Sabre (SABR)

Sabre is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sabre Will Underperform

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

- Lackluster 15.7% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

- 7× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Sabre is in the doghouse. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Sabre

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sabre

At $1.56 per share, Sabre trades at 7x forward EV-to-EBITDA. The current valuation may be appropriate, but we’re still not buyers of the stock.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Sabre (SABR) Research Report: Q4 CY2025 Update

Travel technology company Sabre (NASDAQ:SABR) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 3.4% year on year to $666.5 million. Its non-GAAP loss of $0.01 per share was 80% above analysts’ consensus estimates.

Sabre (SABR) Q4 CY2025 Highlights:

- Revenue: $666.5 million vs analyst estimates of $651.8 million (3.4% year-on-year growth, 2.3% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.05 (80% beat)

- Adjusted EBITDA: $110.5 million vs analyst estimates of $113.2 million (16.6% margin, 2.4% miss)

- EBITDA guidance for the upcoming financial year 2026 is $585 million at the midpoint, in line with analyst expectations

- Operating Margin: 3.2%, down from 8.9% in the same quarter last year

- Free Cash Flow Margin: 17.4%, up from 10.3% in the same quarter last year

- Total Bookings: 83.47 million, up 2.49 million year on year

- Market Capitalization: $370.6 million

Company Overview

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre serves a wide range of customers, including airlines, hotels, travel agencies, and other travel companies. As such, it operates through three main business segments: Travel Network, Airline Solutions, and Hospitality Solutions.

Sabre's largest segment, Travel Network, operates one of the largest electronic travel marketplaces. This marketplace enables travel agents, online travel agencies (OTAs), and corporate travel departments to search, price, book, and manage travel services provided by airlines, hotels, car rental companies, rail providers, cruise lines, and tour operators.

The Airline Solutions segment provides a comprehensive suite of software and services for airlines globally. This includes systems for reservations, inventory, and departure control, as well as data-driven solutions for pricing, revenue management, flight scheduling, and customer experience management.

Sabre's Hospitality Solutions segment offers technology solutions to hoteliers and other accommodation providers. Services provided include central reservation systems, property management systems, and marketing and consulting services. These tools help hoteliers optimize distribution and improve operational efficiency, revenue management, and the overall guest experience.

4. Consumer Discretionary - Travel and Vacation Providers

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Travel and vacation providers operate tour packages, cruise lines, online travel agencies, and vacation rental platforms, connecting consumers with leisure and business travel experiences. Tailwinds include robust post-pandemic travel demand, a consumer preference shift toward experiences over goods, and technology-enabled personalization improving conversion and loyalty. However, headwinds are significant: the industry is acutely sensitive to macroeconomic cycles, geopolitical instability, and fuel price volatility. Low switching costs mean fierce price competition, while capacity additions in segments like cruises can lead to oversupply. Regulatory burdens, weather disruptions, and public health risks further create episodic but potentially severe demand shocks.

Sabre’s primary competitors include Amadeus IT (AMS:AMS), Expedia (NASDAQ:EXPE), Booking Holdings (NASDAQ:BKNG), Trip.com (NASDAQ:TCOM), and private company Travelport.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Sabre grew its sales at a 16.4% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Sabre’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually.

We can dig further into the company’s revenue dynamics by analyzing its number of total bookings, which reached 83.47 million in the latest quarter. Over the last two years, Sabre’s total bookings grew massively as COVID impacted its base year numbers.

This quarter, Sabre reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

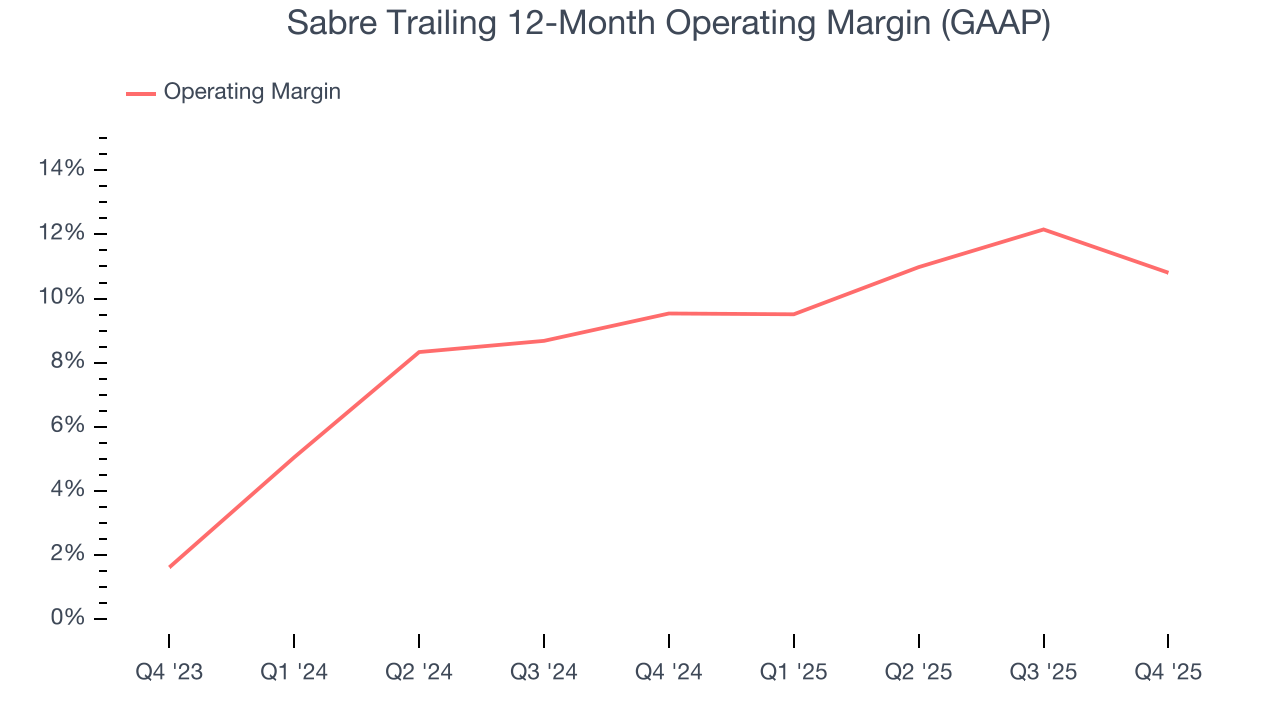

Sabre’s operating margin has risen over the last 12 months and averaged 10.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Sabre generated an operating margin profit margin of 3.2%, down 5.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

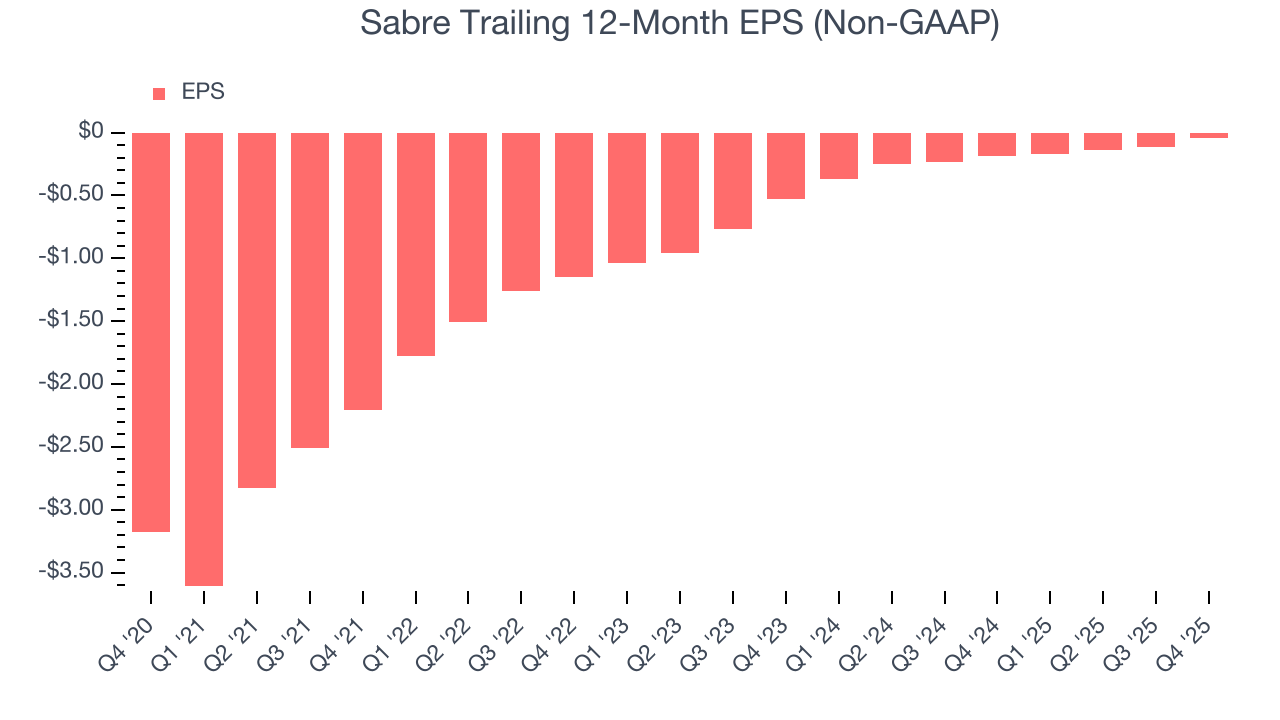

Although Sabre’s full-year earnings are still negative, it reduced its losses and improved its EPS by 58% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Sabre reported adjusted EPS of negative $0.01, up from negative $0.08 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Sabre’s full-year EPS of negative $0.04 will flip to positive $0.13.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Sabre posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Sabre’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 4%, meaning it lit $4.05 of cash on fire for every $100 in revenue.

Sabre’s free cash flow clocked in at $115.8 million in Q4, equivalent to a 17.4% margin. This result was good as its margin was 7 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Sabre’s five-year average ROIC was negative 0.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Sabre’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Sabre’s $4.35 billion of debt exceeds the $910.1 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $504.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Sabre could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Sabre can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Sabre’s Q4 Results

It was good to see Sabre beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The stock traded up 12.8% to $1.08 immediately following the results.

12. Is Now The Time To Buy Sabre?

Updated: March 7, 2026 at 9:04 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Sabre, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies serving everyday consumers, but in the case of Sabre, we’ll be cheering from the sidelines. While its number of central reservation system transactions has surged over the last two years, the downside is its projected EPS for the next year is lacking. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Sabre’s EV-to-EBITDA ratio based on the next 12 months is 7x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $2.00 on the company (compared to the current share price of $1.56).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.