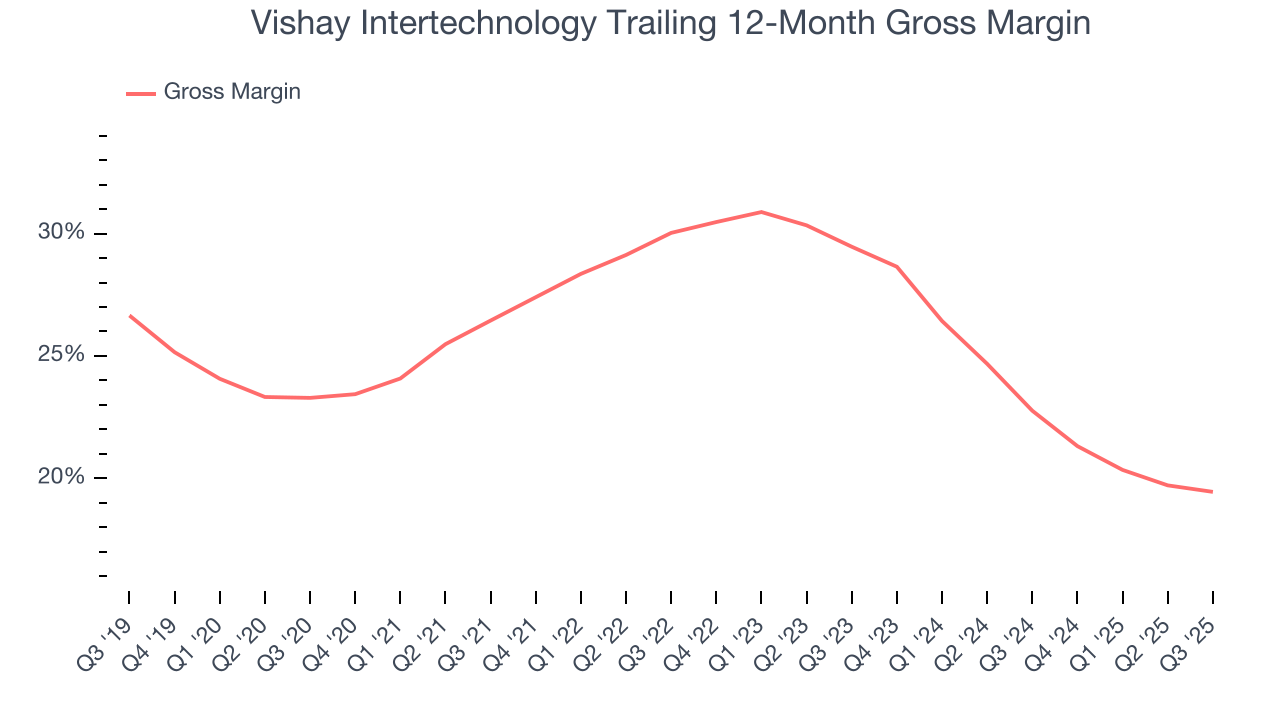

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Vishay Intertechnology’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 21.1% gross margin over the last two years. That means Vishay Intertechnology paid its suppliers a lot of money ($78.88 for every $100 in revenue) to run its business.

Vishay Intertechnology produced a 19.5% gross profit margin in Q3, marking a 1.1 percentage point decrease from 20.5% in the same quarter last year. Vishay Intertechnology’s full-year margin has also been trending down over the past 12 months, decreasing by 3.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

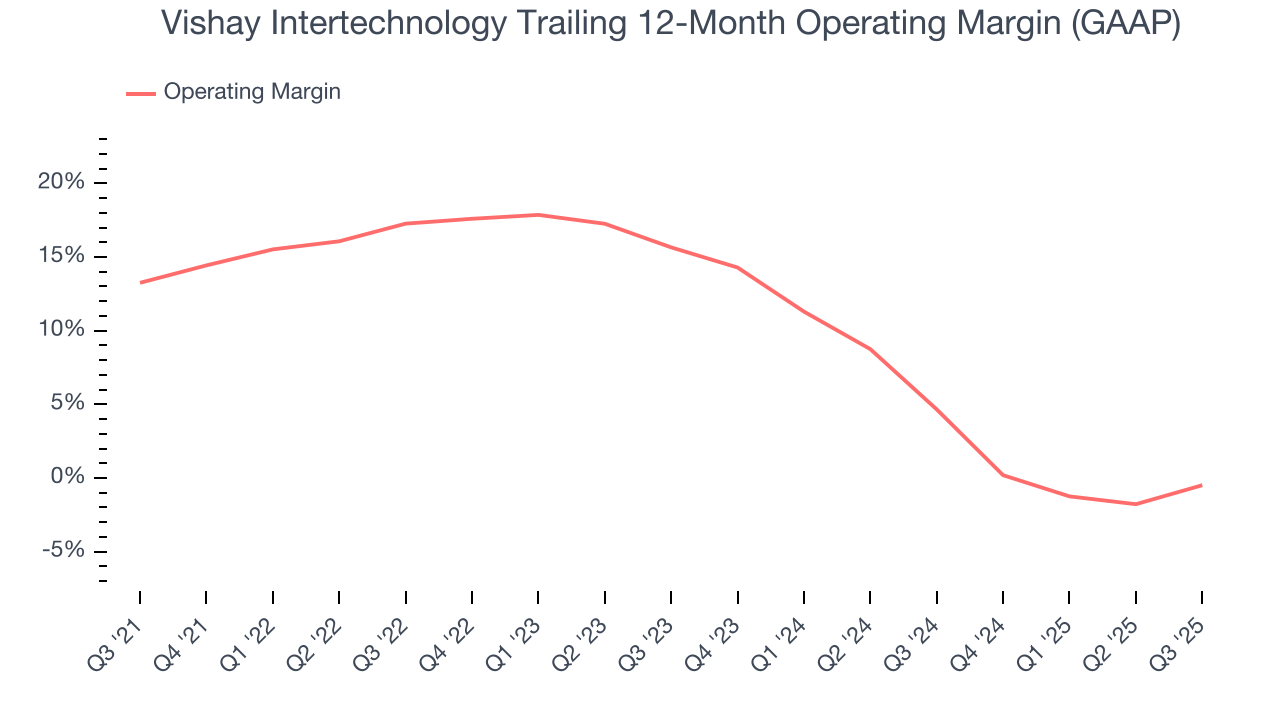

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Vishay Intertechnology was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.1% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Vishay Intertechnology’s operating margin decreased by 13.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Vishay Intertechnology’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Vishay Intertechnology generated an operating margin profit margin of 2.4%, up 4.9 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

8. Earnings Per Share

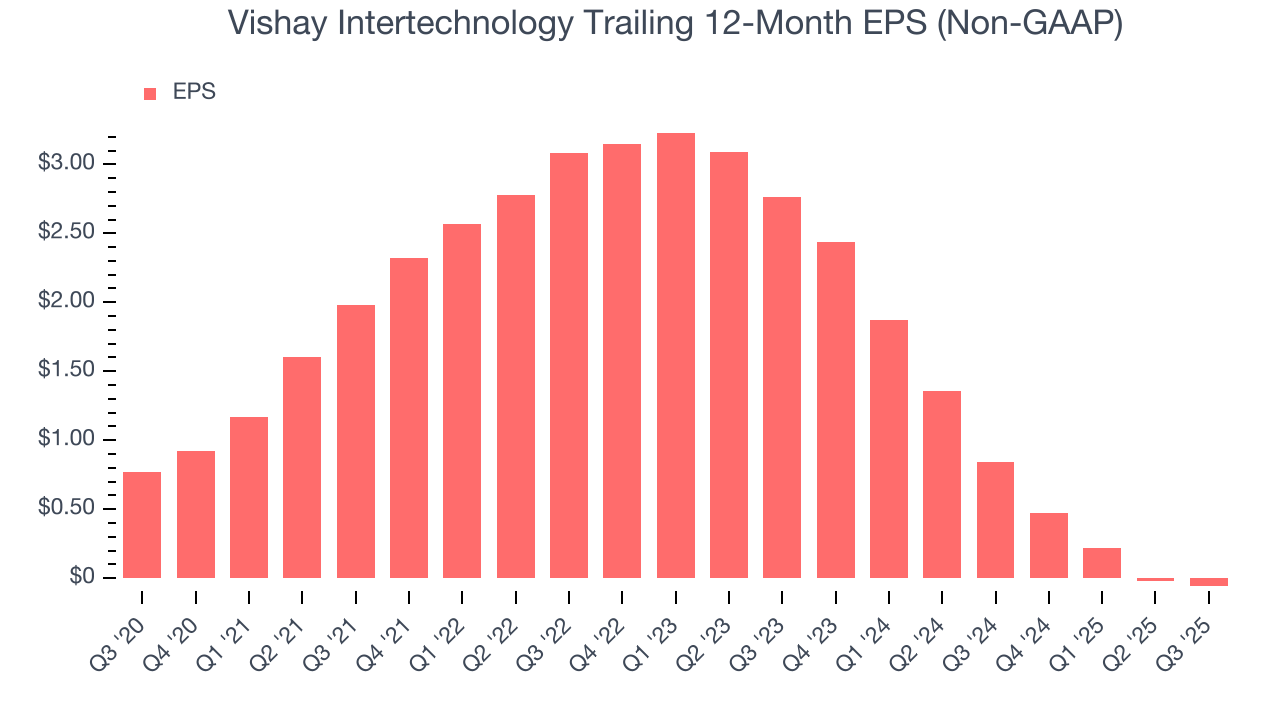

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Vishay Intertechnology, its EPS declined by 15.8% annually over the last five years while its revenue grew by 4.1%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Vishay Intertechnology’s earnings can give us a better understanding of its performance. As we mentioned earlier, Vishay Intertechnology’s operating margin expanded this quarter but declined by 13.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Vishay Intertechnology reported adjusted EPS of $0.04, down from $0.08 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Vishay Intertechnology’s full-year EPS of negative $0.06 will flip to positive $0.48.

9. Cash Is King

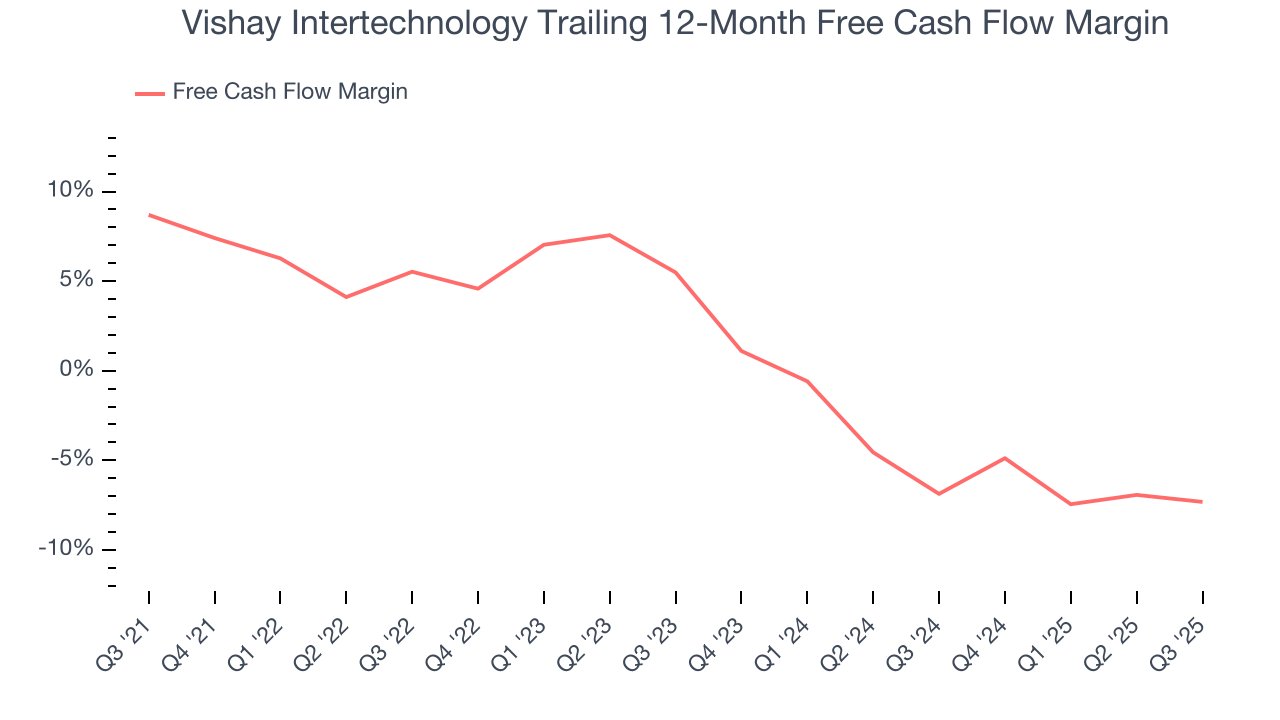

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Vishay Intertechnology’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.1%, meaning it lit $7.09 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Vishay Intertechnology’s margin dropped by 16 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Vishay Intertechnology burned through $24.33 million of cash in Q3, equivalent to a negative 3.1% margin. The company’s cash burn was similar to its $8.83 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

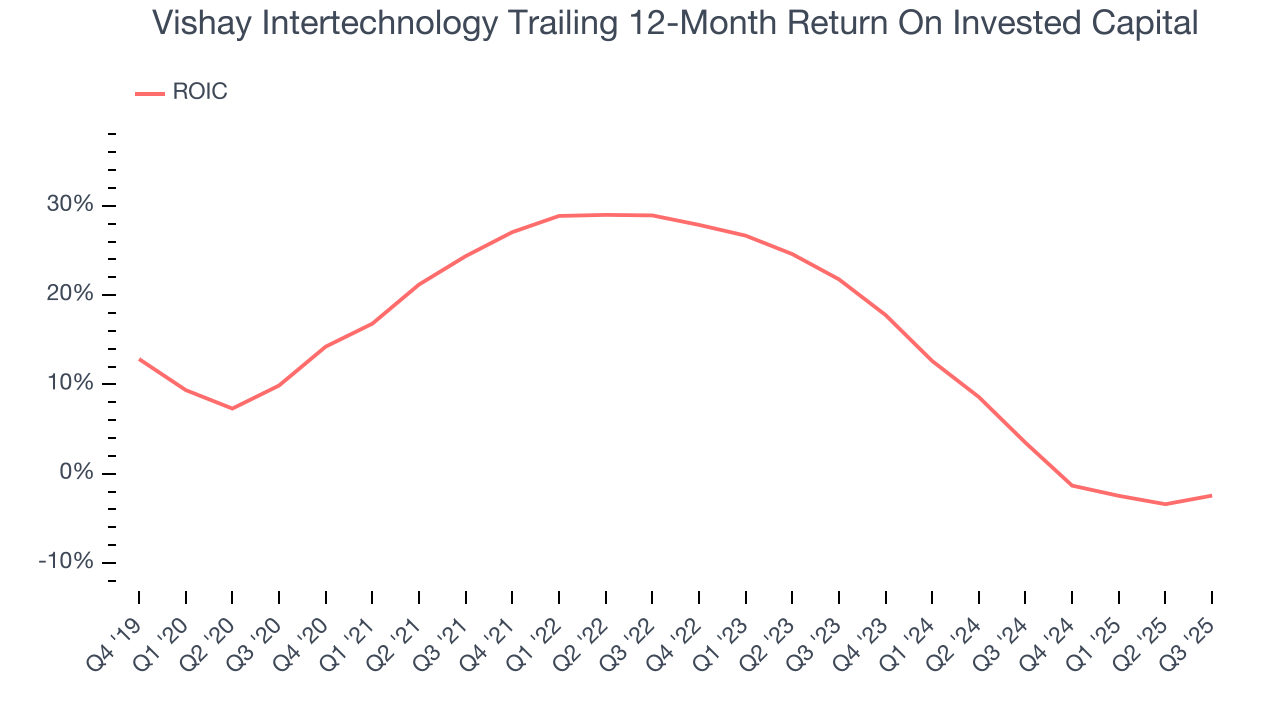

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Vishay Intertechnology historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 15.2%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

11. Balance Sheet Assessment

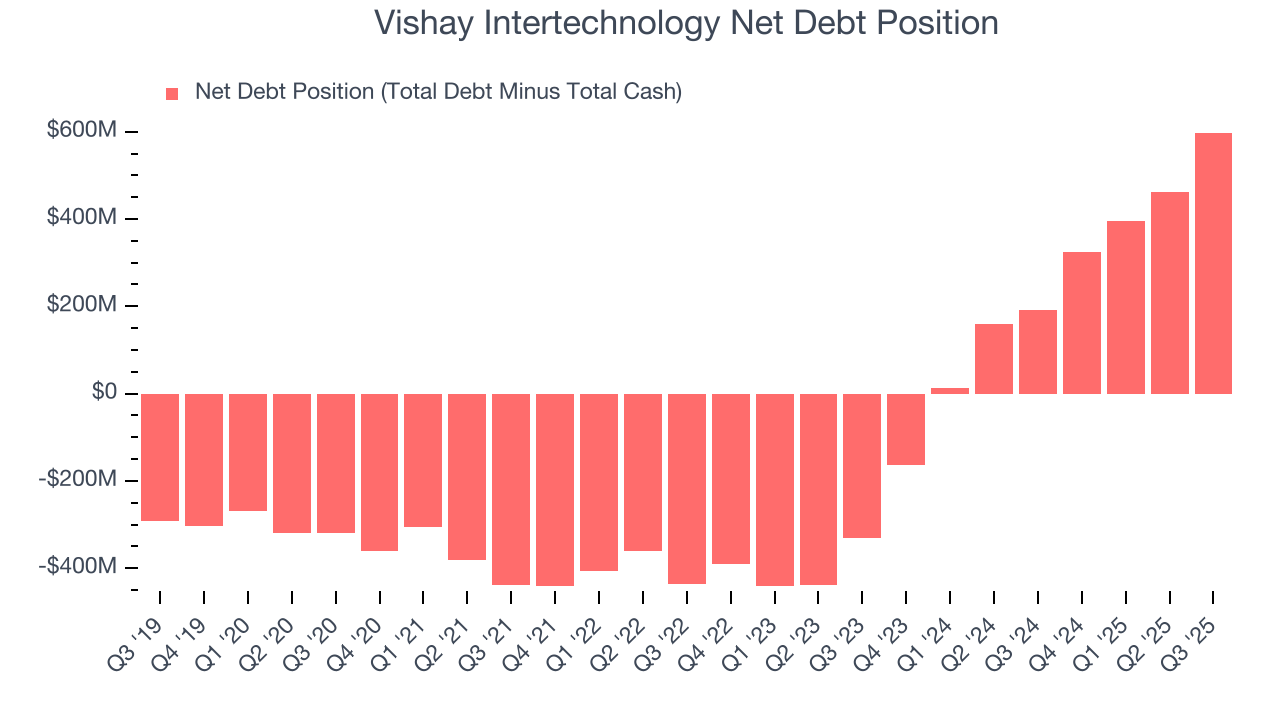

Vishay Intertechnology reported $444.1 million of cash and $1.04 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $273.8 million of EBITDA over the last 12 months, we view Vishay Intertechnology’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $24.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Vishay Intertechnology’s Q3 Results

It was good to see Vishay Intertechnology improve its inventory levels, even if just slightly. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Overall, this was a mixed quarter. The stock remained flat at $16.03 immediately following the results.

13. Is Now The Time To Buy Vishay Intertechnology?

Updated: February 3, 2026 at 9:31 PM EST

Before deciding whether to buy Vishay Intertechnology or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies furthering technological innovation, but in the case of Vishay Intertechnology, we’re out. To begin with, its revenue growth was mediocre over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash profitability fell over the last five years. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

Vishay Intertechnology’s P/E ratio based on the next 12 months is 39.8x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $15 on the company (compared to the current share price of $20.43), implying they don’t see much short-term potential in Vishay Intertechnology.