Target Hospitality (TH)

We wouldn’t recommend Target Hospitality. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Target Hospitality Will Underperform

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

- Lackluster 4.7% annual revenue growth over the last five years indicates the company is losing ground to competitors

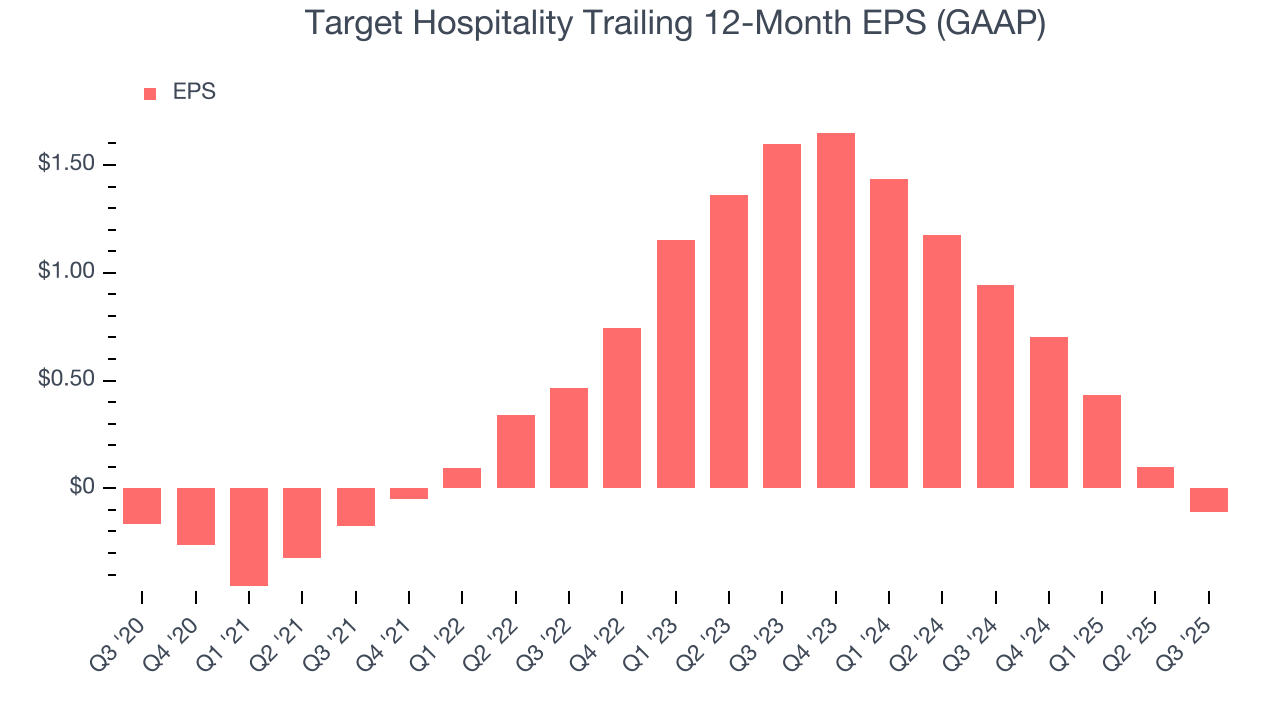

- Earnings per share lagged its peers over the last five years as they only grew by 10.1% annually

- Projected sales decline of 6.2% over the next 12 months indicates demand will continue deteriorating

Target Hospitality doesn’t fulfill our quality requirements. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Target Hospitality

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Target Hospitality

Target Hospitality’s stock price of $7.80 implies a valuation ratio of 15.8x forward EV-to-EBITDA. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Target Hospitality (TH) Research Report: Q3 CY2025 Update

Workforce housing company Target Hospitality (NASDAQ:TH) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 4.4% year on year to $99.36 million. The company expects the full year’s revenue to be around $315 million, close to analysts’ estimates. Its GAAP loss of $0.01 per share was $0.03 above analysts’ consensus estimates.

Target Hospitality (TH) Q3 CY2025 Highlights:

- Revenue: $99.36 million vs analyst estimates of $85.3 million (4.4% year-on-year growth, 16.5% beat)

- EPS (GAAP): -$0.01 vs analyst estimates of -$0.04 ($0.03 beat)

- Adjusted EBITDA: $21.55 million vs analyst estimates of $15.83 million (21.7% margin, 36.1% beat)

- The company reconfirmed its revenue guidance for the full year of $315 million at the midpoint

- EBITDA guidance for the full year is $55 million at the midpoint, below analyst estimates of $57.77 million

- Operating Margin: 0.1%, down from 29.4% in the same quarter last year

- Free Cash Flow Margin: 71.1%, up from 24.9% in the same quarter last year

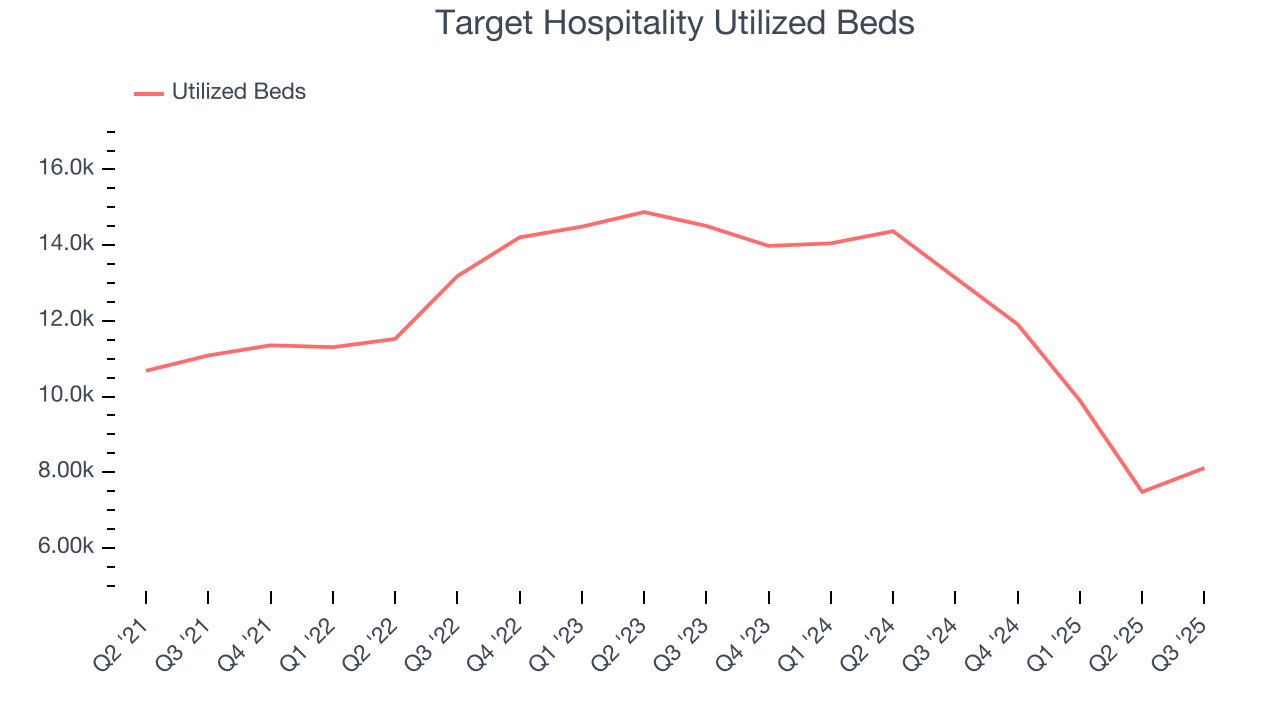

- Utilized Beds: 8,112, down 5,026 year on year

- Market Capitalization: $770.3 million

Company Overview

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

The company creates and manages "man camps" or workforce housing communities, which provide temporary accommodations for workers in remote or underserved areas. Its main customers are energy companies, and its facilities are typically located in or near shale plays (areas with petroleum and natural gas components) and other industrial projects across North America, particularly in the Permian Basin, the most prolific oil-producing area in the United States.

Target Hospitality also offers a comprehensive suite of hospitality services, including catering, housekeeping, laundry, security, and recreational facilities, ensuring a comfortable and productive living environment. This holistic approach to workforce housing solutions is a key differentiator for Target Hospitality, allowing it to meet its clients' complex needs.

The company mostly develops and operates its own properties, occasionally enlisting third parties to help run its locations. This hybrid approach allows Target Hospitality to scale rapidly and provide flexible solutions. Its accommodation solutions range from single-occupancy rooms to larger communal living facilities, all designed with a focus on safety, comfort, and efficiency.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Target Hospitality's primary competitors include Civeo (NYSE:CVEO), Black Diamond Group (TSX:BDI), ATCO (TSX:ACO.X), ProPetro Holding (NYSE:PUMP), and Halliburton (NYSE:HAL).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Target Hospitality’s 4.7% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the consumer discretionary sector, but there are still things to like about Target Hospitality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Target Hospitality’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 27% annually.

We can better understand the company’s revenue dynamics by analyzing its number of utilized beds, which reached 8,112 in the latest quarter. Over the last two years, Target Hospitality’s utilized beds averaged 18.5% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Target Hospitality reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 16.5%.

Looking ahead, sell-side analysts expect revenue to decline by 5.7% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties. At least Target Hospitality is tracking well in other measures of financial health.

6. Operating Margin

Target Hospitality’s operating margin has been trending down over the last 12 months, but it still averaged 18.4% over the last two years, top-notch for a consumer discretionary business. This shows it’s an efficient company that manages its expenses effectively.

This quarter, Target Hospitality’s breakeven margin was down 29.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Target Hospitality’s full-year earnings are still negative, it reduced its losses and improved its EPS by 7.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, Target Hospitality reported EPS of negative $0.01, down from $0.20 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Target Hospitality has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 28.9% over the last two years.

Target Hospitality’s free cash flow clocked in at $70.61 million in Q3, equivalent to a 71.1% margin. This result was good as its margin was 46.2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Target Hospitality’s five-year average ROIC was 21%, beating other consumer discretionary companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Target Hospitality’s ROIC averaged 3.1 percentage point decreases each year. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Target Hospitality is a profitable, well-capitalized company with $30.39 million of cash and no debt. This position is 3.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Target Hospitality’s Q3 Results

It was good to see Target Hospitality beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EBITDA guidance missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.6% to $8 immediately after reporting.

12. Is Now The Time To Buy Target Hospitality?

Updated: February 27, 2026 at 10:20 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Target Hospitality.

Target Hospitality falls short of our quality standards. On top of that, Target Hospitality’s number of utilized beds has disappointed, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Target Hospitality’s EV-to-EBITDA ratio based on the next 12 months is 15.8x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $10.50 on the company (compared to the current share price of $7.80).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.