Wabtec (WAB)

Wabtec is interesting. Although its sales growth has been weak, its profitability gives it the flexibility to ride out cycles.― StockStory Analyst Team

1. News

2. Summary

Why Wabtec Is Interesting

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and related software for the railway industry.

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 17.4% annually

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

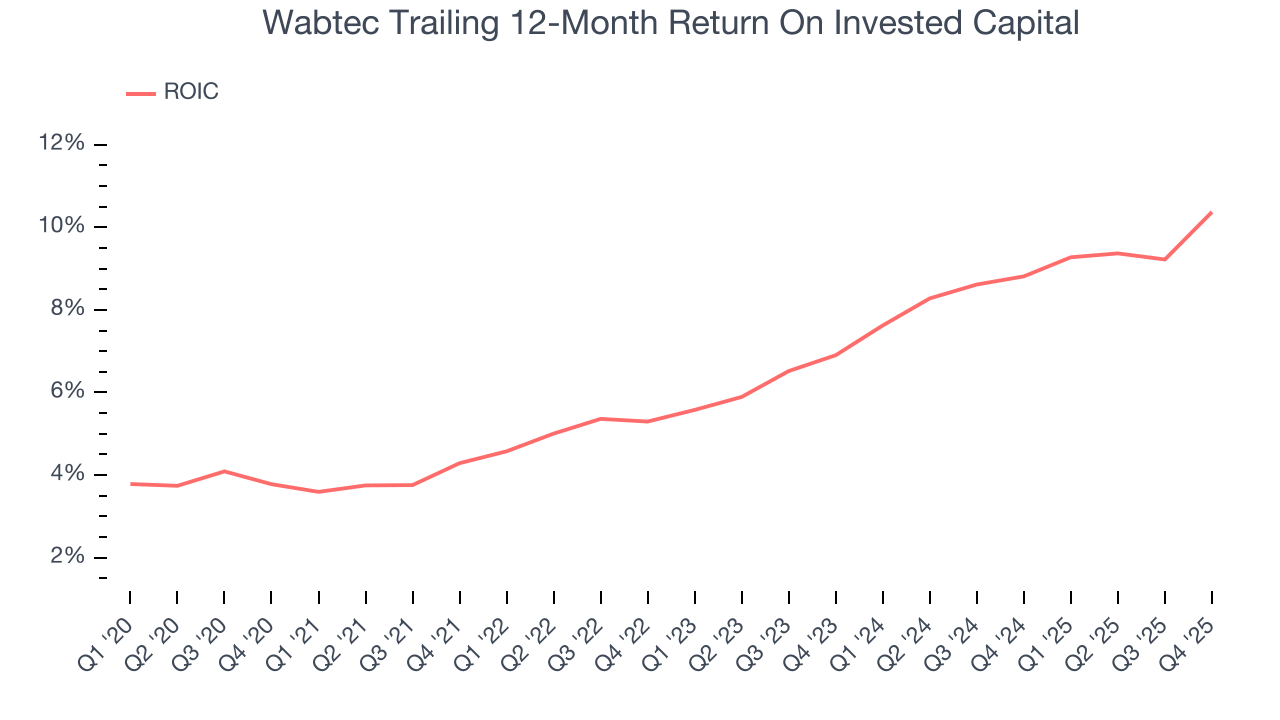

- One pitfall is its ROIC of 6.7% reflects management’s challenges in identifying attractive investment opportunities

Wabtec is solid, but not perfect. If you like the stock, the valuation seems fair.

Why Is Now The Time To Buy Wabtec?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Wabtec?

Wabtec’s stock price of $246.46 implies a valuation ratio of 24.8x forward P/E. Compared to other industrials companies, we think this multiple is fair for the quality you get.

Now could be a good time to invest if you believe in the story.

3. Wabtec (WAB) Research Report: Q4 CY2025 Update

Rail equipment company Westinghouse Air Brake Technologies (NYSE:WAB) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 14.8% year on year to $2.97 billion. The company’s full-year revenue guidance of $12.34 billion at the midpoint came in 2.9% above analysts’ estimates. Its non-GAAP profit of $2.10 per share was 0.9% above analysts’ consensus estimates.

Wabtec (WAB) Q4 CY2025 Highlights:

- Revenue: $2.97 billion vs analyst estimates of $2.86 billion (14.8% year-on-year growth, 3.5% beat)

- Adjusted EPS: $2.10 vs analyst estimates of $2.08 (0.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $10.25 at the midpoint, in line with analyst estimates

- Operating Margin: 12%, in line with the same quarter last year

- Free Cash Flow Margin: 33.5%, up from 24.7% in the same quarter last year

- Backlog: $27.41 billion at quarter end

- Organic Revenue rose 14.8% year on year (beat)

- Market Capitalization: $42.13 billion

Company Overview

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and related software for the railway industry.

As the name suggests, the company was a pioneer in braking technology for locomotives that utilized air pressure rather than friction. Today, the company's product portfolio is broader and it serves both the freight (moving goods) and transit (moving passengers) end markets. It provides products like freight and passenger train cars of various types and uses, brake systems, communication systems, and software for train control and monitoring.

It generates revenue through the sale of its aforementioned equipment and through the aftermarket maintenance, repair, and parts supply for its products. While the macro may cause swings in demand for heavy equipment and complex systems, existing trains will continue to need maintenance and repairs. This revenue stream smooths out Wabtec's topline. Its software also provides operational efficiency analytics and improvements for train operators, which together with its maintenance services act as a diversified stream of recurring revenue. As the world digitizes and data becomes table stakes across all industries, these offerings will be more important for Wabtec's success.

Wabtec's customers include freight rail operators, passenger rail operators, railcar manufacturers, mining and industrial companies, as well as governments responsible for the operation of its transit systems. While it has historically grown mostly through organic means, the company acquired GE Transportation in 2019 for $11 billion, paying with a combination of cash and stock.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Other companies in the freight and passenger rail industry include Trinity Industries (NYSE:TRN), and European competitors Alstom (EPA:ALO) and Knorr-Bremse AG (ETR:KBX).

5. Revenue Growth

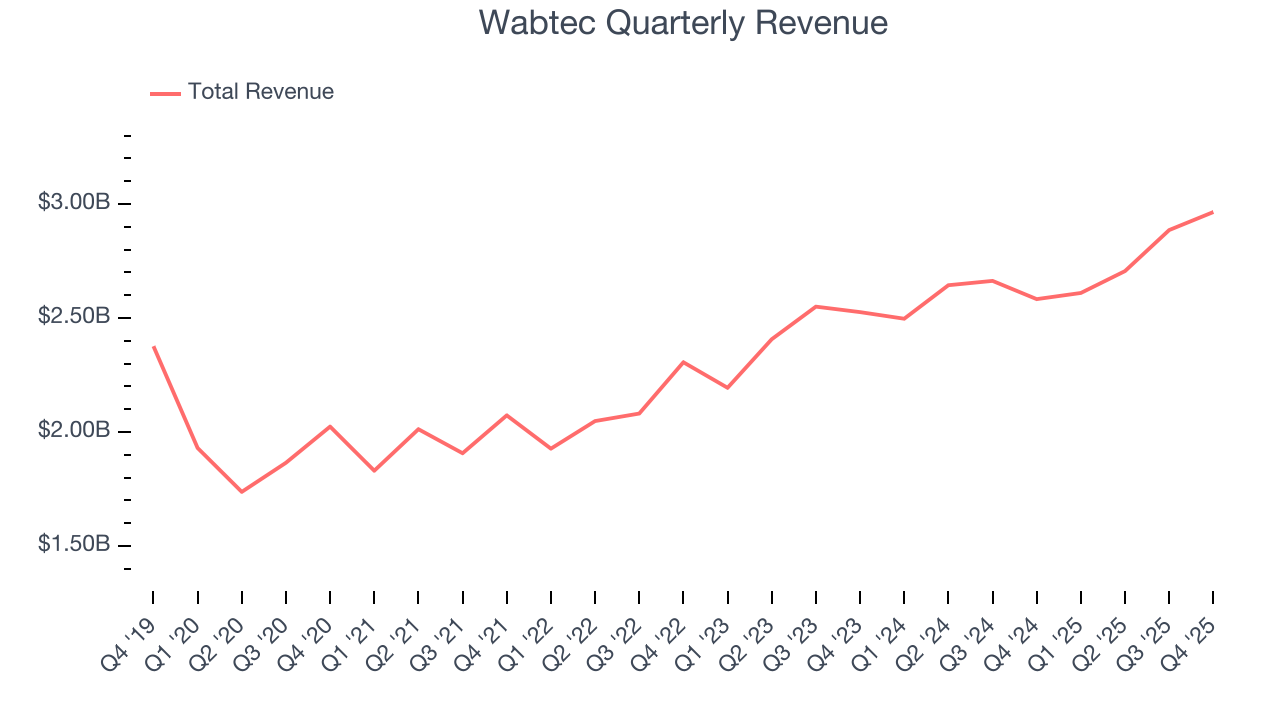

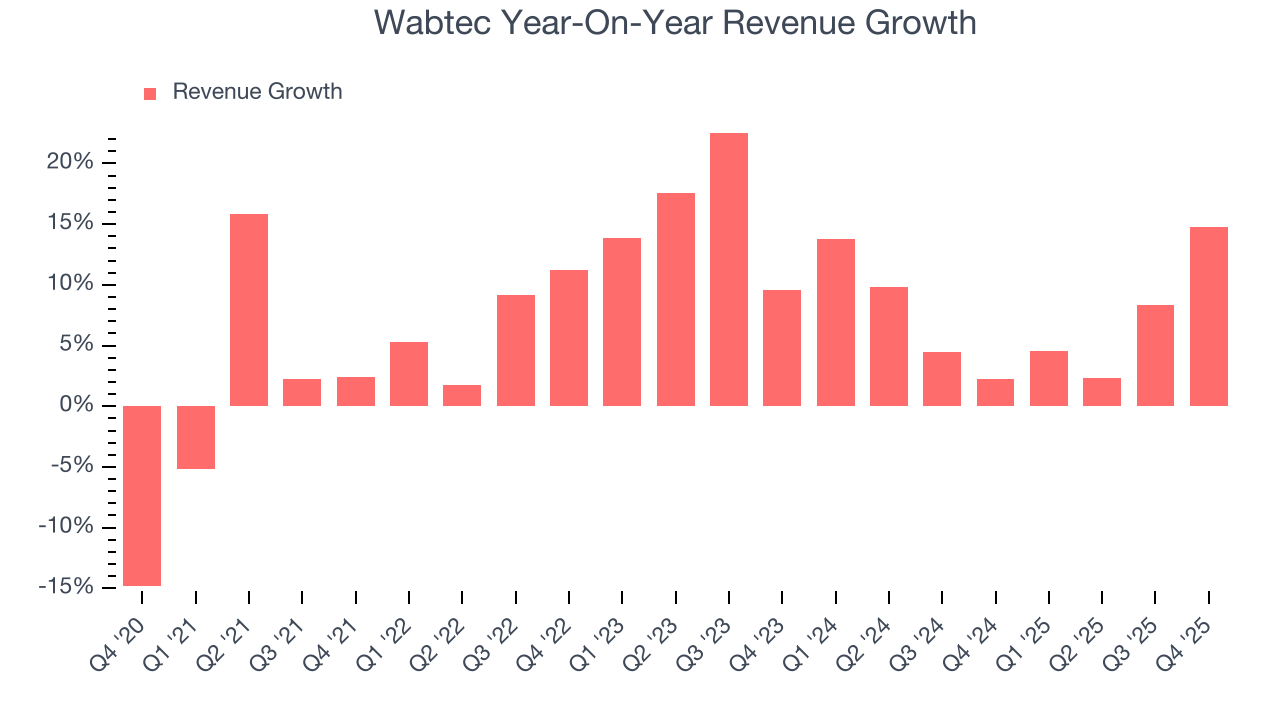

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Wabtec grew its sales at a decent 8.1% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Wabtec’s annualized revenue growth of 7.4% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak. We also note many other Heavy Transportation Equipment businesses have faced declining sales because of cyclical headwinds. While Wabtec grew slower than we’d like, it did do better than its peers.

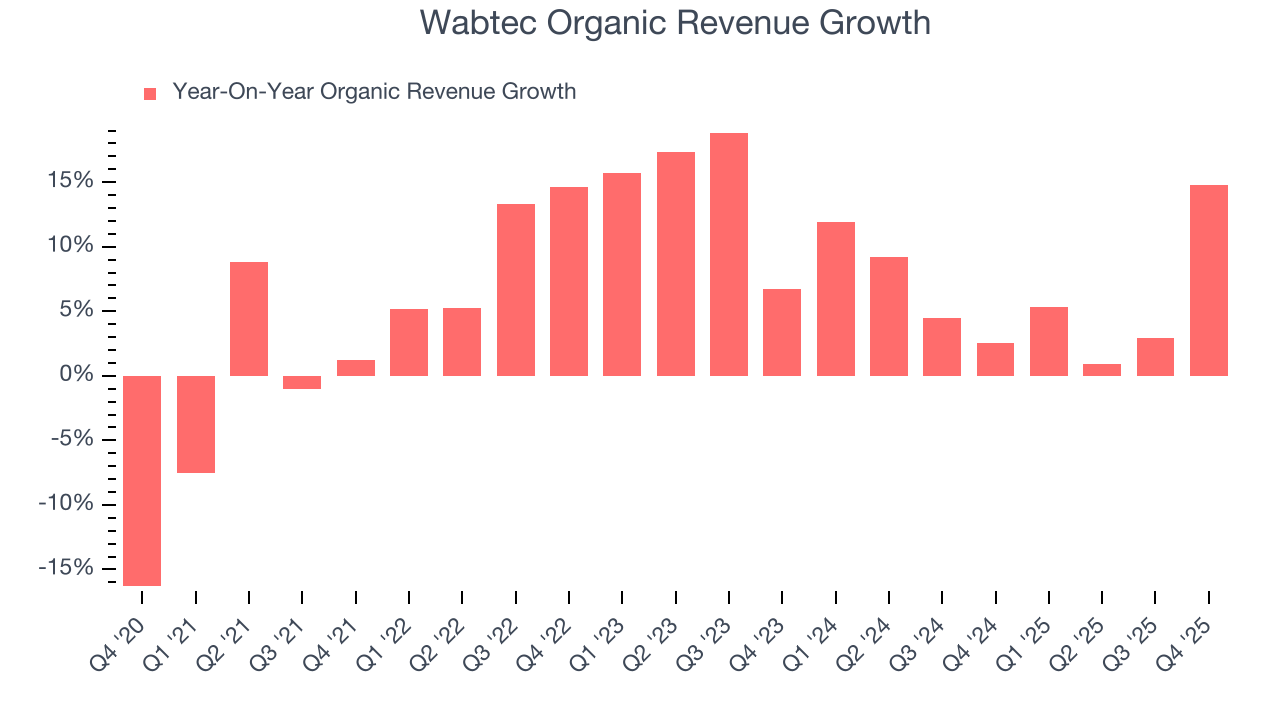

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Wabtec’s organic revenue averaged 6.5% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Wabtec reported year-on-year revenue growth of 14.8%, and its $2.97 billion of revenue exceeded Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, similar to its two-year rate. This projection is above the sector average and implies its newer products and services will help maintain its recent top-line performance.

6. Gross Margin & Pricing Power

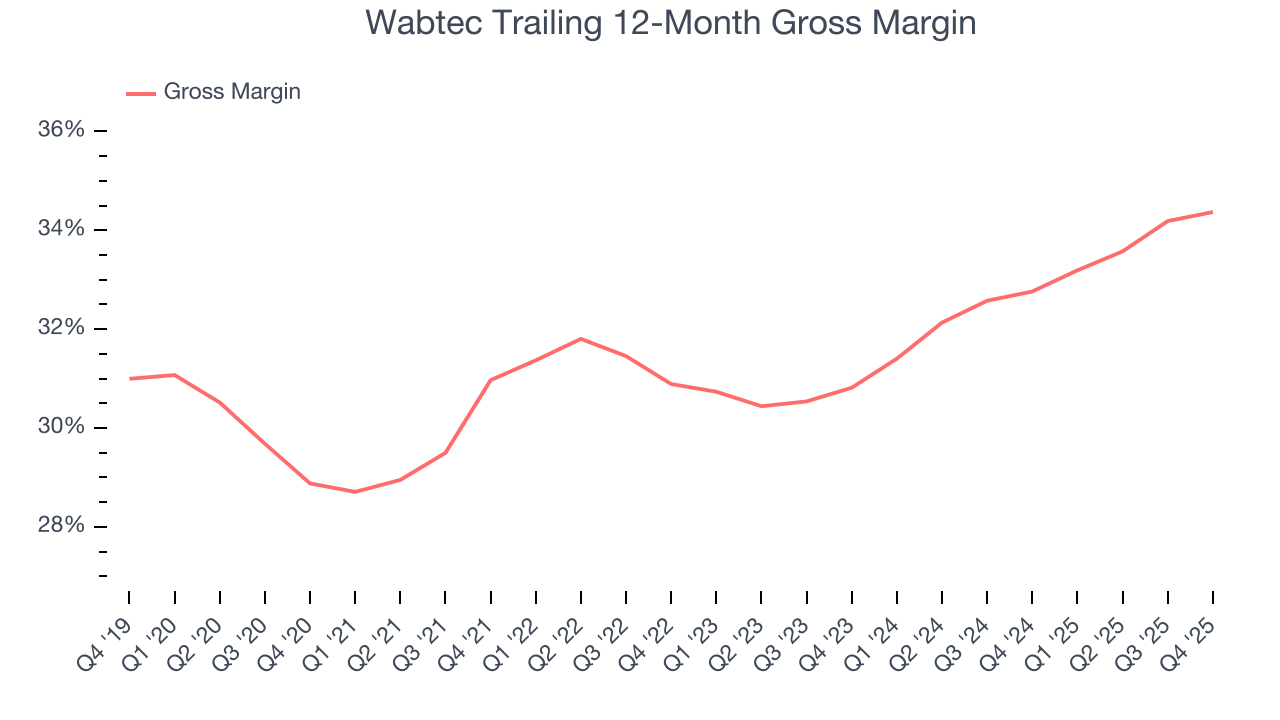

Wabtec’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 32.1% gross margin over the last five years. Said differently, Wabtec paid its suppliers $67.88 for every $100 in revenue.

Wabtec produced a 32.6% gross profit margin in Q4, marking a 1 percentage point increase from 31.6% in the same quarter last year. Wabtec’s full-year margin has also been trending up over the past 12 months, increasing by 1.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

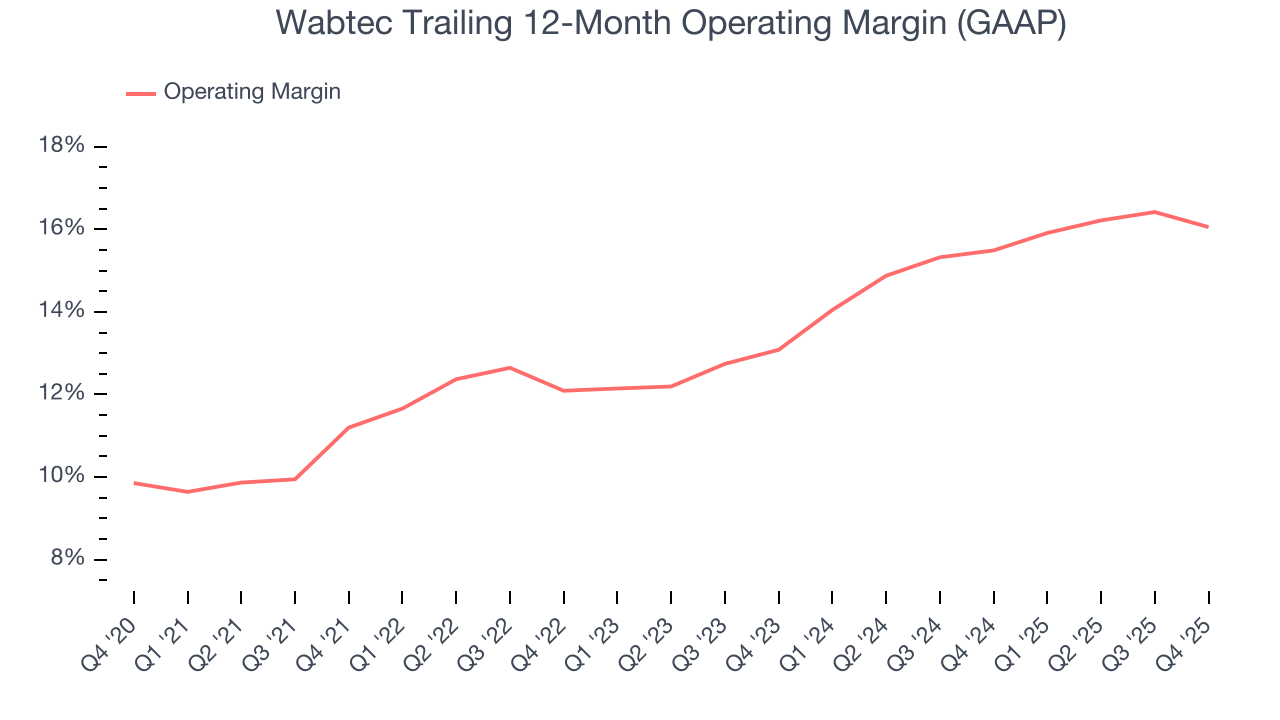

Wabtec has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.8%.

Looking at the trend in its profitability, Wabtec’s operating margin rose by 4.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Wabtec generated an operating margin profit margin of 12%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

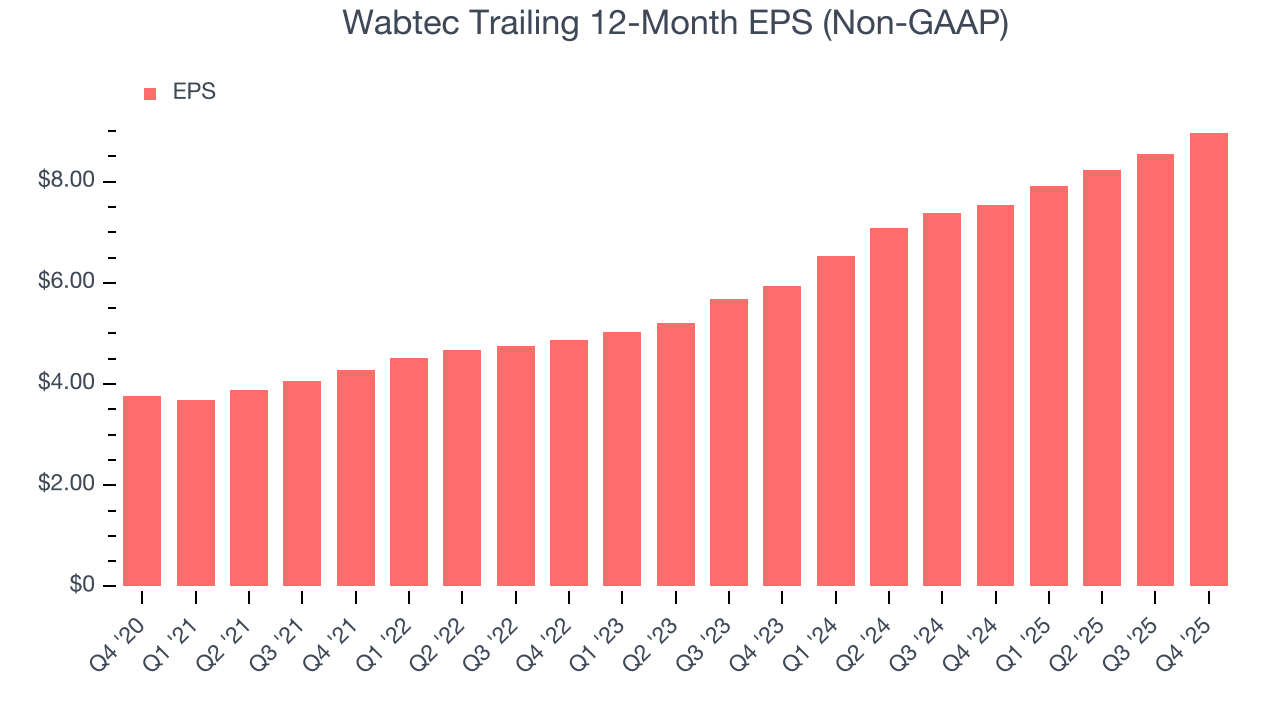

Wabtec’s EPS grew at an astounding 18.9% compounded annual growth rate over the last five years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

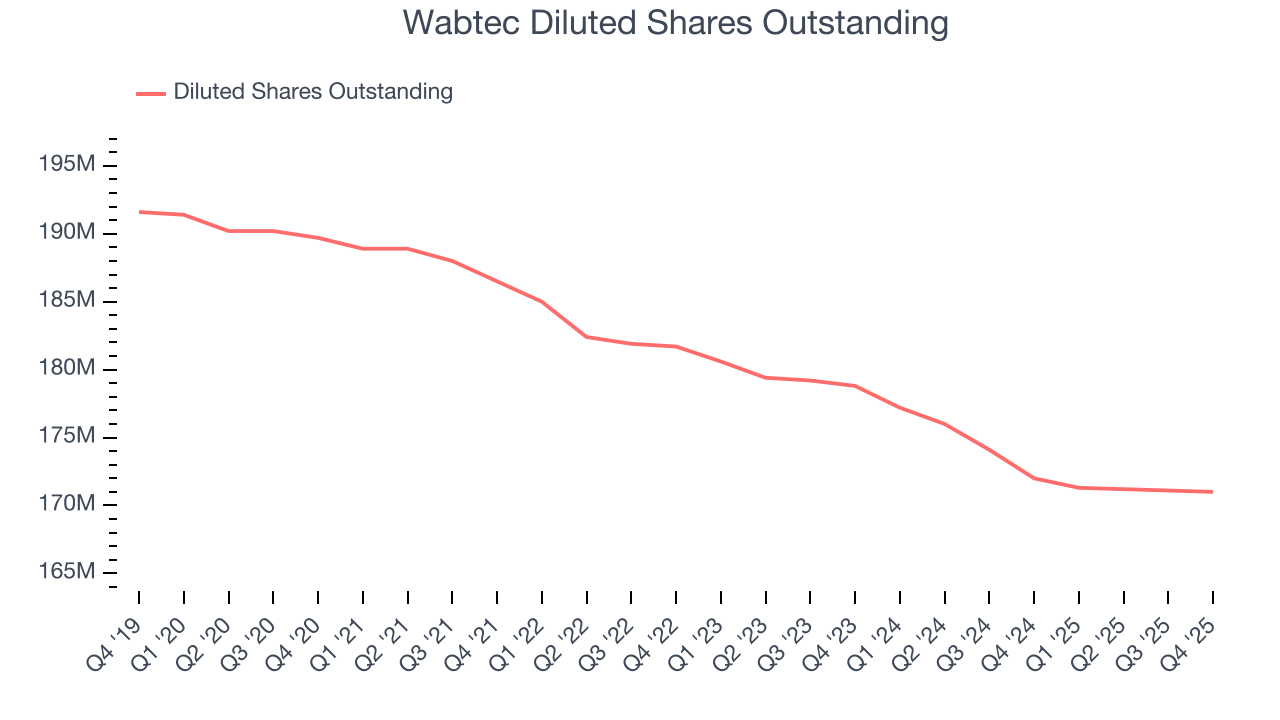

Diving into Wabtec’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Wabtec’s operating margin was flat this quarter but expanded by 4.9 percentage points over the last five years. On top of that, its share count shrank by 9.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Wabtec, its two-year annual EPS growth of 23% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Wabtec reported adjusted EPS of $2.10, up from $1.68 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Wabtec’s full-year EPS of $8.97 to grow 14.1%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

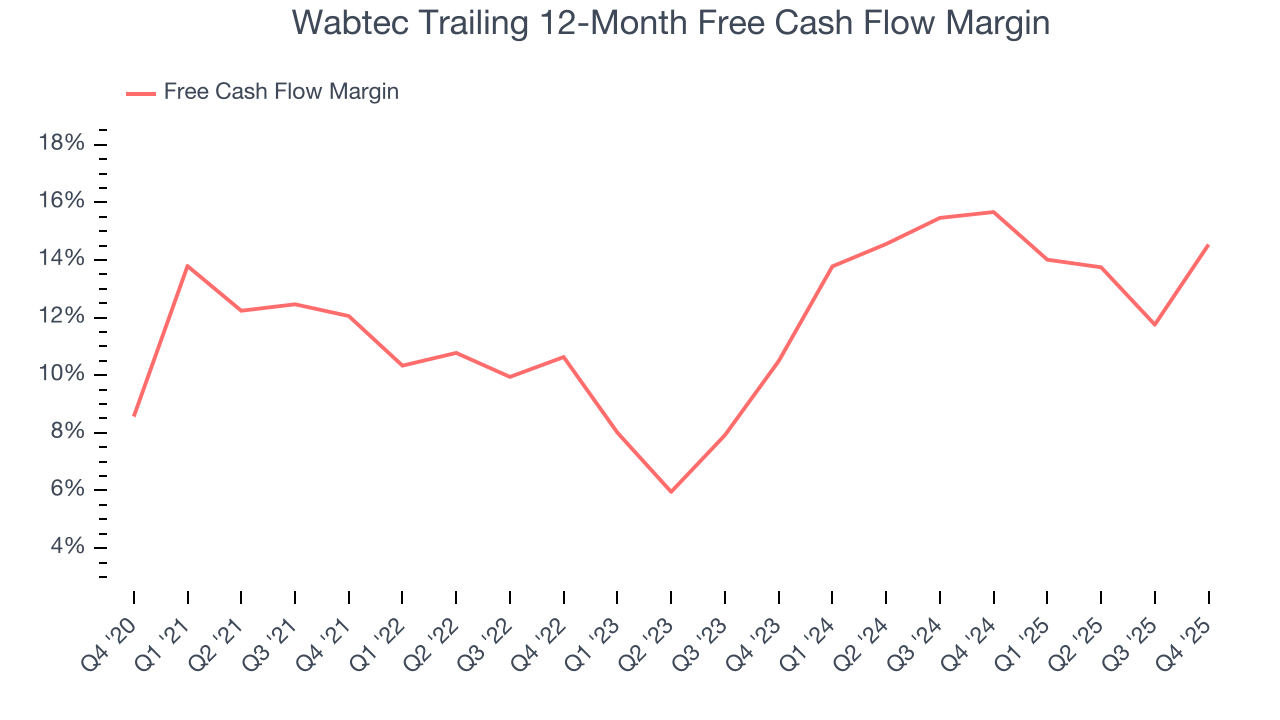

Wabtec has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.9% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Wabtec’s margin expanded by 2.5 percentage points during that time. This is encouraging because it gives the company more optionality.

Wabtec’s free cash flow clocked in at $994.1 million in Q4, equivalent to a 33.5% margin. This result was good as its margin was 8.8 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Wabtec has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.1%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Wabtec’s ROIC averaged 4.8 percentage point increases each year over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

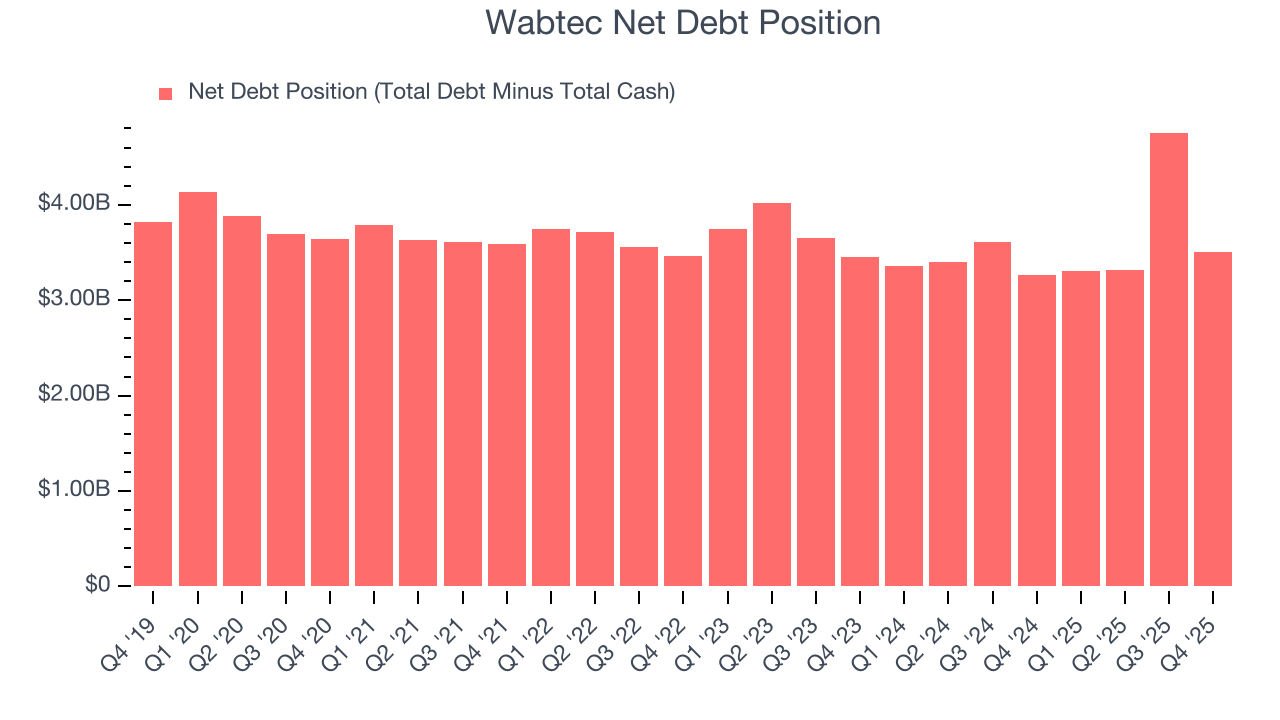

11. Balance Sheet Assessment

Wabtec reported $789 million of cash and $4.29 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.46 billion of EBITDA over the last 12 months, we view Wabtec’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $225 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Wabtec’s Q4 Results

We were impressed by how significantly Wabtec blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. This also led to an EPS beat in the quarter. Zooming out, we think this was a solid print. The stock remained flat at $245.94 immediately after reporting.

13. Is Now The Time To Buy Wabtec?

Updated: February 11, 2026 at 6:43 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

For starters, its revenue growth was decent over the last five years, and analysts believe it can continue growing at these levels. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. Additionally, Wabtec’s expanding operating margin shows the business has become more efficient.

Wabtec’s P/E ratio based on the next 12 months is 24.1x. Looking at the industrials landscape right now, Wabtec trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $249.83 on the company (compared to the current share price of $245.94).