Whirlpool (WHR)

We wouldn’t recommend Whirlpool. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Whirlpool Will Underperform

Credited with introducing the first automatic washing machine, Whirlpool (NYSE:WHR) is a manufacturer of a variety of home appliances.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 4.4% annually over the last five years

- Performance over the past five years shows each sale was less profitable as its earnings per share dropped by 19.6% annually, worse than its revenue

- High net-debt-to-EBITDA ratio of 6× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Whirlpool’s quality isn’t up to par. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Whirlpool

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Whirlpool

At $74.19 per share, Whirlpool trades at 9.3x forward EV-to-EBITDA. This multiple expensive for its subpar fundamentals.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. Whirlpool (WHR) Research Report: Q4 CY2025 Update

Home appliances manufacturer Whirlpool (NYSE:WHR) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $4.10 billion. The company’s full-year revenue guidance of $15.45 billion at the midpoint came in 0.9% below analysts’ estimates. Its GAAP profit of $1.91 per share was 32% above analysts’ consensus estimates.

Whirlpool (WHR) Q4 CY2025 Highlights:

- Revenue: $4.10 billion vs analyst estimates of $4.26 billion (flat year on year, 3.7% miss)

- EPS (GAAP): $1.91 vs analyst estimates of $1.45 (32% beat)

- Adjusted EBITDA: $335 million vs analyst estimates of $269.3 million (8.2% margin, 24.4% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $6.25 at the midpoint, missing analyst estimates by 9.5%

- Operating Margin: 5.9%, up from -3.3% in the same quarter last year

- Free Cash Flow Margin: 24.1%, similar to the same quarter last year

- Market Capitalization: $4.69 billion

Company Overview

Credited with introducing the first automatic washing machine, Whirlpool (NYSE:WHR) is a manufacturer of a variety of home appliances.

Whirlpool has a rich history dating back to its founding in 1911. The company was established to provide solutions to household chores through efficient home appliances.

Today, Whirlpool offers a wide range of home appliances including washing machines, dryers, refrigerators, and dishwashers. Whirlpool also focuses on device connectivity - for example, laundry appliances feature technologies such as smart features and energy-saving options.

The primary revenue sources for Whirlpool stem from the sale of its home appliances through various channels, including retail stores, online platforms, and distribution partnerships. Additionally, the company may generate revenue through recurring sales of consumable products such as water filters and detergents, complementing its core appliance offerings.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors in the household appliance industry include Electrolux AB (STO:ELUX-B), LG (KRX: 066570), and Haier (SHA: 600690).

5. Revenue Growth

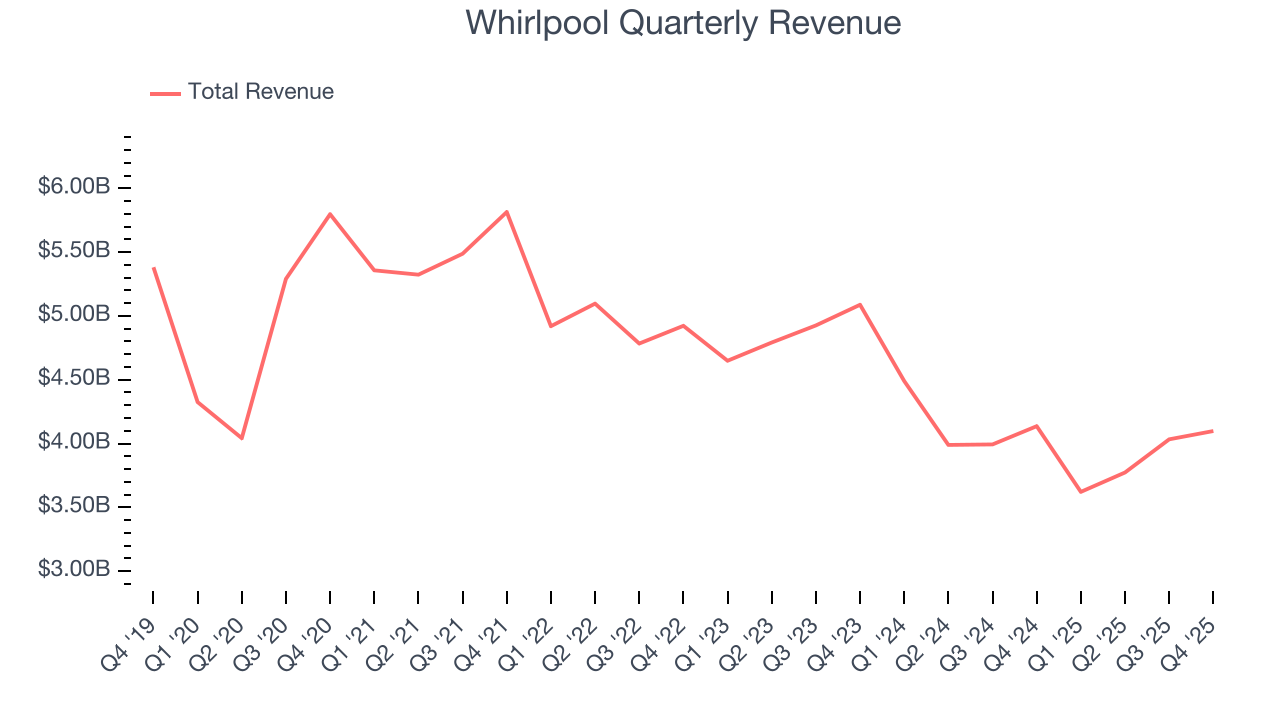

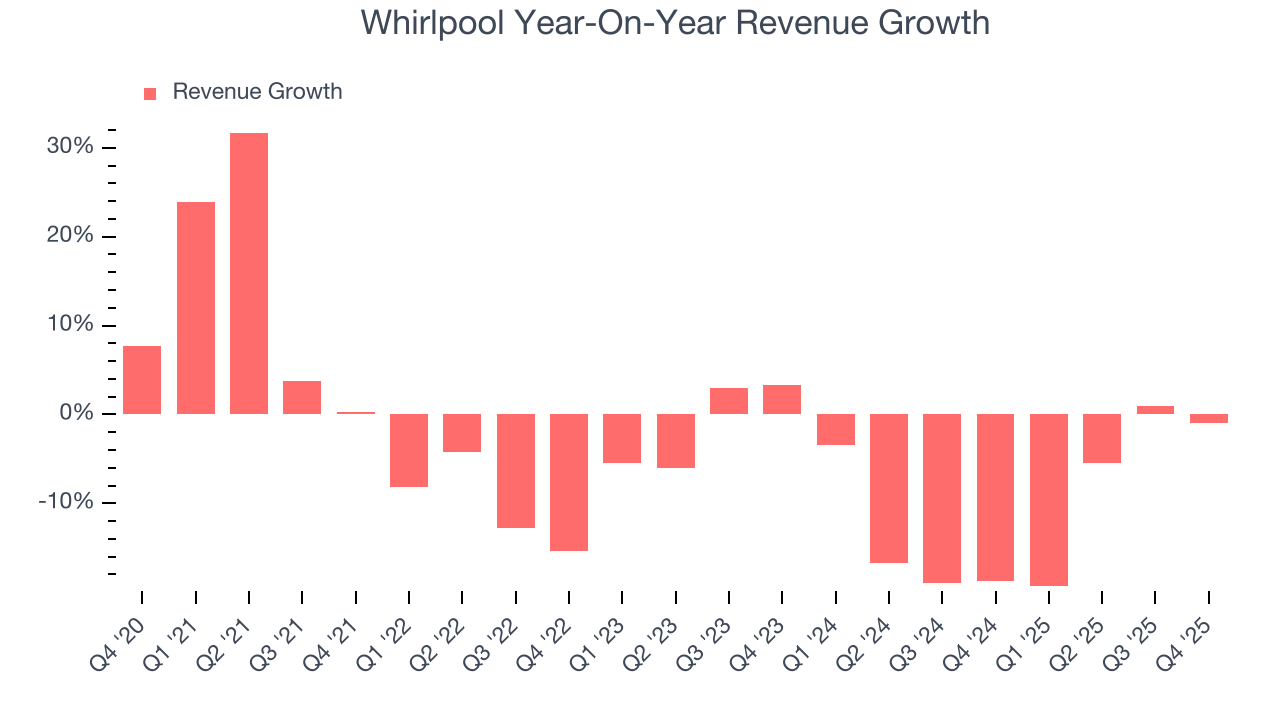

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Whirlpool’s demand was weak over the last five years as its sales fell at a 4.4% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Whirlpool’s recent performance shows its demand remained suppressed as its revenue has declined by 10.7% annually over the last two years.

This quarter, Whirlpool missed Wall Street’s estimates and reported a rather uninspiring 0.9% year-on-year revenue decline, generating $4.10 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

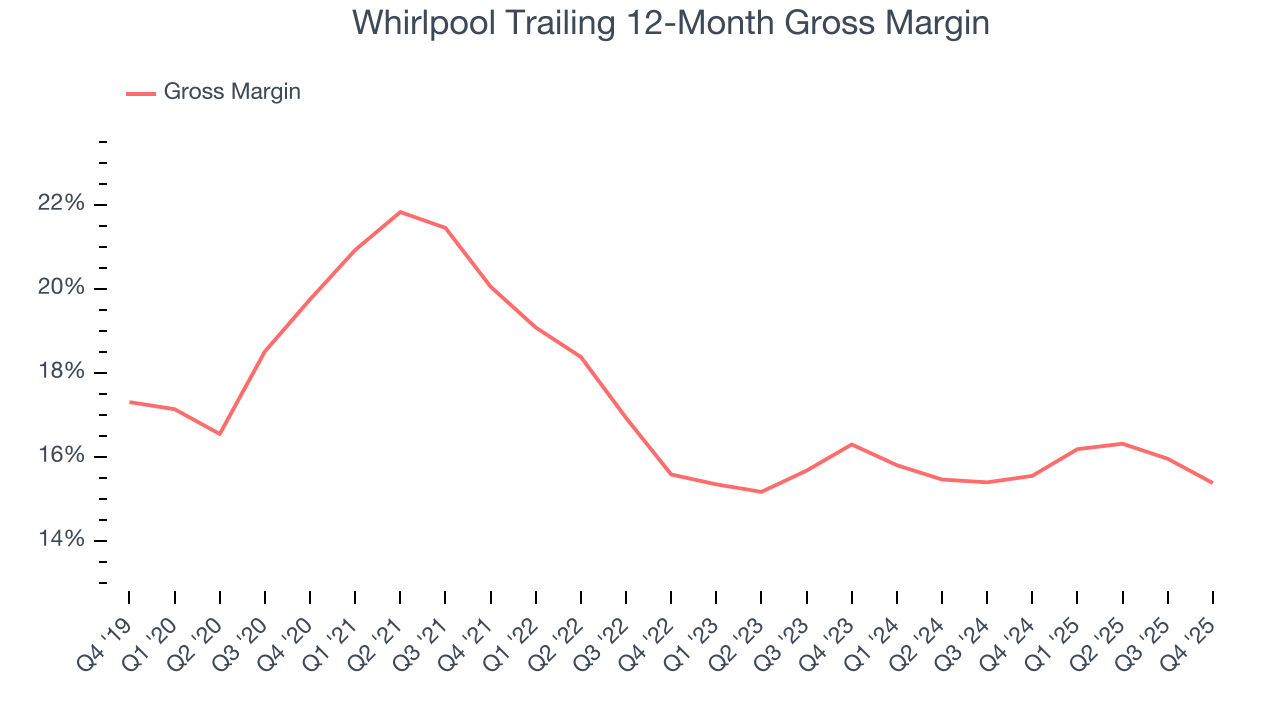

Whirlpool has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16.7% gross margin over the last five years. That means Whirlpool paid its suppliers a lot of money ($83.26 for every $100 in revenue) to run its business.

In Q4, Whirlpool produced a 14% gross profit margin, down 2.2 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

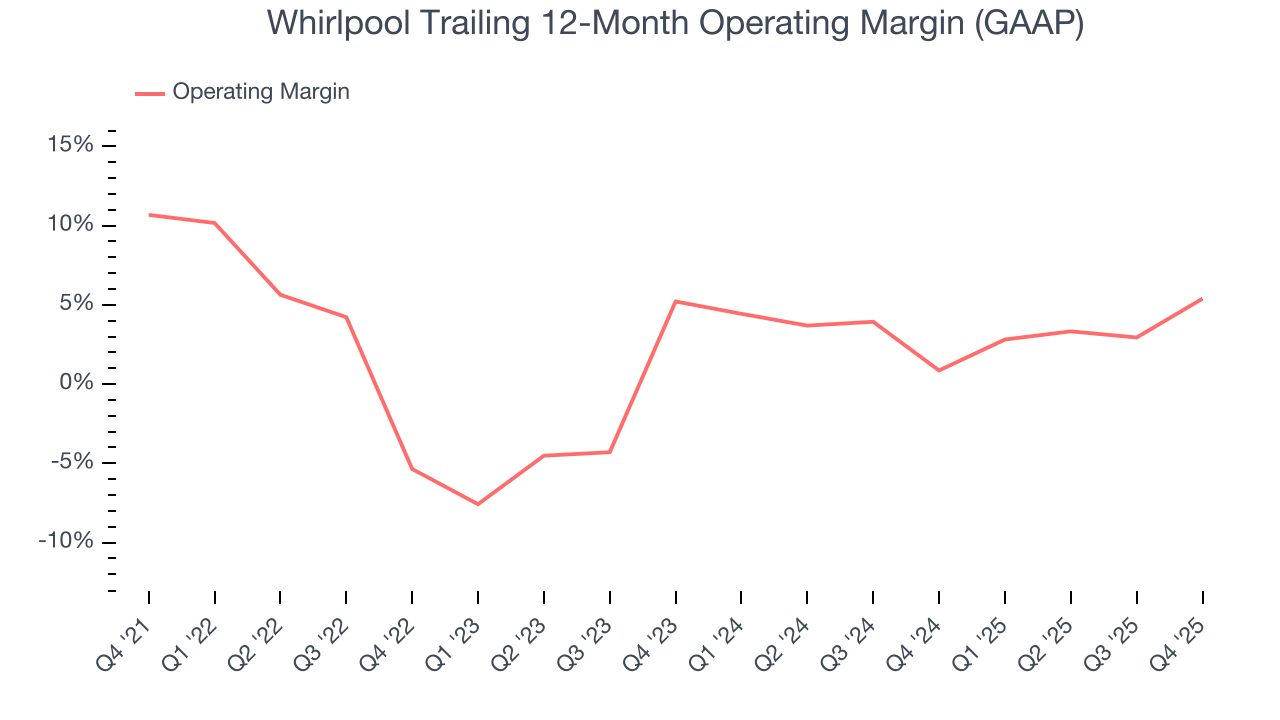

Whirlpool was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Whirlpool’s operating margin decreased by 5.3 percentage points over the last five years. Whirlpool’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Whirlpool generated an operating margin profit margin of 5.9%, up 9.2 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

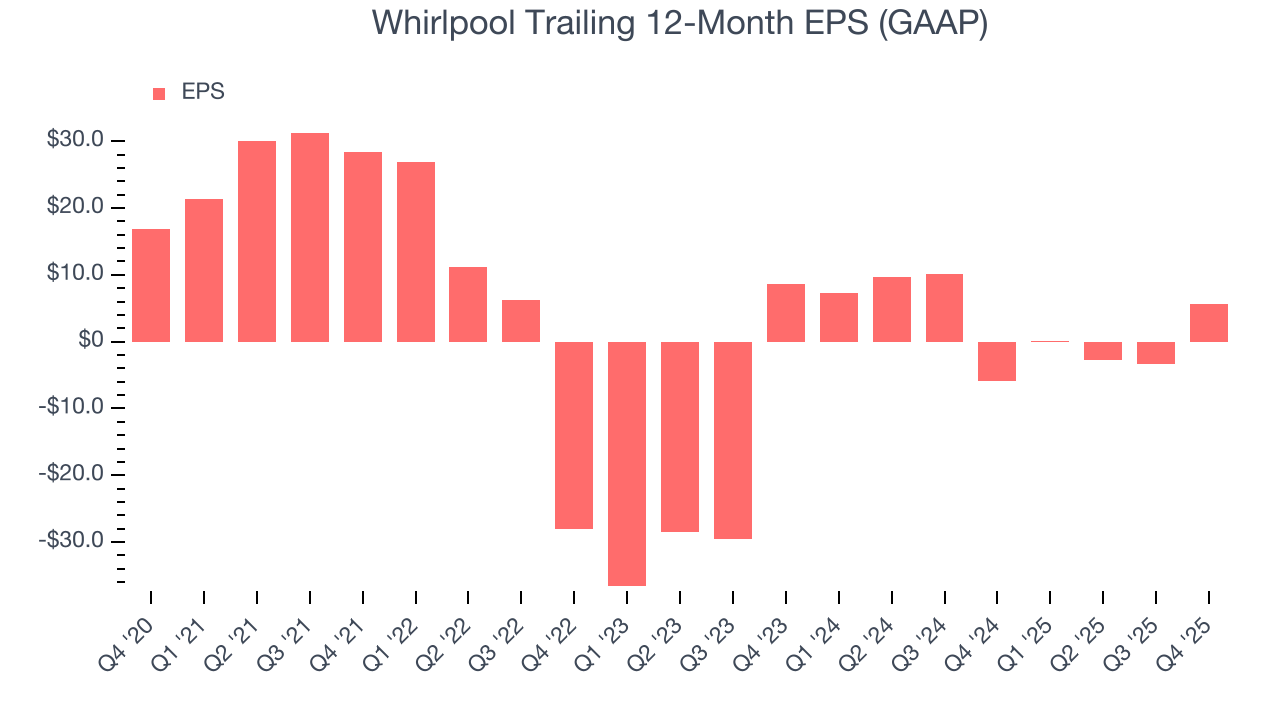

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Whirlpool, its EPS declined by 19.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Diving into the nuances of Whirlpool’s earnings can give us a better understanding of its performance. As we mentioned earlier, Whirlpool’s operating margin expanded this quarter but declined by 5.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Whirlpool, its two-year annual EPS declines of 19.4% are similar to its five-year trend. These results were bad no matter how you slice the data.

In Q4, Whirlpool reported EPS of $1.91, up from negative $7.09 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Whirlpool’s full-year EPS of $5.63 to grow 20.4%.

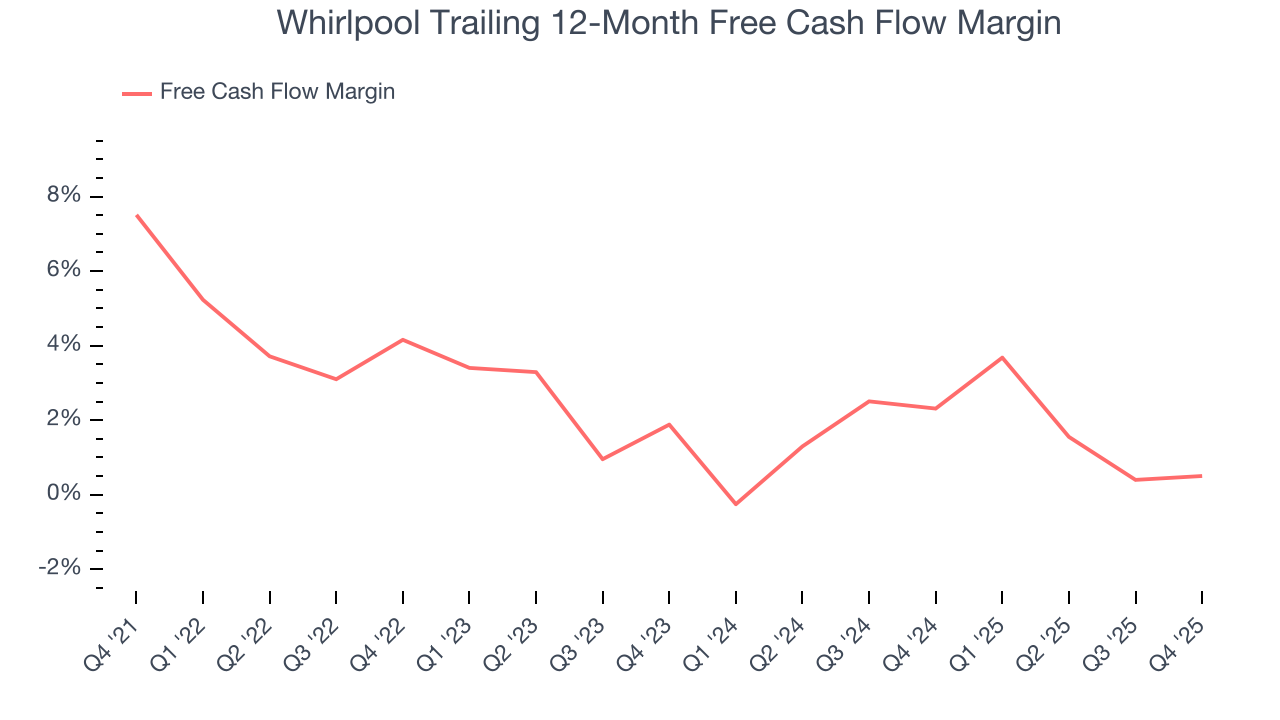

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Whirlpool has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, subpar for an industrials business.

Taking a step back, we can see that Whirlpool’s margin dropped by 7 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Whirlpool’s free cash flow clocked in at $986 million in Q4, equivalent to a 24.1% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

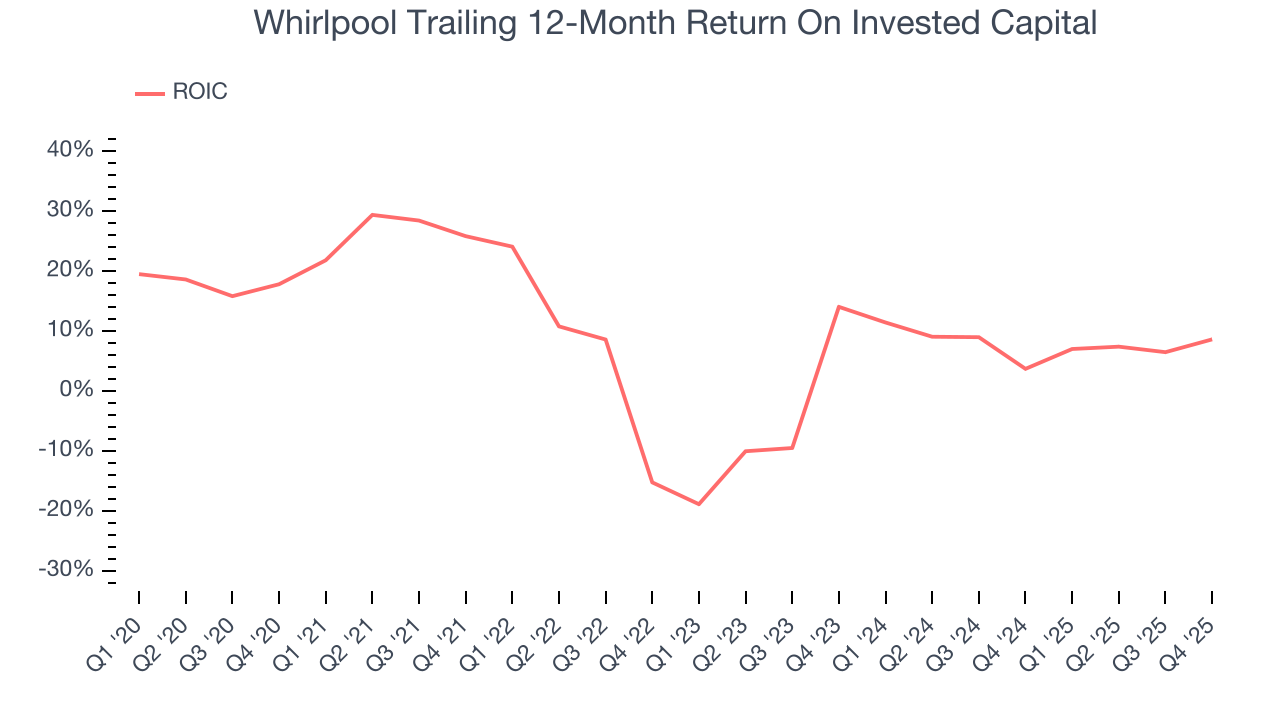

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Whirlpool historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Whirlpool’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

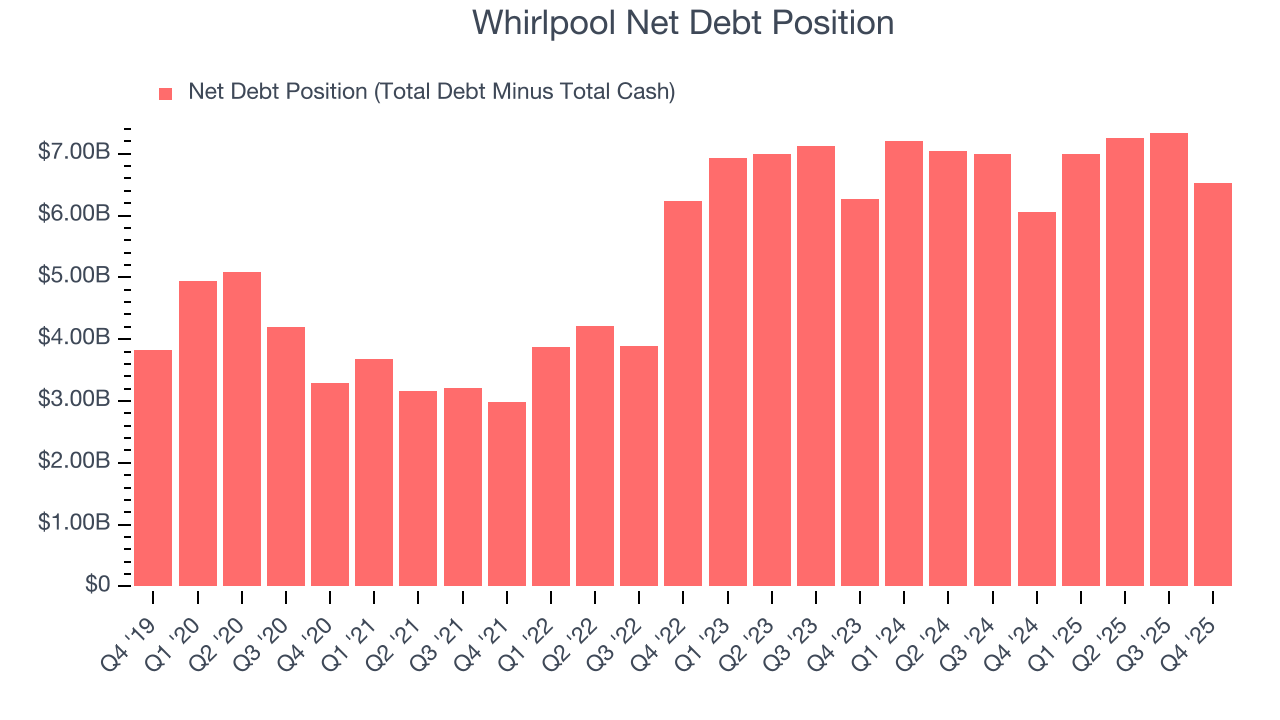

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Whirlpool’s $7.19 billion of debt exceeds the $669 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $1.18 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Whirlpool could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Whirlpool can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Whirlpool’s Q4 Results

It was good to see Whirlpool beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EPS guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.4% to $75.63 immediately after reporting.

13. Is Now The Time To Buy Whirlpool?

Updated: January 28, 2026 at 10:45 PM EST

When considering an investment in Whirlpool, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Whirlpool falls short of our quality standards. To begin with, its revenue has declined over the last five years. On top of that, Whirlpool’s projected EPS for the next year is lacking, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Whirlpool’s EV-to-EBITDA ratio based on the next 12 months is 9.3x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $88.11 on the company (compared to the current share price of $74.19).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.