PTC (PTC)

PTC is intriguing. Its stellar unit economics and efficient sales strategy tee it up for immense long-term profits.― StockStory Analyst Team

1. News

2. Summary

Why PTC Is Interesting

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ:PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its operating leverage amplified its profits over the last year

- Software platform has product-market fit given the rapid recovery of its customer acquisition costs

- On the other hand, its demand will likely fall over the next 12 months as Wall Street expects flat revenue

PTC shows some signs of a high-quality business. If you’ve been itching to buy the stock, the valuation looks reasonable.

Why Is Now The Time To Buy PTC?

High Quality

Investable

Underperform

Why Is Now The Time To Buy PTC?

PTC’s stock price of $163.19 implies a valuation ratio of 7x forward price-to-sales. Compared to other software companies, we think this multiple is fair for the quality you get.

Now could be a good time to invest if you believe in the story.

3. PTC (PTC) Research Report: Q4 CY2025 Update

Product design software company PTC (NASDAQ:PTC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 21.4% year on year to $685.8 million. On top of that, next quarter’s revenue guidance ($740 million at the midpoint) was surprisingly good and 7.9% above what analysts were expecting. Its non-GAAP profit of $1.92 per share was 22.8% above analysts’ consensus estimates.

PTC (PTC) Q4 CY2025 Highlights:

- Revenue: $685.8 million vs analyst estimates of $633.7 million (21.4% year-on-year growth, 8.2% beat)

- Adjusted EPS: $1.92 vs analyst estimates of $1.56 (22.8% beat)

- Adjusted Operating Income: $309.6 million vs analyst estimates of $259.5 million (45.1% margin, 19.3% beat)

- The company slightly lifted its revenue guidance for the full year to $2.81 billion at the midpoint from $2.78 billion

- Management raised its full-year Adjusted EPS guidance to $7.92 at the midpoint, a 2.6% increase

- Operating Margin: 32.2%, up from 20.4% in the same quarter last year

- Free Cash Flow Margin: 39%, up from 11.2% in the previous quarter

- Annual Recurring Revenue: $2.49 billion (13.1% year-on-year growth, beat)

- Billings: $573.4 million at quarter end, up 6.7% year on year

- Market Capitalization: $17.75 billion

Company Overview

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ:PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

PTC's software suite creates a digital thread that connects all aspects of product development, from initial design through manufacturing, service, and end-of-life. Its core offerings include Creo for 3D computer-aided design (CAD), Windchill for product lifecycle management (PLM), Codebeamer for application lifecycle management (ALM), and ServiceMax for service lifecycle management (SLM).

A manufacturer using PTC's solutions might design a new medical device in Creo, manage all associated documentation and collaborative workflows in Windchill, coordinate software development with Codebeamer, and then maintain field service operations with ServiceMax—all within an integrated ecosystem that maintains a single source of truth for product data.

The company generates revenue primarily through subscription-based licensing, with over 90% of its revenue being recurring. This model provides predictable revenue streams and facilitates ongoing customer relationships, as opposed to one-time perpetual license sales. PTC enhances its core offerings with enabling technologies like SaaS platforms, artificial intelligence, Internet of Things capabilities (ThingWorx), and augmented reality solutions (Vuforia).

PTC serves more than 30,000 customers globally across diverse industries including industrial manufacturing, aerospace and defense, automotive, and medical technology. The company sells both directly through its sales force (approximately 75% of sales) and through third-party resellers that help reach small and medium-sized businesses.

4. Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

PTC's main competitors in the CAD and PLM space include Autodesk (NASDAQ:ADSK), Dassault Systèmes (OTCMKTS:DASTY), and Siemens AG (OTCMKTS:SIEGY). For its ALM products, it competes with IBM (NYSE:IBM), Jama Software, and Siemens, while its SLM solutions face competition from enterprise software providers like Oracle (NYSE:ORCL) and SAP (NYSE:SAP).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, PTC grew its sales at a 13.3% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about PTC.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. PTC’s annualized revenue growth of 14.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, PTC reported robust year-on-year revenue growth of 21.4%, and its $685.8 million of revenue topped Wall Street estimates by 8.2%. Company management is currently guiding for a 16.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

PTC’s ARR came in at $2.49 billion in Q4, and over the last four quarters, its growth was underwhelming as it averaged 11.6% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

PTC is extremely efficient at acquiring new customers, and its CAC payback period checked in at 16.9 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

PTC’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 88.1% gross margin over the last year. That means PTC only paid its providers $11.86 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. PTC has seen gross margins improve by 9 percentage points over the last 2 year, which is elite in the software space.

This quarter, PTC’s gross profit margin was 99.1%, marking a 18.9 percentage point increase from 80.2% in the same quarter last year. PTC’s full-year margin has also been trending up over the past 12 months, increasing by 7.4 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

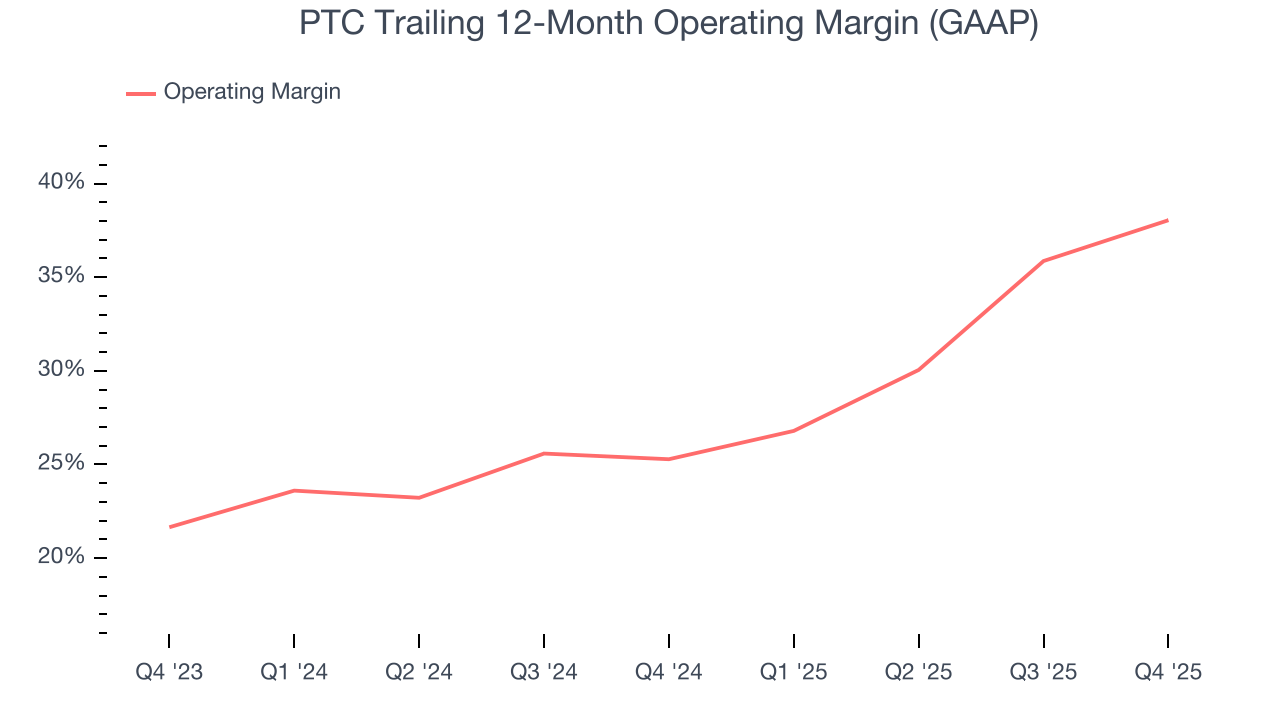

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

PTC has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 38%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, PTC’s operating margin rose by 12.8 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, PTC generated an operating margin profit margin of 32.2%, up 11.8 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

PTC has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.1% over the last year.

PTC’s free cash flow clocked in at $267.4 million in Q4, equivalent to a 39% margin. The company’s cash profitability regressed as it was 2.7 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict PTC’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 31.1% for the last 12 months will increase to 35.2%, it options for capital deployment (investments, share buybacks, etc.).

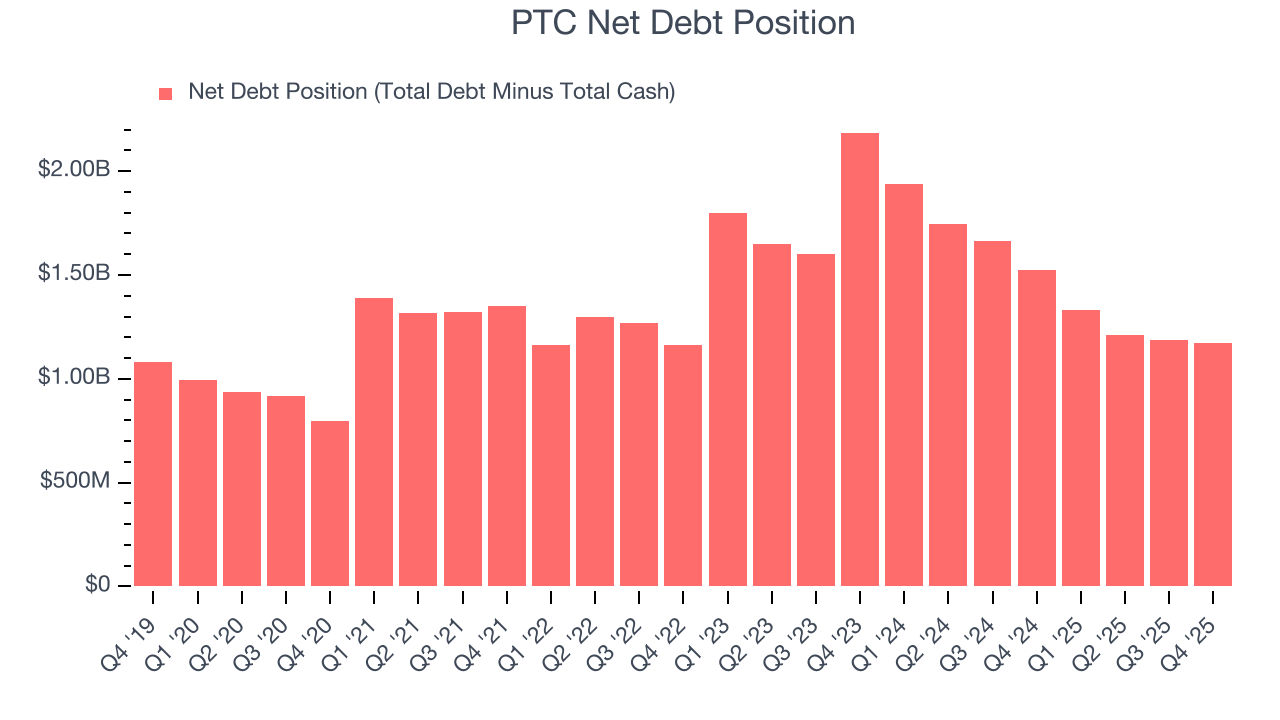

11. Balance Sheet Assessment

PTC reported $209.7 million of cash and $1.38 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.44 billion of EBITDA over the last 12 months, we view PTC’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $52.47 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from PTC’s Q4 Results

We were impressed by PTC’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. On the other hand, its billings missed. Overall, we think this was still a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 1.2% to $149.86 immediately following the results.

13. Is Now The Time To Buy PTC?

Updated: March 8, 2026 at 10:34 PM EDT

Are you wondering whether to buy PTC or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

In our opinion, PTC is a solid company. Although its revenue growth was uninspiring over the last five years and analysts expect growth to slow over the next 12 months, its impressive operating margins show it has a highly efficient business model. And while its ARR has disappointed and shows the company is having difficulty retaining customers and their spending, its efficient sales strategy allows it to target and onboard new users at scale.

PTC’s price-to-sales ratio based on the next 12 months is 7x. Looking at the software space right now, PTC trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $195 on the company (compared to the current share price of $163.19), implying they see 19.5% upside in buying PTC in the short term.