Accounting automation software maker Blackline (NASDAQ:BL) reported Q4 FY2021 results topping analyst expectations, with revenue up 20.4% year on year to $115.3 million. The company expects that next quarter's revenue would be around $119.5 million, which is the midpoint of the guidance range. That was in roughly line with analyst expectations. BlackLine made a GAAP loss of $32.4 million, down on its loss of $12.6 million, in the same quarter last year.

Is now the time to buy BlackLine? Access our full analysis of the earnings results here, it's free.

BlackLine (BL) Q4 FY2021 Highlights:

- Revenue: $115.3 million vs analyst estimates of $113.5 million (1.56% beat)

- EPS (non-GAAP): $0.08 vs analyst expectations of $0.10 (21% miss)

- Revenue guidance for Q1 2022 is $119.5 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for upcoming financial year 2022 is $522.5 million at the midpoint, beating analyst estimates by 1.79% and predicting 22.7% growth (vs 20.6% in FY2021)

- Free cash flow of $15.2 million, up 56.1% from previous quarter

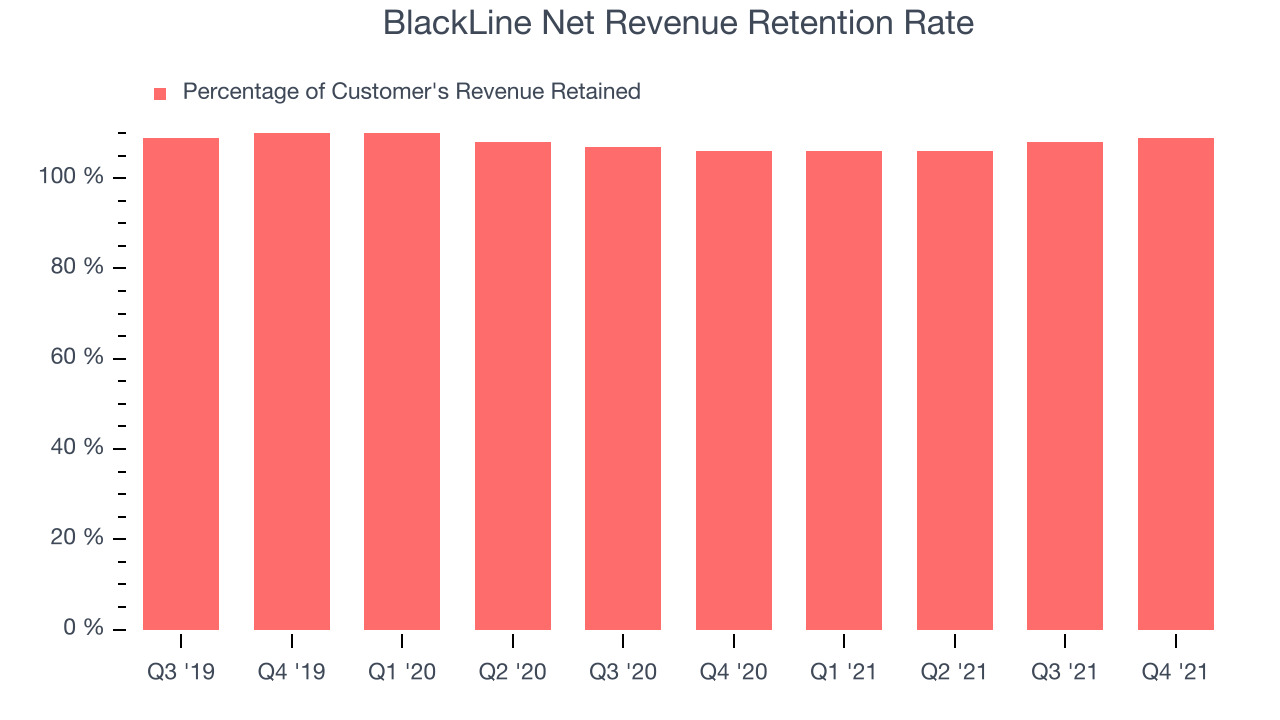

- Net Revenue Retention Rate: 109%, in line with previous quarter

- Customers: 3,825, up from 3,704 in previous quarter

- Gross Margin (GAAP): 75.7%, down from 79.9% same quarter last year

Marc Huffman, CEO, commented, “I am very pleased with our fourth quarter results as we executed our strategy and expanded our existing technology capabilities. In particular, our recent acquisition of FourQ increases our leadership position in the growing market for intercompany transaction solutions and builds on the momentum we have created for 2022. The strong market demand and our execution continue to lay the foundation for our long-term growth as we make investments into our customer success, platform innovation and global reach.”

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

Sales Growth

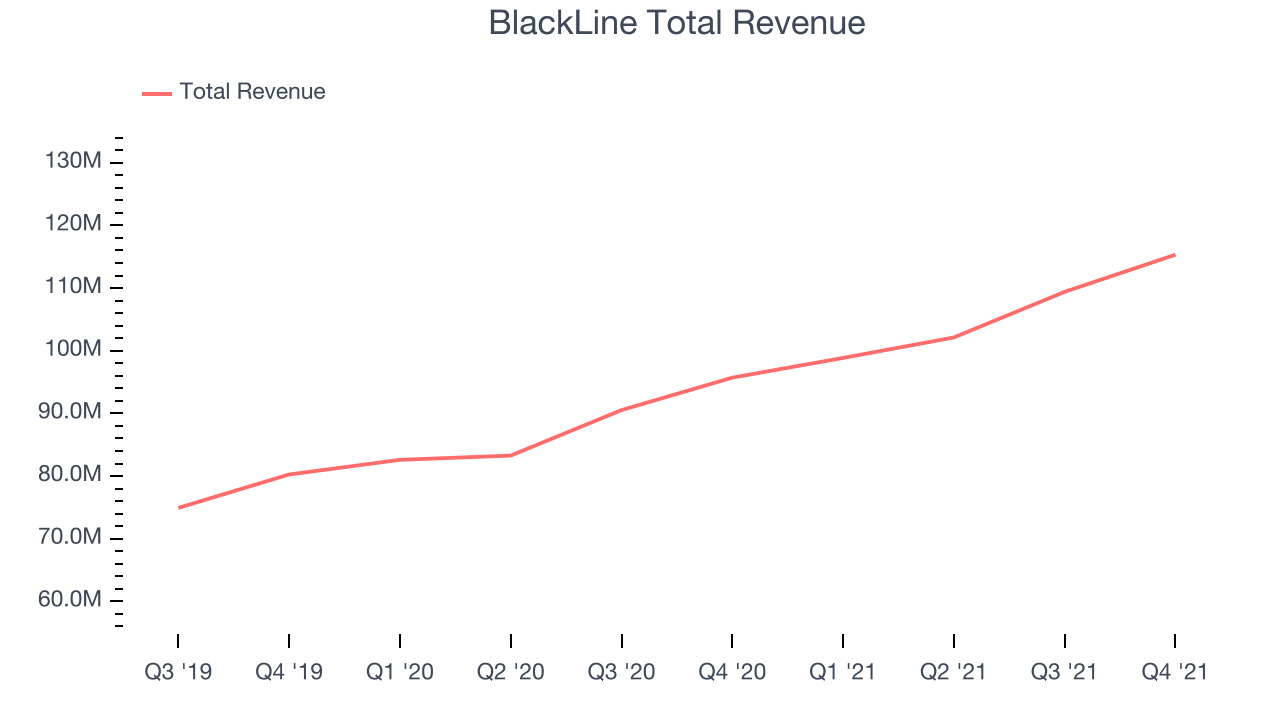

As you can see below, BlackLine's revenue growth has been strong over the last year, growing from quarterly revenue of $95.7 million, to $115.3 million.

This quarter, BlackLine's quarterly revenue was once again up a very solid 20.4% year on year. But the growth did slow down a little compared to last quarter, as BlackLine increased revenue by $5.92 million in Q4, compared to $7.28 million revenue add in Q3 2021. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Guidance for the next quarter indicates BlackLine is expecting revenue to grow 20.8% year on year to $119.5 million, in line with the 19.6% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $522.5 million at the midpoint, growing 22.7% compared to 20.6% increase in FY2021.

There are others doing even better than BlackLine. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

BlackLine's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 109% in Q4. That means even if they didn't win any new customers, BlackLine would have grown its revenue 9% year on year. Trending up over the last year, this is a decent retention rate and it shows us that not only BlackLine's customers stick around but at least some of them get increasing value from its software over time.

Key Takeaways from BlackLine's Q4 Results

With a market capitalization of $5.4 billion BlackLine is among smaller companies, but its more than $1.19 billion in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

We were impressed that BlackLine guided for revenue growth to accelerate next year. And we were also glad that the revenue guidance for the rest of the year exceeded expectations. On the other hand, there was a deterioration in gross margin and the company missed analysts' EPS estimates. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. But investors might have been expecting more and the company is down 7.65% on the results and currently trades at $84.15 per share.

Should you invest in BlackLine right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.