As semiconductor manufacturing stocks’ Q2 earnings season wraps, let's dig into this quarter’s best and worst performers, including Lam Research (NASDAQ:LRCX) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers and data storage. The growth of data and technologies like artificial intelligence, 5G networks and smart cars are also creating a next wave of growth for the industry. To keep up with ever changing customer needs requires new tools that can design, fabricate and test at ever smaller sizes and more complex architectures, and that is driving the demand for semiconductor capital manufacturing equipment.

The 4 semiconductor manufacturing stocks we track reported a decent Q2; on average, revenues beat analyst consensus estimates by 4.18%, while on average next quarter revenue guidance was 2.84% above consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021 and semiconductor manufacturing stocks have not been spared, with share prices down 18.5% since the previous earnings results, on average.

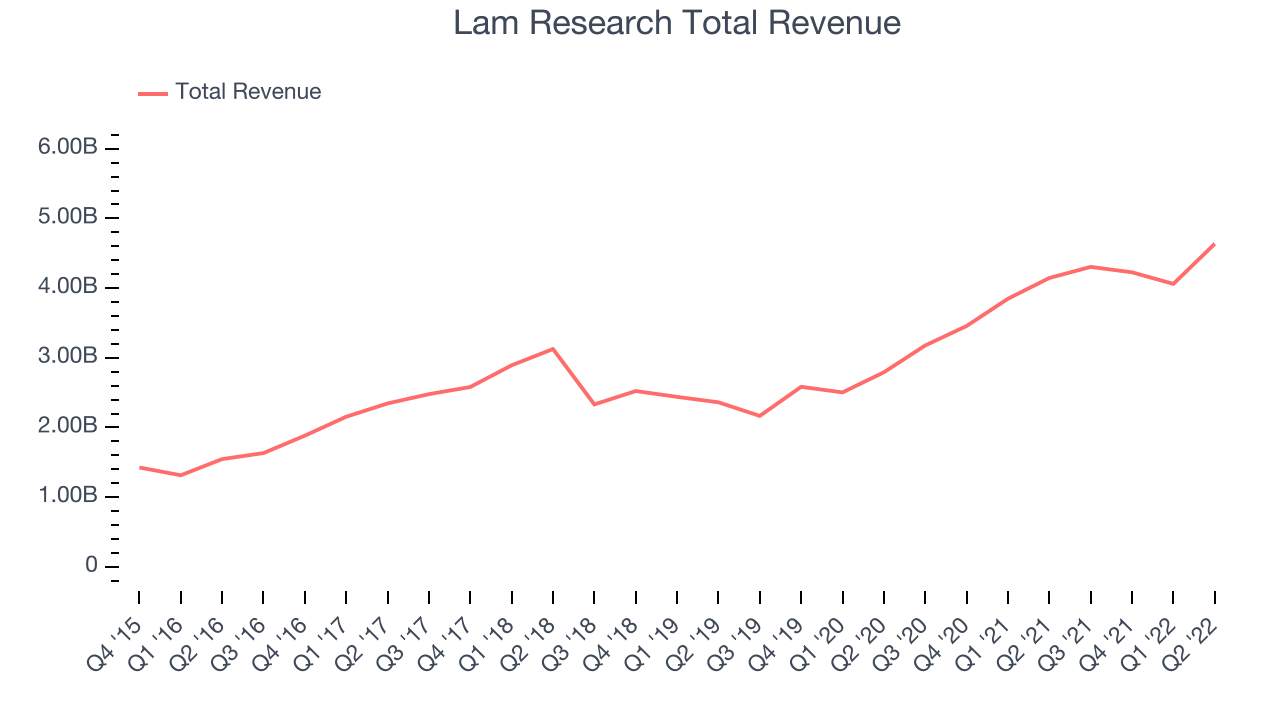

Lam Research (NASDAQ:LRCX)

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $4.63 billion, up 11.8% year on year, beating analyst expectations by 10%. It was a strong quarter for the company, with a beat on the bottom line and guidance for the next quarter above analysts' estimates.

“Lam delivered record levels of revenue and earnings per share in the June quarter, while continuing to operate in a supply-constrained environment,” said Tim Archer, Lam Research’s President and Chief Executive Officer.

Lam Research pulled off the strongest analyst estimates beat of the whole group. The stock is down 18.6% since the results and currently trades at $380.50.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it's free.

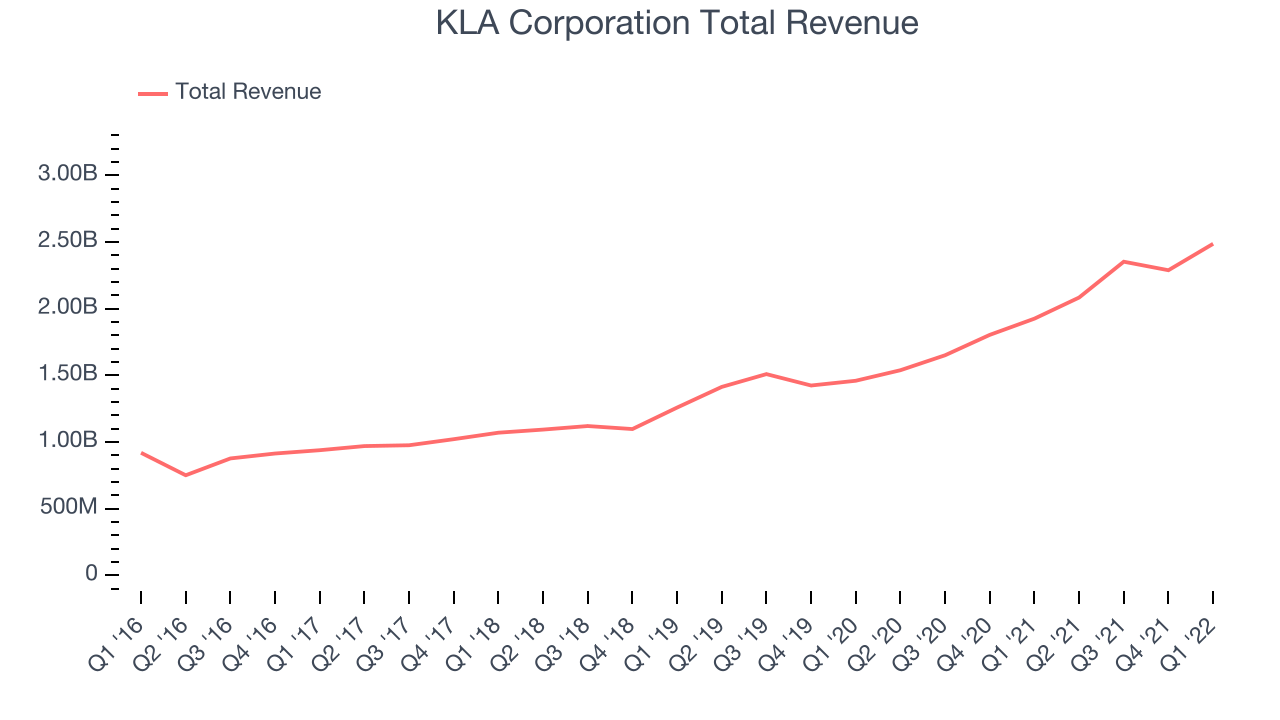

Best Q2: KLA Corporation (NASDAQ:KLAC)

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA Corporation reported revenues of $2.48 billion, up 29.1% year on year, beating analyst expectations by 2.7%. It was a very strong quarter for the company, with a significant improvement in operating margin and a beat on the bottom line.

The stock is down 15.6% since the results and currently trades at $312.25.

Is now the time to buy KLA Corporation? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.51 billion, up 40.9% year on year, in line with analyst expectations. Despite the strong top-line growth, it was a slower quarter for the company, with an underwhelming revenue guidance for the next quarter and a decline in operating margin.

Marvell Technology achieved the fastest revenue growth but had the weakest performance against analyst estimates in the group. The stock is down 19.2% since the results and currently trades at $44.54.

Read our full analysis of Marvell Technology's results here.

Applied Materials (NASDAQ:AMAT)

Founded in 1967 as the first company that built the tools for other companies to use to make semiconductors, Applied Materials (NASDAQ:AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $6.52 billion, up 5.22% year on year, beating analyst expectations by 4.02%. It was a mixed quarter for the company, with a beat on the bottom line but a slow revenue growth.

Applied Materials had the slowest revenue growth among the peers. The stock is down 20.6% since the results and currently trades at $85.95.

Read our full, actionable report on Applied Materials here, it's free.

The author has no position in any of the stocks mentioned