CLEAR Secure (YOU)

CLEAR Secure is an exciting business. Its blend of high growth and robust profitability makes for an attractive return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why We Like CLEAR Secure

Recognized by its signature blue lanes and biometric pods at airport checkpoints across America, CLEAR Secure (NYSE:YOU) provides biometric identity verification technology that allows subscribers to bypass regular security lines at airports and access secure experiences at various venues.

- Prominent and differentiated software culminates in a best-in-class gross margin of 86%

- Healthy operating margin shows it’s a well-run company with efficient processes, and its rise over the last year was fueled by some leverage on its fixed costs

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends

CLEAR Secure is a market leader. The valuation looks fair when considering its quality, so this might be a favorable time to buy some shares.

Why Is Now The Time To Buy CLEAR Secure?

High Quality

Investable

Underperform

Why Is Now The Time To Buy CLEAR Secure?

At $31.94 per share, CLEAR Secure trades at 3.3x forward price-to-sales. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

A powerful one-two punch is a company that can both grow earnings and earn a higher multiple over time. High-quality companies trading at big discounts to intrinsic value are good ways to set up this combination.

3. CLEAR Secure (YOU) Research Report: Q3 CY2025 Update

Identity verification company CLEAR Secure (NYSE:YOU) announced better-than-expected revenue in Q3 CY2025, with sales up 15.5% year on year to $229.2 million. Its non-GAAP profit of $0.37 per share was 17.8% above analysts’ consensus estimates.

CLEAR Secure (YOU) Q3 CY2025 Highlights:

- Revenue: $229.2 million vs analyst estimates of $224.8 million (15.5% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.31 (17.8% beat)

- Adjusted Operating Income: $62.2 million vs analyst estimates of $42.65 million (27.1% margin, 45.8% beat)

- Operating Margin: 23%, up from 17.7% in the same quarter last year

- Free Cash Flow was -$53.47 million, down from $117.9 million in the previous quarter

- Customers: 7,683, up from 7,626 in the previous quarter

- Market Capitalization: $3.36 billion

Company Overview

Recognized by its signature blue lanes and biometric pods at airport checkpoints across America, CLEAR Secure (NYSE:YOU) provides biometric identity verification technology that allows subscribers to bypass regular security lines at airports and access secure experiences at various venues.

The company's flagship service is CLEAR Plus, a subscription-based offering that lets members use dedicated security lanes at airports nationwide. When using CLEAR Plus, members verify their identity through biometric technology (facial recognition or fingerprints) at specialized kiosks rather than showing physical IDs to security personnel. After verification, CLEAR Ambassadors escort members to the front of security screening lines, significantly reducing wait times.

Beyond airports, CLEAR has expanded its platform through its CLEAR1 B2B offering, allowing businesses to integrate CLEAR's identity verification technology into their own customer experiences. This service operates on a "verify once, use everywhere" model, enabling frictionless transactions across various sectors including healthcare, financial services, and hospitality.

The company generates revenue primarily through its CLEAR Plus annual subscriptions (priced at $199 per year), with discounts available for airline frequent fliers and American Express cardholders. Additional revenue comes from TSA PreCheck enrollment services and transaction fees from business partners using the CLEAR1 platform.

CLEAR's network effect strengthens as it adds both members and partner locations—greater membership makes the platform more attractive to potential business partners, while more usage locations increase the value proposition for consumers. The company's physical presence in airports also serves as its most effective customer acquisition channel, with in-person enrollments accounting for the majority of new memberships.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

CLEAR Secure's competitors include government-operated trusted traveler programs like TSA PreCheck and Global Entry, as well as emerging biometric identity verification companies such as IDEMIA and Telos ID that operate in similar spaces.

5. Revenue Growth

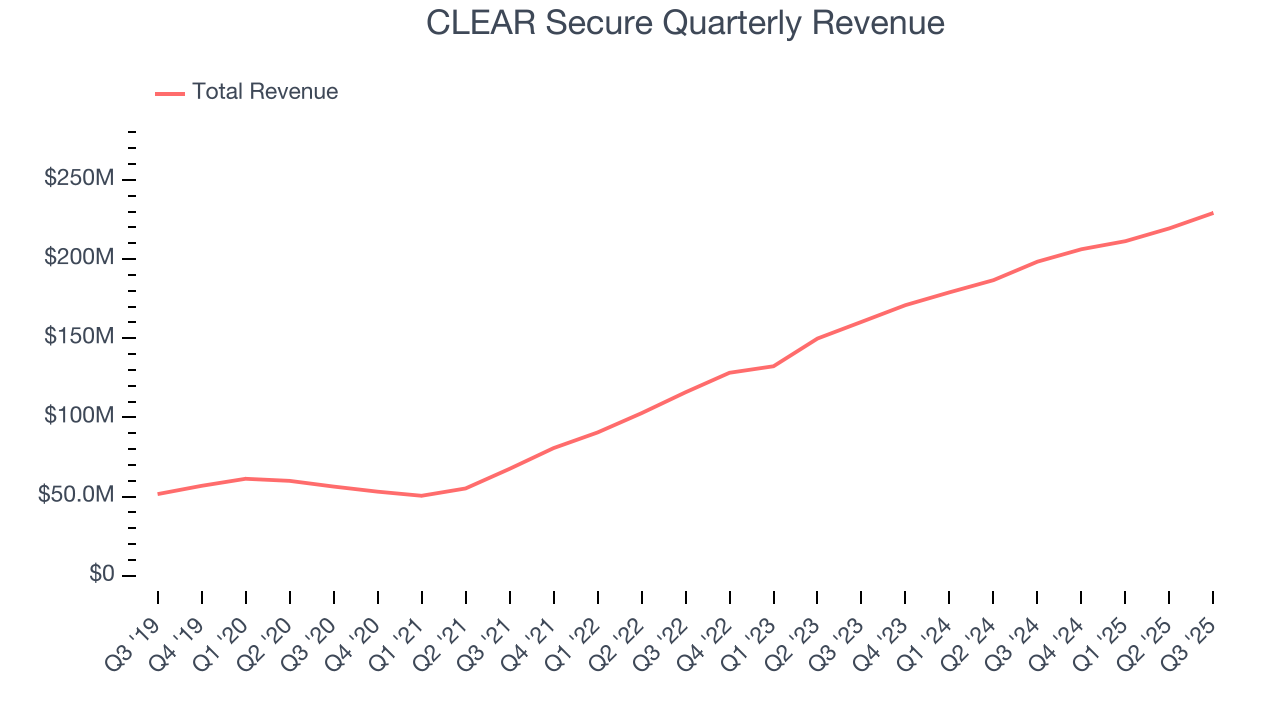

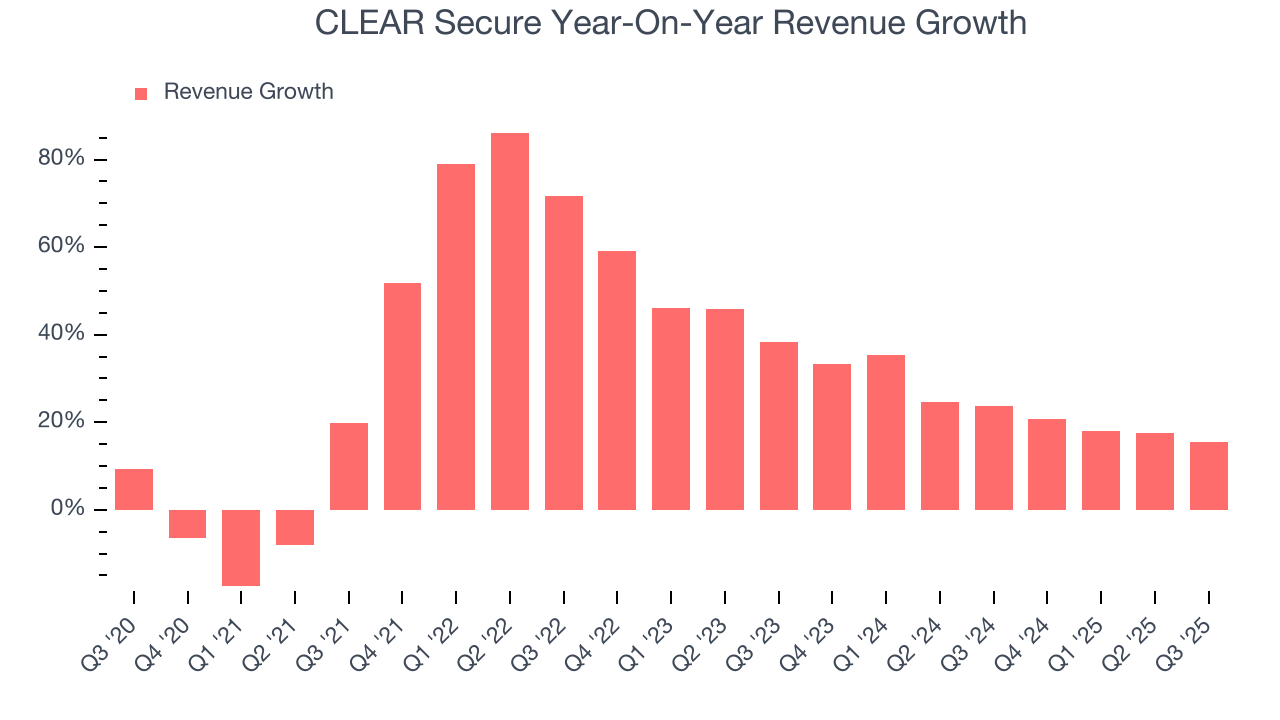

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, CLEAR Secure’s sales grew at an impressive 29.9% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. CLEAR Secure’s annualized revenue growth of 23.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, CLEAR Secure reported year-on-year revenue growth of 15.5%, and its $229.2 million of revenue exceeded Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

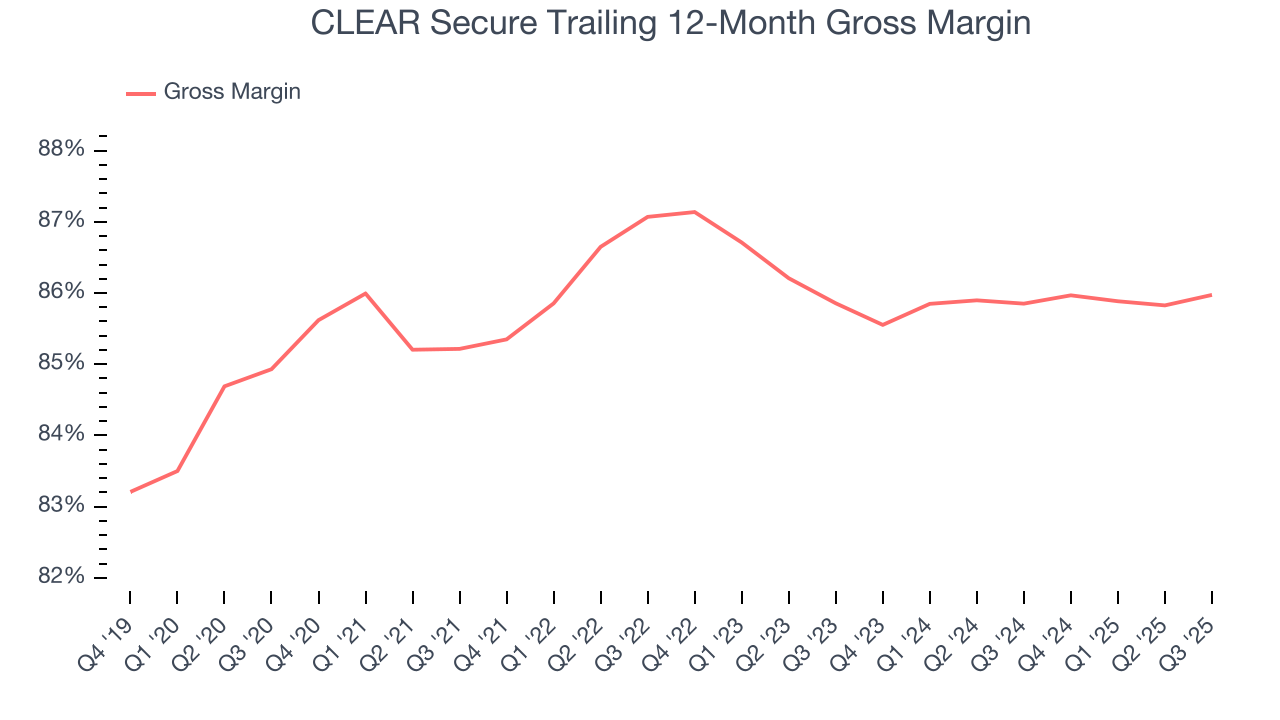

CLEAR Secure’s gross margin is one of the best in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 86% gross margin over the last year. That means CLEAR Secure only paid its providers $14.03 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. CLEAR Secure has seen gross margins improve by 0.1 percentage points over the last 2 year, which is slightly better than average for software.

This quarter, CLEAR Secure’s gross profit margin was 86.2%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

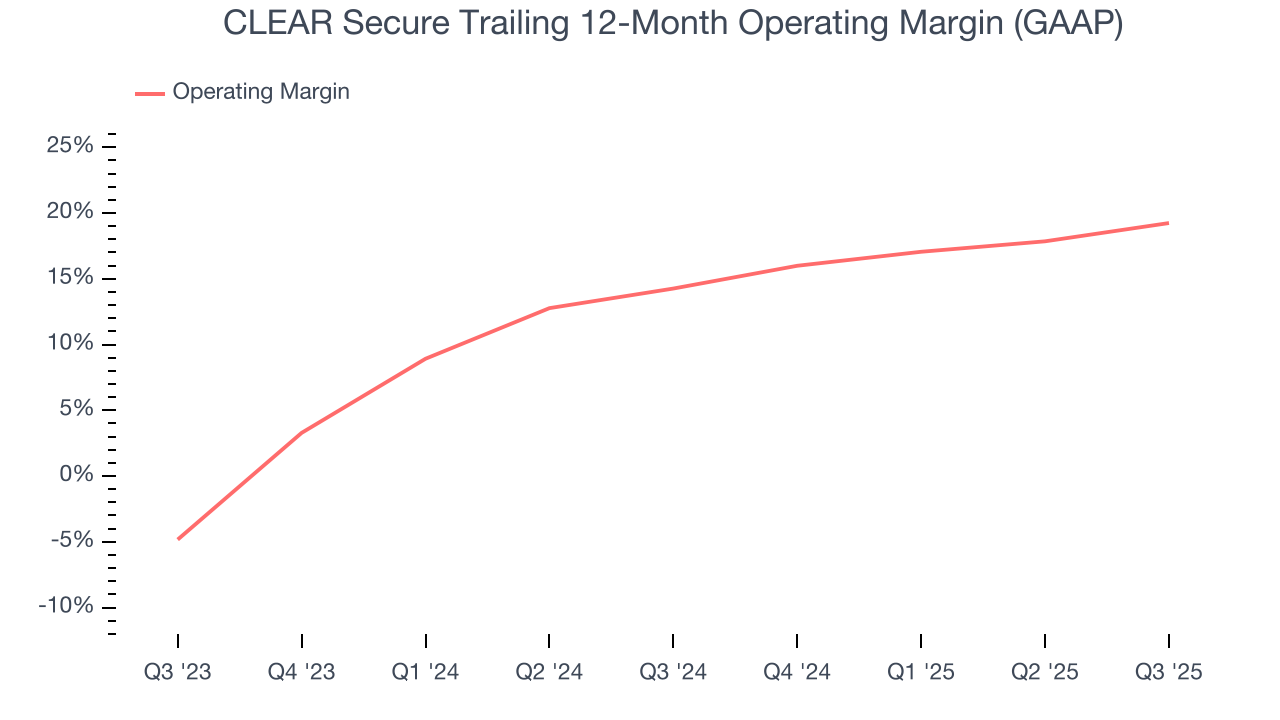

CLEAR Secure has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 19.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, CLEAR Secure’s operating margin rose by 5 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, CLEAR Secure generated an operating margin profit margin of 23%, up 5.3 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

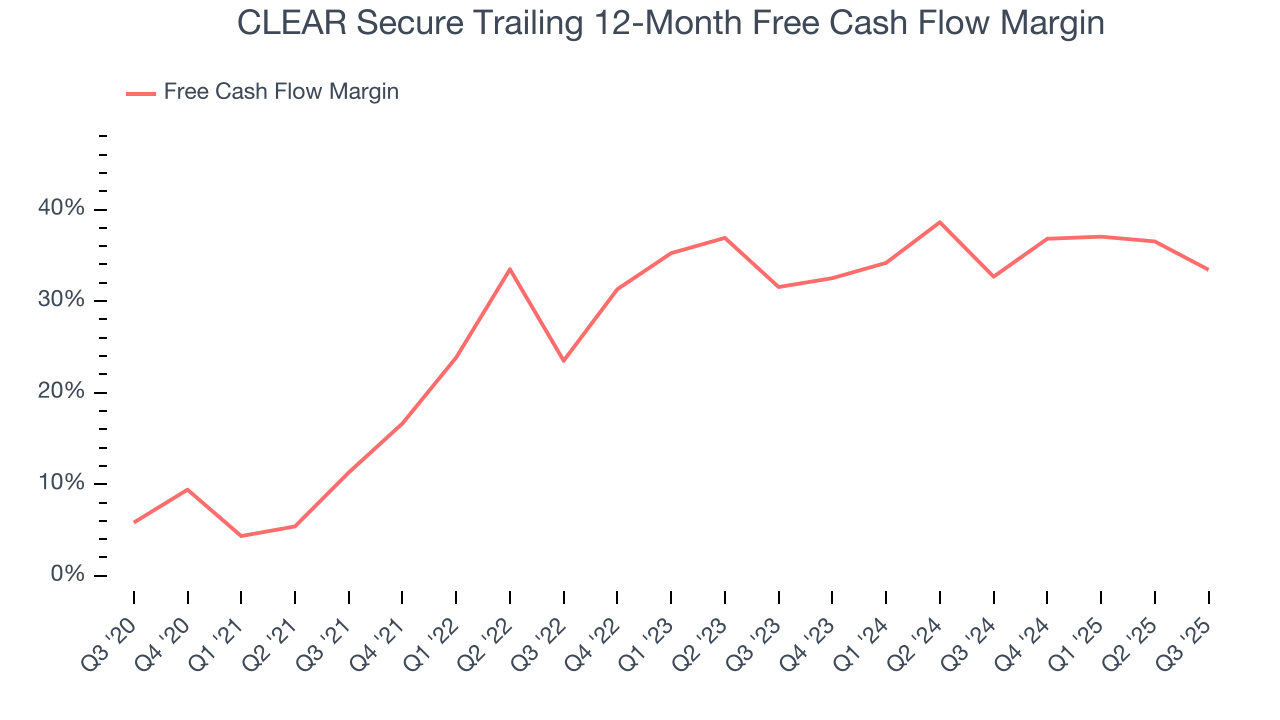

CLEAR Secure has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 33.4% over the last year.

CLEAR Secure burned through $53.47 million of cash in Q3, equivalent to a negative 23.3% margin. The company’s cash burn was similar to its $37.91 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings.

Over the next year, analysts predict CLEAR Secure’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 33.4% for the last 12 months will increase to 36.3%, it options for capital deployment (investments, share buybacks, etc.).

9. Balance Sheet Assessment

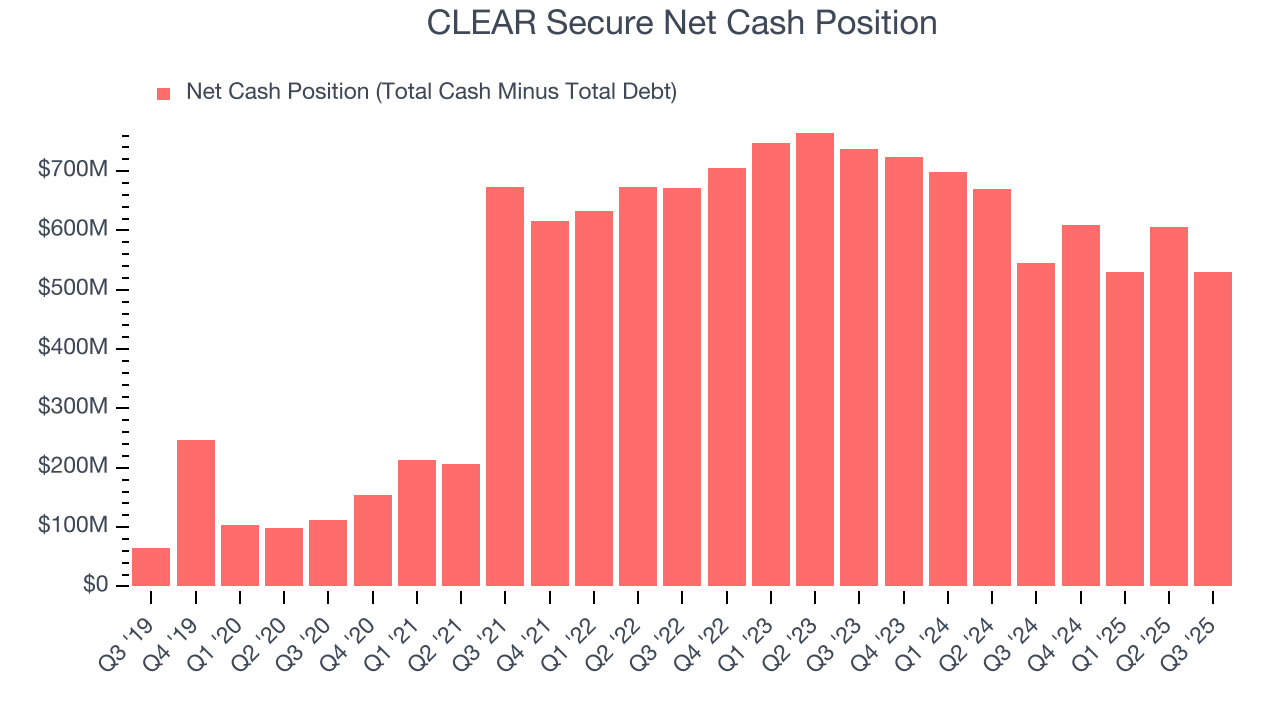

Companies with more cash than debt have lower bankruptcy risk.

CLEAR Secure is a profitable, well-capitalized company with $530.6 million of cash and no debt. This position is 15.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from CLEAR Secure’s Q3 Results

We were impressed by how significantly CLEAR Secure blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $34.57 immediately after reporting.

11. Is Now The Time To Buy CLEAR Secure?

Updated: February 17, 2026 at 12:09 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in CLEAR Secure.

CLEAR Secure is an amazing business ranking highly on our list. First of all, the company’s revenue growth was strong over the last five years. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its admirable gross margin indicates excellent unit economics. Additionally, CLEAR Secure’s impressive operating margins show it has a highly efficient business model.

CLEAR Secure’s price-to-sales ratio based on the next 12 months is 3.3x. Analyzing the software landscape today, CLEAR Secure’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $39.38 on the company (compared to the current share price of $31.94), implying they see 23.3% upside in buying CLEAR Secure in the short term.