The Cheesecake Factory (CAKE)

We’re cautious of The Cheesecake Factory. It not only barely generates profits but also has been less efficient lately, as seen by its falling margins.― StockStory Analyst Team

1. News

2. Summary

Why The Cheesecake Factory Is Not Exciting

Celebrated for its delicious (and free) brown bread, gigantic portions, and delectable desserts, Cheesecake Factory (NASDAQ:CAKE) is an iconic American restaurant chain that also owns and operates a portfolio of separate restaurant brands.

- Estimated sales growth of 4.1% for the next 12 months implies demand will slow from its six-year trend

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

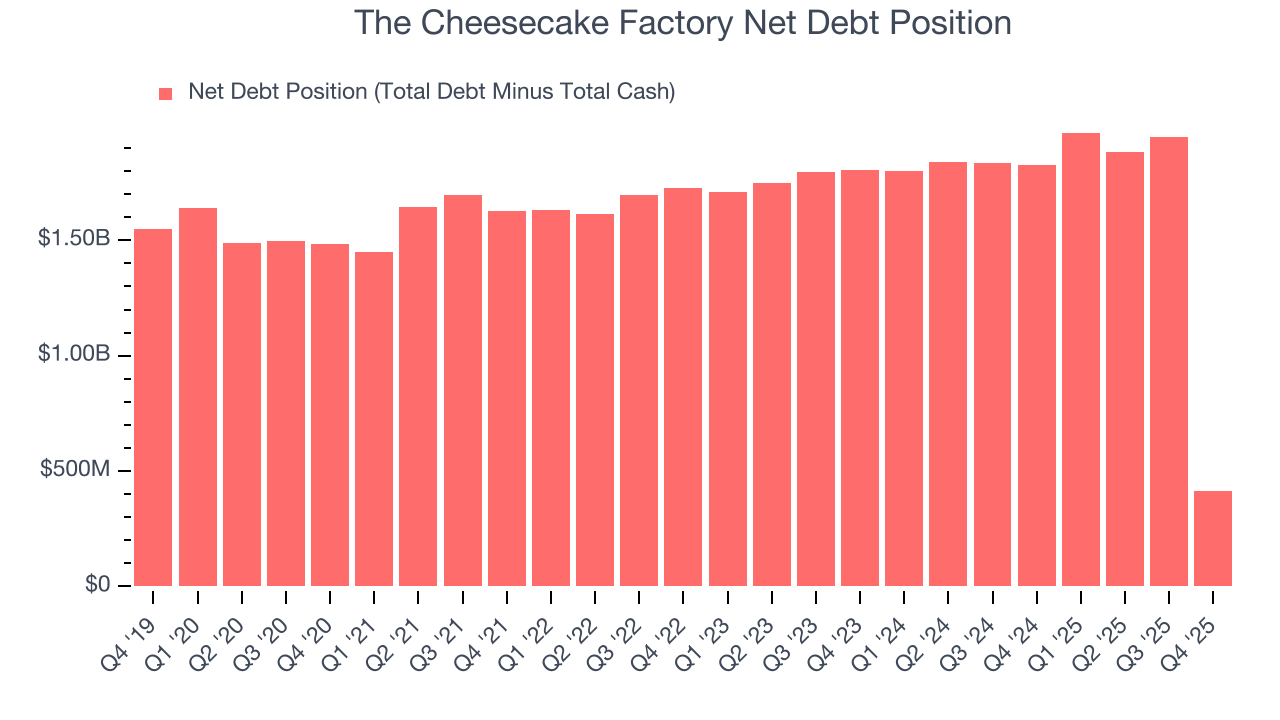

- High net-debt-to-EBITDA ratio of 6× increases the risk of forced asset sales or dilutive financing if operational performance weakens

The Cheesecake Factory’s quality isn’t up to par. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than The Cheesecake Factory

High Quality

Investable

Underperform

Why There Are Better Opportunities Than The Cheesecake Factory

The Cheesecake Factory’s stock price of $62.16 implies a valuation ratio of 15.6x forward P/E. The Cheesecake Factory’s valuation may seem like a bargain, especially when stacked up against other restaurant companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. The Cheesecake Factory (CAKE) Research Report: Q4 CY2025 Update

Restaurant company Cheesecake Factory (NASDAQ:CAKE) announced better-than-expected revenue in Q4 CY2025, with sales up 4.4% year on year to $961.6 million. Its non-GAAP profit of $1 per share was 1.5% above analysts’ consensus estimates.

The Cheesecake Factory (CAKE) Q4 CY2025 Highlights:

- Revenue: $961.6 million vs analyst estimates of $948.4 million (4.4% year-on-year growth, 1.4% beat)

- Adjusted EPS: $1 vs analyst estimates of $0.99 (1.5% beat)

- Adjusted EBITDA: $61.91 million vs analyst estimates of $85.44 million (6.4% margin, 27.5% miss)

- Operating Margin: 3.5%, down from 5.1% in the same quarter last year

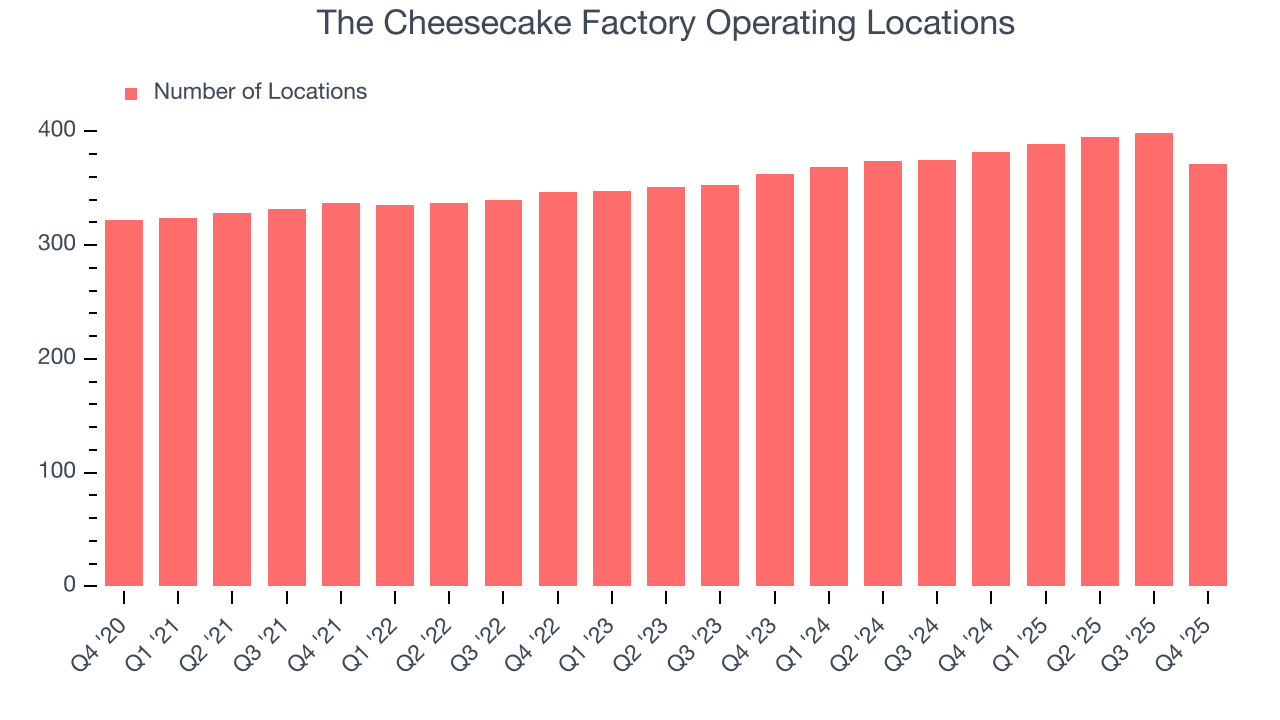

- Locations: 371 at quarter end, down from 382 in the same quarter last year

- Same-Store Sales fell 2.2% year on year (1.8% in the same quarter last year)

- Market Capitalization: $3.12 billion

Company Overview

Celebrated for its delicious (and free) brown bread, gigantic portions, and delectable desserts, Cheesecake Factory (NASDAQ:CAKE) is an iconic American restaurant chain that also owns and operates a portfolio of separate restaurant brands.

Cheesecake Factory’s origins trace back to 1972 when founder David Overton opened The Cheesecake Factory Bakery, where he produced cheesecakes and other desserts for local restaurants. The company was officially founded when David opened his first restaurant in Beverly Hills, California, expanding its menu to include sandwiches and salads.

Since its humble beginnings, Cheesecake Factory has stretched its menu (typically over 21 pages) to accommodate a wide range of tastes and preferences. Diners can indulge in anything from the Macaroni and Cheese Burger to Shrimp and Chicken Gumbo or even Orange Chicken. Most importantly, there are now over 40 different types of cheesecake creations to choose from, including Ultimate Red Velvet and Chocolate Caramelicious.

As Cheesecake Factory has grown to include over 200 locations across the United States, it’s also used its profits to acquire complementary restaurant banners. These include Italian eatery North Italia, upscale American-inspired Grand Lux Cafe, and holding company Fox Restaurant Concepts, which owns over 10 unique restaurant chains.

The target market for restaurants in the Cheesecake Factory family is suburban areas, and each is designed to create an inviting ambiance for its guests regardless of the occasion.

4. Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Multi-brand full-service restaurant competitors include Bloomin’ Brands (NASDAQ:BLMN), Brinker International (NYSE:EAT), Darden (NYSE:DRI), Dine Brands (NYSE:DIN), and Texas Roadhouse (NASDAQ:TXRH).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $3.75 billion in revenue over the past 12 months, The Cheesecake Factory is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions.

As you can see below, The Cheesecake Factory grew its sales at a decent 7.1% compounded annual growth rate over the last six years as it opened new restaurants and expanded its reach.

This quarter, The Cheesecake Factory reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, a slight deceleration versus the last six years. This projection doesn't excite us and implies its menu offerings will see some demand headwinds.

6. Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

The Cheesecake Factory sported 371 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 4.8% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

The Cheesecake Factory’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. The Cheesecake Factory should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, The Cheesecake Factory’s same-store sales fell by 2.2% year on year. This decline was a reversal from its historical levels.

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a restaurant’s pricing power and differentiation, whether it be the dining experience or quality and taste of food.

The Cheesecake Factory has great unit economics for a restaurant company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an excellent 41.4% gross margin over the last two years. Said differently, roughly $41.36 was left to spend on selling, marketing, and general administrative overhead for every $100 in revenue.

This quarter, The Cheesecake Factory’s gross profit margin was 44.6%, up 12.4 percentage points year on year. The Cheesecake Factory’s full-year margin has also been trending up over the past 12 months, increasing by 4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold

8. Operating Margin

The Cheesecake Factory’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5% over the last two years. This profitability was paltry for a restaurant business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, The Cheesecake Factory’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, The Cheesecake Factory generated an operating margin profit margin of 3.5%, down 1.6 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, and administrative overhead grew faster than its revenue.

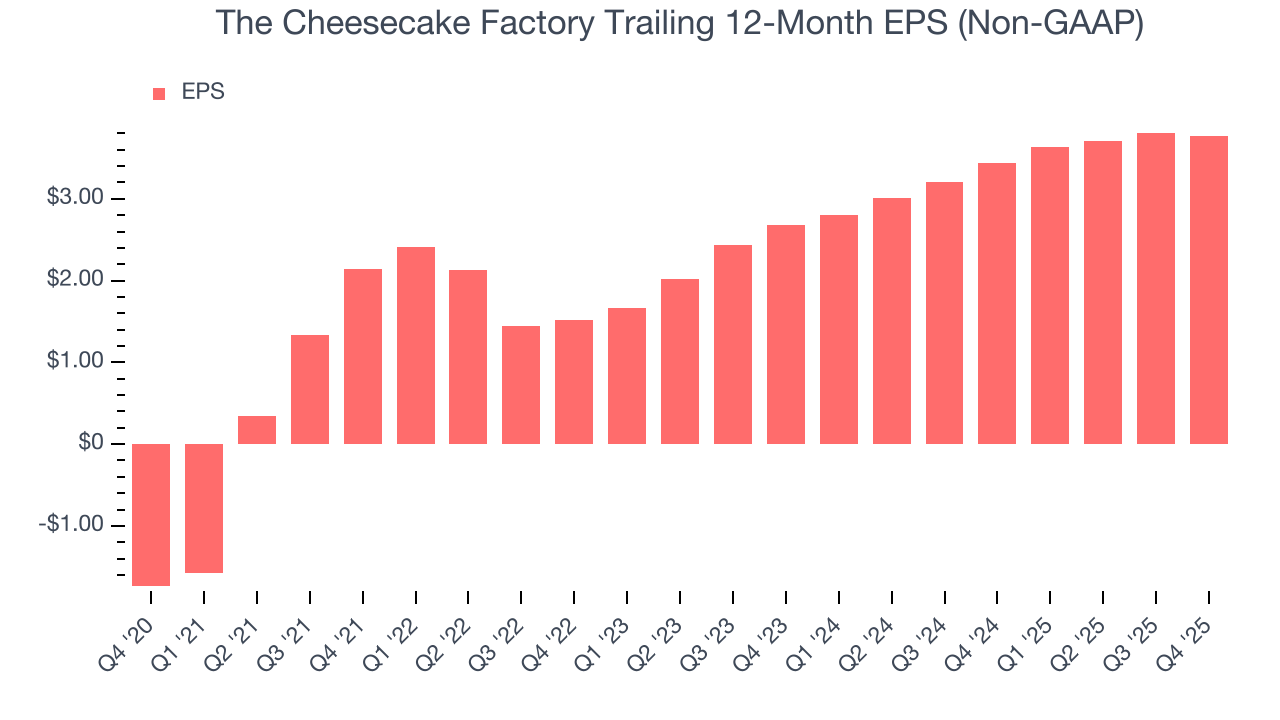

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

The Cheesecake Factory’s unimpressive 6.3% annual EPS growth over the last six years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q4, The Cheesecake Factory reported adjusted EPS of $1, down from $1.04 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.5%. Over the next 12 months, Wall Street expects The Cheesecake Factory’s full-year EPS of $3.77 to grow 6.3%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

The Cheesecake Factory has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 3.3% over the last two years, slightly better than the broader restaurant sector.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although The Cheesecake Factory hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 14.7%, impressive for a restaurant business.

12. Balance Sheet Assessment

The Cheesecake Factory reported $215.7 million of cash and $630.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $299.7 million of EBITDA over the last 12 months, we view The Cheesecake Factory’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $10.45 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from The Cheesecake Factory’s Q4 Results

It was good to see The Cheesecake Factory narrowly top analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its same-store sales fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.2% to $60.00 immediately after reporting.

14. Is Now The Time To Buy The Cheesecake Factory?

Updated: March 8, 2026 at 10:57 PM EDT

Before deciding whether to buy The Cheesecake Factory or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

The Cheesecake Factory isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was decent over the last six years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s new restaurant openings have increased its brand equity, the downside is its operating margins are low compared to other restaurants.

The Cheesecake Factory’s P/E ratio based on the next 12 months is 15.6x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $64.67 on the company (compared to the current share price of $62.16).