Zurn Elkay (ZWS)

Zurn Elkay doesn’t excite us. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Zurn Elkay Will Underperform

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE:ZWS) provides water management solutions to various industries.

- Sales tumbled by 3.5% annually over the last five years, showing market trends are working against its favor during this cycle

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- On the bright side, its robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

Zurn Elkay doesn’t live up to our standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Zurn Elkay

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zurn Elkay

Zurn Elkay’s stock price of $46.80 implies a valuation ratio of 29.4x forward P/E. This multiple is higher than that of industrials peers; it’s also rich for the top-line growth of the company. Not a great combination.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Zurn Elkay (ZWS) Research Report: Q3 CY2025 Update

Water management solutions company Zurn Elkay (NYSE:ZWS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 11.1% year on year to $455.4 million. Guidance for next quarter’s revenue was optimistic at $398.5 million at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $0.43 per share was 8.6% above analysts’ consensus estimates.

Zurn Elkay (ZWS) Q3 CY2025 Highlights:

- Revenue: $455.4 million vs analyst estimates of $442.1 million (11.1% year-on-year growth, 3% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.40 (8.6% beat)

- Adjusted EBITDA: $122.2 million vs analyst estimates of $117 million (26.8% margin, 4.5% beat)

- Revenue Guidance for Q4 CY2025 is $398.5 million at the midpoint, above analyst estimates of $389 million

- EBITDA guidance for the full year is $438.5 million at the midpoint, above analyst estimates of $430.5 million

- Operating Margin: 17%, in line with the same quarter last year

- Free Cash Flow Margin: 20.6%, similar to the same quarter last year

- Organic Revenue rose 11% year on year

- Market Capitalization: $7.81 billion

Company Overview

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE:ZWS) provides water management solutions to various industries.

Specifically, the company's systems seek to conserve water and improve hygiene in public, commercial, and residential settings. Its solutions include professional-grade water safety and control products, flow system products, hygienic and environmental products, and filtered drinking water products for public and private use.

Zurn Elkay generates revenue through the sale of its water management products to a wide array of clientele, including construction firms, municipalities, commercial entities, and private residents. Sales are driven by both direct and distributor channels, with a significant portion of income potentially recurring due to the essential nature of water infrastructure maintenance and upgrades.

4. HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Other companies in the water management solution industry include Watts Water (NYSE:WTS), Pentair (NYSE:PNR), and private company Sloan Valve.

5. Revenue Growth

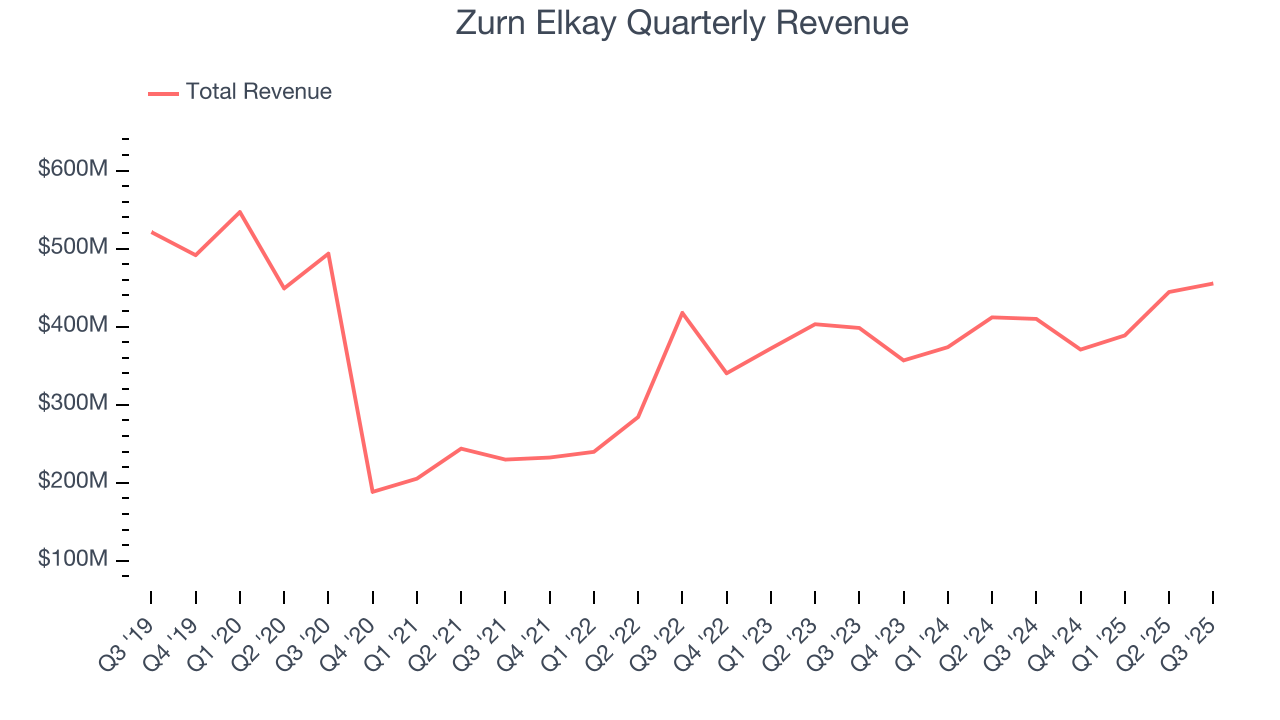

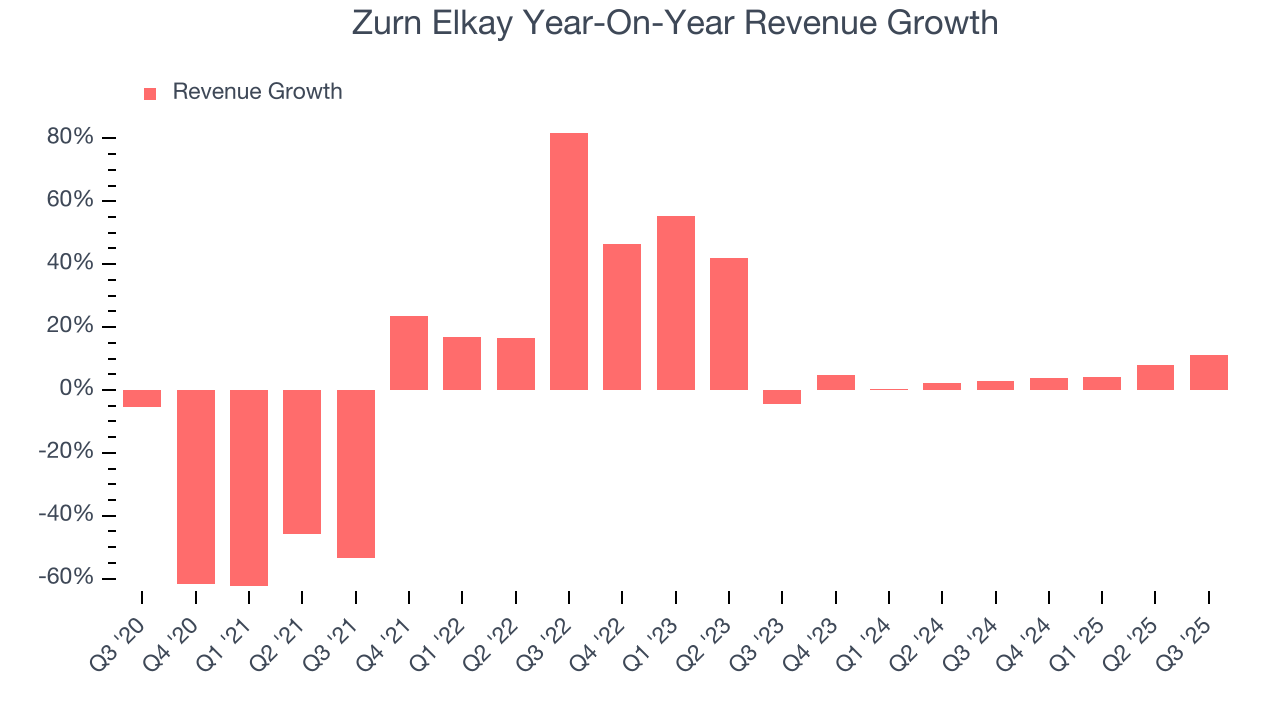

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Zurn Elkay struggled to consistently generate demand over the last five years as its sales dropped at a 3.5% annual rate. This wasn’t a great result and is a sign of lacking business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Zurn Elkay’s annualized revenue growth of 4.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

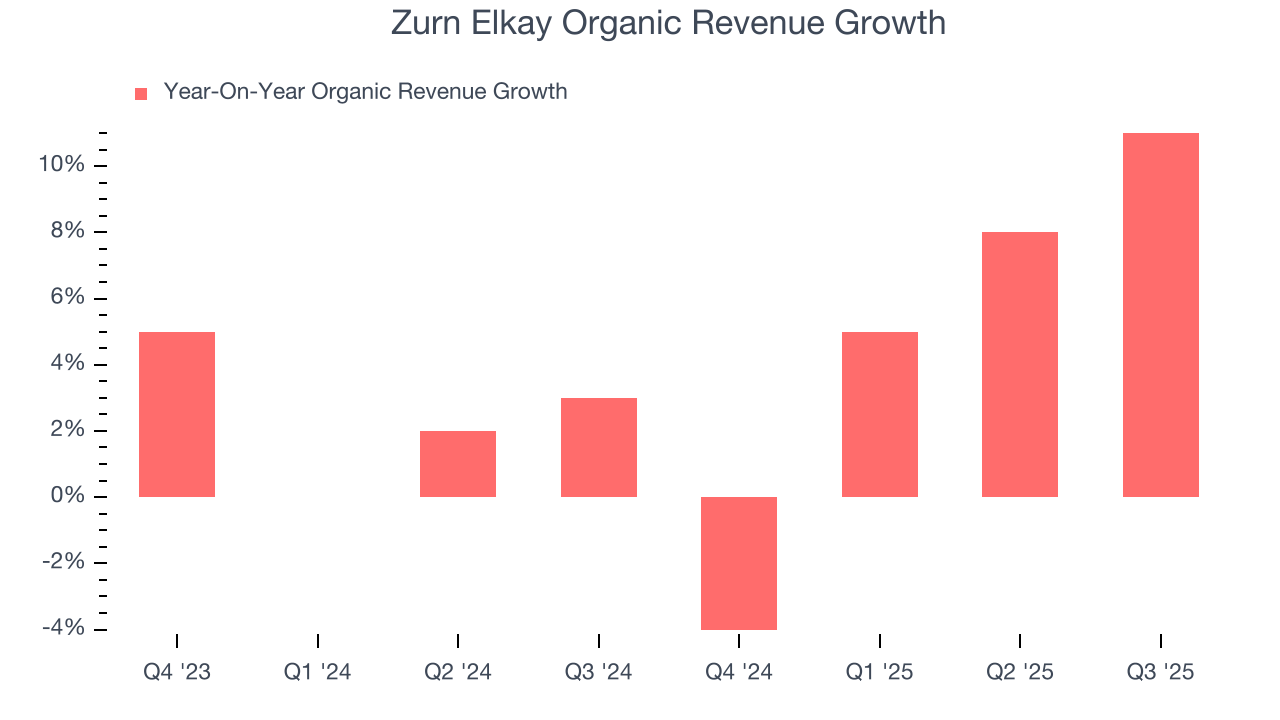

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Zurn Elkay’s organic revenue averaged 3.8% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Zurn Elkay reported year-on-year revenue growth of 11.1%, and its $455.4 million of revenue exceeded Wall Street’s estimates by 3%. Company management is currently guiding for a 7.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

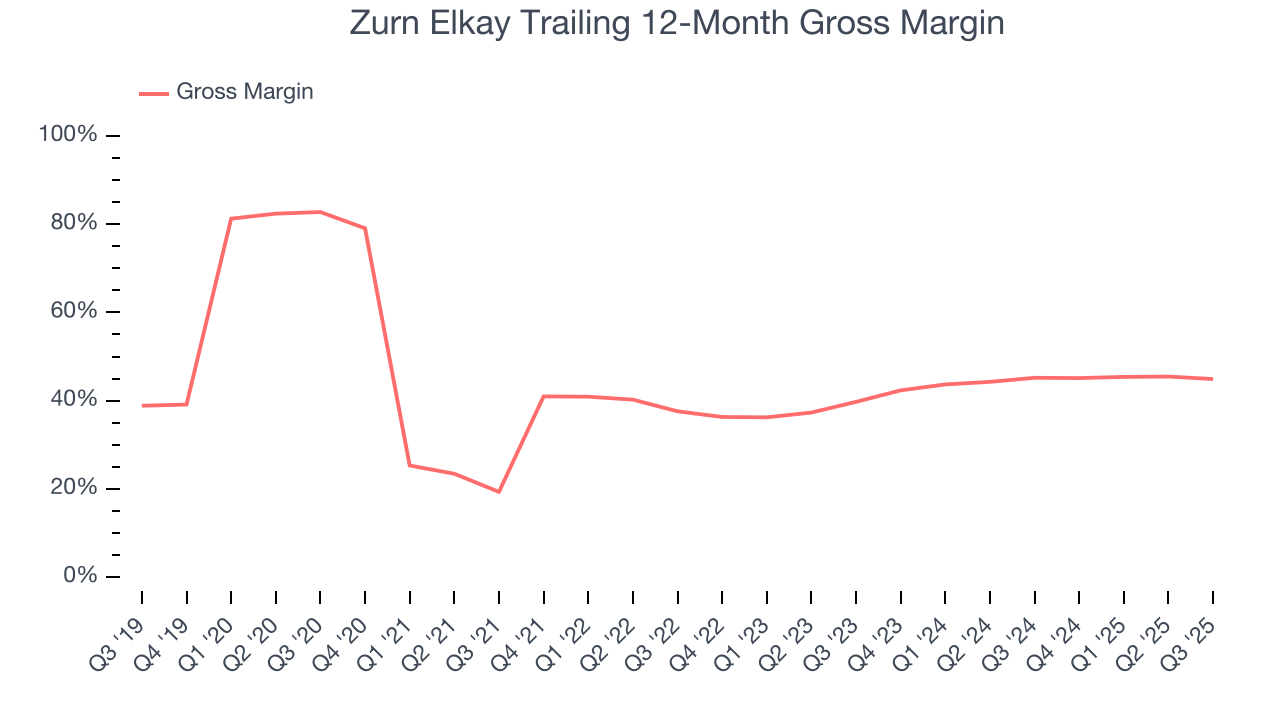

Zurn Elkay’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 39.3% gross margin over the last five years. Said differently, roughly $39.27 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Zurn Elkay’s gross profit margin came in at 44.1% this quarter, marking a 2.1 percentage point decrease from 46.2% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

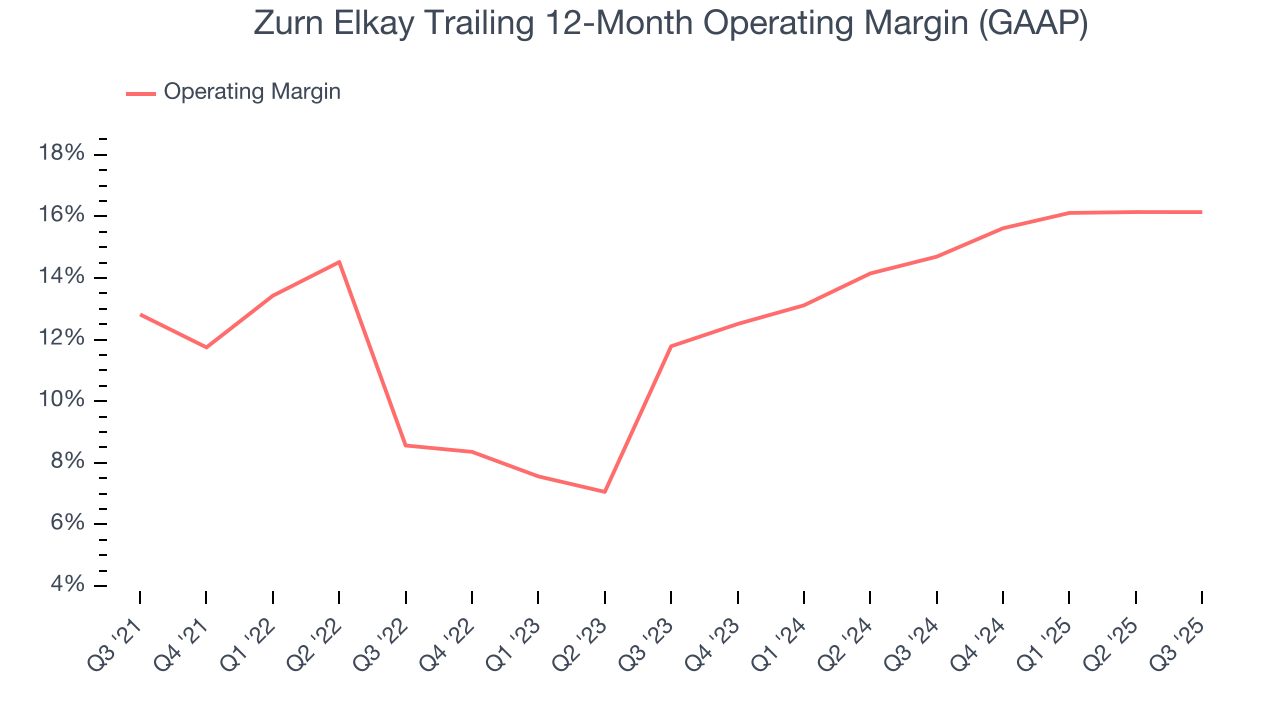

Zurn Elkay has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Zurn Elkay’s operating margin rose by 3.3 percentage points over the last five years, showing its efficiency has improved.

In Q3, Zurn Elkay generated an operating margin profit margin of 17%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

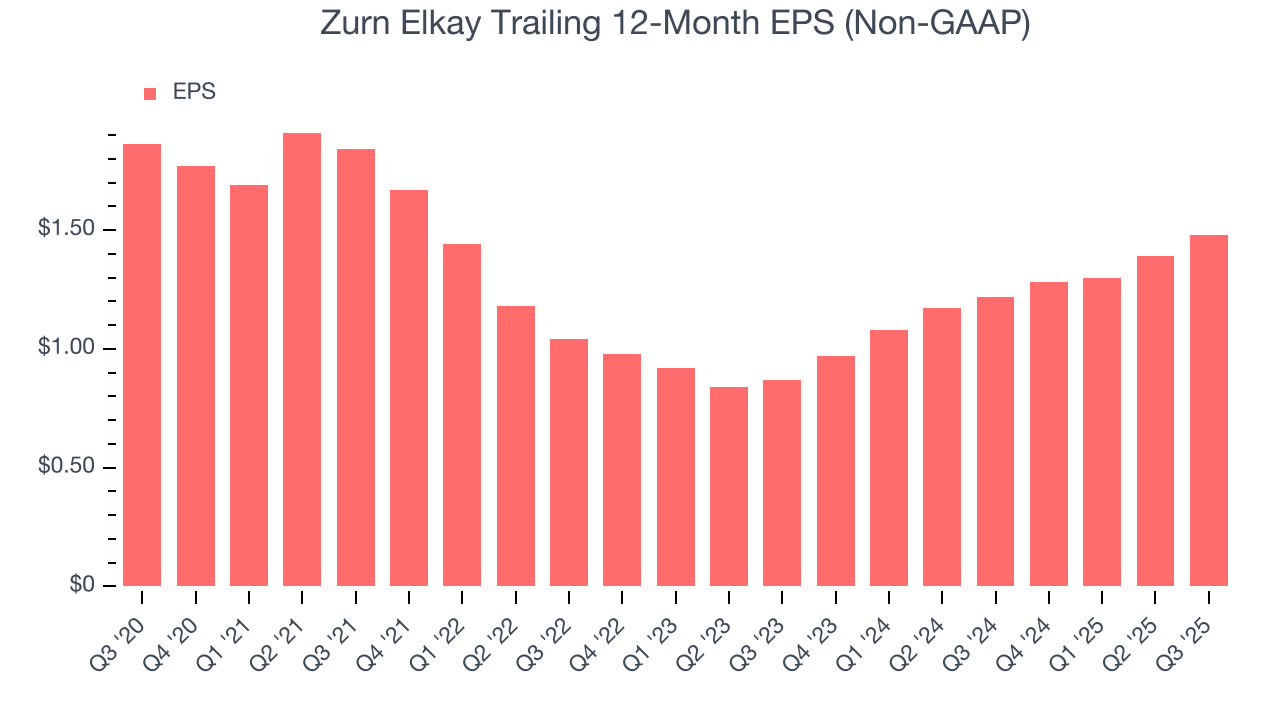

Sadly for Zurn Elkay, its EPS and revenue declined by 4.5% and 3.5% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Zurn Elkay’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Zurn Elkay’s two-year annual EPS growth of 30.4% was fantastic and topped its 4.7% two-year revenue growth.

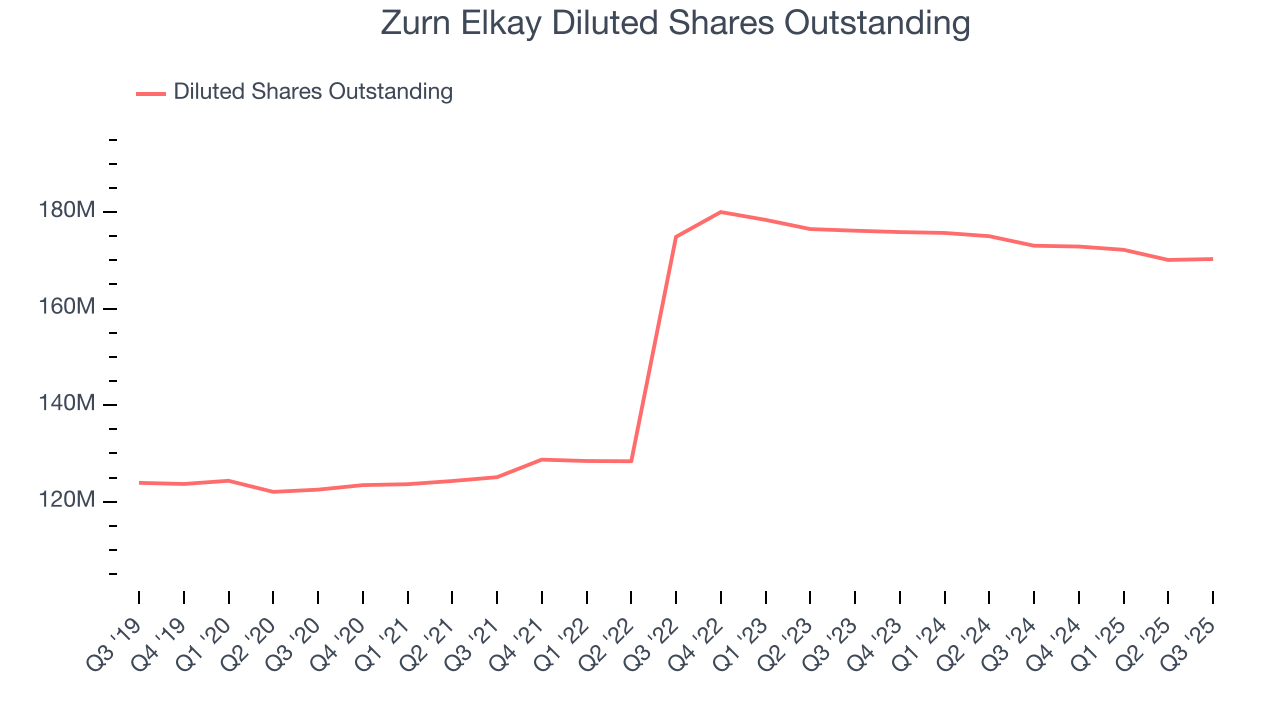

We can take a deeper look into Zurn Elkay’s earnings to better understand the drivers of its performance. While we mentioned earlier that Zurn Elkay’s operating margin was flat this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 3.3%. Improving profitability and share buybacks are positive signs for shareholders as they juice EPS growth relative to revenue growth.

In Q3, Zurn Elkay reported adjusted EPS of $0.43, up from $0.34 in the same quarter last year. This print beat analysts’ estimates by 8.6%. Over the next 12 months, Wall Street expects Zurn Elkay’s full-year EPS of $1.48 to grow 4.1%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

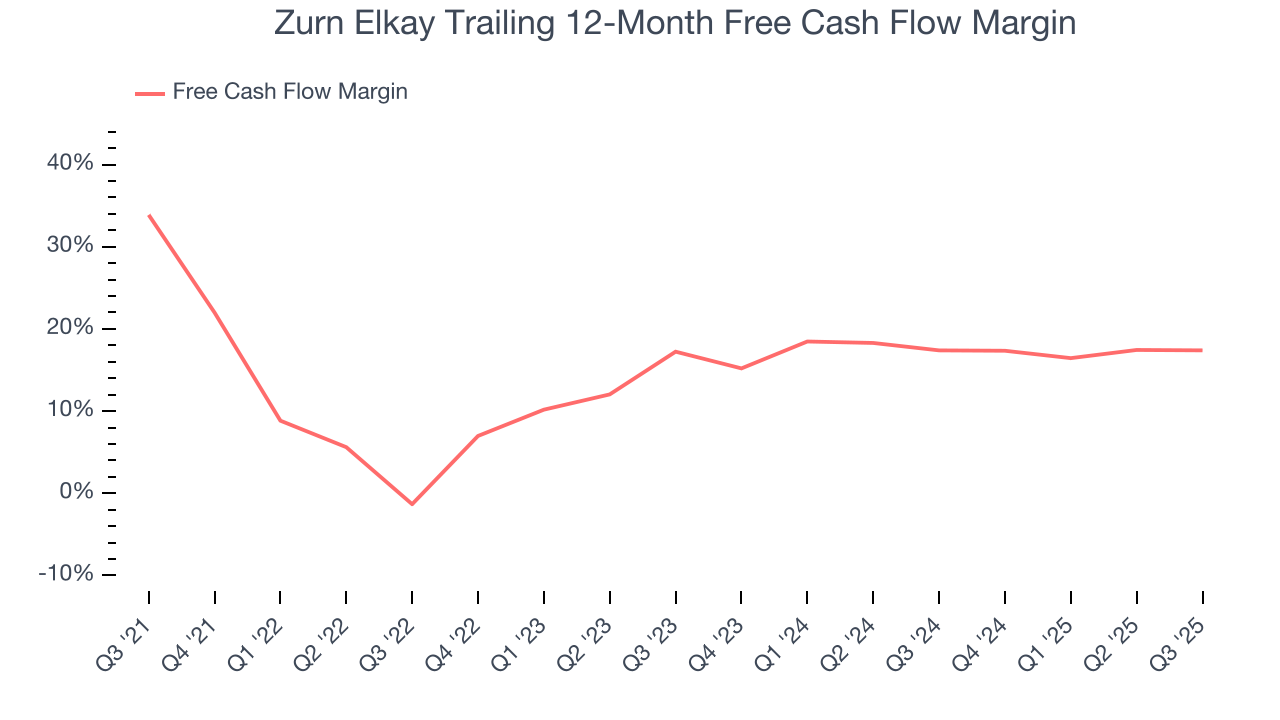

Zurn Elkay has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.2% over the last five years.

Taking a step back, we can see that Zurn Elkay’s margin dropped by 16.5 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Zurn Elkay’s free cash flow clocked in at $93.9 million in Q3, equivalent to a 20.6% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

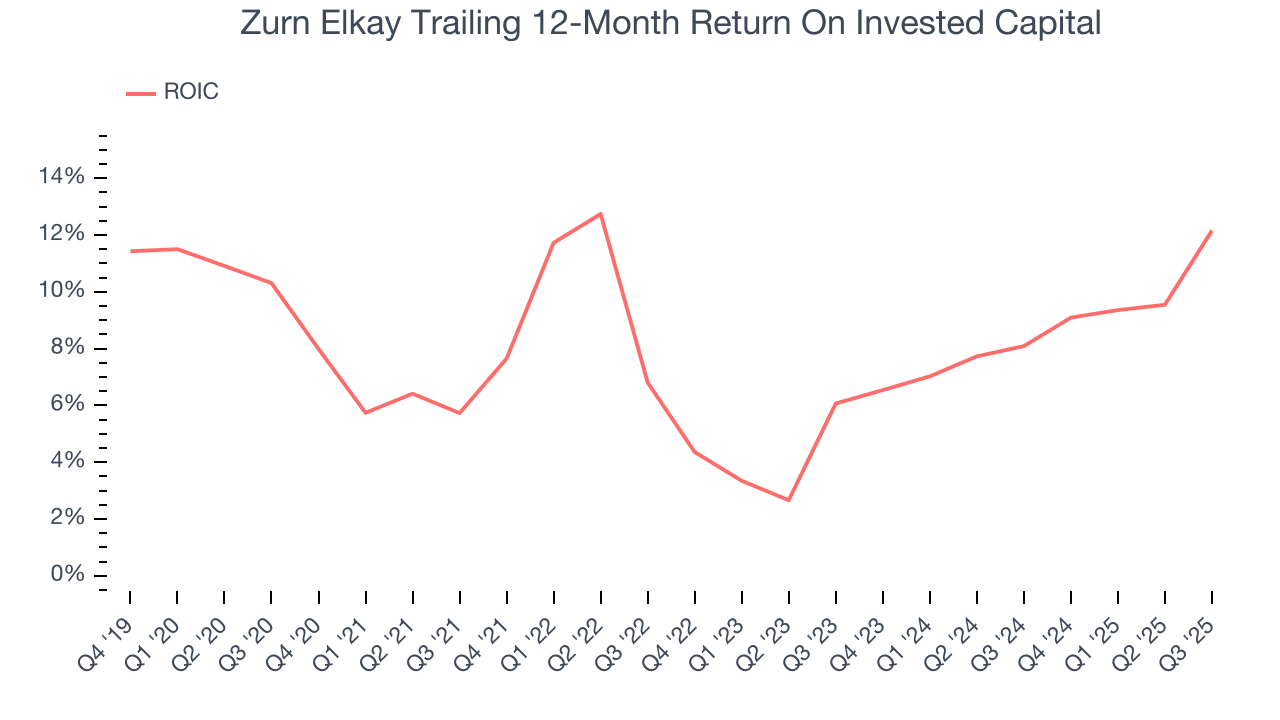

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Zurn Elkay historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Zurn Elkay’s ROIC increased by 3.9 percentage points annually over the last few years. This is a good sign, and we hope the company can continue improving.

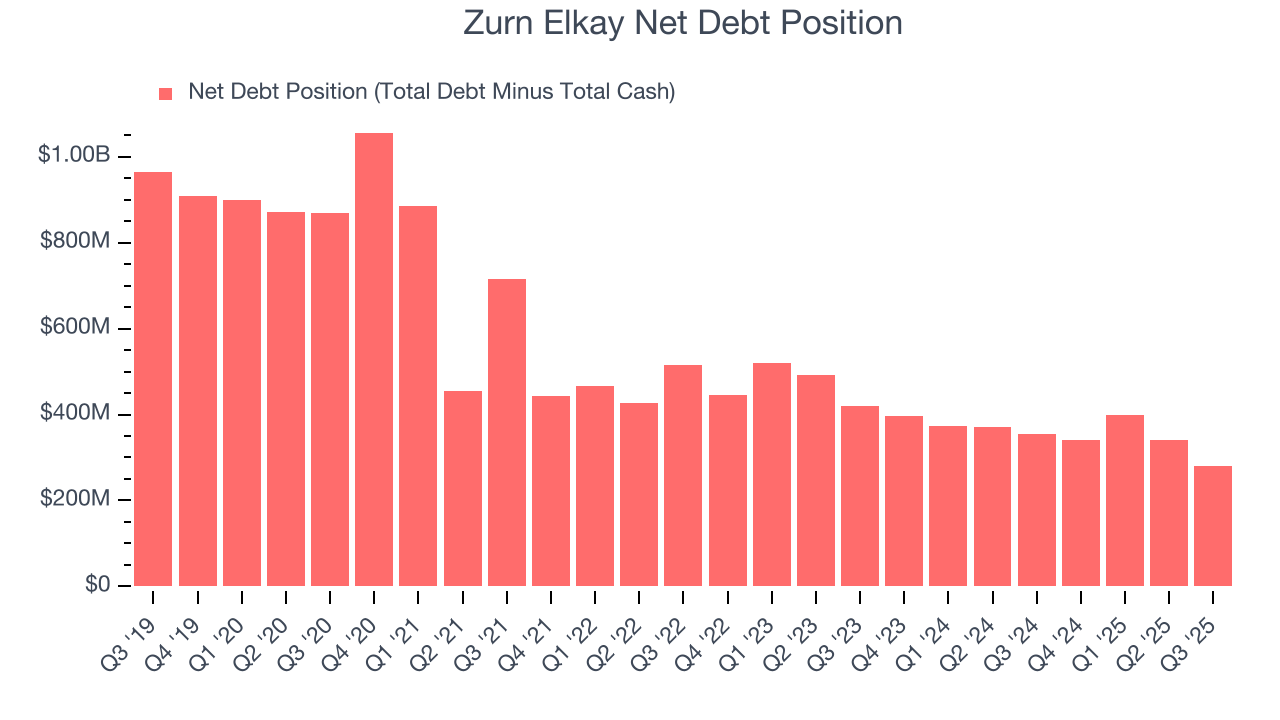

11. Balance Sheet Assessment

Zurn Elkay reported $260.1 million of cash and $540.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $429.2 million of EBITDA over the last 12 months, we view Zurn Elkay’s 0.7× net-debt-to-EBITDA ratio as safe. We also see its $29.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Zurn Elkay’s Q3 Results

We enjoyed seeing Zurn Elkay beat analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.9% to $46.95 immediately following the results.

13. Is Now The Time To Buy Zurn Elkay?

Updated: January 23, 2026 at 10:20 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Zurn Elkay, you should also grasp the company’s longer-term business quality and valuation.

Zurn Elkay isn’t a terrible business, but it doesn’t pass our bar. First off, its revenue has declined over the last five years. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its cash profitability fell over the last five years.

Zurn Elkay’s P/E ratio based on the next 12 months is 29.4x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $51.22 on the company (compared to the current share price of $46.80).