Advanced Drainage (WMS)

Advanced Drainage is a sound business. Its high free cash flow margin and returns on capital show it can produce cash and invest it wisely.― StockStory Analyst Team

1. News

2. Summary

Why Advanced Drainage Is Interesting

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE:WMS) provides clean water management solutions to communities across America.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its rise over the last five years was fueled by some leverage on its fixed costs

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures, and its rising returns show it’s making even more lucrative bets

- On a dimmer note, its demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 2.1%

Advanced Drainage is close to becoming a high-quality business. If you like the story, the price seems fair.

Why Is Now The Time To Buy Advanced Drainage?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Advanced Drainage?

Advanced Drainage’s stock price of $160.28 implies a valuation ratio of 25.6x forward P/E. Looking across the industrials landscape, we think the valuation is justified for the top-line growth characteristics.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Advanced Drainage (WMS) Research Report: Q4 CY2025 Update

Water management company Advanced Drainage Systems (NYSE:WMS) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $693.4 million. The company’s full-year revenue guidance of $3.02 billion at the midpoint came in 1% above analysts’ estimates. Its non-GAAP profit of $1.27 per share was 14.7% above analysts’ consensus estimates.

Advanced Drainage (WMS) Q4 CY2025 Highlights:

- Revenue: $693.4 million vs analyst estimates of $685.6 million (flat year on year, 1.1% beat)

- Adjusted EPS: $1.27 vs analyst estimates of $1.11 (14.7% beat)

- Adjusted EBITDA: $209.2 million vs analyst estimates of $195 million (30.2% margin, 7.3% beat)

- The company lifted its revenue guidance for the full year to $3.02 billion at the midpoint from $2.95 billion, a 2.4% increase

- EBITDA guidance for the full year is $945 million at the midpoint, in line with analyst expectations

- Operating Margin: 19.7%, up from 18.4% in the same quarter last year

- Free Cash Flow Margin: 26.5%, up from 19.7% in the same quarter last year

- Market Capitalization: $12.46 billion

Company Overview

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE:WMS) provides clean water management solutions to communities across America.

The company solves water management challenges in various industries. Because water can be a valuable resource or a destructive force if left unmanaged, Advanced Drainage Systems and its products address rainwater harvesting, stormwater runoff, soil erosion, and water pollution. The company's products provide durable, corrosion-resistant, and sustainable drainage solutions for end markets such as agriculture and residential communities.

Specifically, Advanced Drainage Systems offers a range of products like pipes, fittings, chambers, septic tanks, and high-tech fabric. In addition to its products, the company provides engineering and design services to help customers successfully implement their water management systems. Innovation is a key focus of the company given how top-of-mind and thematic issues like water conservation and climate change are.

The company primarily generates revenue through product sales, with the sales of its pipe products leading the charge, followed by its chambers and septic tanks. The top industries generating the meaningful revenue for the company include both non-residential and residential construction as well as infrastructure and agriculture. A small percentage of the company’s revenue is made through international markets, most notably Canada and Mexico.

4. HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Companies offering water waste management solutions include private companies Contech Engineering, Prinsco, and Armtec.

5. Revenue Growth

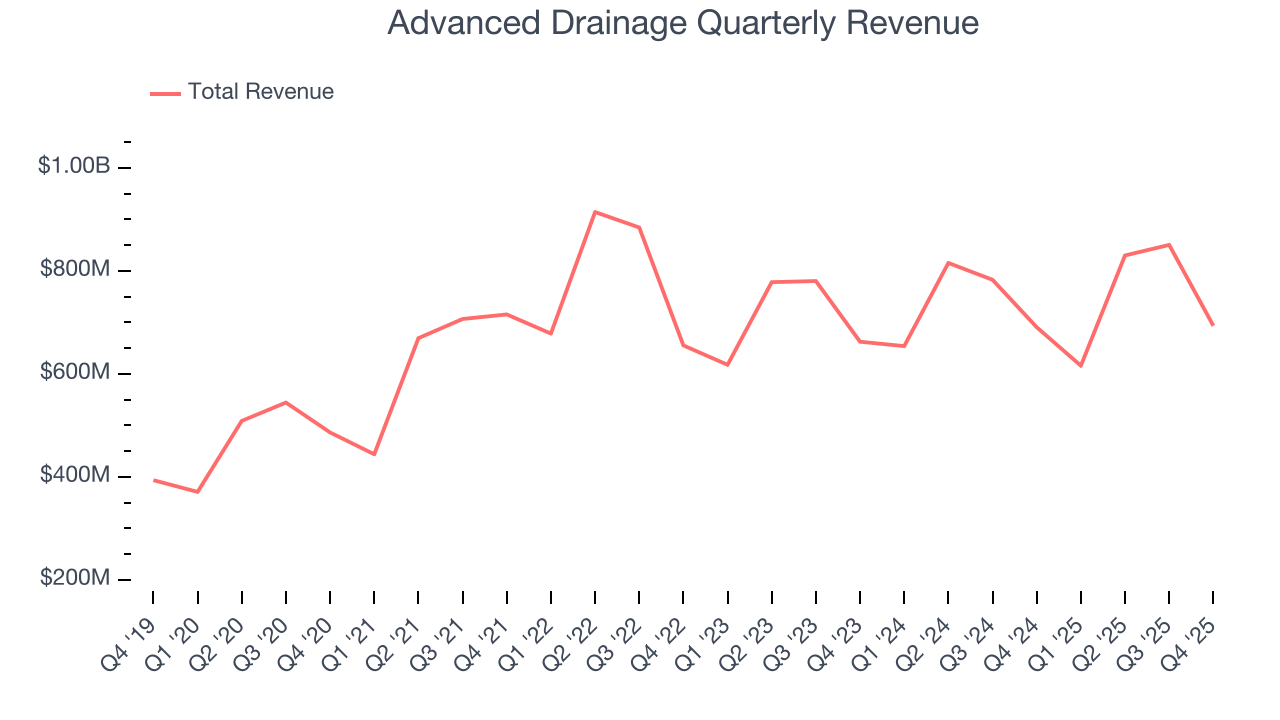

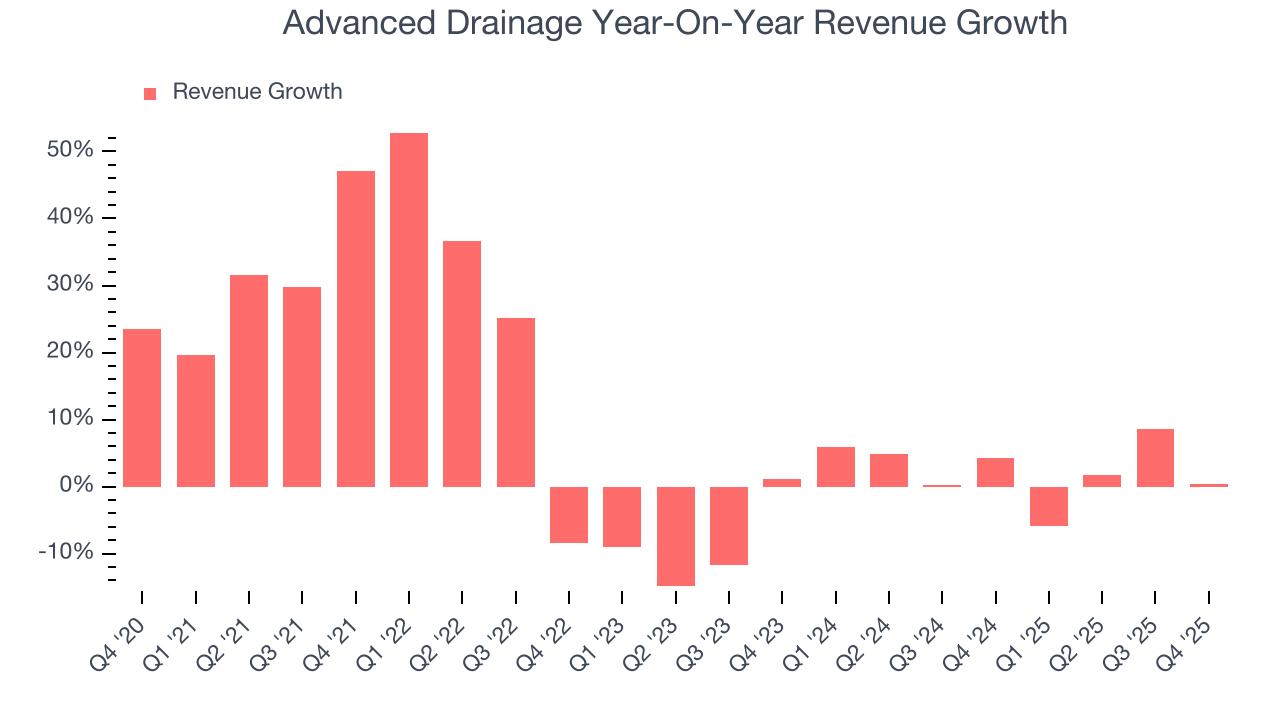

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Advanced Drainage’s 9.4% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Advanced Drainage’s recent performance shows its demand has slowed as its annualized revenue growth of 2.6% over the last two years was below its five-year trend.

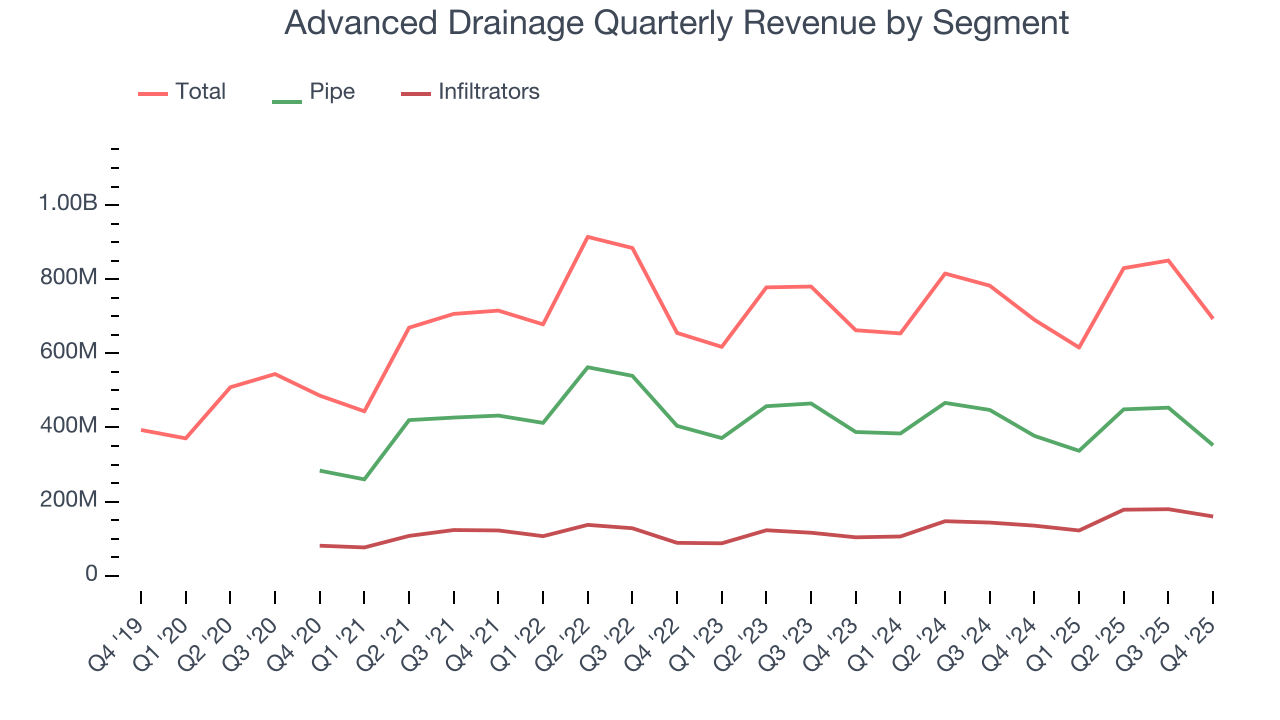

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Pipe and Infiltrators, which are 50.8% and 23.1% of revenue. Over the last two years, Advanced Drainage’s Pipe revenue (thermoplastic corrugated pipes) averaged 2.8% year-on-year declines. On the other hand, its Infiltrators revenue (wastewater treatment systems) averaged 21.8% growth.

This quarter, Advanced Drainage’s $693.4 million of revenue was flat year on year but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

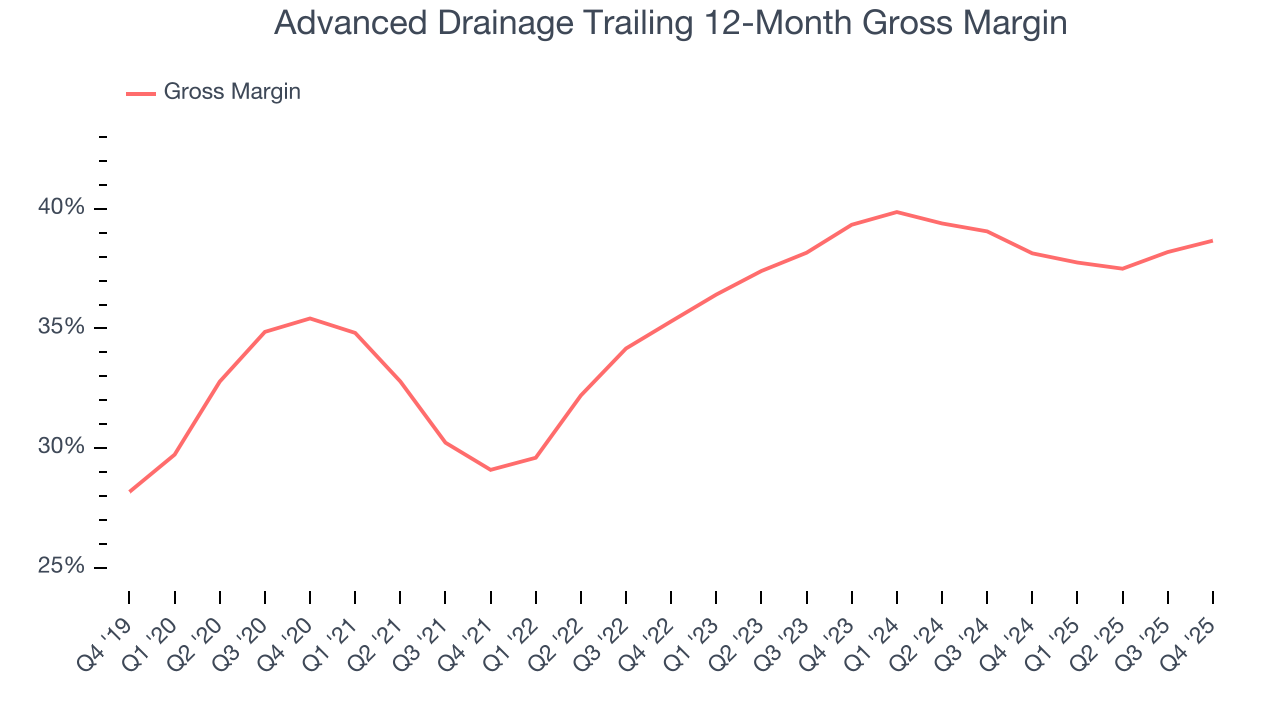

Advanced Drainage’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 36.3% gross margin over the last five years. That means Advanced Drainage only paid its suppliers $63.72 for every $100 in revenue.

Advanced Drainage produced a 37.4% gross profit margin in Q4, up 2.1 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

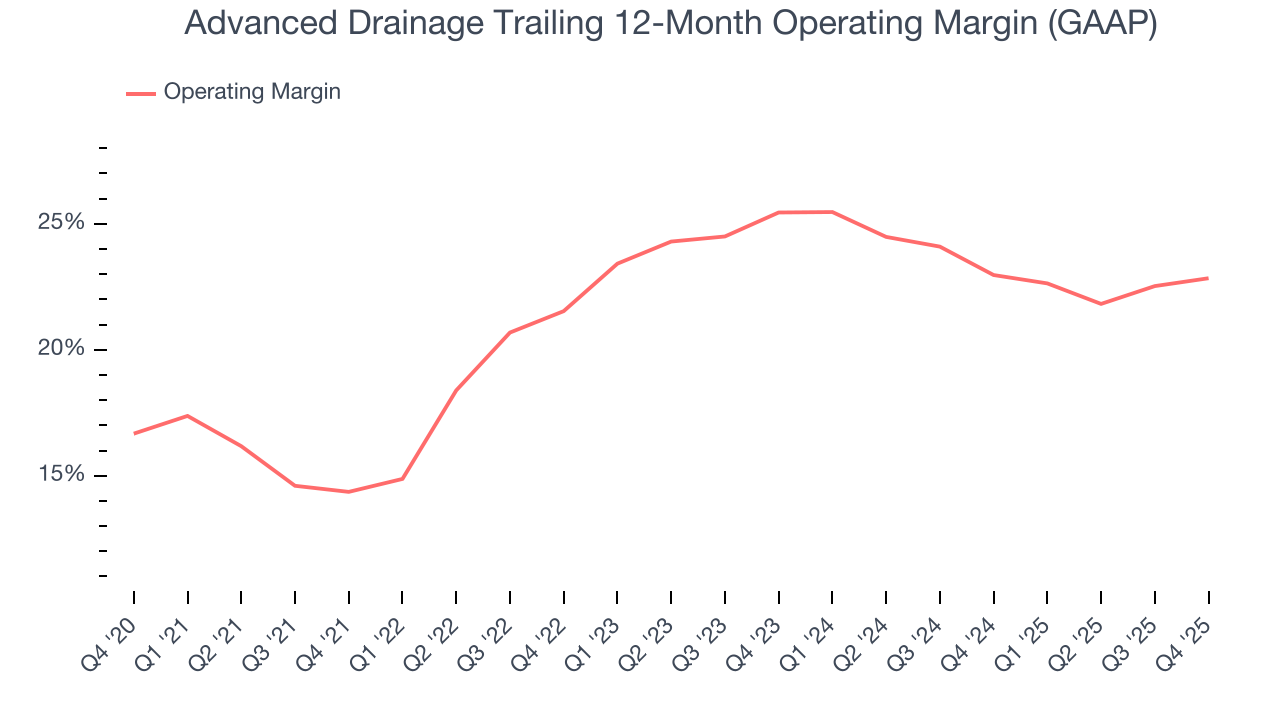

Advanced Drainage has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Advanced Drainage’s operating margin rose by 8.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Advanced Drainage generated an operating margin profit margin of 19.7%, up 1.4 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

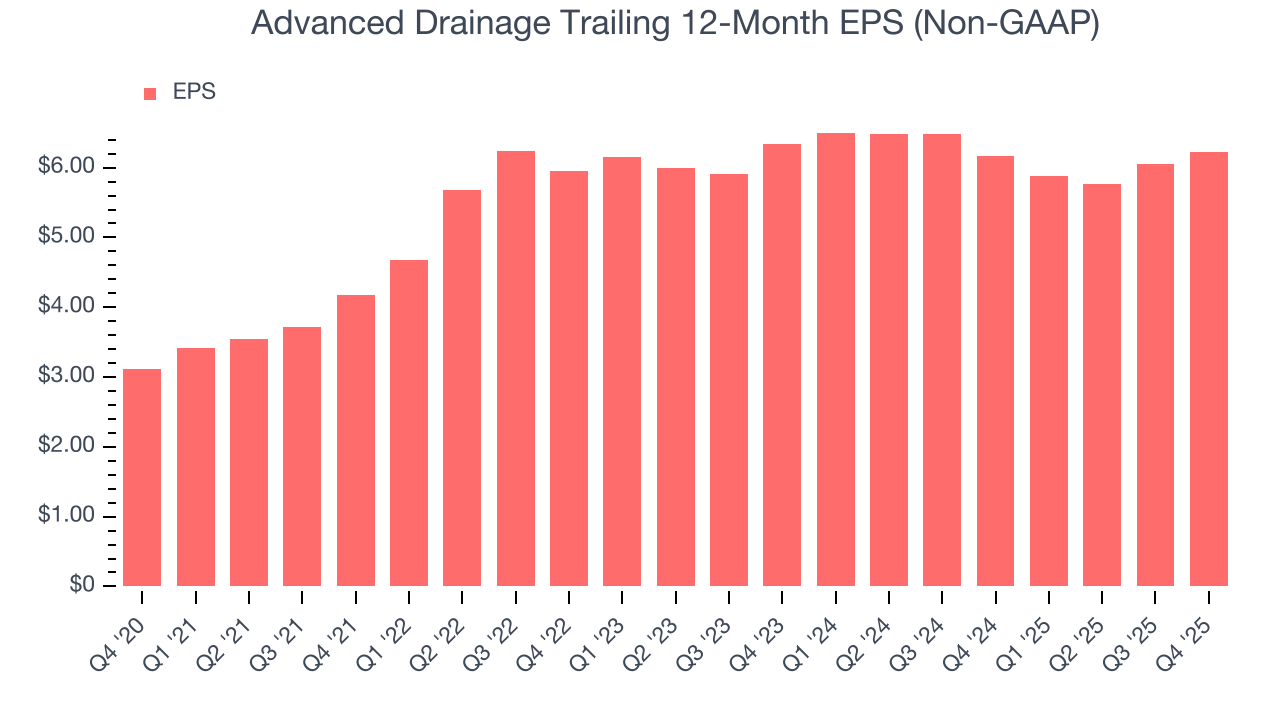

Advanced Drainage’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 9.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Advanced Drainage’s earnings can give us a better understanding of its performance. As we mentioned earlier, Advanced Drainage’s operating margin expanded by 8.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Advanced Drainage, EPS didn’t budge over the last two years, a regression from its five-year trend. Given the merits in other parts of its business, we’re hopeful it can revert to earnings growth in the coming years.

In Q4, Advanced Drainage reported adjusted EPS of $1.27, up from $1.09 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Advanced Drainage’s full-year EPS of $6.23 to stay about the same.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

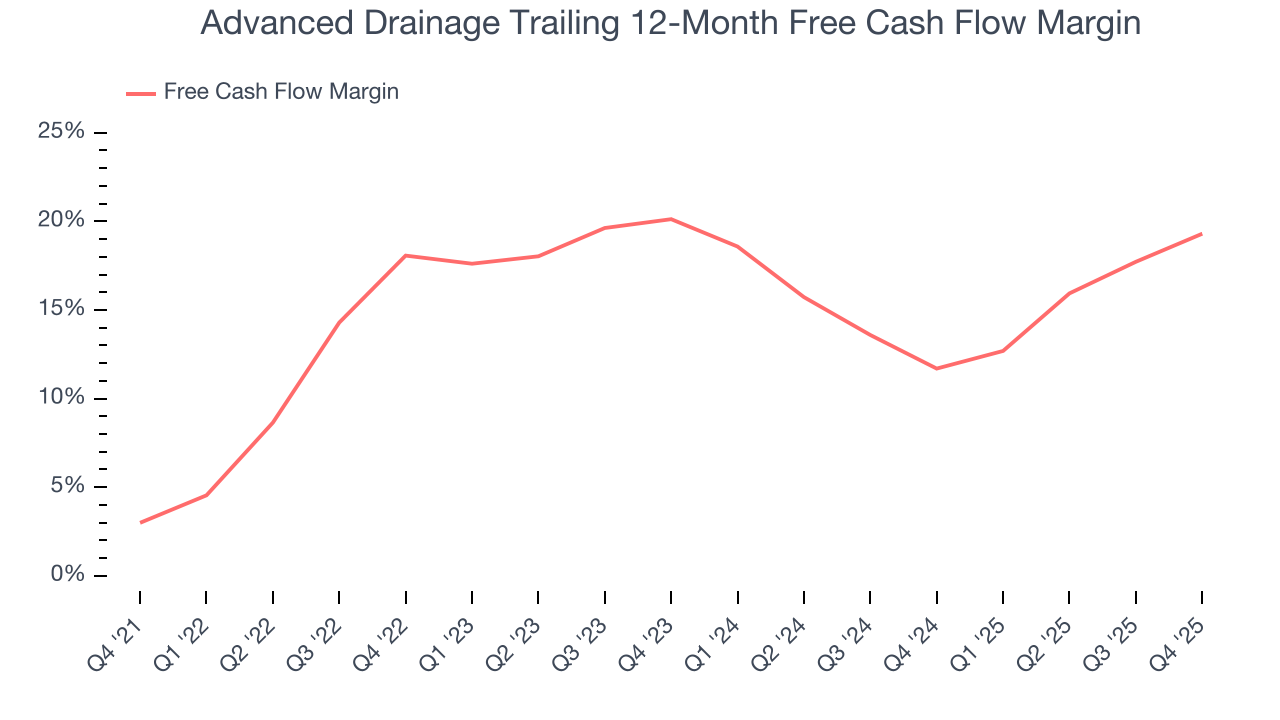

Advanced Drainage has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 14.8% over the last five years.

Taking a step back, we can see that Advanced Drainage’s margin expanded by 16.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Advanced Drainage’s free cash flow clocked in at $183.6 million in Q4, equivalent to a 26.5% margin. This result was good as its margin was 6.8 percentage points higher than in the same quarter last year, building on its favorable historical trend.

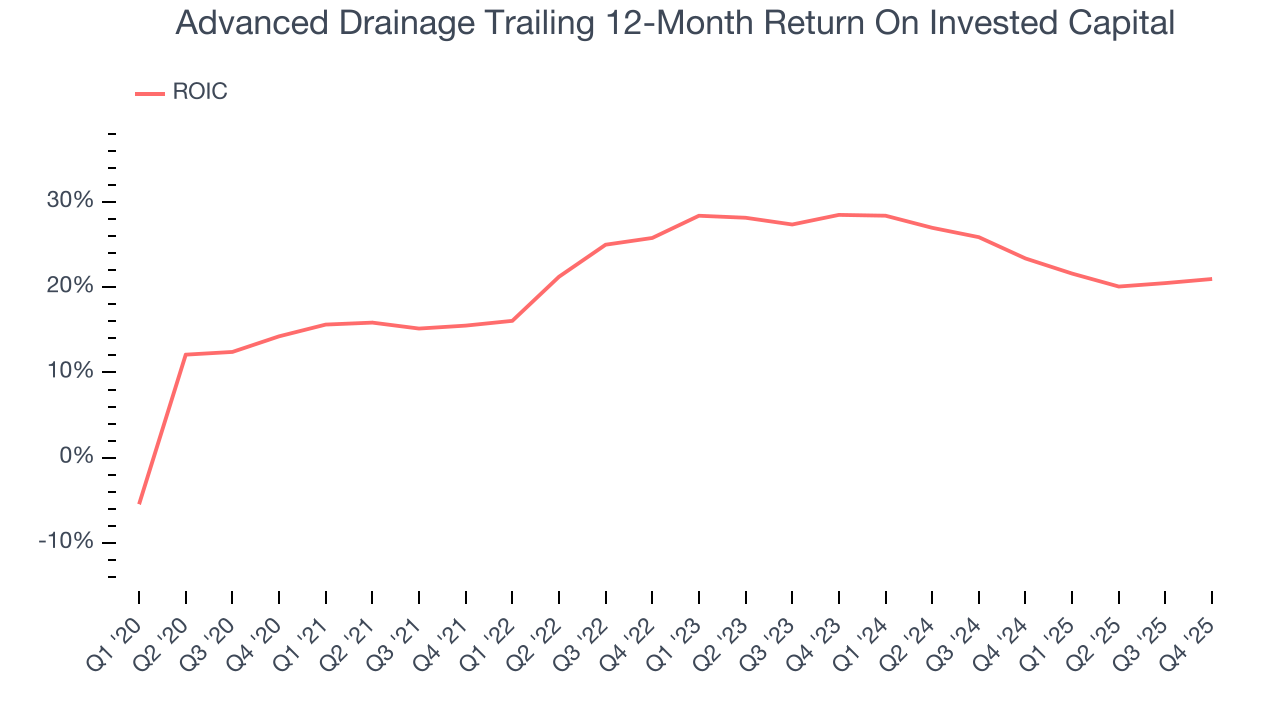

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Advanced Drainage’s five-year average ROIC was 22.8%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Advanced Drainage’s ROIC averaged 1.5 percentage point increases each year over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

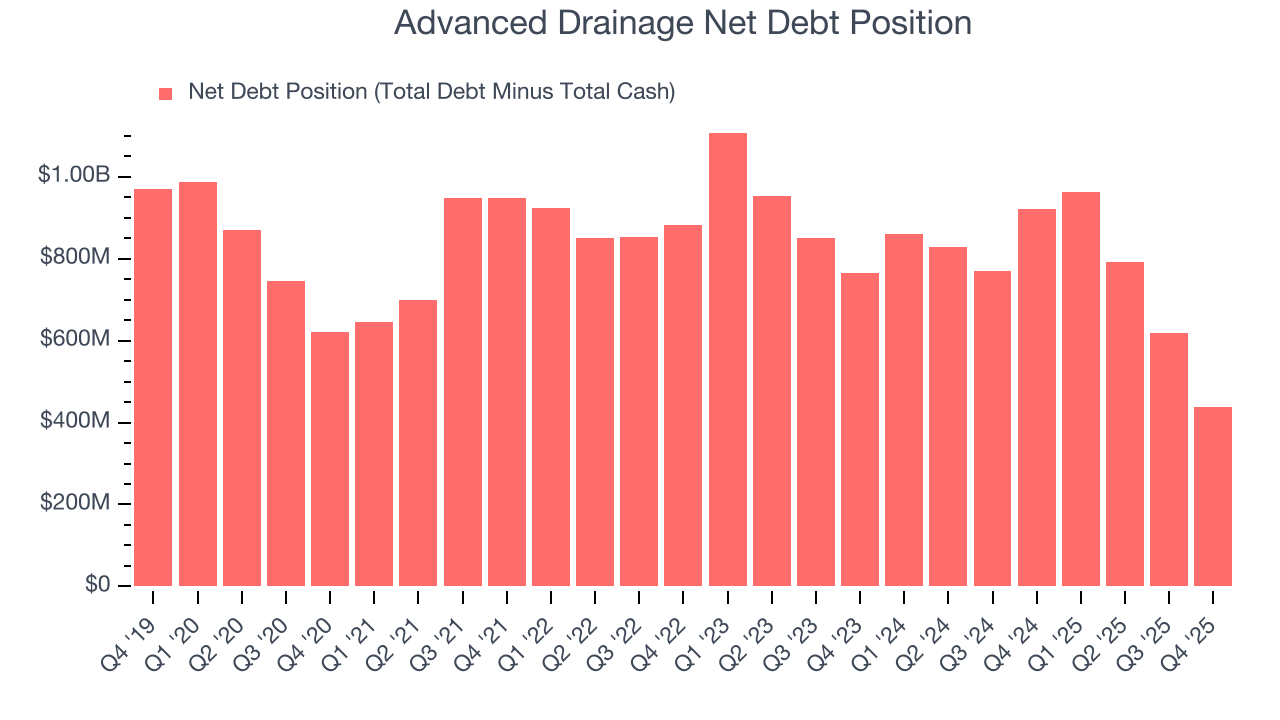

11. Balance Sheet Assessment

Advanced Drainage reported $1.01 billion of cash and $1.45 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $951.6 million of EBITDA over the last 12 months, we view Advanced Drainage’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $59.62 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Advanced Drainage’s Q4 Results

We were impressed by how significantly Advanced Drainage blew past analysts’ Infiltrators revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its Pipe revenue missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $160.28 immediately following the results.

13. Is Now The Time To Buy Advanced Drainage?

Updated: February 5, 2026 at 7:13 AM EST

When considering an investment in Advanced Drainage, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Advanced Drainage possesses a number of positive attributes. To kick things off, its revenue growth was solid over the last five years. And while Advanced Drainage’s projected EPS for the next year is lacking, its impressive operating margins show it has a highly efficient business model.

Advanced Drainage’s P/E ratio based on the next 12 months is 25.6x. Looking at the industrials space right now, Advanced Drainage trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $175.90 on the company (compared to the current share price of $160.28), implying they see 9.7% upside in buying Advanced Drainage in the short term.