Cable One (CABO)

We wouldn’t buy Cable One. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Cable One Will Underperform

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

- Lackluster 2.5% annual revenue growth over the last five years indicates the company is losing ground to competitors

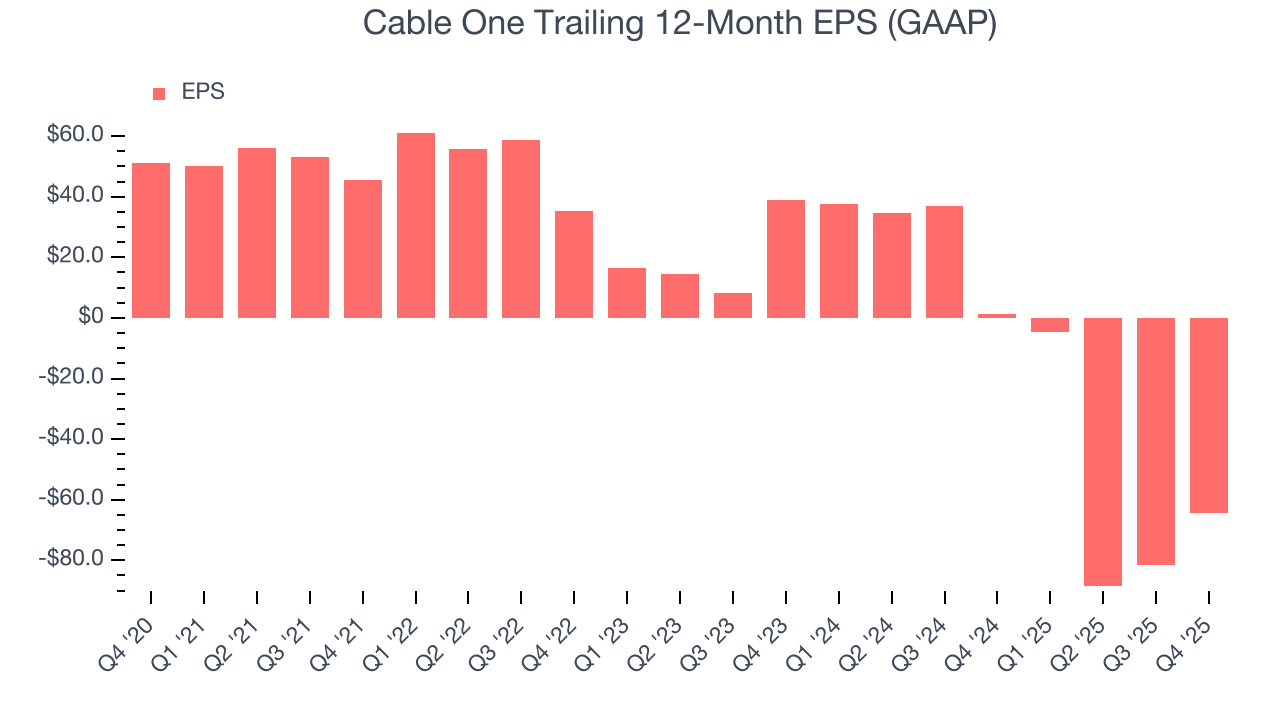

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 3.4% annually

- Forecasted revenue decline of 1.4% for the upcoming 12 months implies demand will fall even further

Cable One doesn’t fulfill our quality requirements. You should search for better opportunities.

Why There Are Better Opportunities Than Cable One

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Cable One

Cable One is trading at $108.81 per share, or 2.6x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Cable One (CABO) Research Report: Q4 CY2025 Update

Internet, cable TV, and phone provider Cable One (NYSE:CABO) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 6.1% year on year to $363.7 million. Its GAAP loss of $1.35 per share was significantly below analysts’ consensus estimates.

Cable One (CABO) Q4 CY2025 Highlights:

- Revenue: $363.7 million vs analyst estimates of $368.3 million (6.1% year-on-year decline, 1.2% miss)

- EPS (GAAP): -$1.35 vs analyst estimates of $6.64 (significant miss)

- Adjusted EBITDA: $193.9 million vs analyst estimates of $193.3 million (53.3% margin, in line)

- Operating Margin: 25.2%, down from 26.2% in the same quarter last year

- Free Cash Flow Margin: 19.7%, down from 24.7% in the same quarter last year

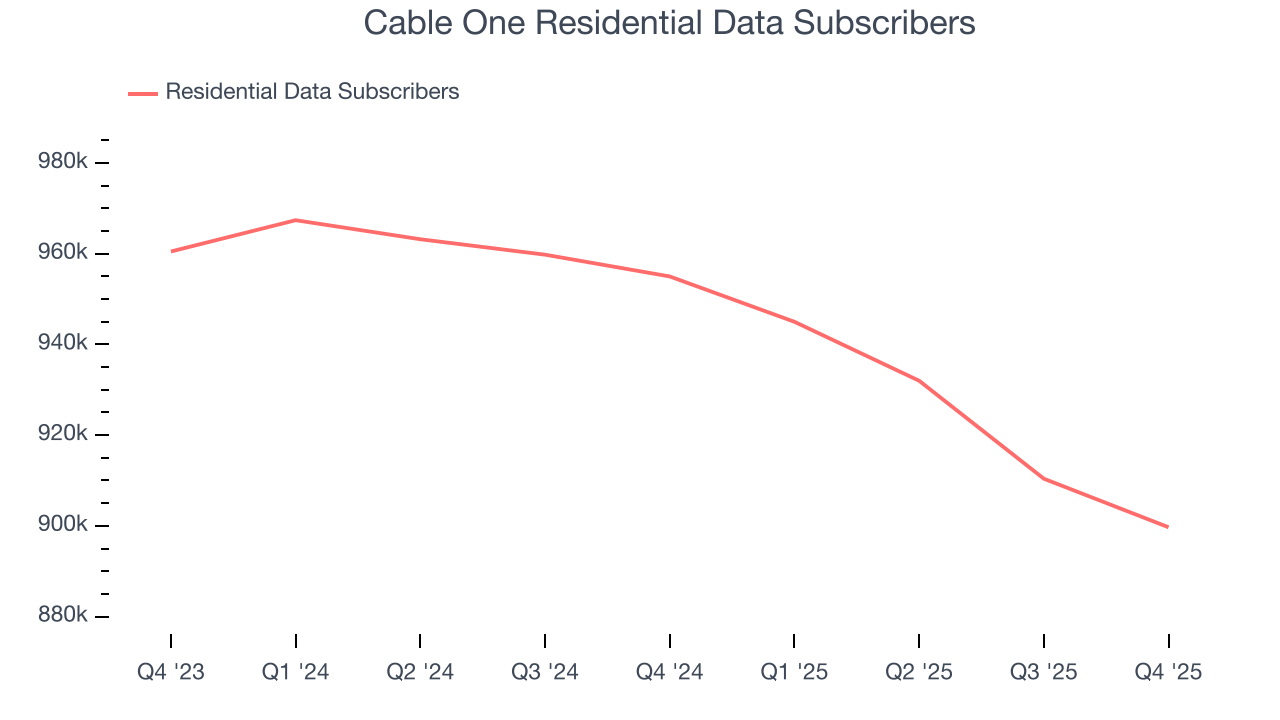

- Residential Data Subscribers: 899,700, down 55,300 year on year

- Market Capitalization: $512.4 million

Company Overview

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

The company was early to recognize the lack of high-quality and reliable communications services in communities often overlooked by larger providers. By focusing on these less urbanized areas, the company was able to carve a niche for itself as an affordable yet reliable provider.

Today, Cable One generates revenue through subscriptions to its various services including internet, cable TV, and cellular wireless plans. The company recently pivoted in 2019 to focus more on its internet business, re-branding itself to Sparklight.

4. Consumer Discretionary - Wireless, Cable and Satellite

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Wireless, cable, and satellite companies provide pay-TV, broadband internet, and mobile connectivity through large fixed-infrastructure networks. Tailwinds include growing bandwidth consumption, bundling opportunities across video, internet, and wireless services, and rural broadband subsidies from government programs. However, headwinds are pronounced: cord-cutting continues to erode traditional video subscriber bases, capital expenditure requirements for network upgrades (such as fiber overbuilds and 5G rollouts) are substantial, and aggressive promotional pricing among competitors compresses margins. Regulatory oversight on pricing and net neutrality adds uncertainty, while streaming platforms increasingly bypass traditional distributors, reducing the value of the legacy pay-TV bundle.

Competitors in the telecommunications and media services industry include Charter Communications (NASDAQ:CHTR), Comcast (NASDAQ:CMCSA), and WideOpenWest (NYSE:WOW).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Cable One’s 2.5% annualized revenue growth over the last five years was weak. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Cable One’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.4% annually.

We can better understand the company’s revenue dynamics by analyzing its number of residential data subscribers and residential video subscribers, which clocked in at 899,700 and 55,900 in the latest quarter. Over the last two years, Cable One’s residential data subscribers averaged 3.4% year-on-year declines while its residential video subscribers averaged 30.8% year-on-year declines.

This quarter, Cable One missed Wall Street’s estimates and reported a rather uninspiring 6.1% year-on-year revenue decline, generating $363.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 3.1% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Cable One’s operating margin has been trending down over the last 12 months and averaged 7.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Cable One generated an operating margin profit margin of 25.2%, down 1.1 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Cable One, its EPS declined by 26.6% annually over the last five years while its revenue grew by 2.5%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Cable One reported EPS of negative $1.35, up from negative $18.71 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Cable One’s full-year EPS of negative $64.33 will flip to positive $28.25.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Cable One has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 21.3%, lousy for a consumer discretionary business.

Cable One’s free cash flow clocked in at $71.55 million in Q4, equivalent to a 19.7% margin. The company’s cash profitability regressed as it was 5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Cable One’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 18.5% for the last 12 months will increase to 21.6%, it options for capital deployment (investments, share buybacks, etc.).

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Cable One historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Cable One’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

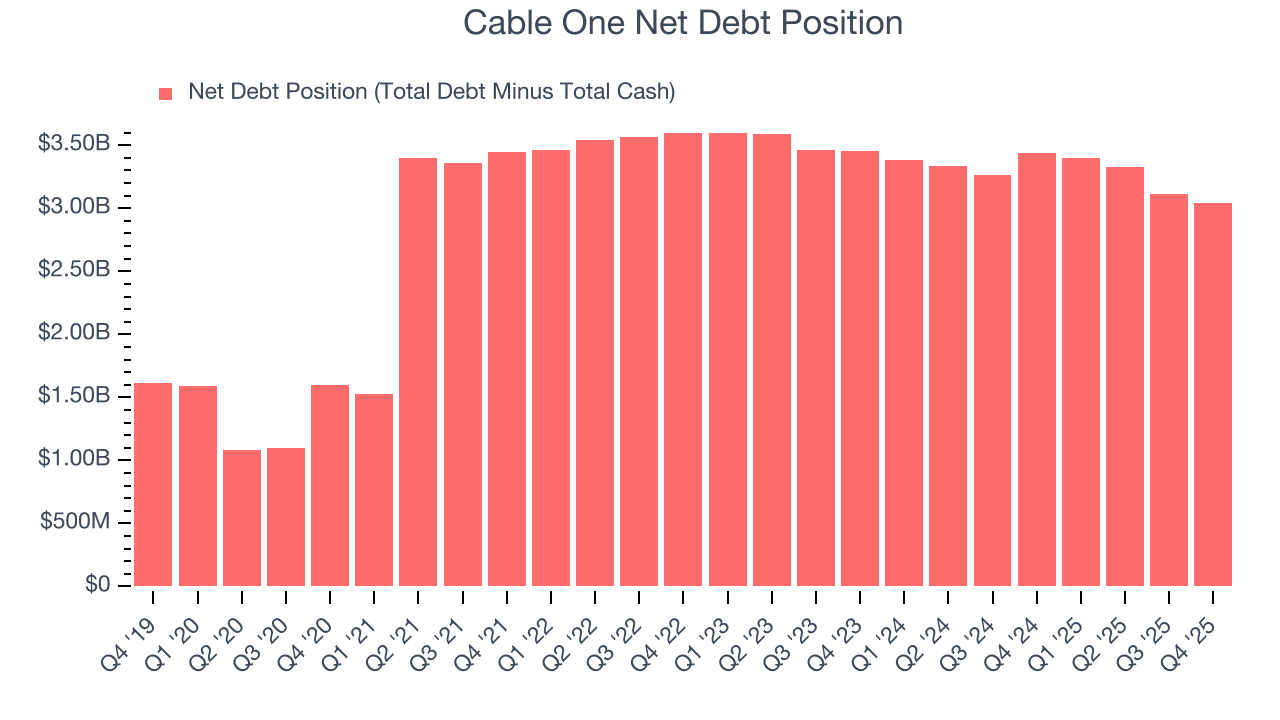

Cable One reported $152.8 million of cash and $3.19 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $801.7 million of EBITDA over the last 12 months, we view Cable One’s 3.8× net-debt-to-EBITDA ratio as safe. We also see its $130 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Cable One’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $91.55 immediately after reporting.

12. Is Now The Time To Buy Cable One?

Updated: March 4, 2026 at 10:05 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Cable One.

We cheer for all companies serving everyday consumers, but in the case of Cable One, we’ll be cheering from the sidelines. On top of that, Cable One’s number of residential data subscribers has disappointed, and its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion.

Cable One’s P/E ratio based on the next 12 months is 2.8x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $114.25 on the company (compared to the current share price of $116).