Accenture (ACN)

Accenture is intriguing. Its rare ability to win market share while pumping out profits is a feature its competitors envy.― StockStory Analyst Team

1. News

2. Summary

Why Accenture Is Interesting

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE:ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

- Unparalleled revenue scale of $70.73 billion gives it an edge in distribution

- ROIC punches in at 38%, illustrating management’s expertise in identifying profitable investments

- The stock is trading at a reasonable price if you like its story and growth prospects

Accenture shows some signs of a high-quality business. If you like the stock, the price looks fair.

Why Is Now The Time To Buy Accenture?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Accenture?

Accenture is trading at $209.90 per share, or 15x forward P/E. Accenture’s valuation is lower than that of many in the business services space. Even so, we think it is justified for the revenue growth characteristics.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Accenture (ACN) Research Report: Q4 CY2025 Update

Global professional services company Accenture (NYSE:ACN) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 6% year on year to $18.74 billion. The company expects next quarter’s revenue to be around $17.68 billion, close to analysts’ estimates. Its non-GAAP profit of $3.94 per share was 5.9% above analysts’ consensus estimates.

Accenture (ACN) Q4 CY2025 Highlights:

- Revenue: $18.74 billion vs analyst estimates of $18.53 billion (6% year-on-year growth, 1.2% beat)

- Adjusted EPS: $3.94 vs analyst estimates of $3.72 (5.9% beat)

- Adjusted EBITDA: $3.92 billion vs analyst estimates of $3.75 billion (20.9% margin, 4.6% beat)

- Revenue Guidance for Q1 CY2026 is $17.68 billion at the midpoint, roughly in line with what analysts were expecting

- Management reiterated its full-year Adjusted EPS guidance of $13.71 at the midpoint

- Operating Margin: 15.3%, down from 16.7% in the same quarter last year

- Free Cash Flow Margin: 8%, up from 4.9% in the same quarter last year

- Market Capitalization: $168.4 billion

Company Overview

With a workforce of approximately 774,000 people serving clients in more than 120 countries, Accenture (NYSE:ACN) is a professional services firm that helps organizations transform their businesses through consulting, technology, operations, and digital services.

Accenture operates through five main service areas: Strategy & Consulting, Technology, Operations, Industry X, and Song. The company works with executives to reinvent their enterprises, implement operational improvements, and drive growth. Its technology services span cloud computing, systems integration, security, software engineering, data and AI, and automation, helping clients build digital cores and optimize operations.

The company's operations services manage business processes for clients, including finance, procurement, supply chain, and human resources functions. Through Industry X, Accenture combines digital capabilities with engineering expertise to help clients transform product design, manufacturing, and servicing. Its Song division focuses on creating personalized customer experiences across design, digital products, marketing, commerce, and customer service.

For example, a global retailer might engage Accenture to modernize its supply chain using AI and cloud technology, redesign its e-commerce platform, and implement new customer service solutions—all while Accenture manages the retailer's back-office operations.

Accenture organizes its business across five industry groups: Communications, Media & Technology; Financial Services; Health & Public Service; Products; and Resources. This industry focus allows the company to develop specialized solutions for specific sectors while leveraging cross-industry expertise. The company maintains partnerships with leading technology providers like Microsoft, Amazon Web Services, Google, and Salesforce to enhance its service offerings.

Revenue comes primarily from Fortune Global 2000 companies and government agencies. Accenture operates through three geographic markets: North America, Europe/Middle East/Africa (EMEA), and Growth Markets, with each region responsible for client relationships and service delivery in their respective territories.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

Accenture's main competitors include other global professional services firms such as Deloitte, PwC, EY, and KPMG, as well as technology consulting companies like IBM (NYSE:IBM), Cognizant (NASDAQ:CTSH), Infosys (NYSE:INFY), and Capgemini (OTCMKTS:CAPMF).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $70.73 billion in revenue over the past 12 months, Accenture is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

As you can see below, Accenture’s 9.6% annualized revenue growth over the last five years was impressive. This is an encouraging starting point for our analysis because it shows Accenture’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Accenture’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.6% over the last two years was well below its five-year trend.

This quarter, Accenture reported year-on-year revenue growth of 6%, and its $18.74 billion of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 6.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, similar to its two-year rate. This projection is above the sector average and implies its newer products and services will help sustain its recent top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Accenture’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 14.7% over the last five years. This profitability was top-notch for a business services business, showing it’s an well-run company with an efficient cost structure.

Looking at the trend in its profitability, Accenture’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Accenture generated an operating margin profit margin of 15.3%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

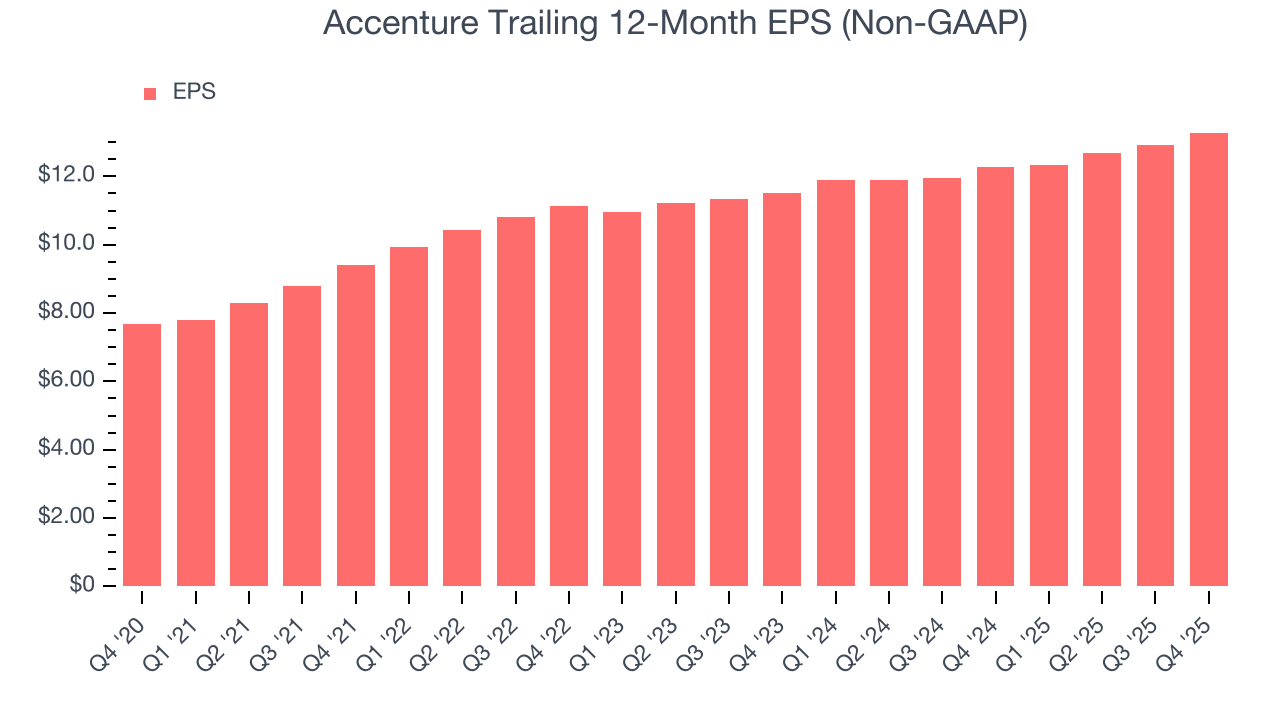

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Accenture’s remarkable 11.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Although it wasn’t great, Accenture’s two-year annual EPS growth of 7.4% topped its 4.6% two-year revenue growth.

Diving into the nuances of Accenture’s earnings can give us a better understanding of its performance. A two-year view shows that Accenture has repurchased its stock, shrinking its share count by 1.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Accenture reported adjusted EPS of $3.94, up from $3.59 in the same quarter last year. This print beat analysts’ estimates by 5.9%. Over the next 12 months, Wall Street expects Accenture’s full-year EPS of $13.28 to grow 5.8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Accenture has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 14.4% over the last five years.

Taking a step back, we can see that Accenture’s margin expanded by 2.8 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Accenture’s free cash flow clocked in at $1.51 billion in Q4, equivalent to a 8% margin. This result was good as its margin was 3.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Accenture’s five-year average ROIC was 38%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Accenture’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Accenture is a profitable, well-capitalized company with $9.66 billion of cash and $5.15 billion of debt on its balance sheet. This $4.51 billion net cash position is 2.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Accenture’s Q4 Results

It was good to see Accenture beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance was in line and its revenue guidance for next quarter was in line with Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 1.5% to $277.98 immediately following the results.

12. Is Now The Time To Buy Accenture?

Updated: March 5, 2026 at 12:06 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We think Accenture is a good business. First off, its revenue growth was impressive over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale makes it a trusted partner with negotiating leverage. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Accenture’s P/E ratio based on the next 12 months is 15x. Looking at the business services space right now, Accenture trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $288.63 on the company (compared to the current share price of $209.90), implying they see 37.5% upside in buying Accenture in the short term.