ABM (ABM)

We’re skeptical of ABM. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think ABM Will Underperform

With roots dating back to 1909 as a window washing company, ABM Industries (NYSE:ABM) provides integrated facility management, infrastructure, and mobility solutions across various sectors including commercial, manufacturing, education, and aviation.

- Low free cash flow margin declined over the last five years as its investments ramped, giving it little breathing room

- Responsiveness to unforeseen market trends is restricted due to its substandard adjusted operating margin profitability

- On the plus side, its revenue base of $8.75 billion gives it economies of scale and some distribution advantages

ABM’s quality isn’t up to par. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than ABM

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ABM

ABM’s stock price of $44.10 implies a valuation ratio of 11.1x forward P/E. This multiple is lower than most business services companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. ABM (ABM) Research Report: Q3 CY2025 Update

Facility services provider ABM Industries (NYSE:ABM) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 5.4% year on year to $2.30 billion. Its non-GAAP profit of $0.88 per share was 19% below analysts’ consensus estimates.

ABM (ABM) Q3 CY2025 Highlights:

- Revenue: $2.30 billion vs analyst estimates of $2.27 billion (5.4% year-on-year growth, 1% beat)

- Adjusted EPS: $0.88 vs analyst expectations of $1.09 (19% miss)

- Adjusted EBITDA: $124.2 million vs analyst estimates of $148.6 million (5.4% margin, 16.4% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4 at the midpoint, missing analyst estimates by 0.5%

- Operating Margin: 3%, up from 0.9% in the same quarter last year

- Free Cash Flow Margin: 4.9%, up from 0.7% in the same quarter last year

- Organic Revenue rose 4.8% year on year vs analyst estimates of 4.3% growth (49.2 basis point beat)

- Market Capitalization: $2.80 billion

Company Overview

With roots dating back to 1909 as a window washing company, ABM Industries (NYSE:ABM) provides integrated facility management, infrastructure, and mobility solutions across various sectors including commercial, manufacturing, education, and aviation.

ABM operates through five distinct business segments, each targeting specific market sectors. The Business & Industry segment delivers janitorial, facilities engineering, and parking services for commercial properties, sports venues, and healthcare facilities. For manufacturing clients, ABM handles specialized facility services tailored to production environments and data centers. Its Education segment maintains school and university campuses with custodial, landscaping, and facilities management services.

The Aviation segment supports airlines and airports with a range of services from passenger assistance to cabin maintenance and transportation logistics. Meanwhile, the Technical Solutions segment focuses on infrastructure projects including electrical services, EV charging station installation, and microgrid systems design.

A typical ABM client might be a large corporate office complex that contracts the company to handle all facility maintenance, from daily cleaning to HVAC system management, allowing the client to focus on their core business rather than building operations. A university might rely on ABM to maintain grounds, clean buildings, and manage parking operations across an entire campus.

The company generates revenue primarily through monthly fixed-price contracts, square-foot pricing arrangements, cost-plus models, and transaction-based services. These contracts are typically secured through competitive bidding processes and can range from basic janitorial services to comprehensive facility management solutions.

ABM enhances its service offerings with proprietary programs like ABM EnhancedClean and ABM EnhancedFacility, which provide standardized approaches to cleaning and maintenance. The company has also expanded its technological capabilities through acquisitions, such as Quality Uptime Services, which strengthened its position in critical power infrastructure maintenance for data centers.

4. Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

ABM Industries competes with other facility services providers such as Aramark (NYSE:ARMK), Sodexo (OTC:SDXAY), ISS A/S (CPH:ISS), and EMCOR Group (NYSE:EME), as well as numerous regional and specialized service providers in each of its business segments.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $8.75 billion in revenue over the past 12 months, ABM is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, ABM’s sales grew at a solid 7.9% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. ABM’s recent performance shows its demand has slowed as its annualized revenue growth of 3.9% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ABM’s organic revenue averaged 3.4% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ABM reported year-on-year revenue growth of 5.4%, and its $2.30 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its products and services will face some demand challenges.

6. Operating Margin

ABM’s operating margin has been trending up over the last 12 months and averaged 3.8% over the last five years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a business services business.

Analyzing the trend in its profitability, ABM’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, ABM generated an operating margin profit margin of 3%, up 2.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

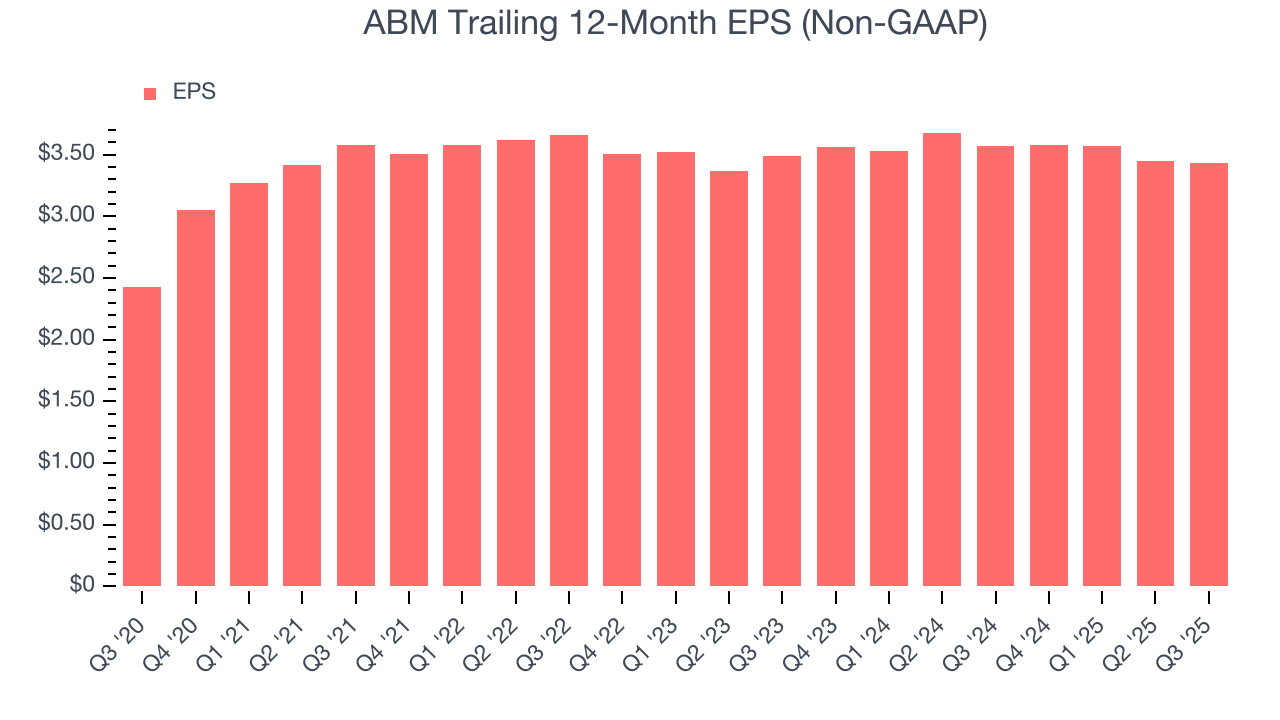

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ABM’s unimpressive 7.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

ABM’s flat two-year EPS was bad and lower than its 3.9% two-year revenue growth.

We can take a deeper look into ABM’s earnings to better understand the drivers of its performance. While we mentioned earlier that ABM’s operating margin expanded this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, ABM reported adjusted EPS of $0.88, down from $0.90 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects ABM’s full-year EPS of $3.43 to grow 17.6%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ABM has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, lousy for a business services business.

Taking a step back, we can see that ABM’s margin dropped by 2.7 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

ABM’s free cash flow clocked in at $112.7 million in Q3, equivalent to a 4.9% margin. This result was good as its margin was 4.2 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ABM historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.4%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, ABM’s ROIC decreased by 2.4 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

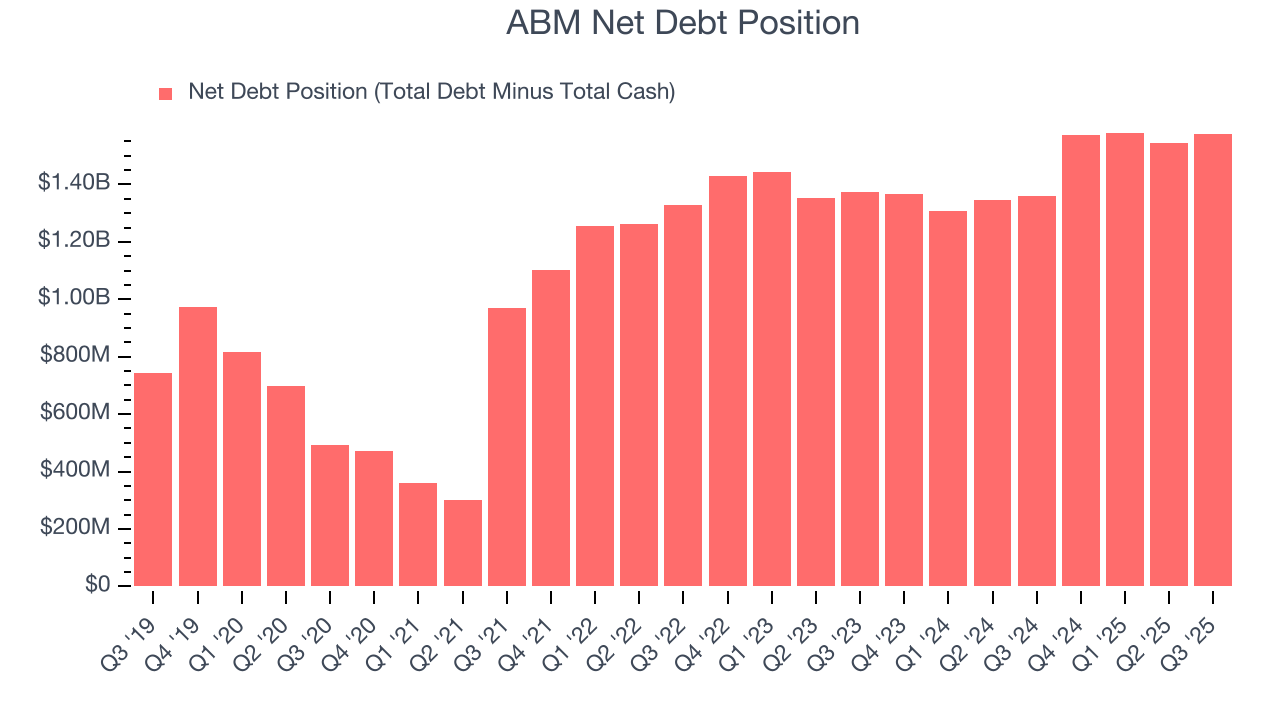

10. Balance Sheet Assessment

ABM reported $104.1 million of cash and $1.68 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $496.5 million of EBITDA over the last 12 months, we view ABM’s 3.2× net-debt-to-EBITDA ratio as safe. We also see its $47.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ABM’s Q3 Results

It was good to see ABM narrowly top analysts’ revenue expectations this quarter. We were also happy its organic revenue was in line with Wall Street’s estimates. On the other hand, its EPS missed and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.6% to $45 immediately after reporting.

12. Is Now The Time To Buy ABM?

Updated: March 4, 2026 at 11:34 PM EST

When considering an investment in ABM, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

ABM isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its low free cash flow margins give it little breathing room. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other business services companies.

ABM’s P/E ratio based on the next 12 months is 11.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $54.67 on the company (compared to the current share price of $44.10).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.