YETI (YETI)

YETI is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think YETI Will Underperform

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

- Sales trends were unexciting over the last five years as its 12.7% annual growth was below the typical consumer discretionary company

- Incremental sales over the last five years were less profitable as its 9.9% annual earnings per share growth lagged its revenue gains

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

YETI falls short of our quality standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than YETI

High Quality

Investable

Underperform

Why There Are Better Opportunities Than YETI

YETI’s stock price of $49.17 implies a valuation ratio of 18x forward P/E. YETI’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. YETI (YETI) Research Report: Q4 CY2025 Update

Outdoor lifestyle products brand (NYSE:YETI) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.1% year on year to $583.7 million. Its non-GAAP profit of $0.92 per share was 4.1% above analysts’ consensus estimates.

YETI (YETI) Q4 CY2025 Highlights:

- Revenue: $583.7 million vs analyst estimates of $582.5 million (5.1% year-on-year growth, in line)

- Adjusted EPS: $0.92 vs analyst estimates of $0.88 (4.1% beat)

- Adjusted EBITDA: $137.3 million vs analyst estimates of $106 million (23.5% margin, 29.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.80 at the midpoint, missing analyst estimates by 1.8%

- Operating Margin: 12.9%, down from 14.9% in the same quarter last year

- Free Cash Flow Margin: 27.8%, down from 38.7% in the same quarter last year

- Market Capitalization: $3.85 billion

Company Overview

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

YETI was born out of frustration with the fragility of standard coolers that failed to meet the rigorous demands of outdoor activities. The founders, two avid outdoorsmen, established the company in 2006 to craft a cooler that could keep food and drinks cool for extended periods of time, withstand harsh conditions, and generally outlast the competition through better durability.

YETI's products command premium prices, which are made possible by its loyal customer base that is willing to pay more for quality and durability. The company's business model involves direct-to-consumer sales through its website and select retail partnerships. It also sponsors various sporting events to market itself to consumers.

4. Consumer Discretionary - Leisure Products

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Leisure products companies manufacture recreational goods such as bicycles, marine vessels, fitness equipment, camping gear, and musical instruments. Tailwinds include heightened outdoor-activity participation, health-and-wellness awareness, and periodic innovation cycles that drive trade-up purchases. Headwinds are pronounced: demand is highly discretionary and sensitive to economic cycles—consumers readily defer big-ticket leisure purchases during downturns. Post-pandemic normalization has created excess channel inventory after demand surged then retreated. Raw-material and shipping cost inflation squeezes margins, while competition from low-cost imports and a fragmented market make pricing power elusive for most players.

Competitors in the outdoor and recreation goods industry include Vista Outdoor (NYSE:VSTO), Johnson Outdoors (NASDAQ:JOUT), and Clarus Corporation (NASDAQ:CLAR).

5. Revenue Growth

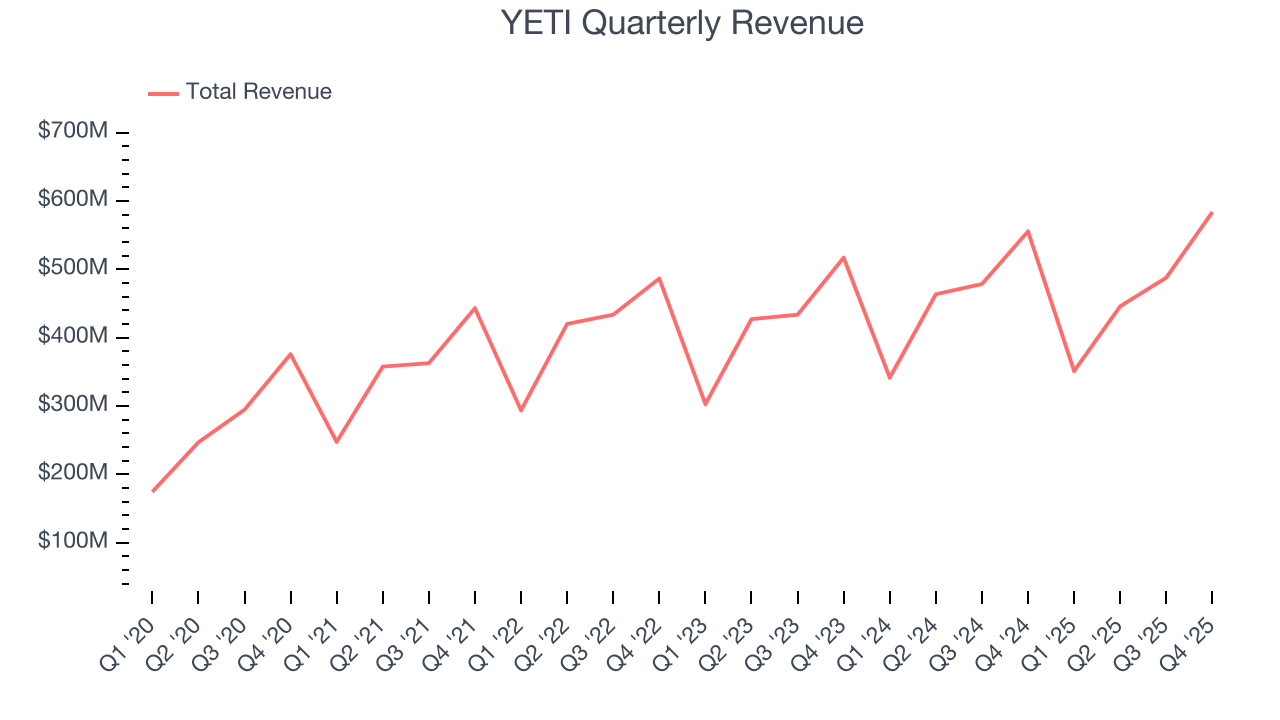

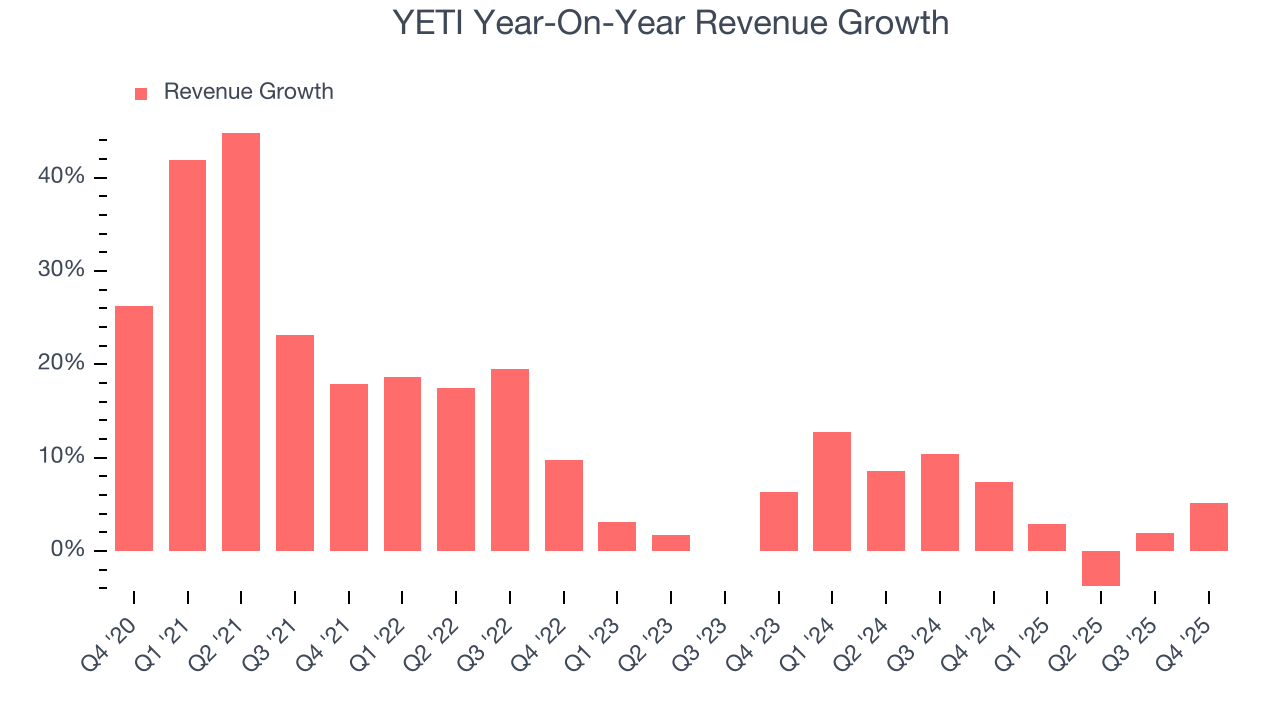

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, YETI grew its sales at a 11.3% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. YETI’s recent performance shows its demand has slowed as its annualized revenue growth of 5.4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

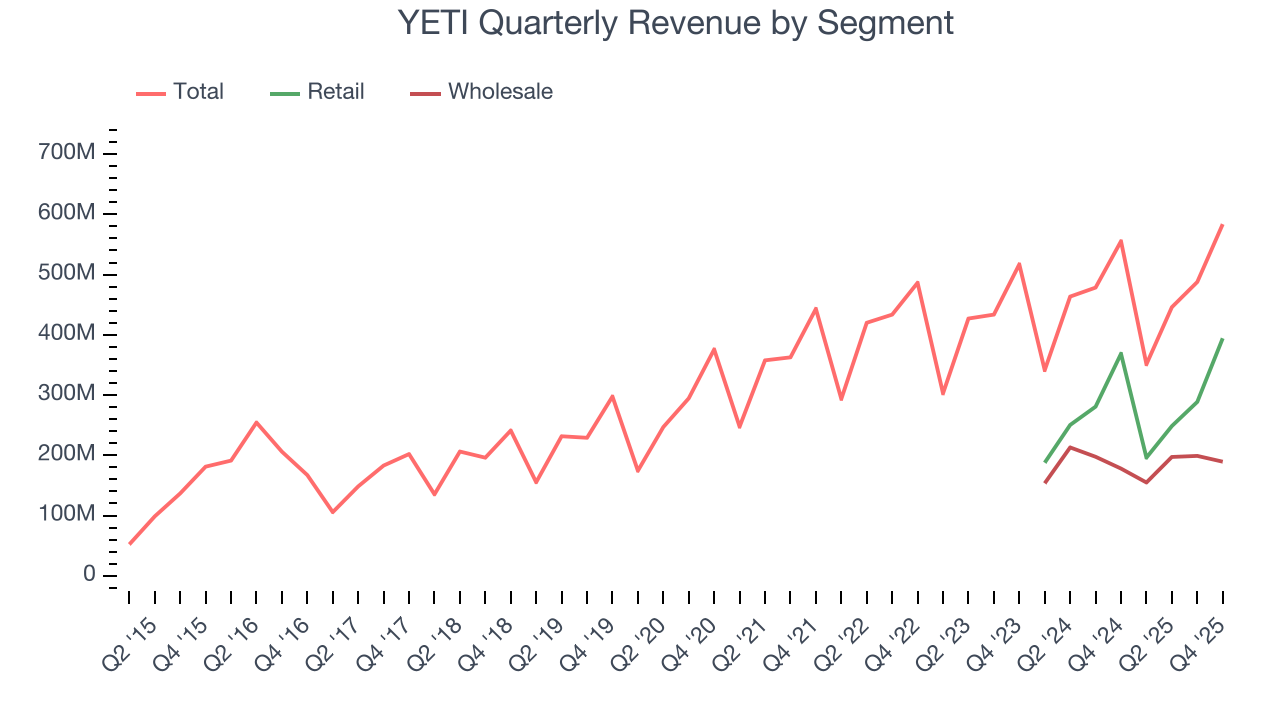

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Retail and Wholesale, which are 67.5% and 32.5% of revenue. Over the last two years, YETI’s Retail revenue (direct sales to customers) averaged 3.4% year-on-year growth while its Wholesale revenue (sales to retailers) was flat.

This quarter, YETI grew its revenue by 5.1% year on year, and its $583.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

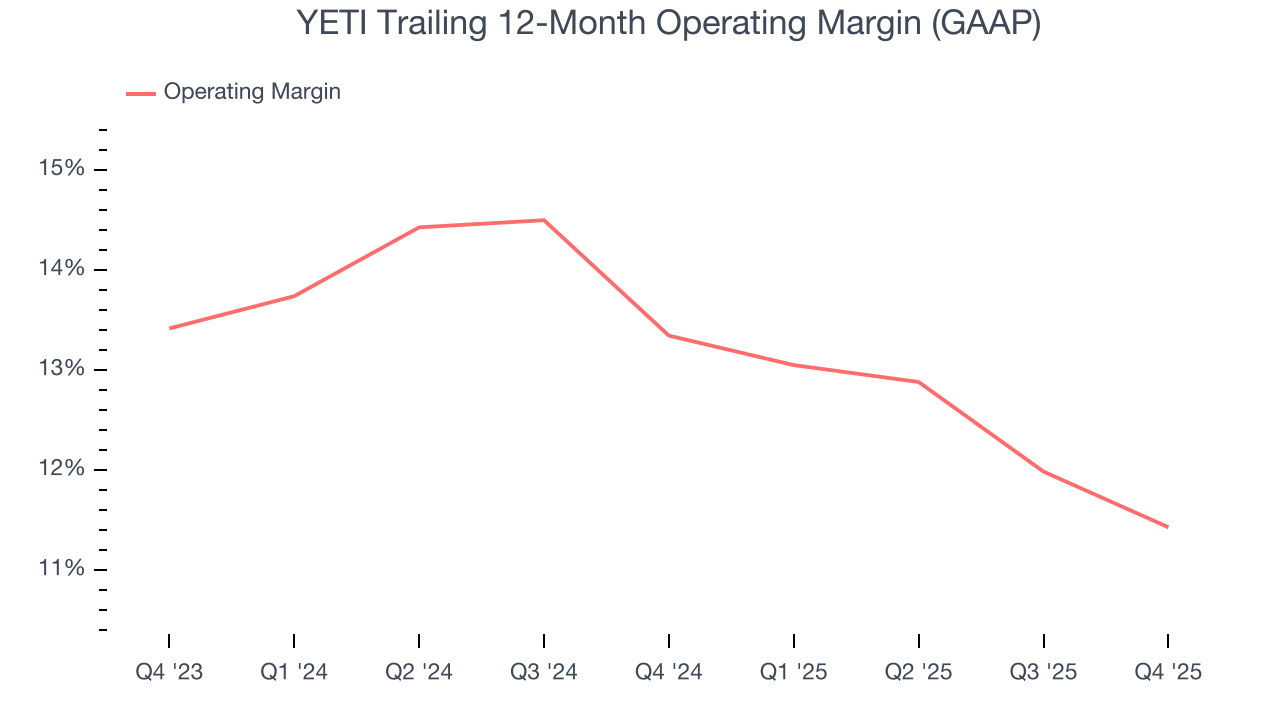

YETI’s operating margin has been trending down over the last 12 months and averaged 12.4% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, YETI generated an operating margin profit margin of 12.9%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

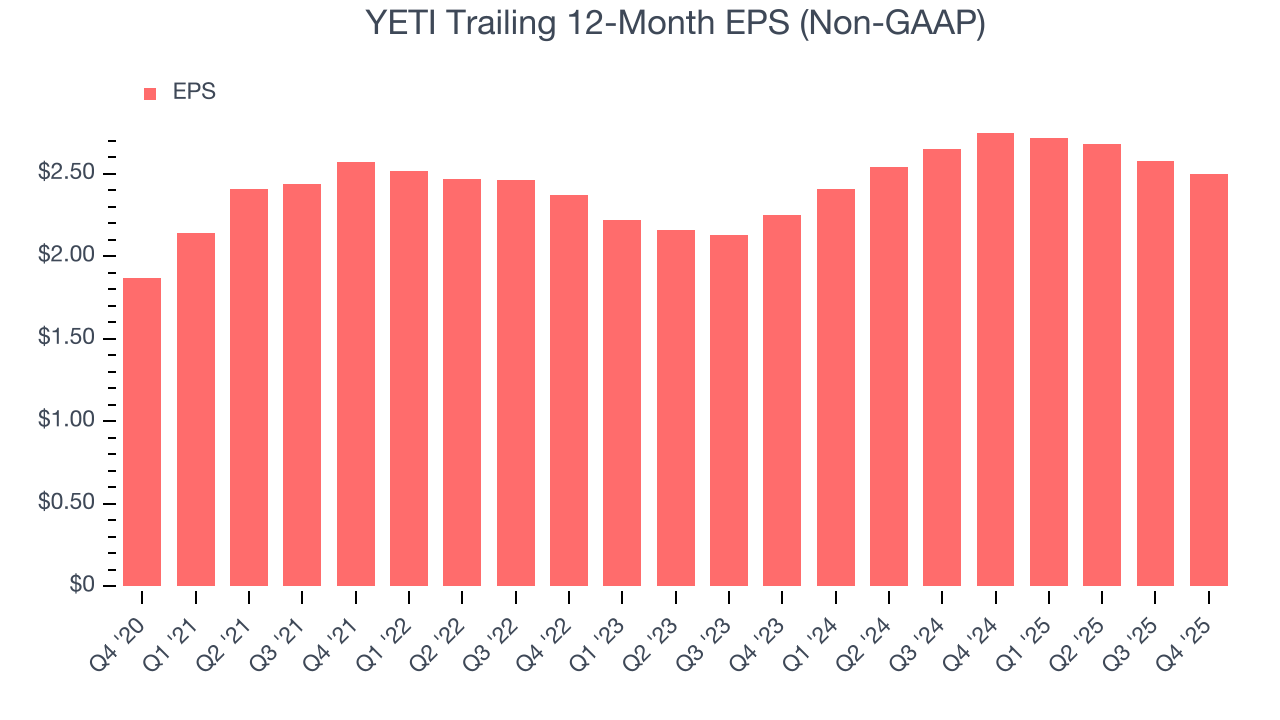

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

YETI’s EPS grew at a weak 6% compounded annual growth rate over the last five years, lower than its 11.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, YETI reported adjusted EPS of $0.92, down from $1 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.1%. Over the next 12 months, Wall Street expects YETI’s full-year EPS of $2.50 to grow 14.2%.

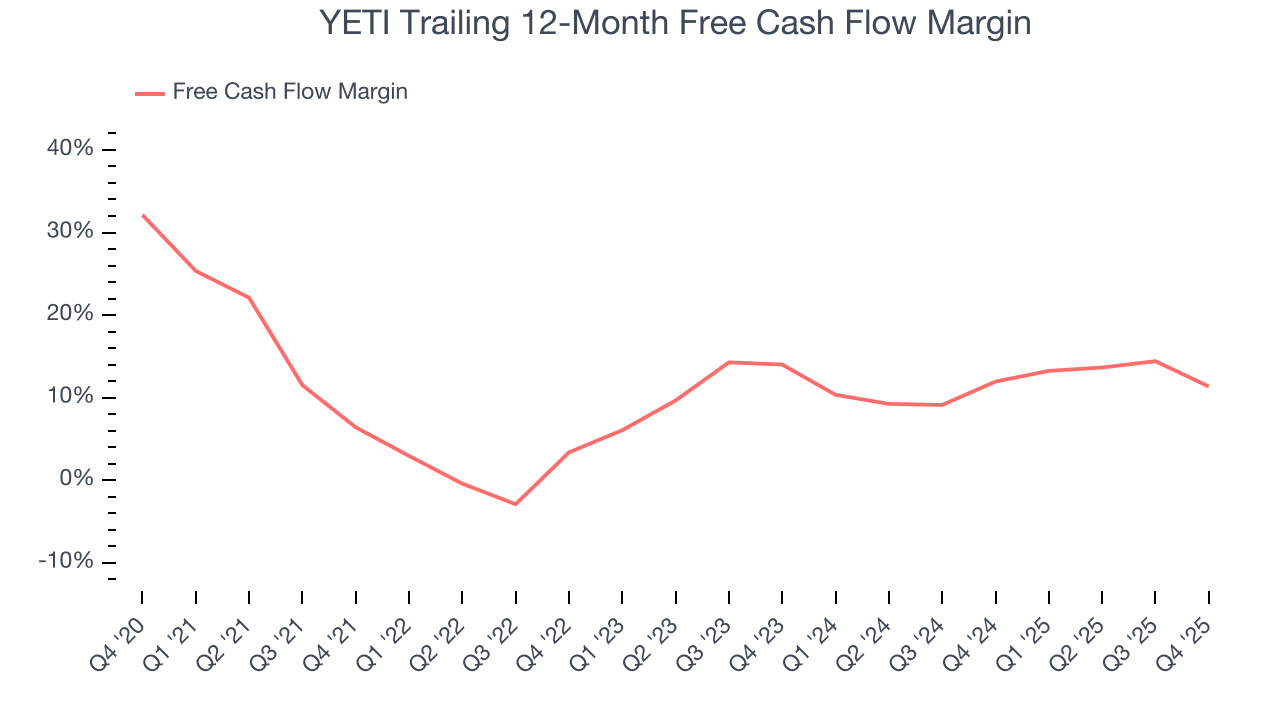

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

YETI has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.6%, lousy for a consumer discretionary business.

YETI’s free cash flow clocked in at $162 million in Q4, equivalent to a 27.8% margin. The company’s cash profitability regressed as it was 11 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict YETI’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 11.3% for the last 12 months will decrease to 6.6%.

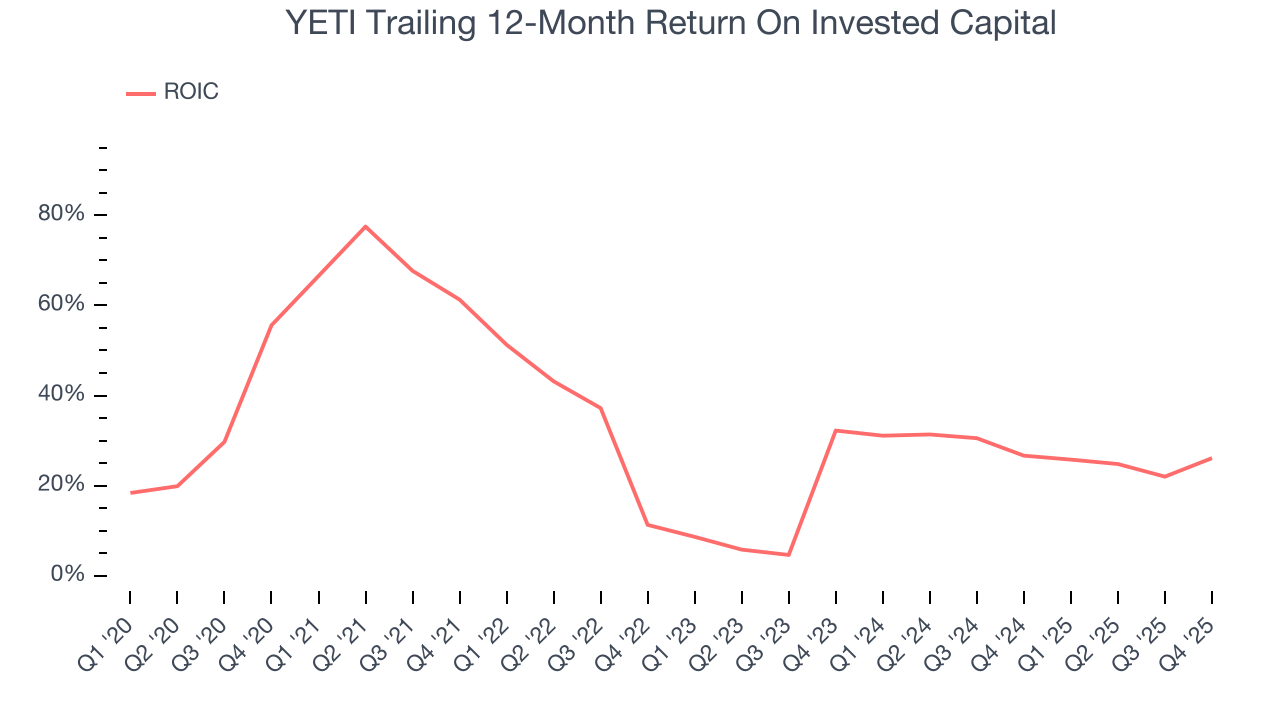

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

YETI historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 31.5%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, YETI’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

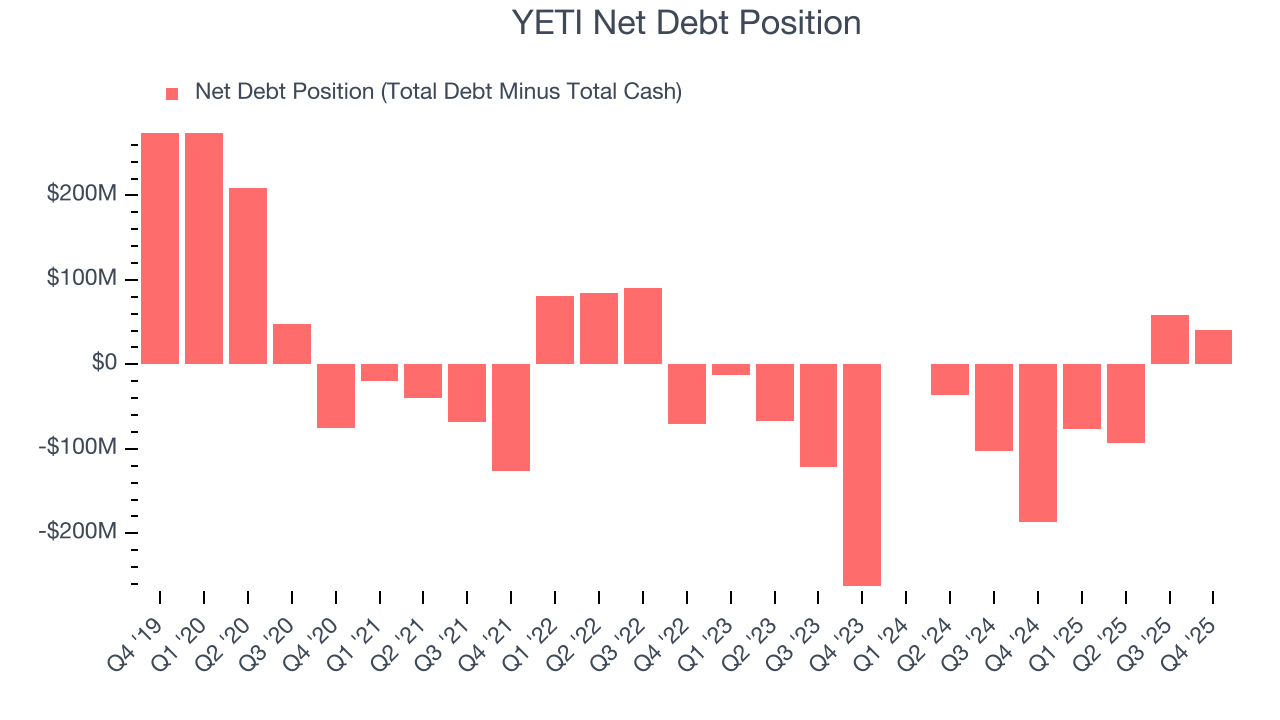

10. Balance Sheet Assessment

YETI reported $188.3 million of cash and $228.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $352.4 million of EBITDA over the last 12 months, we view YETI’s 0.1× net-debt-to-EBITDA ratio as safe. We also see its $443,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from YETI’s Q4 Results

We were impressed by how significantly YETI blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed, and this is weighing on shares. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 4% to $47.44 immediately following the results.

12. Is Now The Time To Buy YETI?

Updated: February 19, 2026 at 6:14 AM EST

When considering an investment in YETI, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping consumers, but in the case of YETI, we’re out. On top of that, YETI’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

YETI’s P/E ratio based on the next 12 months is 17.3x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46.64 on the company (compared to the current share price of $47.44).