Magnachip (MX)

Magnachip keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Magnachip Will Underperform

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE:MX) is a provider of analog and mixed-signal semiconductors.

- Sales tumbled by 16.2% annually over the last five years, showing market trends are working against its favor during this cycle

- Sales are projected to tank by 15.1% over the next 12 months as its demand continues evaporating

- High input costs result in an inferior gross margin of 20.8% that must be offset through higher volumes

Magnachip doesn’t measure up to our expectations. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Magnachip

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Magnachip

At $2.73 per share, Magnachip trades at 0.6x forward price-to-sales. The market typically values companies like Magnachip based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Magnachip (MX) Research Report: Q3 CY2025 Update

Semiconductor manufacturer Magnachip Semiconductor (NYSE:MX) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 30.9% year on year to $45.95 million. On the other hand, next quarter’s revenue guidance of $40.5 million was less impressive, coming in 14.9% below analysts’ estimates. Its non-GAAP loss of $0.01 per share was 91.7% above analysts’ consensus estimates.

Magnachip (MX) Q3 CY2025 Highlights:

- Revenue: $45.95 million vs analyst estimates of $46 million (30.9% year-on-year decline, in line)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.12 (91.7% beat)

- Adjusted EBITDA: -$3.96 million vs analyst estimates of -$3 million (-8.6% margin, relatively in line)

- Revenue Guidance for Q4 CY2025 is $40.5 million at the midpoint, below analyst estimates of $47.6 million

- Operating Margin: -25.1%, down from -16.6% in the same quarter last year

- Free Cash Flow was -$7.49 million compared to -$15.51 million in the same quarter last year

- Inventory Days Outstanding: 91, in line with the previous quarter

- Market Capitalization: $111.4 million

Company Overview

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE:MX) is a provider of analog and mixed-signal semiconductors.

Magnachip is headquartered in South Korea and was founded in 2004 after Hynix Semiconductor’s non-memory business was separated from the parent company. Magnachip went public in 2011.

Magnachip’s product portfolio is divided into two segments: Display Solutions and Power Solutions. The company’s Display Solutions technology delivers defined analog voltages and currents that activate pixels on displays. One example is Magnachip’s display drivers, which are chips that serve as interfaces between microprocessors and LCD screens in smartphones. Another example is timing controllers, which are chips that receive and convert image data on screens.

Magnachip’s Power Solutions technology allows for power consumption regulation and efficiency in devices. Examples include various transistors, which enable low standby power consumption in consumer electronics such as laptops so as not to drain the battery when in sleep or standby modes. Driver and regulator technologies in Power Solutions also aid in the heat dissipation needed for many consumer electronics such as tablets to prevent them from getting too hot.

Magnachip’s customers are largely consumer, computing, and industrial electronics OEMs (original equipment manufacturers). The company manufactures most of its Display Solutions products at external foundries, while Power Solutions products are manufactured through a combination of both in-house manufacturing and external foundries.

Competitors offering analog and mixed-signal semiconductors for display and power management include Diodes (NASDAQ:DIOD), Infineon Technologies (XTRA:IFX), and Novatek Microelectronics (TWSE:3034).

4. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Magnachip’s demand was weak and its revenue declined by 17.2% per year. This was below our standards and suggests it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Magnachip’s annualized revenue declines of 11.2% over the last two years suggest its demand continued shrinking.

This quarter, Magnachip reported a rather uninspiring 30.9% year-on-year revenue decline to $45.95 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 20.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

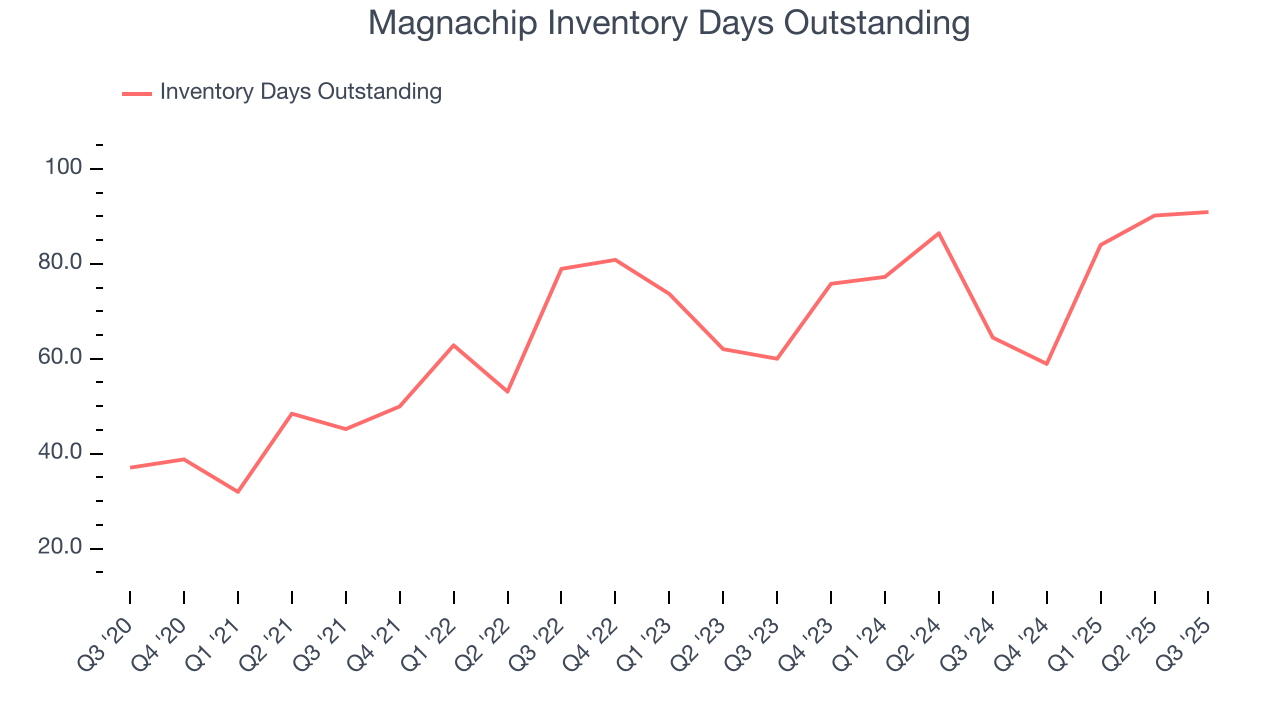

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Magnachip’s DIO came in at 91, which is 25 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

6. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Magnachip’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 18.8% gross margin over the last two years. Said differently, Magnachip had to pay a chunky $81.15 to its suppliers for every $100 in revenue.

Magnachip produced a 18.6% gross profit margin in Q3, marking a 4.7 percentage point decrease from 23.3% in the same quarter last year. Magnachip’s full-year margin has also been trending down over the past 12 months, decreasing by 4.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

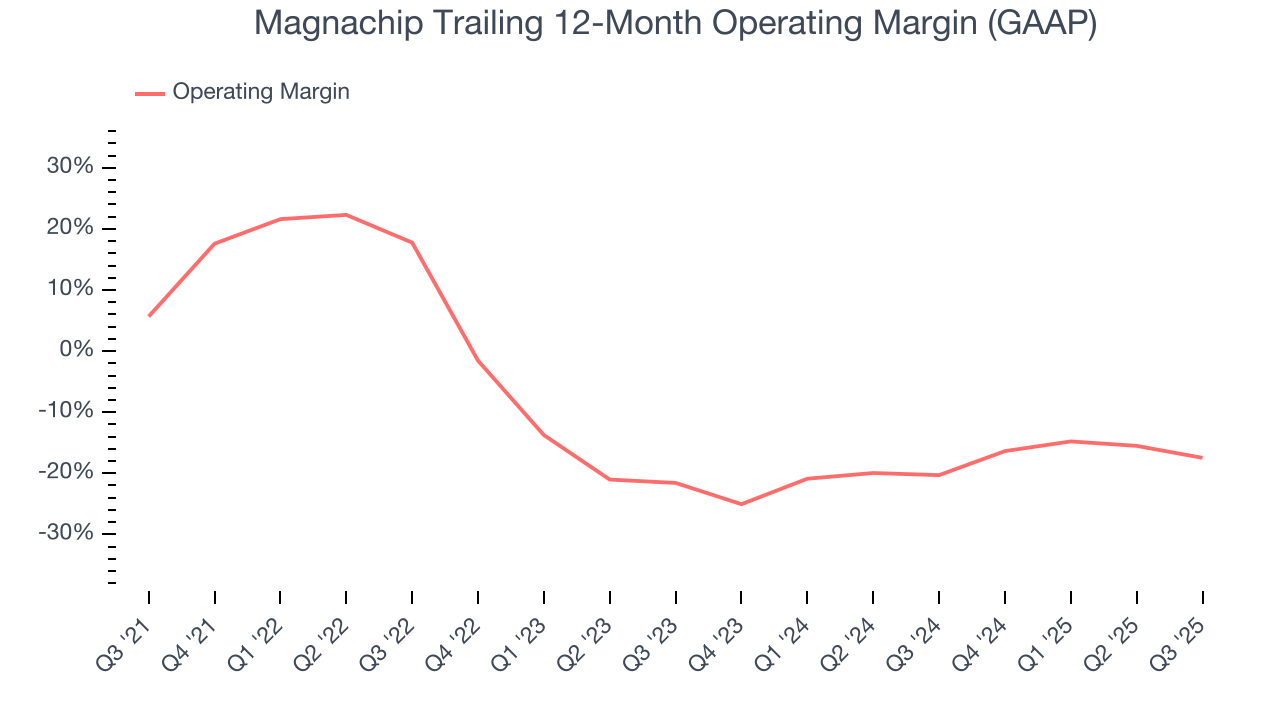

7. Operating Margin

Magnachip’s high expenses have contributed to an average operating margin of negative 19% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Magnachip’s operating margin decreased by 23.1 percentage points over the last five years. Magnachip’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Magnachip generated a negative 25.1% operating margin. The company's consistent lack of profits raise a flag.

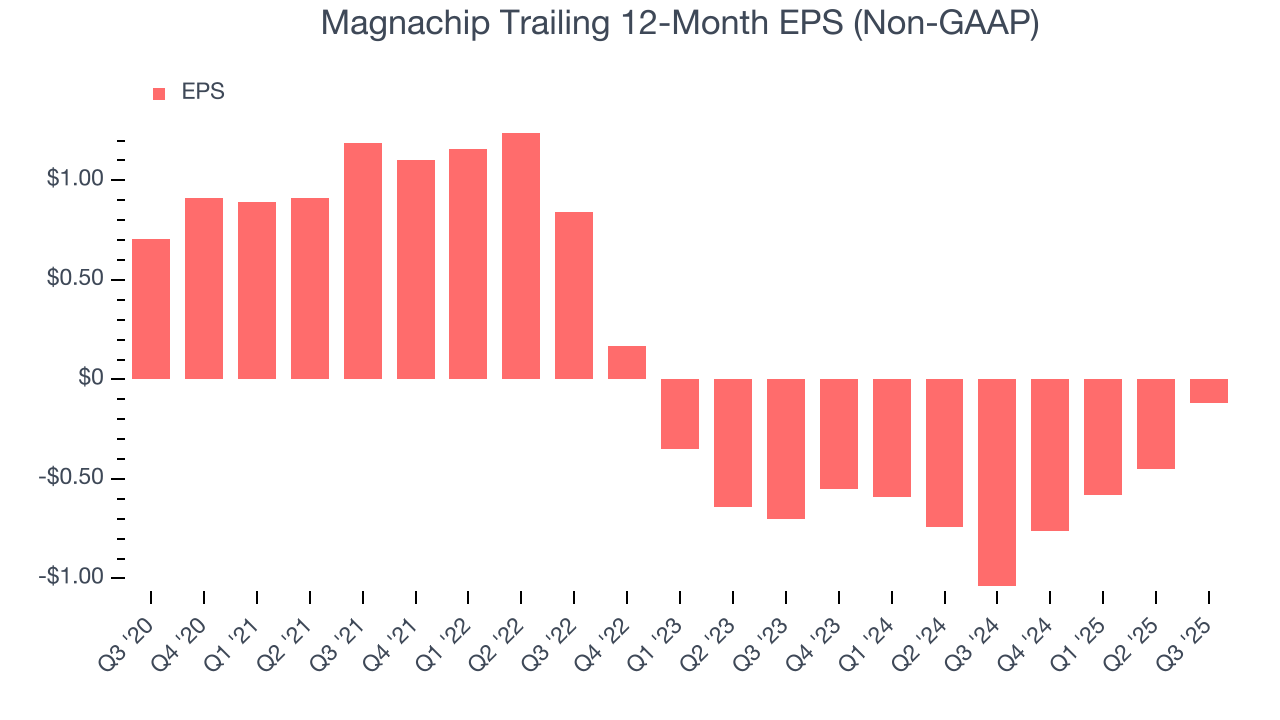

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Magnachip, its EPS and revenue declined by 16.8% and 17.2% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Magnachip’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Magnachip reported adjusted EPS of negative $0.01, up from negative $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Magnachip to perform poorly. Analysts forecast its full-year EPS of negative $0.12 will tumble to negative $0.47.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Magnachip’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 18.8%, meaning it lit $18.81 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Magnachip’s margin dropped by 14.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Magnachip burned through $7.49 million of cash in Q3, equivalent to a negative 16.3% margin. The company’s cash burn was similar to its $15.51 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Magnachip’s five-year average ROIC was negative 0.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the semiconductor sector.

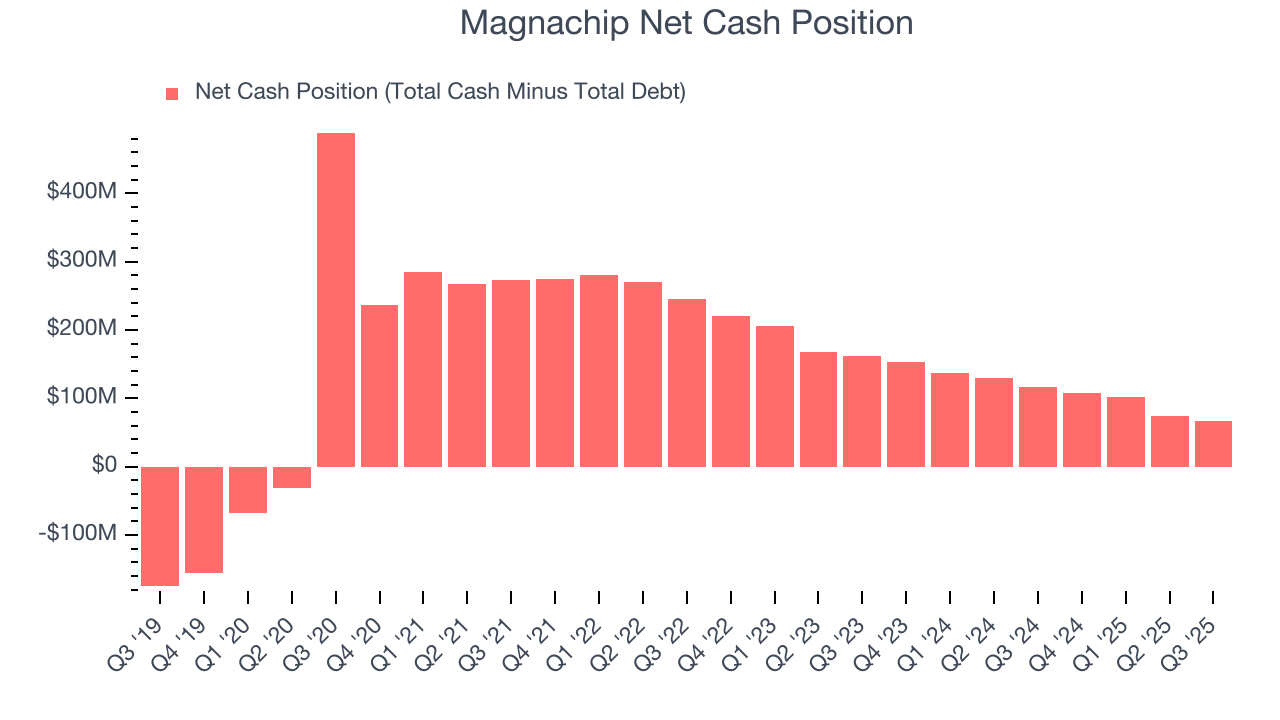

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Magnachip is a well-capitalized company with $108 million of cash and $41.38 million of debt on its balance sheet. This $66.62 million net cash position is 59.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Magnachip’s Q3 Results

It was good to see Magnachip beat analysts’ EPS expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its adjusted operating income fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $3.14 immediately after reporting.

13. Is Now The Time To Buy Magnachip?

Updated: March 3, 2026 at 9:43 PM EST

Before investing in or passing on Magnachip, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We cheer for all companies solving complex technology issues, but in the case of Magnachip, we’ll be cheering from the sidelines. For starters, its revenue has declined over the last five years. On top of that, Magnachip’s projected EPS for the next year is lacking, and its declining operating margin shows the business has become less efficient.

Magnachip’s forward price-to-sales ratio is 0.6x. The market typically values companies like Magnachip based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $4 on the company (compared to the current share price of $2.73).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.