Hyatt Hotels (H)

Hyatt Hotels faces an uphill battle. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hyatt Hotels Will Underperform

Founded in 1957, Hyatt Hotels (NYSE:H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

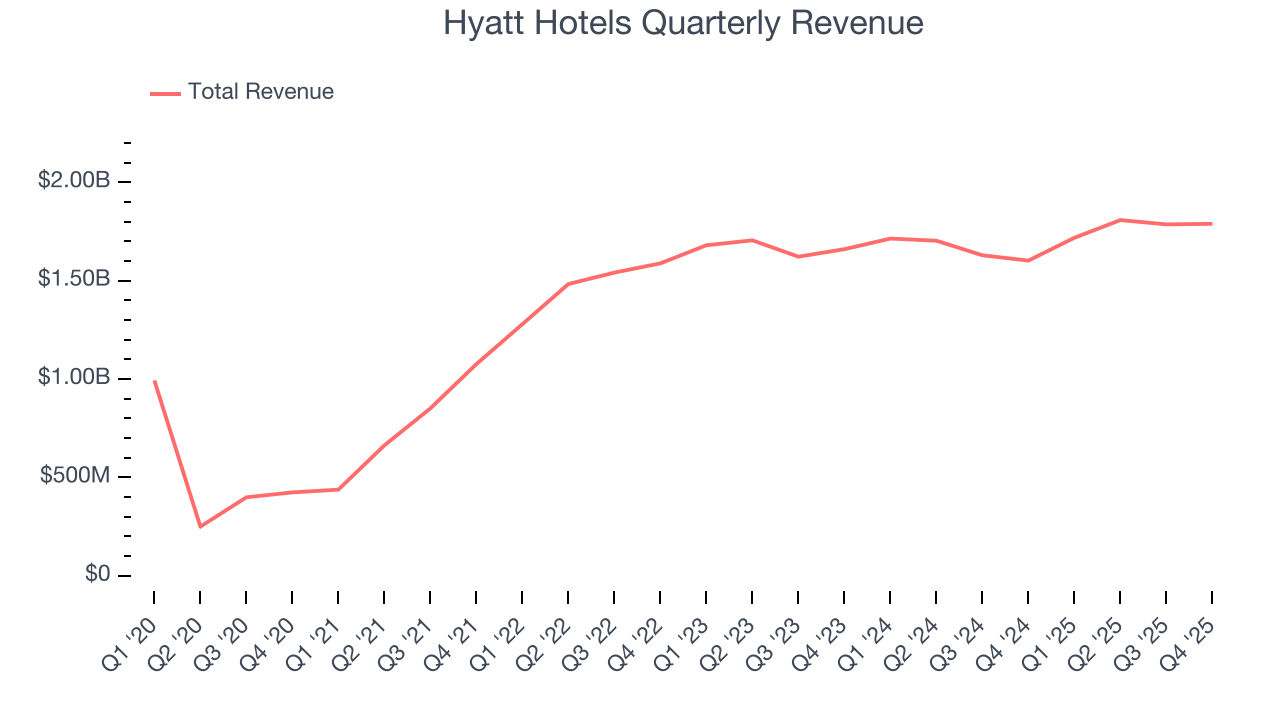

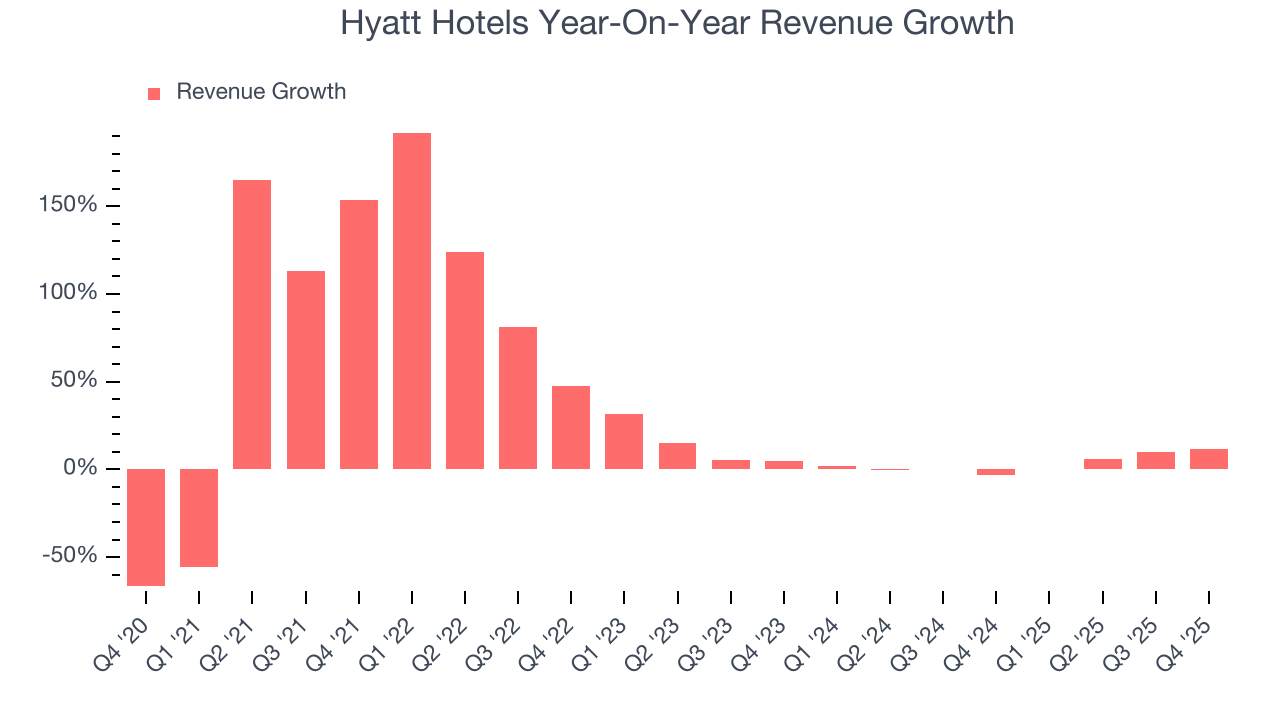

- Muted 18.8% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 5.1% for the last two years

Hyatt Hotels is skating on thin ice. There are more promising alternatives.

Why There Are Better Opportunities Than Hyatt Hotels

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hyatt Hotels

Hyatt Hotels is trading at $169.20 per share, or 60.3x forward P/E. This valuation is extremely expensive, especially for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Hyatt Hotels (H) Research Report: Q4 CY2025 Update

Hospitality company Hyatt Hotels (NYSE:H) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.7% year on year to $1.79 billion. Its non-GAAP profit of $1.33 per share was significantly above analysts’ consensus estimates.

Hyatt Hotels (H) Q4 CY2025 Highlights:

- Revenue: $1.79 billion vs analyst estimates of $1.80 billion (11.7% year-on-year growth, in line)

- Adjusted EPS: $1.33 vs analyst estimates of $0.34 (significant beat)

- Adjusted EBITDA: $292 million vs analyst estimates of $290.4 million (16.3% margin, 0.6% beat)

- EBITDA guidance for the upcoming financial year 2026 is $1.18 billion at the midpoint, below analyst estimates of $1.26 billion

- Operating Margin: 5%, in line with the same quarter last year

- RevPAR: $146.01 at quarter end, up 3.6% year on year

- Market Capitalization: $16.01 billion

Company Overview

Founded in 1957, Hyatt Hotels (NYSE:H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt’s brand portfolio caters to a wide range of travelers' needs and preferences. At the luxury end, brands like Park Hyatt and Andaz offer upscale accommodations and personalized services. The Grand Hyatt and Hyatt Regency brands provide premium experiences for business and leisure travelers, while brands like Hyatt Place and Hyatt House cater to guests seeking practical and comfortable stays. The Alila, Thompson Hotels, and Miraval brands, among others, offer unique boutique and wellness-focused experiences, catering to the growing demand for tailored and immersive travel.

The company has pioneered various industry trends, including unique loyalty programs, digital and mobile services, and distinctive guest amenities. Hyatt's loyalty program, World of Hyatt, offers tailored rewards, experiences, and partnerships that enhance travel experiences.

Hyatt's business strategy blends managed, franchised, owned, and leased properties. This diversified business model allows for flexibility and growth across various market conditions. The company has a strong presence in major global cities, resort destinations, and emerging markets, positioning it well to cater to the demands of global travelers.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Hyatt Hotels’ primary competitors include Marriott International (NASDAQ:MAR), Hilton Worldwide (NYSE:HLT), InterContinental Hotels Group (NYSE:IHG), Accor (EPA:AC), and Wyndham Hotels & Resorts (NYSE:WH).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Hyatt Hotels grew its sales at a 28% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Hyatt Hotels’s recent performance shows its demand has slowed as its annualized revenue growth of 3.2% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

Hyatt Hotels also reports revenue per available room, which clocked in at $146.01 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Hyatt Hotels’s revenue per room averaged 12.3% year-on-year declines. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings. It is sometimes the strategy of hotels to grow ancillary revenues because they are price takers in room revenues.

This quarter, Hyatt Hotels’s year-on-year revenue growth was 11.7%, and its $1.79 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

Hyatt Hotels’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 5.3% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, Hyatt Hotels generated an operating margin profit margin of 5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

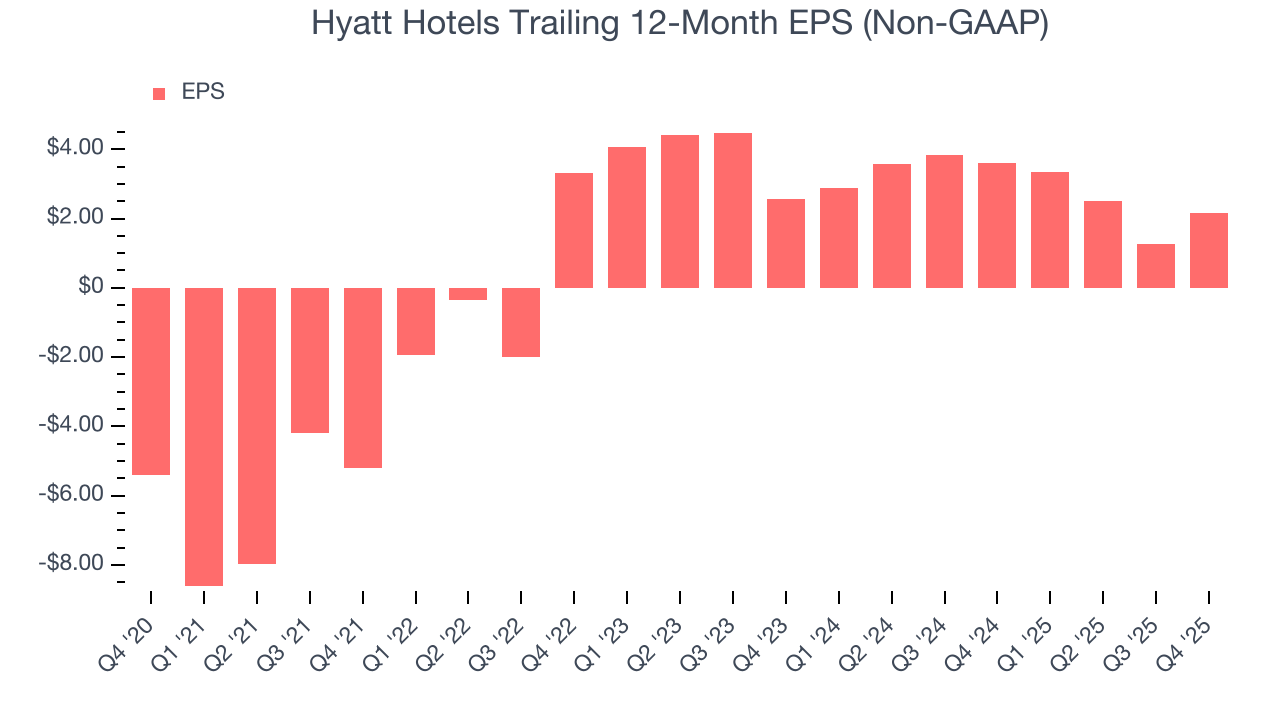

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hyatt Hotels’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Hyatt Hotels reported adjusted EPS of $1.33, up from $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hyatt Hotels’s full-year EPS of $2.17 to grow 50.5%.

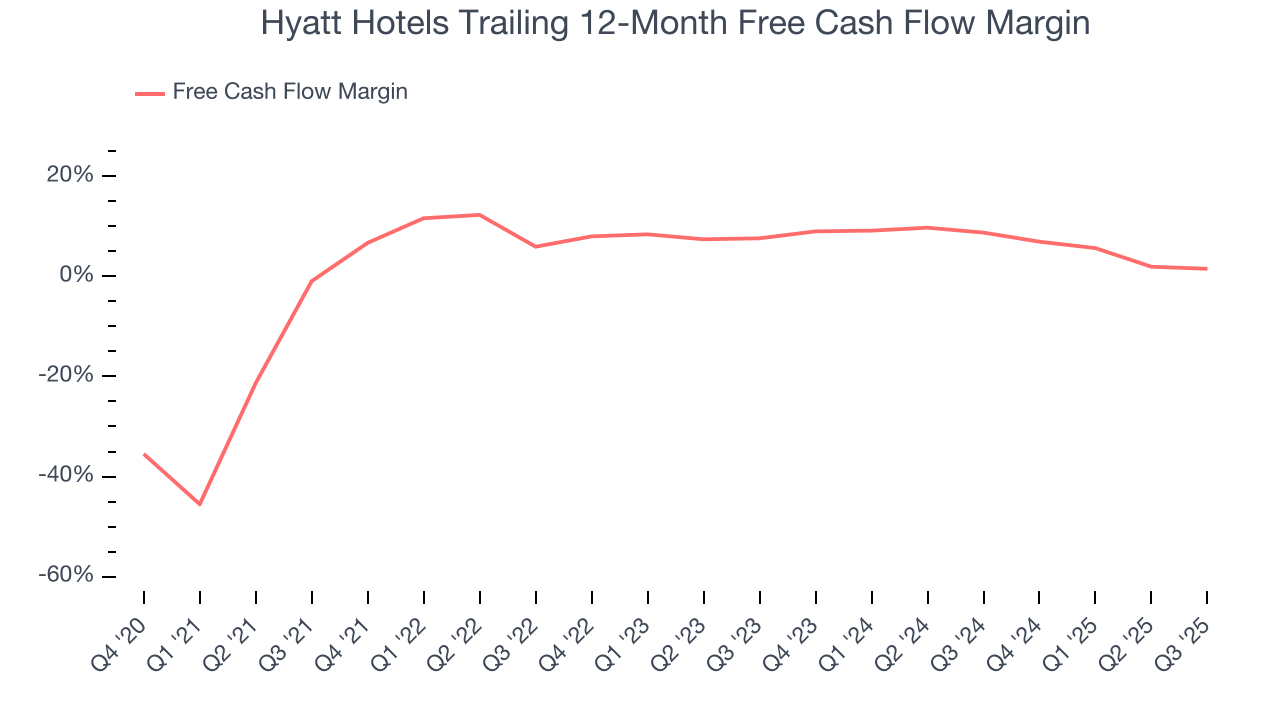

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Hyatt Hotels has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hyatt Hotels historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.2%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hyatt Hotels’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Key Takeaways from Hyatt Hotels’s Q4 Results

It was good to see Hyatt Hotels beat analysts’ EPS expectations this quarter. On the other hand, its full-year EBITDA guidance missed and its revenue was in line with Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $167.26 immediately following the results.

11. Is Now The Time To Buy Hyatt Hotels?

Updated: February 12, 2026 at 8:29 AM EST

Before making an investment decision, investors should account for Hyatt Hotels’s business fundamentals and valuation in addition to what happened in the latest quarter.

Hyatt Hotels falls short of our quality standards. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its revenue per room has disappointed. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Hyatt Hotels’s P/E ratio based on the next 12 months is 51.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $175.91 on the company (compared to the current share price of $167.26).