Norwegian Cruise Line (NCLH)

Norwegian Cruise Line keeps us up at night. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Norwegian Cruise Line Will Underperform

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

- Lackluster 9.5% annual revenue growth over the last two years indicates the company is losing ground to competitors

- Cash-burning history makes us doubt the long-term viability of its business model

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Norwegian Cruise Line doesn’t pass our quality test. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Norwegian Cruise Line

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Norwegian Cruise Line

Norwegian Cruise Line is trading at $24.78 per share, or 10x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Norwegian Cruise Line (NCLH) Research Report: Q3 CY2025 Update

Cruise company Norwegian Cruise Line (NYSE:NCLH) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 4.7% year on year to $2.94 billion. Its non-GAAP profit of $1.20 per share was 3.3% above analysts’ consensus estimates.

Norwegian Cruise Line (NCLH) Q3 CY2025 Highlights:

- Revenue: $2.94 billion vs analyst estimates of $3.02 billion (4.7% year-on-year growth, 2.7% miss)

- Adjusted EPS: $1.20 vs analyst estimates of $1.16 (3.3% beat)

- Adjusted EBITDA: $1.02 billion vs analyst estimates of $1.02 billion (34.7% margin, in line)

- Management raised its full-year Adjusted EPS guidance to $2.10 at the midpoint, a 2.4% increase

- EBITDA guidance for the full year is $2.72 billion at the midpoint, in line with analyst expectations

- Operating Margin: 25.5%, in line with the same quarter last year

- Free Cash Flow was -$726.5 million compared to -$195.5 million in the same quarter last year

- Passenger Cruise Days: 6.83 million, up 306,633 year on year

- Market Capitalization: $10.1 billion

Company Overview

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE:NCLH) is a premier global cruise company.

Norwegian Cruise Line's fleet consists of about 30 ships, each offering different guest experiences. The ships sail to over 490 destinations worldwide, including the Caribbean, Alaska, Europe, South America, and the Far East.

Norwegian Cruise Line pioneered the "Freestyle Cruising" category by offering guests the freedom and flexibility to design their ideal cruise vacation on their schedule. This resort-style cruise vacation has no fixed dining times, formal dress codes, or pre-assigned seating, along with a wealth of entertainment options and activities.

The company's ships offer an array of amenities and entertainment options including award-winning dining experiences, Broadway-style shows, water parks, and modern fitness centers. Norwegian Cruise Line is also known for its unique ship design, with many vessels featuring The Waterfront, a unique oceanfront promenade, and The Haven, an exclusive retreat with private amenities.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Norwegian Cruise Line's primary competitors include Carnival (NYSE:CCL), Royal Caribbean (NYSE:RCL), Disney Cruise Line (owned by Disney NYSE:DIS), and private companies Viking Ocean Cruises and MSC Cruises.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Norwegian Cruise Line’s 28.6% annualized revenue growth over the last five years was exceptional. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Norwegian Cruise Line’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 9.5% over the last two years was well below its five-year trend.

Norwegian Cruise Line also discloses its number of passenger cruise days, which reached 6.83 million in the latest quarter. Over the last two years, Norwegian Cruise Line’s passenger cruise days were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Norwegian Cruise Line’s revenue grew by 4.7% year on year to $2.94 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will fuel better top-line performance.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Norwegian Cruise Line’s operating margin has been trending up over the last 12 months and averaged 15.6% over the last two years. Its solid profitability for a consumer discretionary business shows it manages its expenses efficiently and benefits from operating leverage as it scales.

In Q3, Norwegian Cruise Line generated an operating margin profit margin of 25.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Norwegian Cruise Line’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, Norwegian Cruise Line reported adjusted EPS of $1.20, up from $0.99 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects Norwegian Cruise Line’s full-year EPS of $2.04 to grow 29.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Norwegian Cruise Line’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.9%, meaning it lit $3.89 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Norwegian Cruise Line burned through $726.5 million of cash in Q3, equivalent to a negative 24.7% margin. The company’s cash burn increased from $195.5 million of lost cash in the same quarter last year.

Over the next year, analysts predict Norwegian Cruise Line’s cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 10.7% for the last 12 months will increase by 15.9 percentage points.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Norwegian Cruise Line’s five-year average ROIC was negative 2.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Norwegian Cruise Line’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

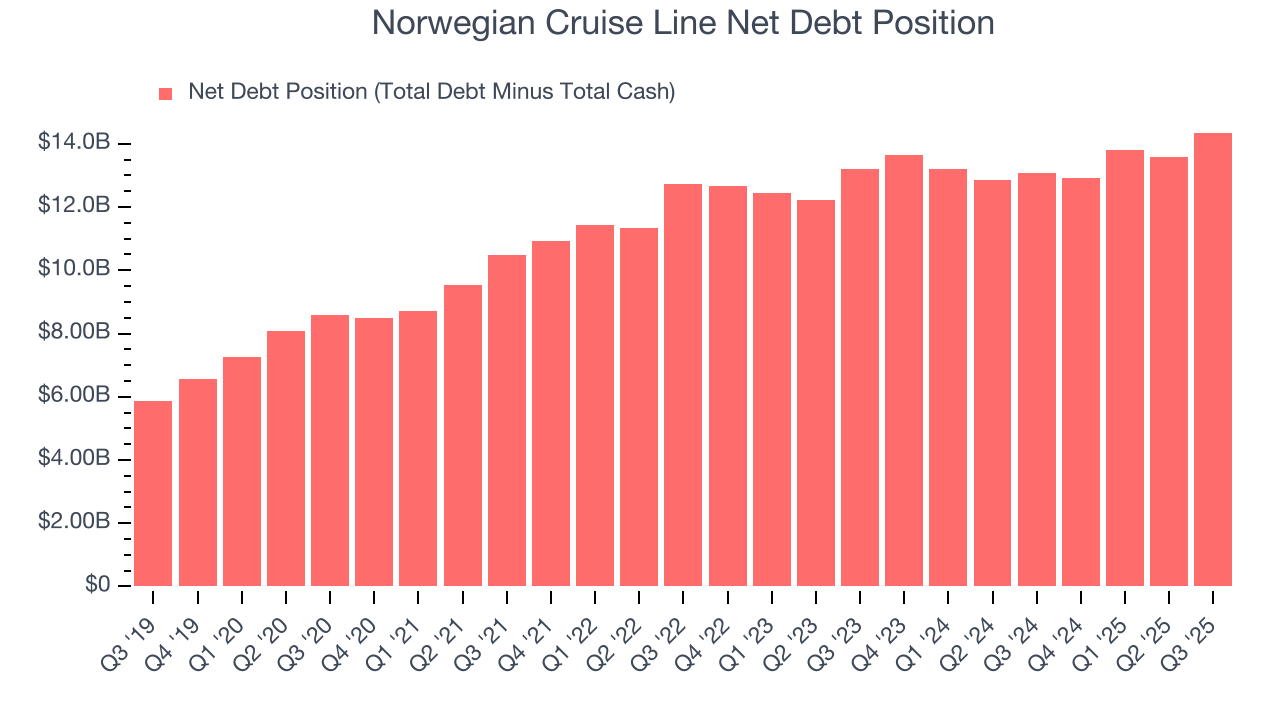

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Norwegian Cruise Line burned through $1.04 billion of cash over the last year, and its $14.52 billion of debt exceeds the $166.8 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Norwegian Cruise Line’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Norwegian Cruise Line until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Norwegian Cruise Line’s Q3 Results

It was good to see Norwegian Cruise Line beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.4% to $20.96 immediately following the results.

12. Is Now The Time To Buy Norwegian Cruise Line?

Updated: February 27, 2026 at 10:12 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Norwegian Cruise Line doesn’t pass our quality test. While its Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, the downside is its number of passenger cruise days has disappointed. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Norwegian Cruise Line’s P/E ratio based on the next 12 months is 10x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $27.25 on the company (compared to the current share price of $24.78).