Interface (TILE)

We’re cautious of Interface. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Interface Is Not Exciting

Pioneering carbon-neutral flooring since its founding in 1973, Interface (NASDAQ:TILE) is a global manufacturer of modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring that specializes in carbon-neutral and sustainable flooring solutions.

- Sales trends were unexciting over the last five years as its 3.3% annual growth was below the typical business services company

- Earnings per share lagged its peers over the last five years as they only grew by 6.2% annually

- One positive is that its free cash flow margin of 6.5% over the last five years means it can fund investments internally, mitigating its dependence on capital markets, and its improved cash conversion implies it’s becoming a less capital-intensive business

Interface’s quality doesn’t meet our expectations. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Interface

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Interface

At $32.55 per share, Interface trades at 16.6x forward P/E. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Interface (TILE) Research Report: Q3 CY2025 Update

Modular flooring manufacturer Interface (NASDAQ:TILE) announced better-than-expected revenue in Q3 CY2025, with sales up 5.9% year on year to $364.5 million. The company expects the full year’s revenue to be around $1.38 billion, close to analysts’ estimates. Its non-GAAP profit of $0.61 per share was 27.1% above analysts’ consensus estimates.

Interface (TILE) Q3 CY2025 Highlights:

- Revenue: $364.5 million vs analyst estimates of $357.3 million (5.9% year-on-year growth, 2% beat)

- Adjusted EPS: $0.61 vs analyst estimates of $0.48 (27.1% beat)

- Adjusted EBITDA: $66.2 million vs analyst estimates of $55.22 million (18.2% margin, 19.9% beat)

- The company slightly lifted its revenue guidance for the full year to $1.38 billion at the midpoint from $1.38 billion

- Operating Margin: 14.6%, up from 12.3% in the same quarter last year

- Free Cash Flow Margin: 18.1%, down from 20.3% in the same quarter last year

- Market Capitalization: $1.56 billion

Company Overview

Pioneering carbon-neutral flooring since its founding in 1973, Interface (NASDAQ:TILE) is a global manufacturer of modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring that specializes in carbon-neutral and sustainable flooring solutions.

Interface's product portfolio spans three main categories: modular carpet tiles (sold under the Interface and FLOR brands), luxury vinyl tile, and rubber flooring (marketed under the noraplan and norament brands acquired from nora in 2018). The company has developed innovative backing technologies like CQuest, which incorporates bio-based materials and recycled content to create products that are net carbon negative when measured on a standalone basis.

The company serves diverse commercial markets including corporate offices, healthcare facilities, educational institutions, hospitality venues, and retail spaces, as well as residential customers. For example, a hospital might choose Interface's antimicrobial carpet tiles for patient rooms and corridors, while using its durable rubber flooring in operating rooms where chemical resistance is crucial.

Interface generates revenue through two primary channels: direct sales to end users and indirect sales through contractors, installers, and distributors. The company's business model emphasizes customization, with a significant portion of sales being made-to-order products designed to customer specifications. Interface's manufacturing capabilities allow it to produce custom samples in less than five days, giving it a competitive edge in securing projects.

The company operates through two geographical segments: Americas (including the United States, Canada, and Latin America) and EAAA (Europe, Africa, Asia, and Australia). Interface maintains showrooms and design studios across the globe to support its international marketing efforts and showcase its products to architects, designers, and end users.

4. Office & Commercial Furniture

The sector faces a tepid outlook as workplace dynamics continue to evolve. Hybrid work means that enterprise demand for office furniture is lower. Consumer demand for the same products likely will not offset the loss from enterprises, as individual workers tend to have less space and need for the sector's wares. The Trump administration also possesses a high willingness to impose tariffs on key partners, which could result in retaliatory actions, all of which could pressure those selling furniture that may feature components or labor from overseas. Lastly, the COVID-19 pandemic showed that there is always a risk that something disrupts supply chains, and companies need contingency plans for this.

Interface competes with major flooring manufacturers including Mohawk Industries (NYSE:MHK), Shaw Industries (a subsidiary of Berkshire Hathaway, NYSE:BRK.A), Tarkett (EPA:TKTT), Armstrong Flooring, and Milliken & Company (privately held).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.37 billion in revenue over the past 12 months, Interface is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

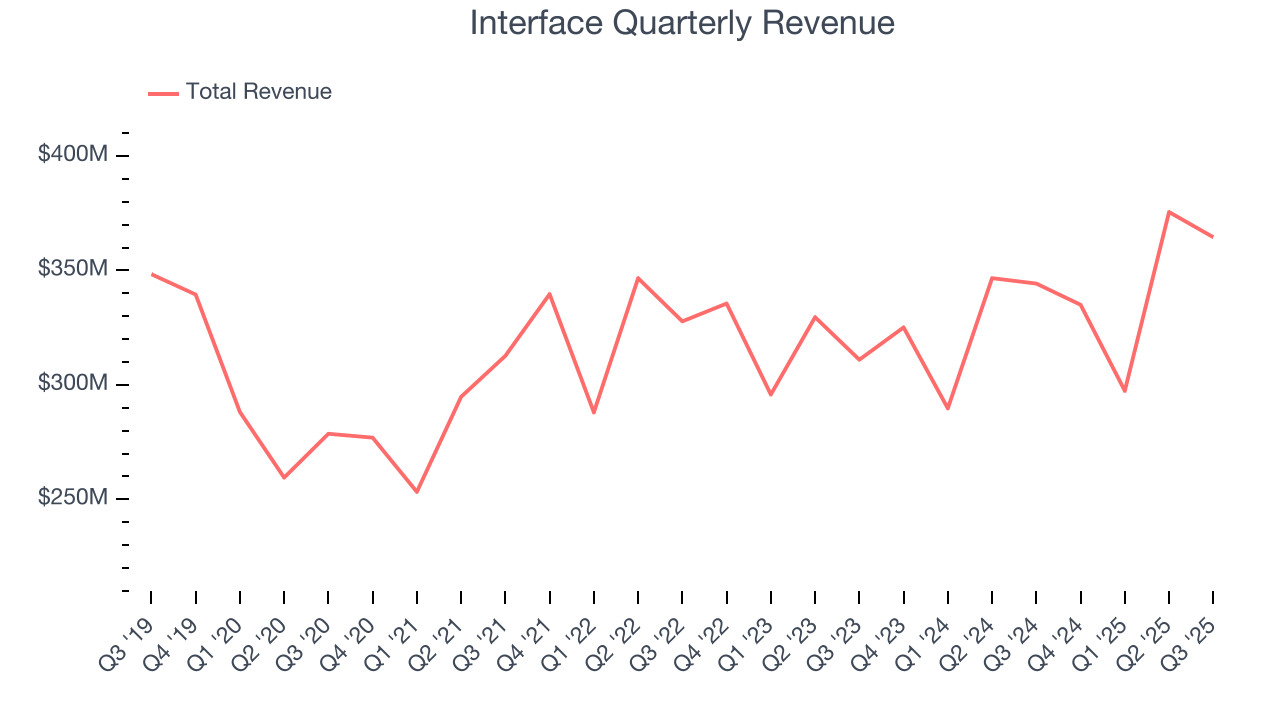

As you can see below, Interface’s sales grew at a tepid 3.3% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Interface’s annualized revenue growth of 3.9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Interface reported year-on-year revenue growth of 5.9%, and its $364.5 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

6. Operating Margin

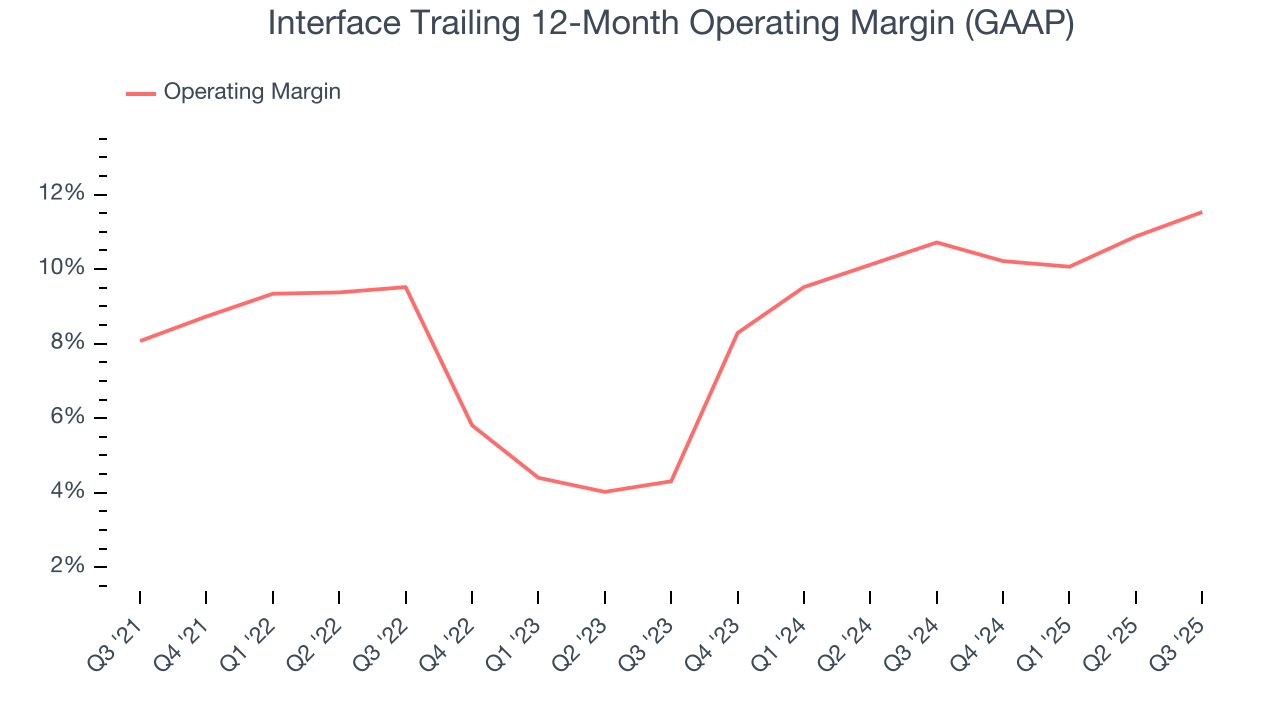

Interface was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.9% was weak for a business services business.

On the plus side, Interface’s operating margin rose by 3.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Interface generated an operating margin profit margin of 14.6%, up 2.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

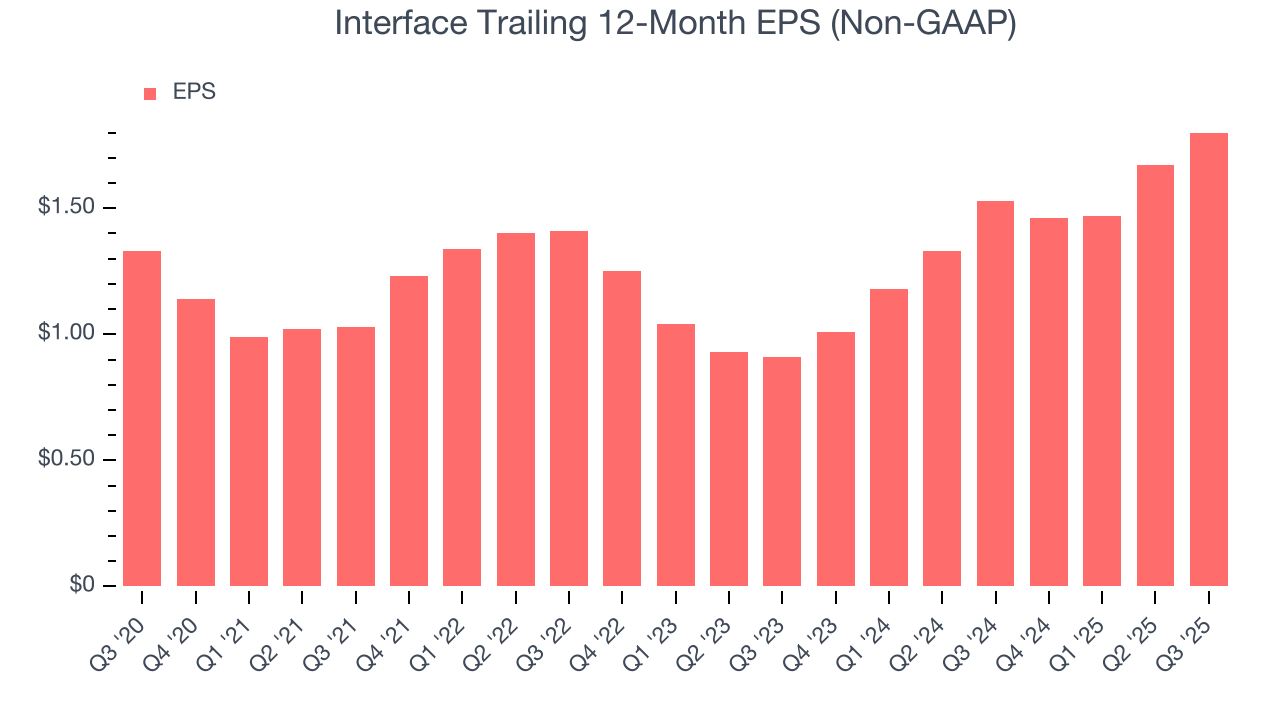

Interface’s EPS grew at an unimpressive 6.2% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Interface’s earnings can give us a better understanding of its performance. As we mentioned earlier, Interface’s operating margin expanded by 3.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Interface, its two-year annual EPS growth of 40.6% was higher than its five-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q3, Interface reported adjusted EPS of $0.61, up from $0.48 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

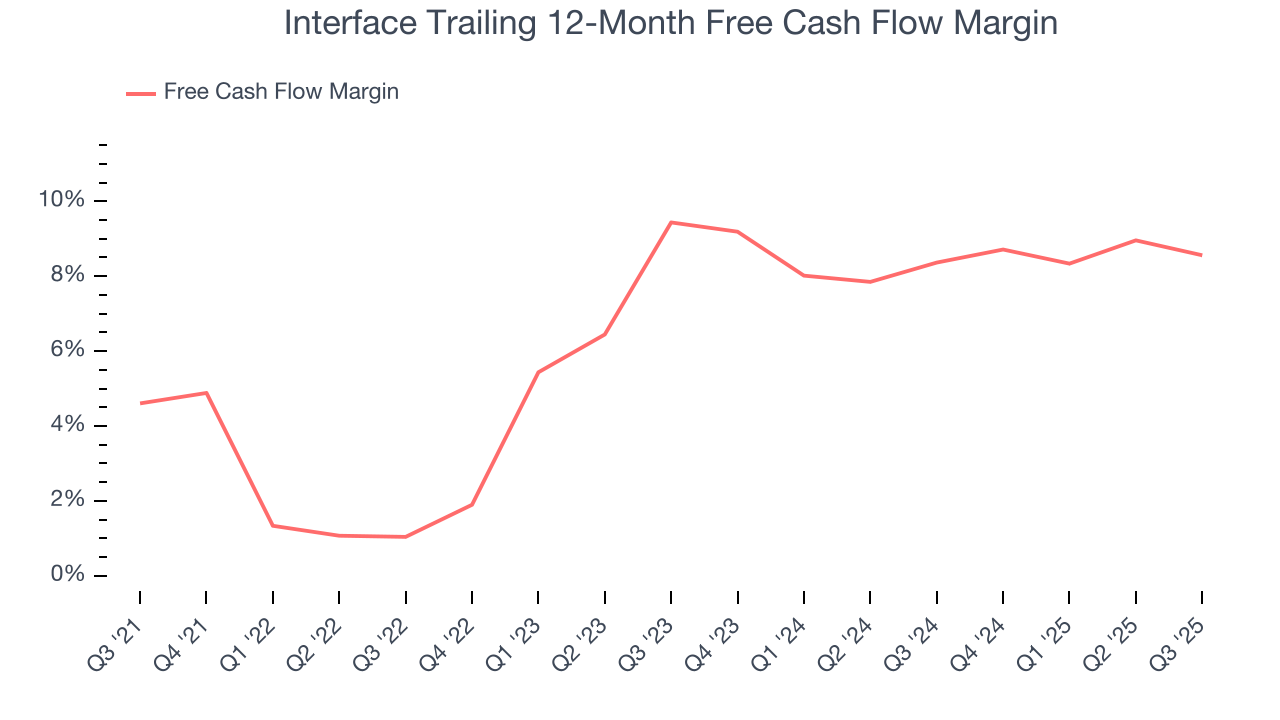

Interface has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.5% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Interface’s margin expanded by 4 percentage points during that time. This is encouraging because it gives the company more optionality.

Interface’s free cash flow clocked in at $66.07 million in Q3, equivalent to a 18.1% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

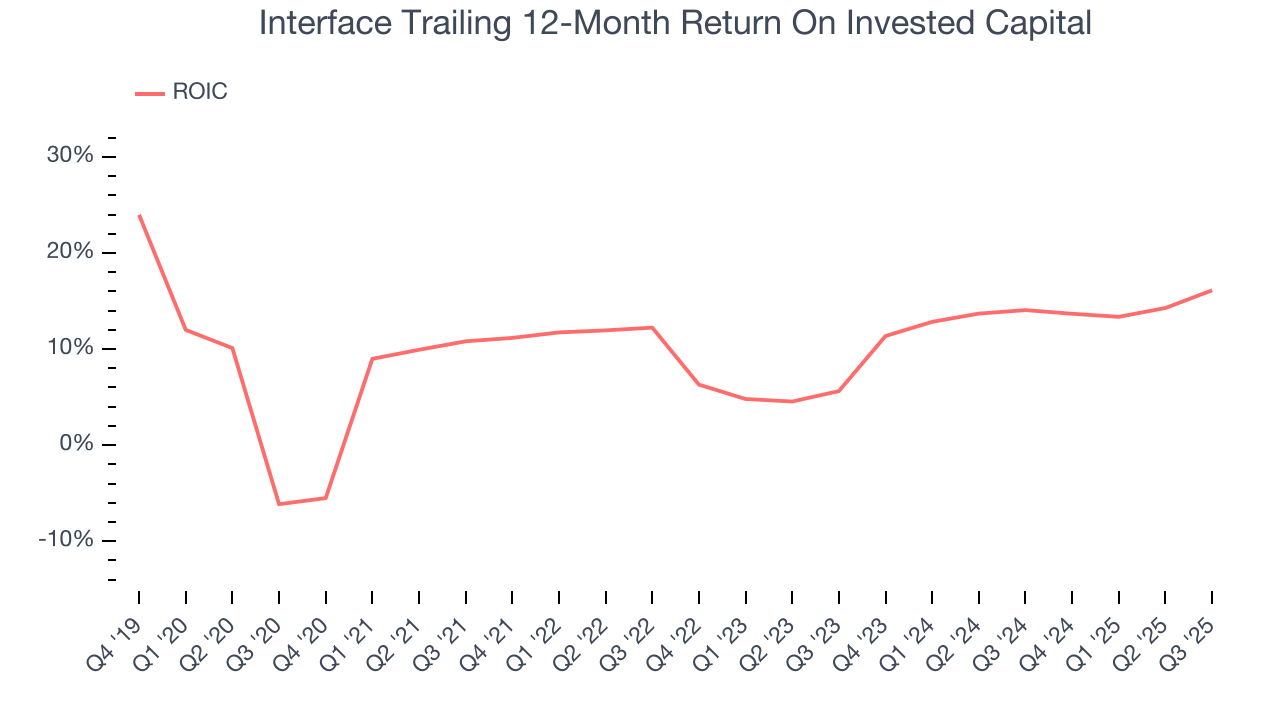

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Interface historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.8%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Interface’s ROIC averaged 3.6 percentage point increases over the last few years. This is a good sign, and we hope the company can continue improving.

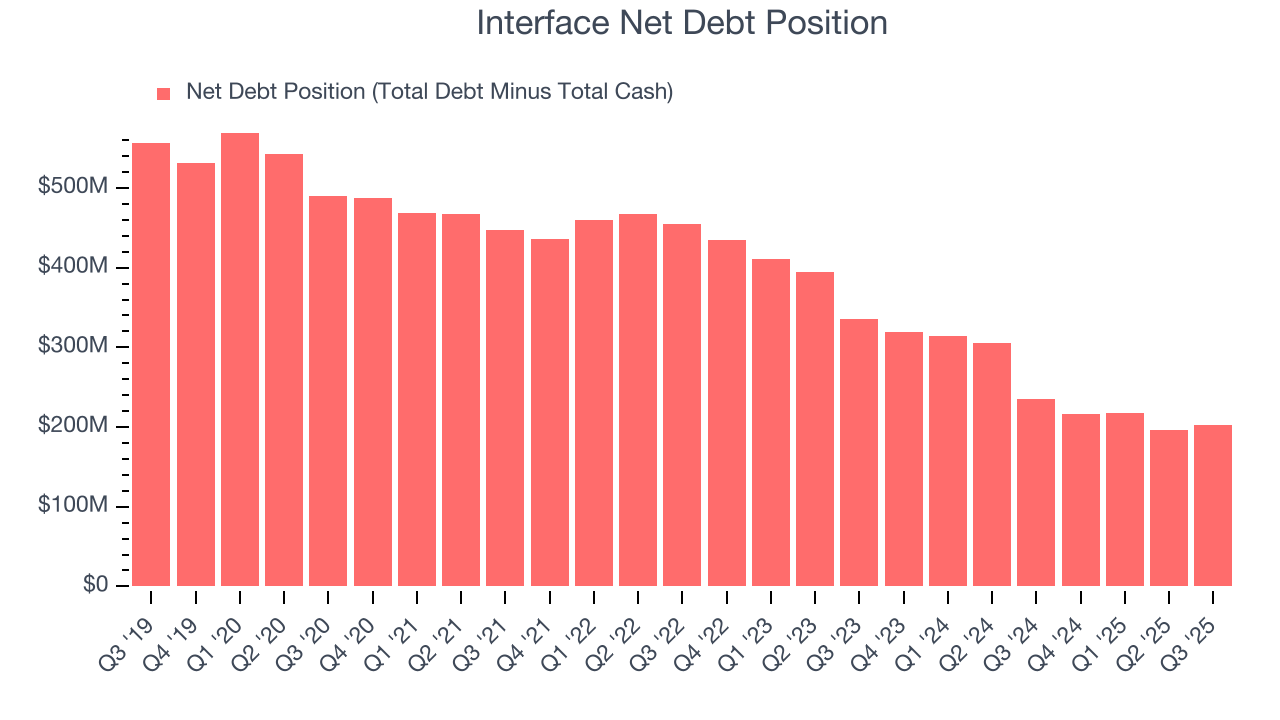

10. Balance Sheet Assessment

Interface reported $187.4 million of cash and $390 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $214 million of EBITDA over the last 12 months, we view Interface’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $9.54 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Interface’s Q3 Results

It was good to see Interface beat analysts’ EPS expectations this quarter and raise full-year guidance for EPS. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.4% to $27 immediately after reporting.

12. Is Now The Time To Buy Interface?

Updated: February 21, 2026 at 11:35 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Interface, you should also grasp the company’s longer-term business quality and valuation.

Interface’s business quality ultimately falls short of our standards. To begin with, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. And while Interface’s rising cash profitability gives it more optionality, its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Interface’s P/E ratio based on the next 12 months is 16.6x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $36.33 on the company (compared to the current share price of $32.55).