Video conferencing platform Zoom (NASDAQ:ZM) beat analyst expectations in Q2 FY2022 quarter, with revenue up 53.9% year on year to $1.02 billion. Zoom made a GAAP profit of $317 million, improving on its profit of $185.9 million, in the same quarter last year.

Is now the time to buy Zoom? Access our full analysis of the earnings results here, it's free.

Zoom (ZM) Q2 FY2022 Highlights:

- Revenue: $1.02 billion vs analyst estimates of $990.2 million (3.15% beat)

- EPS (non-GAAP): $1.36 vs analyst estimates of $1.16 (17.2% beat)

- Revenue guidance for Q3 2022 is $1.018 billion at the midpoint, above analyst estimates of $1.01 billion

- The company reconfirmed revenue guidance for the full year, at $4.01 billion at the midpoint

- Free cash flow of $455 million, roughly flat from previous quarter

- Net Revenue Retention Rate: 130%, in line with previous quarter

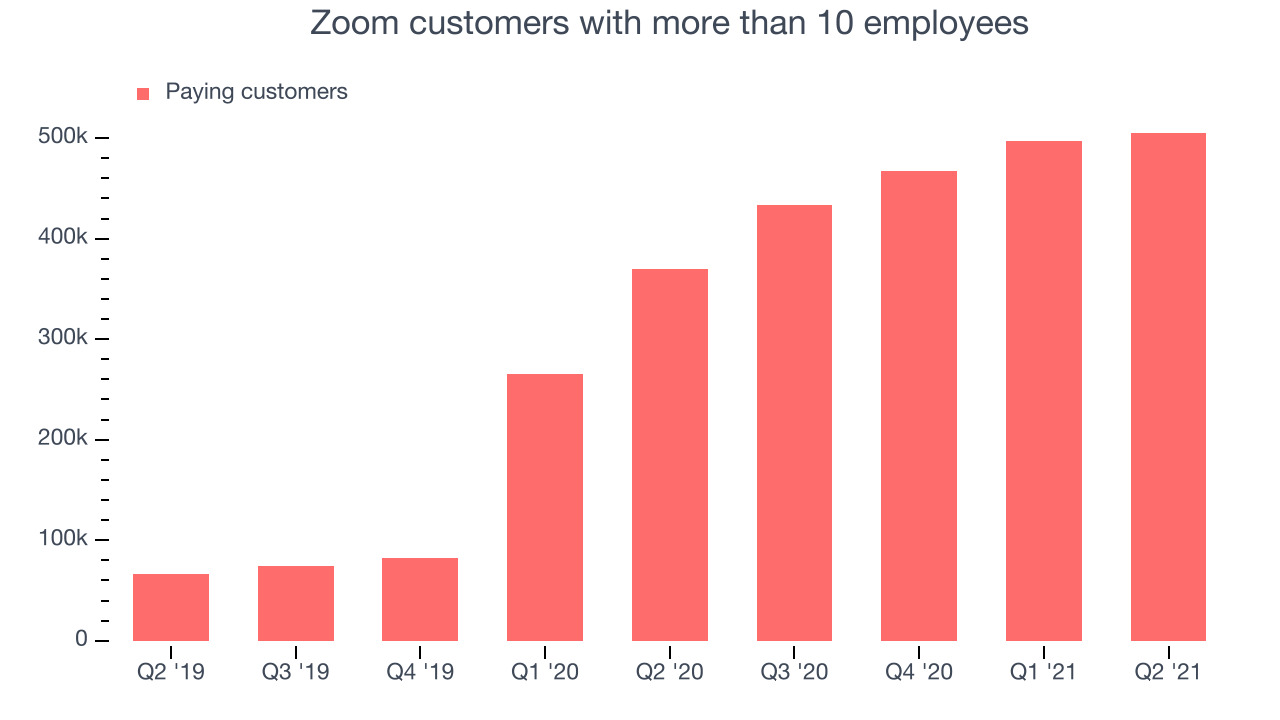

- Customers: 504,900 customers with more than 10 employees

- Gross Margin (GAAP): 74.4%, up from 72.2% previous quarter

“In Q2, we achieved our first billion dollar revenue quarter while delivering strong profitability and cash flow,” said Zoom founder and CEO, Eric S. Yuan.

Started in 2011 by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

It is likely that remote and hybrid models of work are here to stay and video conferencing tools are the clear beneficiaries of it.

Sales Growth

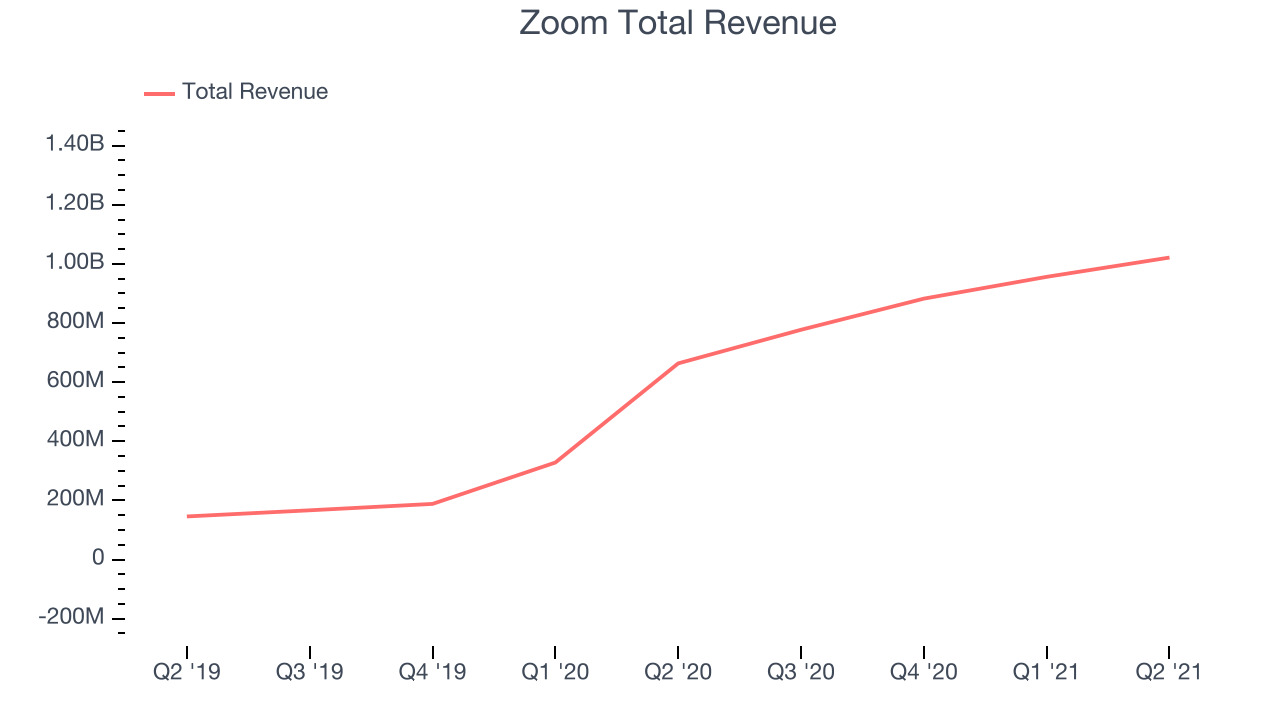

As you can see below, Zoom's revenue growth has been incredible over the last year, growing from quarterly revenue of $663.5 million, to $1.02 billion.

And while we saw even higher rates of growth previously, the revenue growth was still very strong; up a rather splendid 53.9% year on year. But the growth did slow down a little compared to last quarter, as Zoom increased revenue by $65.2 million in Q2, compared to $73.7 million revenue add in Q1 2022. So while the growth is overall still impressive, we will be keeping an eye on the slowdown.

Analysts covering the company are expecting the revenues to grow 19.5% over the next twelve months, although we would expect them to review their estimates once they get to read these results.

There are others doing even better than Zoom. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Large Customers Growth

You can see below that at the end of the quarter Zoom reported 504,900 enterprise customers with more than 10 employees, an increase of 7,900 on last quarter. That is a bit less contract wins than last quarter and also quite a bit below what we have typically seen over the past couple of quarters, suggesting that the sales momentum with large customers is slowing down.

Key Takeaways from Zoom's Q2 Results

With a market capitalization of $101 billion, more than $5.1 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We were impressed by the exceptional revenue growth Zoom delivered this quarter. And we were also glad to see the improvement in gross margin. On the other hand, it was unfortunate to see the slowdown in new contract wins. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. The company is down -5.05% on the results and currently trades at $329.95 per share.

Should you invest in Zoom right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.