Video conferencing platform Zoom (NASDAQ:ZM) reported Q4 FY2023 results that beat analyst expectations, with revenue up 4.33% year on year to $1.12 billion. However, guidance for the next quarter was less impressive, coming in at $1.08 billion at the midpoint, being 2.64% below analyst estimates. Zoom Video made a GAAP loss of $104.1 million, down on its profit of $490.6 million, in the same quarter last year.

Is now the time to buy Zoom Video? Access our full analysis of the earnings results here, it's free.

Zoom Video (ZM) Q4 FY2023 Highlights:

- Revenue: $1.12 billion vs analyst estimates of $1.1 billion (1.56% beat)

- EPS (non-GAAP): $1.22 vs analyst estimates of $0.82 (49.5% beat)

- Revenue guidance for Q1 2024 is $1.08 billion at the midpoint, below analyst estimates of $1.11 billion

- Management's revenue guidance for upcoming financial year 2024 is $4.45 billion at the midpoint, missing analyst estimates by 3.93% and predicting 1.18% growth (vs 7.28% in FY2023)

- Free cash flow of $183.3 million, down 32.8% from previous quarter

- Net Revenue Retention Rate: 115%, in line with previous quarter

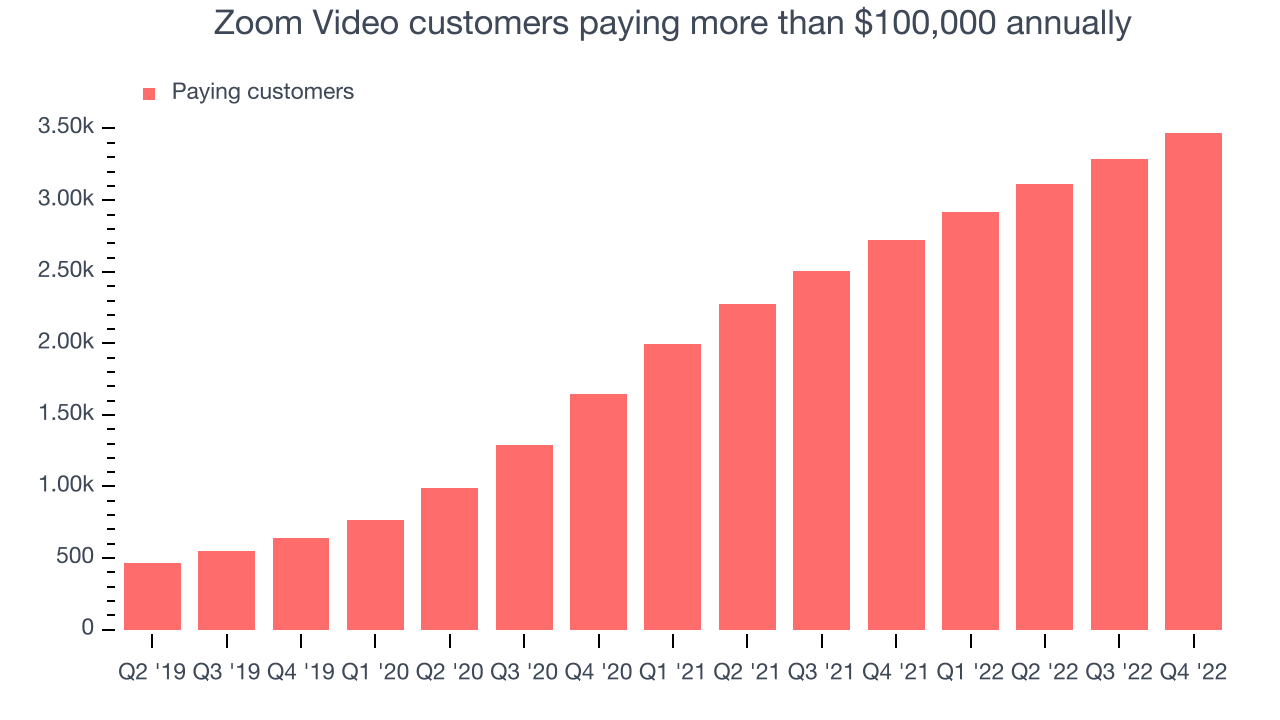

- Customers: 3,471 customers paying more than $100,000 annually

- Gross Margin (GAAP): 73.7%, down from 76% same quarter last year

“In fiscal year 2023, our growing base of Enterprise customers increasingly looked to Zoom to provide a seamless communication and collaboration platform, and drive productivity and efficiency during turbulent times,” said Zoom founder and CEO, Eric S. Yuan.

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

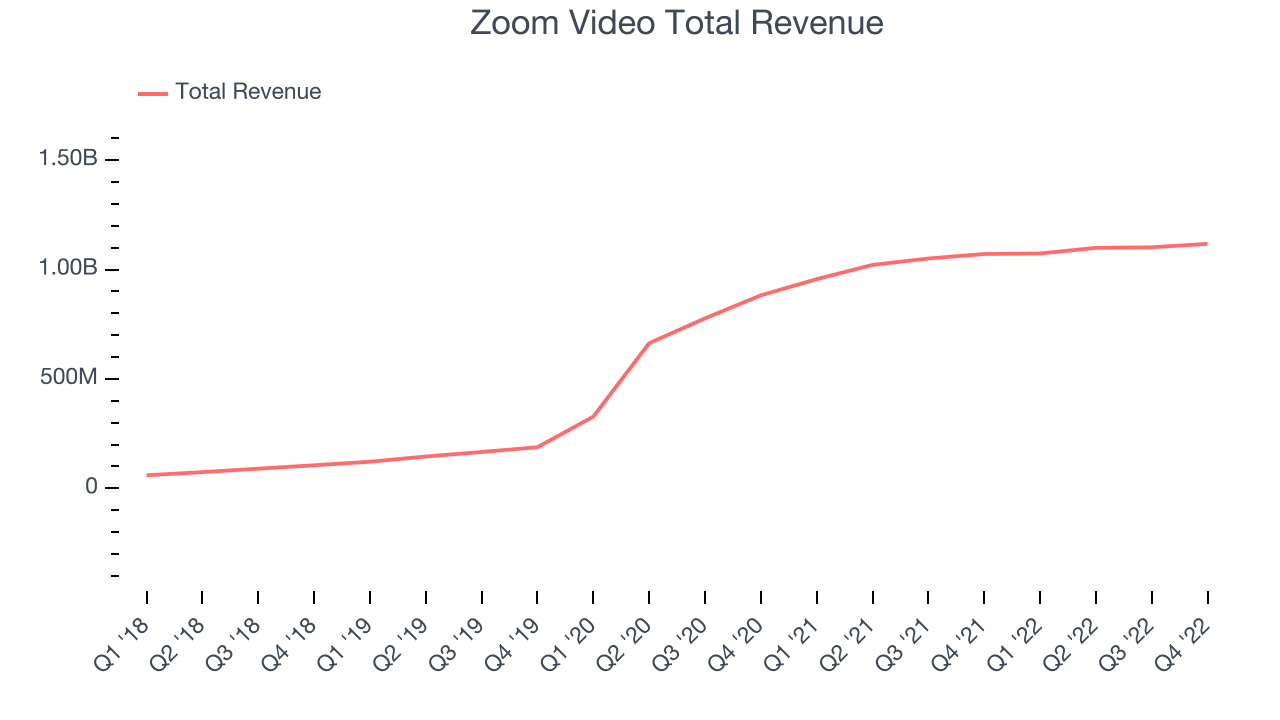

As you can see below, Zoom Video's revenue growth has been strong over the last two years, growing from quarterly revenue of $882.5 million in Q4 FY2021, to $1.12 billion.

Zoom Video's quarterly revenue was only up 4.33% year on year, which might disappoint some shareholders. We can see that the company increased revenue by $15.9 million quarter on quarter accelerating up on $2.44 million in Q3 2023.

Guidance for the next quarter indicates Zoom Video is expecting revenue to grow 0.81% year on year to $1.08 billion, slowing down from the 12.3% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $4.45 billion at the midpoint, staying almost flat and growing only 1.18% compared to 7.15% increase in FY2023.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Large Customers Growth

You can see below that at the end of the quarter Zoom Video reported 3,471 enterprise customers paying more than $100,000 annually, an increase of 185 on last quarter. That's in line with the number of contracts wins in the last quarter but quite a bit below what we have typically seen over the last year, suggesting that the sales slowdown we saw in the last quarter continues.

Key Takeaways from Zoom Video's Q4 Results

With a market capitalization of $21.6 billion, more than $5.41 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

Zoom Video topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. On the other hand, it was unfortunate to see that Zoom Video's revenue guidance for the full year missed analysts' expectations and indicates a significant slowdown in growth. Customer growth has also been slowing down. Overall, it seems to us that this was a mixed quarter for Zoom Video. The company is up 5.2% on the results and currently trades at $77.43 per share.

Zoom Video may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.