Finance and HR software company Workday (NASDAQ:WDAY) reported Q2 FY2023 results beating Wall St's expectations, with revenue up 21.8% year on year to $1.53 billion. Workday made a GAAP loss of $64.1 million, down on its profit of $105.7 million, in the same quarter last year.

Is now the time to buy Workday? Access our full analysis of the earnings results here, it's free.

Workday (WDAY) Q2 FY2023 Highlights:

- Revenue: $1.53 billion vs analyst estimates of $1.51 billion (1.11% beat)

- EPS (non-GAAP): $0.83 vs analyst estimates of $0.80 (3.11% beat)

- Free cash flow was negative $54.2 million, down from positive free cash flow of $380.9 million in previous quarter

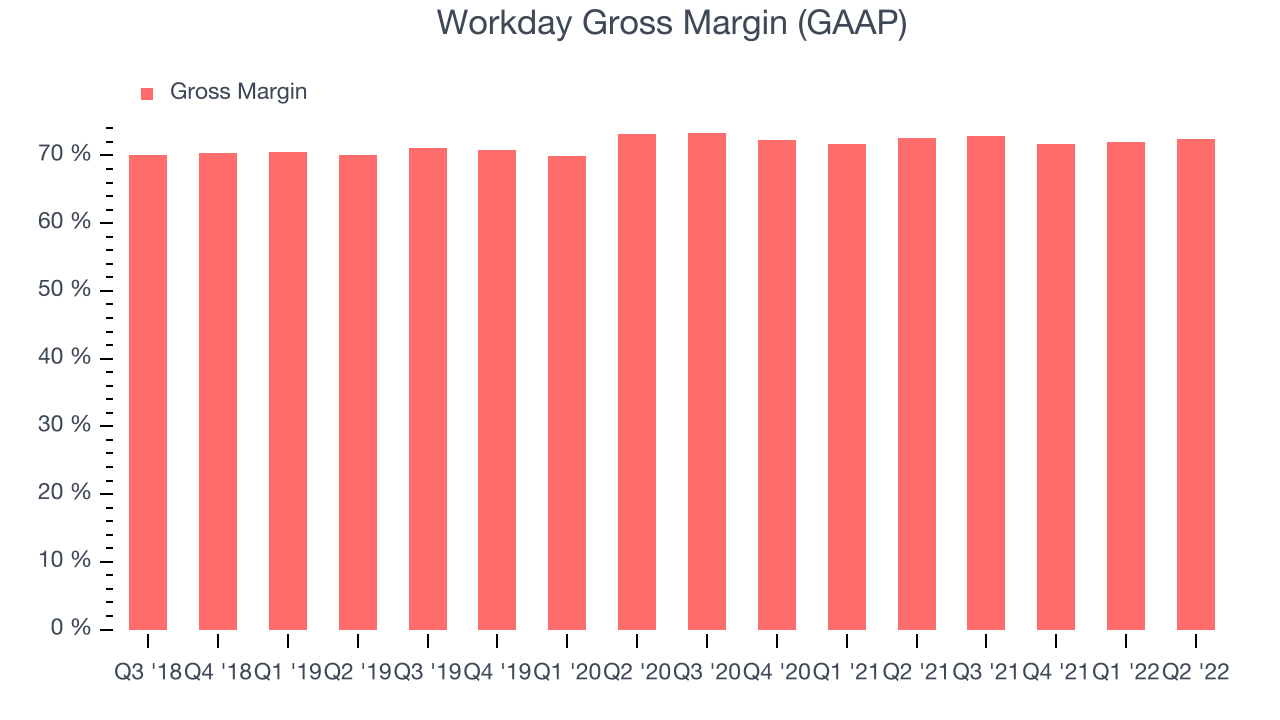

- Gross Margin (GAAP): 72.4%, in line with same quarter last year

"We continue to see a strong global demand for our products, underscoring how organizations are continuing to drive digital transformation across finance and HR to support the changing world of work," said Aneel Bhusri, co-founder, co-CEO, and chairman, Workday.

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

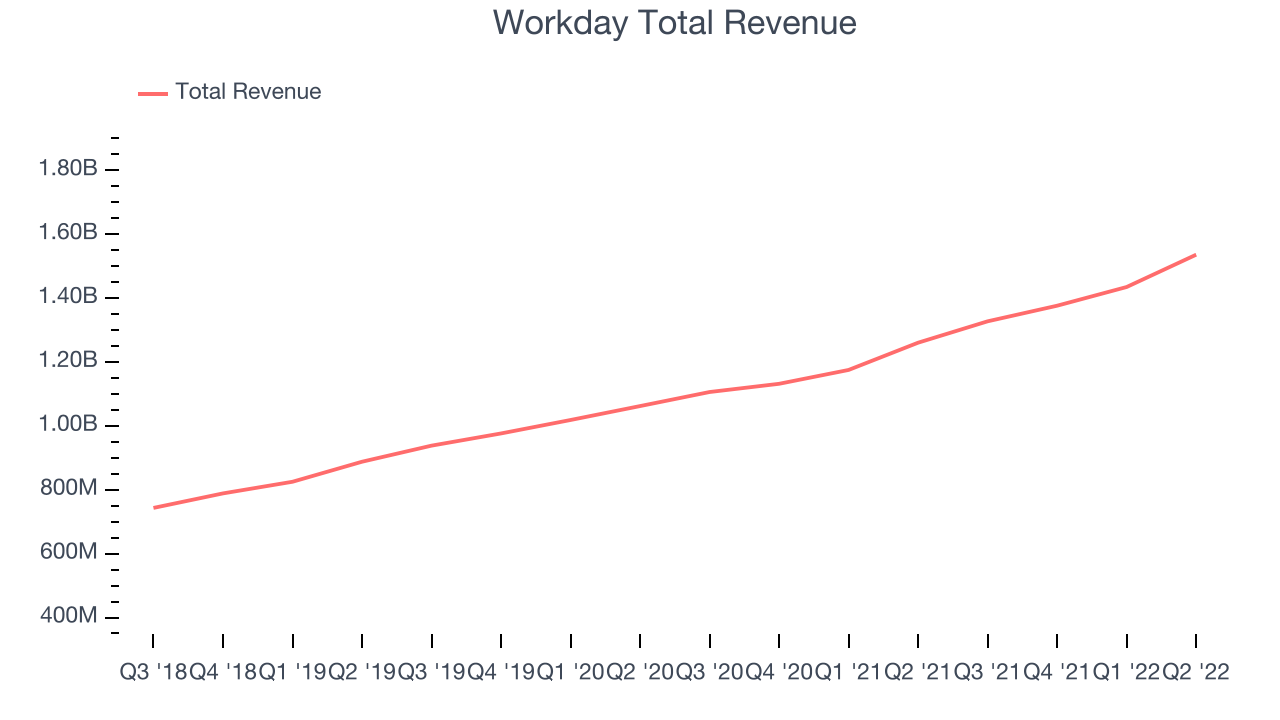

Sales Growth

As you can see below, Workday's revenue growth has been strong over the last year, growing from quarterly revenue of $1.26 billion, to $1.53 billion.

This quarter, Workday's quarterly revenue was once again up a very solid 21.8% year on year. On top of that, revenue increased $101.1 million quarter on quarter, a very strong improvement on the $58.5 million increase in Q1 2023, which shows re-acceleration of growth, and is great to see.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 19.4% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Workday's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 72.4% in Q2.

That means that for every $1 in revenue the company had $0.72 left to spend on developing new products, marketing & sales and the general administrative overhead. This is around the lower average of what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market so it is important to track.

Key Takeaways from Workday's Q2 Results

Sporting a market capitalization of $40.7 billion, more than $6.29 billion in cash and with positive free cash flow over the last twelve months, we're confident that Workday has the resources it needs to pursue a high growth business strategy.

Workday topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. Zooming out, we think this was a decent quarter, showing the company is staying on target. The company is up 8.38% on the results and currently trades at $176.03 per share.

Should you invest in Workday right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.