Bumble (BMBL)

Bumble doesn’t excite us. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Bumble Is Not Exciting

Started by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

- Sales are projected to tank by 13.8% over the next 12 months as demand evaporates

- Key performance metrics have been flashing red recently as its average revenue per buyer dropped by 35.7% annually while engagement was weak

- On the bright side, its disciplined cost controls and effective management have materialized in a strong EBITDA margin, and its profits increased over the last few years as it scaled

Bumble fails to meet our quality criteria. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Bumble

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bumble

Bumble’s stock price of $3.04 implies a valuation ratio of 3.1x forward EV/EBITDA. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Bumble (BMBL) Research Report: Q3 CY2025 Update

Online dating app Bumble (NASDAQ:BMBL) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 10% year on year to $246.2 million. On the other hand, next quarter’s revenue guidance of $220 million was less impressive, coming in 5.6% below analysts’ estimates. Its GAAP profit of $0.33 per share was in line with analysts’ consensus estimates.

Bumble (BMBL) Q3 CY2025 Highlights:

- Revenue: $246.2 million vs analyst estimates of $245.1 million (10% year-on-year decline, in line)

- EPS (GAAP): $0.33 vs analyst estimates of $0.33 (in line)

- Adjusted EBITDA: $83.07 million vs analyst estimates of $81.07 million (33.7% margin, 2.5% beat)

- Revenue Guidance for Q4 CY2025 is $220 million at the midpoint, below analyst estimates of $233 million

- EBITDA guidance for Q4 CY2025 is $63 million at the midpoint, below analyst estimates of $74.62 million

- Operating Margin: 25.9%, up from -306% in the same quarter last year

- Free Cash Flow Margin: 30%, up from 27.3% in the previous quarter

- Paying Users: 3.57 million, down 680,600 year on year

- Market Capitalization: $591.3 million

Company Overview

Started by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

Online dating apps have disrupted the more traditional ways that people meet romantic partners, by greatly expanding the pool of potential dating partners, allowing people to more readily find those with shared common interests. Today, approximately 40% of couples now meet Online in the U.S., up from 20% in the early-2000s.

Bumble operates two dating apps – Bumble and Badoo. The Badoo app, founded by Andrey Andreev and launched in 2006, differentiates itself by its mantra of “Date Honestly” which is meant to be a mix of both dating app and social discovery app, where one can meet friends with similar interests. It is the market leader in Europe and Latin America.

Bumble launched in 2014, with the innovation of giving women the authority to make the first move under the premise that women would feel more confident and empowered, resulting in higher engagement than on other dating apps. As a result, within North America, Bumble has more female users for every male user than any other dating app, an indication of how well the product resonates with its users. Along the lines of being women-centric, Bumble was one of the first major dating apps to launch automated photo verification (ensuring matches are real people), develop in-app video chat, use machine learning to blur lewd images, and ban obscene images, all with the intention of improving the comfort level of meeting in person. Bumble has also added other mental health resources like a crisis support line, suicide prevention lifeline, and stress management tutorials, all of which bolster its reputation of being a safer, kinder, and more accountable dating app experience. The app itself is simple and works similarly to Tinder, profiles of potential matches are displayed to users, who can "swipe left" to reject a candidate or "swipe right" to indicate interest.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Bumble (NASDAQ:BMBL)’s online dating peers include direct rivals Match Group (NASDAQ:MTCH) and Spark Networks (NYSE:LOV), along with social networks like Snapchat (NYSE:SNAP) and Meta Platforms (NASDAQ:FB).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Bumble’s sales grew at a sluggish 4.9% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Bumble reported a rather uninspiring 10% year-on-year revenue decline to $246.2 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 15.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 8.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Paying Users

Buyer Growth

As a subscription-based app, Bumble generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Bumble’s paying users, a key performance metric for the company, increased by 4.8% annually to 3.57 million in the latest quarter. This growth rate lags behind the hottest consumer internet applications. If Bumble wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

Unfortunately, Bumble’s paying users decreased by 680,600 in Q3, a 16% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much the average buyer spends. ARPB is also a key indicator of how valuable its buyers are (and can be over time).

Bumble’s ARPB fell over the last two years, averaging 3.9% annual declines. This isn’t great when combined with its weaker paying users performance. If Bumble tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyer growth would be sustainable.

This quarter, Bumble’s ARPB clocked in at $22.64. It grew by 6.9% year on year, faster than its paying users.

7. Gross Margin & Pricing Power

For internet subscription businesses like Bumble, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Bumble has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 70.6% gross margin over the last two years. Said differently, roughly $70.56 was left to spend on selling, marketing, and R&D for every $100 in revenue.

This quarter, Bumble’s gross profit margin was 71.9%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. User Acquisition Efficiency

Consumer internet businesses like Bumble grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Bumble is very efficient at acquiring new users, spending only 26.6% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Bumble the freedom to invest its resources into new growth initiatives while maintaining optionality.

9. EBITDA

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Bumble has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 29.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Bumble’s EBITDA margin rose by 5.9 percentage points over the last few years, as its sales growth gave it operating leverage.

In Q3, Bumble generated an EBITDA margin profit margin of 33.7%, up 3.6 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Bumble reported EPS of $0.33, up from negative $5.11 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Bumble’s full-year EPS of negative $1.91 will flip to positive $1.09.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Bumble has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 17.1% over the last two years, quite impressive for a consumer internet business.

Bumble’s free cash flow clocked in at $73.79 million in Q3, equivalent to a 30% margin. The company’s cash profitability regressed as it was 3.6 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

12. Balance Sheet Assessment

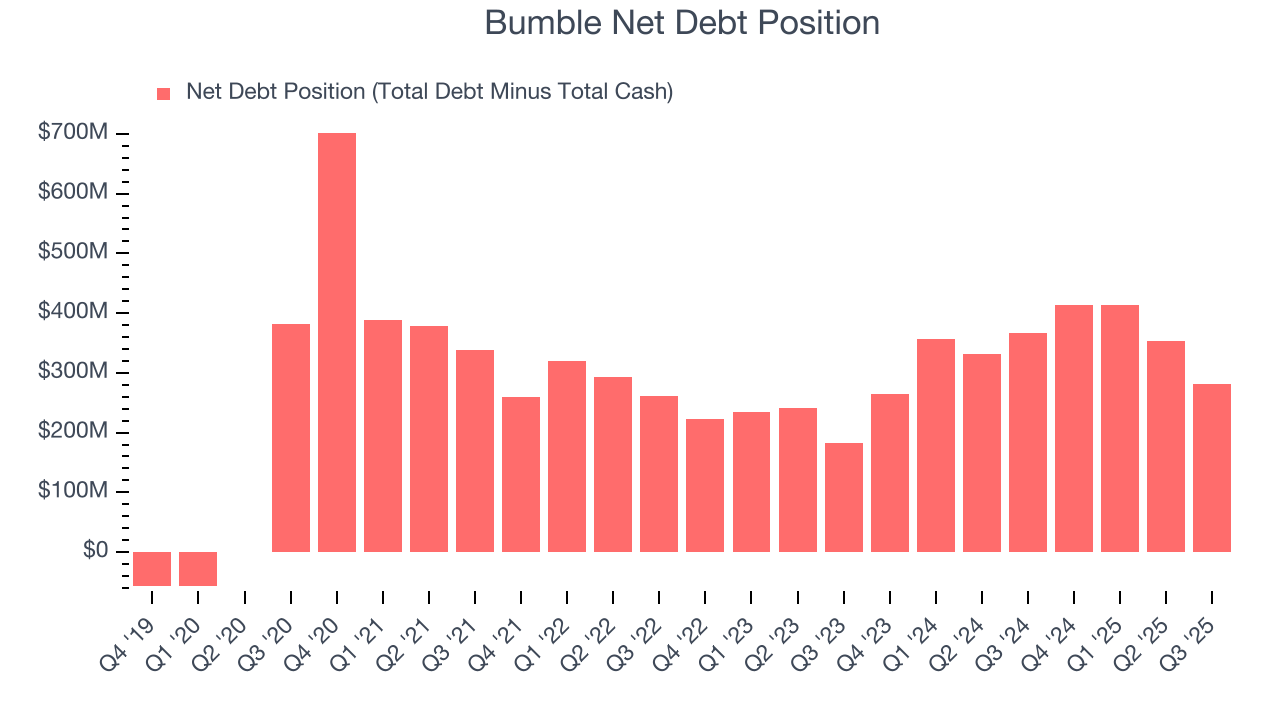

Bumble reported $307.9 million of cash and $589.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $314.6 million of EBITDA over the last 12 months, we view Bumble’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $43.16 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Bumble’s Q3 Results

It was encouraging to see Bumble beat analysts’ EBITDA expectations this quarter. On the other hand, its number of buyers declined and its number of paying users fell short of Wall Street’s estimates. Looking ahead, Q4 guidance for both revenue and EBITDA came in below expectations. Overall, this was a softer quarter. The stock traded down 7.8% to $4.99 immediately following the results.

14. Is Now The Time To Buy Bumble?

Updated: March 8, 2026 at 10:19 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Bumble.

Bumble isn’t a terrible business, but it isn’t one of our picks. For starters, its revenue growth was weak over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its impressive EBITDA margins show it has a highly efficient business model, the downside is its ARPU has declined over the last two years. On top of that, its growth in active buyers has been slower.

Bumble’s EV/EBITDA ratio based on the next 12 months is 3.1x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $4.53 on the company (compared to the current share price of $3.04).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.