Pitney Bowes (PBI)

We’re cautious of Pitney Bowes. Its shrinking sales suggest demand is waning and its lousy free cash flow generation doesn’t do it any favors.― StockStory Analyst Team

1. News

2. Summary

Why Pitney Bowes Is Not Exciting

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE:PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

- Sales tumbled by 10.5% annually over the last five years, showing market trends are working against its favor during this cycle

- Sales are projected to tank by 4% over the next 12 months as its demand continues evaporating

- The good news is that its earnings growth has beaten its peers over the last five years as its EPS has compounded at 31.7% annually

Pitney Bowes’s quality is inadequate. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Pitney Bowes

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Pitney Bowes

Pitney Bowes’s stock price of $10.25 implies a valuation ratio of 7.2x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Pitney Bowes (PBI) Research Report: Q3 CY2025 Update

Shipping and mailing solutions provider Pitney Bowes (NYSE:PBI) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 8% year on year to $459.7 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.93 billion at the midpoint. Its non-GAAP profit of $0.31 per share was in line with analysts’ consensus estimates.

Pitney Bowes (PBI) Q3 CY2025 Highlights:

- Revenue: $459.7 million vs analyst estimates of $467.4 million (8% year-on-year decline, 1.7% miss)

- Adjusted EPS: $0.31 vs analyst estimates of $0.32 (in line)

- Adjusted EBITDA: $134.8 million (29.3% margin, 81.7% year-on-year growth)

- The company reconfirmed its revenue guidance for the full year of $1.93 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $1.30 at the midpoint, a 4% increase

- Operating Margin: 14.8%, up from 13% in the same quarter last year

- Free Cash Flow Margin: 13.1%

- Market Capitalization: $2.03 billion

Company Overview

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE:PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

Pitney Bowes operates through three main business segments that work together to serve its diverse client base. The Global Ecommerce segment offers retailers a complete suite of shipping solutions, including domestic parcel delivery services through a network of sortation centers and transportation systems. This segment also provides cross-border services that help retailers manage international shipping by calculating duties and taxes at checkout, handling currency conversions, and managing customs documentation. Additionally, its digital delivery services enable clients to compare carrier options and track packages in real-time.

The Presort Services segment positions Pitney Bowes as the largest workshare partner of the United States Postal Service (USPS). Through this business, the company sorts and processes high volumes of mail at its nationwide operating centers, helping clients qualify for postal workshare discounts while expediting delivery times.

The Sending Technology Solutions (SendTech) segment provides physical and digital mailing and shipping technologies. These range from traditional postage meters to cloud-based software-as-a-service solutions that can be accessed via connected devices. For example, a small business might use Pitney Bowes' technology to print shipping labels, track packages, and manage postage expenses all from one platform.

Through its subsidiary, The Pitney Bowes Bank, the company offers financing options for equipment purchases and revolving credit solutions for postage and supplies. This banking arm also provides interest-bearing deposit accounts for clients who prepay postage, creating a financial ecosystem around its core shipping and mailing services.

The company experiences seasonal fluctuations in its business, with the fourth quarter typically generating higher revenue due to increased shipping volumes during the holiday season. Pitney Bowes markets its offerings through direct sales, partner channels, and digital platforms, providing ongoing support through call centers and on-site services.

4. Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

Pitney Bowes competes with shipping and logistics giants like FedEx (NYSE:FDX), UPS (NYSE:UPS), and Stamps.com (now Auctane, private), as well as with ecommerce fulfillment providers such as Amazon Logistics (NASDAQ:AMZN) and ShipBob (private).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.93 billion in revenue over the past 12 months, Pitney Bowes is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

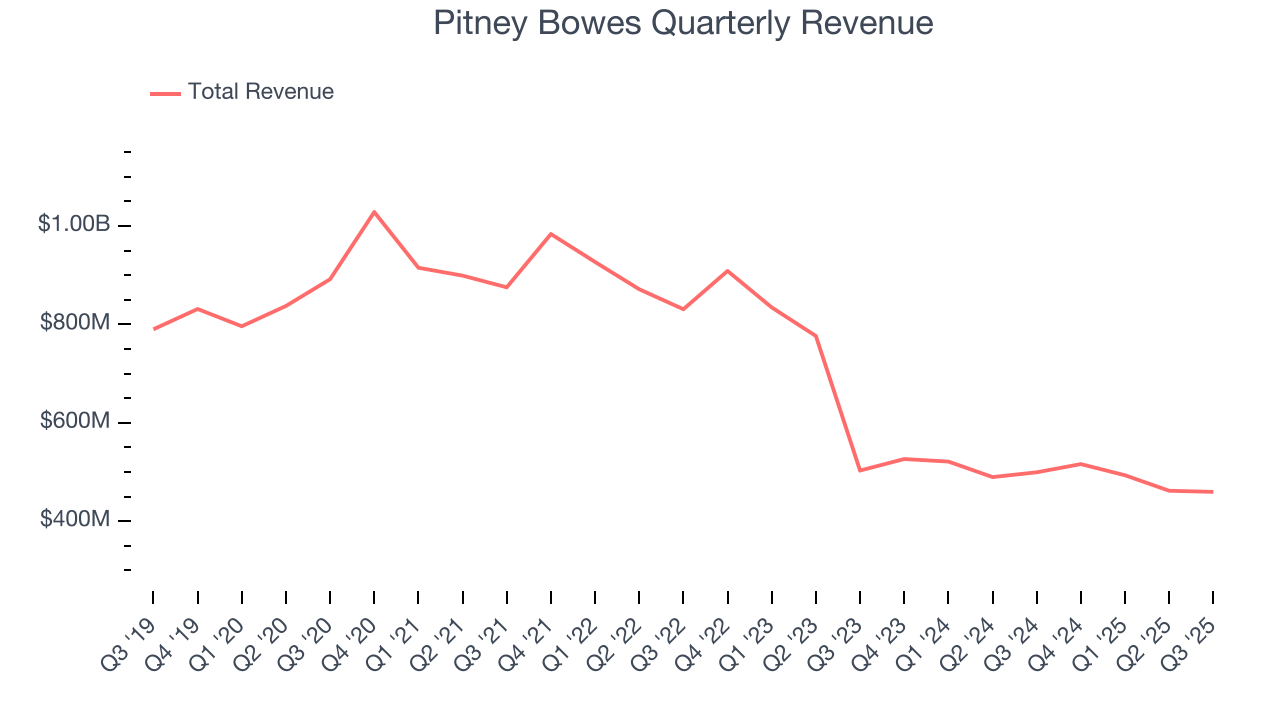

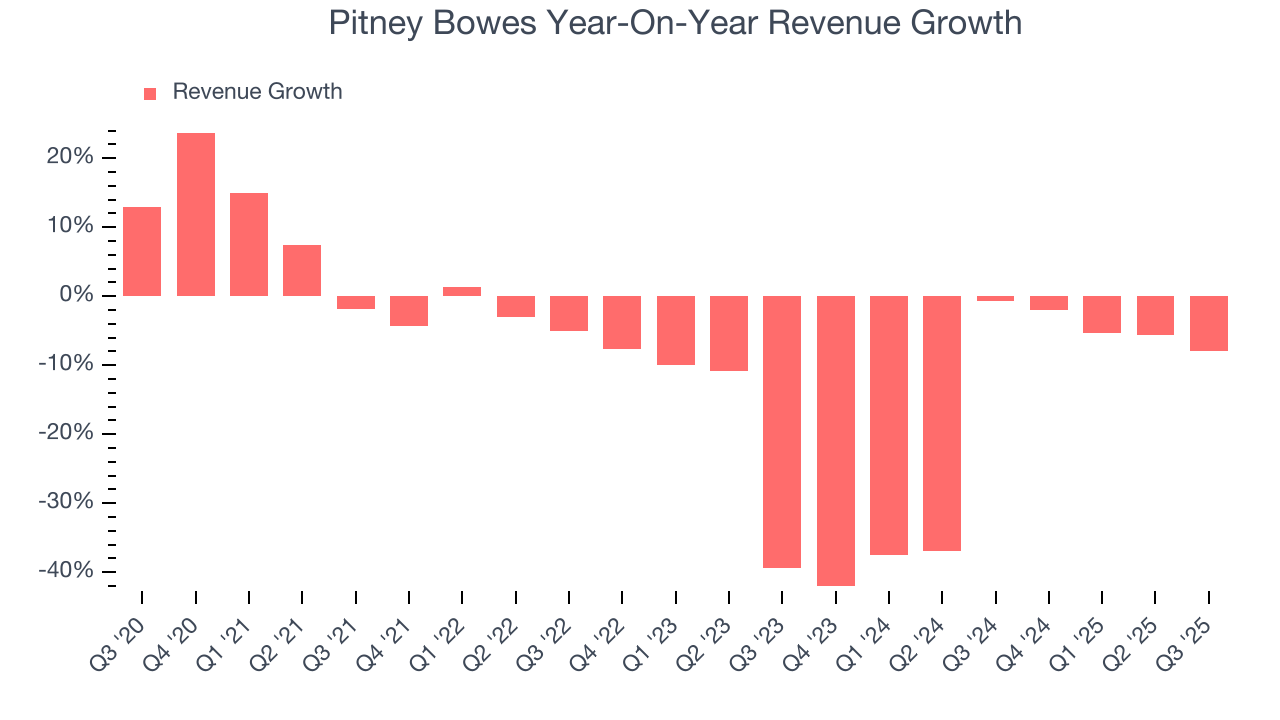

As you can see below, Pitney Bowes struggled to generate demand over the last five years. Its sales dropped by 10.5% annually, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Pitney Bowes’s recent performance shows its demand remained suppressed as its revenue has declined by 20.1% annually over the last two years.

This quarter, Pitney Bowes missed Wall Street’s estimates and reported a rather uninspiring 8% year-on-year revenue decline, generating $459.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

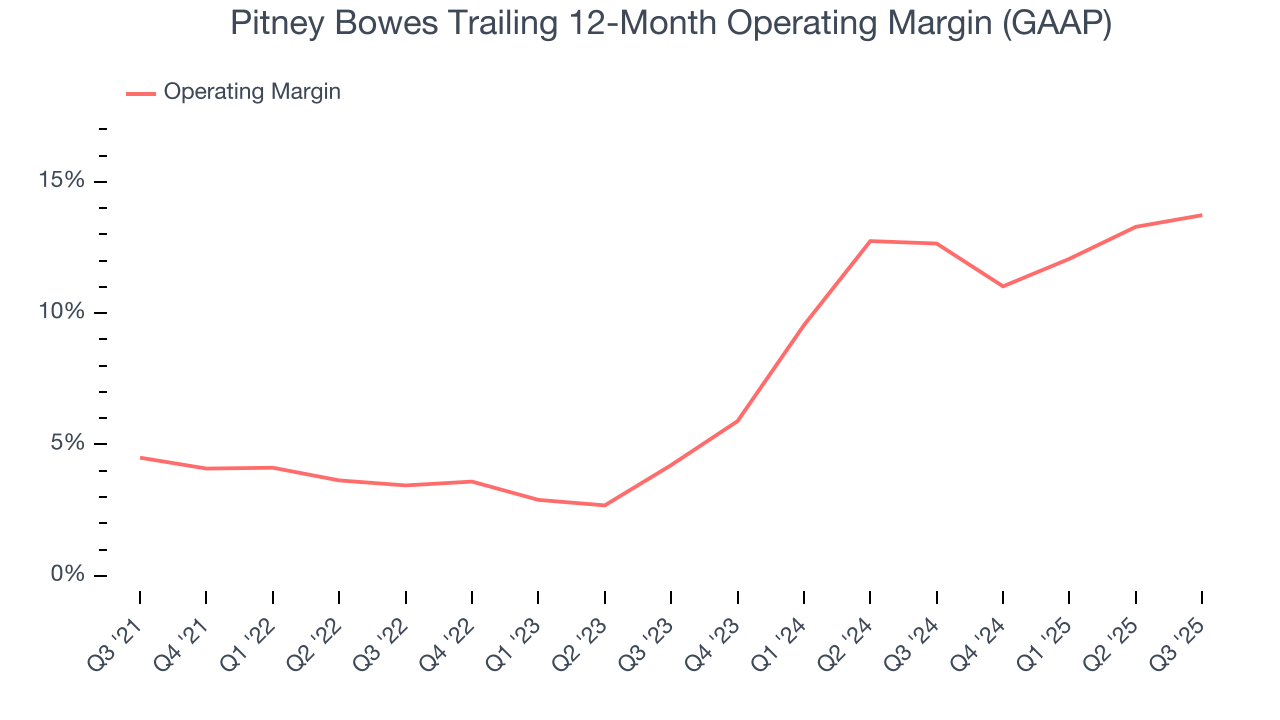

Pitney Bowes was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.6% was weak for a business services business.

On the plus side, Pitney Bowes’s operating margin rose by 9.2 percentage points over the last five years.

This quarter, Pitney Bowes generated an operating margin profit margin of 14.8%, up 1.8 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

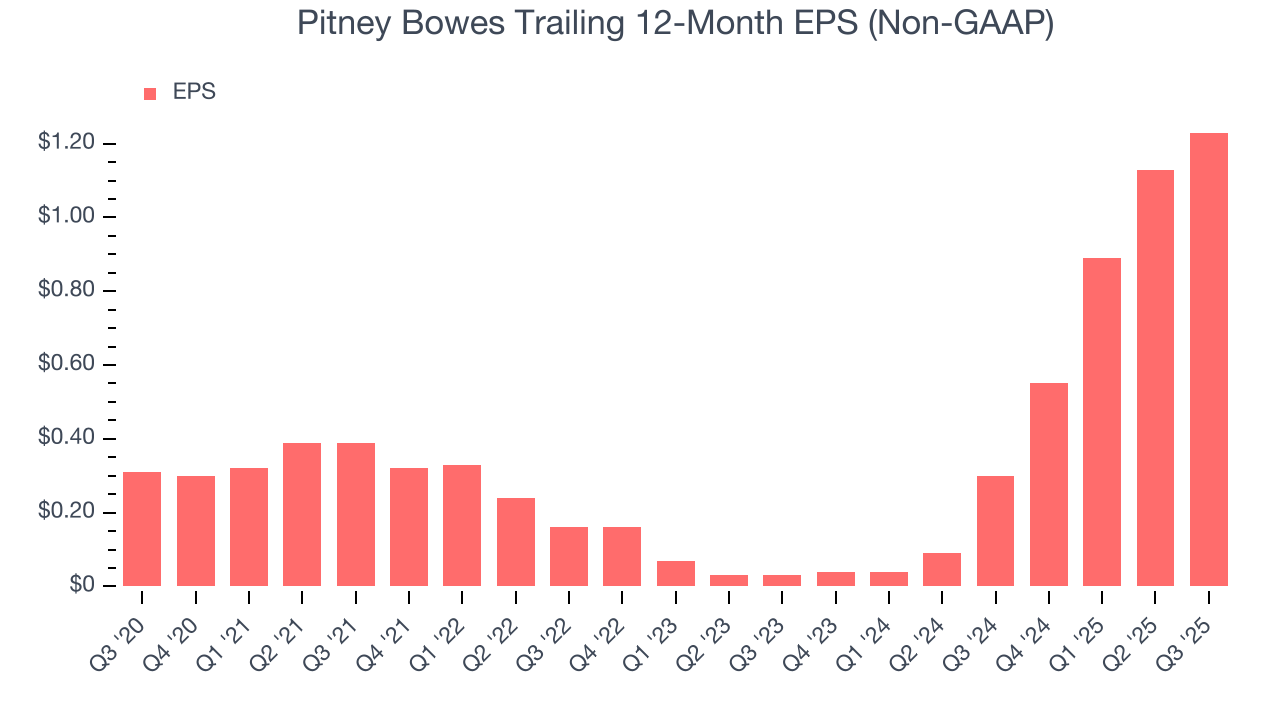

Pitney Bowes’s EPS grew at an astounding 31.7% compounded annual growth rate over the last five years, higher than its 10.5% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

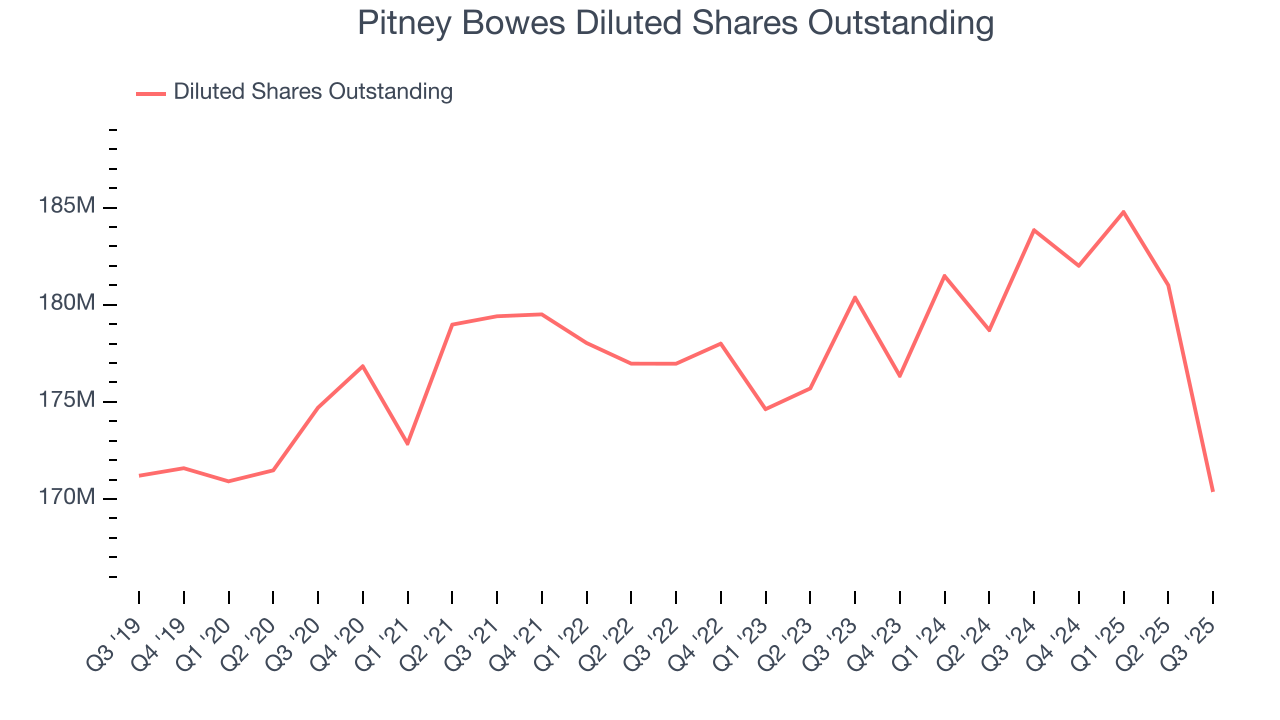

Diving into Pitney Bowes’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Pitney Bowes’s operating margin expanded by 9.2 percentage points over the last five years. On top of that, its share count shrank by 2.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Pitney Bowes, its two-year annual EPS growth of 540% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Pitney Bowes reported adjusted EPS of $0.31, up from $0.21 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Pitney Bowes’s full-year EPS of $1.23 to grow 8.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

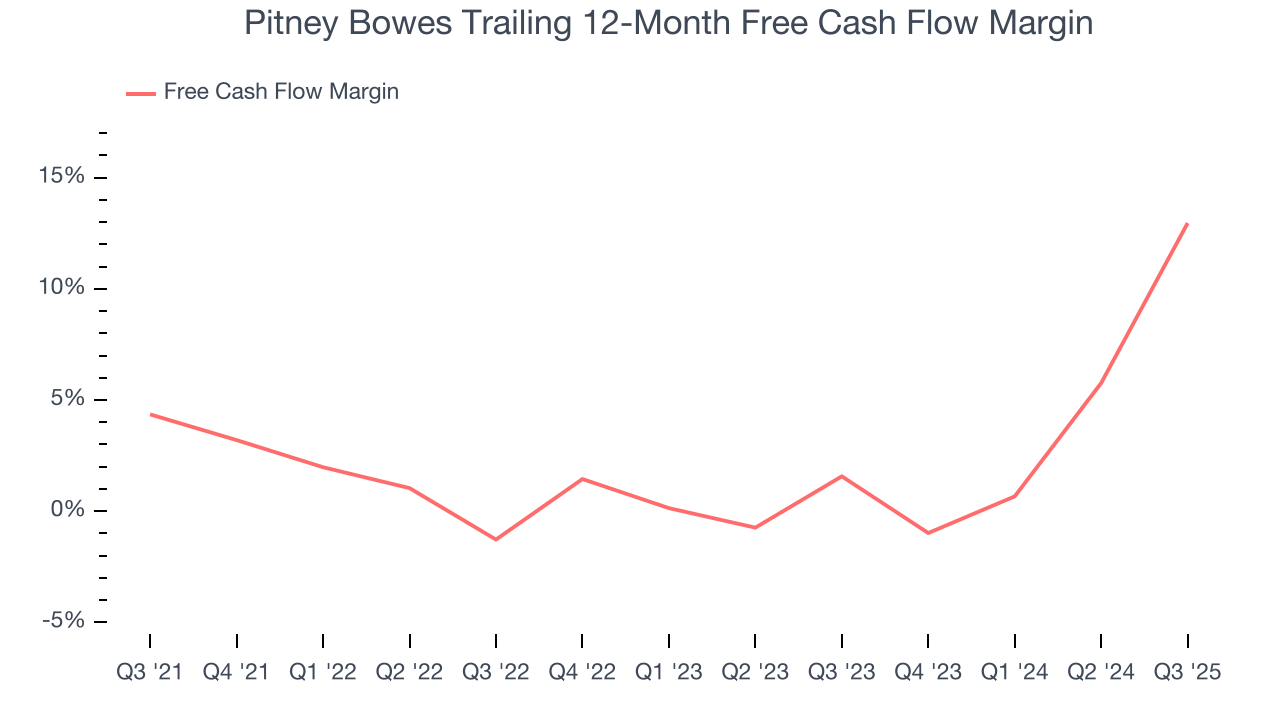

Pitney Bowes has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for a business services business.

Taking a step back, an encouraging sign is that Pitney Bowes’s margin expanded by 8.6 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Pitney Bowes’s free cash flow clocked in at $60.38 million in Q3, equivalent to a 13.1% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

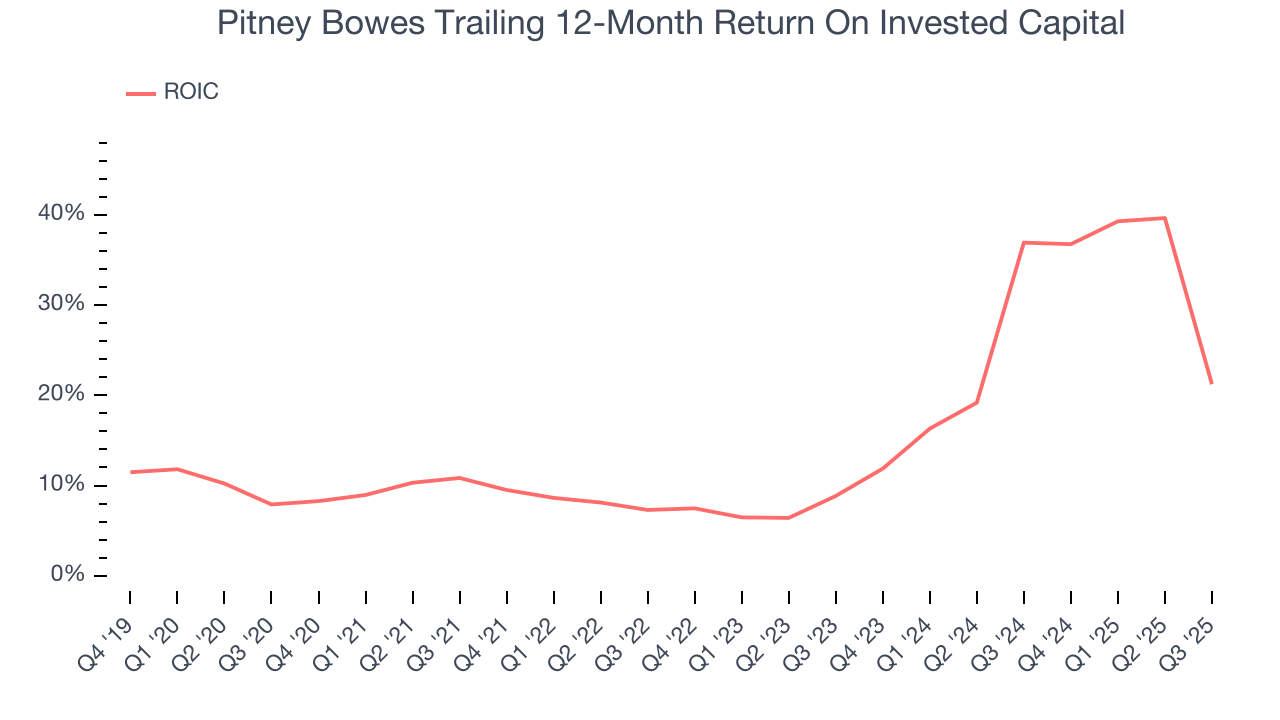

Although Pitney Bowes hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 17%, higher than most business services businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Pitney Bowes’s ROIC has increased significantly over the last few years. This is a good sign, and we hope the company can keep improving.

10. Balance Sheet Assessment

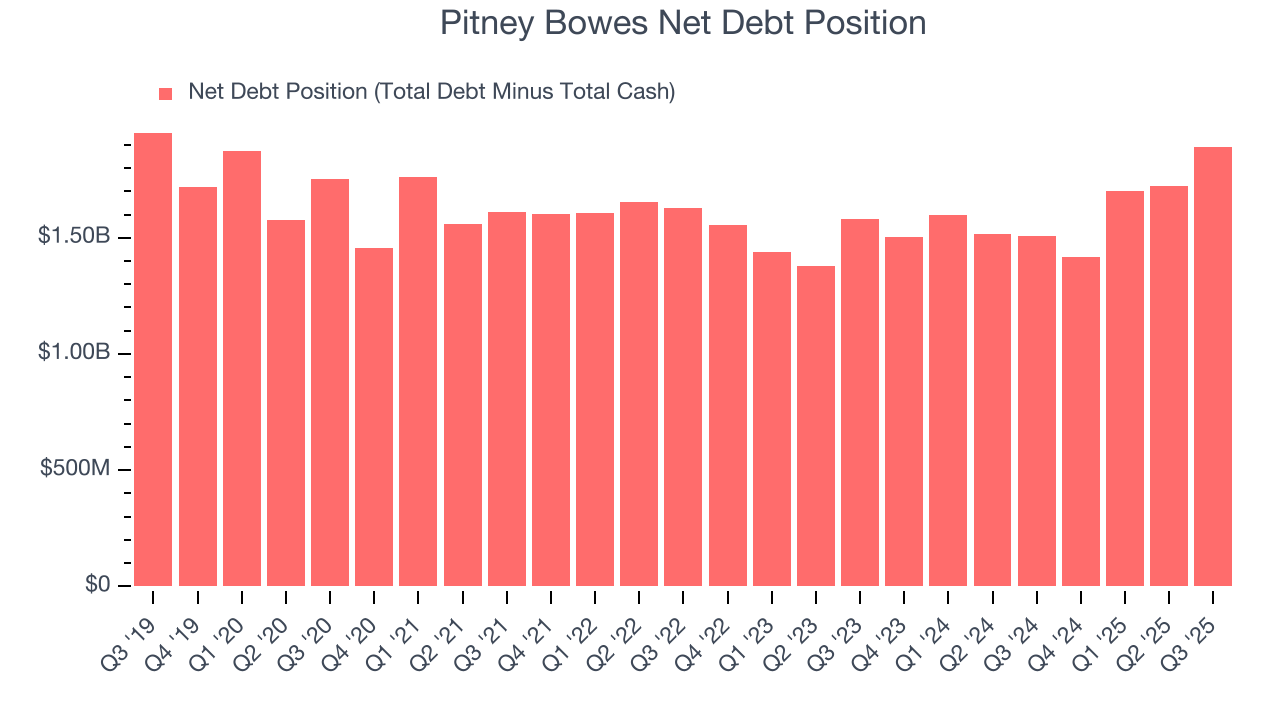

Pitney Bowes reported $336 million of cash and $2.23 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $392.7 million of EBITDA over the last 12 months, we view Pitney Bowes’s 4.8× net-debt-to-EBITDA ratio as safe. We also see its $49.91 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Pitney Bowes’s Q3 Results

It was encouraging to see Pitney Bowes beat analysts’ full-year EPS guidance expectations this quarter. On the other hand, its revenue missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3.7% to $10.80 immediately after reporting.

12. Is Now The Time To Buy Pitney Bowes?

Updated: February 16, 2026 at 10:50 PM EST

Before investing in or passing on Pitney Bowes, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Pitney Bowes’s business quality ultimately falls short of our standards. To begin with, its revenue has declined over the last five years. While its rising cash profitability gives it more optionality, the downside is its operating margins are low compared to other business services companies. On top of that, its low free cash flow margins give it little breathing room.

Pitney Bowes’s P/E ratio based on the next 12 months is 7.2x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $13 on the company (compared to the current share price of $10.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.