DXP (DXPE)

DXP is an exciting business. Its rapid revenue growth gives it operating leverage, making it more profitable as it expands.― StockStory Analyst Team

1. News

2. Summary

Why We Like DXP

Founded during the emergence of Big Oil in Texas, DXP (NASDAQ:DXPE) provides pumps, valves, and other industrial components.

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 50.1% annually

- Impressive 13% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Industry-leading 12.3% return on capital demonstrates management’s skill in finding high-return investments, and its rising returns show it’s making even more lucrative bets

We have an affinity for DXP. The valuation looks reasonable when considering its quality, so this could be a favorable time to invest in some shares.

Why Is Now The Time To Buy DXP?

High Quality

Investable

Underperform

Why Is Now The Time To Buy DXP?

DXP is trading at $149.37 per share, or 23.7x forward P/E. The valuation multiple is below many companies in the industrials sector. We therefore think the stock is a good deal for the fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Entry price matters less, but if you can get a good one, all the better.

3. DXP (DXPE) Research Report: Q3 CY2025 Update

Industrial distributor DXP Enterprises (NASDAQ:DXPE) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 8.6% year on year to $513.7 million. Its non-GAAP profit of $1.34 per share was 14.4% below analysts’ consensus estimates.

DXP (DXPE) Q3 CY2025 Highlights:

- Revenue: $513.7 million vs analyst estimates of $498.8 million (8.6% year-on-year growth, 3% beat)

- Adjusted EPS: $1.34 vs analyst expectations of $1.57 (14.4% miss)

- Adjusted EBITDA: $56.5 million vs analyst estimates of $54.7 million (11% margin, 3.3% beat)

- Operating Margin: 8.5%, in line with the same quarter last year

- Free Cash Flow Margin: 5.5%, similar to the same quarter last year

- Market Capitalization: $1.91 billion

Company Overview

Founded during the emergence of Big Oil in Texas, DXP (NASDAQ:DXPE) provides pumps, valves, and other industrial components.

In 1908 Charles A. Levins founded what was formerly known as Southern Engine and Pump Company to deliver water, help steamships operate, and for irrigation purposes. The company made various acquisitions as it sought to provide customers with a single point of contact for a broad category of products and services.

The company has made 40+ acquisitions since the 2000s, targeting smaller companies that complement its existing portfolio or operate independently. For example, it acquired Florida Valve and Alliance Pump & Mechanical in 2023 which, respectively, expanded its offerings of pumps and valves.

DXP provides various pumps including centrifugal pumps (uses a spinning wheel to push liquid outward and create flow) and rotary gear pumps (uses rotating parts to trap and push liquid through the pump) ideal for handling lubricating oils and other liquids. It also offers all kinds of bearings and power transmissions which are used for reducing friction and transferring power in machinery and equipment.

Its selection also spans different industrial components from abrasives and lubricants to hand tools and welding equipment. Additionally, DXP is a source for safety products such as eye protection, first aid kits, and respiratory gear, as well as safety through services. Some of the services it offers include H2S gas protection and fire safety solutions.

DXP primarily engages in long term contracts with businesses which typically last 3 to 5 years. It also offers volume discounts, providing customers with lower prices when they purchase larger quantities of products.

4. Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

Competitors offering similar products include Grainger (NYSE:GWW), MSC (NYSE:MSM), and Fastenal (NASDAQ:FAST).

5. Revenue Growth

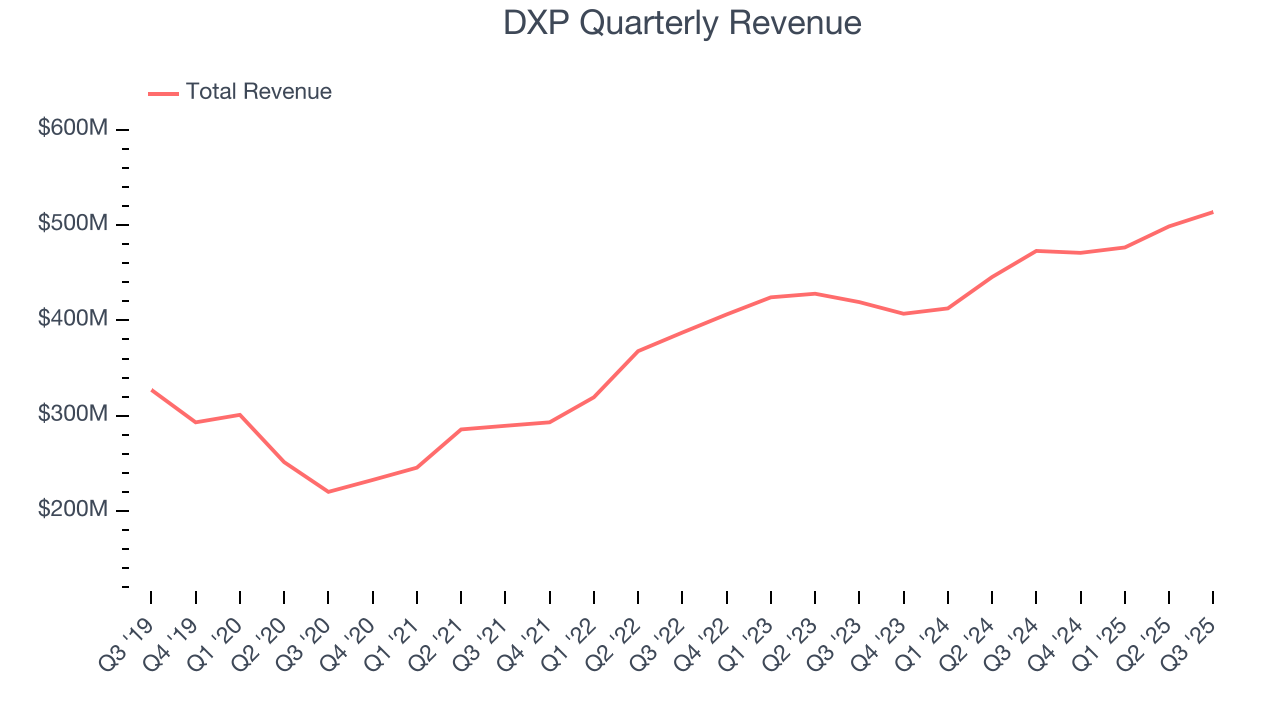

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, DXP’s sales grew at an excellent 13% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. DXP’s annualized revenue growth of 8.1% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, DXP reported year-on-year revenue growth of 8.6%, and its $513.7 million of revenue exceeded Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

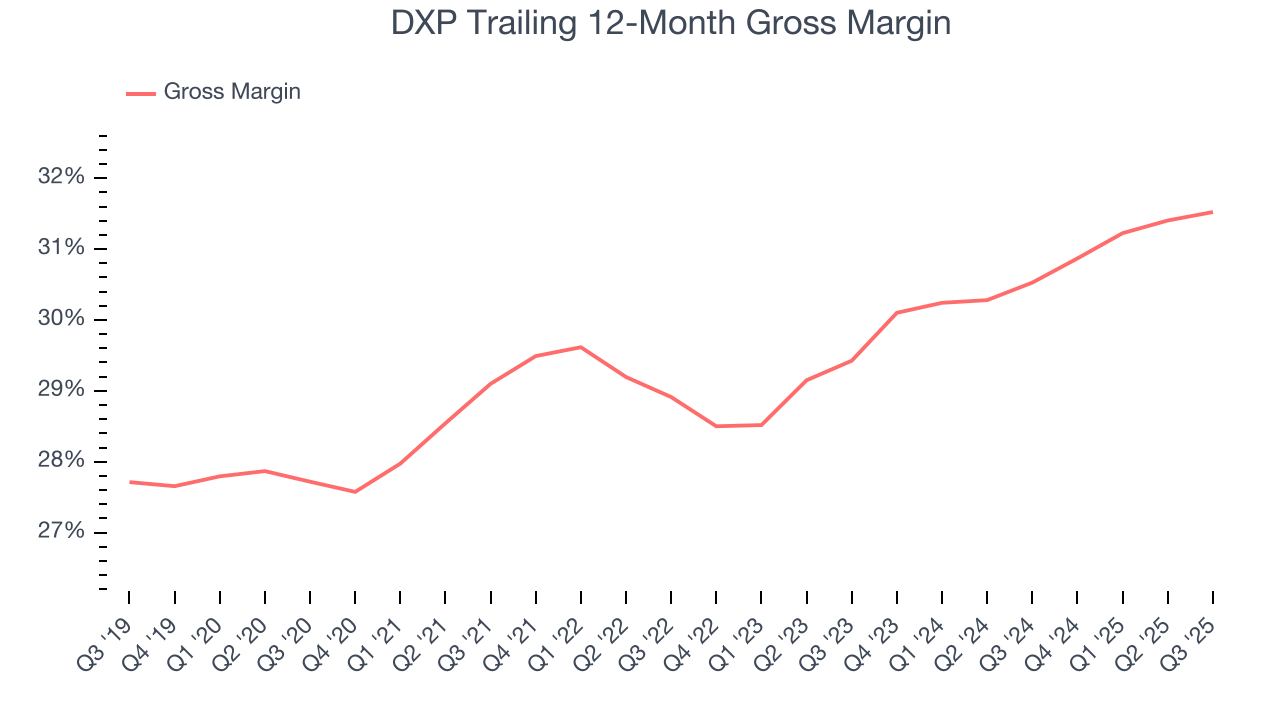

DXP’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 30.1% gross margin over the last five years. Said differently, DXP paid its suppliers $69.94 for every $100 in revenue.

DXP produced a 31.4% gross profit margin in Q3, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

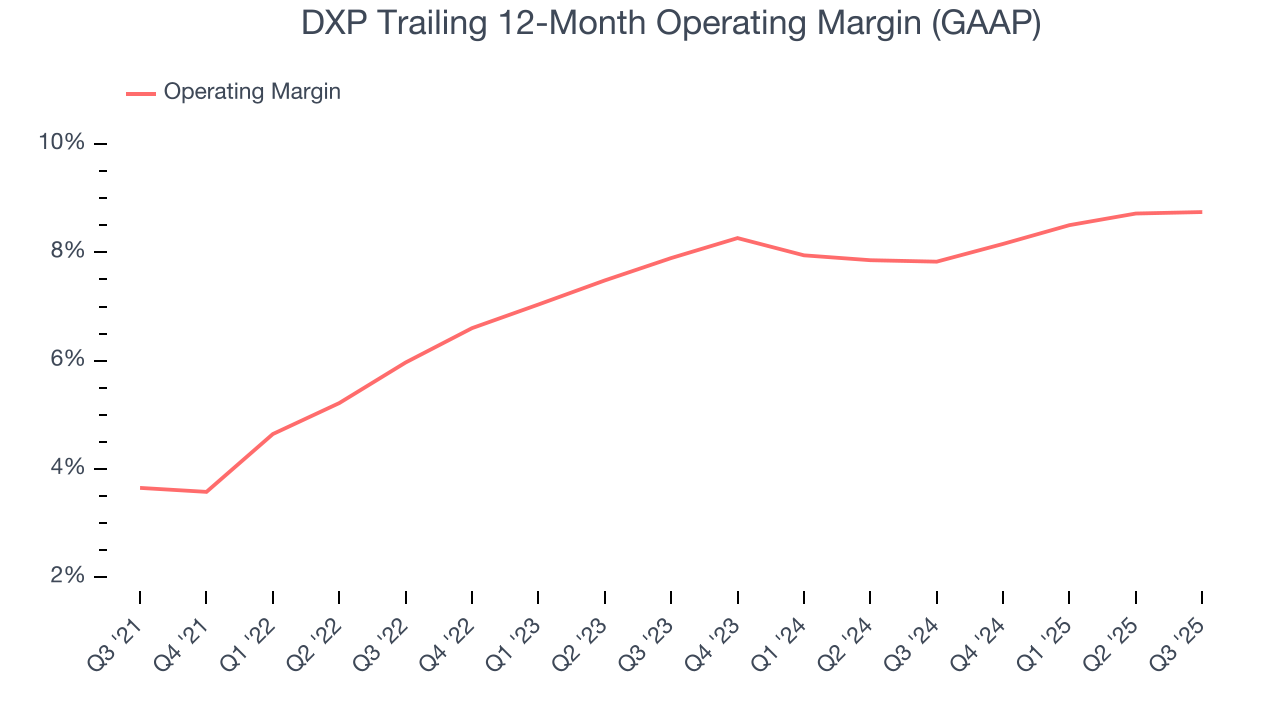

DXP was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.2% was weak for an industrials business.

On the plus side, DXP’s operating margin rose by 5.1 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, DXP generated an operating margin profit margin of 8.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

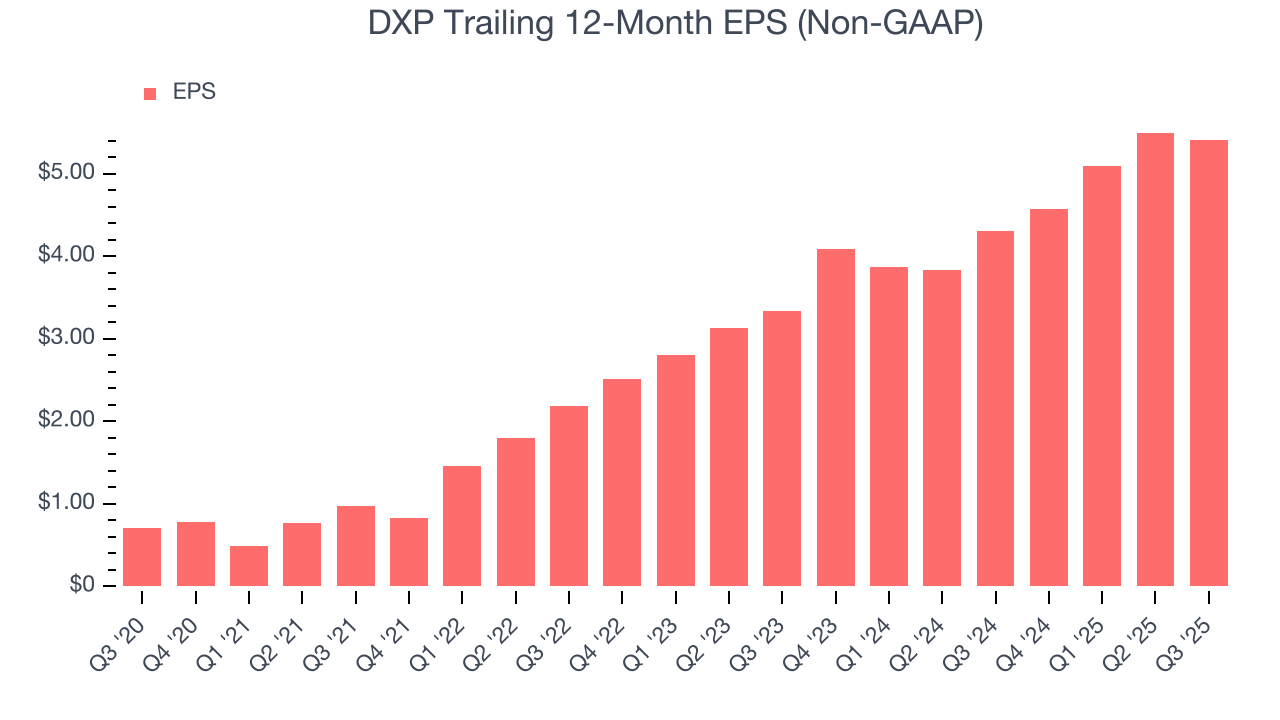

DXP’s EPS grew at an astounding 50.1% compounded annual growth rate over the last five years, higher than its 13% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

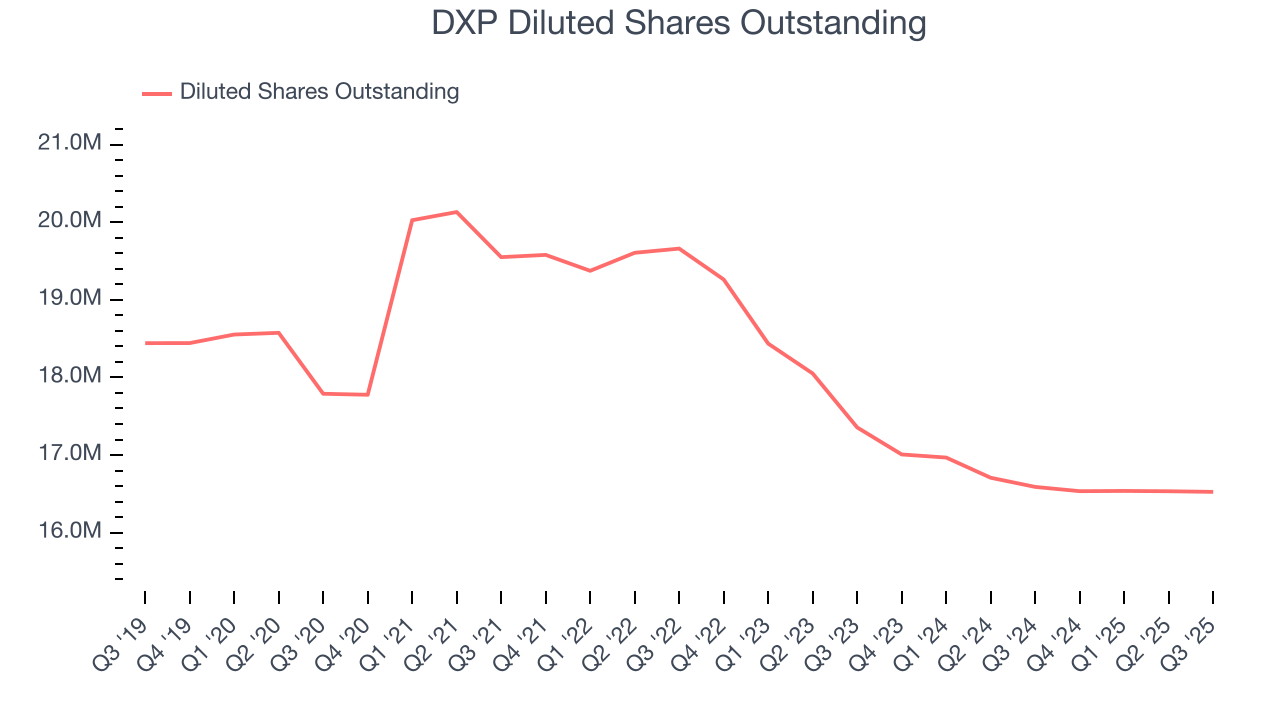

We can take a deeper look into DXP’s earnings to better understand the drivers of its performance. As we mentioned earlier, DXP’s operating margin was flat this quarter but expanded by 5.1 percentage points over the last five years. On top of that, its share count shrank by 7.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For DXP, its two-year annual EPS growth of 27.4% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, DXP reported adjusted EPS of $1.34, down from $1.43 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects DXP’s full-year EPS of $5.41 to grow 22.1%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

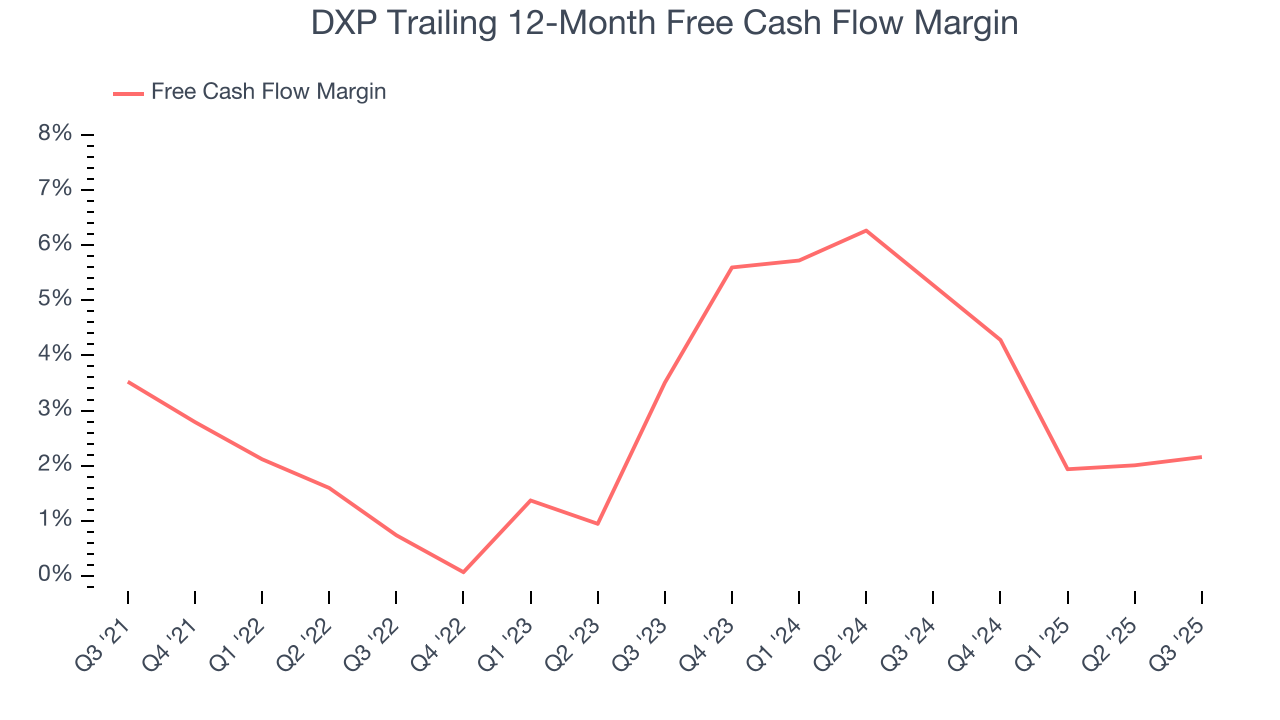

DXP has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.1%, subpar for an industrials business.

Taking a step back, we can see that DXP’s margin dropped by 1.4 percentage points during that time. If the trend continues, it could signal it’s in the middle of an investment cycle.

DXP’s free cash flow clocked in at $28.15 million in Q3, equivalent to a 5.5% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

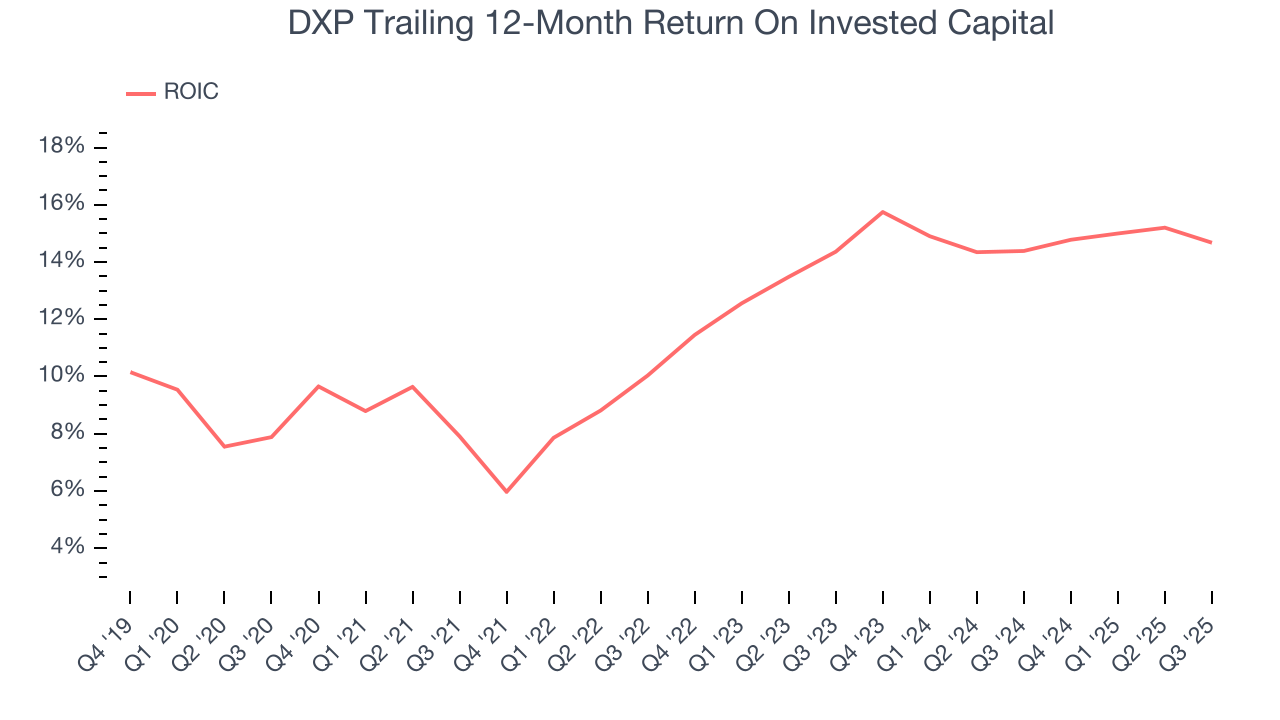

DXP’s five-year average ROIC was 12.3%, higher than most industrials businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, DXP’s has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

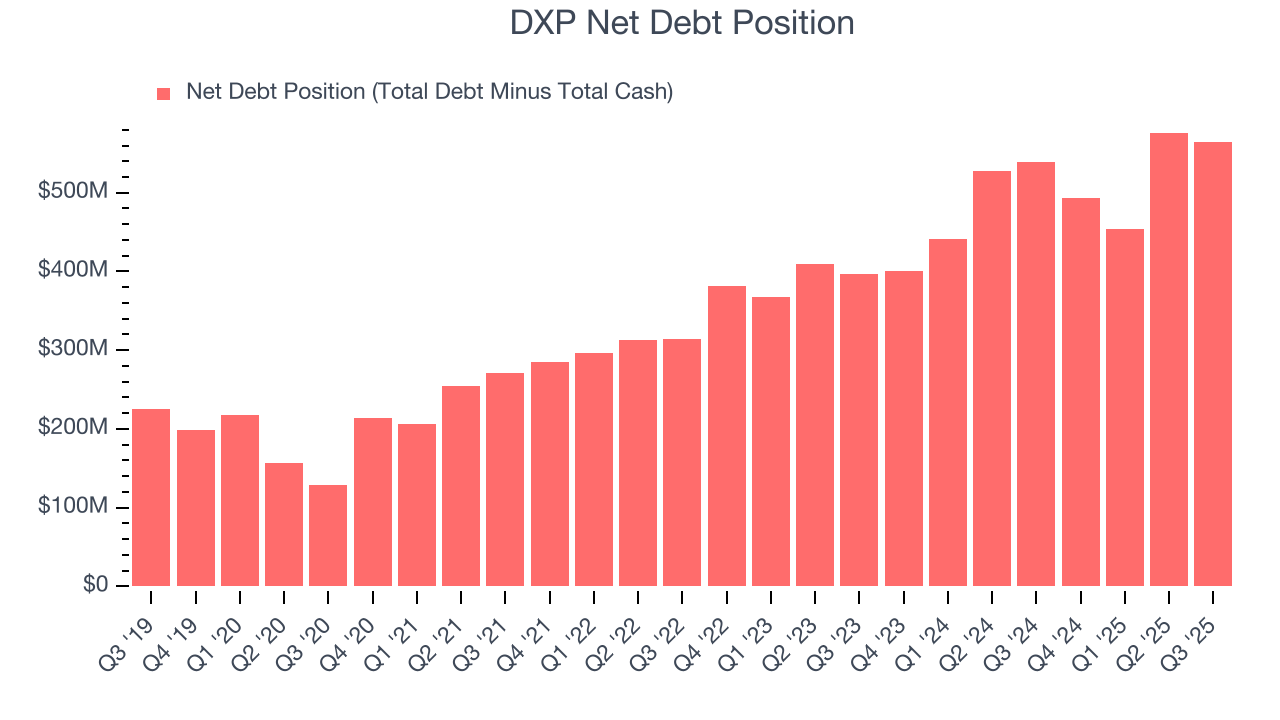

DXP reported $123.8 million of cash and $687.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $198.5 million of EBITDA over the last 12 months, we view DXP’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $28.72 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from DXP’s Q3 Results

We enjoyed seeing DXP beat analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $122.08 immediately following the results.

13. Is Now The Time To Buy DXP?

Updated: February 22, 2026 at 10:36 PM EST

Before deciding whether to buy DXP or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There is a lot to like about DXP. First of all, the company’s revenue growth was impressive over the last five years. And while its low free cash flow margins give it little breathing room, its expanding operating margin shows the business has become more efficient. Additionally, DXP’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

DXP’s P/E ratio based on the next 12 months is 23.7x. Scanning the industrials space today, DXP’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $136.50 on the company (compared to the current share price of $149.37).