YETI (YETI)

YETI is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think YETI Will Underperform

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

- Sales trends were unexciting over the last five years as its 12.7% annual growth was below the typical consumer discretionary company

- Incremental sales over the last five years were less profitable as its 9.9% annual earnings per share growth lagged its revenue gains

- Poor expense management has led to an operating margin that is below the industry average

YETI doesn’t pass our quality test. There are more appealing investments to be made.

Why There Are Better Opportunities Than YETI

High Quality

Investable

Underperform

Why There Are Better Opportunities Than YETI

YETI’s stock price of $47.10 implies a valuation ratio of 18.3x forward P/E. YETI’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. YETI (YETI) Research Report: Q3 CY2025 Update

Outdoor lifestyle products brand (NYSE:YETI) announced better-than-expected revenue in Q3 CY2025, with sales up 1.9% year on year to $487.8 million. Its non-GAAP profit of $0.61 per share was 4.5% above analysts’ consensus estimates.

YETI (YETI) Q3 CY2025 Highlights:

- Revenue: $487.8 million vs analyst estimates of $480.2 million (1.9% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.61 vs analyst estimates of $0.58 (4.5% beat)

- Adjusted EBITDA: $68.15 million vs analyst estimates of $76.57 million (14% margin, 11% miss)

- Management raised its full-year Adjusted EPS guidance to $2.44 at the midpoint, a 1% increase

- Operating Margin: 11.1%, down from 14.6% in the same quarter last year

- Free Cash Flow Margin: 18.3%, up from 15.4% in the same quarter last year

- Market Capitalization: $2.71 billion

Company Overview

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

YETI was born out of frustration with the fragility of standard coolers that failed to meet the rigorous demands of outdoor activities. The founders, two avid outdoorsmen, established the company in 2006 to craft a cooler that could keep food and drinks cool for extended periods of time, withstand harsh conditions, and generally outlast the competition through better durability.

YETI's products command premium prices, which are made possible by its loyal customer base that is willing to pay more for quality and durability. The company's business model involves direct-to-consumer sales through its website and select retail partnerships. It also sponsors various sporting events to market itself to consumers.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the outdoor and recreation goods industry include Vista Outdoor (NYSE:VSTO), Johnson Outdoors (NASDAQ:JOUT), and Clarus Corporation (NASDAQ:CLAR).

5. Revenue Growth

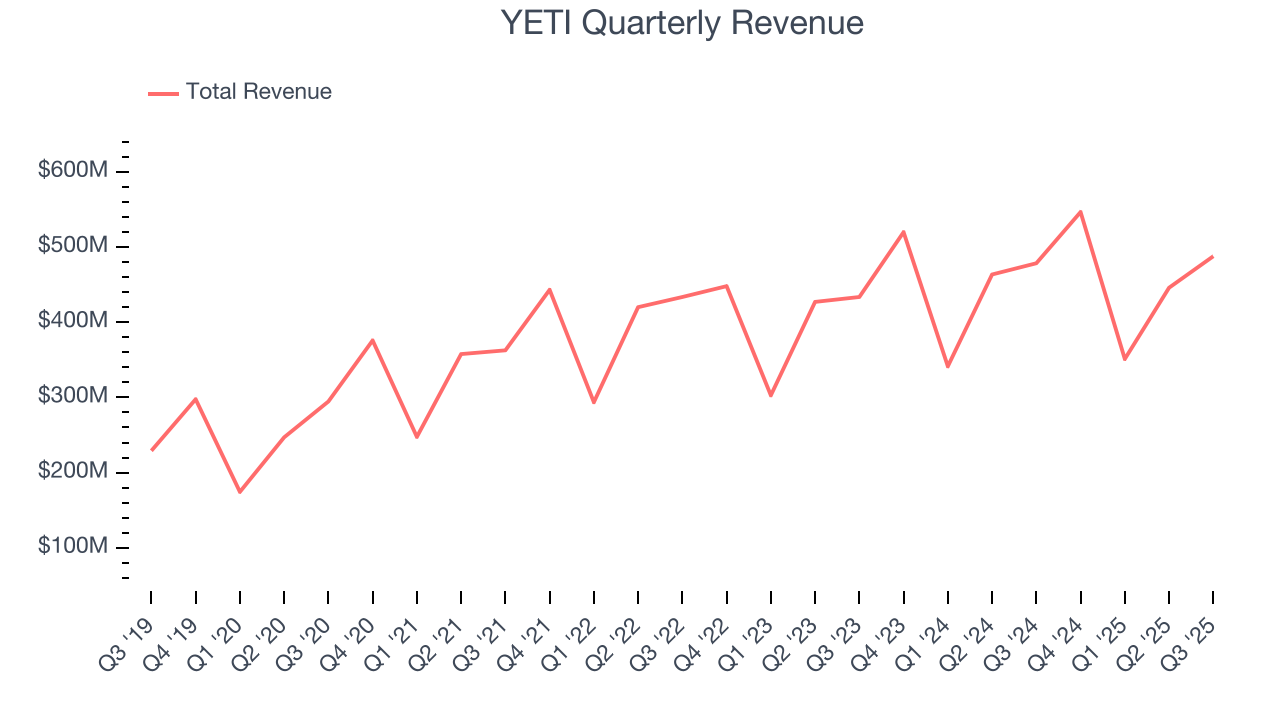

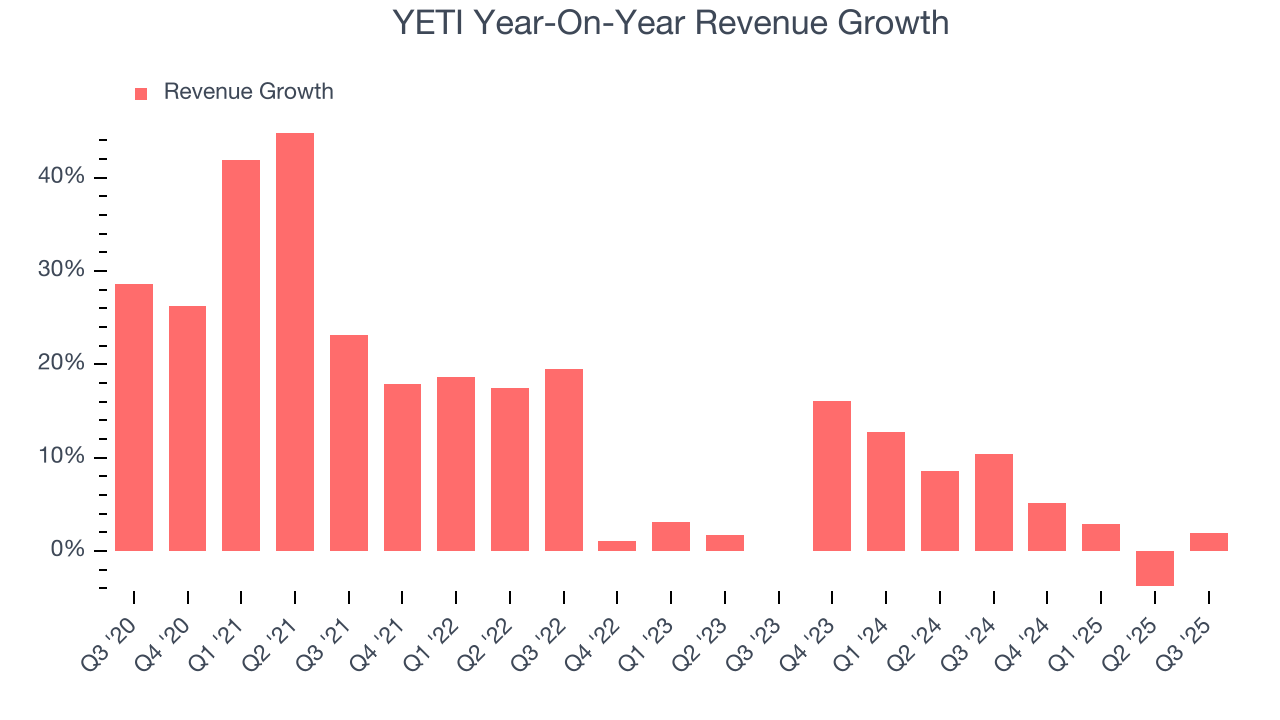

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, YETI grew its sales at a 12.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. YETI’s recent performance shows its demand has slowed as its annualized revenue growth of 6.6% over the last two years was below its five-year trend.

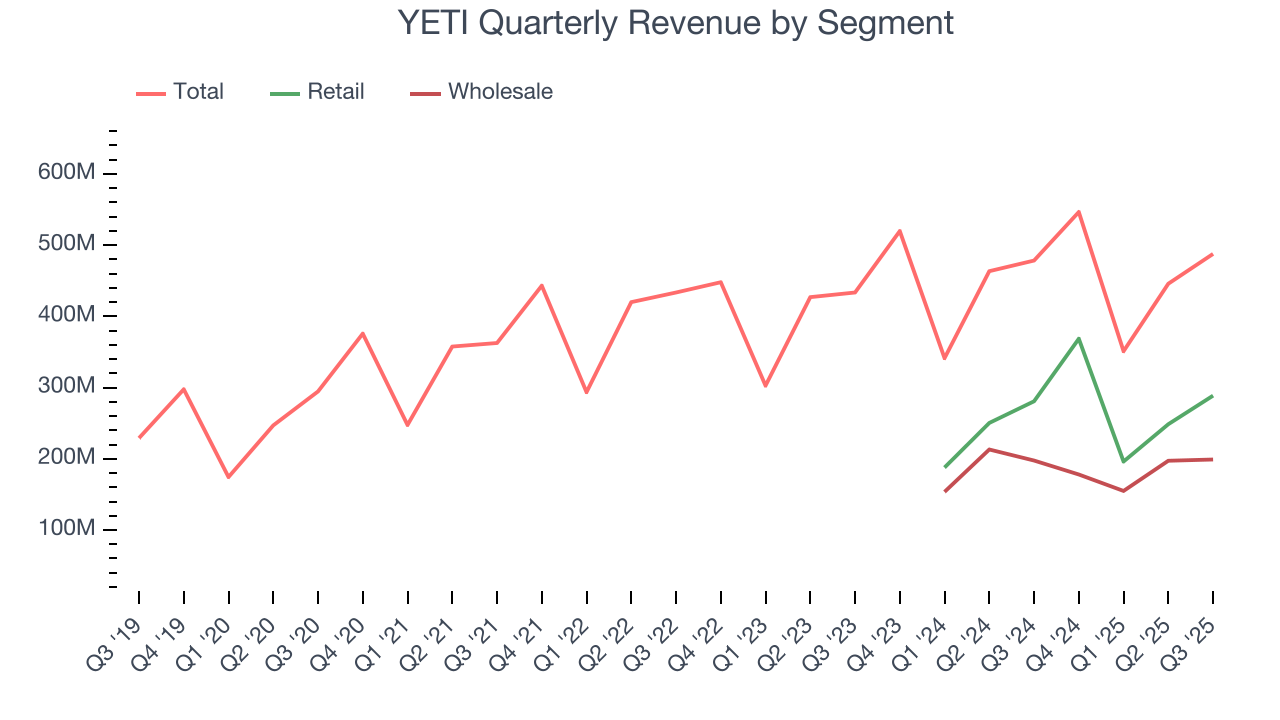

We can better understand the company’s revenue dynamics by analyzing its most important segments, Retail and Wholesale, which are 59.2% and 40.8% of revenue. Over the last two years, YETI’s Retail revenue (direct sales to customers) averaged 2.2% year-on-year growth. On the other hand, its Wholesale revenue (sales to retailers) averaged 1.9% declines.

This quarter, YETI reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

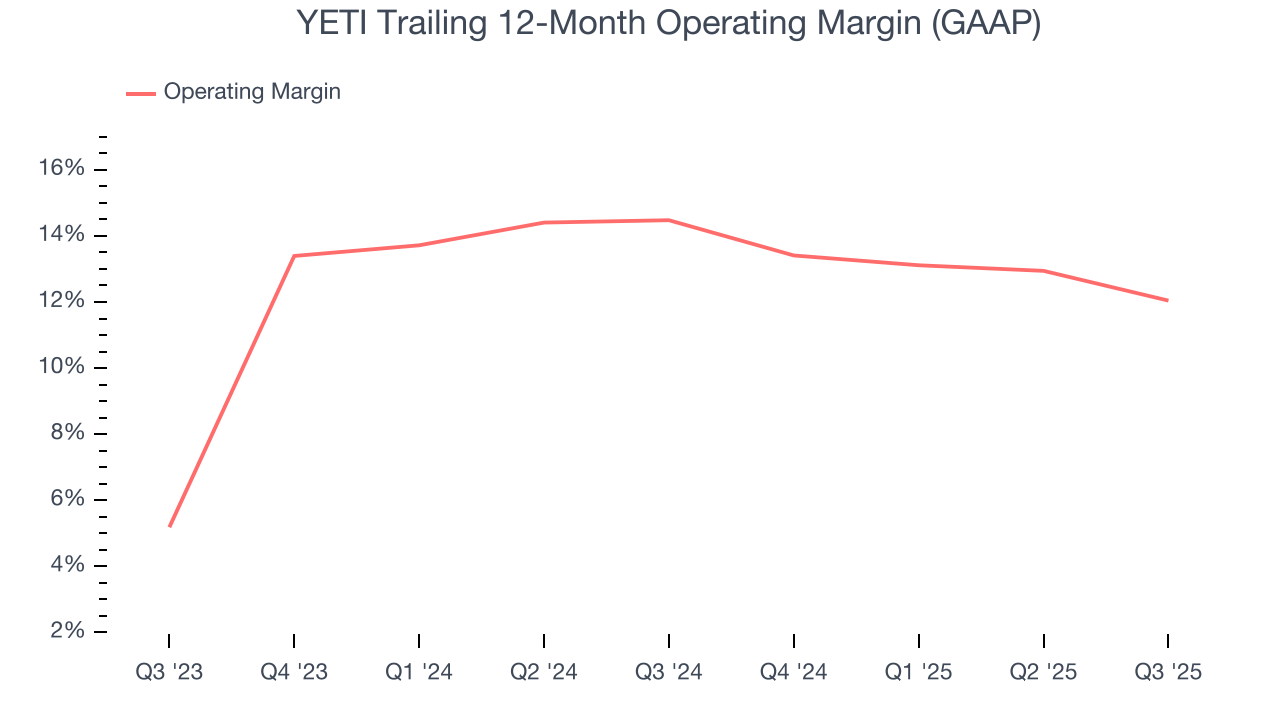

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

YETI’s operating margin has shrunk over the last 12 months, but it still averaged 13.3% over the last two years, solid for a consumer discretionary business. This shows it generally manages its expenses well.

This quarter, YETI generated an operating margin profit margin of 11.1%, down 3.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

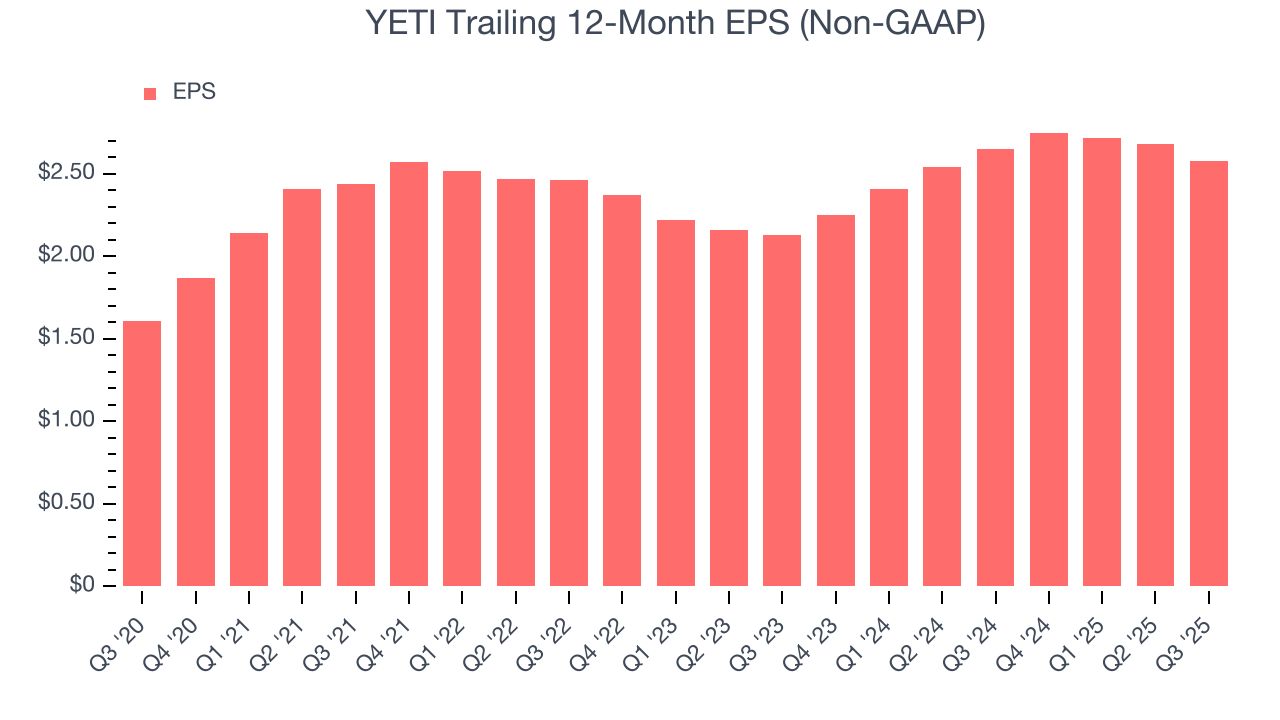

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

YETI’s EPS grew at an unimpressive 9.9% compounded annual growth rate over the last five years, lower than its 12.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q3, YETI reported adjusted EPS of $0.61, down from $0.71 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects YETI’s full-year EPS of $2.58 to grow 1.3%.

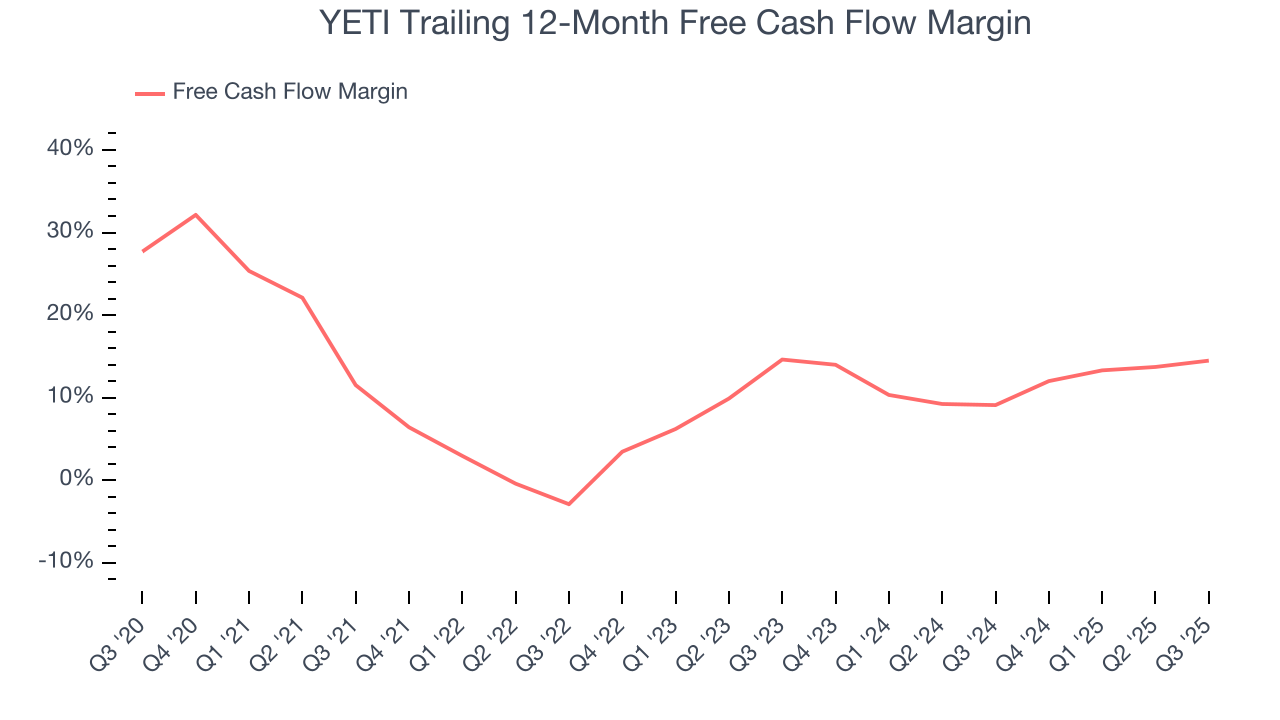

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

YETI has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.8% over the last two years, slightly better than the broader consumer discretionary sector.

YETI’s free cash flow clocked in at $89.11 million in Q3, equivalent to a 18.3% margin. This result was good as its margin was 2.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict YETI’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.5% for the last 12 months will decrease to 7.2%.

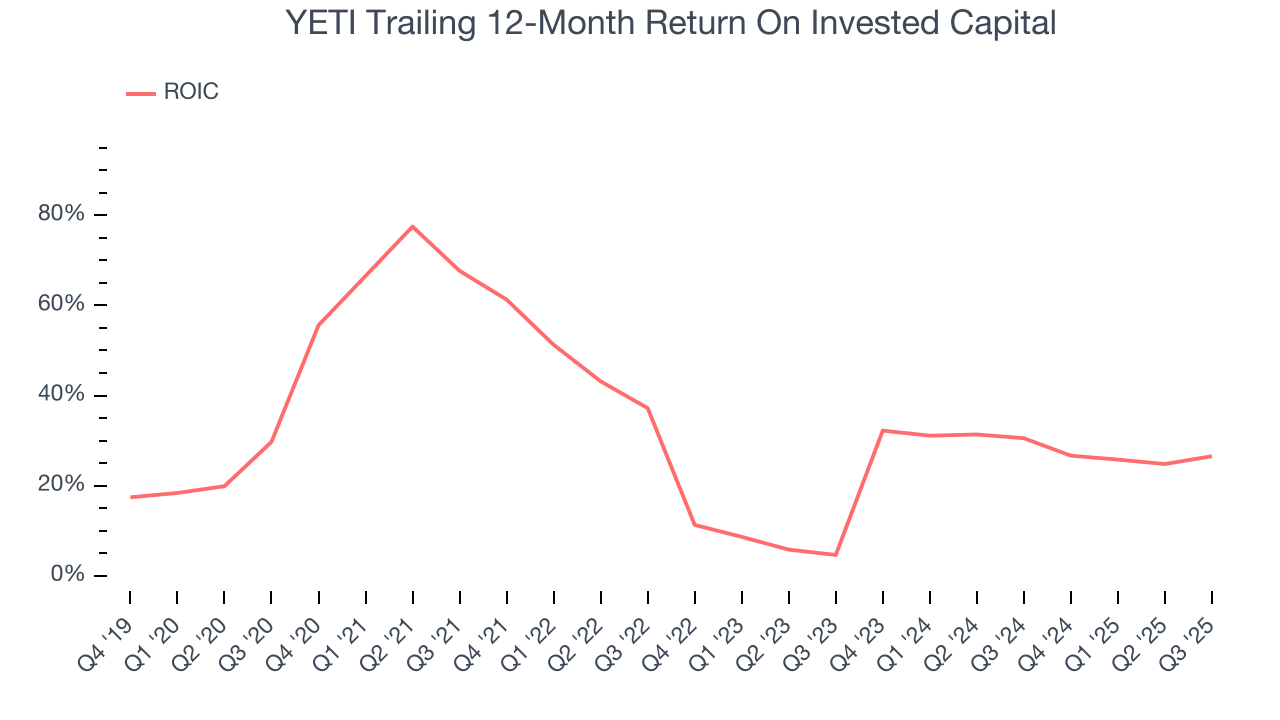

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although YETI hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 33.3%, splendid for a consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, YETI’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

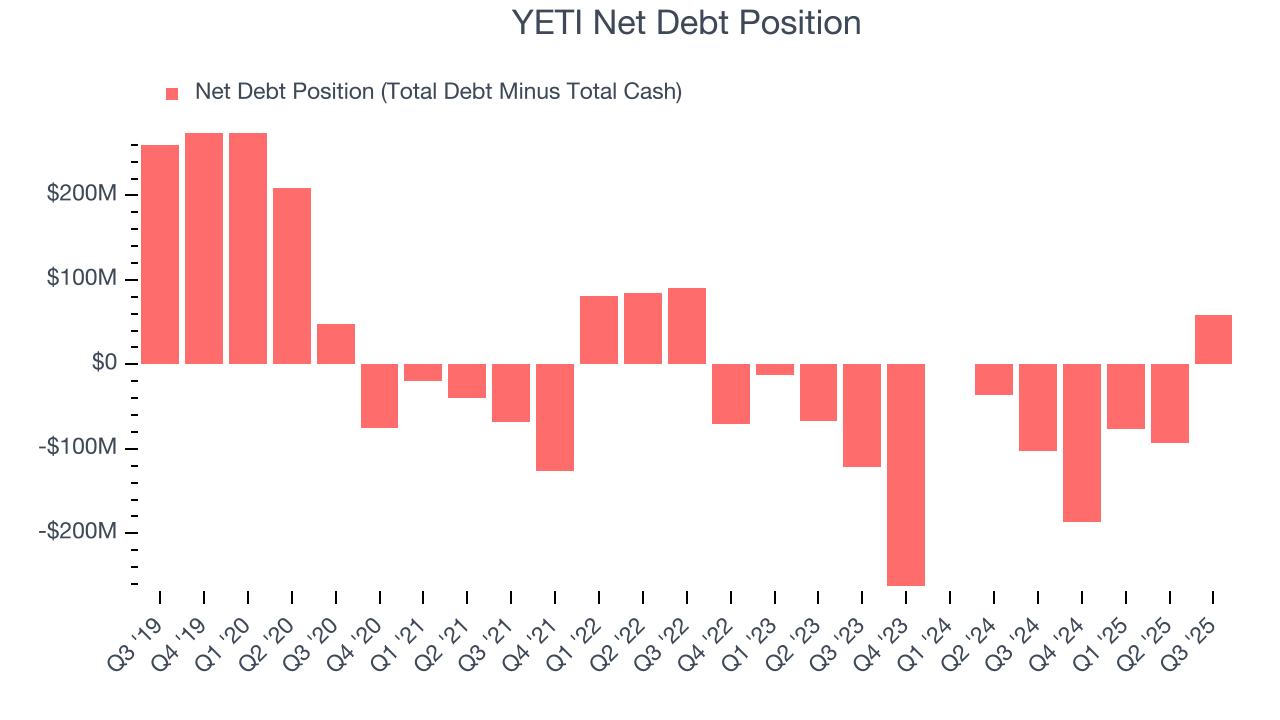

10. Balance Sheet Assessment

YETI reported $164.5 million of cash and $222.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $325.9 million of EBITDA over the last 12 months, we view YETI’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $716,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from YETI’s Q3 Results

It was encouraging to see YETI beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $33.39 immediately following the results.

12. Is Now The Time To Buy YETI?

Updated: January 23, 2026 at 10:08 PM EST

When considering an investment in YETI, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of YETI, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, YETI’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

YETI’s P/E ratio based on the next 12 months is 18.3x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $43.57 on the company (compared to the current share price of $47.10).