LegalZoom (LZ)

LegalZoom is intriguing. Despite its slow growth, its highly profitable model gives it a margin of safety during times of stress.― StockStory Analyst Team

1. News

2. Summary

Why LegalZoom Is Interesting

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ:LZ) offers online legal services and documentation assistance for individuals and businesses.

- Healthy EBITDA margin shows it’s a well-run company with efficient processes, and its rise over the last few years was fueled by some leverage on its fixed costs

- Switching costs of its platform were on full display over the last two years as it not only grew engagement but also increased the average revenue per user by 52.9% annually

- One risk is its muted 6.8% annual revenue growth over the last three years shows its demand lagged behind its consumer internet peers

LegalZoom almost passes our quality test. If you like the stock, the price looks reasonable.

Why Is Now The Time To Buy LegalZoom?

High Quality

Investable

Underperform

Why Is Now The Time To Buy LegalZoom?

LegalZoom is trading at $7.03 per share, or 5.6x forward EV/EBITDA. Price is what you pay, and value is what you get. With this in mind, we think the current price is quite attractive.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. LegalZoom (LZ) Research Report: Q4 CY2025 Update

Online legal service provider LegalZoom (NASDAQ:LZ) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 17.7% year on year to $190.3 million. Guidance for next quarter’s revenue was better than expected at $201.5 million at the midpoint, 0.8% above analysts’ estimates. Its GAAP profit of $0.03 per share was in line with analysts’ consensus estimates.

LegalZoom (LZ) Q4 CY2025 Highlights:

- Revenue: $190.3 million vs analyst estimates of $184.6 million (17.7% year-on-year growth, 3.1% beat)

- EPS (GAAP): $0.03 vs analyst estimates of $0.03 (in line)

- Adjusted EBITDA: $49.89 million vs analyst estimates of $47.31 million (26.2% margin, 5.5% beat)

- Revenue Guidance for Q1 CY2026 is $201.5 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the upcoming financial year 2026 is $195 million at the midpoint, above analyst estimates of $189.4 million

- Operating Margin: 6.6%, down from 8.1% in the same quarter last year

- Free Cash Flow Margin: 14.7%, down from 24.7% in the previous quarter

- Subscription Units: 1.94 million, up 173,000 year on year

- Market Capitalization: $1.24 billion

Company Overview

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ:LZ) offers online legal services and documentation assistance for individuals and businesses.

LegalZoom’s key product is an online legal document preparation service that allows customers to create legal documents without having to hire an often expensive lawyer. Whether you need a will, power of attorney, or a trademark registration, the company can be of assistance. Some legal documents generated by LegalZoom do not involve an attorney’s work or review.

When there is a lawyer involved, LegalZoom activates its partnerships with independent attorneys and law firms. These attorneys and law firms are not LegalZoom employees but rather independent contractors. LegalZoom charges a fee for its services, and the attorneys who do the work are paid compensated by LegalZoom.

LegalZoom charges a fee for its online legal document preparation services, with prices ranging from $39 to $799 depending on the complexity of the document. For example, let's say you're starting a small business and need to draft articles of incorporation. Instead of hiring an expensive lawyer, you can use LegalZoom's service to create the document for just $149.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering online legal or document services include H&R Block (NYSE:HRB) as well as private companies Jackson Hewitt and Rocket Lawyer.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, LegalZoom’s 6.8% annualized revenue growth over the last three years was tepid. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about LegalZoom.

This quarter, LegalZoom reported year-on-year revenue growth of 17.7%, and its $190.3 million of revenue exceeded Wall Street’s estimates by 3.1%. Company management is currently guiding for a 10% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

6. Subscription Units

User Growth

As an online marketplace, LegalZoom generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, LegalZoom’s subscription units, a key performance metric for the company, increased by 12.5% annually to 1.94 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q4, LegalZoom added 173,000 subscription units, leading to 9.8% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and LegalZoom’s take rate, or "cut", on each order.

LegalZoom’s ARPU growth has been exceptional over the last two years, averaging 52.9%. Its ability to increase monetization while growing its subscription units at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

This quarter, LegalZoom’s ARPU clocked in at $266. It grew by 1.1% year on year, slower than its user growth.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For online marketplaces like LegalZoom, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

LegalZoom’s gross margin is ahead of the broader industry and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 65.4% gross margin over the last two years. That means for every $100 in revenue, roughly $65.36 was left to spend on selling, marketing, and R&D.

LegalZoom’s gross profit margin came in at 67.6% this quarter, in line with the same quarter last year. On a wider time horizon, LegalZoom’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. User Acquisition Efficiency

Consumer internet businesses like LegalZoom grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s expensive for LegalZoom to acquire new users as the company has spent 52.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that LegalZoom’s product offering can be easily replicated and that it must continue investing to maintain an acceptable growth trajectory.

9. EBITDA

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

LegalZoom has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 22.3%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, LegalZoom’s EBITDA margin rose by 12.5 percentage points over the last few years, as its sales growth gave it operating leverage.

In Q4, LegalZoom generated an EBITDA margin profit margin of 26.2%, down 1.1 percentage points year on year. Since LegalZoom’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

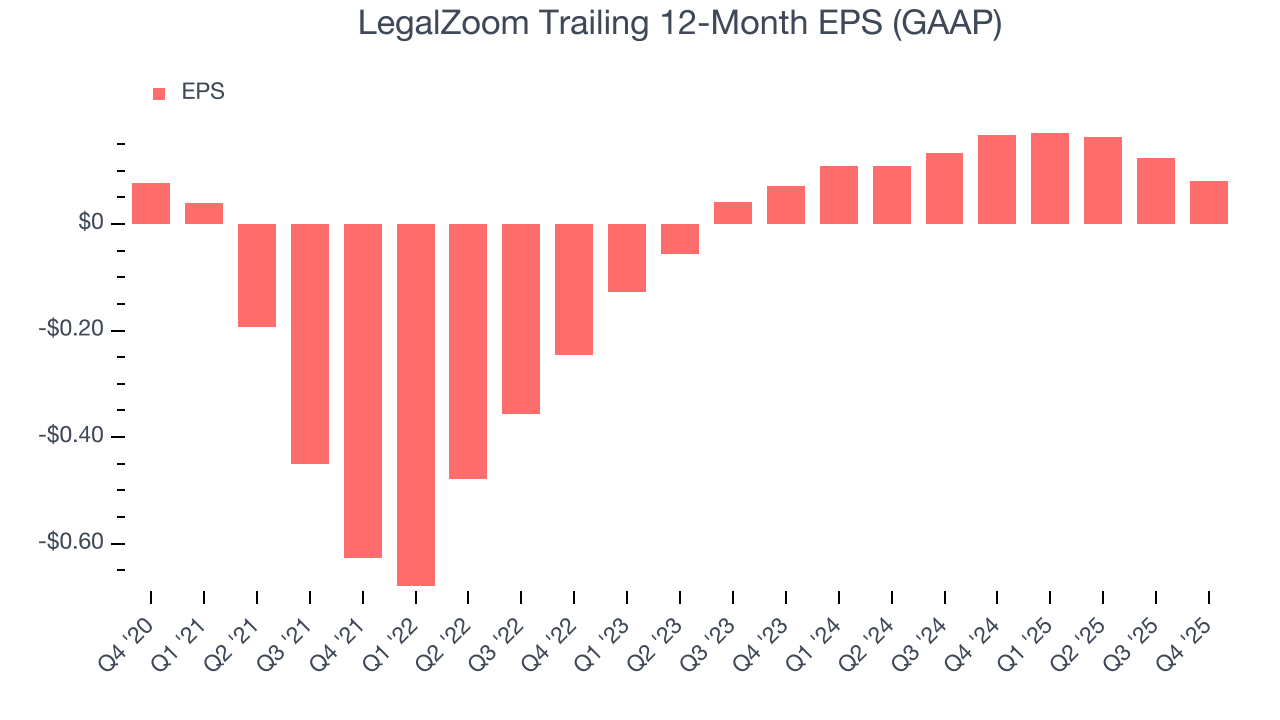

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

LegalZoom’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

In Q4, LegalZoom reported EPS of $0.03, down from $0.07 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects LegalZoom’s full-year EPS of $0.08 to grow 82.9%.

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

LegalZoom has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 17.2% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that LegalZoom’s margin expanded by 11.2 percentage points over the last few years. This is encouraging because it gives the company more optionality.

LegalZoom’s free cash flow clocked in at $28 million in Q4, equivalent to a 14.7% margin. The company’s cash profitability regressed as it was 7.5 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

12. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

LegalZoom is a profitable, well-capitalized company with $203.1 million of cash and $14.36 million of debt on its balance sheet. This $188.7 million net cash position is 15.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from LegalZoom’s Q4 Results

It was great to see LegalZoom’s full-year EBITDA guidance top analysts’ expectations. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 2.5% to $7.07 immediately after reporting.

14. Is Now The Time To Buy LegalZoom?

Updated: February 27, 2026 at 9:32 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in LegalZoom.

We think LegalZoom is a solid business. Although its revenue growth was uninspiring over the last three years, its growth over the next 12 months is expected to be higher. And while LegalZoom’s sales and marketing efficiency is subpar, its impressive EBITDA margins show it has a highly efficient business model. On top of that, its rising cash profitability gives it more optionality.

LegalZoom’s EV/EBITDA ratio based on the next 12 months is 5.6x. Looking at the consumer internet landscape right now, LegalZoom trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $9.14 on the company (compared to the current share price of $7.03), implying they see 30.1% upside in buying LegalZoom in the short term.