AMC Networks (AMCX)

AMC Networks faces an uphill battle. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think AMC Networks Will Underperform

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

- Annual sales declines of 3.9% for the past five years show its products and services struggled to connect with the market

- Earnings per share decreased by more than its revenue over the last five years, showing each sale was less profitable

- Sales are projected to tank by 1.8% over the next 12 months as its demand continues evaporating

AMC Networks’s quality isn’t great. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than AMC Networks

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AMC Networks

AMC Networks is trading at $8.40 per share, or 3.9x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. AMC Networks (AMCX) Research Report: Q3 CY2025 Update

Television broadcasting and production company AMC Networks (NASDAQ:AMCX) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 6.3% year on year to $561.7 million. Its non-GAAP profit of $0.18 per share was 47.4% below analysts’ consensus estimates.

AMC Networks (AMCX) Q3 CY2025 Highlights:

- Revenue: $561.7 million vs analyst estimates of $547.2 million (6.3% year-on-year decline, 2.7% beat)

- Adjusted EPS: $0.18 vs analyst expectations of $0.34 (47.4% miss)

- Adjusted EBITDA: $82.92 million vs analyst estimates of $74.71 million (14.8% margin, 11% beat)

- Operating Margin: 9.9%, down from 15.6% in the same quarter last year

- Free Cash Flow Margin: 7.5%, down from 9% in the same quarter last year

- Market Capitalization: $314.5 million

Company Overview

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

AMC Networks was founded to create orginal, high-quality television and film content. The company's first channel was AMC, known for its classic movies, and it has since expanded to include BBC America, IFC, SundanceTV, and WE TV. These channels offer a variety of genres to audiences.

The company's portfolio features critically acclaimed original series, independent films, and documentaries, and it generates revenue through cable licensing fees, advertising sales, and digital streaming.

In response to the evolving media landscape, the company has effectively balanced traditional cable broadcasting with online streaming. This dual-channel strategy expands its reach as it appeals to both traditional cable subscribers and an increasingly online audience.

4. Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the television and media production industry include Lions Gate Entertainment (NYSE:LGF.A), Paramount Global (NASDAQ:PARA), and Warner Bros. Discovery (NASDAQ:WBD).

5. Revenue Growth

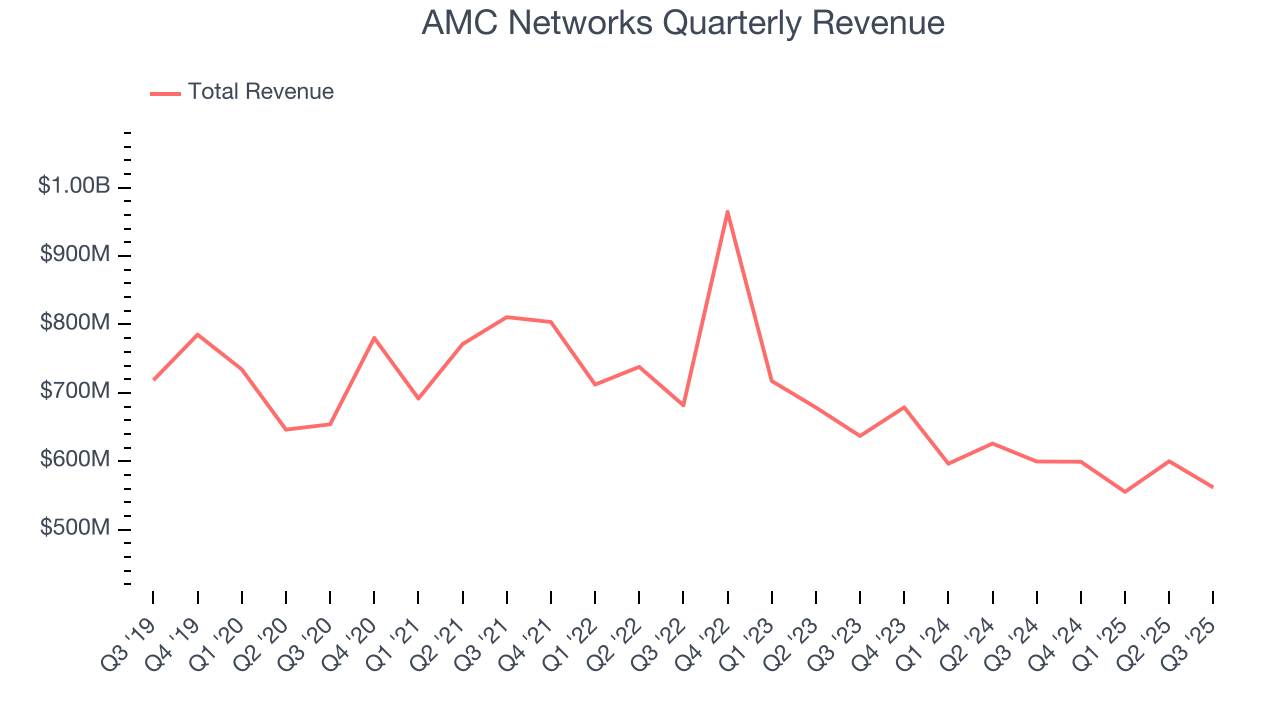

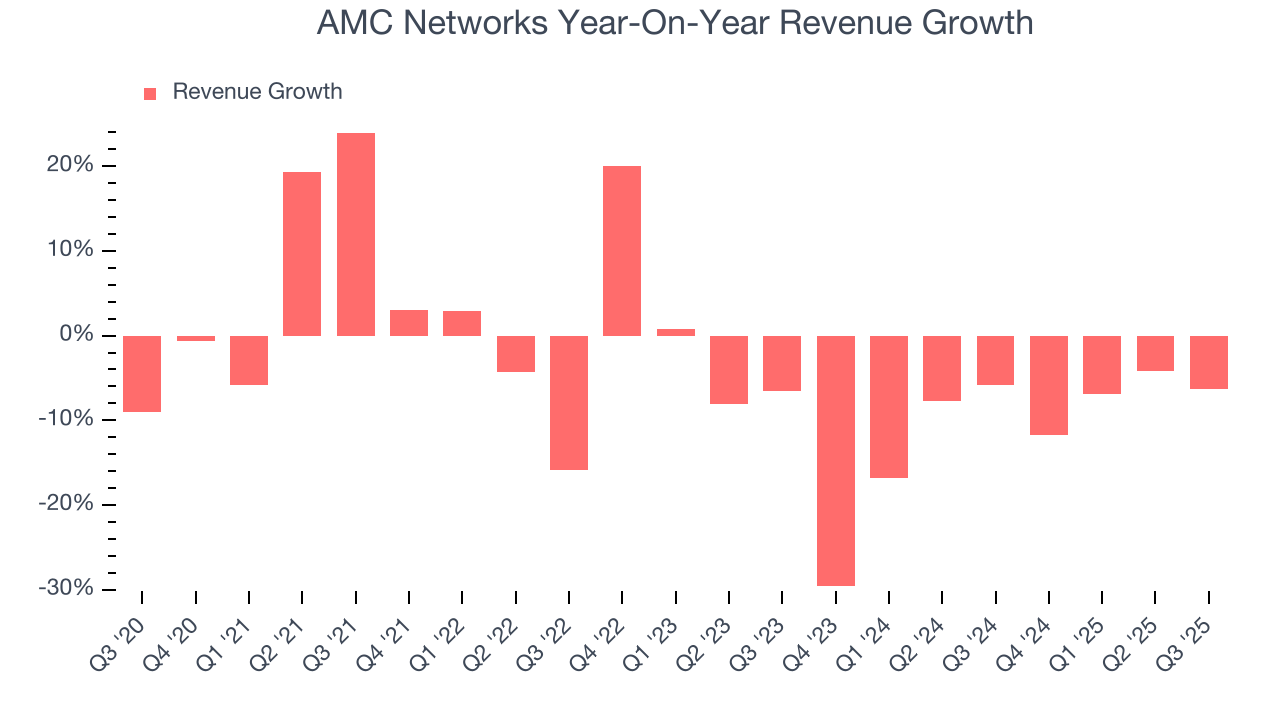

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. AMC Networks’s demand was weak over the last five years as its sales fell at a 3.9% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. AMC Networks’s recent performance shows its demand remained suppressed as its revenue has declined by 12.1% annually over the last two years.

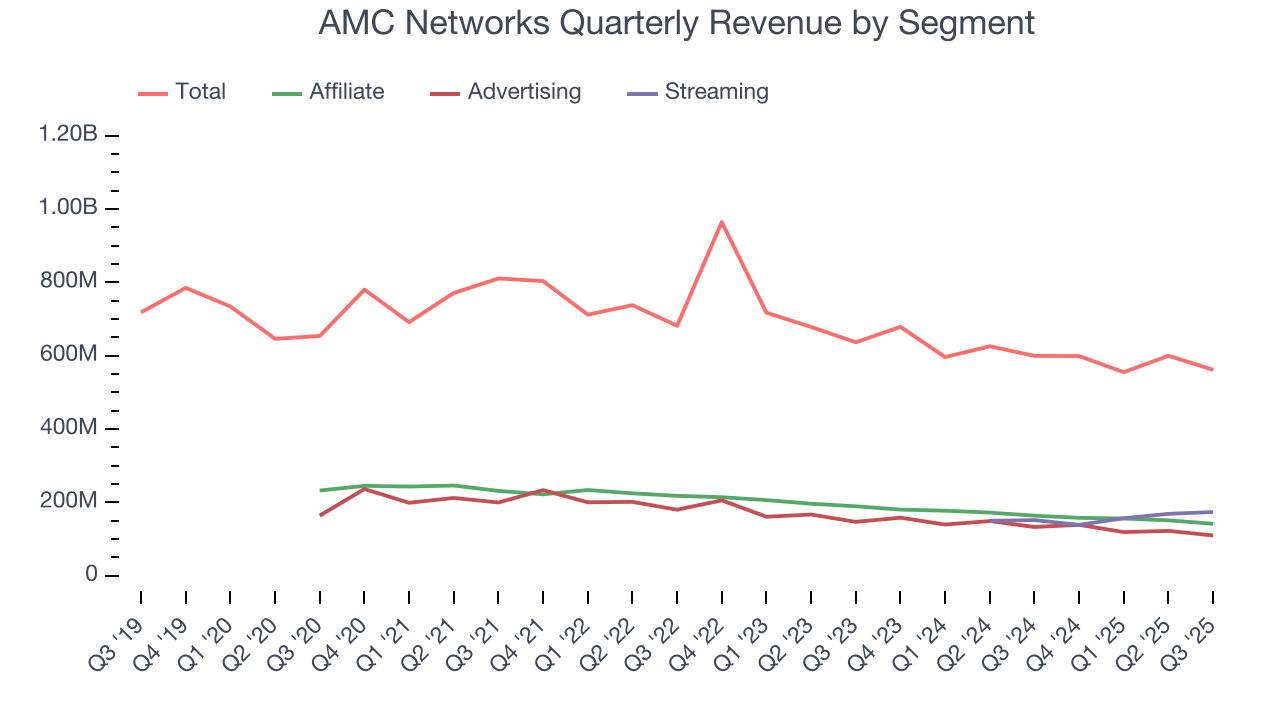

AMC Networks also breaks out the revenue for its three most important segments: Affiliate, Advertising, and Streaming, which are 25.3%, 19.6%, and 31% of revenue. Over the last two years, AMC Networks’s Affiliate (retransmission and licensing fees) and Advertising (marketing services) revenues averaged year-on-year declines of 13.2% and 14.8% while its Streaming revenue (subscription video on demand) averaged 13.6% growth.

This quarter, AMC Networks’s revenue fell by 6.3% year on year to $561.7 million but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to decline by 1.9% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

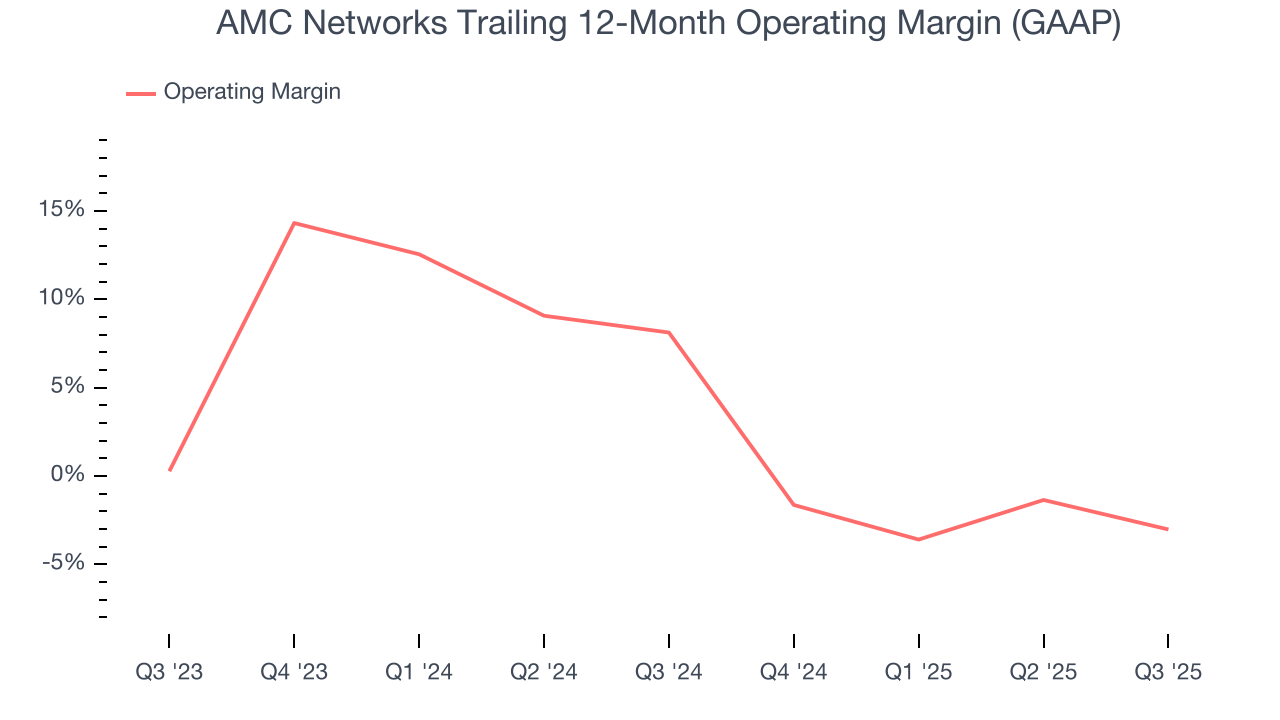

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

AMC Networks’s operating margin has shrunk over the last 12 months and averaged 2.8% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, AMC Networks generated an operating margin profit margin of 9.9%, down 5.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

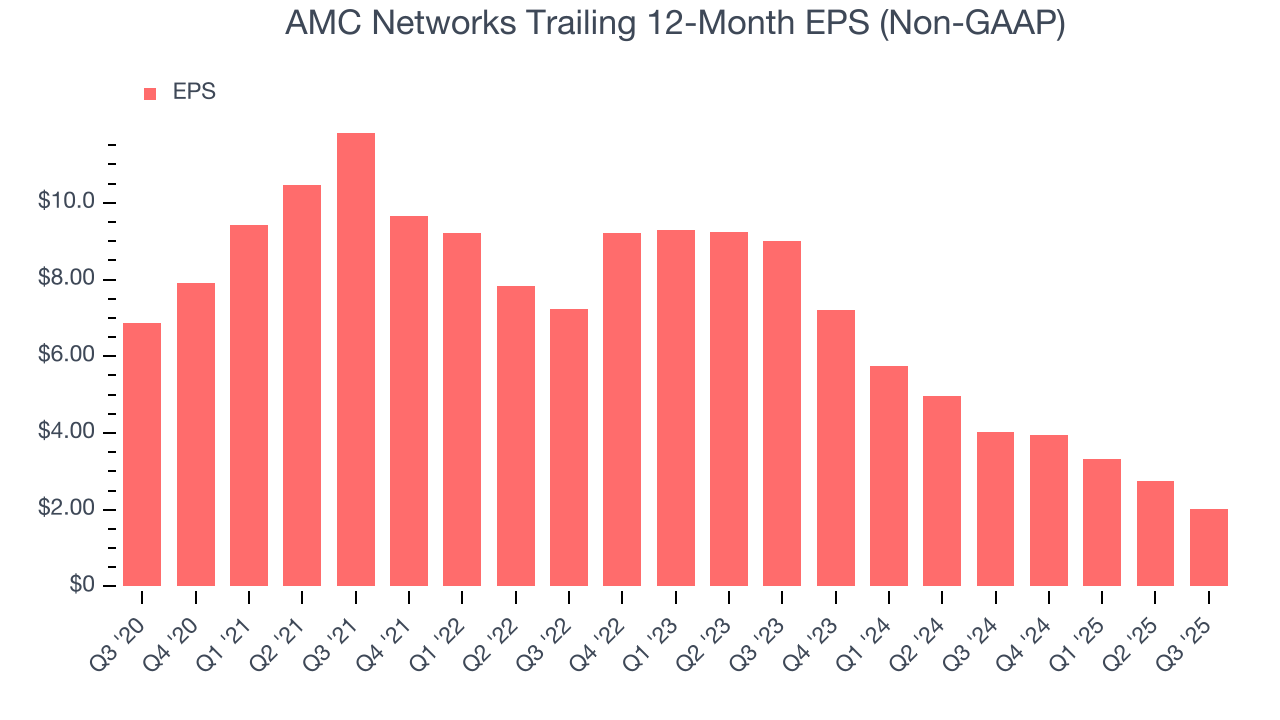

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for AMC Networks, its EPS declined by 21.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, AMC Networks reported adjusted EPS of $0.18, down from $0.91 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects AMC Networks’s full-year EPS of $2.03 to grow 15.5%.

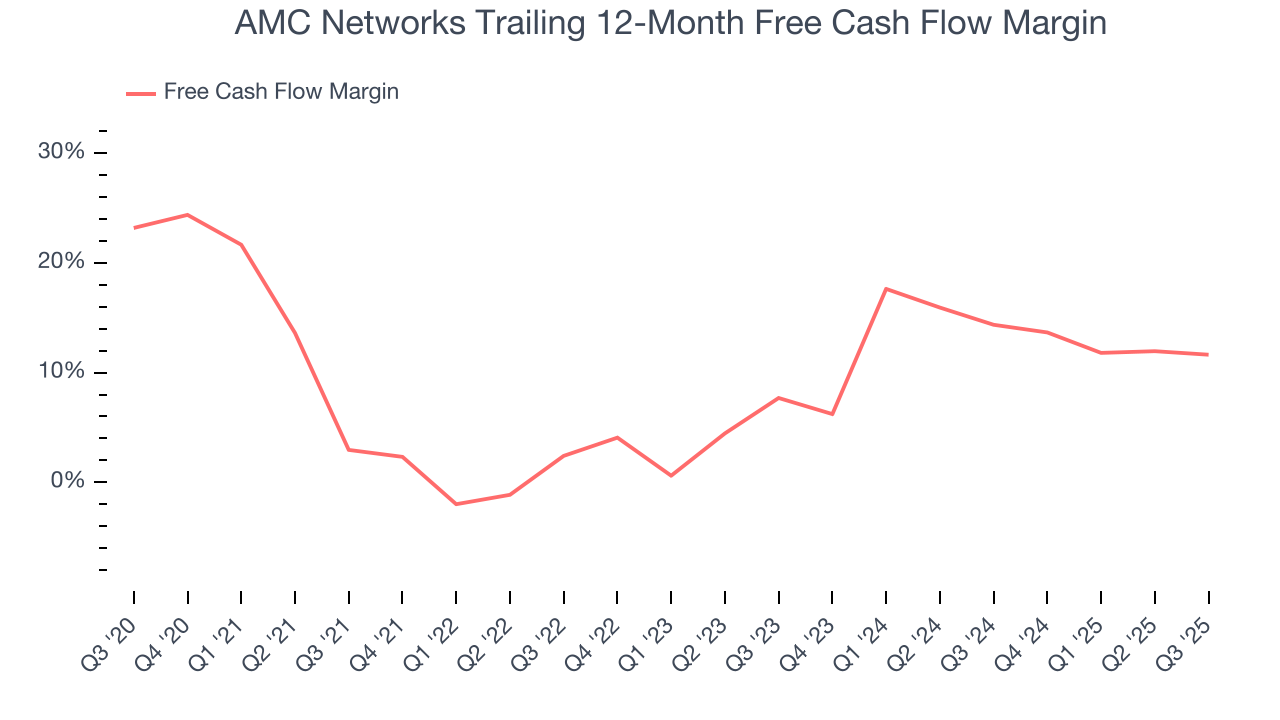

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

AMC Networks has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.1% over the last two years, better than the broader consumer discretionary sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

AMC Networks’s free cash flow clocked in at $42 million in Q3, equivalent to a 7.5% margin. The company’s cash profitability regressed as it was 1.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting AMC Networks’s free cash flow margin of 11.6% for the last 12 months to remain the same.

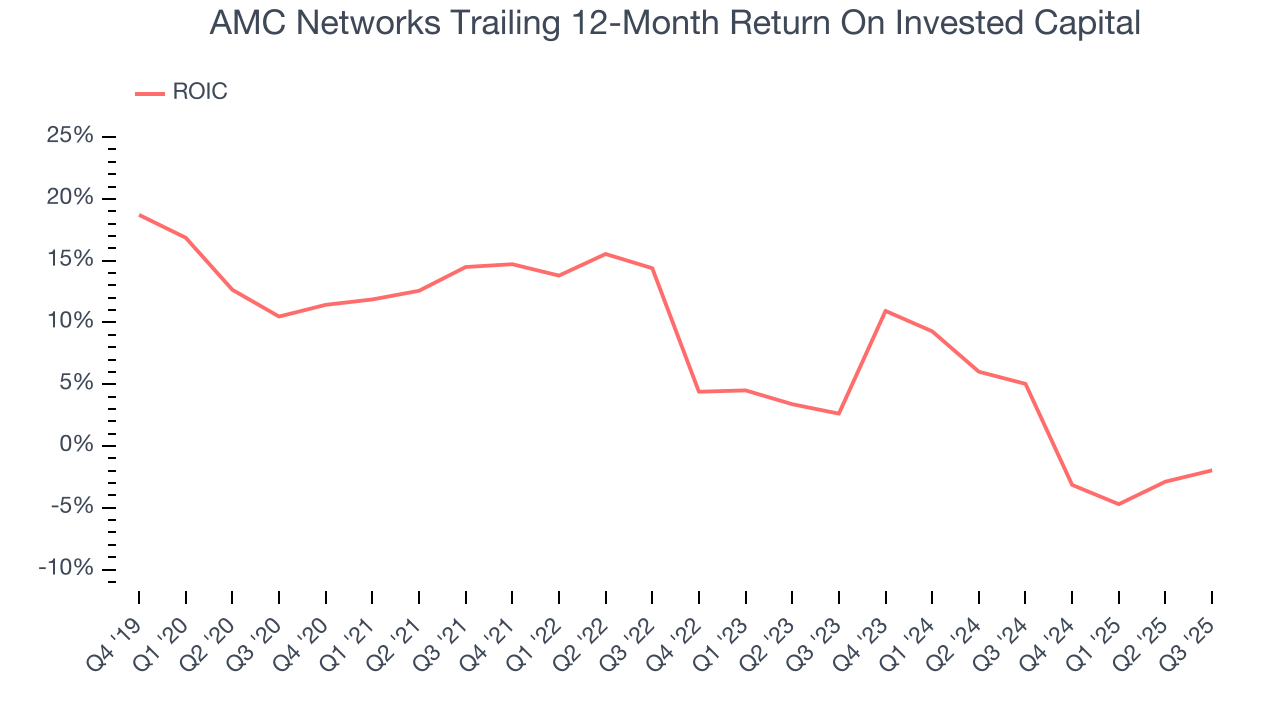

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AMC Networks historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, AMC Networks’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

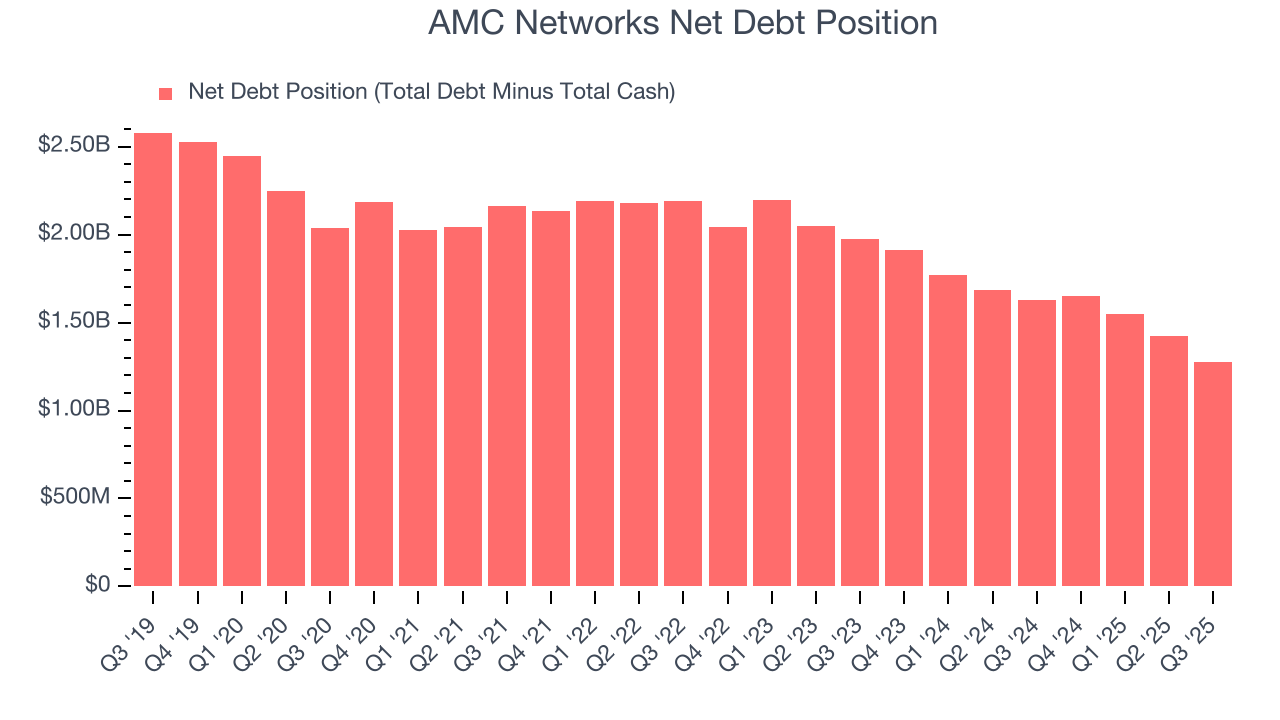

AMC Networks reported $716.8 million of cash and $2.00 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $426 million of EBITDA over the last 12 months, we view AMC Networks’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $66.45 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AMC Networks’s Q3 Results

It was encouraging to see AMC Networks beat analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its Advertising revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $7.27 immediately after reporting.

12. Is Now The Time To Buy AMC Networks?

Updated: January 15, 2026 at 9:50 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AMC Networks.

We cheer for all companies serving everyday consumers, but in the case of AMC Networks, we’ll be cheering from the sidelines. To begin with, its revenue has declined over the last five years. On top of that, AMC Networks’s Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

AMC Networks’s P/E ratio based on the next 12 months is 3.9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $7 on the company (compared to the current share price of $8.40).