Web content delivery and security company Akamai (NASDAQ:AKAM) reported results in line with analyst expectations in Q2 FY2021 quarter, with revenue up 7.31% year on year to $852.8 million. Akamai made a GAAP profit of $156.4 million, down on its profit of $161.9 million, in the same quarter last year.

Is now the time to buy Akamai? Access our full analysis of the earnings results here, it's free.

Akamai (AKAM) Q2 FY2021 Highlights:

- Revenue: $852.8 million vs analyst estimates of $845.9 million (0.81% beat)

- EPS (non-GAAP): $1.42 vs analyst estimates of $1.38 (2.57% beat)

- Free cash flow of $223.5 million, up 162% from previous quarter

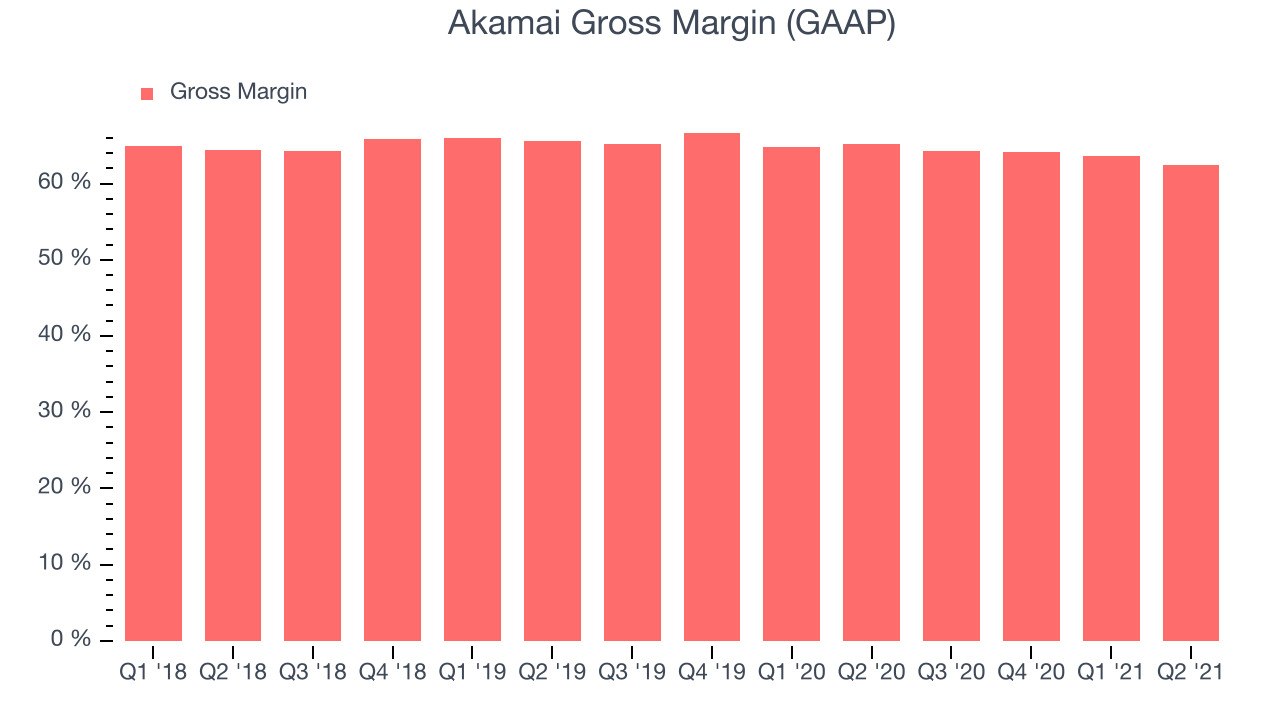

- Gross Margin (GAAP): 62.4%, down from 63.6% previous quarter

"Akamai's excellent second quarter financial performance was highlighted by continued strong growth across our security solutions globally," said Dr. Tom Leighton, Akamai's Chief Executive Officer.

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

Today, more people are moving their business online, which is placing a lot of demand on the global internet network. As the number of functionalities included in websites and apps grows, so does the need for platforms that help to deliver a seamless website experience to users.

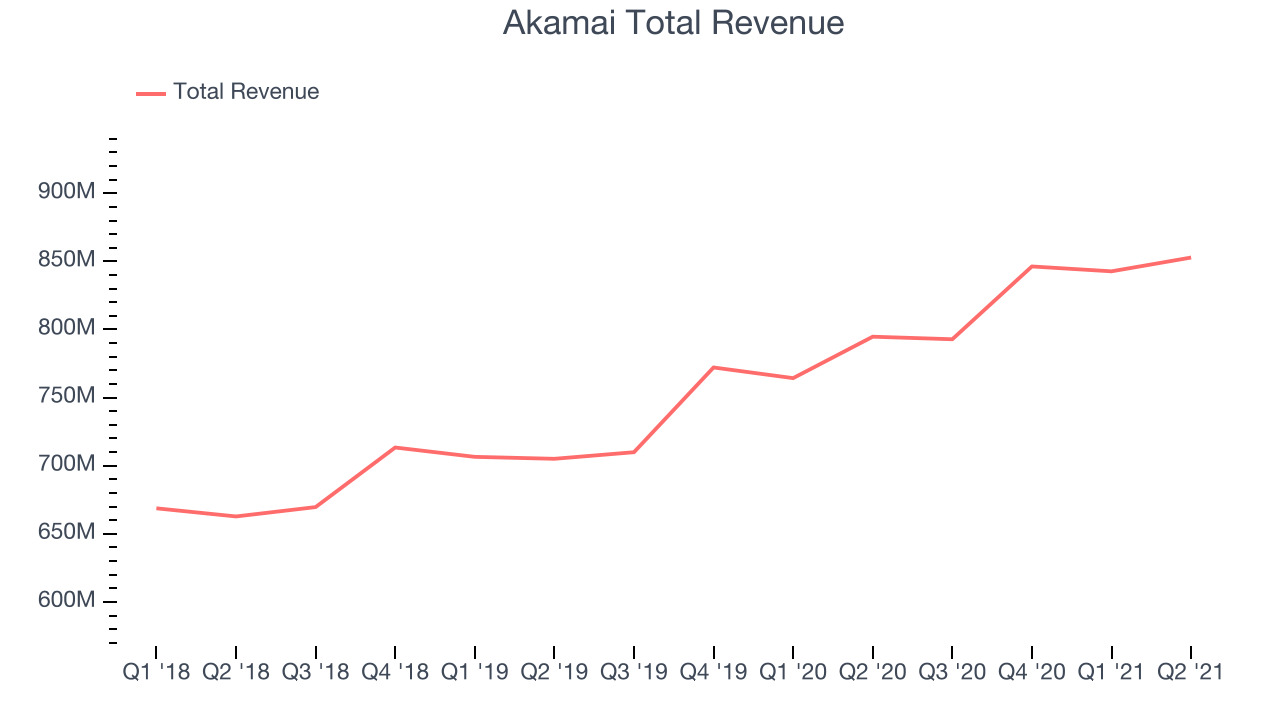

Sales Growth

As you can see below, Akamai's revenue growth has been slow over the last year, growing from quarterly revenue of $794.7 million, to $852.8 million.

Akamai's quarterly revenue was only up 7.31% year on year, which would likely disappoint many shareholders. We can see that the company increased revenue by $10.1 million quarter on quarter accelerating on the $3.58 million decrease in Q1 2021.

Analysts covering the company are expecting the revenues to grow 6.22% over the next twelve months, although we would expect them to review their estimates once they get to read these results.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Akamai's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 62.4% in Q2.

That means that for every $1 in revenue the company had $0.62 left to spend on developing new products, marketing & sales and the general administrative overhead. This would be considered a low gross margin for a SaaS company and it has been going down over the last year, which is probably the opposite direction shareholders would like to see it go.

Key Takeaways from Akamai's Q2 Results

Sporting a market capitalisation of $19.3 billion, more than $1.41 billion in cash and with positive operating free cash flow over the last twelve months, we're confident that Akamai has the resources it needs to pursue a high growth business strategy.

Akamai topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results stood out as a positive. On the other hand, it was unfortunate to see that the revenue growth overall wasn't very strong. Overall, it seems to us that this was a complicated quarter for Akamai. The company is down -3.54% on the results and currently trades at $115.5 per share.

Akamai may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our full report which you can read here, it's free.

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.