VeriSign (VRSN)

We aren’t fans of VeriSign. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think VeriSign Will Underperform

As the silent guardian of the internet's roadmap, VeriSign (NASDAQ:VRSN) operates the authoritative registry for .com and .net domain names, enabling websites to be found reliably when users type web addresses.

- Projected sales growth of 4.9% for the next 12 months suggests sluggish demand

- Operating margin failed to increase over the last year, indicating the company couldn’t optimize its expenses

- A silver lining is that its software is difficult to replicate at scale and results in a best-in-class gross margin of 88%

VeriSign doesn’t measure up to our expectations. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than VeriSign

High Quality

Investable

Underperform

Why There Are Better Opportunities Than VeriSign

VeriSign is trading at $252.44 per share, or 13.9x forward price-to-sales. This multiple is higher than most software companies, and we think it’s quite expensive for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. VeriSign (VRSN) Research Report: Q3 CY2025 Update

Internet infrastructure company VeriSign (NASDAQ:VRSN) announced better-than-expected revenue in Q3 CY2025, with sales up 7.3% year on year to $419.1 million. Its GAAP profit of $2.27 per share was 1.3% above analysts’ consensus estimates.

VeriSign (VRSN) Q3 CY2025 Highlights:

- Revenue: $419.1 million vs analyst estimates of $416.8 million (7.3% year-on-year growth, 0.5% beat)

- EPS (GAAP): $2.27 vs analyst estimates of $2.24 (1.3% beat)

- Operating Margin: 67.8%, down from 68.9% in the same quarter last year

- Free Cash Flow Margin: 72.3%, up from 47.5% in the previous quarter

- Billings: $423.7 million at quarter end, up 5.7% year on year

- Market Capitalization: $23.53 billion

Company Overview

As the silent guardian of the internet's roadmap, VeriSign (NASDAQ:VRSN) operates the authoritative registry for .com and .net domain names, enabling websites to be found reliably when users type web addresses.

VeriSign's core business involves managing the vast databases that translate human-readable domain names (like example.com) into the numerical IP addresses that computers use to locate websites. This critical infrastructure ensures that when someone types a .com or .net address into their browser, they reach the correct destination—a function so fundamental to the internet that billions of people rely on it daily without realizing it.

The company maintains a global constellation of secure servers that process hundreds of billions of DNS (Domain Name System) queries daily with remarkable reliability. These servers must operate continuously with virtually no downtime, as any disruption would render millions of websites unreachable. VeriSign also maintains two of the internet's thirteen root servers, which form the backbone of the global DNS hierarchy.

Beyond registry services, VeriSign serves as the Root Zone Maintainer for the internet's DNS, essentially maintaining the master address book for the top level of the internet's domain name hierarchy. A typical transaction might involve a business registering example.com through a registrar like GoDaddy, with VeriSign handling the authoritative directory that ensures that domain resolves correctly worldwide.

Revenue comes primarily from fixed fees charged to registrars for each domain registration or renewal in VeriSign's TLDs. The pricing for .com domains is regulated under agreements with ICANN and the U.S. Department of Commerce, reflecting the company's unique position in internet infrastructure.

4. E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

VeriSign's competitors in the domain registry space include Public Interest Registry (operating .org), Identity Digital (formerly Donuts), CentralNic (LSE:CNIC), and numerous country-code top-level domain operators like CNNIC (China's .cn) and Nominet (UK's .co.uk).

5. Revenue Growth

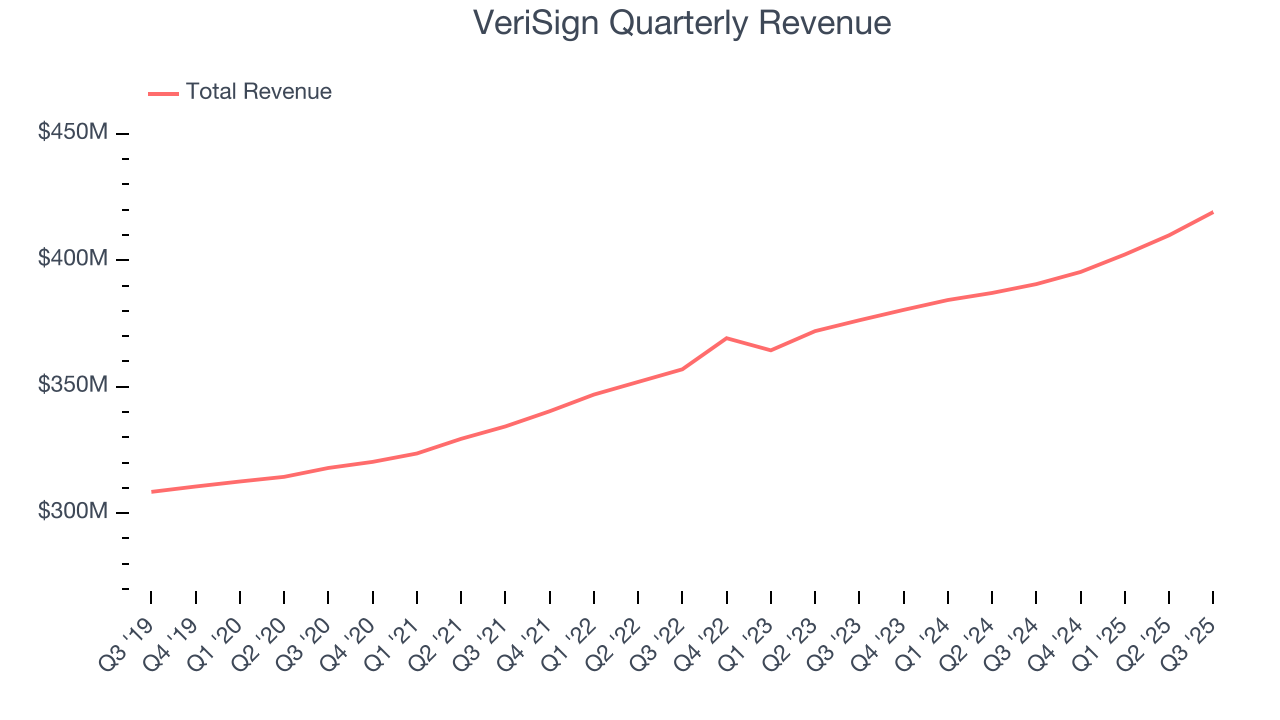

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, VeriSign grew its sales at a weak 5.3% compounded annual growth rate. This was below our standard for the software sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. VeriSign’s annualized revenue growth of 4.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, VeriSign reported year-on-year revenue growth of 7.3%, and its $419.1 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet.

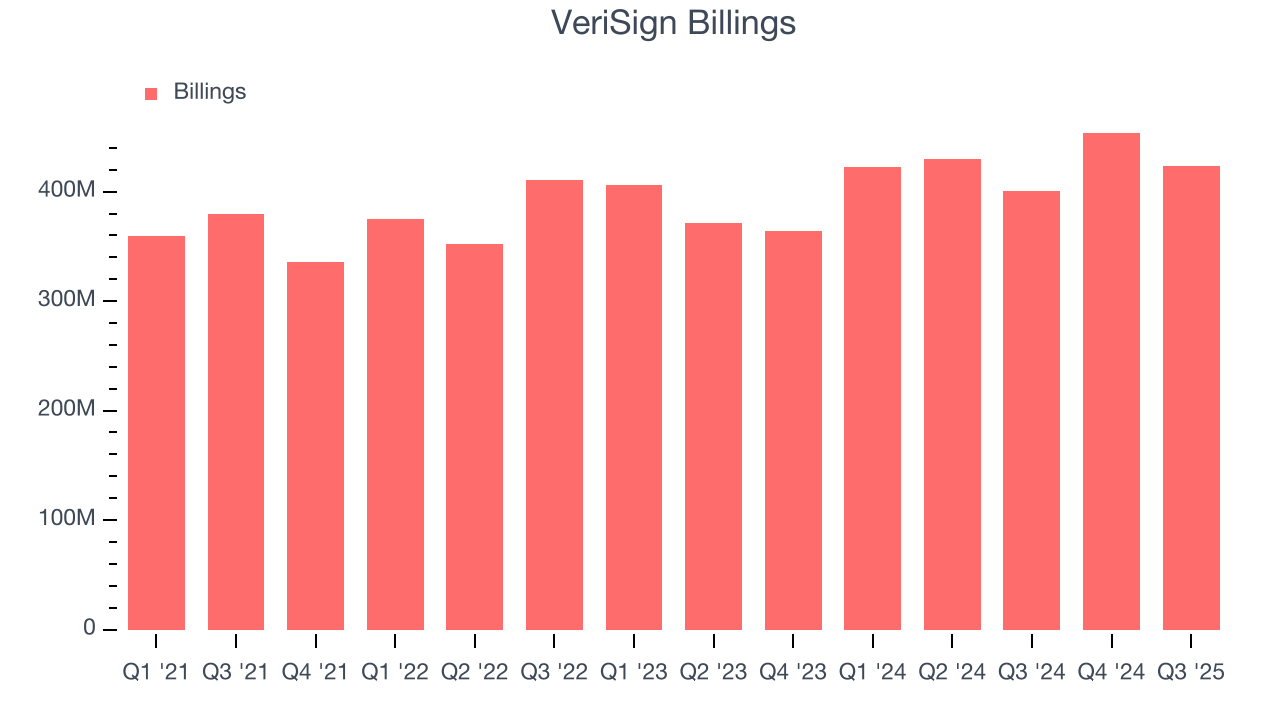

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

VeriSign’s billings punched in at $423.7 million in Q3, and over the last four quarters, its growth slightly outpaced the sector as it averaged 15.1% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

VeriSign is very efficient at acquiring new customers, and its CAC payback period checked in at 22.5 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give VeriSign more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like VeriSign, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

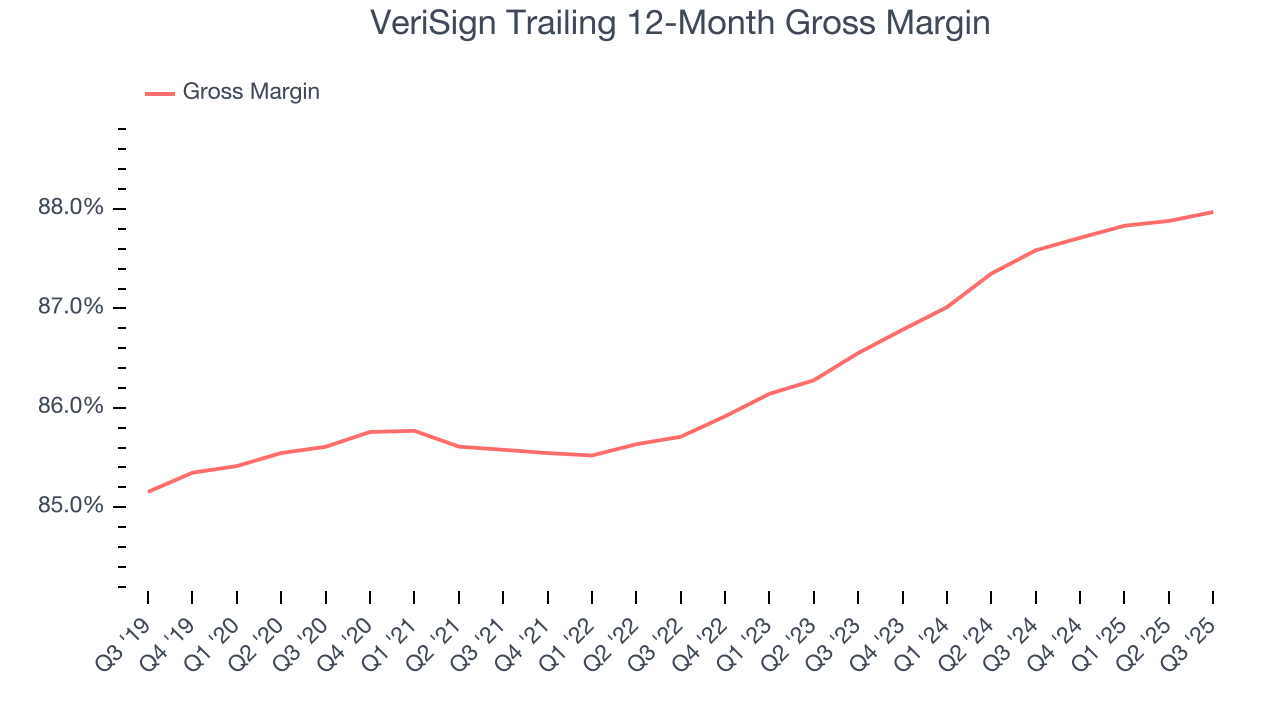

VeriSign’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 88% gross margin over the last year. That means VeriSign only paid its providers $12.03 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. VeriSign has seen gross margins improve by 1.4 percentage points over the last 2 year, which is solid in the software space.

VeriSign’s gross profit margin came in at 88.4% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

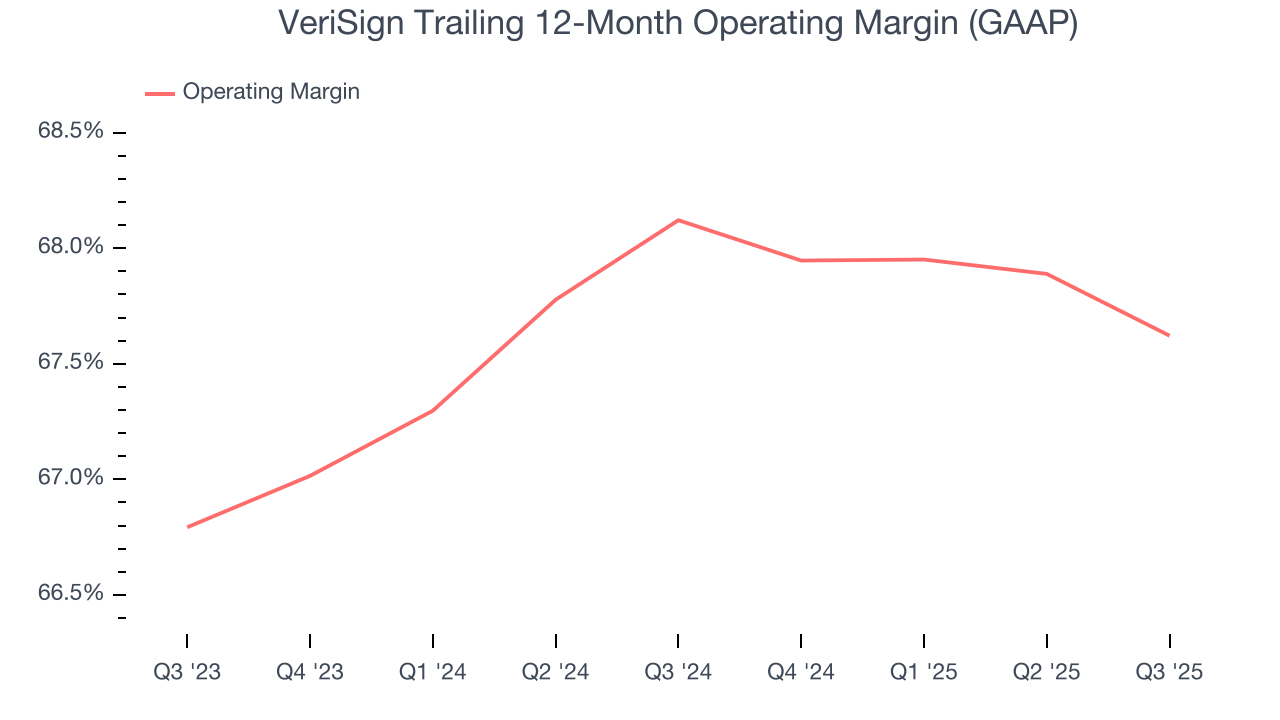

VeriSign has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 67.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, VeriSign’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, VeriSign generated an operating margin profit margin of 67.8%, down 1.1 percentage points year on year. Since VeriSign’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

VeriSign has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 61.8% over the last year.

VeriSign’s free cash flow clocked in at $303 million in Q3, equivalent to a 72.3% margin. This result was good as its margin was 8.9 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

11. Key Takeaways from VeriSign’s Q3 Results

Revenue and EPS both beat slightly. Zooming out, we think this was a decent quarter but one without many big surprises, good or bad. The stock remained flat at $249 immediately following the results.

12. Is Now The Time To Buy VeriSign?

Updated: October 30, 2025 at 10:36 PM EDT

When considering an investment in VeriSign, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

VeriSign’s business quality ultimately falls short of our standards. For starters, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while VeriSign’s bountiful generation of free cash flow empowers it to invest in growth initiatives, its operating margin hasn't moved over the last year.

VeriSign’s price-to-sales ratio based on the next 12 months is 12.9x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $295.50 on the company (compared to the current share price of $230.95).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.